Let’s Discuss your

IDEA!

Pay By Check aimed to simplify financial transactions on a global scale, targeting users who value ease and efficiency in managing multiple currencies. Available on Android, iOS, and the web, this project stands as a testament to our innovative approach in the fintech industry.

Idea of Pay By Check was driven by the need to fill a significant gap in the fintech market – a user-friendly, multi-currency eWallet app. In collaboration with the client, Nimble AppGenie aimed to deliver a platform that not only meets the functional requirements but also exceeds user expectations.

Developing Pay By Check was not without its hurdles. The team faced challenges in ensuring seamless currency exchange features, maintaining robust security for transactions, and creating an intuitive user interface. Plus, creating an app compliant across different regions demanded meticulous attention to detail.

The culmination of this project was an eWallet app that has significantly impacted its target market. Pay By Check has been praised for its user-friendly design, comprehensive features, and reliability, marking a milestone in the eWallet and fintech sector.

The development of Pay By Check was realized in a span of 3 months by a dedicated team of 5 experts, showcasing our commitment to delivering quality and innovation in every project.

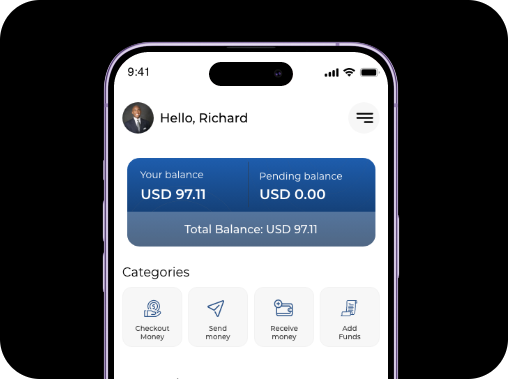

Pay By Check is designed with a focus on user-centric features to enhance the digital wallet experience. Its core functionalities are tailored for convenience and efficiency.

Abcdefghijklmnopqrstuvwxyz

ABCDEFGHIJKLMNOPQRSTUVWXYZ

A geometric sans-serif font designed for user interfaces and web experiences. It provides clarity, legibility, and offers various weights and styles for versatility.

#1CBE2B

#DEFFE0

#777674

#000000

#FFFFFF

#DBDBDB

Pay By Check transforms the eWallet landscape by offering a comprehensive suite of features designed to enhance user financial management and currency exchange capabilities.

Dive into your financial world with ease. Our app provides a detailed view of your balances and transactions, enabling effective management of your funds and spending patterns.

Experience the joy of saving with our innovative feature that visually represents your growing funds. Watch your savings flourish in a digital piggy bank, motivating you towards your financial goals.

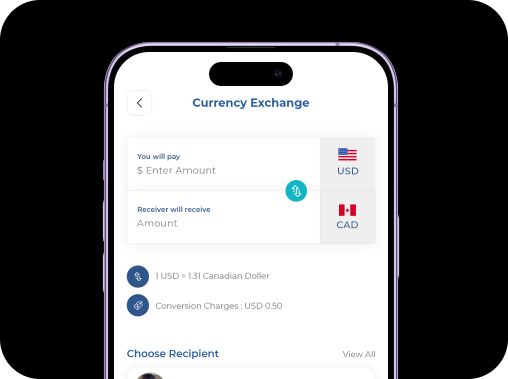

Embrace the freedom of global transactions with our intuitive currency exchange feature. Whether you're traveling abroad or dealing with international payments, our app ensures you're always ready with the right currency.

Our choice of cutting-edge technologies for Pay By Check underscores our commitment to excellence. Utilizing top technologies, we've crafted an app that's robust, scalable, and future-proof.

Ready to redefine the way you handle money? Connect with Nimble AppGenie and embark on your journey towards financial innovation.

Get in Touch

Nimble AppGenie is committed to delivering results that satisfy our client’s needs and their business objectives. Here are testimonials from our clients about their experiences of working with us.

We hired Nimble AppGenie for web development services related to our edtech platform, Glu Learning. They integrated well with our team to solve all the problems and deliver remarkable solutions. Their team have great command of both client side and server side technology. We highly appreciate and recommend their services.

"Our journey with Nimble AppGenie is defined by their consistent availability, reliability, and efficiency. As we look towards expansion, I'm confident our partnership will grow even stronger. And we are eagerly anticipating the next chapter with them.