Financial technology has taken over the entire world. Every country, in one way or another, has started using fintech solutions to efficiently manage its finances.

Irrespective of whether it is a bank, corporate office, insurance, or anything related to money, a fintech solution is available to download and use.

While it offers immense flexibility and ease of access, a fintech solution also brings along a lot of concerns related to how safe the apps are. More than users, developers, and business owners are concerned about fintech security.

When there are financial transactions and personal data involved, cybersecurity is a prime factor to consider. Offering a fintech solution to an average user requires proper security measures and high-quality services.

Hence, if you are planning to launch a fintech app of your own, you must pay attention to the security you put in place, as a secure mobile application is trusted by all, and fintech apps require a built-in trust.

In this post, let us take a look at how fintech apps can be secured, what the different fintech app security measures are that you can take while developing the app, and how to keep your fintech app away from all the potential risks.

Without further ado, let’s start by addressing the need for enhanced security in a fintech app.

Why is Fintech Security Important?

The type of data that a fintech app collects is highly sensitive and can cause severe losses to a customer. From money to personal information, everything is on the line, and you must ensure that all of that stays secure.

Unfortunately, online banking and all the financial transactions that are being carried out always attract unnecessary attention from fraudsters and scammers.

The convenience brings along a lot of risk, which often leads to uninvited scams. These risks can range from an honest mistake to a full-fledged cybercrime.

Common Risks in Fintech Apps

Identify the major security, compliance, and operational risks that can impact the performance and trustworthiness of fintech applications.

-

Data Breaches

Fintech applications are a gold mine of data for any scammer/fraudster. If the security of a fintech app is not up to the mark, one can easily penetrate the thin walls of the app and gain access to all the sensitive customer data, including credit card details.

Data breaches are often associated with cyberattacks, executed through malware attacks, insider leaks, etc.

-

Identity Theft

For any fintech app to thrive, it should have enough security measures to identify the correct user. When a site lacks proper authentication tools, identity theft can happen easily.

Generally, when someone other than the authorized user gains access to the fintech app, it is termed as identity theft. In this type of attack, the culprit poses as the customer by using the stolen identity markers. This further leads to unauthorized purchases and services being obtained by someone else, in your name.

-

Online Scams

Online scams where fintech users are tricked into believing that they are using an authentic platform to complete transactions are highly common these days.

One of the most popular online scams is phishing, where the scammer poses as an authentic entity and steals your personal information, just to blackmail you later.

These scams work on deception. Other ways these online scams work include fake ads, lottery scams, and fake website links/emails.

Fintech security comes in handy to eliminate these risks. Other than this, security is crucial as, without proper measures, you cannot meet all the fintech compliance and regulatory requirements.

Having proper fintech security measures in place makes it easier and easier for the user to trust your app with their sensitive information.

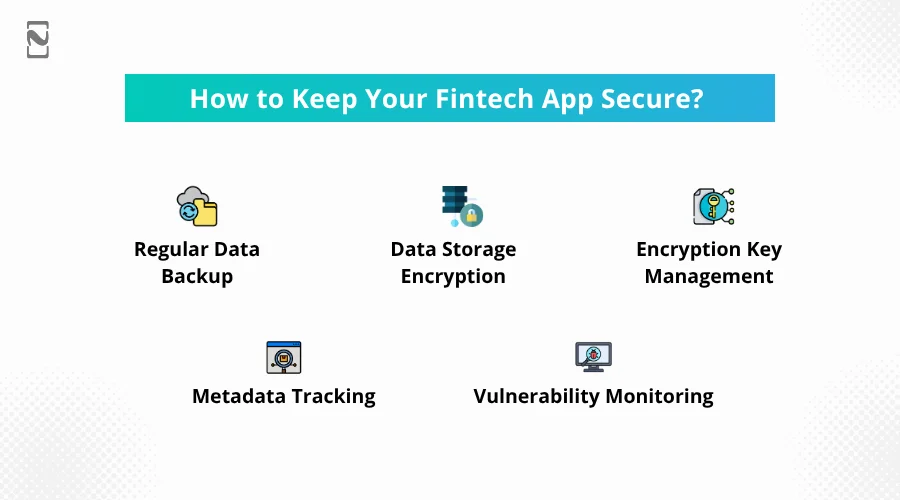

How to Keep Your Fintech App Secure? Best Practices

Knowing what can bother a user and affect your fintech business, you may be wondering how you can avoid all of it.

Well, keeping your application secure is the ultimate way to maintain your good reputation.

In case you are wondering how to do so, check out the following best practices that can help you keep your fintech app secure –

1. Regular Data Backup

Make sure your fintech app data is regularly backed up so that it can be recovered easily in times of distress. The information stored is the backbone of your fintech app. Hence, make sure that there are backup copies of the same, which are kept securely.

2. Data Storage Encryption

The process of encrypting data before directly storing it on a storage device is referred to as data storage encryption. With the help of cryptographic algorithms, the process converts readable data into unreadable ciphertext.

This makes the entire data untouchable, as only people with the correct decryption authority can decrypt it.

3. Encryption Key Management

Serving as a key component in fintech security, encryption key management ensures that the data that you have encrypted stays secure. Everything related to encryption, including creation, distribution, storage, and usage of encryption keys, falls under encryption key management.

Every fintech app that uses encryption must have sound management, as it is important to maintain the confidentiality and integrity of sensitive data.

4. Metadata Tracking

With the help of tracking, the metadata involves gathering IP addresses and device IDs to get login access and detect any unauthorized access.

With the help of Meta Tracking, the organization can easily identify if the individual is trying to access funds and finish the transaction is authorized or not. This also helps in taking protective measures in case something goes wrong.

5. Vulnerability Monitoring

All fintech apps and platforms must undergo regular checks to identify the vulnerabilities of the system that is being monitored. Checking for errors regularly allows you to be more and more aware of the issues that may occur in the future.

This way, you can keep the fintech security intact while ensuring that nothing else happens to your fintech solution, and the issue can be resolved before it happens again.

With all these practices in place, you can easily ensure that the experience of your users is secure. Fintech security is one of the priorities that you need to pay attention to.

If you are worried about how you can do so, do not hesitate to connect with the professional app developers.

Another crucial thing that you need to pay attention to is the fintech app compliance and regulations. To learn more about some popular compliance issues that directly coincide with the security of a fintech app, check out the next section.

Fintech Security Compliance & Regulations to Follow

Staying compliant with relevant regulations and standards is not just about avoiding fines; it’s about ensuring robust security.

Regulations like GDPR, PCI DSS, and others mandate stringent security measures to protect customer data.

Some of the core regulations that can help keep your fintech service safe and give assurance to both the customers and regulatory authorities include –

♦ KYC

Know Your Customer or KYC in fintech is a widely followed policy that allows for direct identification of your customer, ensuring that the services are availed by a legitimate user and no fake aliases are being used.

♦ AML

The Anti-Money Laundering Act, supported by advanced AML software, helps you stay away from any sort of money laundering or fraudulent activity.

This keeps your fintech service protected, as your entire business can go down if you are found guilty of money laundering or assisting the same through your application.

♦ Legislation Acts

Financial legislation consists of rules and regulations that help government bodies monitor and oversee financial activities.

For example, European authorities follow the Basel III Accord, while the United States enforces the Dodd-Frank Act to regulate its financial sector.

♦ Jurisdiction Regulations

Every fintech service has to follow the rules and regulations that apply to it due to geographical jurisdiction. Some practices may be legal in one region, while some may not be allowed.

However, in case of a cyberattack, it is the local authorities that you need for aid, hence these are a must-follow. Security rules are strict for good reason, especially when data is involved across borders.

Some of their equipment had sensitive data, so we had to prepare extra documents for customs and make sure everything was packed securely.

It took a bit more time, but nothing was held up, and everything arrived safely. The extra steps made a big difference.

And more! These regulations ensure that your fintech practices are legit and make you eligible for any assistance that you may require in case of a cyberattack. It is highly recommended that you meet all these requirements to help strengthen your fintech app security.

Review and update your security policies and practices regularly to ensure compliance. Engage with legal and compliance experts to stay informed about changes in regulations and industry standards.

Nimble AppGenie – Your Partner in Secure Fintech Solutions

In the dynamic world of fintech, ensuring robust fintech security is crucial.

At Nimble AppGenie, we specialize in developing secure and innovative fintech solutions tailored to meet your specific needs.

Our expert team delivers exceptional services, ensuring your fintech products are innovative and secure.

Nimble AppGenie is a leading Fintech App Development Company with a proven track record in delivering secure, reliable, and user-friendly FinTech applications.

We understand the complexities and challenges of the fintech industry and offer comprehensive solutions to address them.

When you choose Nimble AppGenie, you get more than a development team; you gain a partner committed to your success. Whether you need to develop a new fintech solution or enhance the security of an existing one, we are here to help.

Hire app developers from Nimble AppGenie and experience the difference that expertise and dedication can make.

Conclusion

Fintech security is something that can never be compromised. Without secure parameters safeguarding a financial transaction, no app can make it to the market.

There are several security issues and cybersecurity errors that might stop your fintech app from being completely safe to use. Ensure that you have proper security measures in place to avoid any type of fraud, scam, or cyber attack of any type.

Fintech app compliance and regulations also play a crucial role in keeping your fintech secure and in line with the modern-day requirements.

All in all, you need to identify and meet all the requirements to strengthen your fintech security to its core. If you are new to the field or are not technically proficient to do the same, hiring a professional can surely help.

Hopefully, this post answers all your questions, including how to keep your fintech app secure. With that said, we have reached the end of this post. Thanks for reading, good luck!

FAQs

Data breaches, phishing attacks, ransomware, insider threats, and unsecured APIs are some of the main cybersecurity risks in fintech. These threats can lead to financial loss, data theft, and reputational damage.

Encryption secures data by making it unreadable to unauthorized users. This approach protects sensitive financial information and ensures the security of fintech data against unauthorized access or theft.

Multi-factor authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of identification. This significantly reduces the risk of unauthorized access.

Employees are often the first line of defense against cyber threats. Regular cybersecurity training can help them recognize and avoid phishing attacks and other social engineering tactics.

By adopting secure coding guidelines, conducting regular code reviews, and using static code analysis tools, fintech companies can minimize vulnerabilities in their software applications.

Advanced threat detection systems use AI and machine learning to identify and respond to cyber threats in real time, providing an effective defense against sophisticated attacks.

Endpoints like laptops and mobile devices are common targets for cyberattacks. Implementing comprehensive endpoint security solutions protects these devices from malware and unauthorized access.

Fintech API security involves using strong authentication, authorization, and encryption methods. Regular audits and testing can also help identify and fix vulnerabilities.

Regular data backups and a robust disaster recovery plan ensure that fintech companies can quickly restore data and maintain operations in the event of a cyber-attack or data loss.

Collaborating with fintech security companies provides access to specialized knowledge and services, such as penetration testing and threat intelligence.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.