More people in Africa are using their mobile phones to pay for things. They don’t want to carry cash or stand in long bank lines.

One payment app that helps with this is JumiaPay. It allows people to buy items, pay bills, send money, and recharge airtime from their mobile phone.

According to TechCrunch, in just the first three months of 2024, people used JumiaPay for over 2 million transactions.

That’s almost 1 in every 3 orders on the Jumia shopping app. Isn’t this huge?

In Africa, mobile payments are growing fast. There are now more than 1.1 billion mobile money accounts, and these handle over $1 trillion every year.

That shows how much people trust these payment apps.

Thus, if you are planning to develop an app like JumiaPay, now is a good time to take your business to greater heights.

In this blog, we’ll discuss with you how to build a mobile payment app like JumiaPay, along with the features people really need and want.

So, let’s begin!

What is a JumiaPay App?

JumiaPay is a mobile payment application that enables users to make online payments for multiple services. It is particularly designed for users in African countries.

Users can use its services like bill payment, mobile recharge, airtime purchases, and so on.

JumiaPay uses a contactless payment system that supports multiple payment methods like cards, mobile money, and so on.

Also, users can avail multiple offers like cashback deals and discounts.

Now, let’s check out the working mechanism of the JumiaPay app in the following:

- Users can register or log in with their phone number or email address.

- Now they can link a preferred payment method or fund their JumiaPay wallet.

- Users can browse and select services like online shopping, airtime purchase, bill payments, or travel bookings.

- After that, they can initiate a transaction and proceed to the payment page.

- They confirm the payment using a secure method like PIN, OTP, or fingerprint.

- The app processes the transaction through encrypted payment channels.

- Lastly, the user receives instant confirmation and a digital receipt.

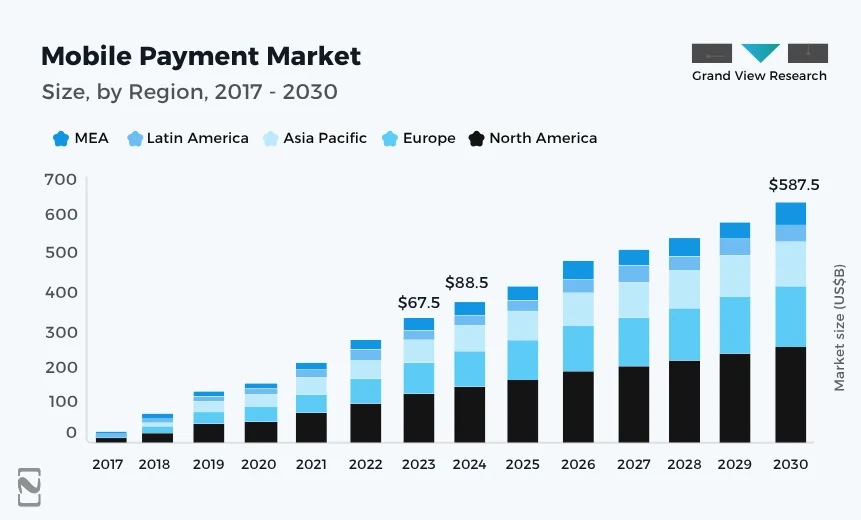

Market Overview of Mobile Payment Services

The market size of the mobile payment industry is forecasted to reach $587.52 billion by 2030, with 38.0% growth every year. The U.S. alone has accounted for mobile payment market growth of $5.66 trillion by 2032.

As more and more businesses are using AI in digital payments, it is boosting the market. If we look at the user segment, it is estimated that over 2 billion people use mobile payment platforms.

Sub‑Saharan Africa has 1.1 billion registered mobile money accounts, which make up over two‑thirds of all registered accounts globally.

These figures show the strong demand for mobile payments worldwide. It’s a great opportunity for businesses to invest in JumiaPay app development and grow as more people start using digital money.

Why Should Your Business Enter the Mobile Payment Space Now?

Now is the best time for businesses to enter the mobile payment market due to huge consumer demand and technological advancements.

As we have already seen, the global evolution of instant payments is going to increase in the coming years, so you should also build a mobile payment application like JumiaPay.

Let’s have a look at the reasons to invest.

People Want Faster Ways to Pay

Consumers today expect quick and easy payments. In 2023, over 266 billion real-time payments were made globally.

That’s a 42% jump from the year before. This shows that mobile payments are not just a trend. They are becoming the standard way people prefer to pay.

Mobile Phones are Used Everywhere

Mobile phone usage is growing fast, even in emerging markets. In Africa alone, mobile money users rose by 52% between 2020 and 2023.

That means millions of people are now ready to use mobile apps for payments, and they’re waiting for businesses like yours to show up.

The Market is Still Open

Even with all this growth, there’s still room for new players like you. For example, only 64% of East Africans used mobile payments in 2023.

That leaves a big untapped audience. If you develop a mobile payment app now, it gives you the chance to reach them before the space gets too crowded.

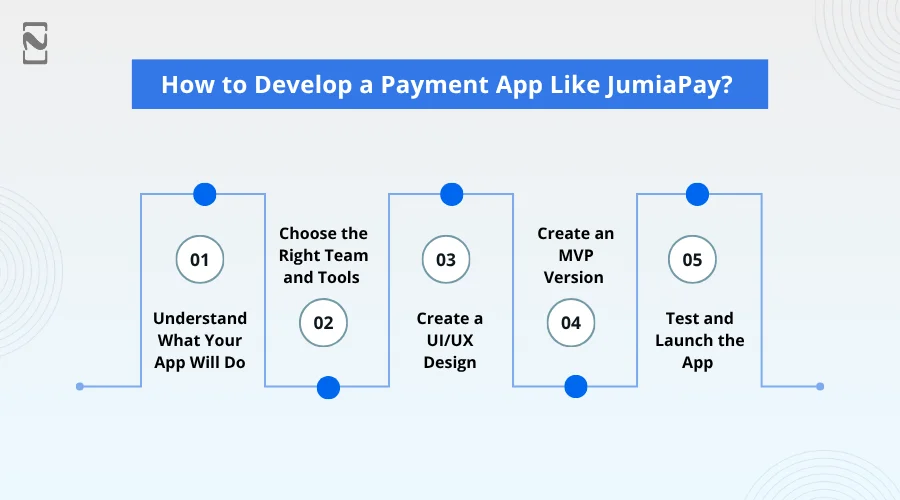

How to Develop a Payment App like JumiaPay?

To develop an app like JumiaPay, you should first focus on creating an MVP version instead of a full-fledged app to test your idea.

Below is the step-by-step JumiaPay app development process you should follow.

Step 1: Understand What Your App Will Do

Before developing a payment application like JumiaPay, just ask yourself what this app is supposed to do.

What will a person open the app for? Is it just for paying bills? Ending the money? Shopping too?

Just start super small. Do not try to do everything JumiaPay does on day one. You do not have to copy the exact features or design of it.

To stand out, just add unique features like offline payments in eWallets, etc, that can attract your target audience.

Once you thoroughly understand what your app will offer, you can move to the next step.

Step 2: Choose the Right Team and Tools

Now, you don’t need a huge development team. Just hire only those who can get things done without overcomplicating it.

If you do not know how to develop an app like JumiaPay, choose the best mobile app development company that has prior experience.

Additionally, you have to choose the right tech stack, like Flutter, React Native, that aligns with your budget. Just don’t spend weeks choosing the tech stack. Just choose one and build it.

Step 3: Create a UI/UX Design

Once you have hired an experienced mobile app development team, it is time to create a visually appealing interface.

It should be very easy to use so that users may not have any difficulty. Just sketch out how you want each screen to look and feel.

You can create a mobile app wireframe, or we can say a simple layout. Also, do not overload the screen with too much information, and it should not look ugly.

Users are attracted to minimalist designs, so keep the buttons easy to find, and each step should feel seamless.

Step 4: Create an MVP Version

This is the stage where you develop an app like JumiaPay. But don’t focus on creating a fully-featured payment app at the start.

You can build an MVP app for JumiaPay-like apps that covers only the core features.

MVP helps you to test your dream payment app idea with real users so that if you get any errors, you can modify it.

This really saves a lot of mobile payment app development time and cost. Don’t try to focus on making it super perfect.

Your main goal is to get a basic working version into people’s hands. Once users start using it, you will learn what they need.

Step 5: Test and Launch the App

Once your payment app’s MVP is perfectly developed, you can rigorously do mobile app testing using different methods.

You can test the MVP version of a JumiaPay-like app with real users and collect their feedback.

Now you have to thoroughly improve and modify your payment application, and once done, you can launch it on the respective platforms.

In addition to this, you have to timely update and modify your payment app with new features, security checks, etc.

Core Features for a JumiaPay-like MVP

To develop an app like JumiaPay, you have to first decide the MVP features.

We have jotted down some must-have features that you can integrate into your mobile payment app like JumiaPay.

Wallet for Shopping Payments

You can integrate a wallet where users can put money inside the app like JumiaPay. They can use this money to pay quickly when buying things online without typing their card details every time.

Bill Payments

You should provide a way for users to pay their bills, like electricity, water, and internet, right from the app. They just pick their bill type, enter the details, and pay.

QR Code Payments

We can provide an eWallet QR code payment feature so users can pay by scanning codes at shops. They just open the app, scan the code, and pay. It’s fast, simple, and contactless. It is really perfect for stores and small businesses.

Mobile Airtime and Data Top-Up

This feature allows users to buy airtime or data for their phones or their friends’ phones. They pick their network, enter their phone number, and pay quickly from their payment app like JumiaPay.

Face ID or Fingerprint Login

You should provide a secure login using Face ID or biometric authentication, like a fingerprint. It keeps the app safe and makes logging in super fast—no need to remember passwords every time.

Card and Bank Linking

You should provide an option for users to connect their bank accounts or cards to the app safely. This helps them add money to their wallet or pay directly without typing in card info every time.

Transaction History

Your mobile payment app will allow users to see all their past payments, money sent, or received. They can check dates, amounts, and download receipts if needed.

Multiple Payment Choices

You need to integrate a payment gateway for users to pay from their wallet, bank account, or card. This gives them freedom to choose how they want to pay, making the app flexible and easy to use.

Rewards and Cashback

If you provide rewards and cashback offers in the app, you are giving users money back or bonuses when they pay bills or shop. This makes using the app more fun and encourages people to keep using it.

Easy Customer Support

You should definitely add a help section in your app similar to JumiaPay, where users can chat or send questions if they have problems paying or using the app. It is really quick and friendly support helps users trust the app and solve issues.

5 Best Mobile Payment Apps like JumiaPay

If you want to develop a mobile payment app like JumiaPay, it’s important to understand what makes top payment apps in this space successful.

Here is a table of the best mobile payment apps like JumiaPay.

| Best Payment Apps like JumiaPay | Available Platform | Downloads | Ratings |

| Kuda | Android & iOS | 10M+ | 4.5 |

| OPay | Android & iOS | 50M+ | 4.5 |

| PalmPay | Android & iOS | 10M+ | 4.2 |

| Paga | Android & iOS | 1M+ | 3.9 |

| FairMoney | Android & iOS | 10M+ | 3.1 |

How Much Does it Cost to Build an App like JumiaPay?

The cost to develop an app like JumiaPay can start from $25,000 and go beyond $150,000. That’s the kind of budget it takes to create something solid in the world of mobile payment technology.

Now, with features like voice payments starting to show up, people expect even more. They want speed. They want ease. They want security. That’s where the real challenge and opportunity lie.

So yeah, when you think about the cost to build a fintech app, you’re not just paying for code. You’re investing in a full-on JumiaPay app development experience that handles money, trust, and convenience, all in one place.

The JumiaPay app development cost sounds really huge at first, but if you’re serious about developing a mobile payment app, it’s one of those things where quality really does pay off.

How to Monetize Your Payment App like JumiaPay?

Once you’ve got a clear idea about the cost of developing an app like JumiaPay, the next big question is, how do you make money from it? That’s where smart app monetization strategies come in.

Below are the essential revenue streams you should take into consideration.

1. Transaction Fees

Whenever someone uses your payment app like JumiaPay, to pay or send money, you get a small fee.

It’s the best way to earn profit because as more people rely on your mobile payment application, those tiny charges quickly add up to a solid income.

2. Merchant Commissions

When customers buy from stores linked to your mobile payment application, like JumiaPay, you get a commission from the sale.

It helps you make money by connecting shoppers with sellers and making payments hassle-free, benefiting everyone involved.

3. Financial Services

You can team up with lenders or insurance companies and offer their products through your app.

Every time a user takes out a loan or buys insurance, you earn a commission, giving your app another way to bring in cash.

4. In-app Advertisement

The most popular monetization strategy is in-app advertising. You can earn money from your payment app like JumiaPay, by adding in-app ads.

It can show relevant ads from trusted brands while users make payments or browse features.

Additionally, you will earn each time users view or click on these ads. This creates a steady income without affecting their payment experience.

How Nimble AppGenie Can Help in Developing an App like JumiaPay?

If you have made up your mind to build an app like JumiaPay, Nimble AppGenie is your one-stop destination.

As an experienced fintech app development company, we excel in creating high-quality mobile payment apps with the latest technologies like AI, ML, and blockchain.

We build mobile payment apps that are fast, secure, and ready to grow, no matter if you are just starting out or already handling millions of transactions every day.

Our team covers everything from PCI compliance to user acquisition and user retention in payment apps.

But what really makes our mobile apps different isn’t just the cool features, it’s the solid foundation behind them. We’ve seen too many apps fail because they couldn’t handle success. Our solutions are built to scale from day one.

So, what are you waiting for? Book a free consultation with us and get a robust mobile payment app solution that aligns with your budget.

Final Thoughts

Creating an app like JumiaPay is not just about copying a feature list. It is about understanding what makes people trust a digital payment app.

Also, it is about speed, security, and that little feeling of comfort when a transaction goes right.

If you can get those things right, you are already halfway there. You just need to start small, follow digital payment regulations, test often, and build something that solves real payment problems.

If you work with the right development team and have a clear plan, your mobile payment app idea can grow into an app.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.