Fintech sector is booming, and the demand for innovative apps is higher than ever.

Whether you’re a startup looking to disrupt the market or an established financial institution aiming to enhance your digital offerings, developing a fintech app is a crucial step.

But where do you start?

That’s where development tools for fintech apps come into play.

In this blog, we’ll explore the essential development tools for fintech apps you need to create a robust, secure, and user-friendly app.

We’ll dive into the fintech app technology that powers these tools, the platforms they operate on, and the features they bring to the table.

So, whether you’re wondering how to build a fintech app from scratch or looking to upgrade your existing fintech app technology, this guide is for you.

Get started on your journey to creating an outstanding fintech app!

Key Components of Fintech App

Creating a successful fintech app requires a deep understanding of its core components.

These elements form the backbone of your application, ensuring it operates smoothly, securely, and efficiently.

Let’s break down these essential components:

1. Fintech App Backend

The backend is the heart of any fintech app.

It handles server-side operations, database management, and business logic.

A robust backend ensures your app can process transactions swiftly, manage user data securely, and scale as your user base grows.

2. Fintech App Frontend

The frontend is what your users interact with. This includes the fintech app UI/UX design, ensuring the app is intuitive and easy to use.

A well-designed frontend keeps users engaged and satisfied.

3. Fintech App Security

As we and many more have said many times and will keep doing “Security is paramount in fintech applications.”

Implementing robust security measures protects user data and maintains trust.

Key security features include encryption, multi-factor authentication, and secure API integration.

4. Fintech App Cloud Platforms

Leveraging cloud platforms enhances the scalability, reliability, and performance of your fintech app.

Cloud services like AWS, Google Cloud, and Microsoft Azure offer solutions for data storage, server management, and real-time analytics, enabling your app to handle increased traffic and data loads efficiently.

5. Fintech App Testing

Thorough testing is essential to ensure your app is free from bugs and vulnerabilities.

Automated testing tools, continuous integration, and deployment (CI/CD) pipelines help in maintaining the app’s quality and performance.

Regular testing cycles prevent potential issues and improve the user experience.

Understanding these core components is vital for developing a successful fintech app. Each element plays a crucial role in ensuring your app is secure, efficient, and user-friendly, ultimately leading to a product that meets the high standards of the fintech industry.

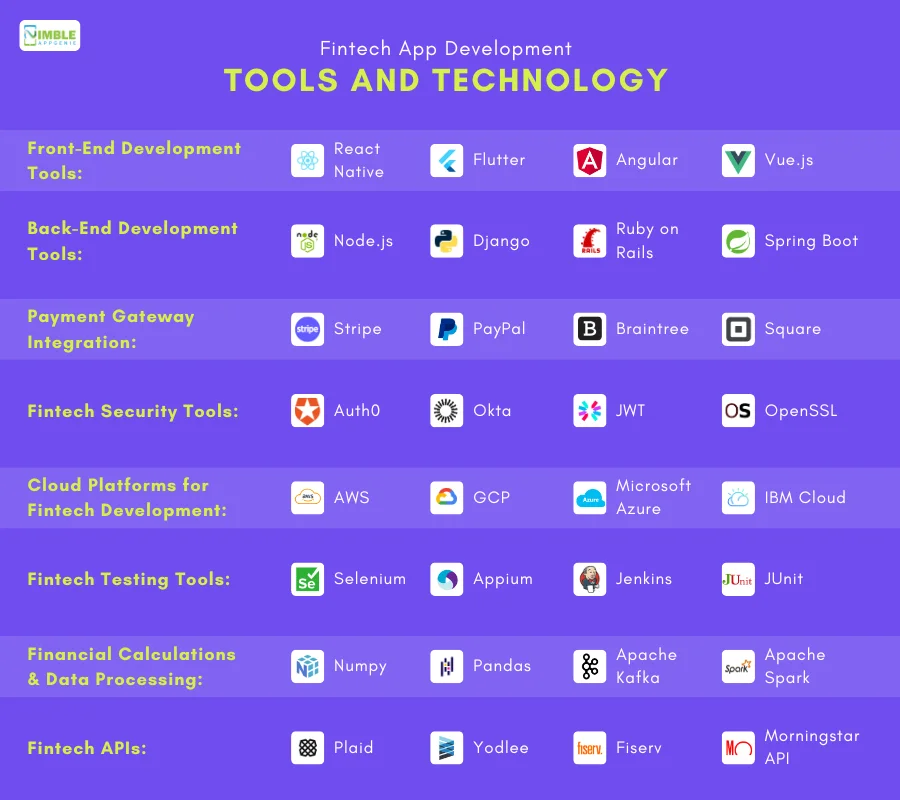

Development Tools for Fintech Apps and Technologies

A fintech app requires a comprehensive understanding of the various tools and technologies available to developers.

Each component of a fintech app plays a critical role in the app’s overall performance, security, and user experience.

Speaking of which, these development tools for fintech apps, as mentioned below:

► Front-End Development Tools

Creating a seamless and engaging user experience is crucial for fintech apps.

The frontend is the part of the application that users interact with directly, and it must be intuitive, responsive, and aesthetically pleasing.

Here are some essential tools for front-end development:

- React Native: A popular framework developed by Facebook for building cross-platform apps with a single codebase, ensuring a consistent user experience on both iOS and Android platforms. React Native is known for its performance and extensive library of components.

- Flutter: Google’s UI toolkit for crafting natively compiled applications for mobile, web, and desktop from a single codebase. Flutter’s rich set of pre-designed widgets and fast performance makes it an excellent choice for fintech app solutions.

- Angular: A platform and framework for building single-page client applications using HTML and TypeScript. Angular provides a solid structure and robust tools for building complex fintech applications with ease.

- Vue.js: A progressive JavaScript framework for building user interfaces. Vue.js is known for its simplicity, flexibility, and ability to integrate with other libraries or existing projects.

► Back-End Development Tools

Backend is the backbone of your fintech app, handling data storage, processing, and business logic.

It’s essential for ensuring that your app can scale, perform efficiently, and remain secure.

Here are some top tools for fintech backend development:

- Node.js: A JavaScript runtime built on Chrome’s V8 engine, perfect for building scalable network applications. Node.js is known for its non-blocking, event-driven architecture, making it ideal for data-intensive real-time applications.

- Django: A high-level Python web framework that encourages rapid development and clean, pragmatic design. Django includes numerous built-in features for security and scalability, which are essential for fintech applications.

- Ruby on Rails: A server-side web application framework written in Ruby. Rails follow the convention over configuration (CoC) principle, making it quick to develop and deploy applications.

- Spring Boot: A Java-based framework used to create stand-alone, production-grade Spring-based applications. Spring Boot simplifies the development of new applications and microservices with its opinionated defaults and extensive ecosystem.

► Payment Gateway Integration

Secure and efficient payment processing is vital for fintech apps.

Payment gateway integration allows your app to process transactions seamlessly, handle various payment methods, and ensure secure financial operations.

Here are some leading fintech payment gateway tools:

- Stripe: A comprehensive payment processing platform that supports various payment methods, including credit cards, ACH transfers, and digital wallets. Stripe also provides robust APIs and extensive documentation for easy integration.

- PayPal: A widely-used online payment system that supports online money transfers and serves as an electronic alternative to traditional paper methods. PayPal offers various integration options, including REST APIs and SDKs for different platforms.

- Braintree: A full-stack payment platform owned by PayPal that provides tools to accept payments, manage finances, and prevent fraud. Braintree supports multiple payment methods and currencies.

- Square: Provides a suite of tools to accept payments, manage finances, and engage customers. Square’s API allows for seamless integration with your fintech app, offering features like recurring billing and custom payment forms.

► Fintech Security Tools

Security is paramount in fintech applications to protect sensitive user data and ensure fintech regulatory compliance.

Implementing robust security measures helps prevent data breaches, fraud, and unauthorized access.

Key fintech security tools include:

- Auth0: A flexible, drop-in solution for adding authentication and authorization services to your applications. Auth0 supports various authentication methods, including single sign-on (SSO), multi-factor authentication (MFA), and social logins.

- Okta: Provides secure identity management with features like Single Sign-On (SSO), Multi-factor Authentication (MFA), and Lifecycle Management. Okta integrates easily with various applications and services.

- JWT (JSON Web Tokens): A compact, URL-safe means of representing claims to be transferred between two parties. JWT is used for securely transmitting information between parties as a JSON object.

- OpenSSL: A robust, fully-featured toolkit for Transport Layer Security (TLS) and Secure Socket Layer (SSL) protocols. OpenSSL is essential for encrypting data in transit and securing communications.

► Cloud Platforms for Fintech Development

Cloud platforms offer scalable and reliable infrastructure for fintech apps.

These platforms give services for storage, computing, data processing, and more, enabling your app to handle increased traffic and data loads efficiently.

Popular choices include:

- Amazon Web Services (AWS): Provides a wide range of cloud computing services, including storage, computing power, databases, and machine learning tools. AWS offers services like Amazon RDS for databases, Amazon S3 for storage, and AWS Lambda for serverless computing.

- Google Cloud Platform (GCP): Offers cloud computing services that run on the same infrastructure that Google uses for its end-user products. GCP provides tools like Google Kubernetes Engine (GKE), BigQuery for data analysis and BigQuery ETL for transforming and loading data, and Cloud Firestore for database management.

- Microsoft Azure: Provides a comprehensive set of cloud services, including analytics, storage, and networking. Azure offers services like Azure SQL Database, Azure Cosmos DB, and Azure Functions for serverless computing.

- IBM Cloud: Offers a range of cloud computing services and solutions, including AI, IoT, and blockchain. IBM Cloud provides tools like IBM Watson for AI-driven applications and IBM Cloudant for database management.

Also Read: AWS Vs Azure Vs Google Cloud

► Fintech Testing Tools

Ensuring your app is free from bugs and performs well is critical.

Comprehensive fintech app testing helps identify and resolve issues early, ensuring a smooth user experience and maintaining the app’s reliability.

Here are some essential testing tools:

- Selenium: A suite of tools for automating web browsers, used for functional testing. Selenium supports multiple programming languages and can be integrated with various CI/CD tools.

- Appium: An open-source tool for automating mobile app testing across different platforms, including iOS and Android. Appium supports various programming languages and testing frameworks.

- Jenkins: An open-source automation server that supports continuous integration and continuous delivery (CI/CD). Jenkins helps automate the testing and deployment process, ensuring high-quality releases.

- JUnit: A framework for writing and running tests in Java. JUnit is widely used for unit testing, providing annotations and assertions to help write and organize test cases.

► Financial Calculations and Data Processing

Accurate financial calculations and efficient data processing are vital for fintech apps.

These tools help manage complex financial computations, analyze large datasets, and ensure precise financial operations.

Here are some key development tools for fintech apps:

- NumPy: A fundamental package for scientific computing with Python, providing support for large multi-dimensional arrays and matrices, along with a vast library of mathematical functions.

- Pandas: A powerful data manipulation and analysis library for Python, offering data structures and operations for manipulating numerical tables and time series.

- Apache Kafka: A distributed streaming platform capable of handling trillions of events a day. Kafka is suitable for real-time data processing and is often used in event-driven architectures.

- Apache Spark: An open-source unified analytics engine for large-scale data processing. Spark provides high-level APIs for Java, Scala, Python, and R, and supports in-memory computing for faster data processing.

► Fintech APIs

Fintech APIs are specifically designed to address the unique needs.

These specialized tools provide functionalities like financial data aggregation, investment insights, and risk management.

Key options include:

- Plaid: Provides a secure way to connect your app to users’ bank accounts, supporting account verification, balance checks, and transaction history. Plaid’s API is widely used for financial data aggregation.

- Yodlee: Offers APIs for financial data aggregation, providing insights into users’ financial behaviors. Yodlee supports various use cases, including personal finance management and credit risk assessment.

- Fiserv: Provides technology solutions, including payment processing, risk management, and customer and channel management. Fiserv’s APIs support various financial services, including payments, banking, and lending.

- Morningstar API: Offers access to financial data, research, and analytics to support investment decisions. Morningstar’s API provides detailed information on stocks, mutual funds, ETFs, and other investment products.

These tools and technologies form the foundation of a robust fintech app, ensuring it is secure, efficient, and user-friendly. By leveraging these resources, you can create a cutting-edge fintech application that meets the high standards of the industry and exceeds user expectations.

Importance of Development Tools in Fintech Apps

Starting a fintech platform-based business is a complex process that requires meticulous planning, precise execution, and the right set of tools.

Fintech tools play a critical role in this development journey, ensuring that the platform is robust, secure, and capable of handling complex financial operations.

Here’s why fintech tools are essential in platform development:

♦ Enhancing Efficiency and Speed

Fintech tools streamline the development process by providing pre-built components, libraries, and frameworks that developers can use to build and deploy applications faster.

Tools like React Native and Flutter enable developers to create cross-platform apps with a single codebase, significantly reducing the development time of a fintech app and effort.

This efficiency allows teams to focus on refining the app’s functionality and user experience.

♦ Ensuring Robust Security

Fintech security is a paramount concern in the fintech industry.

Fintech tools offer robust security features that protect sensitive financial data and ensure compliance with regulatory standards.

Tools such as Auth0 and Okta provide advanced authentication and authorization capabilities, while OpenSSL ensures secure data transmission.

These tools help in mitigating risks associated with data breaches and fraud, fostering trust among users.

♦ Facilitating Seamless Integration

A successful fintech platform often requires integration with various third-party services, such as payment gateways, banking systems, and financial data providers.

Fintech tools like Stripe, PayPal, and Plaid provide

APIs that enable seamless integration with these services, ensuring smooth and secure financial transactions.

This integration capability is crucial for delivering a comprehensive and cohesive user experience.

♦ Enhancing Scalability

As a fintech platform grows, it needs to handle increasing amounts of data and user traffic.

Cloud platforms like AWS, Google Cloud, and Microsoft Azure offer scalable infrastructure that can grow with the platform.

These cloud services provide on-demand resources, ensuring that the platform can handle peak loads and scale seamlessly as user demand increases.

Also Read: How To Boost User Retention in Fintech Apps?

♦ Improving User Experience

User experience is a critical factor in the success of a fintech platform.

Front-end development tools like Angular, Vue.js, and React Native help create intuitive and engaging user interfaces.

These tools provide developers with the capabilities to design responsive and visually appealing apps that enhance user satisfaction and retention.

♦ Streamlining Testing and Quality Assurance

Maintaining high-quality standards is essential for fintech platforms.

Testing tools such as Selenium, Appium, and JUnit facilitate automated testing, ensuring that the platform is free from bugs and performs reliably under various conditions.

Continuous integration and continuous delivery (CI/CD) tools like Jenkins help automate the testing and deployment process, ensuring consistent quality and faster releases.

♦ Supporting Complex Financial Operations

Fintech platforms often involve complex financial calculations and data processing.

Tools like NumPy, Pandas, and Apache Spark provide powerful data processing capabilities, enabling accurate financial computations and real-time data analysis.

These tools help developers handle large datasets efficiently, ensuring that the platform can process financial transactions swiftly and accurately.

♦ Providing Specialized Fintech Capabilities

Certain fintech tools are designed to address the specific needs of the financial industry.

APIs from providers like Yodlee, Fiserv, and Morningstar offer specialized functionalities such as financial data aggregation, investment analysis, and risk management.

These tools enable developers to incorporate advanced financial features into their platforms, enhancing their value proposition.

Fintech tools are indispensable in the development of a fintech platform. They enhance efficiency, ensure robust security, facilitate seamless integration, improve user experience, streamline testing, support complex financial operations, and provide specialized capabilities. By leveraging these tools, developers can create high-quality, secure, and scalable fintech platforms that meet the demands of the modern financial landscape.

Nimble AppGenie, Your Partner in Fintech App Solutions

At Nimble AppGenie, we are a premier fintech app development company dedicated to bringing your innovative financial solutions to life.

Our team of experienced developers and industry experts leverages cutting-edge development tools to create secure, scalable, and user-friendly applications.

We specialize in building robust fintech platforms tailored to meet your unique business needs and ensuring compliance with industry standards and regulations.

Whether you’re looking to develop a new fintech app or enhance an existing one, Nimble AppGenie is your trusted partner in fintech development, committed to delivering excellence and driving your success.

Conclusion

A fintech app can be a complex yet rewarding journey that requires the right tools and expertise. By leveraging advanced fintech development tools, you can create secure, efficient, and user-friendly applications. We are here to support you every step of the way, providing top-notch development services to turn your vision into reality. Let’s innovate and build the future of finance together.

FAQs

A fintech app is a software application designed to provide financial services such as payments, banking, investing, and financial management through digital platforms.

Fintech tools enhance the efficiency, security, scalability, and user experience of the app development process, ensuring high-quality, secure, and compliant applications.

Common programming languages include JavaScript (Node.js), Python, Ruby, Java, and Swift for various parts of the development process of fintech app .

Fintech security tools provide features like encryption, multi-factor authentication, and secure data transmission to protect sensitive user information from breaches and fraud.

Popular payment gateway tools include Stripe, PayPal, Braintree, and Square, which facilitate secure and efficient payment processing.

Cloud computing provides scalable infrastructure, enabling fintech apps to handle increased traffic and data loads efficiently, ensuring reliable performance.

Fintech testing tools automate the testing process by identifying and resolving bugs early on, ensuring the app performs reliably under various conditions.

Key features include robust security, seamless user experience, efficient payment processing, real-time data processing, and compliance with industry regulations.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.