Cryptocurrency has gained immense popularity in the past decade, to such an extent that it has given rise to the concept of decentralized finance.

The idea behind decentralization originates from the use of blockchain in fintech, a key technology that enables the decentralization of financial transactions for enhanced security.

However, decentralized finance, popularly known as DeFi, is not the only concept that has improved finances.

Alongside DeFi, we have CeFi, or centralized finance, which is more of a traditional finance solution that holds direct control over the transactions that are being carried out centrally.

Since both concepts are directly associated with cryptocurrency and crypto transactions, it often becomes a point of confusion for many. If you are confused between DeFi vs CeFi, then do not worry, as this post is for you.

In this one, let us explore everything you need to know and compare the key benefits and shortcomings of both to identify which is better between DeFi vs CeFi. Without further ado, let’s start by understanding them one by one!

What is CeFi? Understanding Centralized Finance

As the name suggests, centralized finance uses a centralized approach to enable transactions and similar operations. It is more traditional banking-oriented, taking advantage of centralized authorities like banks and trusted intermediaries.

One of the key factors that makes crypto transactions autonomous is that people hold their currencies with them in the form of keys and manage them themselves. However, CeFi makes it easy for you to trust a crypto exchange platform to manage services and store your funds.

People prefer centralized finance as it takes away the stress of crypto management from their shoulders. What makes it a more secure approach is that it integrates KYC and AML policies.

These ensure that the platform checks the personal information of the user to ensure that the funds are being accessed by the right person, and that they are not coming from or being used for illegal activities.

While these policies of CeFi help in meeting the financial regulations and making it more and more trustworthy, people often find CeFi highly limiting, as they no longer have direct control over their crypto.

Examples of CeFi: Binance, Coinbase, Gemini.

What is DeFi? An Overview

While centralized finance offers management benefits for your crypto, decentralized finance brings transparency to the table. The idea behind crypto transactions was to give users a currency that was less regulated and could not be traced.

With direct access to the fintech market, a user has the option of directly trading and managing services such as lending, money issuance, transactions, and asset management, without having to depend on a third party.

Since there is no central authority on which a user has to depend for approval or denial, it makes it easier to make peer-to-peer transactions.

However, the transparency and authority over the transactions are not always good, considering there are several novice users. Autonomy makes it difficult for a new user to stay on the blockchain and make the right decisions.

Examples of DeFi: AAVE, Stablecoins, Uniswap.

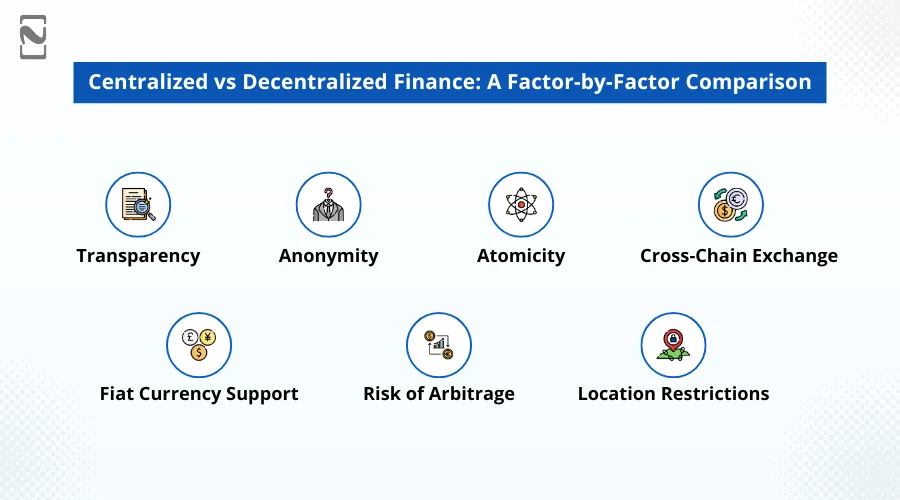

DeFi vs CeFi: Differentiating Factors

Looking at the definition of both systems, the key difference that emerges is in the way they function.

While CeFi uses a centralized approach in managing your crypto assets, and manages things for you. DeFi reduces the hassle of approvals and gives you complete control of the assets you own.

While that is the most obvious difference, there are several other points on which a comparison can be drawn between DeFi vs CeFi.

First, understand the pointers below, and then move on to read the differences between centralized and decentralized financial systems based on those factors.

- Transparency: The degree of transparency between the currency holder and the transaction processing.

- Anonymity: The ability of a transaction to be anonymous, without exposing the user’s identity.

- Atomicity: It refers to the virtue of a process in which all the steps need to be completed to finish the process. If any of these steps fail, the entire transaction fails.

- Cross-Chain Exchange: The ability of a blockchain transaction to be traded across chains.

- Fiat Currency Support: Use of fiat currency to buy and sell cryptocurrencies on the platform.

- Risk of Arbitrage: Arbitrage refers to the continuous buying and selling of currencies to yield profits from the fluctuating rates of exchange.

- Location Restrictions: Refers to the restriction of usage or transactions based on the location of the user.

Check out the table below to understand the differences between DeFi vs CeFi based on the aforementioned factors.

| Differentiating Factors | CeFi | DeFi |

| Transparency | CeFi lacks code and transaction-based transparency, as every step of the process is done by a third party or a centralized organization. | DeFi transactions should be publicly verifiable and transparent so users can check the blockchain for timely state changes. |

| Anonymity | CeFi offers less anonymity, as there are other parties involved in every blockchain transaction that you make. Since the intermediary you choose has your information, the transaction is no longer anonymous. | DeFi (Decentralized Finance) provides strong anonymity due to the absence of third parties. The decentralized nature of blockchain allows individuals to remain private, which is why many transactions are carried out by anonymous users. |

| Atomicity | Atomicity refers to the property of a process by which it depends on the succession of each step to complete the process. This means a transaction will either process or completely fail. CeFi does not offer Atomicity. | DeFi is highly decentralized and requires the entire blockchain to complete the process to complete the transaction. This also means that the atomicity of these transactions is higher. |

| Cross-Chain Exchange | Cross-chain exchanges are supported in CeFi, as it has the option of cross-chain swaps that enable them to obtain asset custody from multiple chains. | DeFi, on the other hand, struggles to perform cross-chain transactions since it lacks atomicity. This makes it difficult to switch processes and delays performing the cross-chain swaps. |

| Fiat Currency Support | CeFi offers high flexibility when you have to use Fiat currency for exchange, as there are organizations that enable the exchange. | DeFi has low flexibility and is slightly tough to meet the flexibility of fiat currency trades, as there is no direct platform to convert the currency into crypto. |

| Risk of Arbitrage | Risk is quite high in CeFi, as if the arbitrage is not yielding profit, the transaction might go through, yielding losses. | The risk of arbitrage is certainly low in DeFi and is negligible, as a user can simply write a smart contract that can directly avoid the transaction if the arbitrage is not yielding a profit. |

| Location Restrictions | CeFi follows the traditional route with multiple intermediaries moderating a transaction. This also means that if the platform you have chosen for blockchain transactions has blacklisted a certain country, you will not be able to make transactions from there. | DeFi, on the other hand, is free of any sort of restrictions and can get the job done from any country or any region that can support the internet and blockchain. The restrictions are negligible. |

Based on all these differences and factors, you can easily identify which of these is the best for your use case.

Each of them has its pros and cons. While one offers guided solutions and simplified options, the other offers a hundred percent transparency and total control. The choice is yours.

Who Can Help You Build a DeFi or CeFi Solution?

Knowing the distinction between the two, you might have a question: can every developer build DeFi or CeFi, or both types of solutions?

Some experts can complete the job for you, but high-end companies like Nimble AppGenie have resources that understand and execute tasks thoroughly.

With years of experience and a strong team of technical experts, we at Nimble AppGenie are the best fintech app development company to make the best decisions while building a crypto platform.

If you’re uncertain about which financial system to choose, consult experts who can blend the benefits of centralized finance (CeFi) and decentralized finance (DeFi) into a complementary infrastructure.

The possibilities are endless as the blockchain technology is highly explorable and offers significantly lucrative opportunities. Connect with the professionals today and start your journey towards excellence.

Conclusion

Both CeFi and DeFi work in the same financial realm, which is lending, trading, insurance, asset management, etc., while there are differences that draw a line, there are significant similarities too that allow a user to be more rational while choosing the option to build.

For experienced blockchain users, DeFi offers better security and anonymity for crypto trading..

However, if you only plan to use it for investment purposes, having an intermediary like CeFi can be beneficial.

Hopefully, this post helps you understand the difference between DeFi vs CeFi. That will be all for this blog. Thanks for reading. Good luck!

FAQs

system, while DeFi uses cryptographic technology and code to ensure high-end fintech security.

server.

more focused on the financial freedom of the user. This gives a pretty good answer to those comparing the two,

as they can choose what they want and make the decision for themselves.

changing the way transactions are done in multiple fields.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.