Do you know legacy systems in banking affect banks’ competitive position and bottom line?

Outdated banking systems come with hidden risks of integrity complexity, lost opportunities, and a shortage of powerful security features that are mandatory to beat modern cyber threats.

| A latest study by IBM states that in financial institutions, data breaches generally cost around 28% higher compared to the global average of approximately $5.9 million per breach. |

Eyeing these challenges, financial institutions’ C-Suite, vendors, banking solution providers, product and digital teams, and all concerned stakeholders should emphasize the need to change their legacy banking systems.

Obviously, you might be hesitant to manage a complete system replacement because of high costs and relevant risks.

Not to fret!

This post is for you, where we will discuss an alternative for this, i.e, core banking modernization, associated challenges with possible solutions, risks you may catch if you don’t modernize, and every minute detail you need for modernizing your banking institution.

Let’s get the ball rolling!

What are Legacy Systems in Banking?

Legacy systems in banking are mainframe-based technology platforms that have been in use for decades of years, running core banking operations, like loans, accounts, and transactions. They leverage outdated tech that is expensive to maintain, inflexible, and find it tough to support the latest digital requirements.

However, most traditional banks still use legacy traditional systems, and their inflexibility is confronting the need to adapt to new regulations.

Challenges Caused by Legacy Banking Systems

Legacy core banking systems pose notable challenges across operational, business, and technical domains, hampering an organization’s ability to innovate, adapt, and compete in the evolving digital space.

While important for core business functions, such outdated technologies create conflicts that impact security, efficiency, and customer experience.

► Operational Challenges

With the discontinued support of older systems from vendors, custom maintenance and specialized expertise consumes 80% of IT budgets.

Above that, legacy systems depend on manual procedures and have no automation capabilities, which increases the chances of human error and operational delay.

Furthermore, as designed specifically for past business requirements, these systems may find it hard to manage the surging workloads, the rising number of users, or market expansion.

► Business & Customer Challenges

Today, customers expect personalized, smooth, and omnichannel experiences, and outdated systems struggle to provide that with limited online functionalities and slow interfaces that leave customers dissatisfied and frustrated.

When your legacy systems fail to adapt to an evolving market, utilize new technologies, and meet escalating customer expectations, it can lead to the loss of a competitive edge.

► Technical Challenges

Obviously, old systems use outdated proprietary and data formats; you will find it impossible to integrate cloud platforms, software, or AI solutions.

Also, you will see various old systems still using batch processing, not real-time data capabilities, which results in slow decision-making and reporting.

Legacy systems lack open APIs that complicate your integration efforts, demanding extensive custom development.

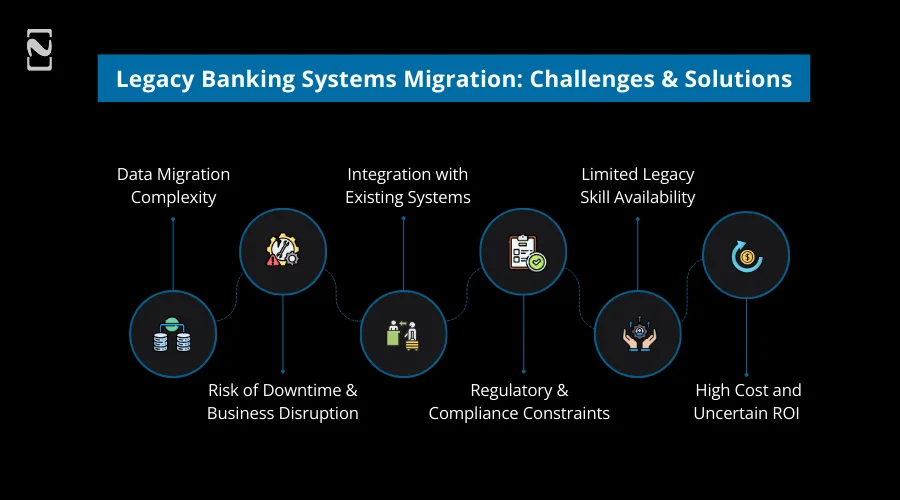

Legacy Banking Systems Migration: Challenges and Solutions

Banks should undertake migration from legacy systems, which involves technology, regulatory, business, and operational changes.

Also, it comes with legacy banking systems migration challenges and solutions to address them.

Below, we have put forth key migration challenges you can encounter and

1. Data Migration Complexity

Legacy systems store data in fragments with inconsistent schemas, which makes migration error-prone and risky.

Solution:

- Conduct early data profiling and cleansing

- Utilize AI-assisted data validation and anomaly detection

- Leverage phased data migration, not one-time transfers

2. Risk of Downtime and Business Disruption

A system outage hampers regulatory compliance and trust.

Solution:

- Run parallel systems during transition

- Choose incremental migration approach

- Implement robust rollback and failover mechanisms

3. Integration with Existing Systems

Legacy centers the struggle to integrate with fintech platforms, modern apps, and open banking APIs.

Solution:

- Split digital channels from core systems

- Implement API-led integration layers

- Utilize middleware to enable real-time communication

4. Regulatory and Compliance Constraints

With rigid banking regulations, banks experience limitations while migrating systems and data.

Solution:

- Employ private or hybrid cloud models when needed.

- Align the migration strategy from day one with compliance teams

- Maintain regulatory reporting and audit trails throughout migration

5. Limited Legacy Skill Availability

Legacy technologies depend on decreasing talent pools, heightening operational risk.

Solution:

- Gradually replace or refactor high-risk components

- Use AI tools for documentation and code analysis

- Upskill internal teams with modernization efforts

6. High Cost and Uncertain ROI

Large-scale migrations demand considerable investment with undefined returns.

Solution:

- Measure ROI via enhanced time-to-market and cost savings

- Prioritize high-impact use cases

- Utilize phased investments, not big-bang migrations

| Did You Know – Why Banks Should Choose a Structured Migration Strategy?

Banks that confront migration challenges with a compliant, phased, and tech-centric approach diminish risk significantly while pacing digital transformation. |

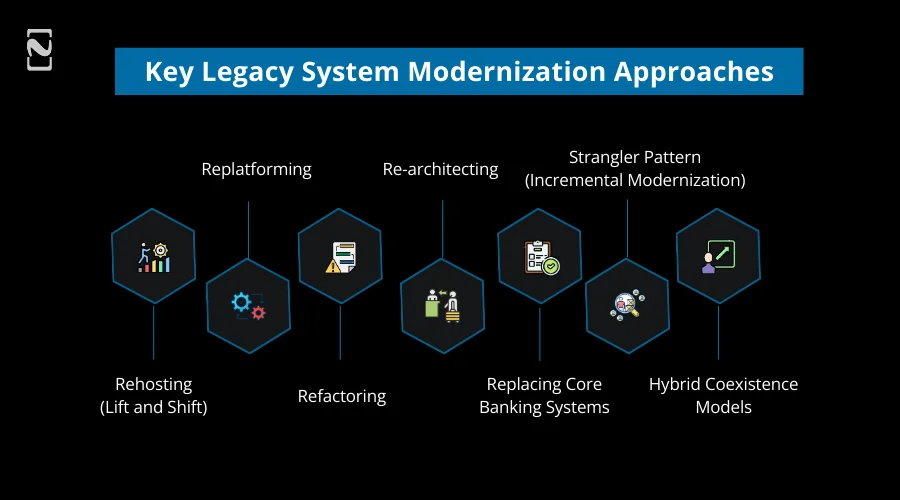

Key Legacy System Modernization Approaches

When you update an old system harnessing modern tech, it’s legacy system modernization, which improves security, efficiency, customer experience, and scalability.

How to modernize legacy banking systems step by step?

Often known as the “7 R’s,” key legacy system modernization approaches incorporate:

- Rehost

- Replatform

- Refactor

- Re-architect

- Replace

- Retain

- Retire

This complete spectrum balances cost, potential business value, and risk for systems.

1] Rehosting (Lift and Shift)

When you move legacy banking applications to a new infrastructure, usually the cloud one, with no change in the core architecture of the application, it is rehosting.

- Best for: Quick infrastructure upgrades with minimal risk.

- Benefits: Rapid migration with lower upfront cost.

- Limitations: Does not eradicate technical debt or improve agility.

2] Replatforming

Next approach, replatforming comes up with limited optimizations during app migration, such as adopting middleware or managed databases, while holding the key application logic.

- Best for: Enhancing performance with no major redesign.

- Benefits: Better scalability and cost efficiency

- Limitations: Partial modernization and legacy restrictions still exist

3] Refactoring

Refactoring includes the modification of the application’s internal code to boost performance, compatibility, and maintainability with modern platforms, without impacting its external behavior.

- Best for: Long-term optimization of critical systems

- Benefits: Decreased technical debt in banking and improved stability

- Limitations: Demands skilled teams and thorough testing

4] Re-architecting

The legacy system modernization approach completely redesigns the system architecture, usually segmenting monolithic systems into event-driven architectures or microservices for banks.

- Best for: Banks looking for agility and scalability.

- Benefits: Faster innovation and enhanced integration capabilities

- Limitations: High complexity and cost

5] Replacing Core Banking Systems

Here, replacing indicates retiring the legacy platform and core banking replacement, and choosing cloud-native core banking system.

- Best for: Banks experiencing large-scale digital transformation

- Benefits: Clean slate and future-ready architecture

- Limitations: High risk, extended timelines, and effective change management

6] Strangler Pattern (Incremental Modernization)

This core banking modernization approach replaces outdated components gradually with modern services, permitting old and new systems to coexist during the shift.

- Best for: Minimizing disruption in highly regulated environments

- Benefits: Lower risk, phased investment, and ongoing value delivery

- Limitations: Needs robust integration and governance

7] Hybrid Coexistence Models

Hybrid models enable legacy as well as modern systems to perform together, usually integrating on-premise mainframes with cloud-based services.

- Best for: Banks with stringent regulatory or data residency needs

- Benefits: Flexibility and gradual transition

- Limitations: Added architectural complexity

| Did You Know – Why Banks Prefer Incremental Modernization?

Most banks choose a combination of legacy modernization approaches, usually starting with replatforming or rehosting, then stepping ahead towards re-architecting models. This diminishes risk while allowing continuous innovation. |

Best Practices for Legacy Modernization in Banking

Best practices for legacy modernization in banks are essential for avoiding risks and ensuring the accomplishment of meaningful outcomes.

Below, we will discuss the best practices you should consider while modernizing a legacy system in investment banking.

1. Start Focusing on Business Outcomes, Not Just Technology Upgrades

You should consider your business goals clearly, like whether you want a rapid product launch, regulatory compliance (GDPR/PCI/PSD2/BCBS), cost reduction, or improved customer experience, despite performing technology upgrades only.

2. Adopt a Phased, Yet Low-Risk Modernization Approach

Banks shouldn’t go for big migrations for once. They should choose incremental modernization to allow systems to step-by-step upgrade, diminishing regulatory and operational risk.

3. Ensure Robust Governance and Executive Sponsorship

For successful modernization, banks need executive alignment, decision-making frameworks, and clear ownership to manage budgets, priorities, and risk across different departments.

4. Prioritize Data Migration and Data Integrity

Data consistency, security, and accuracy are all critical for banks. They should plan data migration meticulously, maintain complete audit trails, and validate data at each stage to meet regulatory needs.

5. Build API-First and Integration-Ready Architectures

Developing an API-led architecture allows legacy systems to accompany the latest digital channels, open banking ecosystems, and fintech partners without disturbing core operations.

6. Embedded Security and Compliance from Day One

Banks should ensure integration of security and compliance throughout the modernization lifecycle, embracing access controls, monitoring, encryption, and adherence to regulations like GDPR, PCI DSS, and local banking standards.

7. Leverage Cloud and Hybrid Models Strategically

Based on the strategy you make, choose on-premise, cloud, or hybrid models according to your regulatory needs, data sensitivity, and workload criticality, despite adopting cloud randomly.

8. Use Automation and AI to Reduce Risk and Effort

Automation and AI can pace legacy modernization by enhancing code analysis, anomaly detection, data validation, and test automation, while mitigating manual errors.

9. Invest in Change Management and Skill Transformation

Modernization impacts people in the same way as the system. For long-term success, you should ensure cross-functional collaboration, manage cultural change, and upskill teams.

10. Measure Progress with Clear KPIs

Banks should constantly track modernization results by defining measurable success metrics, cost savings, time-to-market, customer satisfaction, and system availability.

| Did You Know – Why Best Practices Matter to Banks?

Banks that consider following structured, incremental, and compliant modernization practice are positioned better to improve agility, mitigate risk, and stay competitive in a swiftly changing financial landscape. |

Role of Cloud, APIs, and Microservices

Obviously, if you modernize legacy banking systems, you not only focus on replacing the old one, but you also build a scalable, flexible, and futuristic digital basis.

Microservices, APIs, and cloud computing all play a significant role in supporting this transformation.

Should banks move mainframes to the cloud? Let’s figure this out.

Cloud – Enable Resilience, Scalability, and Cost Efficiency

With cloud platforms, banks can keep a distance from inflexible infrastructure-heavy environments and can go for on-demand scalability.

Cloud-native core banking:

- Boost disaster recovery and system resilience,

- Mitigate maintenance and infrastructure costs,

- Approve elastic scaling during heightened transaction periods, and

- Enables multi-cloud and hybrid models to fulfill regulatory and data residency needs.

| Points to Remember: Cloud adoption offers a robust foundation for incremental modernization without distracting from core banking operations. |

APIs: Linking Legacy Systems with Modern Digital Channels

Acting as a bridge between modern banking applications and legacy core systems, APIs enable smooth integration with fintech partners, mobile apps, and an open banking environment.

APIs in core banking modernization:

- Permit banks to reveal legacy functionality safely with no need to rewrite the whole system,

- Reinforce real-time data access and swift service delivery, and

- Accelerate innovation while upholding control and compliance.

| Points to Remember: API-led integration is usually the first step banks take in gradual legacy modernization. |

Microservices: Driving Agility and Faster Innovation

Microservices divide large, monolithic banking apps into smaller, autonomous deployable services.

Benefits for Banks:

- Enhance system scalability and flexibility,

- Allow rapid development and deployment cycles,

- Reduce the risk linked with large-scale system modifications, and

- Allow teams to gradually modernize components.

| Point to Remember: Banks can modernize their legacy systems at their own pace by fusing the power of microservices with legacy cores while retaining operational stability. |

How They Work Together

When working together, cloud, APIs, and microservices create a modernization ecosystem that lets banks shift from a stringent legacy architecture to digital-first, agile platforms.

| Did You Know – How Cloud, APIs, and Modernization Can Help Banks?

Banks can efficiently use APIs, cloud, and microservices to boost customer experience, diminish technical debt, and accelerate innovation, without hindering compliance or security. |

AI in Legacy Banking Modernization

In legacy banking modernization, AI is becoming a strong assistant that helps banks accelerate conversion, reduce risk, and draw complete value from current systems with no large-scale disruption.

Check out how you can reap the benefits of AI in banking modernization.

1. AI for Legacy System Discovery and Code Analysis

AI-powered tools hold the caliber to scan legacy codebases automatically, like CPBOL and PL/I, to recognize business rules, system risks, and dependencies.

- Decreases dependence on inadequate legacy skillsets

- Enhances planning precision for modernization initiatives

- Accelerates system understanding

2. AI-Driven Test Automation and Quality Assurance

Modernization efforts need deep testing to avoid outages. Here, AI generates and optimizes test cases automatically to improve test coverage.

- Catches regression issues early

- Boosts system stability during phased migrations

- Dwindles manual testing effort

3. AI for Data Migration and Data Quality Management

AI models can intelligently validate, map, and cleanse data while migrating from legacy systems to modern platforms.

- Determines data inconsistencies and anomalies

- Ensures data integrity and accuracy

- Support regulatory audit needs

4. Predictive Monitoring and Risk Management

AI identifies potential performance issues or failures before they affect operations.

- Predictive alerts for system outages

- Improved fraud and anomaly detection

- Intelligent capacity planning

5. AI-Powered Operational Efficiency

AI-driven automation alleviates the operational burden on legacy systems by managing routine jobs and customer interactions,

- Chatbots and virtual assistants reduce system load

- Swift response times and enhanced customer experience

- Intelligent workflow automation boosts efficiency

6. Governance, Explainability, and Compliance

AI should be controllable and transparent in controlled banking environments.

- Robust model governance and auditability

- Explainable AI for regulatory reporting

- Secure data usage oriented towards compliance standards

| Did You Know – Why AI is Important in Legacy Modernization?

Obviously, AI can’t replace legacy systems nightly. Rather, the technology helps banks to modernize, diminishing cost, reducing risk, and pacing results while upholding operational scalability. |

Legacy Modernization Readiness Checklist

Know whether your bank needs to modernize legacy systems by walking through this checklist.

- Legacy systems are delaying product launches and digital initiatives.

- Infrastructure costs and high maintenance are influencing IT budgets.

- Limited integration with fintech partners and modern digital channels.

- Data silos restrict real-time insights and personalization.

- Raising security and compliance risks.

- Reliance on outdated technologies and insufficient skillsets.

- Limited scalability to sustain peak transaction volumes and growth.

- Manual processes and operational inefficiencies.

- Facing challenges in adopting cloud, APIs, and microservices.

- Lack of visibility into technical debt and system performance.

If most of these apply, it’s time to create a well-structured modernization roadmap.

How Nimble AppGenie Can Help You?

Recognized as a leading banking app development company, Nimble AppGenie partners with financial institutions and banks for modernizing legacy systems in banking, following a future-ready approach.

- End-to-end legacy system assessment and modernization roadmap

- Cloud, hybrid, and microservices-based modernization strategies

- API-led integration to connect legacy core systems with modern digital channels

- Intense focus on compliance, security, and risk mitigation

- AI-driven automation for testing, code analysis, and data migration

- Phased execution to minimize disruption and ensure business continuity

- Helping with legacy banking systems migration challenges and solutions

Legacy System Modernization Case Study – Banking

Client: A regional bank struggled with old, outdated core banking systems that raised maintenance costs, delayed digital innovation, and limited integration with modern channels.

Solutions We Offered:

- We helped adopt a phased modernization approach, leveraging API-led integration, AI-driven testing, data validation, and hybrid cloud architecture

- Our team of developers modernized legacy systems gradually without interfering with daily operations.

Results:

- 40% faster time-to-market for digital features

- Improved security, scalability, and customer experience

- 30% reduction in operational costs

Get a legacy system assessment. Talk to our banking modernization experts.

Conclusion

When are you modernizing your legacy systems in banking?

Today, legacy systems in banking are no longer essential to gain a competitive edge. Instead, they have become a restriction on agility, innovation, and growth.

As the digital-first banking landscape requires scalability and intelligence with ultimate speed, core banking modernization is now a new demand.

Adopt a phased modernization approach strengthened by APIs, cloud, microservices, and most importantly, AI.

Thus, banks can reap lasting digital advantages without hampering compliance and security.

It’s time to partner with a trusted firm to modernize legacy banking systems.

FAQs

Well, in the near future, we can’t expect outdated systems to disappear. Rather, banks will modernize them gradually, permitting modern and legacy systems to coexist while incrementally minimizing dependency on legacy systems in banking.

Considering the time core banking modernization takes, it varies depending on the approach and complexity. Incremental modernization can provide value within months, while comprehensive core replacement programs demand several years.

Yes. Cloud-native core banking is safe when you implement it with proper encryption, security controls, regulatory compliance, and governance. Not only cloud, but hybrid models are also safe and widely chosen across the banking industry.

No. AI augments the strength of legacy systems, despite replacing them. It improves code analysis, data migration, testing, and operational efficiency by accelerating modernization.

The cost of core banking modernization varies based on approach, scope, and scale. Typically, phased modernization strategies diminish upfront investment and risk compared to one-time system replacements.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.