Looking to develop your dream banking app?

One of the elements that you cannot ignore is its tech stack adoption.

The selection of a tech stack for a banking app can be difficult; however, with the right guidance, you can address this issue.

Here, we will discuss it all. Let’s examine each aspect of the same.

Mobile Banking App Tech Stack: An Overview

Before we proceed to grasp the idea of selecting the best tech stack for a banking app, it is crucial to know the basics.

The tech stack is all about the set of technologies utilized by businesses for building an app or running a website.

Here, the major components comprise frontend, backend, server, programming languages, and the database.

When it comes to banking apps, the selection of the tech stack widely depends on the foundation of each mobile app.

Thus, for mobile banking apps, the selection depends on various factors, including security, app performance, features, and other elements.

Well, we will cover these factors further in this blog. Prior to this, are you still confused about why selecting the best tech stack matters for banking apps?

The following section will address this question.

Why is Choosing the Right Tech Stack Important for Developing a Banking App?

Bothered about why discussing and selecting the best technology stack matters?

Well, there are many reasons. Let’s discover them below.

♦ Enhances App Performance

Selecting the best mobile banking app tech stack helps enhance the overall app performance.

The technologies that work efficiently all together assist the applications in managing the high volume of data along with the user traffic. Here, users can manage high volumes of data and user traffic without any downtime.

♦ Improves User Experience

Implementing the right technology for banking apps can be beneficial in reducing app crashes and providing users with an exceptional experience of your brand.

With the help of suitable tech stacks, you can streamline the purchasing procedure. By integrating the tech stack, you can automate the workflows among the diversified applications.

♦ Reduces the Risk of Bugs and Errors

With the implementation of prominent banking app programming languages, the risk of bugs and errors is minimized.

The right tech stack is enough to improve the overall performance by adopting the updated technologies. By implementing the latest technologies, you can optimize the app results to enhance the overall performance.

♦ Minimizes Development Cost

By implementing the best tech stack for mobile banking apps, you can reduce the total cost of their development.

The use of a tech stack can help implement the latest technologies, which will be useful in reducing overall development costs. Here, you can optimize the total cost through proper planning and allocating the resources.

♦ Speed up Time to Market

You can shorten the time to launch the app in the market by selecting the proper tech stack on time. A complicated tech stack selection will slow down the process of development.

Thus, selecting the best tech stack is useful in streamlining the product to market as fast as you can.

♦ Scalable for Future Business Expansion

The selection of a suitable mobile banking app tech stack will enhance the scalability of your project. Scalability is beneficial for a web platform to accommodate and grow the traffic over the app.

An effective tech stack should be able to handle the increased traffic over the platform without decreasing the overall performance of the software.

These were all the reasons to consider when selecting the tech stack for creating a banking app.

Now, the major question is “How to select the best tech stack for a digital banking app?”

Consider the following section for more.

How To Choose The Best Tech Stack For Your Banking App?

What are the top steps to undertake to select the best tech stack for online banking apps?

Here are the steps to follow.

Step 1: Evaluate the Objective of the App

It is important to execute the aim and objective of the app before you go after selecting the best tech stack. Every app has its respective objective, and addressing them at the end is all that matters.

You should analyze the objectives that need to be aligned with the overall project goals, as well as organizational energy. This will help evaluate the right series of stacks to be considered.

While considering the aim of the app, you should be able to level up the software after evaluating the best tech stack.

Step 2: Finalize the Platform

Now, there is a quiet requirement for finalizing the platform on which you want to launch the banking app. This step is usually considered in the guide for developing a mobile banking app.

You can hire Android app developers, iOS app developers, or hybrid app developers, depending on the type of platform selection.

You should evaluate the platform and then finalize the type of tech stack accordingly. The tech stack will be differentiated based on the platform selection.

Step 3: Alternatives Evaluation

Now, under this step, it is essential to evaluate alternatives available for developing your dream banking app.

With the available alternatives, you will be able to identify the advantages and disadvantages of the respective tech stack. It will automatically help you select the best.

Here, it is important to consider all the essential factors that can affect your decision to implement a tech stack.

These are all the essential steps that need to be considered, as we discussed that studying the factors impacting the tech stack is crucial.

Are you ready to learn them in detail?

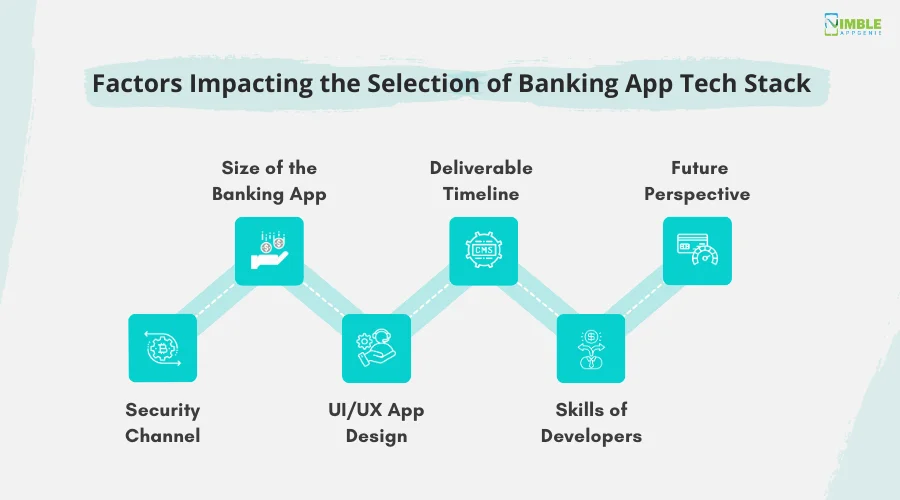

Factors Impacting the Selection of Banking App Tech Stack

What are the top factors affecting the selection of the mobile app tech stack?

Let’s evaluate the type of factors here.

-

Size of the Banking App

The size and complexity of the banking app might impact your opinion on selecting the tech stack. Large and complicated apps will require a more effective tech stack.

Choosing a tech stack that doesn’t align with the needs of the app might result in issues, including poor user experience and avoidable technical debt.

-

Deliverable Timeline

The timeline decided for the launch of the banking app can impact your tech stack selection. Your time to market should be considered as an important parameter.

If you are starting an MVP that requires quick delivery, the tech stack selection for the process should be effective.

Thus, the time spent on coding should be less. For a complete app, take time to develop a custom tech stack based on the project’s objective.

-

Future Perspectives

An app should be developed in a way that addresses the goal. Thus, it’s essential to evaluate the future scope of your app and then determine the right tech stack for the project.

Your selected tech stack must be scalable and adaptable to changing needs. With evolving technology and a user base, you should be able to update the app easily by embracing tech trends.

-

Security Channel

For banking app security, there are no compromises, right? Well, banking is all about dealing with finances, and users tend not to take risks within the same.

Thus, the technology stack needed to be simple and effective. You should not consider any vulnerabilities that might expose your users to cyber threats or compromise their privacy.

-

UI/UX App Design

The type of tech set selection will also depend on the banking app design. You should take advantage of the operating system’s capabilities by ensuring better integration with the device functionalities.

It is an inseparable part of the app development and so of the tech stack. Thus, while evaluating the right technology for your app, it’s essential to note that the app design needs to be attractive.

-

Skills of Developers

Finding the right developers with the proper expertise can be challenging. The implementation of stacks by skilled experts will enable us to achieve the app’s goal.

Here, two important factors that need to be included are the location and expertise of the developers.

These are the essential factors to be considered before selecting the right tech stack for the software.

Now, you might be bothered by the tech stack needed to be adopted for your banking app project, right?

Well, the next section will provide you with a glimpse here.

List of Tech Stack for Banking Apps

To build your dream banking app, you must know which tech stack matches.

Here is a table representing a typical tech stack used in a banking app, organized by categories such as frontend, backend, database, security, and other components that help in building a banking application:

| Category | Technology | Description |

| Frontend | React / React Native | Used for building responsive web and mobile applications. |

| Vue.js / Angular | Alternatives to React for building dynamic and scalable web interfaces. | |

| HTML5 / CSS3 / SASS | Core web technologies for creating the layout, structure, and styling. | |

| TypeScript | A superset of JavaScript, offering type safety for building large-scale apps. | |

| Backend | Node.js / Express.js | JavaScript-based server-side framework, ideal for scalable, fast apps. |

| Java / Spring Boot | A robust, secure, and scalable framework commonly used for enterprise-level apps. | |

| Python / Django | Python-based framework used for backend logic, APIs, and integrations. | |

| Ruby on Rails | Full-stack web application framework using Ruby for rapid development. | |

| Go / Gin | Fast and lightweight backend framework, ideal for performance-sensitive apps. | |

| Database | PostgreSQL / MySQL | Relational databases for storing transactional data securely. |

| MongoDB | NoSQL database for flexible, schema-less data storage. | |

| Redis | An in-memory data store for caching and fast access to frequently used data. | |

| API Integration | RESTful API | The standard method for building APIs is used for communication between the client and the server. |

| GraphQL | A query language for APIs that allows flexible and efficient data retrieval. | |

| Security | OAuth 2.0 | Open standards for token-based authentication, ensuring secure login. |

| JWT (JSON Web Tokens) | Compact, URL-safe means of representing claims for secure authentication. | |

| SSL/TLS | Secure Socket Layer/Transport Layer Security for encrypting data transmission. | |

| HSM (Hardware Security Module) | Used to secure key management and cryptographic operations. | |

| 2FA (Two-Factor Authentication) | Adds an extra layer of security during user authentication. | |

| Cloud / Hosting | AWS (Amazon Web Services) | Cloud services for scalable infrastructure, computing, storage, and security. |

| Azure / Google Cloud | Cloud platforms that provide storage, computing, and other services. | |

| Docker | A containerization platform for packaging an application and its dependencies. | |

| Kubernetes | Orchestration tool for automating deployment, scaling, and management of containerized apps. | |

| Payment Integration | Stripe | Payment gateway API for processing online transactions. |

| Plaid | Used to connect banking apps to user accounts for financial data retrieval. | |

| Adyen / PayPal | Payment processing platforms for secure online transactions. | |

| Analytics | Google Analytics / Mixpanel | Tools for tracking and analyzing user behavior and app performance. |

| Apache Kafka | A distributed event streaming platform used for real-time data processing. | |

| DevOps | Jenkins / CircleCI | Continuous Integration/Continuous Deployment (CI/CD) tools. |

| Terraform | Infrastructure as Code (IaC) tools for provisioning and managing infrastructure. | |

| Monitoring | Prometheus | Open-source monitoring and alerting toolkit designed for reliability and scalability. |

| Grafana | Used for monitoring and visualizing application metrics. | |

| Message Queues | RabbitMQ / Apache Kafka | Messaging platforms for handling asynchronous communication between services. |

| Caching | Varnish / Nginx | Reverse proxy and caching tools to handle high traffic and reduce load. |

| Version Control | Git | A distributed version control system for code collaboration and management. |

| CI/CD | Jenkins / GitHub Actions | Automates code deployment and ensures efficient delivery pipelines. |

This stack covers many essential technologies used in modern banking apps for managing security, performance, and scalability while also ensuring a smooth and reliable user experience.

Are you still confused about utilizing the best tech stack for your banking business?

Well, in the next section, we are accessing the popular banking apps and their tech stack solutions.

Popular Banking Apps and their Tech Stack

If you aspire to turn the tables, it’s essential to know your competitors.

Let’s check out the following top banking apps and the type of tech stack they implement.

➤ Chime

Chime makes use of different programming languages: Ruby on Rails, JavaScript, Python, HTML5, ES6, CSS 3, Ruby, Elixir, and Go.

Along with this, the types of tools used by the platform can be GitHub, Jenkins, CircleCI, Helm, and Visual Studio.

➤ Nubank

This is a South American Fintech Leader who makes use of recent technologies, programming languages, and databases.

The app made use of Python, HTML, Ruby, and other languages. Based on its platform, the app has used distinct databases.

➤ Ally Financial

Ally Financial is a bank holding company and has its headquarters in Michigan. Currently, the app uses 101 technologies for its website.

Additionally, it comprises iPhone/Mobile Compatible, Viewport Meta, and Domain.

➤ Chase Mobile App

Chase mobile app is a comprehensive platform that offers a consolidated model for successfully managing accounts.

The app makes use of technologies such as HTML, Python, and Ruby, along with diversified tools for managing the user’s performance.

These are all the apps that need to be considered along with their tech stack while you are preparing your dream project.

Still confused? Connect with the experts.

Conclusion

To select the banking app tech stack, you should evaluate diverse factors impacting it. These factors comprise the size of the app, deliverable timelines, future perspective, app design, and the skills of developers.

You can continue with the process of creating a mobile banking tech stack that starts with evaluating the objective and finalizing the platform and alternative options.

Additionally, there are many reasons to consider for selecting a suitable tech stack, including app performance, improved user experience, and help to minimize the development cost.

After evaluating the popular banking apps and their tech stacks, you can connect with an experienced team successfully.

Selecting a company can be as difficult as implementing the tech stack, right? Connect with Nimble AppGenie to help adopt the customized tech stack for your dream app.

Along with this, our team will assist in converting your dream banking app into reality with the assistance of updated technologies.

We are the best Mobile Banking App Development Company, focused on delivering quality based on your dream app.

FAQs

You can go through several steps here.

- Step 1: Evaluate the Objective – It is important to analyze the objective of your app in the very first step in the process of selecting a suitable tech stack.

- Step 2: Platform Analysis – You should analyze the platform, such as whether it will be Android, Hybrid, or iOS. This can help evaluate the selection of a prompt tech stack for your app.

- Step 3: Alternative Evaluation – Considering all the mentioned alternatives along with their positive and negative sides can help examine the right stack.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.