Use of fintech apps has grown significantly in the past few years.

However, irrespective of how popular fintech as an entity has become, the harsh truth is that 7 out of 10 fintech apps get shut down in their first year of business.

The reason behind this issue is not the lack of demand or user base, but the user experience and features. Entering the market with an unbalanced app that lacks modern features is nothing less than suicide in this cut-throat competition.

Features play a crucial role in creating the balance of the application. In this post, let us take a look at some fintech features that are a must-have. We will also be looking at advanced features that can uplift your app’s user experience, as well as some additional features that you can opt to keep.

So without further ado, let’s get started!

Types of Fintech App Features

Before we jump to the list of features, we need to understand the types of features that make up a successful app. Adding features to your fintech app is more like preparing a medium-rare steak; a simple mistake and the temperature and your chances of achieving the best are gone.

Now you may be wondering, what does it mean when we talk about “types of features” in a fintech app? While everything you interact with in an app is a feature, the degree of those features varies.

There are features that are the base of the app, for which people install it, then there are features that make the experience different from existing apps, and then there are features that are just there to gain retention

Based on these, fintech features can be classified into 3 categories:

- Core/Essential Features

- Advanced Features

- Additional Features

The classification of features can be further made based on the panel or the type of users for whom the features are intended. For instance, there are Admin features, User Features, Backend Features, etc.

To give you a better understanding and clarity, we have listed all the fintech app features below as per their category. Check them out!

Core Fintech App Features

Let’s start with the essential or core fintech app features.

These are basic features that a fintech app should have. Whether you are talking about creating a loan lending platform or a neobank app development, this statement holds true.

In any case, let’s get right into the features:

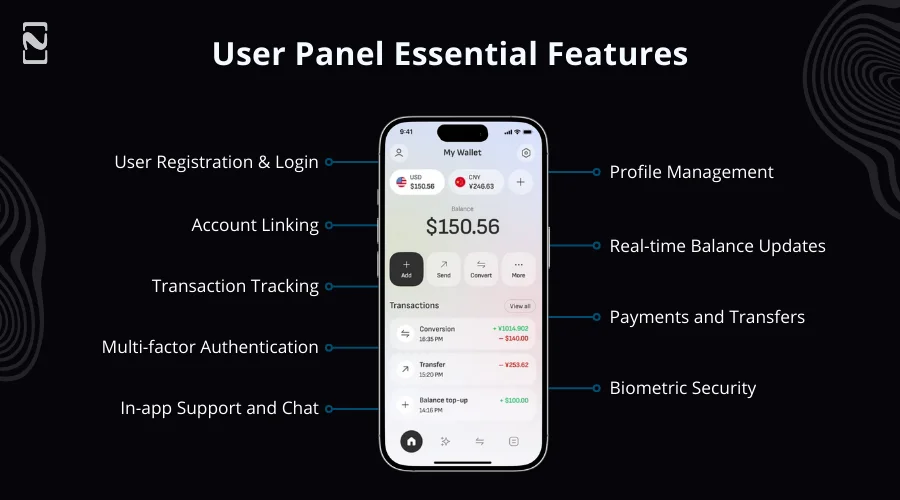

► User Panel Essential Features

Let’s start with the core feature for the user panel of the fintech app.

For those who aren’t familiar with the concept, an app is often divided into panels depending on the user and their needs.

When we speak of the user panel, we are talking about end users.

So, in layman’s terms, the core features for end-users of fintech apps are, as mentioned below:

1. User Registration and Login

This feature allows users to securely register and log into the app using various methods, including email, phone number, or through social media integrations, providing flexibility and ease of access.

2. Profile Management

Users can update and manage their personal information and account settings, ensuring their details are always current and accurate.

3. Account Linking

This functionality allows users to link multiple bank accounts to the app, enabling them to manage all their financial assets from a single platform.

4. Real-time Balance Updates

Real-time balance updates, as the name suggests, provide users with immediate updates on the balances of all their linked accounts, ensuring they have the latest information at their fingertips.

5. Transaction Tracking

With transaction tracking, the user can easily view and categorize their past transactions, which helps in tracking spending patterns and better financial management.

6. Payments and Transfers

With this, the fintech app supports peer-to-peer (P2P) payments and facilitates other types of transfers, including international transactions, making it easier to move money when needed.

7. Multi-factor Authentication

This authentication system enhances the security of the app by requiring multiple forms of verification for logging in and executing transactions, adding an extra layer of protection.

8. Biometric Security

You should integrate biometric security measures such as fingerprint scanning and facial recognition, offering users a secure and rapid way to access their accounts.

9. In-App Support and Chat

Lastly, we have the much-needed support feature, which provides users with direct access to customer support through FAQs and live chat options within the app, ensuring help is always available when needed.

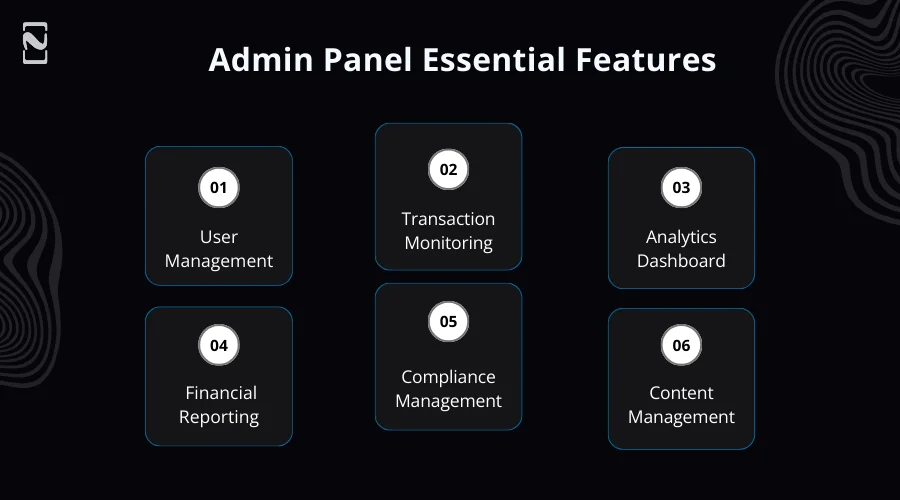

► Admin Panel Essential Features

Let’s talk about the admin panel.

Admin stands for the administrator of the platform, or we can say the team that manages the platform.

There can indeed be more platforms depending on the fintech app’s business model, but these are the two core features.

Speaking of which, these are, as mentioned below:

10. User Management

Admins can oversee user activities, approve new accounts, manage user roles, and handle disputes efficiently. This control is essential for maintaining the security and functionality of the platform.

11. Transaction Monitoring

The feature’s robust tools for monitoring all transactions within the app are aimed at detecting fraudulent activity and ensuring adherence to financial regulations.

12. Analytics Dashboard

With this, you provide the user with comprehensive insights into app usage patterns, financial trends, and key operational metrics, helping stakeholders make informed decisions.

13. Financial Reporting

Financial Reporting Feature: Generates detailed financial reports for both regulatory compliance and internal analysis purposes. This is helpful in decision-making.

14. Compliance Management

Let’s have a look at the compliance management feature of the admin panel. With this, you will equip the platform with the tools necessary to maintain compliance with evolving financial regulations and laws.

15. Content Management

Lastly, we have the content management functionality of the admin panel. This enables admins to easily update educational materials, notifications, and other app content, ensuring that information remains current and relevant.

► Advanced Fintech App Features

Let’s take things to the next step.

There are amazing fintech app ideas and, to complement them, advanced features.

Moreover, when considering the development or upgrade of a fintech app, integrating advanced features can significantly boost its appeal and functionality.

Here are some sophisticated features that cater to a discerning audience looking to leverage cutting-edge technology:

16. Artificial Intelligence (AI) Advisory

AI app development has become quite prominent.

The effects of this trend are seen across the industry. One example is this fintech app’s advanced feature. AI advisory.

Here, we utilize AI in fintech to deliver personalized financial advice and investment strategies.

By analyzing user data and market trends, this feature can help users make smarter investment choices tailored to their goals and risk tolerance.

17. Machine Learning Fraud Detection

Take a look at this amazing example of Machine Learning in app development and ML-driven fraud detection features.

With the rise of fraud across the world, fintech has to fortify itself.

With this feature, you can implement machine learning algorithms to identify and prevent fraudulent activities.

Moreover, it will continuously learn from transaction patterns, enhancing its ability to quickly spot anomalies and secure user assets.

18. Blockchain Integration

Blockchain is yet another of the big Industry 4.0 technologies set to change the world.

So how does it apply to fintech apps’ advanced feature list?

Well, incorporate blockchain technology to ensure transactions are secure and transparent.

This decentralized approach not only enhances security but also builds trust among users by providing an immutable record of transactions.

19. Multi-Currency Support

The entire world doesn’t use one currency.

Rather, there are a lot of different currencies, and with this feature, you can tempt them all.

It will support multiple currencies for transactions, which is particularly beneficial for users who travel frequently or engage in international business.

Nimble AppGenie developed “Pay By Check” wallet, a fintech platform that leverages multi-currency support to take over the market. What are you waiting for?

20. Robotic Process Automation (RPA)

Yet another one of the Industry 4.0 trends we have is robotic process automation.

In similar terms, platforms automate routine and repetitive tasks such as data reconciliation and compliance reporting.

This increases operational efficiency and allows staff to focus on more strategic activities.

21. Voice Recognition Systems

Well, voice recognition systems are limited to Siri and Google Assistant anymore.

Voice payment has become a trend in fintech.

This feature takes full advantage of it, enabling users to perform financial transactions and access important information via voice commands.

This hands-free interaction enhances accessibility and user convenience.

22. Augmented Reality Interfaces

AR/VR trends have made their way to the fintech space, giving us this feature.

Uses augmented reality to help users visualize financial scenarios, such as projected savings or investment growth.

This immersive technology can make complex data more understandable and engaging.

23. Advanced Biometrics

Biometric authentication has now become a basic fintech feature.

But what if we were to take it to the next step?

Advanced Biometrics is all about that.

Here, we employ sophisticated biometric technologies, such as iris scanning, providing a higher level of security compared to traditional methods.

This can prevent unauthorized access and enhance user confidence.

24. Predictive Analytics

Features aren’t just to keep the user happy; they are also to study them.

And that’s made possible via analytics, which drives decision-making. When we speak of predictive analytics, it leverages historical data to forecast future financial conditions and user behaviors.

Financial institutions can use these insights to tailor their services and meet user needs.

25. Chatbots and Virtual Assistants

To be a truly next-gen fintech app, you should definitely consider this feature.

Chatbots and virtual assistants.

Here, we implement AI-driven chatbots and virtual assistants to provide round-the-clock customer support and financial guidance, making the service accessible at any time without human intervention.

26. Cryptocurrency Transactions

Don’t create a crypto app; rather, integrate it into your fintech solution as a feature.

Supports handling of digital currencies, allowing users to perform transactions in cryptocurrencies alongside traditional money.

Thus, it appeals to tech-savvy users and investors in the digital currency space.

27. P2P Lending Platforms

The growth and popularity of loan lending apps are unmatched.

Being a part of fintech, it’s a good idea to add this advanced fintech feature to your app.

Here’s how it works: Integrates peer-to-peer lending functionalities, enabling users to lend and borrow money directly without the need for traditional financial intermediaries.

Therefore, often results in more favorable terms.

Related: Develop a P2P Lending App

28. Crowdfunding Integration

Crowdfunding app development within the fintech niche is super popular.

So, how about you integrate this into your platform to leverage that?

Well, by allowing users to engage in crowdfunding activities, either as contributors or recipients, you can go very far.

This could democratize access to capital for startups and projects.

29. Dynamic Risk Assessment Tools

Again, coming to the security aspect, dynamic risk assessment tools play a huge role in the same.

This fintech functionality utilizes real-time data to assess the risk levels of investments and loans dynamically.

This can help users make more informed decisions based on current market conditions.

30. API-driven Financial Products

Fintech APIs are the soul of the industry.

With API driven financial products, you can capture it all. We are suggesting offering seamless integration with various financial services through APIs.

This opens up a plethora of services to users, from insurance to investment products, all accessible within the app.

31. Customizable Dashboards

Dashboards are at the heart of a fintech application. While it’s more of a fintech app design feature, here it is:

This feature lets users customize their financial dashboards, and that’s where all the fun lies.

This personalization feature helps users track the financial metrics most relevant to them directly from their homepage.

32. Regulatory Technology (RegTech)

Fintech regulation and compliance are very, very important things.

For this, you should focus on RegTech and regulatory technology.

The advanced functionality of the fintech platform will focus on technologies that facilitate the management of regulatory compliance.

This is crucial in the heavily regulated financial sector, helping firms avoid fines and legal issues.

33. Internet of Things (IoT) Payments

There are a lot of mobile payment technologies. For instance, NFC or via mediums like UPI.

However, covering IoT payments would give your platform an extra edge.

This will enable users to make payments through IoT-connected devices, expanding the possibilities for mobile payment ecosystems and enhancing user convenience.

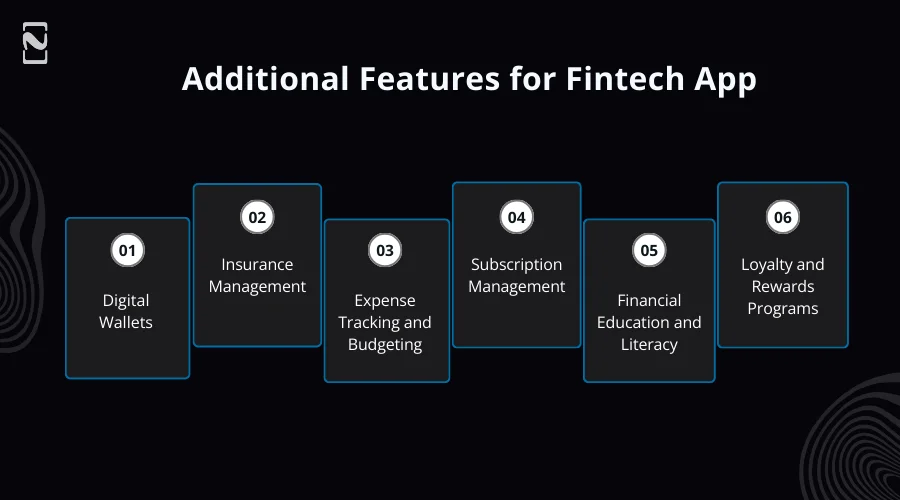

► Additional Features for Fintech App

It’s time to look at some additional features for fintech applications.

Well, let’s get right into it:

34. Digital Wallets

The market for eWallets is huge, but you don’t need to start an eWallet startup to appease them; rather, you can integrate it as a feature.

With an integrated digital wallet, you allow users to store, manage, and use various forms of digital currency, from traditional money to gift cards and loyalty points.

35. Insurance Management

Insurance has become as important as a home or food in today’s world.

Now, don’t let your users download a stand-alone insurance app; rather, integrate management of various insurance policies.

Includes the ability to view policy details, file claims, and track claim status all from within the app.

36. Expense Tracking and Budgeting

Inspired by expense management app development, we have added this additional feature for fintech apps: expense tracking and budgeting.

With this, you provide tools for users to track daily expenses and create budgets, helping them manage their finances effectively and achieve their savings goals.

37. Subscription Management

Subscription apps have become a household thing now.

But what if we told you we could make it easier for your users to manage all of them? With this feature, you can:

It allows users to manage their subscriptions, view expenses, and even cancel subscriptions directly through the app, helping them avoid unnecessary charges.

38. Financial Education and Literacy

Again, inspired by financial literacy apps, we integrated fintech education and literacy functionality into the platform.

This includes educational content and resources to improve users’ financial knowledge, such as articles, tutorials, and webinars on financial topics.

39. Loyalty and Rewards Programs

Don’t forget to thank your users for their loyalty!

To do this, you can integrate loyalty programs where users can earn rewards for transactions and certain behaviors within the app.

This can be redeemed for various perks and discounts.

It also opens up a great fintech monetization opportunity.

With this, we are done with the core, advanced, and added fintech app features. With that out of the way, it’s time to choose how to find the right app feature set.

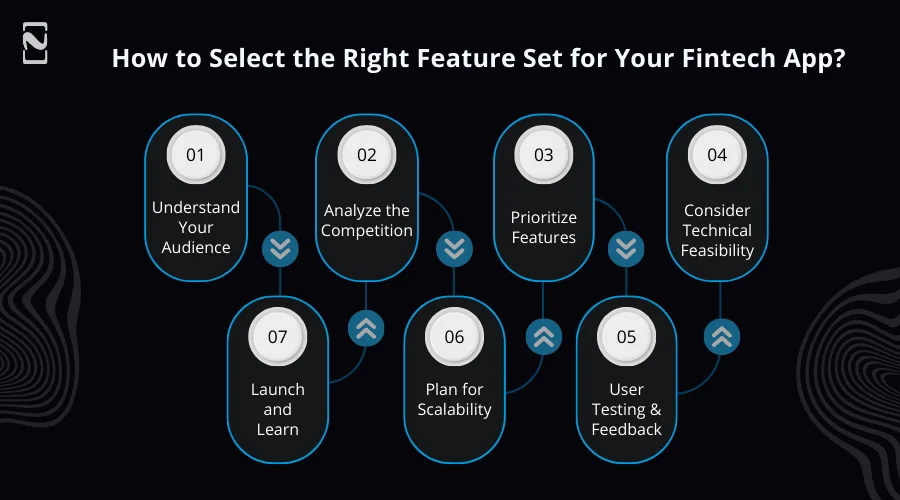

How to Select the Right Feature Set for Your Fintech App?

Looking at the list above, you may be wondering how to choose the right set of features for your app, considering there are so many in the market and you can integrate only a handful.

Well, there is a way, a process that you can apply to finish your selection of fintech app features. You see, it is not possible to integrate all the listed features in a single app, unless you are building a fintech super app.

Hence, you need to select a set of fintech features that help you get your fintech application. Especially when you already have a core functionality ready and want to add additional features to your app to make it a complete package.

Step 1: Understand Your Audience

Start by understanding who your users are via market research. Conduct surveys, interviews, and market research to gather insights into their needs, preferences, and financial behaviors.

Develop user personas that represent your typical customers. This should include financial goals and the main problems they may be looking to solve.

Step 2: Analyze the Competition

Examine what features are offered by competing apps. Identify gaps in their offerings and consider how you can fill those gaps or offer improved solutions.

Benchmarking: Benchmark against industry standards and top players to understand which features are considered essential and expected by users.

Step 3: Prioritize Features

Must-have vs. Nice-to-have: Distinguish between essential features (must-haves) that your app can’t function without and nice-to-have features that could enhance the user experience but aren’t critical for the initial launch.

Impact Analysis: Check the potential impact of each feature on user experience and your business objectives. Focus on features that offer the most value and align with your strategic goals.

Step 4: Consider Technical Feasibility

Technology Stack Assessment: Determine if your current fintech technology stack can support the desired features. Consider the need for new technologies or infrastructure upgrades.

Security and Compliance: Ensure that the features follow all relevant financial regulations and security standards. This is crucial for user trust and legal compliance.

Step 5: User Testing and Feedback

Develop a prototype of your app incorporating the selected features. This doesn’t have to be fully functional, but it should help visualize how the app works. Conduct user mobile app testing sessions to gather feedback on the app’s functionality and the utility of the features.

See how users interact with the features and what challenges they face. Use the feedback to refine and iterate on your features. It is essential to be flexible and make adjustments based on real user experience.

Step 6: Plan for Scalability

Ensure the features you choose can scale as your user base grows. Building a fintech application is not just a short-term plan; It is a commitment of decades.

Hence, you must plan your app while keeping scalability as one of the priorities. For starters, you should consider cloud solutions, microservices architecture, and other scalable technologies that are less resource-intensive and can be scaled as per the size of your user base.

Step 7: Launch and Learn

After you are done with all the steps, you are ready to launch your app for good. If you still feel a bit dicey, you do have the option of launching an MVP, which further allows you to iterate and helps you understand the solution.

After launch, monitor the performance of your app and user satisfaction. Plan regular updates to introduce new features and refine existing ones based on user data and feedback

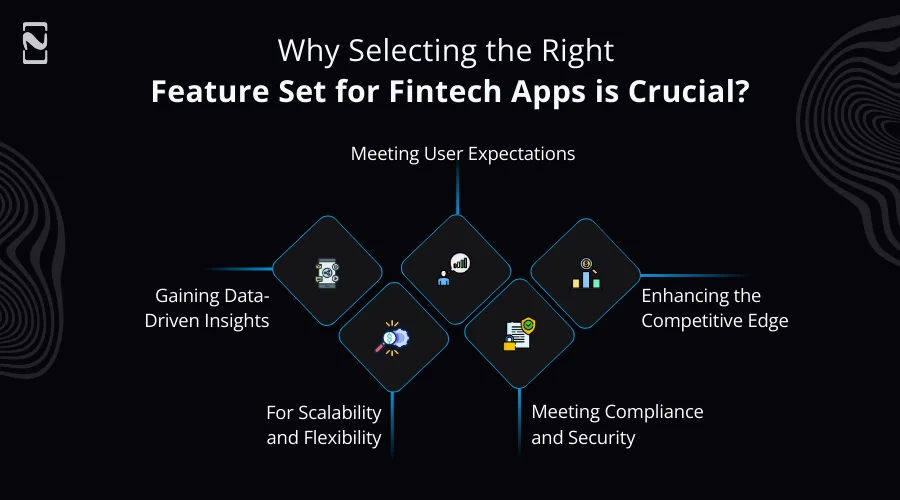

Why Selecting the Right Feature Set for Fintech Apps is Crucial?

Selecting the right fintech app features can dramatically enhance user engagement, ensure compliance with regulatory requirements, and improve overall financial management.

With so many players already in the market, you need to understand what the market responds to and how you can stand out from the competition.

Some of the more crucial reasons why you need to pay attention when selecting fintech app features may include:

Meeting User Expectations

Your job as a fintech app is to gain the trust of your customers, and you cannot achieve the same without meeting the user expectations.

Today, where the applications are always working to bring new features to the table, it is important that you enter the market with a set of features that not only get the job done, but also raise the user’s expectations so they are more inclined towards your app.

Enhancing the Competitive Edge

When you have the right set of features, you automatically gain an edge over the existing solutions. Having a competitive edge is crucial, especially in a field like fintech, where the competition is cutthroat.

Your fintech app feature selection can certainly define the further path for your solution. Not to mention, choosing the right set of features at the time of development is certainly a better choice, as integrating additional features can become a headache later.

Meeting Compliance and Security

Fintech app features also play a crucial role in creating a compliant and secure app. With so many regulatory requirements to meet, choosing the right fintech app features is crucial.

Hence, you must pay attention to the feature as it directly affects your fintech app security, and with your app having the core functionality related to the finances of a user, you surely need to have a series of security features.

For Scalability and Flexibility

The right set of fintech app features can surely help in achieving scalability and flexibility.

Your app must have scalability options that allow for the handling of increased transactions and expanding customer bases without compromising performance. Flexibility in features also allows fintech apps to adapt to changing market conditions and emerging trends.

Gaining Data-Driven Insights

For a thriving fintech app, you need a better decision-making process. The top features of a fintech app should provide users with valuable insights derived from their data.

Features that offer comprehensive analytics and reporting capabilities can help users better understand their financial habits and make informed financial decisions.

All in all, spending time on choosing the right feature set for fintech app development is definitely a fruitful decision. Apps often define their core functionality based on what they tend to offer.

However, for advanced user retention and keeping your app up to date, it is important to choose the right features.

Conclusion

Selecting the right feature set for your fintech app is a crucial step in ensuring its success.

By understanding your audience, analyzing the competition, and strategically choosing features that align with both user needs and business objectives, you can create a powerful tool that stands out in the competitive fintech landscape.

If you are struggling to choose the right set of features or you need assistance in narrowing down the list to find the right balance, you must hire a fintech app development company like Nimble AppGenie to guide you on the right path.

Remember, the ultimate goal is to balance innovation, user engagement, and compliance, all while keeping scalability in mind. With that said, we have reached the end of this post. In case you need further assistance or are looking to get your fintech app developed, Nimble AppGenie can be a great resource.

Thanks for reading, Good luck!

FAQs

Start with a minimal viable product (MVP) that includes essential features necessary for basic operations and a good user experience. Typically, this would be around 5-10 core features, depending on the complexity and focus of your app.

A feature is considered essential if it solves a fundamental problem for your users, complies with regulatory requirements, or is critical for the basic functionality of the app. Use user feedback and competitive analysis to identify these must-have features.

Absolutely. User feedback is crucial throughout the development process, especially in the early stages. It helps validate your assumptions about what users want and need, and guides how to improve and adapt your feature set.

Regular updates are important to keep your app relevant and secure. Plan to review and possibly update your app’s features every 3-6 months. However, the frequency can vary based on user feedback, emerging technologies, and changes in the financial landscape.

Work closely with legal and compliance experts to understand the specific regulations that apply to your app. Incorporating regulatory technology (RegTech) can also help manage compliance more efficiently.

Not necessarily. While advanced features can enhance your app’s capabilities, they should be incorporated thoughtfully based on user needs, market demands, and after establishing a stable user base with your MVP.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.