Looking for a banking app for kids? You have come to the right place.

Kids are growing faster than ever. Most of them already have a smartphone. So, one must wonder what’s the right time to teach them about finance.

Well, when it comes to financial literacy for kids, you are never too early. And with the banking app for kids, it’s easier than ever.

The Global FinLit Survey, reveals that the two third of the world’s population lack financial literacy. The survey found that only 28% of adults who own a bank account are considered financially literate.

If you don’t already know, there is a banking app for kids that are specially designed to introduce concepts to kids. In today’s time where money is so important, these apps are simply essential.

Now, there are a lot of people, “Parents” who are looking for banking apps, financial management, or money management for kids. If you are one of these, this blog is for you.

But first, let’s look at one of the best money apps for kids and a very popular platform, GoHenry.

“By giving kids access to banking apps, parents can empower them to take control of their money and develop smart spending habits.”- Jill Schlesinger

GoHenry: Debit Card & Financial Literacy App For Kids

If you are someone who knows anything about banking apps for kids, there are high chance you have heard of GoHenry.

GoHenry is a leading fintech solution for kids. It’s an entire package that comes with a prepaid debit card for kids, financial lessons to improve kids’ financial literacy, and of course, a fintech app.

Since it’s a banking app for “kids”, parents have access to the online account. They can help with kids’ money management skills. The account can either be accessed on GoHenry App or the online portal.

Well, well, here comes the exciting part for kids: there are more than 45 different designs for debit cards. And if that’s not enough, for just $4.99, you can create your custom design.

Because there’s no minimum age recruitment for kids to open an account in GoHenry, it’s a fantastic cash app for kids.

It’s easy to use and very amazing in all manners. And it’s very safe because kids can only spend what’s already in their account. So, there’s no fear of overdraft or anything like that.

How Does GoHenry Work?

So, how does this app for kid money tracking and overall financial management work? Well, let’s see the entire process below.

♦ Sign Up for GoHenry

Parents can sign up for GoHenry online or through the app. After signing up, they will receive a parent account and a debit card for each child they add to the account.

♦ Set Up Tasks and Allowances

Parents can set up tasks for their children to complete to earn extra money. They can also set up regular weekly or monthly allowances for their children.

♦ Manage Spending Limits

To prevent overspending, parents can set spending limits on their children’s debit cards. They can also block certain types of spending, such as online purchases or cash withdrawals.

♦ Monitor Spending

Parents can monitor their children’s spending through the GoHenry app. They can see where their children are spending their money and receive alerts for any unusual transactions.

♦ Teach Financial Responsibility

With GoHenry, parents can use real-life situations to teach their children about money management. They can encourage saving, discuss budgeting, and teach their children how to make responsible financial decisions.

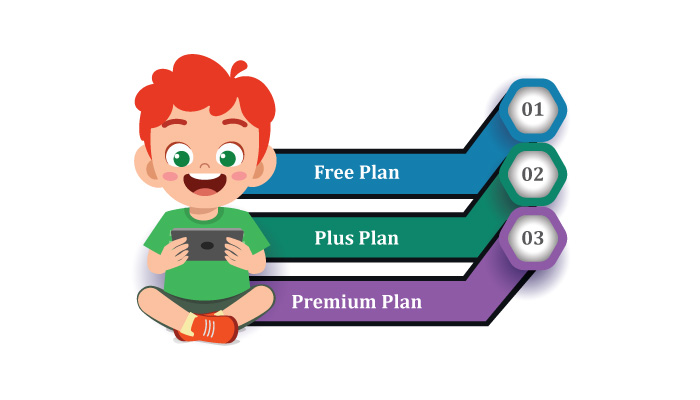

GoHenry: Pricing of Personal Finance for Kids

Let’s answer the big question, how does GoHenry’s Financial plan cost? Well, there are a few plans that you can choose from.

So, let’s discuss them briefly:

► Free Plan

Being a top banking app for kids, the platform offers a free plan that has no monthly fees. This plan includes one parent account and up to two child accounts. Moreover, the free plan also includes features such as chores management, savings goals, and spending limits.

► Plus Plan

The Plus plan costs $3.99 per month and includes one parent account and up to five child accounts. In addition to the features in the free plan, the Plus plan also includes an allowance feature, where parents can schedule and automate allowance payments to their children.

► Premium Plan

The Premium plan costs $5.99 per month and includes one parent account and up to ten child accounts. It has all the features of the Plus plan and more. This includes a debit card for each child’s account. Parents can also set up direct deposit for their child’s account.

This is all you need to know about GoHenry. And with this out of the way, let’s move to the next section.

Banking Apps for Kids, Are They Worth It?

Fintech, Finance apps, or banking apps whatever you call them, these solutions are growing quite popular these days.

Banking apps for kids can be a great tool to help children learn about money management and financial literacy. These apps can teach children about budgeting, saving, investing, and spending responsibly.

However, the effectiveness of a finance app for kids will depend on various factors such as the child’s age their level of interest in the subject, and the quality of the app itself.

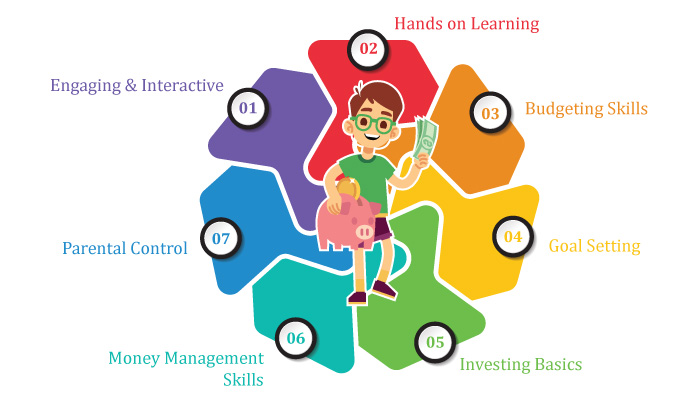

Benefits of using finance apps for kids include:

1. Engaging and Interactive

Money apps for kids can teach children about money management. Plus, financial literacy provides them with a strong foundation for their future decisions.

2. Hands-on Learning

For starting banking apps provide children with hands-on learning experiences that make financial concepts more tangible and easier to understand.

3. Budgeting Skills

Finance apps are best for developing budgeting skills in kids. It not only allows them to track their expenses but also teaches them “how to save money”.

4. Goal Setting

Another best benefit of banking apps is it helps children to develop healthy goal-setting skills. And finance apps motivate kids to set goals and develop a plan to achieve them.

5. Investing Basics

Investing app for kids introduces the basic of investing to children. Also the importance of diversification, compound interest, and the risk & rewards of different investment options.

6. Money Management Skills

Today, this is the most crucial skill that saves not only kids but everyone from financial crises. Money management app for kids teaches children about responsible spending, saving, and investing which is very important money management skills.

7. Parental Control

The best thing about the money apps for kids is that these apps have parental control features that allow parents to monitor their child’s progress and control their spending.

Plus, parents can set limits on investing and guide as needed.

Overall, banking apps for kids can provide children with a fun and engaging way to learn about money management. And develop important financial skills that will serve them well throughout their lives.

Other Fintech & Banking Apps For Kids In 2025

In 2023, there is a variety of fintech and banking apps for kids available that can help them learn about money management and financial literacy.

Some of the popular banking apps for kids and cash apps for kids in 2025 include:

1] Chase First Banking

Chase First Banking is a free banking app designed for parents to teach their children about money management. With the Chase mobile app, parents can manage all their accounts in one location and enjoy no monthly fee. The kids finance app comes with one of the best free debit cards for kids and teens that works anywhere Visa is accepted.

Benefits of Chase First Banking:

- Users can access over 16,000 Chase ATMs around the country for withdrawing money.

- Parents can monitor their child’s spending and saving.

- Users can get a $200 sign-up bonus for setting up direct deposit within 90 days of enrolment with Chase Total CheckingSM

2] Step Banking – Financial Literacy App For Kids

If you want to control how your child spends or looking for an app for kid money tracking?

There is nothing better than Step Banking. Step Visa is a free hybrid spending card that combines the feature of a debit and credit card. Additionally, it allows parents to build their child’s credit history. The account is FDIC- insured and parents can control how the child is spending.

The best thing about banking apps for kids is they are highly secure. Plus step bank card comes with fraud protection and a zero liability guarantee from Visa.

Benefits of Step banking:

- Kids 13+ or older can buy and sell Bitcoin through the Step app for a small transaction fee

- Easily earn Bitcoin or cash rewards by opting into offers from companies like Hulu, Chick-Fil-A and CVS, and the New York Times.

- Improves child credit scores which helps them obtain lower-cost student loans.

3] Greenlight – Best Banking App For Kids

For parents who want to give their children some spending freedom while still maintaining control, Greenlight is a great option. The best thing about Greenlight debit cards is parents can choose to receive alerts on Greenlight debit card spending.

If children need money they can ask for approval by sending a photo of the item they want to purchase. It depends on parents for the approval. It helps teach How to manage personal finance apps for kids.

In addition, the Greenlight debit card offers a one-month trial period and has three subscription plans including:

- Core: $4.99/mo.

- Max: $9.98/mo.

- Infinity: $14.98/mo.

Note: All plans include cards for up to 5 children

Benefits of Greenlight:

- Each monthly subscription includes up to five debit cards and replacement cards cost $3.50 each, but the first replacement is free.

- It offers an investment account for kids to invest in stocks and ETFs

- Monthly saving rewards based on the subscription plan.

4] Revolut <18

Revolut <18 is a free prepaid debit card designed to teach the importance of management of money apps for kids from an early age. The card can also be used to manage chores and allowances, set savings goals, and help kids manage their money.

Furthermore, parents can send parent-paid bonuses as a reward when their child completes specific tasks, and they can do so by adding money to their child’s digitized piggy bank through the app.

Revolut also offers instant money transfers between account holders and global transfers at transparent rates through their Payments feature.

Benefits of Revolut:

- The card allows parents to freeze it, set spending limits, and control how it’s used online and with contactless payments.

- It helps parents teach kids about earning, budgeting, saving, and even investing money.

- It allows parents to send parent-paid bonuses when their child completes specific tasks.

- Money can be added to a digitized piggy bank through the app, and instant transfers can be made through Revolut’s Payments feature.

- A personal Revolut account is required to open a Revolut <18 account for children.

- Up to five Junior accounts can be added per parent account.

5] Mazoola – eWallet for kids

If you want to teach financial literacy apps for kids, Mazoola is a free COPPA( Children’s Online Privacy Protection Act) –compliant mobile wallet for kids. It can monitor the transaction and set spending limits on specific retailers to manage chores. Not to mention, it’s the best example of an eWallet app on the list.

Last year, 1.25Mn children were victimized by ID theft, this is the only platform that is certified to handle your children’s information securely.

Benefits of Mazoola:

- Enter and track chores and automatically deposit allowances upon chore completion, teaching responsibility.

- Teens can send money to each other with all the convenience of Venmo but with Mazoola’s heightened security and privacy.

- Help your child learn to save by setting long-term and short-term goals and automatically setting aside money from each deposit to reach those goals.

- Teens and parents can easily send and receive money, and even donate to a class fund.

6] Acorns (Best for Long-Term Growth)

Lastly, it is among the best banking apps for kids. It is a financial app that provides investment and money management solutions for minors and young adults.

It offers two subscription models:

- Acorns Personal – $3/m

- Acorn Family- $5/m

Benefits of Acorns:

- Both subscription options include Acorns Checking, a bank account with no account fees, and a linked debit card that allows you to withdraw from over 55,000 ATMs nationwide.

- Real-Time Round-Ups automatically invest spare change when you round up purchases to the nearest dollar.

- Install the Acorns Earn Chrome Extension to earn bonus investments by shopping online at over 15,000 top brands.

- For a limited time, Acorns offers a $5 sign-up bonus for people who open an account and meet certain conditions.

Bottom Line

Today, several banking apps for kids are available in the market, but GoHenry stands out as one of the best options due to its range of features and overall value for money.

Ultimately, the right banking app for your child will depend on your specific needs and preferences. So it’s essential to do your research and choose the one that best fits your family’s financial goals.

If you want to build a banking app for kids or want to know more feel free to contact us.

FAQs

There are several banking apps for kids and teens like Greenlight, FamZoo, and Current that offer features similar to GoHenry. Each app has its own set of unique features, so it is best to compare them and choose the one that suits your family’s needs the most.

Many banking apps for kids and teens, including GoHenry, Greenlight, and Current, allow kids to transfer money to friends and family. Parents can also set up recurring payments or allowances to their child’s account.

There are always new banking apps coming out for kids and teens, but one of the latest is Step. It is a mobile app aimed at teenagers that offers no-fee banking services, a debit card, and a savings account.

Teen banking apps work similarly to regular banking apps. Parents can set up an account for their child and monitor their spending. The child can use the app to transfer money, make purchases, and save money.

Banking apps for kids and teens are designed to teach financial literacy and responsibility. Parents can set up accounts for their children, monitor their spending, and control their access to money.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.