Core banking modernization is the process of identifying flaws or outdated systems and upgrading them with the latest technology, allowing them to be more scalable and robust.

While banking today has already become a super tech-dependent platform, the core banking processes in some cases are yet to undergo modernization.

Every type of banking process, from transactions (online & offline) to account management, falls under the core banking umbrella, as these are the prime functionalities that any user requires to engage with the bank.

Now, when an individual engages with these features, a bank has the opportunity to understand the market by breaking down the user behavior.

However, one needs modern core banking features and technologies to identify these insights. And that is where your core banking modernization comes in.

In this post, let us break down the entire modernization of the core banking spectrum and understand the need for it and the challenges that one might face while implementing it.

Without further ado, let’s begin!

Core Banking Modernization: An Overview

When we talk about the modernization of core banking, we tend to upgrade the core banking system that a bank may already be using.

This can be a traditional banking method that simply relies on human intervention and manual processing, or it can be a digital core banking solution.

Either way, keeping it up to date with the modern banking scenario is a must. Hence, you may be in need of the modernization of core banking.

If you are wondering, what is core banking modernization? So here’s a brief definition –

Core banking modernization is the process of upgrading the existing banking solution and making it ready for the current generation of users. This involves moving from legacy banking systems to modern platforms that can help in refining the user experience and allow institutions to offer personalized and real-time banking services directly to their customers.

Modernization helps a banking business stay competitive with new emerging fintech companies that are completely based on modern technology and service features.

To maintain a competitive edge and stay ahead of the competition, opting for core banking system upgrades appears to be a vital option.

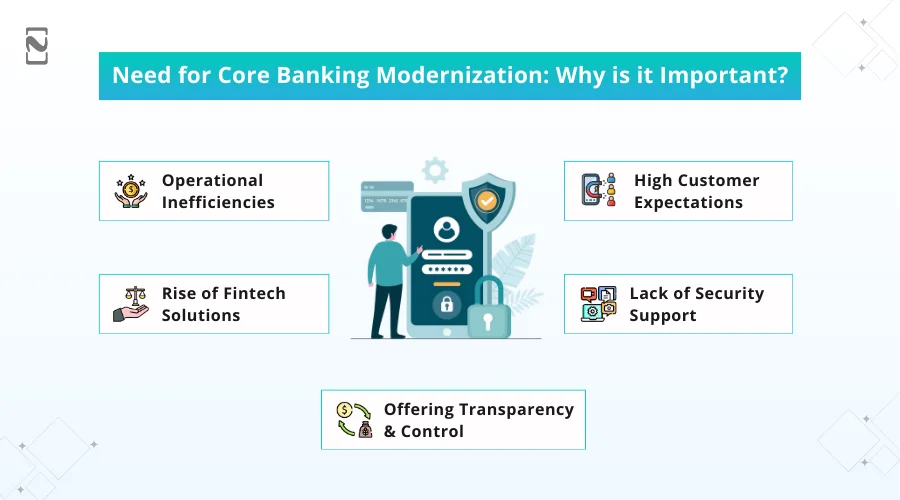

Need for Core Banking Modernization: Why is it Important?

Through this definition, you may have gained an understanding that core banking modernization is needed to keep legacy banks afloat in this ever-changing market.

However, staying competitive is not the only reason why modernization of core banking is required.

There are several reasons why it has become the need of the hour. These include –

-

Operational Inefficiencies

Users today are looking for the smoothest and fastest way to get things done. Legacy core banking solutions lack it big time.

Since more and more manual processes being used in legacy banking are often difficult to integrate into existing systems, it makes it difficult to upgrade or scale. This further introduces operational inefficiencies.

-

High Customer Expectations

One of the main reasons why core banking systems need modernization is the rising expectations of the customers. You see, with money going digital, people need access to their banks 24/7.

Not to mention, the digital services are expected to be highly personalized. This personalization can only be achieved through proper modernization of core banking.

-

Rise of Fintech Solutions

Financial technology has made it difficult for legacy banks to survive without a digital transformation. That is because, unlike traditional banking solutions, fintechs use innovative ways to gain the attention of their customers.

And without modernization, your traditional banks might lack those features. To compete with the current market, modernization is required.

-

Lack of Security Support

While legacy systems have worked properly for decades and decades, today they lack the security and compliance that is required for a financial institution to survive.

Modernized core banking systems come with integrated security measures, such as multi-factor authentication, biometric verification, fraud detection, and more. Legacy systems lack these features.

-

Offering Transparency & Control

Banking and financial services are highly dependent on the way users interact with the solution. The more transparent your banking system is, the more a user is inclined towards it.

In legacy banking systems, a user has to interact with multiple individuals, going through different phases to gain information about their own funds. Modernization of core banking systems offers transparency to the users.

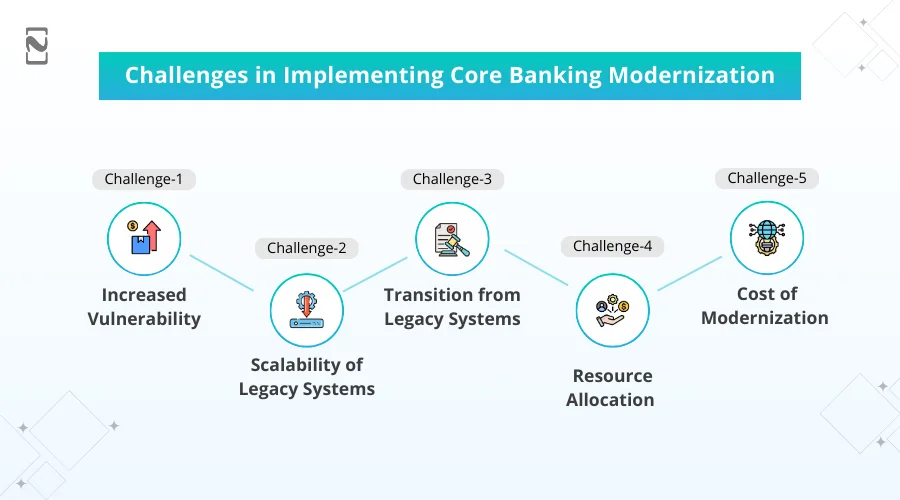

Challenges in Implementing Core Banking Modernization

The need for banking modernization can be established by the fact that more and more legacy banks are coming forward to adopt banking modernization.

The need is real, as for traditional banks to survive in this market, it is really important to offer what the customer is looking for.

However, it is not that easy. A lot of banks struggle to build the right infrastructure to support the modernization of core banking, and that is just the tip of the iceberg of challenges that these institutions have to face.

Here are some to give you a perspective –

Challenge #1 – Increased Vulnerability

One of the key challenges in the implementation of core banking modernization is the increased vulnerability to data theft and breaches.

You see, while migrating to a modern core banking system from a legacy one, all the data is exposed. Not to mention, since everything is uploaded to the cloud, it is more exposed to breaches and fraud than ever before.

Solution: Implementing data security when making the transition is key. While digital data is exposed online, there are several security measures that you can take for advanced security.

Challenge #2 – Scalability of Legacy Systems

Legacy systems have been in use for decades now, and with all that accumulated data, people have found their way to function properly.

Now, when designing a core banking system, you need the assurance that the solution you are building is scalable and can cope with the increasing workload accordingly.

Solution: With technology taking the front seat, it is clear that the future will be using modernized banking solutions. Choosing the right tech stack when planning core banking modernization can help you reduce scalability issues.

Challenge #3 – Transition from Legacy Systems

Transferring the data and training the existing staff to be compatible with the modern core banking system is another challenge that legacy systems face.

Sure, it will take time for the transition to take place, as it is not easy for users to get a clear understanding of the modern tools. More importantly, it becomes difficult for a bank to explain everything to the stakeholders.

Solution: Change can certainly be typical, especially in the banking sector, as the executives are set in their ways. However, a gradual shift towards the system and introducing the right guides for making the transition simple can be a step taken to reduce the hassle.

Challenge #4 – Resource Allocation

When designing a modern core banking system, you need to understand the crucial nature of resource allocation. You see, there are several new roles and responsibilities introduced with digitisation.

And while a bank can take the step of opting for core banking modernization, it becomes difficult to onboard the necessary resources instantly. Hence. Allocating the resources and using them to their full potential often becomes an issue for you.

Solution: This challenge can be significantly reduced by planning your modernization ahead of time. Hire the necessary human resources when the technology is being developed.

This way, you will have the resources to execute when required. Also, spending on employee training early can help you reduce the costs further.

Challenge #5 – Cost of Modernization

Last but not least, some of the legacy systems find it difficult to upgrade as they are not directly able to fund the modernization.

As mentioned earlier, modernization of core banking is the process of replacing outdated systems, and in the majority of cases, it becomes a complete rebuilding of the banking solution.

This cost has to be borne by the legacy system itself, which is a huge challenge.

Solution: Since you are more aware of your financial status than anyone, you should break down your expenses and identify things that can be neglected in the early days of the transition.

Manage the cost of modernization in the most optimized way by discussing the budget with the development company that you have hired for help.

While these challenges may seem a bit typical, planning your core banking modernization can help you overcome all these challenges effectively. The core identification of these implementation challenges depends on the approach that you take.

There are several core banking software options that you can opt for; however, gaining insights into how they work is another challenge you might face.

Hiring a professional can guide you through these implementation issues that you might face.

Why Choose Nimble AppGenie for Core Banking Modernization?

Finding the right partner to help you modernize your core banking solution is crucial. You see, while you have been iterating with a system for years, implementing changes that not only take your banking services to the next level but also reflect the same robustness as it did previously.

If you are looking for recommendations or you find yourself confused in making decisions, we surely can help!

At Nimble AppGenie, we have a team of highly experienced fintech developers and professionals who understand the pulse of the market and offer insights on effective modernization.

Nimble AppGenie is one of the leading names in finding a banking software development company. Ensure that the core banking solution is timely upgraded and modernized as required.

So what’s stopping you from making the most of our services? Connect now and start your journey towards core banking modernization today!

Conclusion

Core banking modernization offers existing legacy banking systems and traditional banks an exciting opportunity to get refurbished and compete in the current, fintech-dominated market.

The idea of core banking modernization originates from the fact that banking services have been operating in the traditional method for a while now.

With so many fintech applications changing the user experience, it only makes sense to go with the flow and implement modernization.

Identifying the challenges in modernization can help you be at the top of the implementation.

With that said, it is equally important to have a solid team of core banking modernization experts to guide you in the right direction. Hopefully, this post gives you all the possible insights. That will be all for this one.

Thanks for reading, Good Luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.