With improvements in technology, the borders between the countries have become a physical concept. People from all over the world are connected beyond borders thanks to the internet and globalization.

With the number of people traveling to different countries and businesses making profits from different countries, it can be said that the world of business has no boundaries.

One of the key factors that has played a role in facilitating these international businesses is the currency exchange.

Irrespective of where you live or where the business is based, you can use currency exchange and complete the transaction easily.

While it is a facilitator of other business transactions, currency exchange in itself is a great way to start earning profits.

In this post, let us take a look at currency exchange as a business and how you can start your venture in forex and maximize profits. Without further ado, let’s get started!

What is Meant by Currency Exchange & Forex?

Every country has its currency that it uses in everyday life. In order to make international payments, an individual must hold the currency of the respective country they plan to make a payment.

To do so, individuals need to get their hands on the currency of the country, and for that, they can exchange the currency they possess.

Every currency in the world has a value attached to it, and as per the trade, a user can match the value of the currency they want to have and get it easily. This exchange of currency is called currency exchange.

Foreign exchange or Forex is a widely known business that revolves around the currency exchange that happens around the world.

Let’s take an example of exchanging Dollars for Euros. If we go by today’s exchange rate, if you change $1 to Euro, it will give you somewhere around €0.85.

However, that is the international exchange rate. As a Currency exchange business, you can charge a markup fee on this exchange, making profits.

Not to mention, these rates keep fluctuating, which means you can buy currencies when they are low and sell when they are high to make further profits.

A currency exchange business is certainly a reliable business as it has a never-ending demand.

People will travel to different countries, trades will take place in different currencies, and hence, starting a currency exchange business of your own can be a vital step.

Components of a Currency Exchange Business

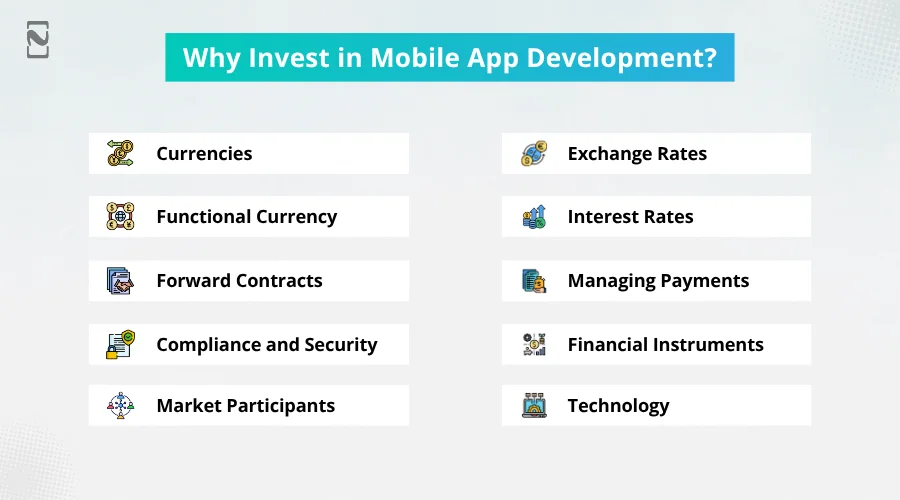

To launch a profitable currency exchange business, you need to quickly identify the components of the business.

These components lay the foundation of the field that you plan to enter. Hence, before you start your journey towards the Forex business, it is important to learn about them.

There are 10 components of a currency exchange business running like a well-oiled machine:

-

Currencies

Denominations from around the world and their values are something that you need to know on your tips to start your business.

-

Exchange Rates

Knowing the price value of each currency is that you trade and what the exchange rates are is also really important.

-

Functional Currency

This is the currency in which your business will carry out all of its transactions. Based on your functional currency, you will maintain your books and statements.

-

Interest Rates

For any currency, if the interest rate is higher, the currency grows stronger as it encourages more and more international investments. Hence, you need to keep in mind all the interest rates to be more profitable in the long run.

-

Forward Contracts

Currency exchange businesses often have forward contracts in place that allow them to buy or sell a specific currency at a predetermined rate in the future, irrespective of market fluctuations.

-

Managing Payments

For a currency exchange business to be more and more profitable, you will need a solid payments management system that allows flawless handling and monitoring of incoming and outgoing payments.

-

Compliance and Security

Dealing in international markets is not easy without the support of governing authorities. Hence, you have to pay extra attention to maintaining fintech regulations & compliance, and security requirements related to handling sensitive data and financial transactions.

-

Financial Instruments

Foreign exchange is not only applicable to currencies but financial instruments such as bonds, contracts, options, etc. They are also available and equally necessary.

-

Market Participants

Entities involved in the currency exchange market, including banks, institutional investors, individual traders, etc. They are a crucial part of the currency exchange business.

-

Technology

The currency exchange business has seen a lot of changes in the way these functions are performed. With advanced multi-currency wallets, automated currency rate updates, and online transaction management, your currency exchange business can thrive from anywhere in the world.

All of these components, when combined, form a currency exchange business. You have to individually meet all the requirements to ensure each of these components works flawlessly for your business.

Benefits of Starting a Currency Exchange Business

The components can make it complex to start a currency exchange business for a novice in the fintech industry; however, the market is certainly lucrative and has its benefits.

In this section, let us take a look at all the benefits that you can enjoy upon launching your currency exchange business.

Currency Exchange Business Benefits:

- Easily Scalable

The currency exchange business is highly scalable, as you can start by simply flipping currencies for a markup and scale up by launching your own exchange platform or going further and integrating a payment gateway that supports multiple currencies. It also has immense opportunities for scaling the business into financial markets.

- High Growth Potential

If you are worried about entering the market and not finding enough growth in the currency exchange market, then you should relax, as the currencies are always fluctuating and giving forex experts enough opportunity to capitalize and earn enough profits. Needless to say, the growth potential of a currency exchange business is massive.

- Income Stability

The currency exchange market can be extremely fluctuating, depending on the currency values. But when it comes to income stability, the market is lucrative as it offers a regular income. The currency exchange business is a never-ending process as it is always functioning irrespective of the market conditions.

- International Expansion

If your goal is to expand your business internationally, entering the currency exchange market can be a great opportunity. This is because with a hold on multiple currencies and forex instruments, you can open your outlets for exchange in different international expansions. You can easily expand your business across borders, reaching a massive audience.

- Smooth Business Transition

Other than these international expansion opportunities, the currency exchange business also offers a way for you to easily enter the financial market, as you can start with the currency exchange and smoothly transition into a company that facilitates international payments and transactions in one way or another.

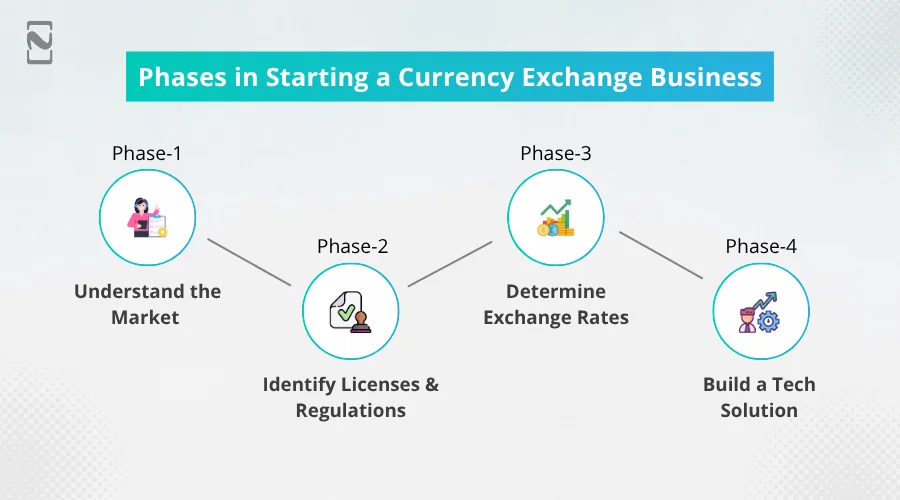

Phases in Starting a Currency Exchange Business

Now that you are aware of everything you should know about how to start a fintech business, it’s time to find out the steps that can help you start a business on your own.

There are a series of phases involved in establishing a fully functional currency exchange business.

Phase 1 – Understand the Market

Break down the market and run and carry out a thorough research and analysis. You must research all aspects of launching your business, including the market, customers, and financial factors that may be required to monitor the business.

Phase 2 – Identify Licenses & Regulations

All the regulatory requirements should be met before launching the business else the authorities may pose significant risks.

You must have a license to trade between currencies, and if you plan to go digital, all the regulations and compliances should be met.

Identify all the necessary regulations, based on the region, and accordingly set up your business.

Important Licenses and Regulations for the currency exchange business as per regions:-

| Region | Regulatory Body | Key Regulations / Frameworks | Compliance Requirements |

| European Union (EU) | ESMA (via MiFID II) | MiFID II (Markets in Financial Instruments Directive II) | Transparency, investor protection, market integrity, licensing under MiFID II |

| United Kingdom (UK) | Financial Conduct Authority (FCA) | FCA Regulatory Framework | Licensing, capital adequacy, conduct standards, and consumer protection |

| United States (USA) | FinCEN, OCC | Bank Secrecy Act (BSA) | AML/CFT compliance, federal registration, state-level licenses (varies by state) |

| Saudi Arabia | SAMA, CMA, Inter-ministerial Committee | SAMA & CMA regulations | Licensing, religious compliance (Sharia), coordination with multiple government ministries |

| MENA Region (General) | Varies by country (SAMA, DFSA, etc.) | Sharia-compliant frameworks, local regulatory requirements | Adherence to Islamic finance principles, local licensing, ethical and religious compliance |

Phase 3 – Determine Exchange Rates

To enter the currency market, you need to have a system that allows you to determine exchange rates regularly and keep track of the changes in the market. Monitoring every trend in the market can be beneficial; however, keep in mind that you should only rely on official sources.

Phase 4 – Build a Tech Solution

Today, maintaining a multi-currency business can be easy with a technologically advanced solution that can help you maintain the business, identify the market, and allow your users to easily send money by exchanging it online through a multi-currency e-wallet, giving them more control over the business.

Simply hire an expert company that can build a customized currency exchange solution for you and help you take advantage of existing businesses.

With all those phases out of the way, you can easily get started with a fully functional, robust currency exchange business. To finish all these phases, you need a helping hand or a team of experts to guide you through.

If you are worried about finding the right experts and resources to get the job done, do not worry, as the next section will resolve the issue for you!

Who Can Help In Building a Digital Currency Exchange Solution? – Nimble AppGenie

To develop a currency exchange solution that is powered by the best technologies and is highly optimized to fetch the best results, you need a solid tech team.

We at Nimble AppGenie are experts in fintech app development services, fulfilling the requirements when it comes to starting a currency exchange business.

With years of experience and multiple fintech applications in our portfolio, we are the best option that you can rely on.

After applying currency exchange solutions to different apps, including a remittance application, an online forex platform, or a multicurrency e-wallet, our experts have become so multifaceted that they can understand your requirements exactly and build a solution for you.

Conclusion

Building a business around the currency exchange market is certainly a lucrative proposition, considering it has multiple benefits and offers a stable career path.

Ideally, building a currency exchange business requires you to be aware of several parameters, including the regulations, license requirements, compliance, and more.

If you plan to build a currency exchange business of your own, make sure you start with the market research phase and make your way towards other crucial phases, such as licensing, exchange rates, and a technologically advanced solution.

Hopefully, this post guides you through the process of starting a currency exchange business. In case you need further assistance, feel free to connect with our experts. Share your vision with the best developers, and they will bring your vision to life.

Thanks for reading, good luck!

FAQs

- Currencies

- Exchange Rates

- Functional Currency

- Interest Rates

- Forward Contracts

- Managing Payments

- Compliance and Security

- Financial Instruments

- Market Participants

- Technology

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.