Technology has been the leading force in the transformation of financial services over the past two decades, with open banking playing a key role in this evolution.

From enabling users to make online payments to allowing them to make international purchases from the convenience of their homes, it is technology that has allowed users to enjoy experiences like never before.

Powering multiple such experiences is Open Banking, which helps non-banking applications to access banking data of their users securely, without having to worry about fintech regulations and compliance.

Open banking is one of the most powerful tools to have existed in the digitization of financial services.

But what exactly is this open banking system? How does it work? More importantly, how has it been instrumental in transforming the financial services industry? If these are some questions you need an answer to, then this is the ultimate post for you!

In this one, let us take a look at two important aspects, Open Banking & Open Banking APIs, that have been at the heart of boosting financial services, allowing them to expand financial services to non-banking platforms.

What is Open Banking? Overview of Open Banking API

As the name suggests, open banking refers to a system that allows financial service providers to access consumer banking information directly from the financial institution with the consumer’s consent, securely through APIs.

The idea of open banking is to strengthen data-sharing between third parties who are not traditionally financial institutions but offer fintech services to make them more accessible.

Banks, financial institutions, and fintech companies can fetch and share data among themselves to create a more connected ecosystem that is more efficient and standardized.

A key role player in implementing open banking is the open banking API. With the help of this API, the data is fetched in real time.

They act as a bridge between the banks’ systems and external applications, allowing them to access account data, initiate payments, and perform various financial tasks on your behalf.

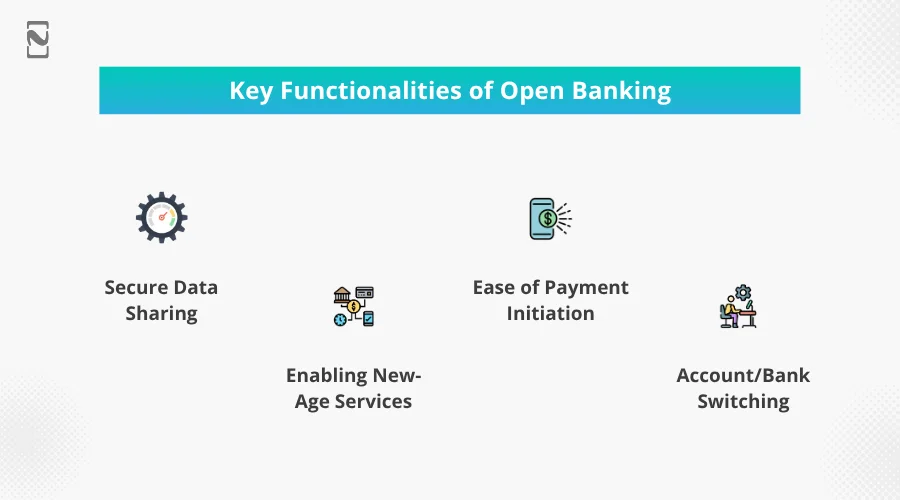

Some of the key functionalities that Open Banking offers with the help of an API include –

-

Secure Data Sharing

With an open banking API, robust security measures are in place, and users can share financial information selectively and safely with authorized third-party apps. Plus, it helps you manage your money better.

-

Enabling New-Age Services

Financial apps that can analyze user spending, help you save money, provide personalized financial advice, and much more, all powered by data from your bank account.

-

Ease of Payment Initiation

Making payments to merchants or transferring money to friends can become a breeze with open banking APIs, as users can initiate transactions directly from trusted financial apps.

-

Account/Bank Switching

Open banking promotes the ability to switch between banks effortlessly, as user financial data can be transferred securely to your new provider, eliminating the hassle of starting from scratch.

There are several other things that an Open Banking API can help you with. The entire concept of this API is to replace a highly complex financial infrastructure and allow consumers to share financial data with apps that they use every day through a simple API that is connected to their respective solutions.

Impact of Open Banking API: Stats & More

According to Statista, the number of open banking users worldwide is expected to grow at an average annual rate of nearly 50% between 2020 and 2024, with the European market being the largest.

The value of open transactions reached a worldwide 57 Bn U.S. dollars in 2023. And it’s expected to increase in the following years. The number of these calls will increase to $580 Bn in 2027.

The number of open banking application programming interface (API) calls is forecast to grow from $102 bn in 2025 to $580 bn in 2029. During this period, the value of open banking transactions is expected to grow to reach $330 billion in US dollars by 2027.

By looking at the reports, you can see that it opens the door for innovations. Plus, it serves consumers with their needs while maintaining a strong focus on privacy and security.

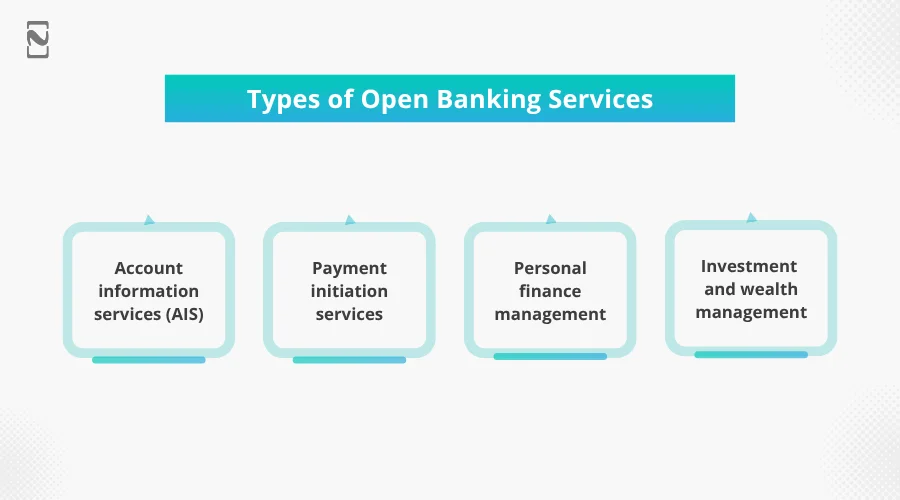

Types of Open Banking Services

Open banking services encompass a diverse range of offerings that leverage Application Programming Interfaces (APIs) to facilitate secure data sharing and financial transactions.

Whether it’s digital onboarding APIs or open banking APIs, they have transformed the fintech industry in many ways.

| 1. Account Information Services (AIS) | It allows third-party providers to access and consolidate a user’s financial data from multiple accounts across various banks or financial institutions. With the user’s consent, AIS can provide a comprehensive view of their finances, including account balance, transaction history, income, and expenses. |

| 2. Payment initiation services | It enables users to initiate payments directly from their bank accounts through third-party applications. |

| 3. Personal Finance Management | PFM tools help users create budgets, track expenses, and set financial goals to improve their overall financial well-being. |

| 4. Investment & Wealth Management | Open banking can also be used to offer investment & wealth management services. By analyzing users’ financial data and risk tolerance, investment platforms can provide personalized investment advice and portfolio recommendations. |

How Does Open Banking Work?

If we go into the technicalities, Open Banking allows a fintech app to gain access to a user’s financial data, which is necessary for the service provider to be more accurate in order to offer services diligently.

You see, the banking and financial information is usually kept with traditional financial institutions, which turned out to be a barrier for non-financial businesses to enter the market.

With the help of secure open banking solutions, that is no longer the case. Users can securely direct their data with these third-party applications, without having to worry about a data breach or any security lapse.

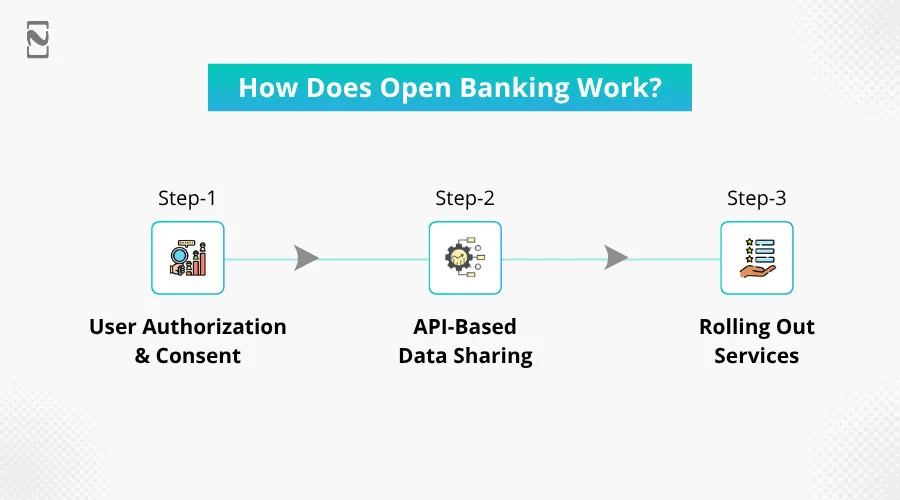

3 steps are involved in the working of Open Banking:

Step 1: User Authorization & Consent

The first thing that open banking looks for is consent and authorization of the user. An individual looking to use the services first has to initiate the process by granting consent to share their data with a third party.

Step 2: API-Based Data Sharing

The user’s request to share data is sent to the open banking API that the bank is using. These APIs are more like a bridge between the financial institution and the third-party provider, allowing safe data sharing so that the third-party can perform the task.

Step 3: Rolling Out Services

The data received by the third-party provider is now used to roll out the service that the user was looking for. It can be anything from budgeting to loan processing.

The data is fetched according to the service requested and then processed based on what the data states.

When it comes to open banking API security, banks provide their APIs to authorized financial providers, as these APIs contain various pieces of sensitive information, such as account type, account holder’s name, transactions, and currency.

Therefore, when consumers agree to share their data with third-party service providers, they can access the shared information via APIs.

Implementing and building the APIs is up to the banks. It is more or less a collaborative practice to make the data transaction more and more secure.

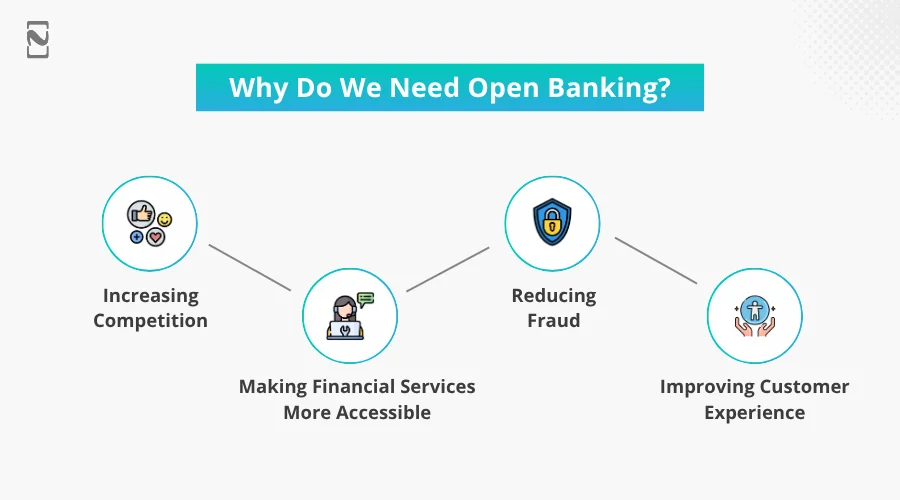

Why Do We Need Open Banking?

Open banking addresses several key challenges and offers numerous benefits that make it a crucial development in the financial industry.

Open banking API solutions have brought innovations to the banking industry.

Moreover, open banking is a system that puts control of financial data back into the hands of customers. It allows them to securely share their financial information with trusted third-party providers of their choice.

With this, it empowers consumers to access more personalized financial services and make better-informed decisions about their money.

However, there are many reasons why we need open banking; here are some of the most important ones:

1. Increasing Competition

It can help to increase competition in the financial services market. This is because it allows new and innovative financial service providers to enter the market and compete with traditional banks.

Moreover, this can lead to lower prices, better products, and more choices for consumers.

2. Making Financial Services More Accessible

Open banking can make financial services more accessible to consumers who are currently underserved by traditional banks.

For example, people who do not have a credit history or who live in rural areas may be able to get better access to financial products and services through open banking.

3. Reducing Fraud

Open banking can help reduce fraud by giving customers more control over their financial data. For example, customers can choose to share their data only with trusted third-party providers.

4. Improving the Customer Experience

Open Banking API services can help to improve the customer experience by making it easier for customers to manage their finances.

For example, customers could use open banking to see all their accounts in one place, track their spending, and set up automatic payments.

The whole purpose of using open banking and APIs is to ensure that customers have more flexibility in using their preferred banking and third-party services.

Not only does this enable a user to share their banking information with other apps, but it also allows other apps to be compatible with your bank, which is the need of the hour.

Benefits of Open Banking – The API that Makes a Difference

Open banking is not just a trend or a technology that will become obsolete; it is here to stay. What makes it irreplaceable today is the benefits that it has to offer.

It is one of the most sought-after solutions that allows even a business that is not traditionally from the financial world to enter the fintech market and offer its services.

On the other hand, users get the convenience of getting things done faster via a third-party provider. However, the benefits of using Open Banking APIs do not stop there.

Check out the benefits that both businesses and consumers enjoy when using open banking services.

► Benefits for Businesses

-

Access to Data

Open banking API architecture has changed the traditional banking landscape. Now, not only can fintech companies access the data, but even small fintech companies have the tools to join the competition.

-

Better Customer Engagement

The data shared by open banking helps businesses offer their customers personalized offerings. The data analysis helps in making suggestions to different clients based on their financial habits, which significantly increases client engagement.

► Benefits for Consumers

-

Centralized Information

Open banking integration has made it possible to track all financial information in one place. With this, users can make better financial decisions and achieve better financial well-being. In this way, consumers can gain more control over their finances.

-

Client Experience

Since the introduction of open banking, there is not a single bank that is not providing its banking services via banking apps. In the same order, fintech has introduced various solutions that improve payment flows and simplify overall transactions.

-

Innovative Solutions

With open banking API integration, many solutions have been developed to give new banking systems to benefit consumers. It’s easier for mobile payments and digitalized banking services to take off.

With all those benefits available with open banking APIs, you may be wondering, How do I integrate one into my business? Well, the process can be quite complicated as there is a series of API development & integration steps that you have to follow. However, if you want to simplify the process, hiring a banking app development company can help you out!

Nimble AppGenie: Your Open Banking Integration Partner!

Ideally, you need solid fintech development skills, along with knowledge of the latest banking trends in the open banking market.

We at Nimble AppGenie can help you with all the necessary resources, from building your open banking solution from scratch to integrating the Open Banking API into your existing application.

If you are interested in implementing an open banking solution for your fintech services, then ask our developers to guide you through, as they are highly experienced in delivering quality integration and development services for fintech solutions.

Connect today and take your first step towards open banking!

Conclusion

Open Banking & Open Banking APIs play a crucial role in implementing modern-day fintech solutions. While open banking supports the use of third-party providers to simplify fintech services, the API plays an instrumental role in sharing data between banking partners and third parties.

The idea is to build a safe and secure passage for data to be shared without worrying about leaks and compromises. Integrating with the Open Banking API has its advantages, which benefit both businesses and consumers.

The app is completely safe and makes all the difference between traditional banking and modern-day fintech services. All in all, it can be said that Open Banking is here to stay, and by integrating an Open Banking API, you can make the most of the services available in the market.

With that said, we have reached the end of this post. Hopefully, you got all your answers related to open banking & API associated with it. In case you need more information on the integration, feel free to connect with our experts! Thanks for reading, good luck!

FAQs

Open Banking refers to the use of APIs that enable secure data sharing between financial institutions and third-party providers. It allows customers to share their financial data with authorized apps, fostering innovation and competition in the financial sector.

Open Banking empowers consumers by providing them with better financial services, personalized recommendations, enhanced transparency, streamlined payments, and improved control over their data.

Yes, Open Banking is designed with strong security measures. Customers must provide explicit consent before data is shared, and APIs are built with encryption and authentication protocols to protect sensitive information.

Open Banking APIs facilitate account information services, payment initiation services, personal finance management tools, investment advice, real-time payments, and much more.

Absolutely! Open Banking APIs enable personal finance apps to analyze your spending habits, set budgets, and offer insights that can help you save money and achieve your financial goals. If you want to create a mobile banking app, contact us. We are experts in creating fintech apps.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.