Here’s something many of us have noticed: starting with a basic way to send money internationally might seem fine at first, but as you send regularly, the small issues start adding up.

Maybe it takes too long, or you do not have all the options you need. Sound familiar? Well, you are not alone. Around 66% of people use remittance apps, but many find that their current app does not quite meet their needs over time.

This is not just annoying. It can also waste a lot of time. That’s why many users choose to upgrade to apps like Remitly that better fit what they need. So, are you an aspiring entrepreneur who wants to develop an app like Remitly? If yes, then this guide is for you!

It will discuss the step-by-step process to build a remittance app like Remitly, what features to integrate, and how you can earn money from it.

So, let’s begin!

What is a Remitly App?

Remitly is a digital remittance app, or in simple words, a money transfer app. It helps users to send money to their family or friends in other countries. For example, if someone is working in the US and wants to send money back home to their family in another country.

They can use this instant payment system called Remitly. Founded in 2011 by Shivaas Gulati, Josh Hug, and Matthew Oppenheimer, Remitly makes the money transfer process a lot easier.

Instead of going to the bank, users can simply use their mobile phone. It is very easy to use, has fast transfers, requires low fees, and supports many different countries.

Market Overview of a Digital Remittance App

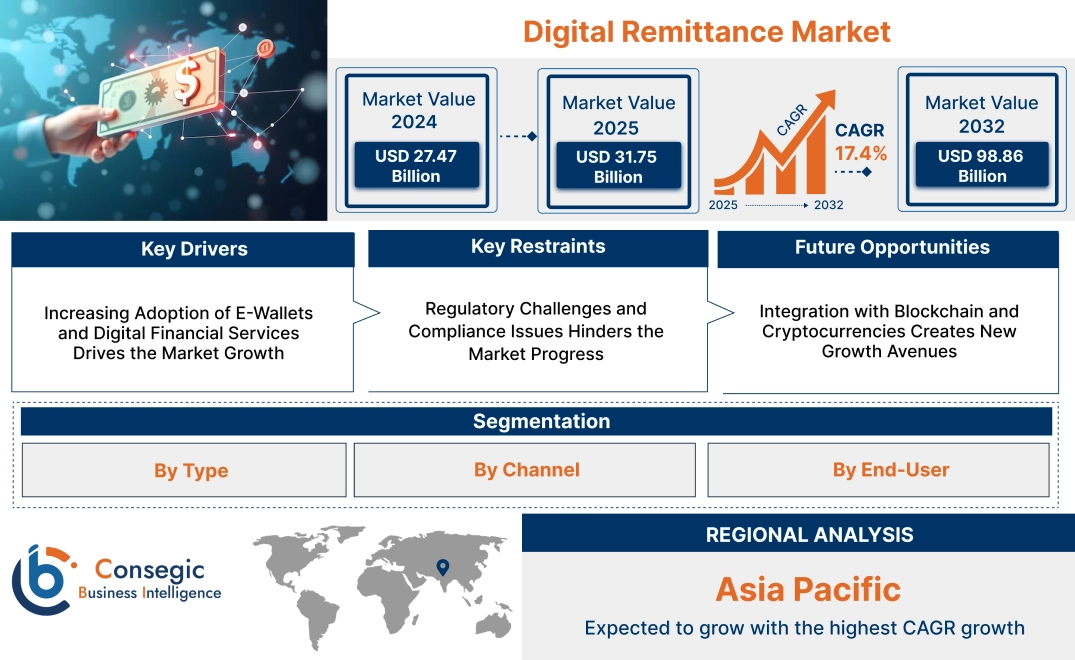

People around the world are sending money to family and friends in other countries more and more, especially using apps and websites. If we look at the fintech app statistics, in 2025, the total money sent this way, including all methods, is expected to be about $900 billion.

This amount will keep growing, and by 2030, it could reach around $1.4 trillion. At the same time, the number of people sending money is also growing. By 2030, about 331 million people will be using these services.

When we look just at digital ways, like sending money through apps, the market is growing super fast. In 2024, it was worth about $27 billion, and in 2025, it’s expected to grow by another $31 billion.

By 2032, the digital money transfer market could be almost $98.86 billion, growing about 17% every year.

Source: www.consegicbusinessintelligence.com

Since more people are using remittance apps to send money, businesses have a big opportunity to build a money transfer app that helps people send money quickly, safely, and easily.

Steps to Develop an App like Remitly

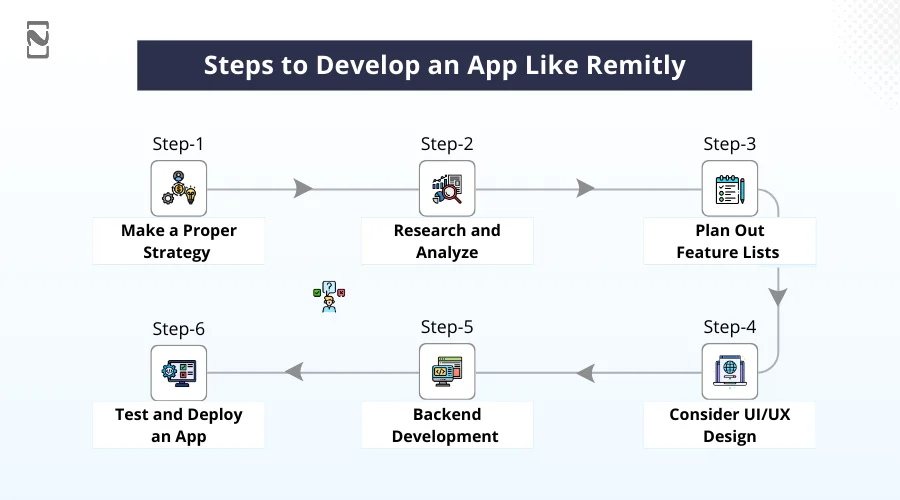

So, how do you create a digital remittance app like Remitly? Turning a money transfer fintech startup idea into a fully working solution takes careful planning and smart execution.

To succeed, the Remitly app development process should be well-structured, thoroughly researched, and thoughtfully designed. Here is the step-by-step process to develop an app like Remitly using a reputable iOS app development company.

-

Make a Proper Strategy

To build a successful digital remittance app like Remitly, it is important to first share your project app ideas with a development company’s technical team and business analysts. Just discuss what you want the app to achieve and how it should work.

This helps everyone understand your objective clearly. Also, if you are developing an app like Remitly, make sure to discuss how to include the latest fintech trends so your app stays the latest, secure, and competitive in the digital payment market.

-

Research and Analyze

Now, once you have made a strategy, on the basis of that, you can do market research and competitor analysis. After looking at what the target audience needs, what other digital remittance apps offer, and the fintech regulations, businesses should come together to check if the app idea fits well in the current market.

This stage reveals many essential details, like smart features and regional needs, that might be missed otherwise. It is also the right time to create a clear roadmap for digital remittance app development.

-

Plan Out Feature Lists

Once you thoroughly research the market and the idea looks promising, it is time to plan out the feature list for your digital remittance app. You can think about what your target audience really needs. For example, it’s simple to use, offers money transfer, real-time tracking, low fees, and strong app security.

Besides, you can look at what apps like Remitly are providing and see if you can add something better. To stand out from competitors, you need to include unique features and also choose a fintech business model that best fits your app. This stage is all about listing out the must-haves and advanced features.

-

Consider UI/UX Design

Now it is time to focus on the app design, or you can say UI/UX. A simple and visually appealing interface can really set your digital remittance app apart from others. The objective here is to keep things minimal and simple, so users can send money without any confusion.

The mobile app design team works on a user-friendly design that looks familiar and seamless. Instead of overloading the application, the team focuses on clear layouts and small details that make the overall experience better.

-

Backend Development

At this stage, the developers started to develop an app like Remitly. Based on all the earlier planning and research, they begin creating the core features of your money transfer app. They design a solid fintech app architecture to make sure the app is secure and scalable.

The mobile app development team also works on the backend, sets up the database, and integrates important fintech APIs for things like payments, currency conversion, and identity verification. Every part is developed carefully to ensure seamless money transfer and strong data protection.

-

Test and Deploy an App

Fintech app testing plays a role in making sure your money transfer app works properly and does what it is supposed to do. During this stage, the team checks for any bugs, design issues, or anything that does not feel right.

They fix these problems to make sure the app runs smoothly and gives a good experience. Once everything looks fine, the app is ready to launch. Additionally, the team plans for future updates and security fixes to keep user feedback in mind and follow best practices.

Must-have Features of an App like Remitly

Whether you’re building a money transfer or remittance app, adding the right fintech app features is important.

These features will help your remittance app work smoothly and stand out from the competition. Below are some of the must-have features that your remittance app, like Remitly, should include.

| User Panel | Admin Panel |

| User registration | User account management |

| Send money | Transaction monitoring |

| Add or edit recipient | Fraud detection |

| Track transfer status | KYC compliance checks |

| View transfer history | Transfer approval and renewal |

| Push notifications | Access logs and activity history |

| Manage promo codes | Risk scoring and flagging |

| Manage profile and settings | Refund & Dispute Handling |

| Identity verification | Reporting & Analytics |

| Contact Support | System Configuration |

| Currency conversion preview | Payment gateway method |

Advanced Features to Include in a Remittance App like Remitly

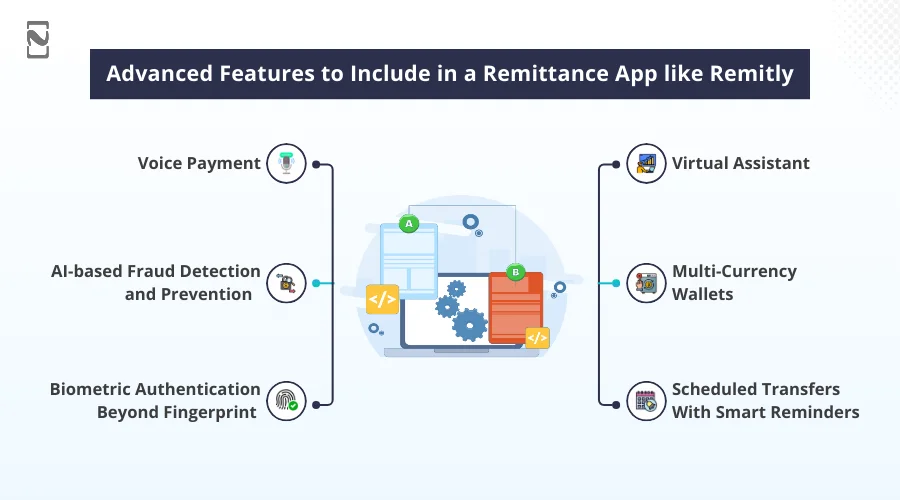

The core features are not sufficient. To improve user retention in fintech apps like Remitly, you also need to integrate advanced features based on your project requirements. Below, we’ve listed advanced features that can help you attract and keep a large user base.

-

Voice Payment

The voice payment feature can be a game-changer for your remittance app. Currently, there are no remittance apps that offer this feature, so if you integrate, it can make your app stand out. It allows users to send money using voice commands that make the experience faster and more convenient.

-

Virtual Assistant

Virtual assistants are a trending feature in fintech apps. If you integrate it into your mobile transfer application, it helps users by answering questions, guiding them through money transfers, and checking currency trends. It is fully AI-powered, which gives personalized assistance to users.

-

AI-based Fraud Detection and Prevention

As you know, the integration of AI in fintech apps is very common nowadays. It keeps users’ money safe by spotting suspicious traders quickly and stopping fraud. This way, users do not lose money or face any delays.

-

Multi-Currency Wallets

Users can hold and send money in multiple currencies easily. For example, if a user wants to send money in dollars to rupees, they can simply use the multi-currency wallets feature. It saves them time and money without switching apps or accounts.

-

Biometric Authentication Beyond Fingerprints

As you know, fintech security is very important in remittance apps. So, when you develop an app like Remitly, you can integrate face recognition or behavior to unlock the app safely and fast. It keeps their account secure from others.

-

Scheduled Transfers With Smart Reminders

You can allow users to automate regular payments and receive timely reminders. This ensures transfers happen on time and reduces the chance of missed payments or late fees. Besides, you can build a notification transaction processing system that sends reminders before the transfer occurs.

How Much Does it Cost to Develop an App like Remitly?

The cost to build a fintech app like Remitly can range between $25,000 – $180,000. This cost is not a fixed or actual cost. The cost can vary based on your project’s complexity, features, app size, platform choice, customizations, etc.

Basically, your project requirements affect the whole Remitly app development cost. You need to make sure that proper planning and a budget are set up before making a huge investment.

For example, if you want an IoT in a fintech app like Remitly, then the cost will increase. But if you want a simpler version, then the cost to develop an app like Remitly will be less.

Let’s have a look at the table below of the costs to build an app like Remitly for a clearer image.

| Application Complexity | Cost Estimation |

| Simple Remitly-like App | $25,000 – $70,000 |

| Medium Remitly-like App | $70,000 – $140,000 |

| Complex Remitly-like App | $140,000 – 180,000+ |

These are just ballpark estimates. If you want to know the actual remittance app development cost, share your project requirements with a mobile app development company. They will provide a custom quote for your Remitly-like app.

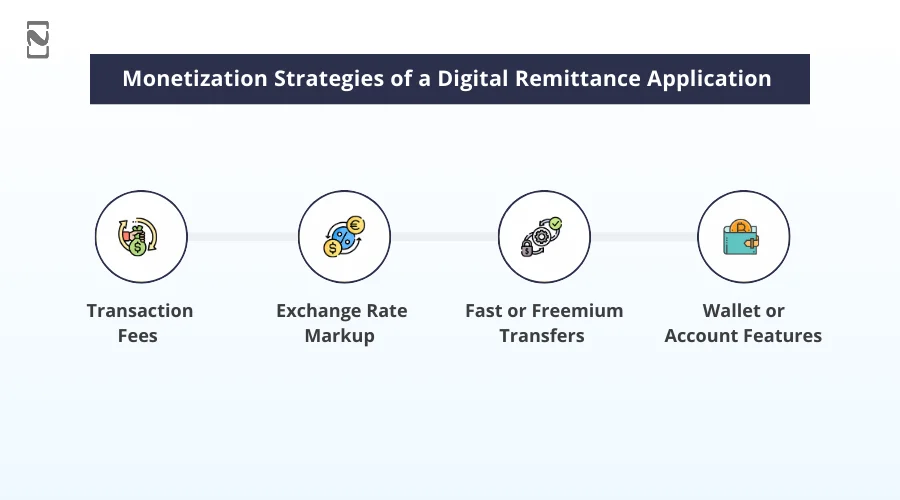

Monetization Strategies of a Digital Remittance Application

If you are building a money transfer app like Remitly, you are probably wondering, How do these remittance or fintech apps make money? The good news is, there are multiple monetization strategies they follow to earn money. Let’s take a look at the revenue streams below.

-

Transaction Fees

The most common way to make money is by charging users a small fee when they send money. It is called a transaction fee. For example, if someone wants to send $100 to another country through your electronic payment services, you might charge a fee of $3 or $5.

The exact amount can depend on the country, amount, and how fast they want the money to arrive. These small transaction fees can add up quickly when you have many users sending money every day.

-

Exchange Rate Markup

Another big revenue stream is through the exchange rate. When a user sends money from one currency to another, you can offer them a slightly lower rate than the actual market rate. The rest of the money, you can keep whatever the difference is.

For example, if the real rate of $1 is equal to ₹84, you might give them $1, which is equal to ₹81. That small margin goes to you as a profit, and it is something users often do not notice. This variable recurring payments in fintech is very popular in many money transfer applications.

-

Fast or Freemium Transfers

People are often willing to pay more to send money faster. You can offer two options. A low-cost economy transfer that takes a few days, or a premium or express transfer that arrives instantly or within minutes, and costs more. This gives users flexibility and earns you more from faster services.

-

Wallet or Account Features

If your digital remittance app, like Remitly, offers a digital wallet or account to hold the money, you can add a small service fee.

For example, withdrawals, currency holding, or subscription upgrades. While this is not required at first, it is something you can add as the app grows.

Why Choose Nimble AppGenie to Build an App like Remitly?

Nimble AppGenie is a fintech app development company that specializes in creating custom mobile apps for banks and fintech companies. From a money transfer app to a full digital remittance solution, we assist financial services in growing with secure and scalable technology.

We use the latest technology to keep your users’ data safe and protected. Our fintech solutions are designed to scale as your business grows, and they connect easily with other systems.

Our team supports businesses going through digital transformation in fintech, helping them stay competitive with better customer experiences.

If you are planning to develop an app like Remitly, we have the expertise to bring that to life.

From tracking spending to sending money, we give users what they need to stay in control. At Nimble AppGenie, we merge tech expertise with real-world understanding to develop apps people trust and love to use.

Conclusion

If you are seeking a promising business niche that is absolutely booming, fintech is the perfect choice.

Although digital money transfer apps are gaining huge popularity, the market still has a plethora of room for new players. This is especially true with more people sending money across borders every day.

So, how can you develop a fintech super app like Remitly that stands out and succeeds? The answer is partnering with the right development team that understands the remittance market and has the right experience to bring your idea to life.

FAQs

- Do proper market analysis

- Plan out the features list

- Designing the user interface

- Build an MVP version

- Do proper mobile app testing

- Launch the application

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.