Slow money transfer, multiple digital wallet management, interoperability issues, long wait times for funds clearing, and high operational charges are a few pain points that most end-users, whether they are financial institutions or consumers, encounter while using digital payment systems.

Back in 2017, Early Warning Services, a financial services and technology giant, rolled out Zelle, a money transfer app, to confront such challenges.

It emerged as a great help for users looking to send money to friends and family via their mobile devices.

Per the latest records, Zelle witnessed an annual rate of around 10% across distinct segments in the first half of 2025.

“With continued surging growth, it’s clear Zelle is where the U.S. economy flows,”

said Denise Leonhard, general manager of Zelle.

If you are here, you are seeking a comprehensive understanding of what Zelle is and how it works, Zelle’s revenue model, how Zelle makes money, and a lot more.

Kick back, as this post will put forth every minute detail you are here for.

Let’s get the ball rolling!

What is the Zelle App?

Zelle is a fast and secure peer-to-peer money transfer app that helps users send and receive money, usually taking minutes, straight to any bank account in the United States.

Unveiling an answer to “Who owns Zelle and the grounds for its creation”?

Early Warning Services, LLC, a private financial services brand, owns Zelle, which itself is a joint association owned by the largest banks in the US.

The main motive behind the development of this collaborative structure was to create a unified payment network that can be integrated directly into existing banks for seamless access to Zelle to accomplish third-party services, like Venmo.

You should have a US mobile phone number or an email address to transfer or receive money from your trusted connection.

Above all, for flawless operations, the P2P payment app performs within your online banking portal or existing mobile banking without any requirement for a separate app.

How Does Zelle Work?

Here we will explore how Zelle works. As you know, Zelle conducts direct bank-to-bank money transfers, so the distinct processes will be there for sending and receiving money.

Let’s break it down:

► For The Sender

- Enroll: First, log in to your online banking platform or your bank or credit union’s money app.

- Pay & Transfer: Choose this or a similar section, next select Zelle, accept terms and conditions.

- Add a Recipient: Select the phone number of recipients you want to send money to or manually type your U.S. mobile phone number or email address.

- Send Money: Enter the amount to send and confirm.

Note: Zelle payments can’t be revoked; that’s why prior verification is essential.

► For The Recipient

- Receive Notification: After the sender processes the transfer, the receiver gets a text or email notification.

- Enrolled or Not: A Zelle-registered mobile number or email will automatically get money into their bank account, mostly within a few minutes. If not enrolled, the notification they receive includes a link to sign up and payment claim instructions. Once the receiver gets enrolled with Zelle, the money is sent directly to their bank account.

What is the Zelle Business Model?

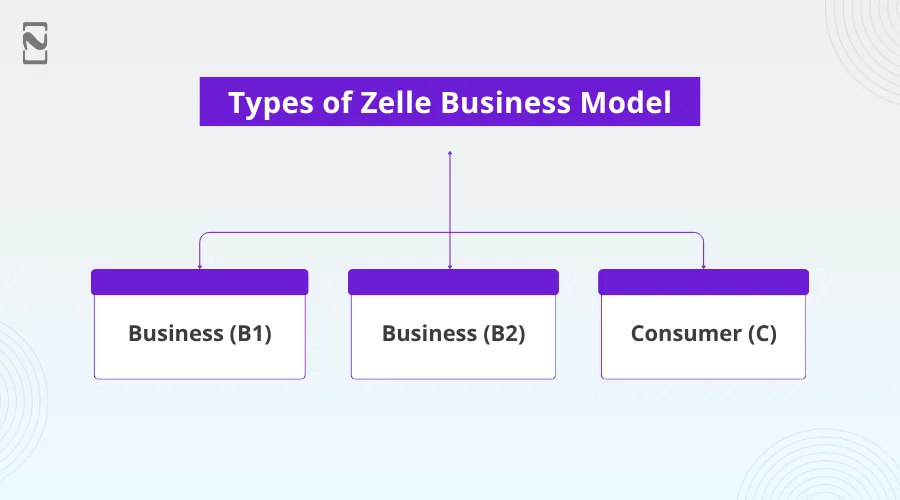

Basically, Zelle works on a business-to-business-to-consumer (B2B2C) model.

- Business (B1): It’s the parent company of Zelle, namely Early Warning Services, which is owned by a group of seven leading US banks – Bank of America, U.S. Bank, Capital One, Truist (formerly BB&T), JPMorgan Chase, PNC Bank, and Wells Fargo.

- Business (B2): The owner, Early Warning Services, integrates Zelle’s rapid and secure payment network straight in 2,200+ financial institutions.

- Consumer (C): Ahead, the bank’s customers leverage the potential of Zelle at no cost to send and receive money with family, businesses, and friends.

Zelle Ecosystem and Stakeholders

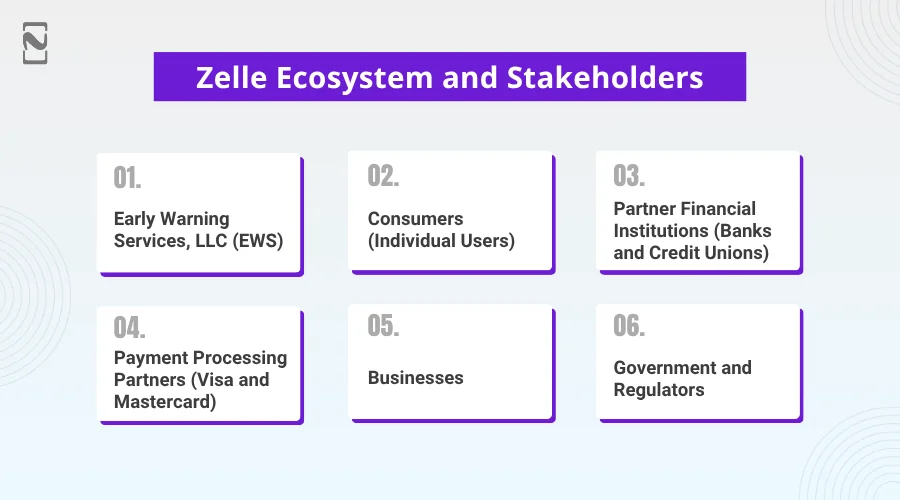

The complete ecosystem of Zelle incorporates an association of numerous key players with a prime focus on financial institutions, despite a direct-to-consumer approach.

1. Early Warning Services, LLC (EWS)

- Role: We read earlier also that this company owns and operates the Zelle network.

- Stake: Seven ruling U.S. banks that possess EWS created Zelle, a bank-centric peer-to-peer (P2P) payment solution.

2. Consumers (Individual Users)

- Role: They reap the rewards of the Zelle payment system to send and receive money with family, friends, and other trusted people.

- Stake: Consumers benefit from free, swift, and safe P2P money transfers right from their bank accounts with no need for a third-party app.

3. Partner Financial Institutions (Banks and Credit Unions)

- Role: They provide Zelle in the name of a feature to their account holders via their mobile banking apps and online portals.

- Stake: The access to the Zelle network comes at a cost that the institutions need to pay, and as a result, they experience increased customer engagement, enhanced retention, and get easy access to an extensive built-in user base.

4. Payment Processing Partners (Visa and Mastercard)

- Role: They help with a smooth transaction processing system for merchant payments conducted through Zelle.

- Stake: Ahead accumulates a percentage-based fee on every business transaction, a chunk of which is shared with the issuing bank and Zelle.

5. Businesses

- Role: Zelle registered businesses experience seamless payment acceptance directly from customers while using Zelle.

- Stake: This payment method usually comes with transaction fees, like other card processing costs that businesses pay.

6. Government and Regulators

- Role: They supervise the financial industry and define parameters for digital payments.

- Stake: Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) analyze payment networks, embracing Zelle, over consumer protection measures and fraud concerns.

Instead of charging individual users a direct fee, Zelle’s business model aims to partner with banks and financial institutions.

So far, Zelle offers swift peer-to-peer (P2P) money transfers at no extra cost for consumers, unlike its competitors (we will talk about them later in this post).

In turn, utilizing Zelle, the banks boost their customer retention and engagement with their platforms only.

How Zelle Makes Money – Revenue Strategy

You might also be seeking particulars about how Zelle earns profit. In this section, we will unveil how Zelle generates income through numerous channels.

-

Direct Fees from Partner Banks

The direct fee from the financial institutions is one of the most common Zelle revenue sources, in which they provide Zelle’s services to their customers.

Well, in some cases, the fee is fixed for those with the platform’s license, while others pay for each successful transaction.

Most banks have no issue in paying these amounts, as they enjoy cost-cutting linked to traditional payment modes, such as paper checks.

-

Merchant Transaction Fees

On every payment made by a Zelle user to a business, the merchant is charged a sum of money as a processing fee (usually around 1%) by a card network, like Mastercard or Visa.

Part of that fee is next shared with the card-issuing bank, which is the chief contributor of the comprehensive revenue stream for Zelle’s owner.

-

Value-Added Services

By offering extra services, such as fraud detection, security features, reporting tools, and customer behavior analysis to its partner banks, Zelle drives revenue sources.

Top Competitors of the Zelle App

Considering the major competitors of Zelle, the top names are Cash App, Apple Cash, PayPal, and Venmo.

► Venmo

A top rival, Venmo is widely recognized for its social feed, leveraging which users can share payment updates with whomever they want.

Millennials are mostly fond of it and cherish using its other features like a debit and credit card.

► Apple Cash

The Apple Messages app and Wallet already arrive integrated with the Apple Cash app that facilitates Apple device users to flawlessly send and receive money.

► Cash App

This financial platform supports P2P transfers and emerges with more advanced financial tools. Users are free to invest in Bitcoin and stocks, and get paychecks early.

Challenges of the Zelle Payment System

Undoubtedly, Zelle is picked for the various rewards it offers to a user, such as no transaction fees, fast transfers, high-level security, convenient integration, and cashless freedom.

Besides, there are several difficulties that Zelle carries. We will talk about some major ones below:

-

Irreversible Payments

We discussed above that once you send a payment to an enrolled user, you can’t cancel it, not at least practically.

-

No Purchase Safe

Because Zelle provides secure payment transfers between people who are connected outside the app and know each other, you can’t rely on it for purchase protection.

It states that if you pay an outsider for goods that are not delivered to you, it’s impossible to get the amount back.

-

High Scam Risk

Zelle’s strength of instant and irreversible transactions becomes its weakness as it is potentially in direct target of scammers.

If you are the victim of lottery scams, fraudulent online marketplace listings, or fake invoices, banks can’t help you.

Future Outlook of Zelle

In April 2025, Zelle’s standalone app shut down; now, it’s only accessible via its network of around 2,200 and more financial institutions.

- New Payment Types: In the near future, we can predict Zelle going ahead of simple P2P money transfers, covering a wide range of payment types, like Request for Payment (RFP), expanded business payments, and broad disbursement power.

- In-Depth Integration into Financial Institution Apps: As its standalone app is eliminated, this is going to push all its activities into bank-owned apps.

- Increased Security and Fraud Prevention: Zelle is intensifying its consumer protection and fraud prevention efforts.

- New Features: The app will likely explore more features, focusing on staying ahead of the curve while competing with its rivals.

How Nimble AppGenie Can Help?

Business owners who are planning to build an app like Zelle should have complete knowledge of the Zelle financial model, how fintech apps make money, and every minute detail.

While hunting for fintech development outsourcing, you should go for one that can meet all your custom requirements.

Well, to save you time and to ensure you finalize the right option, opt for Nimble AppGenie, the best fintech app development company with years of experience and proficiency.

Key Highlights to Consider:

- Extensive industry knowledge

- Specialized Talent

- Robust security protocols

- Secure architecture

- Fraud detection and risk management

- Agile and transparent process

- Seamless integration of AI in Fintech

- Post-launch support and maintenance, etc.

Wrapping Lines

Do you know why fintech startups fail? It’s usually because most people are unsure about how to start a fintech business and how fintech is affecting businesses.

Well, fintech is strengthening innovation in lending, payment processing, wealth management, and more.

You can also reap its rewards by empowering your business to embrace the latest technologies, like IoT in fintech terms.

Finding yourself in a muddle? Not to fret! Connect with us with your fintech startup ideas, and we are all set to serve you the best.

FAQ

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.