Let’s Discuss your

IDEA!

DafriBank represents a pioneering venture in the digital banking sector, aimed at providing comprehensive banking solutions alongside cryptocurrency trading facilities. Targeted at users across Africa, the platform is accessible on both web and mobile devices, offering an unparalleled banking experience.

DafriBank idea was driven by the ambition to fill a crucial gap in the African financial market – integrating digital banking with cryptocurrency. The collaboration with Nimble AppGenie was pivotal in sculpting a platform that would become a bridge between traditional banking & cryptocurrency.

The development journey of DafriBank was marked by a series of challenges – from ensuring crypto wallet integration to delivering a seamless UX across banking services. The team navigated stringent security requirements, and the necessity to accommodate banking functionalities.

DafriBank's launch marked milestone in digital banking within Africa, with its dual focus on traditional banking and crypto trading. Post-launch, DafriBank has been recognized for its innovation and user-centric design.

The development of DafriBank was a meticulously orchestrated endeavor, completed over several months by a dedicated team of Nimble AppGenie's finest developers and designers, ensuring quality and efficiency at every stage.

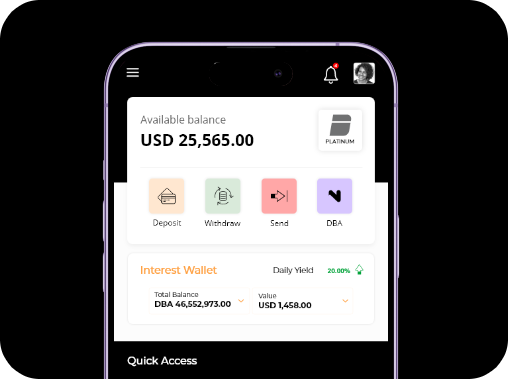

DafriBank stands out with its rich array of features designed for an optimal banking experience. From personal to enterprise-level banking, the app caters to all.

Abcdefghijklmnopqrstuvwxyz

ABCDEFGHIJKLMNOPQRSTUVWXYZ

A friendly and open-source sans-serif font originally designed for magazines. It offers good legibility and distinctive letterforms, making it suitable for a variety of branding and web design applications.

#FDC287 #FFA143

#FFA143

#000000 #FFFFFF

#000000

#FFFFFF

#080808

DafriBank stands at the forefront of digital banking innovation, merging the worlds of traditional banking and cryptocurrency to cater to the diverse needs of the African market.

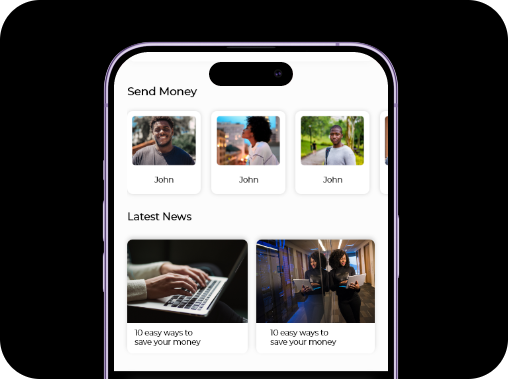

With a user-centric design, DafriBank simplifies account management, offering a seamless experience for checking balances, viewing transaction histories, and managing various account types.

The platform offers advanced tools for tracking financial growth, providing users with valuable insights into their financial health and helping them make informed decisions.

DafriBank enhances user convenience by facilitating easy and secure money transfers, bill payments, and cryptocurrency trading, all within a few taps.

DafriBank's development leveraged a robust tech stack, highlighting Nimble AppGenie's commitment to using state-of-the-art technologies

Ready to transform your banking journey with innovative solutions? Connect with Nimble AppGenie today!

Get in Touch

Nimble AppGenie is committed to delivering results that satisfy our client’s needs and their business objectives. Here are testimonials from our clients about their experiences of working with us.

We hired Nimble AppGenie for web development services related to our edtech platform, Glu Learning. They integrated well with our team to solve all the problems and deliver remarkable solutions. Their team have great command of both client side and server side technology. We highly appreciate and recommend their services.

"Our journey with Nimble AppGenie is defined by their consistent availability, reliability, and efficiency. As we look towards expansion, I'm confident our partnership will grow even stronger. And we are eagerly anticipating the next chapter with them.