Have you heard of open banking? Well, surely you have. First introduced in 2017, open-banking is growing with help of impeccable APIs in Fintech.

With this, the financial world have finally realized open banking’s dominance over traditional banking. This is one of the biggest force behind digitalization of financial industry.

Most of us are already using these open banking services with platforms like Wells Fargo, PayPal, and Visa.

There are endless benefits of open banking and the revolution is being driven by Fintech APIs. In this blog, we shall be discussing all about Fintech APIs and everything related to that.

Therefore, let’s get right into it:

What Are Fintech APIs?

APIs in general terms to set of protocols and codes. It allows a program to collaborates with another program or software companies. In simpler words, they allows two systems to connect with each other to exchange data.

Coming to APIs in Fintech, these are programs that are specially designed around financial technologies and banking services. many reports shows the importance of fintech APIs in modern fintech development solutions.

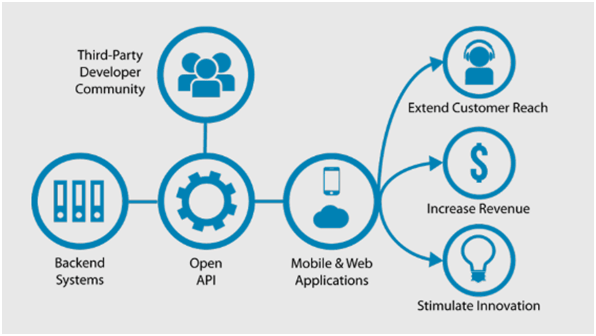

In fact, Fintech APIs are the driving force behind the open banking ecosystem. Plus, it is also a significant part of “BaaS” or Banking-as-a-Service. For those who aren’t familiar with the concept, it’s an end-to-end process that allows third parties to connect to bank systems via APIs.

As such, there are different types of APIs and here we shall see what these are.

Types of Fintech APIs

There are different types of APIs in fintech. Let’s discus what these are:

Partner APIs

One of the most popular API in banking and fintech is, this one.

What happens here is, banks provide services via this app to specific partner only. Thus, the name “Partner” APIs.

Private APIs

As opposed to last one, this type of Banking APIs are made for inner use only. That’s the reason behind the name private APIs.

Open APIs

This is the Fintech API we were all waiting for.

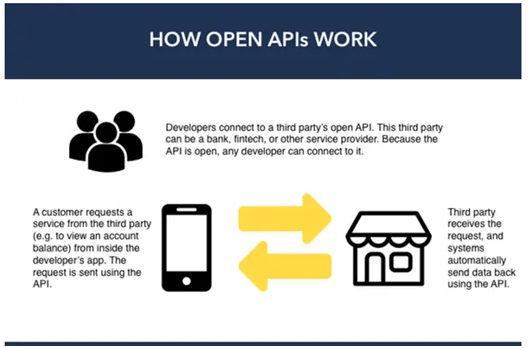

Well, Open APIs or also known as Open Banking APIs, allows third-party companies to access the bank account data.

This enables a range of services like eWallet, bank-to-bank transfer, loan lending services that we see in form of digital wallet app development.

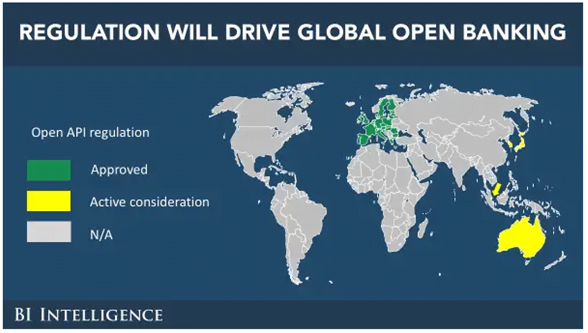

Image Source: Business Insider Intelligence

Image Source: Business Insider Intelligence

Open Banking Ecosystem And Role of APIs

So, what’s open banking?

It is no secret that banking information is something very sensitive. And banks only kept this information between themselves for obvious reasons.

But it did provide a lot of issues for third-party platforms who were trying to provide financial services.

But everything changed with introduction of fintech APIs. Well, API in fintech has been around for long time. But open banking APIs allows the banks to share their information with third party platforms thus opening door to way more possibilities.

Open Banking Ecosystem

Open banking ecosystem is all set to change or flip the customer’s financial experience across the globe to the good side. This system will help the banks in opening up their application programming interfaces (APIs) or. Allowing third parties to access useful financial information. Open banking will help third parties to develop new applications and services. That provide more flexible and transparent financial options to account holders.

With the help of open banking, third parties can develop improved personal financial management applications(PFM). This creates pressure on financial companies to improve their offerings and services. Open banking services are creating more competition in the banking market, creating pressure on incumbents either to improve the services they are providing or to partner up with finTech companies.

Open Banking in UK and US

Image Source: Business Insider Intelligence

Image Source: Business Insider Intelligence

Starting from UK, open banking has consequently increased and spread across Europe. In 2018, the UK Competition and Markets Authority’s (CMA) open banking rules came into effect. Requiring the nine largest retail and SMB account providers to give qualified third-party providers access to customer-permitted data.

UK regulations have made waves across Europe, with a large number of countries following these steps. Forming their very own open banking frameworks.The pace of open banking operations has been slow due to varying regulations across Europe. The opposite was observed in the rest of Europe compared to the UK. because there were no such rules. However, we are seeing that developing client demand and stress from the competition is forcing the USA to begin playing catch-up to Europe.

Examples of Open Banking

HSBC

![]()

In May 2018, HSBC launched its Connected Money app. The app allows users to explore multiple bank accounts as well as credit cards, mortgages, and loans at a single place. As the UK launched new open banking regulations in 2018. Which provided more control over financial data to customers, HSBC launched the Connected Money app.

BBVA

![]()

BBVA launched its open platform BaaS application in the USA in 2018. With the help of this open platform APIs, third parties can offer financial products to customers without providing full suite banking services.

Barclays

![]()

With continuous growth and success in the open banking market, Barclays is popular to be the first UK bank with the feature of account aggregation inside its mobile banking app. The open banking feature of the Barclays app allows its users to view their bank account details with other banks also.

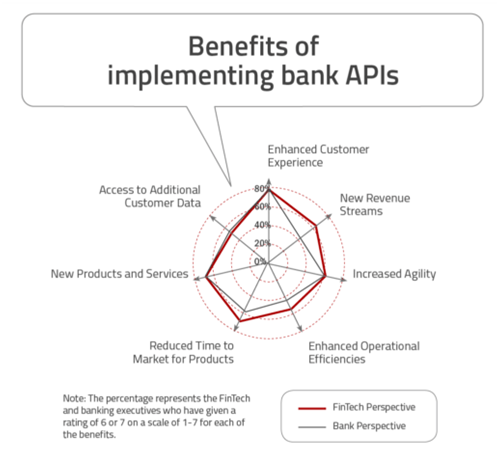

Benefits of Fintech APIs

- Open banking has the capacity to improve revenue streams by increasing customer services for financial industries.

- Open banking creates revenue-sharing ecosystems, allowing companies and banks to offer third party services to users.

- Open banking also allows the banks to degrade their framework by integrating with the BaaS platform to provide essential services to third parties and fintechs.

- Business Insider Intelligence forecasts that with around 25% compound annual growth rate (CAGR), the open banking market will reach around $2 billion by 2024.

Read also: FinTech App Development Cost Including Advanced Features Read also: FinTech App Development Cost Including Advanced Features |

|---|

Advantages of APIs In Fintech

APIs or Application Programming Interfaces are becoming increasingly popular in the financial technology (fintech) industry. They offer several advantages that can help fintechs streamline their operations, improve their customer experience, and stay ahead of the competition.

Here are some of the key advantages of APIs in fintechs:

Smooth Data Sharing – Better User Experience

APIs facilitate smooth data sharing between Fintech firms and other stakeholders such as banks, payment processors, and investment firms. This has enabled Fintech firms to offer better user experiences, as they can access more data and services that enhance their products.

It’s a lot more cost effective

APIs have made it possible for Fintech firms to access services such as payment processing, identity verification, and credit scoring from established financial institutions. This has significantly reduced the cost of entry for Fintech firms, as they no longer have to build these services from scratch.

APIs in Fintech will stand the test of time

As the financial industry continues to evolve, APIs will remain relevant. They provide a flexible and scalable infrastructure that can adapt to changing market needs and new technology trends.

Better Overall Operations

APIs have enabled Fintech firms to automate many of their operations, reducing the need for manual intervention. This has resulted in better overall operations, as it reduces the risk of errors and improves efficiency.

Product Portfolio Augmentation

APIs have made it possible for Fintech firms to expand their product offerings by integrating with other financial institutions. This has enabled them to create more diverse and comprehensive products, which has contributed to their growth and success.

Moving on, APIs in fintech have brought about numerous benefits to the Fintech industry. From cost savings to better user experiences, Fintech firms can leverage APIs to improve their operations and create more value for their customers.

Open Banking Use Cases in Fintech

Open banking is a term that refers to the process of sharing financial information electronically. Moreover, open banking has revolutionized the financial sector and has opened up new opportunities for fintech companies.

Here are some interesting use cases of open banking in the fintech sector.

Use Case 1: Personal Finance Management

Open banking has made it easier for fintech companies to access financial data, which has resulted in the development of personal finance management tools.

These tools help users to manage their finances effectively by aggregating data from multiple financial institutions. Users can track their expenses, set budgets, and analyze their spending patterns. Fintech companies such as Mint and Personal Capital have been successful in this space.

Use Case 2: Credit Scoring

Open banking has also made it possible for fintech companies to develop credit scoring models that are more accurate and reliable than traditional credit scoring models.

With access to real-time financial data, fintech companies can assess a customer’s creditworthiness more accurately. This has led to the development of innovative lending models, such as peer-to-peer lending platforms.

Use Case 3: Payment Initiation

Open banking has also made it possible for fintech companies to initiate payments directly from a customer’s bank account.

Moreover, this has streamlined the payment process and has made it more convenient for customers to make payments. Fintech apps such as TransferWise and Revolut have been successful in this space.

Use Case 4: Wealth Management

Open banking has also enabled fintech companies to develop wealth management tools that are more personalized and effective.

By accessing a customer’s financial data, fintech companies can develop investment portfolios that are tailored to the customer’s risk appetite and financial goals. Fintech companies such as Wealthfront and Betterment have been successful in this space.

Use Case 5: Fraud Detection

Open banking has also made it easier for fintech companies to detect and prevent fraud. With real-time access to financial data, fintech companies can monitor transactions more closely and identify suspicious activity.

Moving on, this has led to the development of innovative fraud detection tools that can help prevent financial crime.

Use Case 6: eWallet Apps

Open Banking APIs have made it possible for eWallet apps to integrate with multiple banks and financial institutions.

Moreover, this has enabled users to access all their financial accounts in one place, making it easier to manage their finances.

With Open Banking APIs, eWallet apps can also provide real-time updates on account balances and transactions, as well as offer personalized financial recommendations based on the user’s spending patterns.

Use Case 7: Peer-to-Peer Lending

Peer-to-peer lending platforms have grown in popularity in recent years.

Open Banking APIs have made it easier for these platforms to verify borrowers’ identities and creditworthiness, as well as facilitate loan disbursements and repayments.

By integrating with multiple banks, peer-to-peer lending platforms can also offer borrowers better interest rates and more flexible repayment terms.

Use Case 8: Payment Processing APIs

Open Banking APIs have made it easier for payment processing providers to offer their services to businesses of all sizes.

By bank API integration, payment processing providers can offer faster and more secure payment processing, as well as reduce the risk of fraud.

Open Banking APIs have also enabled payment processing providers to offer more personalized payment options, such as instalment plans and pay later options.

Best Fintech API Providers

Fintech API providers and companies are revolutionizing the financial services industry by offering innovative solutions that enhance customer experience and streamline financial transactions. Here are some of the best fintech APIs providers companies:

1. Plaid

Let’s discuss one of the best Fintech API in the world today, the Plaid. It is actually a suite of open banking APIs that fintech app developers absolutely love.

Their APIs enable developers to access bank account information, authenticate accounts, and verify balances.

2. Stripe

This is yet another one of the fintech APIs companies those businesses to accept payments online.

3. Twilio

Twilio is a fintech API provider that offers a suite of APIs that enable businesses to communicate with their customers via SMS, voice, and video.

4. TrueLayer

TrueLayer is a fintech API provider that offers a suite of APIs that enable developers to build Fintech applications.

5. Adyen

Adyen is one of the best API in the open banking ecosystem. Their APIs enable businesses to accept payments from customers all over the world, in multiple currencies.

These fintech API companies are transforming the financial services industry by offering innovative solutions that enhance customer experience and streamline financial transactions.

Advantages of APIs In Fintech

APIs or Application Programming Interfaces are becoming increasingly popular in the financial technology (fintech) industry. They offer several advantages that can help fintechs streamline their operations, improve their customer experience, and stay ahead of the competition.

Here are some of the key advantages of APIs in fintech:

Smooth Data Sharing – Better User Experience

APIs facilitate smooth data sharing between Fintech firms and other stakeholders such as banks, payment processors, and investment firms. This has enabled Fintech firms to offer better user experiences, as they can access more data and services that enhance their products.

It’s a lot more cost effective

APIs have made it possible for Fintech firms to access services such as payment processing, identity verification, and credit scoring from established financial institutions. This has significantly reduced the cost of entry for Fintech firms, as they no longer have to build these services from scratch.

APIs in Fintech will stand the test of time

As the financial industry continues to evolve, APIs will remain relevant. They provide a flexible and scalable infrastructure that can adapt to changing market needs and new technology trends.

Better Overall Operations

APIs have enabled Fintech firms to automate many of their operations, reducing the need for manual intervention. This has resulted in better overall operations, as it reduces the risk of errors and improves efficiency.

Product Portfolio Augmentation

APIs have made it possible for Fintech firms to expand their product offerings by integrating with other financial institutions. This has enabled them to create more diverse and comprehensive products, which has contributed to their growth and success.

Moving on, APIs in fintech have brought about numerous benefits to the Fintech industry. From cost savings to better user experiences, Fintech firms can leverage APIs to improve their operations and create more value for their customers.

Future OF Fintech APIs

So, what can you expect from APIs in Fintech in times to come? Well, in this section we shall be discussing possible development in opening banking API and the entire fintech scene.

Increased integration with artificial intelligence (AI)

APIs can be used to access data and functionality from AI Solutions. In the future, we can expect to see APIs that are specifically designed to work with AI systems, making it easier for developers to incorporate AI capabilities into their applications.

Greater emphasis on security

With the increasing amount of data being transmitted through APIs, security will become an even greater concern. We can expect to see more emphasis on security in API design, with features like authentication and encryption becoming standard.

Expansion of the Internet of Things (IoT)

As more devices become connected to the internet, the number of APIs required to facilitate communication between these devices will continue to grow. We can expect to see APIs designed specifically for IoT devices, making it easier for developers to create applications that can interact with these devices.

Increased use of GraphQL

GraphQL is a query language for APIs that allows developers to retrieve exactly the data they need, making it more efficient than traditional REST APIs. We can expect to see more APIs built using GraphQL in the future.

More emphasis on developer experience

As the number of fintech APIs continues to grow, developers will want to choose APIs that are easy to use and well-documented. API providers will need to focus on creating a good developer experience to remain competitive.

The future of APIs in fintech looks bright, with increased integration with AI, greater emphasis on security, expansion of the IoT, increased use of GraphQL, and more emphasis on developer experience. As technology continues to advance, we can expect to see even more exciting developments in the world of APIs.

Conclusion

Open banking has completely changed the banking scenario in the UK. And now, it is spreading across Europe and the US. Open Banking and the corresponding technologies are driving rapid changes throughout the financial services industry.

More technological advancement and a continued relationship between banking and fintech app development will undoubtedly continue. And that will help create innovative solutions that meet the expectations of the future.

No matter which strategic option(s) you choose to follow, open banking will fundamentally change banking the same way internet banking once did. As banks become integrated parts of digital ecosystems, the distribution of banking products will change and, in the end.

Become more valuable in the right context for the end customer. And with this, we have come to the end of this blog about APIs in Fintech, Opening Banking API, and overall banking industry.

FAQ

API (Application Programming Interface) plays a crucial role in the fintech industry. It allows different software applications to communicate and exchange data with each other. In fintech, APIs enable financial institutions to share data with third-party developers, allowing them to create innovative applications and banking services.

There are several commonly used APIs in the fintech industry, such as:

Payment APIs: These APIs enable secure and fast payment processing.

Banking APIs: These APIs provide access to banking data and enable transactions.

Investment APIs: These APIs enable users to invest in stocks, bonds, and other financial instruments.

Identity APIs: These APIs allow for identity verification and authentication.

Bank of America uses a variety of APIs in its operations, including:

Merchant Services API: This API enables payment processing for merchants.

Account Information API: This API provides access to account information, such as balances and transactions.

Foreign Exchange API: This API enables foreign currency exchange transactions.

Open APIs allow third-party developers to access financial data and services from banks and financial institutions. This enables the creation of innovative fintech solutions that can improve customer experiences and drive business growth. Open APIs typically require authentication and authorization from users before granting access to their financial data.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

One Comment

Comments are closed.