Fintech is an abbreviation for financial technology used to access financial services. The traditional economic system is disrupted through fintech as it offers innovative solutions.

Fintech offers advanced technologies, including big data analytics, machine learning, and cloud computing, to develop creative financial solutions for businesses.

With the changes in the financial ecosystem, Fintech has significant implications for financial inclusion.

In the presented blog, the considerable impact of fintech on businesses is detailed. Along with this, fintech opportunities and use cases for enterprises are discussed.

Understanding Fintech For Businesses

Fintech refers to using technology for financial assistance, which includes completing financial transactions and improving the financial management of the firm.

Fintech is crucial for businesses to gain data-driven insights, have better access to capital, adopt digital transformation, and reduce risk.

Understanding what fintech is and its impact is important for businesses to design business strategies and excel in the competitive landscape.

Leveraging technology, companies are assisting customers with payments, lending, borrowing, blockchain, and digital banking services.

Using Fintech also refers to the integration of technologies offered by financial services companies to improve the usage of advanced technologies for user benefits.

The Growth of Fintech

Along with this, the fintech market is expected to reach USD 882.30 billion by the end of 2030. With the growth in the fintech industry, there has been an opportunity for various shareholders to invest in fintech.

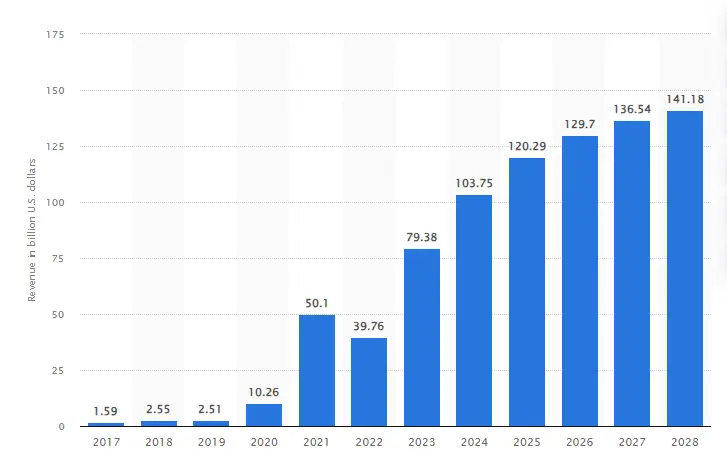

- Revenue in the global fintech industry has sharply increased between 2017 and 2023.

- It has been stated in the graph that the total revenue of the industry was 79.38 billion USD and is estimated to grow further to 141.18 billion USD by 2028.

- The digital payments market is also expected to grow to amount to 4,805 million users by 2028.

- By the end of 2025, the revenue of the digital payment market is expected to grow by 17.38%.

- As of January 2024, America is one of the largest regions with the largest number of fintech firms globally.

- Similarly, there were 13,100 fintechs in America, which is almost 1500 more than the previous year.

- There are almost 10,969 fintech businesses within the regions of Europe, the Middle East, and Africa.

- Along with this, it has been found that the United States has the greatest number of start-ups in the fintech unicorn globally.

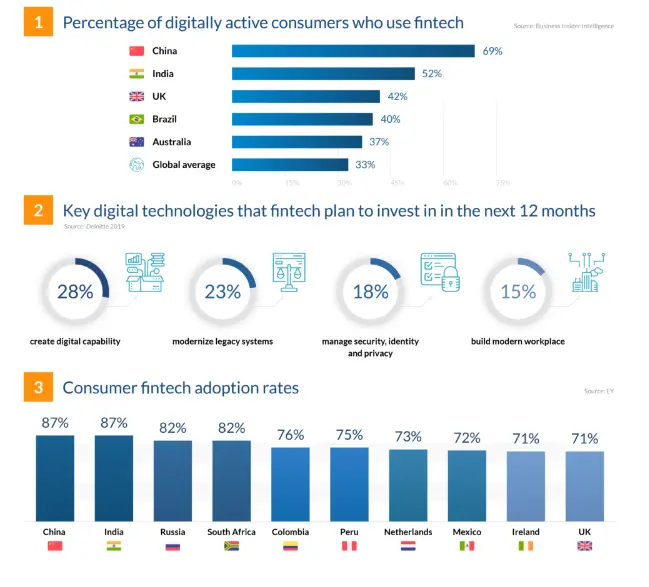

- With the above data, China is among the top countries using fintech apps.

- 87% of customers in China and India have high fintech adoption rates. Meanwhile, the UK has a 71% adoption rate.

- Thus, it can be stated that the trend for fintech users has increased in the current decade.

How Does Fintech Impact Businesses?

Get the stats and data on the fintech company’s growth! Now it’s time to see how fintech impacts businesses.

Businesses with fintech solutions are serving audiences with an advanced number of technologies. With the growing demand for financial management technologies, you can serve the customer better.

Learn about the fintech impact on businesses to further invest in app development.

1. Easier Payments, More Revenue

The fintech industry has helped businesses access finance, especially for small and medium-sized firms.

These companies also streamline the payment procedure by offering faster and more convenient payment options, including mobile payments as well as digital wallets.

It helps businesses to improve the customer experience and also improves the sales of the brands.

The impact of fintech on linking payment gateway integration is assisting businesses in moving to easier payments.

2. Adapting to the Future

Investing in fintech is permitting businesses to stay ahead of the curve by remaining competitive and by positioning themselves as one of the greatest industry leaders in the digital business.

The impact of fintech on economic growth can be seen through the increasing revenue rate of businesses and the way they are contributing to economic development.

The implementation of fintech innovations, including IoT and AI, permits businesses to remain competitive.

3. For Happier & More Satisfied Customers

The impact of fintech on businesses can also be observed through the happier and satisfied customers of the brand who are opting for fintech solutions.

Along with this, it can be stated that through fintech, businesses offer personalized, efficient, and convenient services to their customers that result in the growth of the firms.

Fintech also offers an AI-powered chatbot to increase customer satisfaction rates. You can check these tips for effective fintech app design.

Fintech apps avail businesses and also ensure customer accessibility as well as convenience by offering customers intuitive software interfaces.

4. Better Security (& Compliance)

Through better security measures, fintech impacts businesses to improve the trust of the customers towards the firms.

By using artificial intelligence and blockchain technological parameters, businesses can reduce the risk of cyber fraud by following the fintech regulations.

Businesses are using fintech solutions to better know and understand their compliance and financial regulations that add value to their firms.

You can avail these benefits with a fintech solution expert, as ensuring customer data security is their prime motive while developing the app.

5. Streamlined Operations

Beginning with digital invoicing for payment processing, automated accounting, and payroll systems, FinTech offers a diversified range of services to businesses.

These invoice template services are helping firms to ensure effective business growth by connecting with a diversified range of customers.

By streamlining operations, businesses can focus on their core activities and improve business productivity by driving overall performance initiatives.

Creating an investment platform can be a difficult task without specific fintech app guidance. Thus, fintech guidance can assist you in improving the functioning of your app.

6. Unparalleled Business Insights

Fintech also provides businesses with valuable insights that can help them make informed decisions and strategic planning.

By focusing on fintech development outsourcing, businesses can relax and focus on core business activities.

This is a prominent way to gain business insights and minimize the stress of managing the financial system of the firm.

With the usage of fintech analytical tools, businesses can also recognize the opportunities, resulting in mitigating the risks to optimize their business strategies.

Fintech businesses also offer core business insights by evaluating the customer’s feedback; businesses can update their marketing to take advantage of the favorable conditions in the market.

Industries that can Help by Leveraging Fintech

Would you like to know how different industries can benefit from leveraging fintech?

If yes, then the next section deals with all the industries that are being impacted by the advanced technology used by fintech functions.

1. On-Demand Industry

Fintech solutions for businesses can be effective in delivering and enhancing financial management services for on-demand app development, including food delivery, taxi booking, and salon booking.

Fintechs can leverage the on-demand industry by providing instant payment processing mediums to their customers.

Fintech is helping organizations provide diversified and new ways to invest, share, and manage funds.

The impact of FinTech on e-commerce can be determined through the services it provides to e-commerce firms.

With speed and convenience being the payment system, fintech has provided leverage to the on-demand industry.

2. eCommerce

Businesses with fintech solutions have made accepting payments easier for e-commerce businesses while managing the payments and assisting the firm in arranging finances successfully.

Businesses can track spending, manage, and create budgets to make better investment decisions.

Fintech impacts on e-commerce can be identified through performing personalized shopping experiences, providing cross-border payments, and also providing fraud prevention services.

It can track spending, create budgets, and also assist e-commerce firms in making better investment decisions.

With the assistance of fintech, e-commerce firms can expand into new markets to reach more customers.

This is one of the top reasons why firms that are investing in e-commerce app development should consider fintech integration.

3. Healthcare

You can analyze the use of fintech for healthcare app development by reviewing the role of fintech in this specified area.

This is how fintech makes money; it provides enhanced access and affordability to its customers.

Fintech businesses can also foster healthier populations via timely payments and improving healthcare providers’ cash flow.

The financial challenges in the healthcare sector are huge. It not only impacts the care received by the patient but also impacts the individual’s finances and later society.

With short intervals of transaction periods, it provides effectiveness to the patient and also to the family through effortless transactions.

4. Logistics

Fintech does play an important role in logistics through leveraging new technologies and digital payment systems.

This streamlines the supply chain operations and also realizes significant cost savings, resulting in increased efficiency for the brands.

Through expense tracking app development, logistics firms can effectively make use of fintech solutions.

The impact of fintech on supply chain operations can be examined through improved cash flow management.

Fintech leverages different financial options for businesses, such as logistics businesses that can pay suppliers but do not need to have cash on hand.

Through cross-border payments, fintech contributes to the expansion of global trade, where fintech’s impact on the economy can be analyzed.

5. Education

The impact of fintech can also be analyzed through the platforms that provide financial assistance to assist students in understanding budgeting, savings, and responsible borrowing.

With integration in education app development, fintech provides secure and transparent verification systems.

Fintech businesses also provide efficient payment systems and solutions for students to receive tuition payments, student aid, and scholarship disbursements.

With mobile payment technology, students can access payment to their school, university, or any course fees.

Fintech firms provide a simple and accessible way for students so that they can enable cashless transactions from remote locations.

6. FitTech

Businesses are leveraging fitness by utilizing financial technology to motivate and incentivize individuals to lead healthier lives.

The use of fintech in fitness apps has a wide impact on society. With the emergence of many fitness companies, including Paceline, Ness, and Krowdfit, the usage of fintech cannot be overlooked in the fitness industry.

New fitness apps and businesses are emerging in the current era. This represents the impact on society along with the fitness enthusiast people.

With the usage of digital financial services, fitness applications are being impacted positively.

7. Music Streaming

Several music streaming apps provide tiered subscription models to their users to remove the commercial ads for a monthly fee.

Through the use of blockchain technology, music streaming apps are providing control to the artist over their music.

The relationship between fintech and the music industry is growing significantly.

Music streaming apps with fintech solutions are leveraging the artist to become independent. As with fintech, music streaming apps can analyze the data to build customer profiles.

Along with this, businesses with fintech also provide insights into the user’s demographics, preferences, and mood.

8. Banking

Fintech’s impact on commercial banking can be identified by comparing the traditional banking facilities provided by the banks to the current resources available to the customers to avail the banking services.

Fintech firms utilize the core banking software list and use it to provide banking services to the end user.

Banks with fintech solutions also offer a secure payment experience to the user for accessing faster money transfers.

Fintech’s impact on investment banking also includes trading bonds, mutual funds, stocks, hedges, etc.

Users at the bank can take advantage of the automation and speed of transactions, which represents fintech’s impact on banking.

Nimble AppGenie – Your Partner in Fintech Innovation

With the current increasing trend in fintech and the growing number of users, there is a high possibility of entering the fintech industry.

Nimble AppGenie has gained expertise in fintech app solutions.

Explore how our fintech apps work with already-built apps, including Pay By Check, CUT, and many others.

Fintech App Development Company can help you design your fintech app with all the advanced features.

We are here to help you by providing you with the actual guidance in discovering the current trends and needs of the market.

Additionally, we will help you cover the impact fintech has on businesses and how your app can fit into different industries.

Contact us for more information.

Conclusion

Concluding the above information, it can be stated that the users of fintech in China and India are 87%. The market size of fintech has recorded a growth of USD 257.26 billion.

Hence, it is a great opportunity for the fintech firms to have the upper hand in the fintech industry.

Fintech has a diversified impact on businesses as it provides an easy payment gateway to customers and offers security to firms with unparalleled business insights.

Fintech has opportunities in digital payments, investment and wealth management, data analytics, and also in offering personalized services to businesses.

Industries that are leveraging fintech include healthcare, logistics, banking, education, and music streaming. Other fintech trends include IoT, AI, blockchain, SaaS, and many others.

FAQ

Fintech stands for financial technology, used to provide innovative financial services, disrupting traditional financial systems.

Fintech impacts businesses by providing easier payment methods, adopting future technologies, ensuring customer satisfaction, enhancing security and compliance, streamlining operations, and offering unparalleled business insights.

Fintech solutions offer opportunities in digital payments, lending and financing, accounting and bookkeeping, investment and wealth management, security and risk management, data analytics, and personalized financial services. Examples include digital payment apps like PayPal, lending platforms like NEOGROWTH, and accounting software like QuickBooks.

Various industries such as on-demand services, e-commerce, healthcare, logistics, education, fitness, music streaming, and banking benefit from leveraging fintech by improving financial management, streamlining operations, enhancing customer experiences, and enabling innovative solutions.

Current trends in fintech include blockchain, embedded finance, Software as a Service (SaaS), open banking, digital wallets and payments, robo-advisors, AI, IoT, sustainable finance, cybersecurity, Regtech, and cryptocurrency.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.