Financial literacy is becoming increasingly important with every passing day, as the rise of fintech services has made people self-reliant.

Gone are the days when a banking official was responsible for handling all your accounts. Today, all of it happens through your smartphone or PC, depending on your account type.

Fintech applications have surely given power right into your hands to manage your finances; however, as they say, with great power comes great responsibility.

You need to be highly aware of all the norms and changing regulations. This is where your financial literacy comes into play.

In this post, let us take a look at the concept of financial literacy apps and identify the best applications that you can use to start your journey.

What is a Financial Literacy App?

Financial literacy apps, as the name suggests, are applications that are built to spread awareness about various financial concepts that users may use in their daily lives.

These applications educate individuals about personal finance concepts, tools, and how to make informed decisions based on financial market conditions.

There are thousands of financial products and apps available in the market. But wait, how do you keep yourself up to date with everything?

Well, there are several financial literacy apps that you can find, install, and use to gain an understanding of the dynamic financial changes.

However, it is not easy to choose the right financial literacy application, as there are thousands of applications available in the market.

Well, to help you resolve your queries related to which is the best financial literacy app available in the market, we have curated this list!

Check out the list of the best financial literacy apps that you can find online and choose the one that suits you. Without further ado, let’s begin!

Top Financial Literacy Apps That Are Worth Your Time!

Before we begin with the list, you must understand that there are different categories of financial literacy apps.

This categorization is based on the aim of the applications. For instance, there are educational apps that are used to stay up to date with the norms of the financial world.

Some apps help you understand stocks and investments, and some applications convey financial information through games and interactive experiences.

The following is a list of financial literacy apps that combine all of the categories. Check them out!

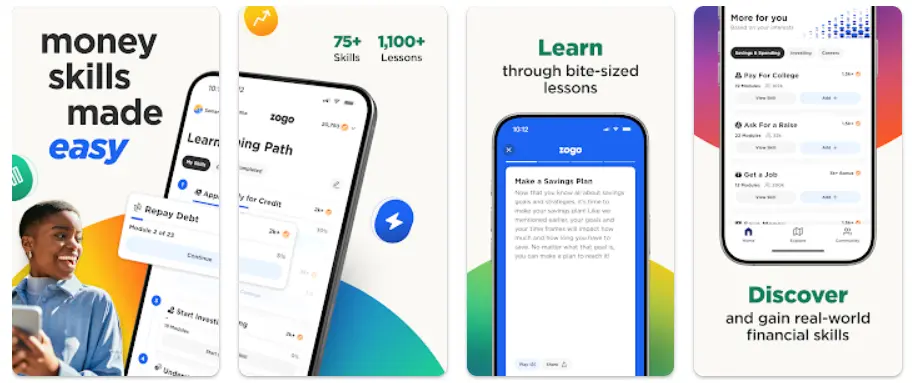

► Zogo

| Category | Cost | Supported Platforms | Supported Languages |

| Educational | Free | iOS, Android | English |

The best financial literacy app provides users with financial knowledge and empowerment. This app is the ultimate destination for those seeking to master their finances.

With its unique approach to financial education, Zogo has transformed the landscape of financial literacy apps for adults.

By making learning about money management not only informative but also incredibly fun.

Whether it’s budgeting to investing, credit to savings, the logos cover a wide range of essential financial topics that are relevant to adults of all ages.

The best thing about Zogo is that it pays you to complete lessons. Pay rewards to users with gift cards, including Amazon, Starbucks, and Target.

Plus, the app’s gamified approach to financial education is like thrilling quests, solving financial puzzles and competing with friends to earn points, badges, and rewards as you level up your financial knowledge.

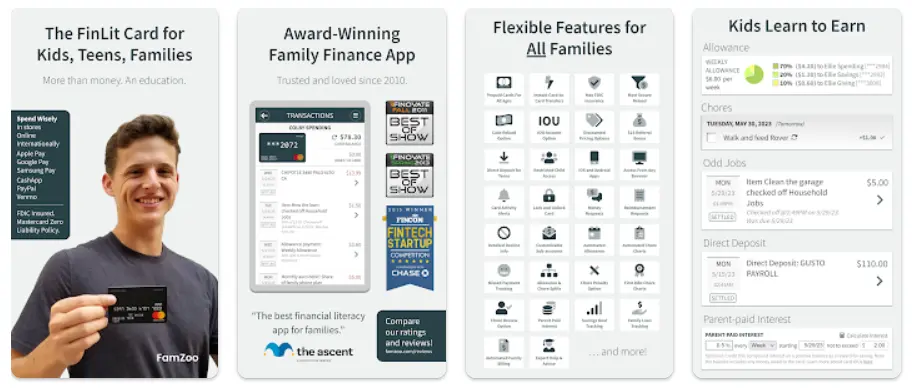

► FamZoo

| Category | Cost | Supported Platforms | Supported Languages |

| Money Management | Free | iOS, Android | English |

Financial literacy with FamZoo becomes exciting as it is the ultimate tool for parents and kids to master personal finance in a fun and interactive way.

In other words, FamZoo is just another financial literacy app, but a complete family financial management system. With these apps, “try financial literacy” sounds exciting.

The app empowers parents to guide their children’s financial education. With FamZoo, parents can set up virtual family banks to create customized budgets all in one place.

Moreover, the game offers a gamified experience that makes learning about money enjoyable and exciting. Parents can automate allowances, create budgets, give out loans, and much more.

The best thing about this app is that parents can start with simple teaching and can teach more sophisticated financial concepts later.

Also, kids can track their spending, saving, and set saving goals, and even invest in virtual stocks.

Earn rewards and badges for completing financial challenges and quizzes, making the learning process rewarding and motivating.

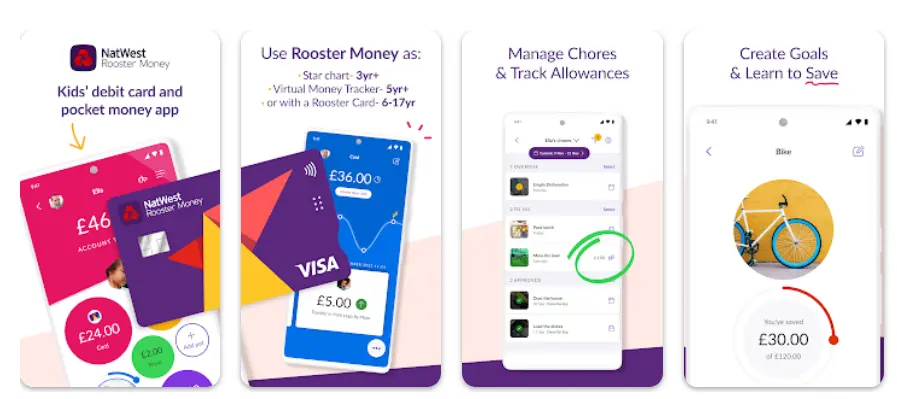

► NatWest Rooster Money

| Category | Cost | Supported Platforms | Supported Languages |

| Money Management/Educational | Free | iOS, Android | English |

With innovative features and a user-friendly interface, Rooster Money has become one of the top financial literacy apps for kids. It helps raise responsible and savvy children.

Moreover, with this app, kids can set saving goals, track their spending, and manage their allowances or earnings in a virtual bank account.

One of the standout features of Rooster Money is its unique parent-child collaboration. Parents can set up chores and tasks for their kids, assign allowances or payments, and track their progress.

When kids can complete chores and mark them as done, it provides a sense of responsibility and accomplishment. Parents can set up automated allowances and rewards, helping kids learn about regular income and savings.

With this app, kids can think about different ways of using their money, and parents can split allowances with this app.

If you want to enhance the financial literacy of your kids, there is no better app than RoosterMoney.

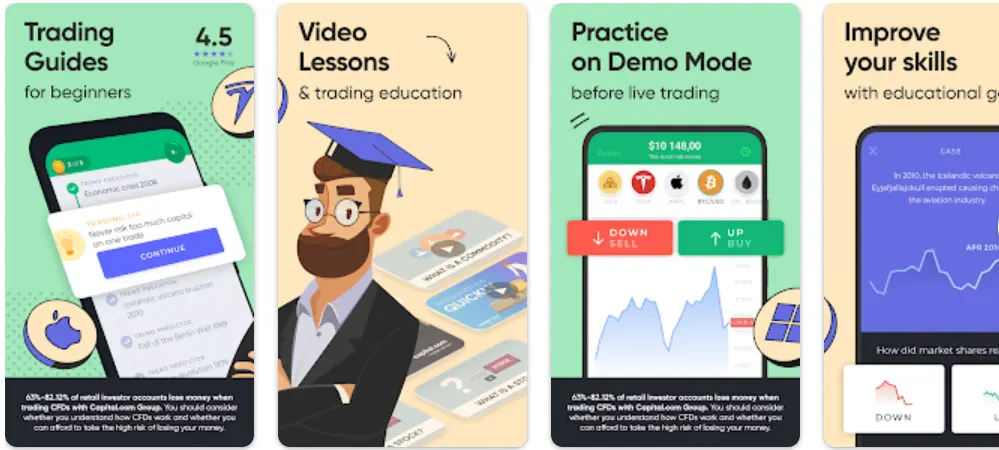

► Investmate

| Category | Cost | Supported Platforms | Supported Languages |

| Stocks & Investment Training | Free | iOS, Android | English |

Investopedia is a cutting-edge app that provides a comprehensive learning experience to build financial literacy and help individuals achieve their trading goals.

It is more than just a financial literacy app, a complete trading education platform that offers a wide range of educational resources for beginners and experienced traders.

The app covers a variety of topics, including market analysis, technical and fundamental analysis, risk management, and trading psychology.

It also offers a step-by-step learning path that is designed to empower users with the knowledge and skills needed to make informed trading decisions.

Moreover, the app offers a variety of educational materials, including articles, videos, quizzes, and interactive exercises that cater to different learning styles.

Users can track their progress, earn badges, and unlock new levels as they complete each module.

It also provides users with a practical approach to learning by offering a simulated trading experience.

Plus, users can practice their trading skills in a risk-free environment with a virtual trading account, allowing them to apply what they have learned without risking real money.

So, whether you’re a beginner who is just starting to learn about trading or an experienced trader looking to further enhance your skills.

Investopedia is the perfect companion to help you build your financial literacy application and succeed in the trading world.

► GoHenry

| Category | Cost | Supported Platforms | Supported Languages |

| Educational | Free to Use, Subscription Available | iOS, Android | English |

Lastly, it is a popular financial literacy app that aims to educate young users about financial literacy. One of the key features of GoHenry is its goal-setting functionality that allows users to set savings goals and track their progress.

The app also provides real-time notifications to parents. Plus, allowing them to monitor their children’s spending, set spending limits, and provide allowances or rewards based on financial behaviors.

In addition to goal-setting, GoHenry includes educational content such as financial quizzes and interactive lessons. This covers various financial topics, including budgeting, earning money, and making responsible spending decisions.

The app provides a virtual Visa debit card for kids and teenagers, which can be used for online and in-store purchases.

Helping them learn about responsible card usage and financial transactions in a controlled environment.

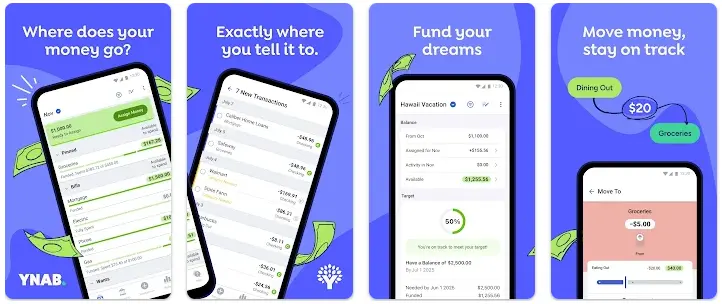

► YNAB

| Category | Cost | Supported Platforms | Supported Languages |

| Financial Tracking/Money Management | Free / Subscription Available | iOS, Android | English |

You Need a Budget (popularly referred to as YNAB) is a renowned app used for personal budgeting and money management. The app teaches a user about creating a budget and following it through the month for better financial stability.

The application promotes proactive budgeting, with the idea of making a user aware of their expenses, allowing them to plan them rather than calculating them once they are done.

This money management application offers insights into different budgeting approaches such as the envelope system, zero-based budgeting, and more.

It is a must-have application if you are struggling to make ends meet with your current income, as it can change your spending habits and help you be more cautious about how you use your money.

The application is certainly a good way to start your journey towards financial literacy and independence.

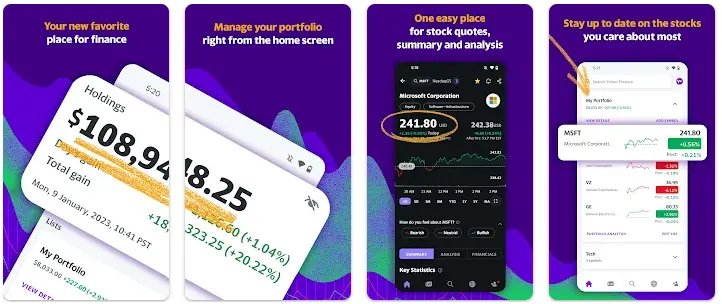

► Yahoo Finance

| Category | Cost | Supported Platforms | Supported Languages |

| Stocks & Investment | Free / Subscription Available | iOS, Android | Multilingual |

Yahoo Finance is a renowned financial literacy platform that offers market insights, news, and different financial tools to manage your assets properly. The app helps you track your investments and market trends. This is one of the best investment apps you can find for beginners.

With classified markets and detailed financial information about every stock and its ratings, Yahoo Finance offers you the best opportunities to choose the right investment opportunity.

You can even track the performance of the stocks that you have invested in, from their ESG ratings to the list of top holders.

The app also offers real-time notifications, news, and trends on your investments, helping you stay on top of all the financial decisions you make in the current landscape.

Other than these, it offers original content in the form of blog posts, commentary and personal finance management.

► Fortune City

| Category | Cost | Supported Platforms | Supported Languages |

| Interactive / Financial Games | Free / Subscription Available | iOS, Android | Multilingual |

One of the most popular gamified financial literacy apps is that it allows users to learn the concepts of financial literacy while offering an interactive experience that keeps the user engaged.

This is a great app if you want to introduce financial concepts to someone young.

The application offers an interactive gameplay in which you take up the role of a mayor in a city. Now, as a mayor, it is your responsibility to spend money wisely.

This leads to an understanding of budgeting, bookkeeping, and the economy of a city.

Fortune City is one of the most popular games that promotes financial literacy while making it all seem so interesting.

It can teach you to record your income, manage expenses, and offer you ways to manage your money in real life scenarios, so you are ready when the time comes.

There are several financial literacy apps available on the market. It is important to research and choose an app that aligns with your financial goals, preferences, and comfort level with technology.

How Can Financial Literacy Apps Help You?

Going through the list of all these popular apps, you may be wondering, “OK, these apps can do a lot, but how can they help me?”. Well, these applications are a modern-day guide to leading a balanced life.

Hence, if you are starting your financial journey or are already an earning individual, these apps can help you be on the right track, helping you avoid several issues, including financial crisis, bankruptcy, and debt trap.

To give you a better perspective, here are some ways financial literacy apps can help you:

- Financial Stability Financial literacy plays a crucial role in achieving and maintaining financial stability. It helps individuals to maintain financial stability.

- Empowerment, financial literacy, empowers individuals to make responsible financial decisions. It equips them with the knowledge and skills necessary to manage money effectively.

- Wealth CreationKnowledge of finance is essential for wealth creation. With a financial literacy app, individuals can understand the various investment options available to them.

- Financial SecurityIt helps individuals understand the importance of insurance, estate planning, and retirement planning. It enables them to make informed decisions about insurance coverage.

- Protect Yourself From Debt and Bankruptcy literate person knows how to cut expenses and how much to save for an emergency. It takes up to three to six months to maintain that level all the time.

Conclusion

Overall, it is recommended to use the best apps for financial literacy, and you are good to go.

The idea of being taught about financial concepts not only comes from the evolving fintech industry trends but originates from the fundamentals of leading a successful life.

Hence, you should pay attention to your financial literacy and ensure you make the most out of available resources.

With that said, we have reached the end of this post. Hopefully, you might have gotten an understanding of what financial literacy apps are, which are the top fintech apps that you can choose from, and how these applications can help you in the long run.

If you have any questions related to financial app development services or you plan to build your own financial literacy apps, then feel free to reach out to us! Thanks for reading, good luck!

FAQs

Financial literacy refers to the knowledge and understanding of financial concepts. Also, the skills necessary to make informed financial decisions and manage personal finances effectively.

Financial literacy is important as it empowers individuals to make informed financial decisions, manage money wisely, & avoid financial pitfalls. And build a strong foundation for long-term financial success.

The cost of building a financial literacy app depends on various factors such as features, complexity, platform, and development team. It can range from thousands to tens of thousands of dollars.

To build a financial literacy app, one needs to define the app’s goals, research financial topics, create engaging content & design user-friendly interfaces. Plus, develop relevant features such as budgeting tools, goal-setting, and educational content.

The development time for a financial literacy app depends on its complexity and features, ranging from a few weeks to several months, considering the design, development, testing, and deployment stages.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.