The impact of A2A payments technology on how things have changed and how user habits have changed has been phenomenal.

People from all over the world today use fintech services that not only save them the hassle of standing in queues but also save time.

But as they say, technology and time never stop evolving. Multiple new approaches have emerged to improve the field of finance, and A2A payments are a prime example.

Account-to-account payments make it easy for users to be more flexible about how they make transactions. The fintech market is certainly catching up with A2A payments as more and more payment platforms are integrating the A2A payments option, enabling the app to support and process payments faster and securely.

Wondering what A2A payment is? Well, don’t worry, as we will be discussing everything in this post about account-to-account payments. So without further ado, let’s get started!

What are A2A Payments? Types of A2A Transactions

Account-to-account payments are a method of transferring funds directly between two bank accounts without having to depend on any middleman or intermediaries such as credit card networks, payment processors, or any other third party. People can directly transfer an amount from their account to another person’s account in no time.

The best example of A2A payments is peer-to-peer apps, where it is most commonly used. The whole purpose of using account-to-account payments is to make direct payments faster.

Another interesting use case of A2A payments can be your salary/payroll transaction. The amount is directly deposited into the employee’s account from the employer’s account on the designated day.

However, the application of A2A payments is not limited to these examples, as it leverages open banking, which pushes its ability to the next level, but we will talk more about it later in this post. For now, let’s take a look at the types of A2A transactions.

Types of A2A Payment Transactions

Account-to-account payments can be categorized into two primary payment types –

-

Push Payments

As the name suggests, push payments are those that are initiated by the payer to fulfill the requirements. This is one of the most common types of account-to-account payments as it fulfills the majority of use cases for Bank Transfers, Instant Payments, consumer-to-business payments, and Business-to-Business Payments.

-

Pull Payments

This payment method is commonly used for recurring transactions, where the recipient initiates the transaction, pending authorization from the payer. Direct debits and ACH payments are prime examples of pull payments. These transactions have gained popularity thanks to the growing use of subscriptions for entertainment and other necessities.

The key difference between Push and Pull transactions is that Push transactions are commonly used for irregular transactions, and Pull payments are used for recurring payments.

How Do A2A Payments Work?

Knowing about the transaction types, you might have an idea of the key functionalities that A2A payments have to offer. As convenient as they sound, there are a lot of steps that are required to make A2A payments work.

You are already aware that account-to-account transactions do not follow traditional transactions and bypass intermediaries like payment processors and credit card networks.

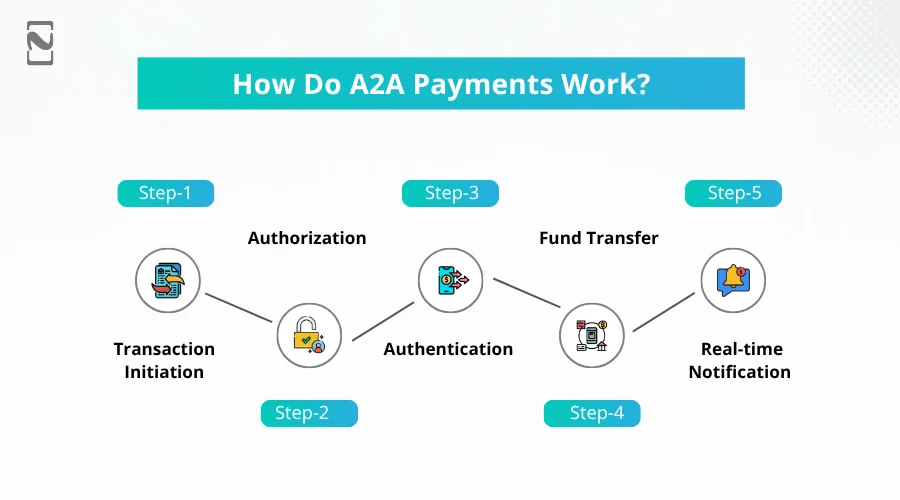

So, how do these transactions go through? Well, here are the steps to help you understand –

Step 1 – Transaction Initiation

The first thing to do is to initiate the transaction. As you know, there are two types of transactions, and both are initiated by different entities.

Hence, the transfer is initiated according to the transaction type and use case. If it is a Push transaction, the payer will initiate using the interface, whereas if it is a Pull transaction, the initiation will be done by the recipient.

Step 2 – Authorization

Based on the type of transaction, authorization is done for the transaction to go through. The payer uses their bank password, PIN, or email confirmation to validate the transaction so that the funds can be transferred.

If it is a recurring transaction, the receiving entity requests that the user’s bank complete the transaction based on the payer’s set payment parameters.

Step 3 – Authentication

If the transaction is authorized, it cannot be completed without proper authentication. Account-to-account transactions generally depend on multi-factor authentication techniques that help in keeping the transfer of funds safe and secure.

Measures like One-Time Passwords, Security PINs, Biometric data, and other applications make it possible to keep it safe & secure.

Step 4 – Fund Transfer

Once the authentication and authorization processes are complete, the funds are transferred. Typically, account-to-account transfers are completed instantly using open banking.

The system allows a third party to access banking data through an app, making it easier for users to initiate and complete transactions without needing to repeatedly enter their account details.

Step 5 – Real-time Notification

When the transfer is complete, the respective parties are notified about it accordingly. In case the transaction is not completed or not approved for any reason, the same is also communicated to help the user manage it accordingly.

Account-to-account transactions can help you finish a payment transfer instantly, as there are no intermediaries involved. The whole process hardly takes a few minutes thanks to open banking infrastructure and a solid A2A transfer app.

Key Aspects of A2A Payments That Make it Futuristic

Identifying the process and how account-to-account payments are made in the application, you might have thought that it works similarly to other payment options, then what is the buzz about?

Well, the key aspect here is that it offers direct transfers from one account to another without depending on any sort of third-party processor. However, that is not the only thing that makes it stand out.

Here are some key aspects of A2A payments that make it one of the fastest-growing and adopted payment systems.

-

Real-Time Settlement

The application offers direct settlement in real-time, making it ready for instant payments.

-

Lower Transaction Fees

Since there are no extended parties like a payment processor or a card network involved, the transaction fees are comparatively low.

-

Enhanced Security

Direct encryption along with added layers of multi-factor service makes the transaction highly secure and deters fraudsters better.

-

Open Banking Integration

The account-to-account transactions are powered by open banking, which speaks volumes about the flexibility of online transactions that A2A transactions can offer.

-

Cost Efficiency

Setting up the solution can be cost-effective, as you can find quality payment system developers who can help you integrate A2A payments easily.

-

Improved Cash Flow

Real-time settlement helps a business significantly in improving its cash flow. Users have the option of using their cash instantly as they receive it, making the entire transaction more simple.

-

Customer Experience

With the ability to collect instant payments, any business can uplift the customer experience by miles. Not to mention the option can be integrated into existing apps, giving customers a seamless experience.

-

Compliance

Based on open banking norms, account-to-account transactions are highly compliant with all fintech regulations & compliance requirements and banking regulations.

While the application covers all the aspects nicely, there are a few things to keep in mind. One of the key aspects where A2A may not be as complete as other transactions is fraud prevention.

You see, account-to-account payments do not have built-in chargeback protections that make it a bit weaker than others.

However, by asking the right experts to guide you through, you can easily add fraud protection strategies and make the process robust.

Applications of A2A Payments: Current & Future Prospects

The opportunities with account-to-account payments are endless, considering it is being adopted by users globally. With that said, it is also true that not every industry has adopted the payment method properly.

If you are wondering where exactly account-to-account transactions are being used and where they can be used,

Check them out below:

-

Online Purchases

Users can simply choose an A2A transaction to buy anything online through the integrated payment gateway options on the platform.

-

Instant Refunds

For any product that is being returned or the order is not completed for any reason, businesses can offer instant refunds.

-

Peer-to-Peer Transfers

Transferring funds from one account to another has become super smooth, and family members and friends can easily send and receive money when required.

-

Bill Payments

Consumers can pay bills (utilities, subscriptions, etc.) directly from their bank accounts, sometimes with variable recurring payment options.

-

Investment Platforms

A2A payments allow users to be more active in the market as the funds can be made available instantly in case they want to exit the market. Similarly, investing in the market is also easy.

-

Charitable Donations

Donations can be processed through A2A payments, allowing funds to be settled in real-time for immediate use by the charitable organization.Not to mention, lower transaction fees are always a plus.

-

Payroll Processing

You can easily use Pull transactions to design payroll processing. Since it is usually a preempted transaction you can set it up accordingly and automate it.

-

Merchant Payments

Account-to-account transactions also support B2B payments, allowing you to pay other merchants and suppliers easily.

Other than these full-fledged applications, you can also find a few potential applications of A2A that can benefit from A2A payment implementation –

- Government Disbursements

- Insurance Claims

- Real Estate Transactions

- Crowdfunding

- Travel and Hospitality

What are the Benefits of Using A2A Payments?

Account-to-account payments have certainly found their way into every industry and beyond. No wonder the payment system has gained immense popularity.

Another reason that A2A payments have gained popularity is the benefits and ease of access that they offer.

Looking at the applications alone, you might have a solid understanding of how A2A payments are making things simpler and better for the users.

If you need a better perspective, check out the list of benefits you can get!

- Faster Transactions

- Lower Transaction Costs

- Enhanced Security

- Improved Cash Flow Management

- Integration with Financial Services

- Convenient for Users

- Reduced Chargebacks

- Potential for Innovation

The list highlights how account-to-account payments transform interactions with payments and money management.

Needless to say, any business that works with online transactions or offers banking and financial services must go for A2A payments. How? Well, check out the next section to find out!

Nimble AppGenie: Your Go-To A2A Payment Solution Developer

Knowing the potential of A2A payments, it only makes sense that you start integrating A2A payments in every solution built be it a fintech or non-financial platform. If you are looking for a professional to guide you through, Nimble AppGenie is the perfect fintech app development company that provides a solution for you.

Not only do our developers understand the market needs, but they are also highly efficient in terms of taking up a project and tuning it with the best functionalities and latest technology.

The idea of building an A2A payment solution is not new. Our experts have done it in the past as well, allowing all the first movers in the market to take advantage of the benefits that account-to-account services have to offer.

However, it is certain that these types of solutions have emerged recently as a global phenomenon and have gained insane popularity.

Capitalize on the popularity and give your customers a better payment experience with Nimble AppGenie’s curated A2A payment solution.

Reach our experts today for the best results!

Conclusion

When online payments emerged as a concept it had its flaws. Sometimes the servers did not work and sometimes the transactions took too long.

Over the past few years, we have seen multiple iterations of the best payment system and no doubt, account-to-account payments are one of the finest of them all.

It resolves tons of problems and offers the best financial solution for instant payments. The future of account-to-account payments is certainly ready to be better as a whole.

Hopefully, this post helps you identify everything about A2A payments. Feel free to connect with our experts if you are looking to build an A2A payments system or need help with implementation. Thanks for reading. Good luck!

FAQs

The top 3 benefits of A2A payments for businesses are:

- Real-time settlement – Improves cash flow.

- Lower transaction fees – Reduces overall costs.

- Simplified process – Enhances user experience and efficiency.

A2A payments support multiple types of transactions including:

- Peer-to-Peer (P2P)

- Business-to-Business (B2B)

- Consumer-to-Business (C2B)

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.