In a Nutshell:

- Insurance process automation leverages AI, RPA, and data intelligence to digitize claims, policy administration, underwriting, and customer service workflows across insurers and InsurTech platforms.

- A reliable insurance automation software development company, like Nimble AppGenie, builds custom insurance automation software tailored to compliance needs, business rules, and legacy system integrations.

- Enterprise insurance automation solutions utilize machine learning in insurance automation and intelligent insurance automation to improve fraud detection, risk assessment, and decision accuracy at scale.

- Modern insurance software development services integrate RPA in insurance with cloud platforms, APIs, and core systems to reduce manual effort and operational costs.

- Emerging technologies like generative AI in insurance enable automated document processing, conversational AI, and personalized customer experiences for rapid digital transformation.

Witnessing AI driving innovation, competitive advantages, and cost savings, insurers are increasingly adopting AI-powered software and services, leading to the rapid expansion of AI in the insurance market.

| By 2033, the valuation of AI in the Insurance Market is anticipated to boost by $59.50 billion, surging at a CAGR of 27.32%. |

What is the major reason behind the rise?

Traditional insurance systems find it challenging to withstand operational and internal inefficiencies, financial and market pressures, customer pain points (like slow claims settlement), and fraud and compliance blockages.

In 2026, AI Insurance Automation Software Development can help Insurtech partners & vendors, investors, policyholders, underwriting teams, fraud investigation teams, claims management teams, and AI teams with lower operational costs, improved underwriting precision, faster claim processing, 24/7 automated customer engagement, and diminished fraud.

How to build AI insurance software?

This insurance AI development guide will put forth what is AI insurance automation, steps to develop AI insurance software, use cases for AI in insurance automation, and insurance AI implementation best practices.

Why Insurance Companies Are Adopting AI Automation

Insurance companies are adopting AI-driven automation to combat operational challenges and meet dynamic customer expectations.

AI insurance automation empowers insurers to mitigate human dependency, modernize workflows, and reveal data-backed insights across the insurance value chain.

Key Business Drivers Behind AI Adoption

Insurance organizations choose AI automation to deal with acute pain points, like:

- Underwriting inaccuracies caused by rule-based decision-making.

- High claim settlement turnaround times due to manual verification.

- Rising fraud losses and hidden risk patterns.

- Operational inefficiencies across policy, claims, and support teams.

- Poor customer experience driven by delayed responses.

Such challenges directly influence compliance, profitability, and customer retention.

Benefits of AI Insurance Automation

Let’s talk about the measurable business advantages insurers gain by implementing AI-powered insurance automation software.

- 40-70% rapid claim processing via straight-through automation.

- Drop in fraud losses through pattern analysis and anomaly detection.

- Boosted underwriting precision leveraging predictive risk models.

- Reduced operational costs by diminishing manual intervention.

- Personalized policy pricing according to the real-time risk assessment.

- 24/7 automated customer engagement with AI chatbots and virtual assistants.

AI helps with insurance workflow automation, converting insurance operations’ reactive processing to proactive, intelligent decision-making, allowing insurers to scale rapidly while maintaining compliance and precision.

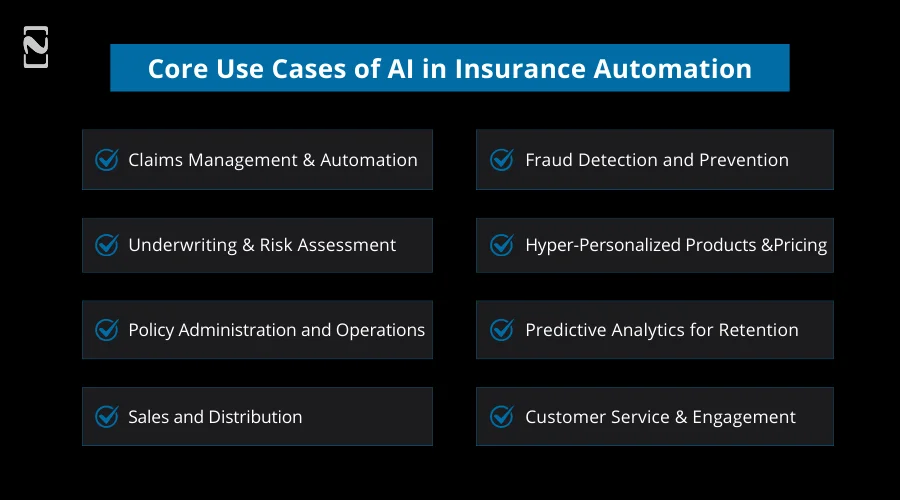

What are the Core Use Cases of AI in Insurance Automation

AI-driven insurance process automation uses machine learning, RPA, and intelligent insurance automation to streamline underwriting, claims processing, fraud detection, and policy administration.

Generative AI in insurance further enhances document automation and customer interactions, boosting speed and accuracy across enterprise insurance operations.

In this section, we will find out how you can harness the potential of the latest technology through AI insurance automation software development.

1. Claims Management and Automation

AI claims automation helps insurers mitigate processing time from weeks to minutes by streamlining operations from First Notice of Loss (FNOL) to settlement, which means the whole lifecycle.

Considering use cases of AI in insurance claims, computer vision examines photos or videos of damaged vehicles or property to offer prompt repair estimates.

Also, AI rapidly evaluates claim complexity and severity to automatically route them to the right team or fast-track the simple ones for swift payout.

2. Fraud Detection and Prevention

Using machine learning insurance software, you can scan huge data volume in real-time to pinpoint anomalies and doubtful patterns. Therefore, insurance fraud detection AI reduces false claims payouts by approximately 25%.

3. Underwriting and Risk Assessment

Leveraging the strength of AI underwriting software, insurers analyze vast datasets like medical records, IoT, and telematics to create more accurate issue policies and risk profiles in minutes. Thus, they experience rapid, data-driven underwriting.

4. Hyper-Personalized Products and Pricing

Using wearable data and telematics, you can offer “pay-how-you-live” or “pay-how-you-drive” policies to the policyholders with premiums adjusted based on behavior in real-time.

5. Policy Administration and Operations

Insurance document AI automation helps with intelligent document processing, in which NLP and OCR pull out and validate data from unstructured documents, such as invoices, medical reports, and police reports, mitigating manual data entry errors.

With AI, you can monitor regulatory modifications and automate policy renewals and compliance checks across numerous jurisdictions.

6. Predictive Analytics for Retention

AI models foretell when a customer will likely convert, enabling proactive retention approaches like targeted discounts.

7. Sales and Distribution

AI ranks leads according to their conversion possibility and assists agents in discovering upsell and cross-sell opportunities, usually integrated directly into HubSpot CRM and Salesforce Financial Services Cloud.

8. Customer Service and Engagement

Conversational AI in insurance software manages daily inquiries, initial claims filings, and policy updates with no human involvement. Furthermore, Natural Language Processing (NLP) interprets customer tone in emails and calls to proactively recognize and address dissatisfaction.

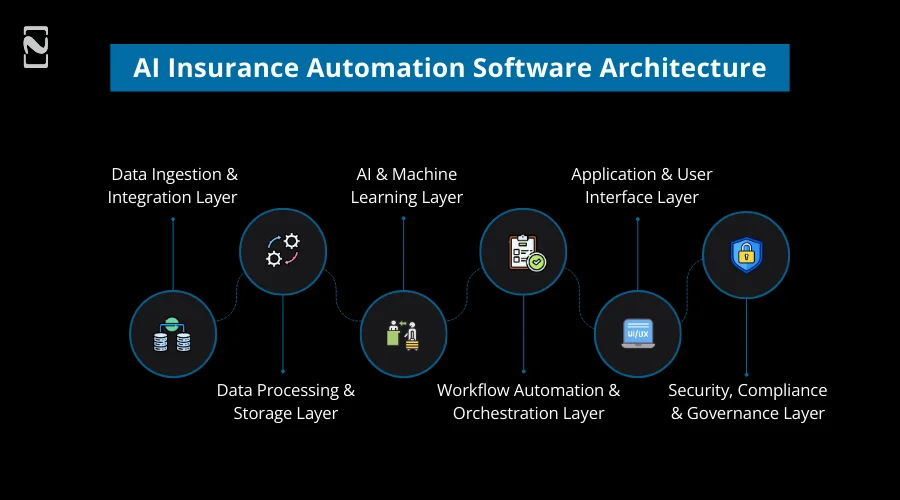

AI Insurance Automation Software Architecture

With a powerful AI insurance automation software architecture, insurance companies can address huge volumes of structured and unstructured data, smoothly integrate with outdated core systems, and attain AI insurance workflow automation.

But the architecture should be secure, scalable, compliant, and help with real-time decision making. A modern insurance AI technology stack typically follows a layered, cloud-native approach.

Core Layers of AI Insurance Software Architecture :

► Data Ingestion & Integration Layer

This layer accumulates and combines data from several sources, embracing:

- Claims management platforms.

- CRM and customer interaction channels.

- Policy administration systems.

- Third-party data providers (credit scores, telematics, IoT, medical data).

APIs and ETL (Extract, Transform, Load) pipelines ensure batch data flow in real-time across systems.

► Data Processing & Storage Layer

Once the data is ingested, it’s processed and securely stored for AI consumption.

The steps that are followed are:

- Data cleansing and normalization.

- Secure data lakes and warehouses.

- Structured and unstructured data handling.

This layer creates a base for accurate model training and inference.

► AI & Machine Learning Layer

This layer of AI Insurance Software Architecture is the intelligence core that’s responsible for:

- Predictive risk scoring.

- Fraud detection using anomaly detection models.

- Claims classification and decisioning.

- Computer vision for image and damage assessment.

- NLP-based document understanding.

Real-world insurance data is used to constantly train and optimize models.

► Workflow Automation & Orchestration Layer

This layer seamlessly executed the complete suite of insurance workflows by:

- Automating underwriting, claims, and policy processes.

- Handling rule-based and AI-driven decisions.

- Allowing human-in-the-loop approvals for controlled tasks.

In the end, the layer helps witness flawless coordination between AI outputs and operational actions.

► Application & User Interface Layer

It offers interfaces for distinct stakeholders, like:

- Agent and underwriter dashboards.

- Customer portals and mobile apps.

- Admin and analytics dashboards.

The AI insurance software architecture layer targets transparency, real-time insights, and usability.

► Security, Compliance & Governance Layer

This layer promises enterprise-grade protection and regulatory readiness:

- Audit trails for AI decisions.

- Data encryption and access control.

- Explainable AI (XAI) mechanisms.

- Compliance with data privacy laws and insurance regulations.

Insurers looking to innovate rapidly while maintaining regulatory compliance and operational stability should build.

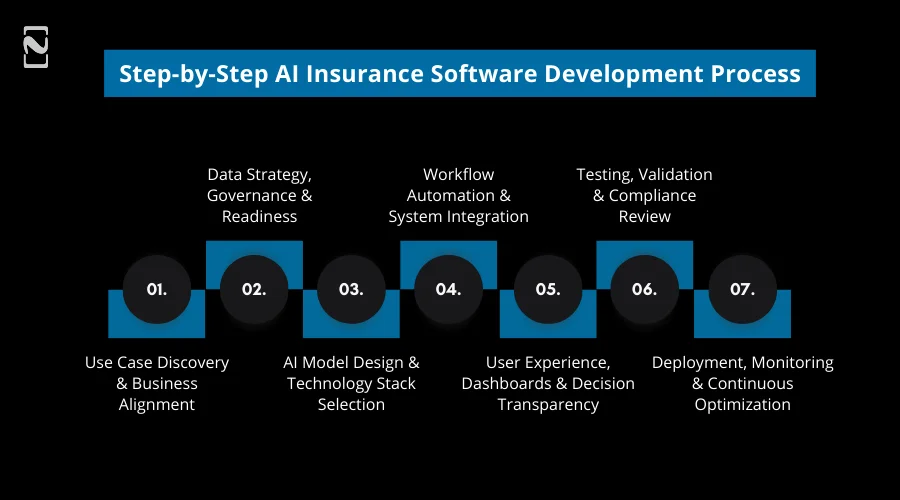

What is the Step-by-Step AI Insurance Software Development Process

How to build AI insurance software?

AI insurance software development involves analyzing insurance workflows, crafting AI-ready architectures, and implementing machine learning and smart automation.

The solution is tested, integrated, deployed, and continuously optimized to support enterprise insurance automation at scale.

Let’s check out the insurance AI development process.

1. Use Case Discovery & Business Alignment

Timeline: 2-3 weeks

Roles Involved: Insurance business stakeholders, product managers, solutions architects, and underwriting & claim leaders.

What Happens in This Phase:

- Impactful automation opportunity identification (underwriting, claims, CX, and fraud).

- Assess system readiness and data availability.

- Success metrics determination (TAT reduction, cost savings, and accuracy).

- Use cases prioritization based on feasibility and ROI.

Key Deliverables:

- Business KPI framework

- Use case definition document

- AI feasibility assessment

2. Data Strategy, Governance & Readiness

Timeline: 3-5 weeks

Roles Involved: Data scientists, data engineers, IT security teams, and compliance & legal teams.

What Happens in This Phase:

- Data labelling, cleansing, and normalization,

- Data sourcing from claims, third-party systems, policy, and CRM.

- Data privacy, regulatory checks, and consent.

- Creation of safe training datasets

Key Deliverables:

- Data governance and compliance plan

- Data pipelines and schemas

- Labeled training datasets

3. AI Model Design & Technology Stack Selection

Timeline: 4-6 weeks

Roles Involved: DevOps engineers, Solution architects, and AI/ML engineers.

What Happens in This Phase:

- Selection of platforms and frameworks within the insurance AI technology stack.

- Choosing ML models (classification, NLP, regression, and CV)

- Planning bias monitoring and explanability mechanisms.

- Designing model validation, training, and retraining workflows

Key Deliverables:

- Model architecture design

- Explainability and monitoring plan

- Technology stack documentation

4. Workflow Automation & System Integration

Timeline: 4-6 weeks

Roles Involved: QA engineers, Backend developers, RPA specialists, and integration engineers

What Happens in This Phase:

- API and microservices orchestration

- Automating insurance workflows

- AI models and core insurance systems integration

- Implementing human-in-the-loop checkpoints and business rules.

Key Deliverables:

- Integrated APIs and services

- Automated workflow blueprints

- Escalation logic and exception handling

5. User Experience, Dashboards & Decision Transparency

Timeline: 2-4 weeks

Roles Involved: UI/UX designers, business users (UAT participants), and frontend developers

What Happens in This Phase:

- Visualizing AI decisions and confidence scores

- Designing dashboards for underwriting, claims, and leadership teams

- Guaranteeing usability and adoption readiness

- Offering override and approval mechanisms

Key Deliverables:

- Role-based dashboards

- User training materials

- Decision explanation interfaces

6. Testing, Validation & Compliance Review

Timeline: 2-3 weeks

Roles Involved: Risk management teams, compliance & audit teams, and QA teams

What Happens in This Phase:

- Model accuracy and bias evaluation

- Functional and performance testing

- Regulatory and audit readiness checks

- Stress testing with real-world scenarios

Key Deliverables:

- Bias and explainability documentation

- Test reports and validation results

- Compliance sign-off

7. Deployment, Monitoring & Continuous Optimization

Timeline: Ongoing

Roles Involved: AI operations (MLOps) teams, business analytics teams, and DevOps engineers

What Happens in This Phase:

- KPI tracking and ROI measurement

- Cloud deployment and CI/CD setup

- Model retraining and optimization

- Real-time performance monitoring

Key Deliverables:

- Live AI insurance automation platform

- Continuous improvement roadmap

- Monitoring dashboards

Typical AI Insurance Automation Software Development Time Overview

| Phase | Duration |

| Discovery & Alignment | 2–3 weeks |

| Data Readiness | 3–5 weeks |

| Model & Stack Design | 4–6 weeks |

| Automation & Integration | 4–6 weeks |

| UX & Transparency | 2–4 weeks |

| Testing & Compliance | 2–3 weeks |

| Deployment & Optimization | Ongoing |

Total Initial MVP Timeline: Approx. 3-5 months

Enterprise-Scale Platform: Approx. 6-9 months

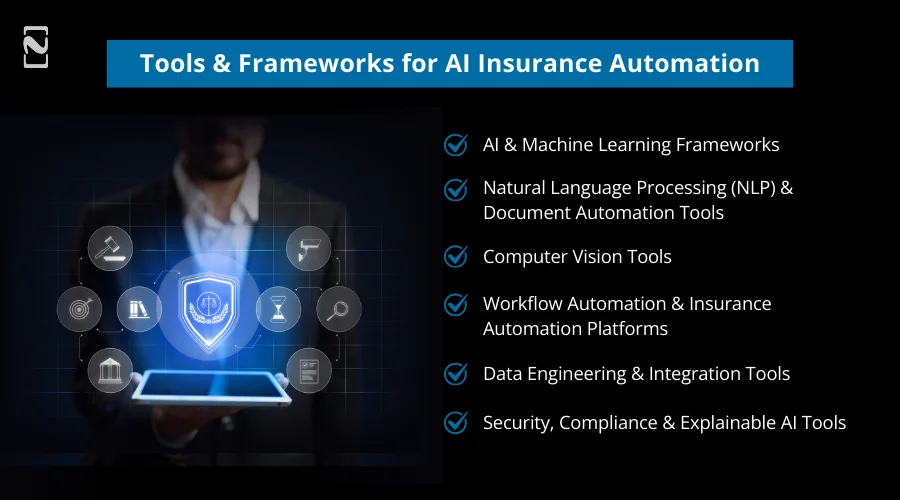

Tools & Frameworks for AI Insurance Automation

AI insurance automation utilizes machine learning frameworks like TensorFlow and PyTorch, and RPA platforms such as UiPath and Automation Anywhere to foster intelligent insurance automation.

Cloud infrastructure, secure API integrations, and analytics tools support custom insurance automation software development, automating underwriting, claims processing, fraud detection, and policy management.

Choosing the right AI insurance software tools and insurance automation platforms is essential for creating high-performing insurance solutions with the expected scalability and compliance.

Also, you should ensure that the technology stack supports complex decision-making, smooth integration with legacy insurance systems, and data-heavy workflows.

Below is a breakdown of frameworks and the best tools for insurance automation you can consider for AI insurance automation software development.

1. AI & Machine Learning Frameworks

These frameworks build the core intelligent layer of insurance automation systems.

Commonly Used Tools:

- TensorFlow

- Scikit-learn

- PyTorch

Primary Use Cases:

- Claims classification and approval prediction

- Pricing optimization

- Risk scoring and underwriting models

- Fraud detection and anomaly analysis

Why They Matter for Stakeholders: It allows constant improvements of AI models.

2. Natural Language Processing (NLP) & Document Automation Tools

Insurers already know that insurance operations include vast documents, like medical reports, policies, invoices, and claims forms. NLP tools streamline data extraction and document understanding.

Commonly Used Tools:

- OCR engines

- SpaCy

- Hugging Face Transformers

Primary Use Cases:

- Email and communication analysis

- Claims document processing

- Policy data extraction

Why They Matter for Stakeholders: It notably diminish manual claim turnaround time and review effort.

3. Computer Vision Tools

Computer vision supports automated analysis of submitted videos and images during claims processing.

Commonly Used Tools:

- OpenCV

- Deep learning vision models

Primary Use Cases:

- Property and asset inspection

- Vehicle damage assessment

- Image-based fraud detection

Why They Matter for Stakeholders: Automated claims processing software helps improve assessment accuracy while mitigating reliance on physical inspections.

4. Workflow Automation & Insurance Automation Platforms

For expected AI insurance automation software development, you can opt for these platforms to organize AI-driven and rule-based insurance workflows.

Commonly Used Tools:

- RPA platforms integrated with AI

- BPM engines

Primary Use Cases:

- Exception handling and approvals

- Policy lifecycle management

- Claims and underwriting automation

Why they Matter for Stakeholders: These insurance automation platforms transform AI insurance industry insights into end-to-end, actionable automated workflows.

5. Data Engineering & Integration Tools

Insurance companies should ensure integration of AI insurance systems with various data sources and legacy systems.

Commonly Used Tools:

- ETL and data pipeline tools

- API management platforms

Primary Use Cases:

- Real-time and batch processing

- Data ingestion from core insurance systems

- Third-party data integration

Why They Matter for Stakeholders: Such tools support scalable, secure, and reliable data flow across different systems.

6. Cloud Infrastructure & DevOps Tools

Leveraging cloud platforms, you can offer operational efficiency.

Commonly Used Tools:

- CI/CD pipelines

- AWS, Azure, Google Cloud

- Docker and Kubernetes

Primary Use Cases:

- High availability and disaster recovery

- Scalable model deployment

- Continuous delivery and monitoring

Why They Matter for Stakeholders: Cloud infrastructure and DevOps tools allow cost optimization and enterprise-grade performance.

7. Security, Compliance & Explainable AI Tools

These AI tools are mandatory for Insurance AI systems to keep them in adherence with strict regulatory and ethical standards.

Commonly Used Tools:

- Monitoring and audit tools

- Explainable AI (XAI) libraries

- Data encryption and access control frameworks

Primary Use Cases:

- Regulatory audits

- Bias detection and governance

- AI decision transparency

Why They Matter for Stakeholders: Harnessing the potential of such tools helps you foster trust with auditors, regulators, and customers.

How to Choose the Right Insurance Automation Platform

Well, while you select insurance automation platforms, stakeholders need to evaluate:

- Support for AI and ML workloads

- Compatibility with existing insurance systems

- Built-in compliance and audit capabilities

- Total cost of ownership

- Scalability and performance

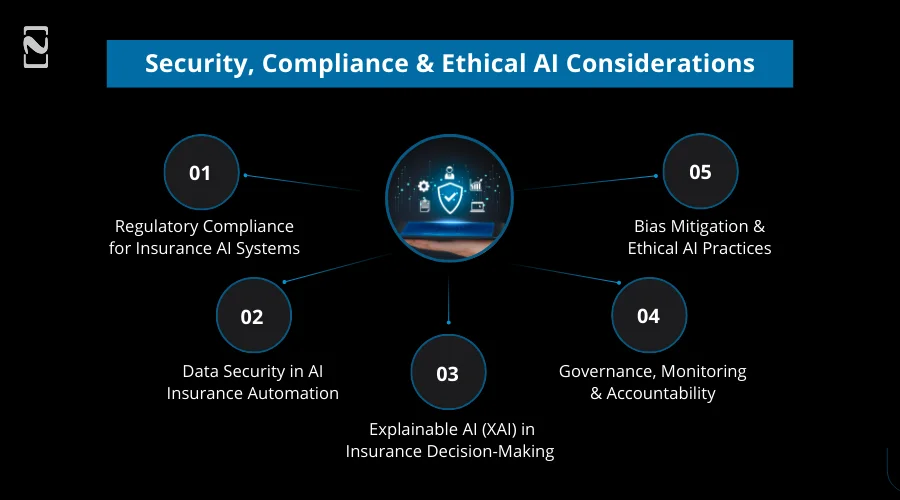

Security, Compliance & Ethical AI Considerations

AI insurance automation must ensure powerful security, regulatory compliance, and ethical AI practices.

Custom insurance automation software safeguards sensitive data while supporting fair, transparent, and efficient underwriting, claims, and policy workflows.

If you want your AI-driven insurance automation software to perform well, you need to ensure that you have a highly-regulated environment for it to operate, and where ethical AI usage, regulatory compliance, and data security are non-negotiable.

So, embed compliance, governance frameworks, and security throughout the AI lifecycle to reinforce transparency, long-term scalability, and trust.

♦ Regulatory Compliance for Insurance AI Systems

Insurance AI solutions must adhere to automated decision-making, customer rights, and local and global regulatory frameworks governing data usage.

Core Compliance Areas:

- Retention and data lifecycle policies

- Automated decision transparency

- Data privacy and consent management

- Model auditability and traceability

Best Practices for Insurance AI Compliance:

- Implement approval workflows for high-risk decisions

- Maintain detailed audit trails for AI decisions

- Frequently review and update models for regulatory alignment

Why It Matters: Thus, you can ensure AI adoption doesn’t violate consumer protection laws or insurance regulations.

♦ Data Security in AI Insurance Automation

Insurance systems process extremely sensitive financial and personal data. To protect policyholders and to comply with regulations, you should opt for robust security controls.

Key Security Measures:

- Secure cloud infrastructure and disaster recovery

- End-to-end data encryption (at rest and in transit)

- Secure API gateways and authentication

- Role-based access control (RBAC)

- Continuous vulnerability assessments

Why It Matters: It diminishes breach risk, safeguards customer data, and protects the insurer’s reputation.

♦ Explainable AI (XAI) in Insurance Decision-Making

Opting for Explainable AI in insurance guarantees that automated decisions are understood, challenged, and justified when needed.

Key XAI Powers:

- Human-readable decision summaries

- Transparent reasoning behind claim approvals or rejections

- Model confidence scores and feature importance

- Risk score explanations for underwriting decisions

Use Cases Demanding Explainability:

- Fraud flagging

- Claim denials

- Policy cancellations

- Premium pricing

Why It Matters: It strengthens trust among auditors, regulators, and customers while mitigating legal risk.

♦ Governance, Monitoring & Accountability

Powerful governance leads to the development of AI systems that stay effective and compliant over time.

Governance Components:

- Incident response and rollback mechanisms

- AI oversight committees

- Periodic compliance audits

- Continuous monitoring of model drift

- Defined ownership and accountability

Why it matters: It helps keep AI systems aligned with expected business goals, ethical principles, and regulatory standards.

♦ Bias Mitigation & Ethical AI Practices

Without intention, AI models intensify biases existing in training data. By following ethical AI, you can ensure inclusivity and fairness.

Ethical AI Best Practices:

- Transparent AI governance policies

- Bias detection and fairness testing

- Regular model performance reviews

- Diverse and representative training datasets

- Human-in-the-loop decision validation

Why It Matters: It avoids discriminatory results and favors responsible insurance automation.

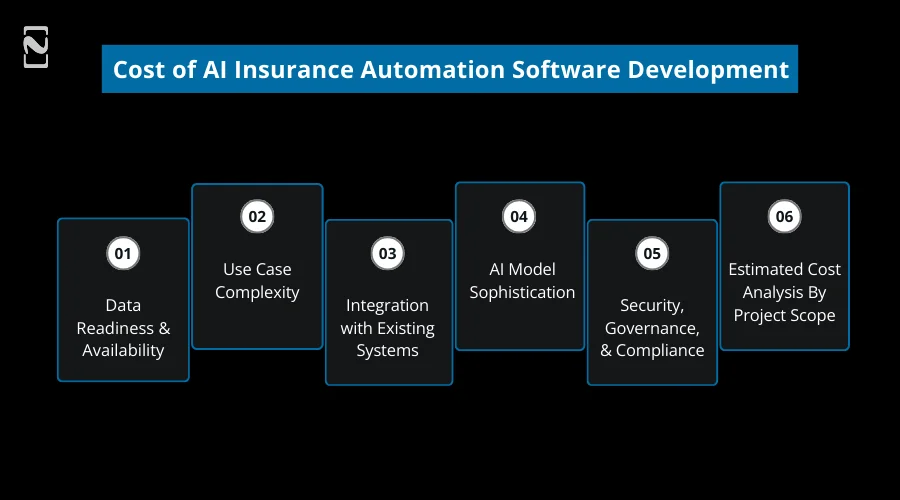

Cost of AI Insurance Automation Software Development

To know the exact cost to develop an insurance app or software, you need to connect with experienced AI consultants with your project requirements and scope.

For the time being, we will know the average AI insurance automation software development cost lies anywhere between $40,000 -$80,000 for an MVP and $150,000-$400,000+ for enterprise-grade solutions based on the data complexity, automation, integration depth, and compliance needs.

Key Factors Affecting AI Insurance Software Cost :

➤ Data Readiness & Availability

With clean and well-labeled data, you can reduce development time. However, poor data quality leads to increased preprocessing and validation pricing. Also, third-party data integrations contribute to the expenses.

➤ Use Case Complexity

Claim automation is generally complex, and underwriting and fraud detection demand advanced modeling. Additionally, multi-workflow automation elevates the development effort.

➤ Integration with Existing Systems

Integration of AI insurance software with old core insurance systems increases the cost. API readiness leads to reduced maintenance and development costs.

➤ AI Model Sophistication

You need a high investment for deep learning models for computer vision and NLP. However, rule-based and ML hybrid models don’t add much to the cost. Bias mitigation and explainable AI add complexity but are crucial.

➤ Security, Governance, & Compliance

It requires regulatory compliance implementation, data security, access controls with audit trails and explainability.

Yes, there’s no doubt that AI automation requires upfront investment, but you need to be sure that it provides robust insurance automation ROI via operational savings, boosted accuracy, and rapid processing.

➤ Estimated Cost Analysis By Project Scope

| Project Scope | Estimated Cost Range |

| Proof of Concept (PoC) | $20,000 – $40,000 |

| MVP AI Automation Solution | $40,000 – $80,000 |

| Single Workflow Automation | $80,000 – $150,000 |

| Enterprise-Grade AI Platform | $150,000 – $400,000+ |

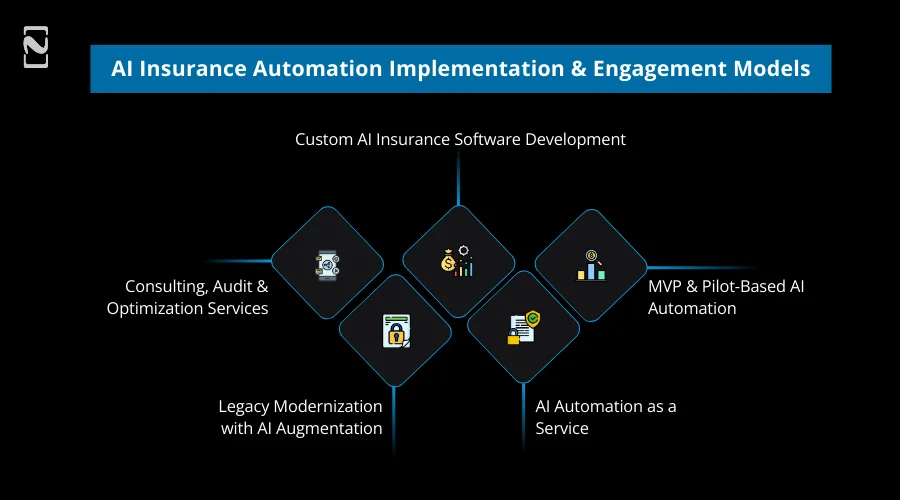

AI Insurance Automation Implementation & Engagement Models

AI insurance automation is implemented through custom software, enterprise solutions, or SaaS models.

Flexible engagement models ensure scalable enterprise insurance automation solutions while optimizing costs, improving efficiency, and accelerating digital transformation for insurers.

Insurance companies can attain AI insurance automation through several engagement and monetization models, relying on their budget, objectives, and internal caliber.

1. Custom AI Insurance Software Development

Best for: Mid-to-large insurers, insurtechs, and enterprises

- Entirely customized AI automation platform

- Tailored workflows for underwriting, fraud, and claims

- Deep integration with core insurance systems

- Ownership of IP and models

Monetization Outcome: Long-term operational savings and competitive differentiation.

2. MVP & Pilot-Based AI Automation

Best for: Insurers initiating AI adoption

- Limited-scope automation like document processing and claims intake

- ROI validation before full-fledged rollout

- Faster time-to-market (around 8 to 12 weeks)

Monetization Outcome: Early wins and data-driven investment justification.

3. AI Automation as a Service

Best for: Insurers looking for flexibility and scalability

- Cloud-based deployment

- Continuous model optimization

- Consistent support and compliance updates

- Usage-based or subscription pricing

Monetization Outcome: Predictable costs and ongoing improvement.

4. Legacy Modernization with AI Augmentation

Best for: Insurers with legacy core systems

- Minimal disruption to current operations

- AI layered on top of existing platforms

- Gradual transformation

Monetization Outcome: Rapid ROI without complete system replacement.

5. Consulting, Audit & Optimization Services

Best for: Enterprises with existing AI systems

- AI readiness assessment

- Performance optimization

- Compliance and bias audits

Monetization Outcome: Risk reduction and increased system efficiency.

What are the Challenges in AI Insurance Automation Software Development and Solutions

While you develop AI insurance automation software, you may face various major issues, like complex legacy system integration, poor data quality, ethical AI considerations, and strict regulatory compliance.

Insurers can confront these challenges by utilizing custom insurance automation software with modern technologies. They can also implement scalable enterprise insurance automation solutions to improve claims processing and policy management efficiency.

Common challenges with solutions are:

Challenge #1: Poor Data Quality Can Reduce the Accuracy Of AI Models and Automation Tools

Solution: You should implement machine learning with powerful data preprocessing and validation to catch up with reliable outcomes.

Challenge #2: Legacy System Integration

Solution: Insurers can harness the potential of custom insurance automation software crafted to integrate with existing processes and platforms.

Challenge #3: Regulatory Compliance Requirements

Solution: Organizations should create enterprise insurance automation solutions by adhering to security, data privacy, and industry regulations.

Challenge #4: Ethical AI Concerns

Solution: By implementing insurance automation with explainable AI models and routine auditing, you can attain fairness.

Challenge #5: Repetitive manual processes increase operational costs and reduce efficiency.

Solution: RPA in insurance can help you automate routine jobs like data entry, claims processing, and policy administration.

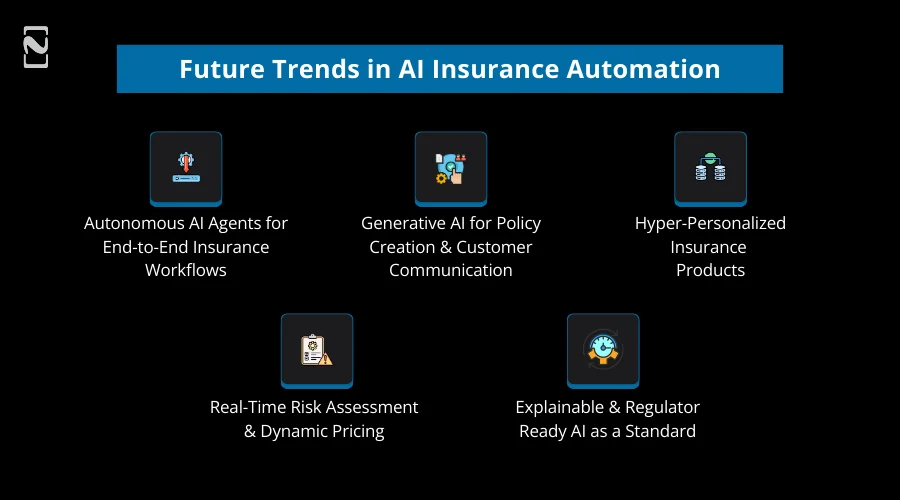

What are the Future Trends in AI Insurance Automation

Future AI insurance automation trends incorporate generative AI, machine learning, and robotic process automation to deliver predictive risk assessment, personalized policies, and autonomous claims processing. Enterprise insurance automation solutions and custom insurance automation software will drive accuracy, efficiency, and enhanced customer experience.

With the changing digital space, AI insurance automation is evolving, surpassing task-based automation towards autonomous, intelligent, and highly personalized insurance ecosystems.

Insurers who adopt these surfacing trends early will attain a competitive edge in risk management, efficiency, and customer experience.

1. Autonomous AI Agents for End-to-End Insurance Workflows

Soon, you will witness AI agents managing comprehensive insurance workflows, from claim approval to settlement, with no consistent human intervention.

What’s Changing:

- Dynamic decision-making based on real-time data

- Self-learning AI agents managing underwriting, claims, and renewals

- Automatic escalation only for high-risk or complex cases

Impact: Faster processing, lower operational costs, and scalable insurance operations.

2. Generative AI for Policy Creation & Customer Communication

Generative AI will reshape how insurance policies, customer communications, and endorsements are built.

Key Applications:

- Personalized policy recommendations

- Auto-generated policy documents

- Dynamic FAQs and support content

- Context-aware customer responses

Impact: Decreased reliance on manual content creation and improved personalization.

3. Hyper-Personalized Insurance Products

AI will empower insurers to switch from static pricing models to behavior-driven, real-time personalization.

Key Drivers:

- Behavioral analytics

- Telematics and IoT data

- Usage-based insurance models

Impact: Fairer pricing, higher customer retention, and better risk prediction.

4. Real-Time Risk Assessment & Dynamic Pricing

Insurance pricing will become more adaptive and data-driven.

What’s Evolving:

- Event-driven premium adjustments

- Constant risk monitoring

- Predictive loss modeling

Impact: Enhanced underwriting profitability and accuracy.

5. Explainable & Regulator-Ready AI as a Standard

From being a “nice-to-have”, explainable AI will become a mandatory need.

Key Developments:

- Transparent audit trails

- Built-in decision explainability

- AI governance frameworks

Impact: Robust regulatory trust and rapid AI approvals.

How Nimble AppGenie Help With AI Insurance Automation Software Development?

Choosing a leading insurance automation software development company will help you build custom insurance automation software. The enterprise insurance automation solutions they create streamline underwriting, policy management, and claims processing, and improve overall operational efficiency.

With years of experience as a leading AI development company, Nimble AppGenie has been chosen for AI insurance automation software development.

With deep proficiency in AI, workflow automation, insurance system integration, and machine learning, our AI developers help InsurTech shift from manual processes to data-backed operations.

Our team of AI experts does not just offer one-size-fits-all solutions; instead, our approach targets use-case-driven AI automation, ensuring regulatory readiness, measurable ROI, and lasting scalability.

Our AI Insurance Automation Capabilities

- AI-Powered Fraud Detection.

- Claims & Underwriting Automation.

- Legacy System & Core Insurance Integration.

- Scalable Insurance AI Technology Stack.

- Explainable & Compliant AI.

- End-to-End AI Insurance Software Development.

Real-Time Case Study (Client Name Withheld)

Client :

A mid-sized general insurance provider (Asia Pacific region) was facing issues with increasing operational costs, slow claims processing, and rising fraud risks. Their manual claims review procedure results in poor customer satisfaction and lengthy settlement cycles.

Challenges They Faced :

- Legacy system constraints

- Average claim settlement time exceeded 12 days

- Limited fraud detection capabilities

- Heavy dependence on manual document verification

- High operational overhead across claims teams

Solutions We Offered :

By following proven development and insurance AI implementation best practices, we created and implemented a custom AI insurance automation platform targeting claim processing.

Results Achieved :

- 65% drop in claim settlement turnaround time

- 50% reduction in manual claim review workload

- Diminished operational costs within the first 6 months

- Boosted fraud detection accuracy with fewer false positives

- Increased customer satisfaction through faster claim resolution

Business Impact :

The insurer witnessed expected insurance automation ROI within the first year. Later, the solution was scaled to extra insurance lines.

Conclusion

Are you planning to do AI insurance automation software development? It’s the right decision you would take at the right time. It’s not a future initiative now; it’s a strategic need for insurers to outshine their competitors in the dynamic digital landscape.

AI in insurance software strengthens insurers to operate smarter, faster, and more efficiently. This insurance AI development guide includes every minute detail you need for insurance workflow automation.

However, success relies on choosing the right AI development company that understands insurance domain complexities, scalable AI architecture, and regulatory needs. Contact us now and get started with the development of your insurance automation software.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.