In a Nutshell:

- The cost to build an app like AfterPay can range between $25,000 to $250,000 or more based on the app complexity, features, and project requirements.

- A BNPL app makes money through merchant fees, interest on payments, premium subscriptions, and insights that help retailers improve sales.

- Must-have BNPL app features include instant credit checks, secure KYC onboarding, AI-driven fraud prevention, virtual cards, and intuitive merchant dashboards.

- The right tech stack for BNPL apps ensures speed, security, and scalability by combining React Native or Flutter for mobile, Node.js or Python for backend.

- Nimble AppGenie provides custom BNPL app solutions that align with your project requirements and budget.

Buy Now Pay Later has certainly found its way with the users, as it has become one of the most popular payment methods that is used by consumers while shopping online.

It is apps like Afterpay that have played a significant role in popularizing and normalizing the concept of BNPL, as if these apps were not easy to use and impactful, people would not have caught hold of these applications.

While Afterpay has become a leading name in the market, it has also paved the way for new BNPL apps, as there is a void in the space for more competition and more BNPL apps with flexible terms and benefits. It can be said that developing an app like Afterpay is a profitable decision.

If you are planning to enter the lucrative market of BNPL, your competition can serve as your roadmap to success.

How? Well, you can build an app like Afterpay to get the ball rolling and then, through research and development, surpass it through improved features and experiences.

But many of you may be wondering how to create an app like Afterpay in the first place. Well, don’t worry, as in this post, we are going to learn about every aspect of developing a similar platform to Afterpay, or even better.

Without further ado, let us start by learning about the Afterpay app and identifying how it works.

What is the Afterpay App?

The Afterpay app was established back in 2014 by Nick Molnar and Anthony Eisen in Australia. While the app started as an Australia-only platform, today it is also available in the United Kingdom, the United States of America, and New Zealand.

The app has over 43,000 global retailers. Out of these, over 9,000 retailers are in the United States of America alone, which shows the impact that the app has made over the years.

Keep in mind that this number is growing by the hour, making Afterpay more and more relevant for the user.

The ease of access that it provides, along with access to different retailers, makes it a great app to use.

Another thing that goes in favor of Afterpay is the user interface and experience that it offers. A user can simply finish the transaction from the application directly in a matter of seconds.

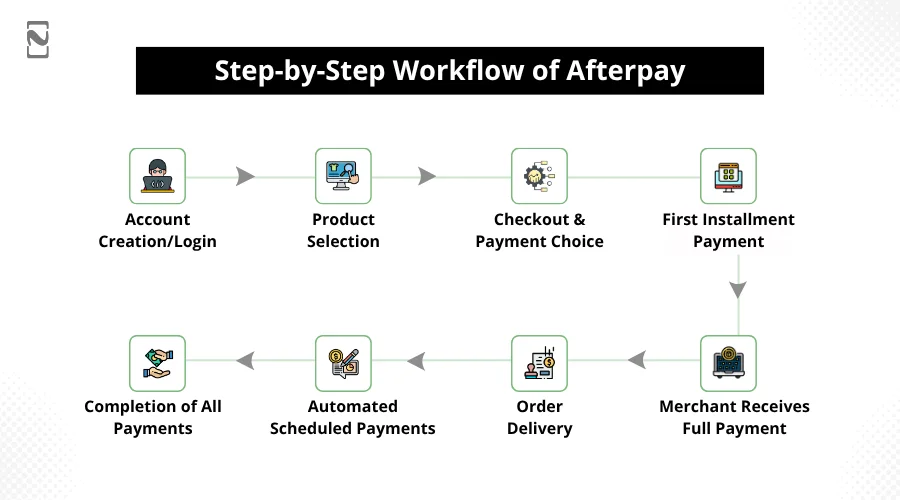

How Does the Afterpay App Work?

Apps like Afterpay allow customers to purchase an item or service online and pay for it after a specific interval of time. Users can pay back in easy EMIs over a decided period. This is why it is also known as a pay-in-installments online shopping platform.

Afterpay is generally integrated with different platforms and allows a user to choose it as a mode of payment for the purchases a consumer makes.

After selecting the application, you can simply select the tenure of payment and finish the transaction on the platform instantly.

Keep in mind that to complete the transaction through Afterpay, you need to provide your information so that your credit eligibility can be checked.

This means your creditworthiness is always essential when you want to use the Afterpay app.

The best course of action to ensure your credit score is not hurt and your Afterpay limit is to pay back within the defined timeline. This way, your Afterpay stays active and you can use it further for more purchases.

Core Features Required to Create an App Like Afterpay

Knowing exactly how the Afterpay application works, you now have an idea of what you are getting yourself into.

In order to build an app similar to Afterpay, you need to identify the features it offers. Generally, users are inclined towards using an app that offers the convenience of making purchases.

If it were only about borrowing money, there are several loan offering platforms in the market that a user can turn to.

However, the entire concept of Afterpay app depends on two things: ease of repayment and ease of access.

To start your app, you need to focus on the features you integrate.

Some of the core and advanced features to have in your Afterpay-like app include –

| Features | User Panel | Admin Panel |

| 1. Account Management | ● Login/Signup

● Profile editing (name, email, contact information) ● Change password ● Manage linked bank accounts/payment methods |

● User management (create, edit, delete)

● View user details and activity ● Manage user roles and permissions |

| 2. Transactions | ● View transaction history

● Search and filter transactions ● Download transaction statements ● Make repayments ● Schedule upcoming payments |

● View all transactions

● Search and filter transactions by user, date, amount, etc. ● Manage refunds and disputes ● Export transaction data |

| 3. Loan Management | ● View current loan details (amount, interest rate, repayment schedule)

● Simulate different repayment scenarios ● Request early repayment – Manage automatic repayments |

● Set loan limits for users

● Manage different loan products and terms ● Monitor loan performance (defaults, delinquencies) ● Generate loan reports |

| 4. Security & Compliance | ● Two-factor authentication

● Secure login and transaction processes ● Access our privacy policy and terms of service |

● User data encryption

● Compliance with relevant regulations (KYC, AML) ● Manage user access controls and permissions |

| 5. Notifications & Messaging | ● Receive payment reminders and notifications

● Contact customer support through in-app chat or email |

● Send targeted notifications to users (promotions, updates)

● Manage communication channels with users |

| 6. Additional Features |

● Budgeting tools and financial insights ● Loyalty programs and rewards ● Marketplace integration to discover BNPL-enabled merchants |

● Merchant management (onboarding, approvals)

● Fraud detection and prevention tools ● Data analytics and reporting dashboards |

While these features define the basic identity of a buy now, pay later application, what makes Afterpay special is the advanced features and functionalities that it offers to the users.

The list below is a combination of existing features and potential features that you can add to your list while building an app like Afterpay.

Advanced Features for Afterpay Like App:-

- AI-Powered Budgeting & Insights

- Gamify Responsible Spending

- Expanding Credit Access

- Pre-Approved Spending Power

- Bill Pay Integration

- Subscription Management Hub

- Marketplace Expansion

- Building a Financial Community

- Open Banking Connection

- In-app Financial Education

With all these features backing your application, you can surely take over the market and provide a better quality of experience for the user.

As they say, you have to be the best to beat the best, and certainly, if you plan to create an app like Afterpay, you need features that overpower the competition.

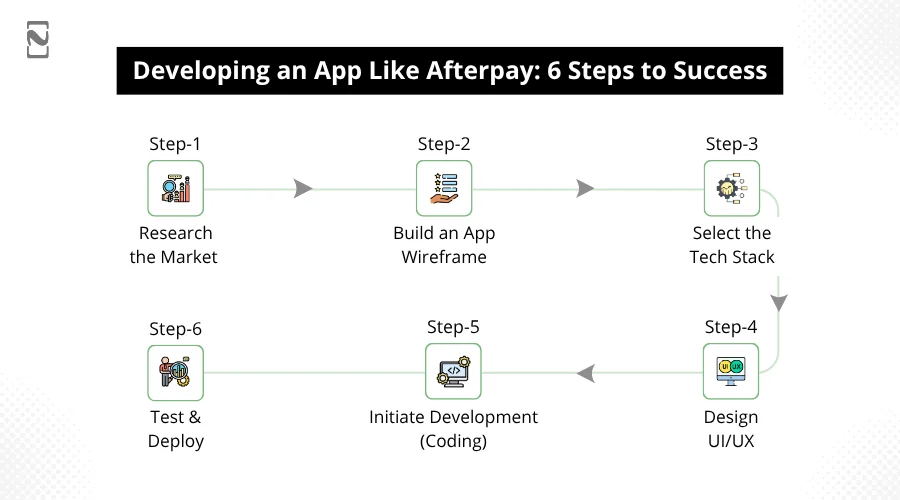

How to Build an App Like Afterpay: Step-by-Step Process

Identifying the features and choosing what you need to integrate is just the beginning. The next crucial step you need to take is developing the app.

Integrating all the features and building an infrastructure as robust as that of Afterpay.

To develop an app like Afterpay, you need to follow a series of steps. These steps include –

Step 1: Research the Market

The first thing to do is identify the market opportunities and how you plan to enter them. Studying the BNPL market stats can be a great way to start your research.

Look at the competition in the market and examine where exactly they are going wrong. To create an app like Afterpay, proper market research lays the foundation of your application; hence, it is a crucial step you cannot skip.

Step 2: Build an App Wireframe

A wireframe of an app is the core groundwork that you do for the design of your app. The idea is to sketch out how your app will look and what features it will have.

This step helps you decide on the workflow of the application, giving you clarity on whether the vision you have is viable or not.

To take this a step further, you can even plan MVP development for your app, like Afterpay, as it will help you understand the vision better.

Step 3: Select the Tech Stack

After you have identified the features and the flow of the application, it is time to choose the right fintech tech stack to power them.

The tech stack is the soul of your application, as one wrong move in deciding the tech, and the app’s performance will suffer. To find an ideal balance between technology and performance.

| Components | Technology Options | Pros | Cons |

| 1. Frontend | React Native, Flutter | Cross-platform, flexible UI, large community | Requires more development effort for a native look and feel |

| 2. Backend | Node.js, Python (Django/Flask) | Scalable, mature frameworks, large developer pool | It can be complex for beginners |

| 3. Database | PostgreSQL, MongoDB | Robust, ACID-compliant (PostgreSQL), flexible schema (MongoDB) | Choosing the right one depends on specific needs |

| 4. Payment Gateway | Stripe, Braintree, Adyen | Secure, integrated payment processing solutions | Fees associated with transactions |

| 5. Fraud Detection | Sift, Riskified, FraudLabs Pro | Reduce fraudulent transactions and ensure financial security | Requires ongoing monitoring and configuration |

| 6. Credit Scoring | Plaid, LexisNexis Risk Solutions | Assess the creditworthiness of borrowers and make informed lending decisions | may require additional compliance measures |

| 7. Notifications | Twilio, Pushwoosh | Send real-time updates to users and improve engagement | Cost associated with sending notifications |

| 8. Analytics | Google Analytics, Firebase Analytics | Track user behavior and measure app performance | Requires integration and data analysis expertise |

With all these technologies, you are now ready to start building the app.

Step 4: Design UI/UX

The next step is to define the app’s user interface and experience. This is where all your application starts to take shape. Build the UI and UX with the necessary tools from the tech stack.

The user interface and experience should be unique but simplified, such that a user finds it easier to use than any other present app.

Even if your idea is to create an app like Afterpay, you need to create a distinguished user experience to make the app more preferable.

Step 5: Initiate Development (Coding)

This is the step where you start writing code for your app. Studying the functionalities of Afterpay can be beneficial for you, considering you plan to build a similar app.

However, we recommend you let a professional developer define the functionalities from a fresh perspective. This way, you not only are able to develop an app like Afterpay, but can easily surpass it with innovation and better functionalities.

Step 6: Test & Deploy

Once the code is written, simply prepare your application for deployment. To make it ready for deployment, you need to test the functionalities for different test cases and accordingly find bugs and resolve them.

Let the quality assurance professionals work on your application so they can perform multiple tests that can easily define the ability of your application and give it a clean chit for deployment.

With all these steps, you have a solid app like Afterpay ready for the market. All you need now is a team to help you keep the application afloat with proper maintenance and regular updates.

Hire an app development company that not only develops the application for you but also offers a dedicated maintenance package.

How Much Does It Cost to Create an App Like Afterpay?

Looking at the process, you may be wondering how much it would cost to develop an app like Afterpay. The query is valid considering it is not cheap to enter the BNPL market without having a development solution.

The cost associated with developing a mobile application isn’t accurately predictable. The reason is that each project is unique, and so are its requirements. Therefore, the cost associated with them is also unique.

These are some of the factors that can affect the development cost. However, if we talk about the average cost to build a BNPL app, you can expect anything between $25,000 and $150,000, with additional features taking the final investment to more than $250,000.

For a development estimate for a applike Afterpay, it is recommended that you consult a mobile app development company, as they can give you a better quote based on your specifications.

How Can Nimble AppGenie Help to Create an App like AfterPay?

What’s more difficult than building an app like Afterpay? Find a development partner that can help you achieve the same. Ideally, the process is only effective if it is executed by professionals, and when it comes to building an Afterpay-like app, Nimble AppGenie is the best you can hire!

With 250+ projects under our name and recognition from top platforms like Clutch, we are the best BNPL app development company in the market.

Here are some of our top projects

- Pay By Check – Ewallet Mobile App

- Dafri Bank – Digital Bank of Africa

- SatPay – E-wallet Platform

- CUT–E-Wallet Mobile App

- SatBorsa – A Currency Exchange Fintech App

If you want to be the next best in the fintech industry and create platforms like Afterpay and Klarna a run for their money, hire mobile app developers with us.

We are just a click away.

Conclusion

The BNPL market presents a dynamic and exciting space for entrepreneurs to make their mark.

By delving into the intricacies of this sector, you can gain valuable insights into the essential features, functionalities, and mobile app development process required to craft a robust and user-centric app that rivals industry leaders like Afterpay.

Remember, the key to success lies in prioritizing user experience. Design an app that is intuitive, user-friendly, and fosters responsible financial practices. Don’t shy away from incorporating innovative features that set you apart from the competition.

By focusing on these crucial aspects, you can attract and retain a loyal user base, propelling your app, like Afterpay, to supersede even its inspiration and move towards long-term success in this ever-evolving market.

FAQs

Afterpay is a popular Buy Now, Pay Later (BNPL) platform that allows users to make purchases online and pay for them in installments over a short period, typically four installments every two weeks.

When you shop at a store that partners with Afterpay, you can choose Afterpay as your payment method at checkout. The total purchase amount is then split into four equal installments, which you pay off over six weeks. There are no interest charges if you make your payments on time.

- Spread out payments: Break down your purchases into smaller, more manageable payments.

- No interest: Pay no interest if you make your payments on time.

- Shop now, pay later: Enjoy your purchases immediately while spreading out the cost.

- Late fees: If you miss a payment, you will be charged a late fee.

- Insufficient Funds Fee: If there are insufficient funds in your account to make a payment, you will be charged a fee.

Afterpay uses industry-standard security measures to protect your personal and financial information. However, it’s important to be responsible with your spending and make sure you can afford the repayments before using any BNPL service.

- Klarna, PayPal Credit, Sezzle, and Affirm are some popular BNPL apps in the market.

The cost of developing an app like Afterpay can vary depending on several factors, such as the features, complexity, and chosen tech stack. However, a rough estimate can range from $25,000 to $250,000.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.