Let’s Discuss your

IDEA!

Turn your idea into digital products with our expert developers.

At Nimble AppGenie, we are delivering innovative solutions across the various web and app industries.

Hire highly skilled developers who are ready to help you with every technology, reach out to us today!

Nimble AppGenie has worked with some of the best platforms in the market, delivering business success. Dive into case studies.

Read More

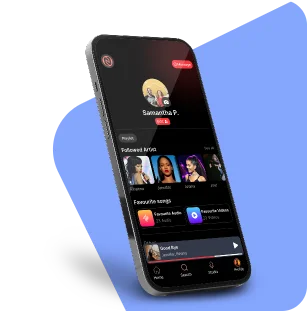

Go through to the brilliant and star-studded portfolio of Nimble AppGenie filled with amazing web solutions, web apps, and mobile apps.

Read More

The link you followed may be broken, or the page may have been removed. Don't Worry,

Go Back to Homepage

You have the Idea & We have the tools.

Our team will contact you in no time.

Discuss your project requirements with experts.

Based on your requirements, we create a proposal.

Project Manager at Nimble AppGenie

Partner with seasoned experts to transform your vision into a seamless, innovative app. Let's start your journey today!

Let's start your journey today!

Projects Completed

Clients Globally

Client Retention

Years of Experience