The real estate industry has a competitive landscape, with real estate investing apps it has revolutionized the entire industry landscape.

When you invest in real estate it maintains the cash flow and gives a tax advantage with portfolio diversification. It has been a reliable source of passive income for a long time.

Therefore, real estate investing apps make the market more accessible than before.

The real estate market is projected to reach US$613.60 Tn in 2023 according to Statista. And expected to show an annual growth rate of 3.52% CAGR 2023-2038, resulting in a market volume of US $729.40 tn by 2028.

With this, the real estate market has seen a surge in innovation and investors are increasingly turning to technology to streamline their investment strategies.

As a result, a multitude of real estate investing apps has emerged, each offering unique features and benefits. So start your real estate investments today with the best real estate investment apps that are transforming the way investors engage with the property market.

Whether you are a seasoned real estate pro or just starting out in real estate these apps can provide you with the tools and data that you need to make informed decisions and maximize your returns. So without further ado, let go.

Real estate investing apps can help you find deals, analyze properties, and manage your investments.” – Forbes

Top 10 Real Estate Investing Apps

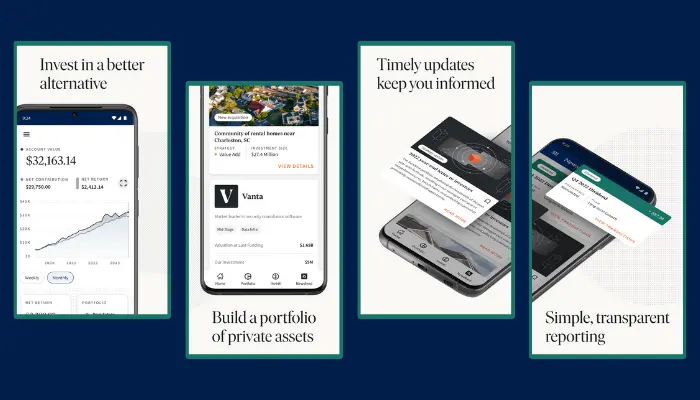

1. Fundrise: A beginner-friendly way to invest in real estate

Best real estate investing apps for beginners, with a $10 minimum investment. The App offers eREITs, fundrise IPOs and venture capital funds.

If you are looking for low fees Fundrise is the best among all the real estate investment apps. Plus, you can also access real estate investing online through mobile or desktop.

Fundrise offers:

- Joint brokerage accounts

- Entity accounts

- IRA accounts

- Trust accounts with three portfolio options

If you have a standard Fundrise account you have to pay a 0.15% annual advisory fee and Fundrise Pro charges a $10 monthly fee. And for accessing Fundrise IPOs you need an investment of $500.

However, Fundrise is a place where you can start with real estate investment without spending too much money. If you want to invest in real estate app development it is essential consult with the real estate app development agency.

| Pros | Cons |

| Multiple offerings are available to non-accredited investors. | Extended hold periods |

| A simple menu of investment options | Limited secondary market rewrite |

| Incredibly affordable buy-ins | Limited control over the selection & management of specific properties. |

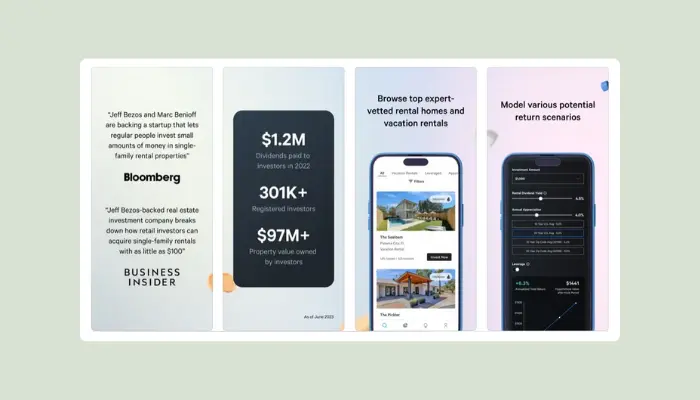

2. Arrived Homes: Start Investing in Real Estate with as Little as $100

It is one of the best real estate crowd-funding platforms in the market and quickly gaining popularity. What sets it apart is its user-friendly approach that makes real estate investing accessible to a broader audience.

With a minimum investment of just $100, anyone can get started. The app simplifies the entire real estate investment process. It takes care of all the hassles that typically come with being a landlord, like property acquisition, tenant management, and day-to-day property operations.

Investors, on the other hand, can sit back and collect their share of rental income every quarter. Plus, they get the benefit of their invested properties appreciating over time.

| Pros | Cons |

| It provides a user-friendly platform that is easy for anyone to navigate | One drawback is the relatively limited selection of properties available on the app. |

| This diversification can help spread risk and potentially enhance long-term returns | It offers personalized guidance and support from a real estate agent or advisor. |

| It provides investors with detailed analytics and data | Investing in properties through the app carries the risk of insufficient research and due diligence |

| The app provides a passive income stream through rental properties |

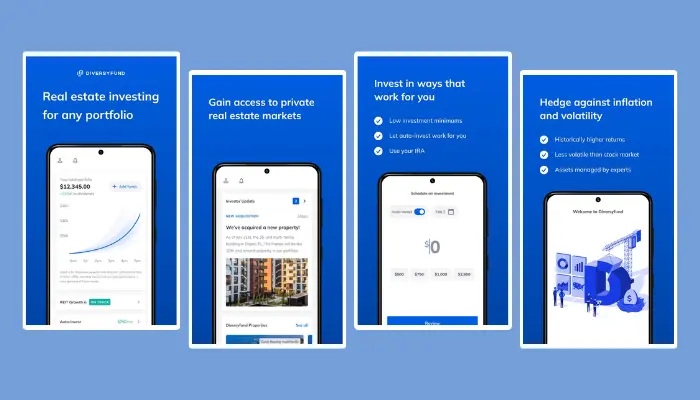

3. DiversyFund: Best robo-advisor for non-accredited investors

With low $500 offers, although it is a little higher than Fundrise, and the app that lets you invest in real estate & manages your real estate investments for you. Plus, it offers its services to both accredited investors and non-accredited.

Moreover, it charges a 2% annual asset management fee and closing real estate transaction fee. Plus, it offers Growth REIT invests in multifamily properties with more than 100 units.

In other words, the robo-advisor owns and manages all the real estate assets you are going to invest in. The best thing about the REIT investment strategy is that it aims to generate growth over five years. And the platform returns for each property within the range between 10% and 20%, which makes it the best real estate investing app among all.

Let’s take a look at its pros and cons.

| Pros | Cons |

| Access to real estate investments | It typically has longer investment horizons and limited liquidity. |

| Relatively low minimum investment requirement | Investors have limited investment control |

| It doesn’t charge management fees for investors | Due to market fluctuation investors are exposed to market risk. |

| It creates passive income for investors | Lack of personalized guidance |

| Diversification opportunity | Limited investment options |

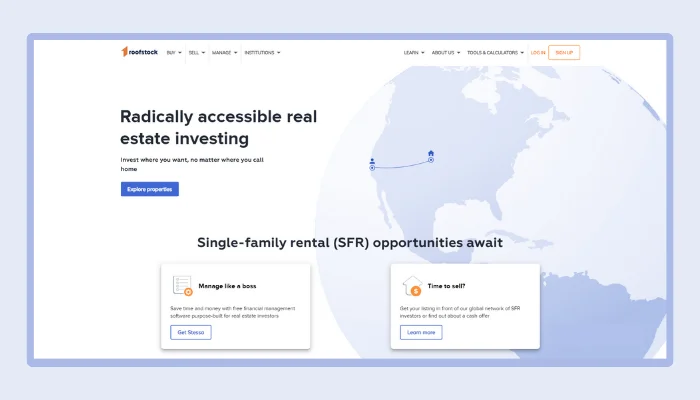

4. Roofstock: Buy and Sell Rental Properties with Confidence

If you are an active real estate investor and looking for a unique real estate investing app, don’t look any further than Roofstock.

You can start with as little as $0 and use the app to buy, sell and manage properties. They also provide free financial management software, if you are an accredited investor, you can access fractionalized investments in specially curated portfolios.

Now what make Roofstock stand out among all the real estate investing app is that it allows you to invest in single-family rental properties. Once you buy a property, you don’t have to worry about managing it all by yourself. It assigns a property manager to each rental property.

In addition, these properties usually have tenants, and the property managers are there to help with the monthly collection of rent.

While Roofstock does not require a specific minimum investment, they do charge a fee of $500 or 0.5% of the contract price. With this being said, let’s look at the pros and cons of Roofstock.

| Pros | Cons |

| Offers low minimum investment | Additional costs such as down payments and property-related fees |

| It provides tools to buy, sell, and manage properties | It offers an active investment platform |

| Also, assign property managers to each property | Limited control over property selection |

| Tenant-occupied properties are best for rental income | Market risk |

| It provides free financial management software to help investors track and manage their real estate investments. | Accredited investor requirement for fractionalized investments |

5. CityVest: The best way for institutions to invest in real estate

It is the best among all the real estate investing apps, it provides access to institutional real estate investment opportunities to accredited investors.

Moreover, the minimum investments start at just $25,000 as compared to the typical six-figure investment that is required to access deals for these types.

What’s more, CityVest partners only with intuitional funds that allow strict financial practices. Each investment opportunity comes with a thorough report from an independent party that checks the investment manager’s information, making sure it’s reliable and safe.

Lastly, CityVest pools together a sizable $5 m, they not only get access to these institutional private equity funds, but they can also negotiate better investment terms.

With this being said, let’s look down upon the pros and cons of CityVest.

| Pros | Cons |

| Easy access to real estate investments | Limited property availability in some areas |

| Diversification of investment portfolio | Lack of personalized real estate guidance |

| Convenient investment management | |

| Potential for higher returns |

6. Collab: Best way to invest in student housing

Collab is the best real estate apps for investors that offers unique investment opportunities, especially when it comes to the student housing sector.

Although when you invest in this platform it can save you from inflation and earn profits. It is a decentralized platform for student housing and asset management.

Additionally, it allows you to invest in these types of properties. Plus, it has a system where both investors and tenants can easily manage things together.

- If you are considering using Collab, keep in mind that it offers:

- Access for investors looking to invest for medium to long periods

- Investment opportunities that are well-balanced and not too risky

- Investments that recent graduates may already be familiar with

- Access to different kinds of assets aside from the usual ones

- The potential for significant cash dividends

- Good-quality service

- Low minimum investment requirements, making it accessible to many investors.

| Pros | Cons |

| Access to student housing near universities | Limited investment opportunities |

| High monthly cash dividend | Low liquidity |

| High equity growth potential | |

| Excellent service offerings |

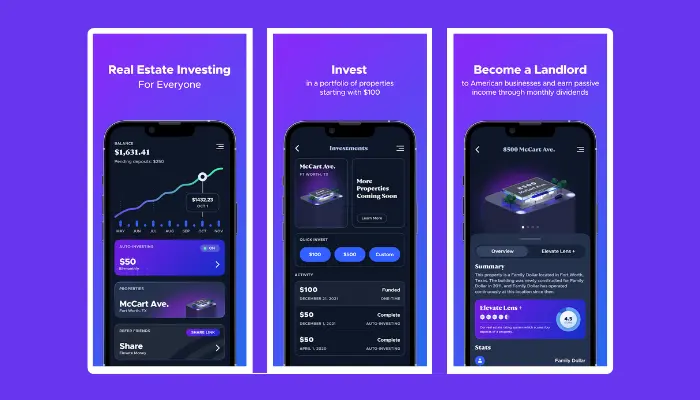

7. Elevate money: Transparent real estate investing platform

Elevate Money is another real estate investment app that is a user-friendly platform that makes investing easy, even if you have just $100 to start with. What’s unique is that it is managed by the people who own the investment properties in the REIT (Real Estate Investment Trust).

Moreover, the folks who handle the day-to-day operations of these properties are the ones making the decisions. It’s an excellent choice if you want to be closely involved in your investments.

To begin with the Elevate money you can connect it with your bank account and choose how much you want to invest. You have the option to invest a lump sum at once or set up automatic monthly contributions.

Additionally, the platform offers a 6.5% annualized dividend, and this dividend is paid to you every month. Currently, they have two properties in their portfolio, and as more people buy shares they’ll add more properties. So, as the portfolio grows your ownership in it will also increase.

| Pros | Cons |

| Low minimum investment | Limited property portfolio |

| Owner-managed properties | Risk of concentration |

| Easy and quick setup | Limited track record |

| Monthly dividend payments | Limited diversification |

| Portfolio growth | Dependence on property managers |

8. EquityMultiple: Diverse Real estate investing platform

EquityMultiple is a modern investment platform designed to simplify real estate investing, especially when you need guidance in choosing the right investments.

It offers short-term and long-term growth options, allowing you to make the most of your invested cash without having to buy physical properties.

It provides:

- Quick returns relatively fast returns on your investments

- Low minimum investment starts with an investment of less than $10,000

- The platform offers excellent client support to assist you in your investment journey.

| Pros | Cons |

| It provides quick returns | Exclusive to accredited investors |

| The platform offers low minimum investment | Potential for investment risk |

| EquityMultiple provides excellent client support | Fees and costs |

| Investment diversification | Limited hands-on control |

9. Groundfloor: Best for real estate notes

Groundfloor is a platform for short-term real estate investments. You can start with just $1000 and it is open to both accredited and non-accredited investors.

Moreover, investment terms can be as short as 30 days or as long as 18 months. You can use their self-directed and automatic investing features. They have a history of providing a 10% annual return on your investments.

In addition, Groundfloor also offers IRAs and a mobile investing option called Stairs which has a base rate of 4% annual interest.

Let’s look at the Groundfloor pros and cons:

| Pros | Cons |

| It allows low minimum investment | Risk of real estate investments |

| Open to accredited and non-accredited investors | Limited investment terms |

| Short-term real estate investments | Mobile app interest rate limitation |

| Self-directed and automatic investing | |

| Proprietary loan grading algorithm | |

| IRAs and mobile investing availability |

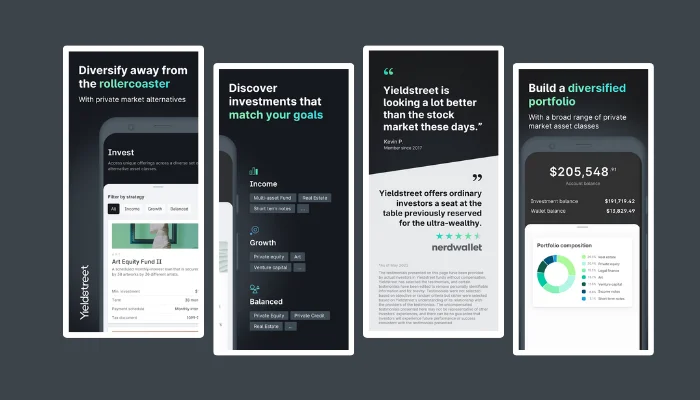

10. YieldStreet: Best for real estate and alternative investments

Yieldstreet is an investment platform for accredited investors, which means you need at least $500 to get started. They offer various types of alternative investments like real estate, legal finance, marine finance, crypto, and more.

Moreover, if you are not an accredited investor, you can still join their Yieldstreet Prism fund with a $500 minimum. This fund lets you invest in different types of assets. They also have short-term notes with the same $500 minimum, where you earn regular interest payments.

It is flexible in terms of investment duration and you can invest for as short as six months or as long as five years.

With this being said, let’s look at its pros and cons.

| Pros | Cons |

| Diverse investment opportunities | Accredited investor requirement |

| Flexible investment terms | High minimum investment amounts |

| Regular interest payments | Complex investments for novice investors |

Conclusion

With real estate investing apps, investing in real estate has become more accessible than before. Now you don’t need a pile of money to become a millionaire.

With online real estate agent websites and apps, you can easily invest in the real estate market and easily look at the capital you have invested in and the variety of real estate platforms. If you want to invest in real estate app development it is recommended to consult an expert real estate app development company.

FAQs

An overview of what real estate investing apps are and how they function as a platform for investing in real estate.

Discuss the advantages of using these apps, such as accessibility, diversification, and potentially higher returns.

Address whether these apps are user-friendly and suitable for individuals new to real estate investing.

Provide step-by-step guidance on how to sign up, create an account, and start investing through these apps.

Explain the various investment options available through real estate investing app, such as residential, commercial, crowdfunding, and more.

Detail the minimum investment amounts for each app, if applicable, and how they can vary.

Discuss the potential returns and risks associated with investing in real estate through these platforms.

Explain how users can monitor and manage their real estate investments, including tracking performance and receiving payouts.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.