What is the best core banking software?

This is a commonly asked question in the world of business since every top tech and non-tech company deals with money.

Core banking system software makes everything that much easier. Now, with this being said, we shall be discussing everything you need to know about core banking software and go through the best core banking software list.

So with that being said, let’s get right into it:

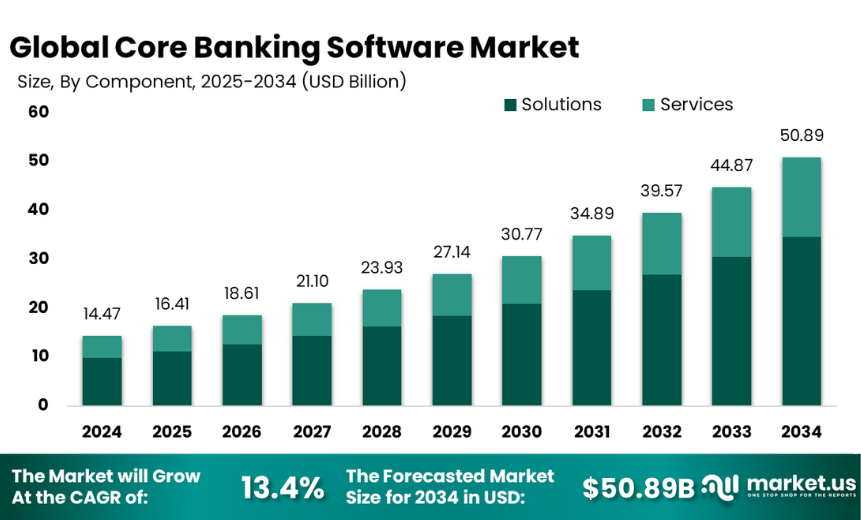

Core Banking Software Market

Let’s start with banking statistics for the core banking software market.

- The global core banking software market size was valued at USD 14.47 billion in 2024 and is projected to grow to USD 50.89 billion by 2034, at a CAGR of 13.4% during the forecast period.

- Growth in the core banking software market share is driven by increasing demand for digital banking, the need to improve operational efficiency, and the growing adoption of cloud-based solutions.

- Moving on, the key players in the core banking systems market include Temenos, Oracle, SAP, Infosys, Finastra, Mambu, Backbase, and TCS.

We shall be discussing more about these market-leading and best core banking software in the world later down the line. Meanwhile, let’s look at the definition of the same in the sections below:

Best Core Banking Software in the World

Now, let’s look at some of the best core banking software in the world. Let’s look at them below, discussing each of them in detail.

1. Finacle

Finacle, developed by EdgeVerve (a subsidiary of Infosys), is a banking software that has gained significant popularity in the industry.

Known for its robustness and flexibility, Finacle empowers financial institutions with the ability to streamline their operations and enhance customer experience.

Moreover, its user-friendly interface and comprehensive suite of tools enable banks to deliver seamless banking services, whether it’s through traditional channels or digital platforms.

Finacle’s innovative approach towards core banking, online banking, mobile banking, and analytics allows banks to stay ahead in a rapidly evolving digital landscape.

Features:

- Account Management

- Loan processing

- Treasury Management

- Customer Relationship Management

- Multi-channel banking

- Risk management

- Regulatory compliance

Benefits:

- Scalability and flexibility

- Robust security

- Wide range of features

- Global reach

- Proven track record

2. Temenos

Temenos Transact is a core banking software that has established itself as a leading player in the market.

What sets Temenos Transact apart is its ability to cater to diverse banking needs, ranging from retail and corporate banking to universal banking.

With a strong focus on scalability and efficiency, Temenos Transact enables financial institutions to manage their operations seamlessly and deliver personalized services to their customers.

The solution’s comprehensive suite of features and its integration capabilities with other systems make it a preferred choice for banks seeking to modernize their infrastructure.

Features:

- Real-time customer service

- Mobile banking

- Fraud prevention

- Cloud-based

- Open architecture

- Regulatory compliance

Benefits:

- Reduced costs

- Improved efficiency

- Enhanced customer experience

- Increased security

- Global reach

3. Oracle FLEXCUBE

Oracle FLEXCUBE is a comprehensive banking platform offered by Oracle, one of the world’s leading technology companies. Designed to meet the complex requirements of modern financial institutions,

FLEXCUBE provides an extensive range of functionalities beyond core banking, such as customer relationship management, wealth management, and risk management.

Oracle’s deep industry expertise combined with its robust technology infrastructure ensures that FLEXCUBE delivers high performance, security, and scalability to banks of all sizes.

Features:

- Multi-currency support

- Cross-border payments

- Regulatory compliance

- Real-time processing

- Risk management

- Customer Relationship Management

Benefits:

- Meets the needs of a global marketplace

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

4. Mambu

Mambu is a cloud-native banking platform that has emerged as a disruptor in the banking software space.

Built on modern technology principles, Mambu empowers financial institutions to deliver agile and innovative banking services.

Its cloud-based infrastructure enables banks to scale their operations rapidly and provides the flexibility to adapt to changing market dynamics. Mambu’s modular architecture and extensive API capabilities allow for easy integration with existing systems and the seamless launch of new products and services.

This makes it an ideal choice for banks looking to accelerate their digital transformation journey into fintech.

Features:

- Cloud-based

- Open architecture

- Low cost

- Quick to implement

- Easy to use

- Scalable and flexible

Benefits:

- Ideal for small and medium-sized banks

- Quick and easy to get started

- Low cost

- Scalable and flexible

5. Backbase

Backbase offers a digital banking platform that revolutionizes the way financial institutions engage with their customers.

By combining sleek design with powerful functionality, Backbase enables banks to deliver immersive and personalized experiences across multiple channels.

Its user-centric approach ensures that customers can effortlessly access banking services, manage their accounts, and conduct transactions, thereby fostering loyalty and satisfaction.

Backbase’s intuitive interface and advanced analytics capabilities empower banks to gain valuable insights into customer behavior and make data-driven decisions.

Features:

- Real-time customer service

- Mobile banking

- Personalization

- Cloud-based

- Open architecture

- Regulatory compliance

Benefits:

- Improves customer experience

- Increases customer engagement

- Reduces costs

- Improves efficiency

- Global reach

6. SAP Transactional Banking

Let us introduce you to one of the best core banking software.

SAP Transactional Banking is a comprehensive banking solution offered by SAP, a global leader in enterprise software. Designed to support end-to-end banking operations, SAP Transaction Banking provides a unified platform for core banking, payments, liquidity management, and regulatory compliance.

Leveraging SAP’s extensive experience in the financial services industry, the solution helps banks streamline their processes, enhance operational efficiency, and ensure compliance with evolving regulatory requirements.

With its integration capabilities and robust reporting tools, SAP Transactional Banking equips banks with the tools they need to thrive in a highly competitive market.

Features:

- Real-time processing

- Risk management

- Regulatory compliance

- Cloud-based

- Open architecture

- Wide range of features

Benefits:

- Improves efficiency

- Enhances security

- Meets the needs of a global marketplace

- Scalable and flexible

- Proven track record

7. Finastra Fusion

Finastra Fusion is a core banking software platform that combines core banking capabilities with a wide range of additional financial services functionalities.

With a focus on empowering financial institutions to drive innovation and agility, Finastra Fusion offers a unified view of customer data, enabling banks to provide personalized services and streamline their operations.

The platform also includes features for lending, payments, treasury management, and risk management, making it a comprehensive solution for banks looking to transform their digital offerings.

Finastra Fusion’s modular architecture allows banks to choose and integrate specific modules based on their requirements, providing flexibility and scalability as their business evolves.

Features:

- Multi-currency support

- Cross-border payments

- Regulatory compliance

- Real-time processing

- Risk management

- Customer Relationship Management

Benefits:

- Meets the needs of a global marketplace

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

8. TCS BaNCS

TCS BaNCS is a comprehensive banking software suite developed by Tata Consultancy Services (TCS), one of the largest IT services and consulting firms globally.

BaNCS caters to a wide range of financial institutions, including banks, insurers, and capital market firms. Its modular architecture and extensive functionality cover core banking operations, payments, risk management, and compliance.

TCS BaNCS leverages emerging technologies like artificial intelligence (AI) and blockchain to drive innovation and help banks stay ahead in a rapidly changing industry. With its robust infrastructure and global presence, TCS BaNCS is trusted by financial institutions worldwide.

Features:

- Account Management

- Loan processing

- Treasury Management

- Customer Relationship Management

- Multi-channel banking

- Risk management

- Regulatory compliance

Benefits:

- Meets the specific needs of banks of all sizes

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

9. Fiserv DNA

Fiserv DNA is a comprehensive core banking platform offered by Fiserv, a leading provider of financial technology solutions.

Designed to meet the complex needs of financial institutions, DNA offers a modern, flexible, and scalable architecture. It provides a wide range of banking functionalities, including deposits, lending, payments, customer relationship management, and business intelligence.

Moreover, DNA’s open architecture enables seamless integration with other systems, allowing banks to create a unified ecosystem that supports their digital transformation initiatives.

Fiserv DNA’s industry expertise and commitment to innovation make it a preferred choice for banks seeking to deliver exceptional customer experiences.

Features:

- Real-time processing

- Fraud prevention

- Regulatory compliance

- Cloud-based

- Open architecture

- Wide range of features

Benefits:

- Improves efficiency

- Enhances security

- Meets the needs of a global marketplace

- Scalable and flexible

- Proven track record

10. Avaloq Banking Suite

Avaloq Banking Suite is a comprehensive banking software solution developed by Avaloq, a leading provider of banking solutions.

The suite covers various aspects of banking operations, including core banking, wealth management, payments, and regulatory compliance.

Avaloq Banking Suite’s modular architecture enables banks to choose and integrate specific modules based on their requirements, ensuring flexibility and scalability. With its focus on automation and digitization, Avaloq empowers banks to streamline their processes, enhance operational efficiency, and deliver personalized services to their customers.

The suite’s advanced analytics capabilities provide valuable insights, enabling data-driven decision-making for banks.

Features:

- Account Management

- Loan processing

- Treasury Management

- Customer Relationship Management

- Multi-channel banking

- Risk management

- Regulatory compliance

Benefits:

- Meets the specific needs of banks of all sizes

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

11. FIS

Fidelity National Information Services, popularly known as FIS, is a global financial technology company with expertise in providing solutions.

FIS serves over 14000 clients and is present in over 100 countries, showcasing its vast reach and why it is on the top core banking software list.

Offering ease of access and high-quality features, FIS dominates the markets in the US and the UK with its payment processing services.

FIS is also known to facilitate digital transformation in traditional banking services, as it is more and more flexible and offers significant robustness, making it easier for traditional banks to go digital.

Features:

- Digital Banking

- Account Management

- Loan Processing

- Customer Relationship Management (CRM)

- Interest Calculations

- Financial Reporting

- Real-time Operations

- Scalability and Flexibility

Benefits:

- Scalability and flexibility

- Robust security

- Wide range of features

- Global reach

- Proven track record

12. Novatti

International Bank of Australia serves as a subsidiary of Novatti to provide highly robust solutions for accepting and processing cross-border payments.

The system also supports embedded finance, allowing all types of businesses to enjoy a seamless customer experience and reduced friction during transactions.

Novatti offers a single platform for managing all types of banking transactions and services such as account management, transaction processing system, and more.

It also supports branchless banking and has more than 2 decades in fintech solutions. Novatti is a Visa Principal Partner, which means it also works as a card issuer program to offer branded prepaid cards to businesses.

Features:

- Payment Processing

- Card Issuing

- Digital Wallet Solutions

- Cross-Border Payments

- Supports API Integration

- Online Payment

- Account Management

Benefits:

- Streamline Operations

- Increased Efficiency

- Robust Security

- High Scalability

- Cost Savings

13. Forbis

Forbis is a leading name in the industry that offers its cloud-based Core Banking System called FORPOST. It is designed to optimize the efficiency of banking operations.

The idea is to execute a hands-free approach to banking, making it easier for financial institutions to delegate their resources to improve customer service and business strategy.

With proven experience in CEE and CIS markets, Forbis can help you with features for the local clients. Not to forget, FORPOST is a SAAS product, which means more ease of access from anywhere in the world.

The company is also active in providing professional consulting services and training on core banking services to its clients.

Features:

- Lending

- Accounting and Reporting

- Client Relationship Management (CRM)

- Digital Banking Channels

- Encryption & Other Security Features

- Scalability

- Interfaces

- Multi-currency

- Blockchain

Benefits:

- Seamless Integration

- Faster Transactions

- Ease of Access (Anytime, Anywhere)

- Integrated Risk Management

- Access to an Array of Services

14. Securepaymentz

Another interesting approach towards solutions is Securepaymentz. It offers a virtual banking system that helps financial institutions take care of banking operations.

What makes Securepaymentz stand out from other core banking systems in the market is its subscription-based model. You can start using the services with a subscription fee, rather than paying a large license fee upfront.

The subscription makes the application more dependent on the Securepaymentz team, as they are the ones taking care of all the updates and management.

Securepaymentz also offers account administration and currency exchange features embedded in the system, making it globally appealing.

Features:

- Credit Cards

- Financial Transactions

- Loan Account Management

- Online Banking

- Compliance Tracing

- Payments & Transfers

- Private Banking

- Security Management

Benefits:

- Transparent View of Finances

- Low Upfront Cost of Investment

- Automated Alerts & Notifications

- Improved Security Protocols

- Real-time Activities & Settlement

15. nCino

Founded in 2012 as a commercial loan facilitation platform, nCino has come a long way since then. Today, it offers a complete suite of solutions.

The app targets both regional and communal banks to expand its reach, offering them streamlined solutions for efficient operations. The focus of nCino, however, has always been on simplifying lending and loans.

Banks use nCino as a solution to the endless paper trail created during the process, which eventually slows down the approval process for commercial loans.

However, with nCino’s core banking system, the entire process can be managed digitally, making it entirely paperless and hassle-free for the users.

Features:

- Loan Origination

- Digital Documentation

- Streamlined Onboarding

- Communication Encryption

- Salesforce Integration

- Multi-channel Access

- Interest Calculators

- Digital-First Applications

Benefits:

- Enhanced Efficiency

- Faster Loan Decisions

- Simplified Compliance

- Multiple Lines of Business Support

- Highly Transparent

Conclusion

All of these platforms are impressive in their own right and can be considered among the best core banking software in the world.

However, the ideal solution ultimately depends on the unique needs and goals of your financial institution.

Whether you’re looking to build a custom solution or enhance existing systems, partnering with a provider of expert banking software development services can help you make the right choices and ensure long-term success. With that said, we conclude the blog.

FAQs

It depends on the bank’s requirements, but popular options include Finacle, T24, and Flexcube.

Yes, most core banking software supports multiple currencies for global banking operations.

Yes, core banking software can be integrated with various systems like CRM, payment gateways, etc.

Yes, core banking software provides real-time processing for quick and accurate transactions.

Yes, core banking software helps banks comply with regulations and perform necessary checks.

Yes, core banking software is designed to handle high transaction volumes efficiently.

Yes, core banking software caters to the needs of banks of all sizes.

Yes, core banking software often includes CRM features for effective customer management.

Yes, core banking software automates loan processes and helps manage loan portfolios.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.