Lending is a vital part of the entire finance and banking industry. With the evolution of time and the market, lending as a concept has significantly changed, thanks to the introduction of advanced technologies, such as AI.

AI in lending has overtaken several manual processes, making it more accurate and accessible for banks and non-banking financial companies (NBFCs). Artificial intelligence is one of the most powerful tools to have emerged in the past decade or two.

With the power of AI, every crucial job that requires precision can be automated through the implementation of new-age features that can be run with AI. You might have read about AI in finance and how it is making a global impact.

Well, let’s just say technology has helped lending, too. In this post, let us take a look at AI in loans and what it means. What are the benefits, features, and functionalities that it adds to the existing system? let’s get started!

An Overview of AI in Lending

AI in loan lending refers to the application of Artificial Intelligence technologies to streamline and enhance various aspects of the loan process.

This includes using machine learning algorithms, predictive analytics, and natural language processing to automate tasks, improve risk assessments, and enhance customer interactions.

AI is revolutionizing the loan lending industry by making processes more efficient, accurate, and customer-friendly.

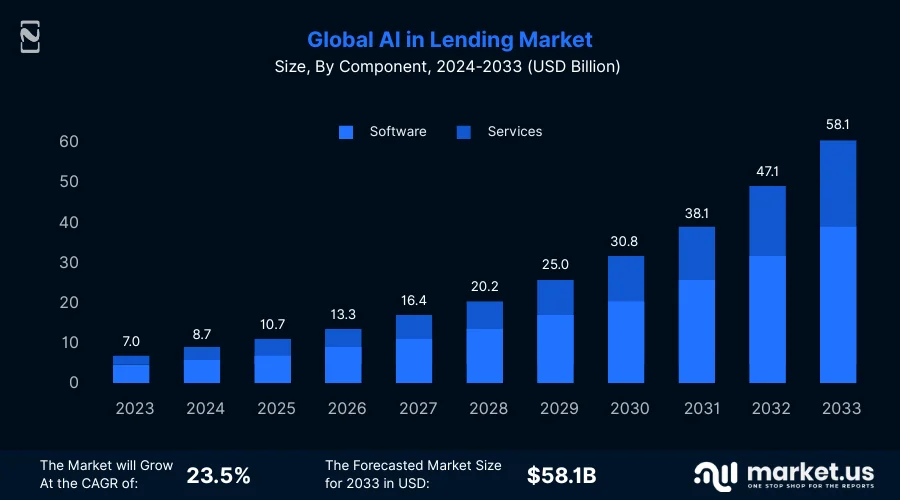

The market itself is clear proof of how the concept of using AI in lending is growing, considering it was valued at $7 billion back in 2024, with an estimated growth rate of 23.5%, ready to touch $58.1 billion by 2033.

Traditional loan processes often involve manual data collection, analysis, and decision-making, which can be time-consuming and prone to human error.

On the other hand, AI in loan lending apps automates these tasks, significantly reducing processing time and minimizing errors. What helps the implementation of AI in lending is the bouquet of technologies that power the entire automation process.

Key AI Technologies in Loan Lending Apps

When implementing artificial intelligence in the loan lending process, several components need to be considered. The process in itself is built of different phases, and for each phase, a dedicated tech has to be implemented.

Recognizing “how to build a loan lending app?” It’s important to evaluate the role of new and updated technologies, such as AI, in the sector.

From crafting an algorithm to support automation to deploying computer vision for interpreting visual information from documents, all these additional technologies play a crucial role. And implementing AI in finishing the product is just impossible.

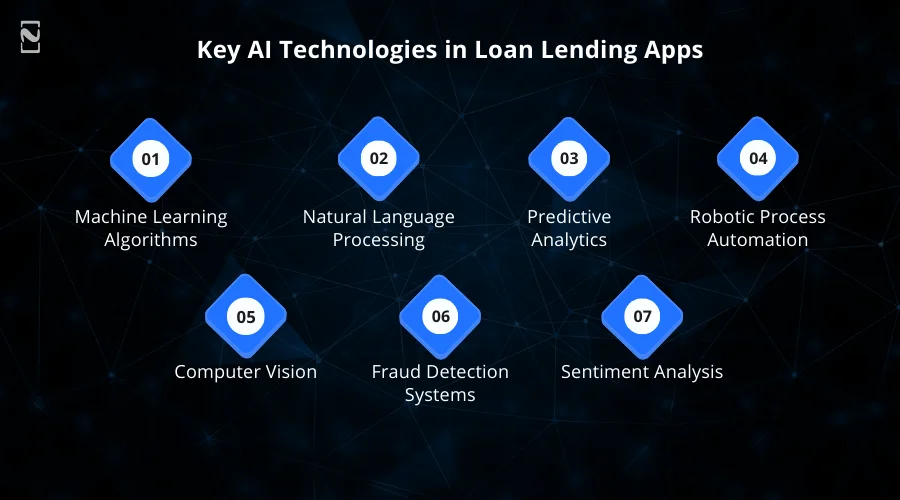

Let’s take a look at these technologies that can help you enable AI in lending :

► Machine Learning Algorithms

Machine learning (ML) algorithms analyze vast amounts of data to identify patterns and make predictions. In loan lending, ML algorithms assess creditworthiness by examining traditional data (credit scores, income levels) and non-traditional data (social media activity, utility payments).

This comprehensive analysis allows for more accurate risk assessments and credit decisions, reducing default rates and improving loan approval processes.

► Natural Language Processing (NLP)

Natural Language Processing enables computers to understand, interpret, and respond to human language. In loan lending apps, NLP powers chatbots and virtual assistants that provide instant customer support.

These AI-driven tools can answer queries, guide users through the loan application process, and offer personalized financial advice, enhancing the overall customer experience.

► Predictive Analytics

Predictive analytics uses statistical techniques and machine learning algorithms to forecast future outcomes based on historical data.

In the context of loan lending, predictive analytics helps lenders anticipate borrower behavior, such as the likelihood of default or early repayment. This technology aids in making informed lending decisions and developing strategies to mitigate risks.

► Robotic Process Automation (RPA)

Robotic Process Automation involves using AI to automate repetitive and time-consuming tasks. In loan lending, RPA can automate document verification, data entry, and compliance checks. This reduces processing time, minimizes errors, and allows human employees to focus on more complex tasks.

► Computer Vision

Computer vision technology enables AI systems to interpret and analyze visual information from documents. In loan lending, this technology is used to automate the verification of identity documents, such as passports and driver’s licenses.

By extracting and validating information from these documents, computer vision accelerates the onboarding process and ensures accuracy.

► Fraud Detection Systems

AI-powered fraud detection systems analyze transaction patterns and behaviors to identify and flag suspicious activities. These systems continuously monitor loan applications and transactions for signs of fraud, such as identity theft or false information.

By detecting potential fraud early, lenders can take preventive measures and protect their financial assets.

► Sentiment Analysis

Sentiment analysis involves analyzing text to determine the sentiment or emotional tone behind it. In loan lending, this technology can be used to gauge customer satisfaction and identify potential issues from customer feedback.

The integration of these AI technologies in loan lending apps is transforming the industry by automating processes, improving risk assessment, enhancing customer interactions, and ensuring security.

Leveraging these technologies, lenders can offer more efficient, accurate, and personalized services, ultimately driving better outcomes for both lenders and borrowers.

Benefits of AI in Loan Lending Apps

By utilizing advanced technologies such as machine learning, natural language processing, and predictive analytics. AI enhances various aspects of the lending process, making it more efficient, accurate, and user-friendly.

Here, we discuss the detailed roles and impacts of AI in loan lending apps :

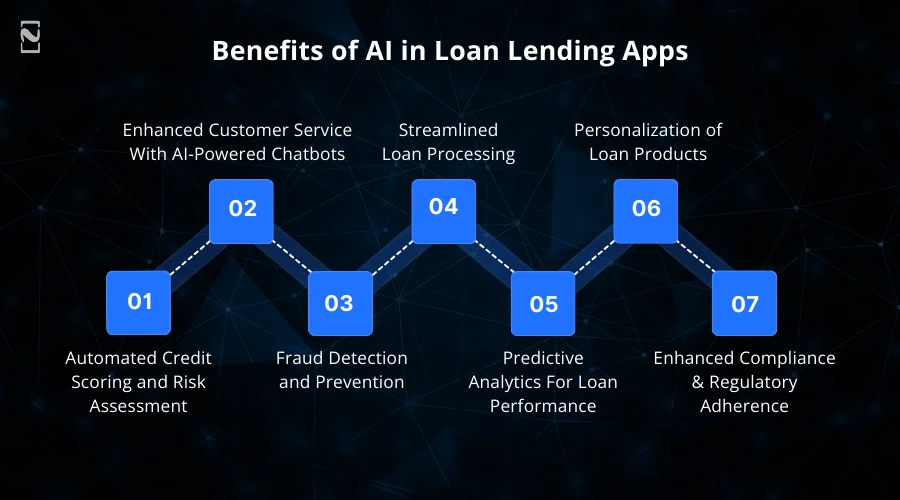

♦ Automated Credit Scoring and Risk Assessment

AI algorithms excel at analyzing vast amounts of data to provide a comprehensive assessment of a borrower’s creditworthiness. Traditional credit scoring models are often limited to historical credit data, which can exclude many potential borrowers.

AI overcomes this limitation by incorporating alternative data sources such as social media activity, transaction history, and even behavioral patterns to generate a more accurate credit score.

AI uses machine learning models to identify patterns and predict a borrower’s likelihood of default. These models continuously improve over time as they are exposed to more data.

By incorporating non-traditional data sources, AI provides a more inclusive assessment of creditworthiness, enabling lenders to extend credit to individuals with limited or no credit history.

♦ Enhanced Customer Service With AI-Powered Chatbots

AI-powered chatbots and virtual assistants in loan lending apps offer instant customer support, guiding users through the loan application process, answering queries, and providing personalized financial advice.

These chatbots leverage natural language processing (NLP) to understand and respond to customer inquiries in real-time, significantly enhancing the user experience.

Chatbots are available around the clock, ensuring that customers can get support whenever they need it. AI can tailor interactions based on the user’s profile and previous interactions, providing a more personalized and satisfying experience.

♦ Fraud Detection and Prevention

AI enhances the security of loan lending apps by detecting and preventing fraudulent activities. AI systems continuously monitor transactions and user behavior to identify unusual patterns that may indicate fraud.

This proactive approach helps in mitigating risks and protecting both the lender and the borrower. AI algorithms are adept at identifying anomalies in transaction patterns that could signify fraudulent activity.

They analyze transaction data in real-time to detect inconsistencies or suspicious behavior. AI systems can send real-time alerts to relevant stakeholders when suspicious activity is detected, enabling swift action to prevent fraud.

♦ Streamlined Loan Processing

AI automates various aspects of the loan processing workflow, significantly reducing the time and effort required to approve and disburse loans. Tasks such as document verification, data entry, and compliance checks can be handled by AI systems, allowing human employees to focus on more complex tasks.

RPA uses AI to automate repetitive tasks, such as verifying identity documents and processing loan applications. This leads to faster processing times and reduced operational costs. AI accelerates the loan approval process by quickly analyzing and validating data, enabling borrowers to receive funds more rapidly.

♦ Predictive Analytics For Loan Performance

Predictive analytics powered by AI helps lenders forecast loan performance by analyzing historical data and identifying trends. This allows lenders to anticipate potential issues, such as late payments or defaults, and take preemptive measures to mitigate risks.

AI models can predict the likelihood of loan repayment based on various factors, helping lenders manage their portfolios more effectively. These models consider a wide range of data points, including economic indicators, borrower behavior, and market trends.

By identifying high-risk loans early, lenders can implement strategies to reduce the impact of potential defaults, such as adjusting loan terms or increasing monitoring efforts.

♦ Personalization of Loan Products

AI enables lenders to offer personalized loan products tailored to the individual needs of borrowers. By analyzing a borrower’s financial behavior and preferences, AI can recommend loan products with customized terms and interest rates.

AI can create loan offers that are specifically tailored to the financial situation and needs of each borrower, improving customer satisfaction. These personalized offers can lead to higher acceptance rates and better customer retention.

AI allows for dynamic pricing models that adjust interest rates based on real-time data and market conditions. This ensures that borrowers receive competitive rates while lenders maintain profitability.

♦ Enhanced Compliance and Regulatory Adherence

AI helps ensure that loan lending apps comply with regulatory requirements by automating compliance checks and monitoring changes in regulations. AI can automatically verify that loan applications adhere to regulatory standards.

This includes checking for necessary documentation, verifying borrower information, and ensuring that all legal requirements are met. AI systems can stay updated with the latest regulatory changes and ensure that the lending processes are always compliant.

This adaptability is crucial in the constantly evolving financial landscape. The integration of AI in loan lending apps is revolutionizing the lending industry by automating processes, improving risk assessment, enhancing customer service, detecting fraud, and personalizing loan products.

By leveraging AI, lenders can offer better services, reduce operational costs, and manage risks more effectively, ultimately benefiting both lenders and borrowers.

AI-Driven Features in Loan Lending Apps

The integration of Artificial Intelligence (AI) into loan lending apps is revolutionizing the industry by enhancing efficiency, accuracy, and customer satisfaction.

Here are the key features of AI in lending that make the entire process smooth as butter for both the users and businesses –

| Must-Have Features for a Loan Lending App | |

| User Profile and Account Management | Loan Tracking Feature |

| Loan Application Form Processing | Content Management System (CMS) |

| Adaptive Loan EMI Calculator | AI-Powered Credit Scoring |

| App Security | Blockchain Integration |

| Online Support/Chatbot | Support Services |

| Smart Storage Integration | Multiple Loan Alternatives |

| Automated Credit Score Check | Payment Integration With Mobile Wallet |

| Dashboard | Customized Repayment Reminders |

To learn more about how these loan lending app features work, you can refer to the guide that we have already provided on our website. For any technology to be a good partner, it is important for you to understand its potential and limitations.

While these features can be fascinating for any individual, you must understand the challenges and considerations before taking the step and investing in the integration of AI in lending.

Challenges of Integrating AI in Lending: Key Considerations

While AI offers numerous benefits to the loan lending industry, its implementation comes with several challenges and considerations.

Here are the key points to challenges for loan lending apps that you might face :

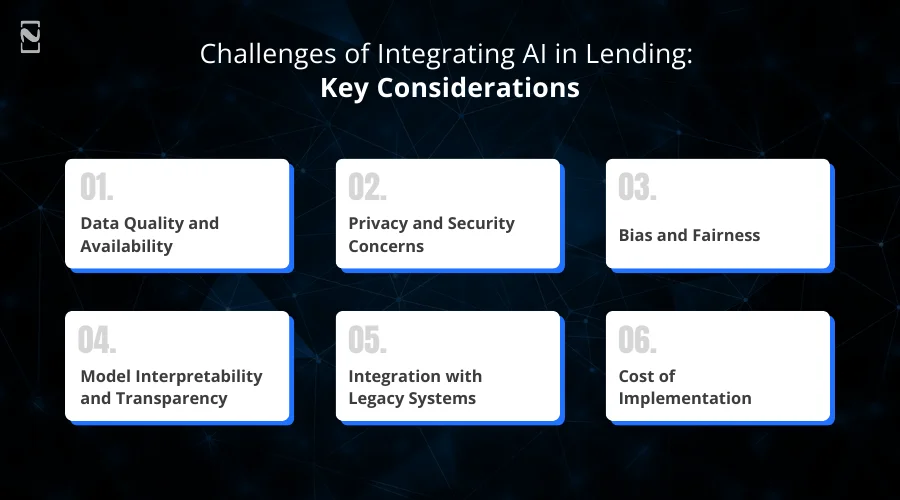

➤ Data Quality and Availability

AI models require large volumes of high-quality data to function effectively. Poor data quality or insufficient data can lead to inaccurate predictions and unreliable AI performance.

➤ Privacy and Security Concerns

Handling sensitive financial and personal data raises significant privacy and security concerns. AI systems must comply with data protection regulations.

➤ Bias and Fairness

AI models can accidentally pick up biases from their training data, which may cause unfair loan decisions and discrimination. While one should not rely on technology, you have to ensure that bias and fairness are taken into account when any application is accepted or rejected.

➤ Model Interpretability and Transparency

AI models, especially complex ones like deep learning, can act as “black boxes,” making it difficult to understand how decisions are made. This lack of transparency can be problematic for regulatory compliance and user trust.

The interpretation of every move made by AI in lending is crucial for an organization to identify the course of action. However, not all can do so as they do not focus on transparency when integrating the technology.

➤ Integration with Legacy Systems

Integrating AI solutions with existing fintech legacy systems can be complex and costly, requiring significant changes to infrastructure and processes.

When you have a legacy system that needs to be upgraded with tools such as AI, it requires you to focus on the way you implement the changes. Not all systems are open to integrations, especially the ones that have been around for years.

➤ Cost of Implementation

The cost to develop a loan lending app can be expensive, thanks to the various types of costs associated with acquiring technology, hiring skilled personnel, and ongoing maintenance. The issue with the cost is more of an implementation issue and varies from individual to individual.

If you are planning the upgrade but are unsure about investing all the money, you need to identify if the decision is worth it for your business. Other than these, another crucial challenge that people face when implementing AI in lending is the monitoring of the operations.

Sure, there is AI to take care of the automation of the process; however, the job of a human is definitely not over, as you need an experienced individual to look after the AI and its functionality in lending.

Transform Your Lending Business With Nimble AppGenie

If you have read till here, you might have understood that implementing AI in lending is certainly a great opportunity for your business.

Not only does it simplify the overall process, but it also helps you finish tedious tasks efficiently.

To make the most of your decision, you need an experienced fintech app development company to help you integrate AI in lending without making any sort of compromise with the efficiency of your system.

Nimble AppGenie is one of the leading names to have pioneered the use of AI in lending software development services, making it easier for you to shift your work towards a smarter application.

With decades of experience, our professionals are equipped with all the tools to guide you towards the right direction for your business, including the implementation of AI in lending solutions.

Conclusion

The integration of AI in loan lending apps represents a significant leap forward for the financial sector. By automating processes, enhancing risk assessments, and providing personalized customer experiences, AI-driven solutions are setting new standards in efficiency and reliability.

As AI technologies continue to evolve, their role in lending will only grow, offering even more innovative ways to serve borrowers and lenders alike. Embracing AI is not just about staying competitive; it’s about leading the way in a rapidly transforming industry.

With that said, you should also keep in mind that, irrespective of how beneficial the integration is, it is incomplete without addressing and dealing with the challenges involved in the process.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.