There was a time when getting help from your insurance company meant waiting on hold, filling out long forms, and hoping someone would call you back. Things have changed. And AI is leading that change.

Today, insurance apps can approve claims in seconds, chatbots can answer questions anytime, and smart systems can suggest the best policy just for you. It is not magic! It is AI doing the hard work behind the scenes.

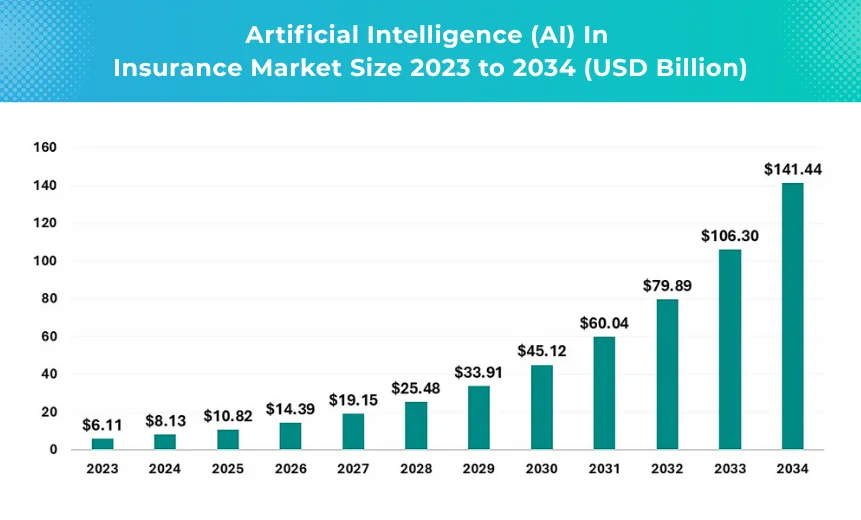

As per reports, the AI in the insurance market is projected to reach $141.44 billion by 2034. This is a clear sign that AI is not just a trend; it is becoming the backbone of modern insurance.

In this blog, we will discuss the impact of AI in the insurance industry for both companies and customers. From real-time chatbots to personalized policy plans, let’s look at the real ways AI is reshaping the industry.

So, let’s begin!

What is AI in Insurance?

AI in insurance is used to make things faster and better for both insurance companies and the customer.

For example, in the past, if someone had a car accident, they had to fill out the forms and talk to agents, and also wait for days to hear back.

Now, with the advent of AI, the insurance app can help look at photos of the damage and help approve the claim within minutes. AI helps in selecting the right insurance plans.

It looks at things like a user’s age, health, driving habits, and any records. Based on that, AI suggests a plan that fits users the best.

Besides, there are many insurance companies that provide AI chatbots that solve queries of users anytime. Basically, AI helps companies to do their work faster and better.

Market Overview of AI in the Insurance Industry

AI is important in modern insurance apps because it helps the app work faster, gives better service, catches fraud, and offers plans that fit each user. Let’s justify this with the following insurance statistics.

Source: Precedence Research

- The market size of AI in insurance is forecasted to hit $141.44 billion by 2034 with a CAGR of 06%.

- North America is projected to dominate the market during the forecast period.

- The insurance sector will grow $1223.5 by 2030 with a CAGR of 2%.

- A survey says 74% of people have a health insurance app, and 69% use it monthly.

- Another study shows 78% of young people want to do things like payments and claims through their phones, showing mobile use is growing fast.

5 Benefits of Using AI in Insurance Apps

Adding AI to insurance apps isn’t always simple. Many companies are still unsure because they worry about things like data safety and whether the AI will always give the right results.

However, as technology grows, it’s becoming clear that AI can really help. It can save time, reduce mistakes, and help insurance teams work smarter.

The more it’s used, the more useful it’s proving to be. So, let’s check out some benefits of using AI in insurance apps.

1. Faster Claim Approvals

We all know how stressful it is to file a claim after an accident or emergency. You had to fill out forms, collect documents, talk to different agents, and so on. Am I correct? Well, with AI in insurance apps, this process becomes much easier and very fast.

The app can read photos, check documents, and decide if the claim is real or not. This can all be done within minutes. It means you can get help or money faster. Also, it minimizes mistakes, since AI can check everything carefully.

2. 24/7 Customer Support

You will often need help outside normal working hours. You may have a question at night or on a weekend. With AI, insurance applications can provide customer support anytime through chatbots.

These chatbots can answer questions, help customers find the right plan, and explain policy details. Unlike human agents who need breaks, an OpenAI Agent can work 24/7 without stopping. This makes customers feel supported at all times and enhances the overall experience.

3. Personalized Insurance Plans

Everyone has multiple needs when it comes to insurance. One person drives carefully every day. Others may have health issues.

When building a health insurance app, AI assists in looking at each person’s habits, past data, and lifestyle to recommend the best insurance plan.

For instance, a safe driver can get a low-cost car insurance policy, or someone who works out daily might get a better health plan.

It helps customers save money and makes them feel like the company knows and values them. It is just no longer a one-size-fits-all; AI can help in making personal offers.

4. Less PaperWork and Manual Work

AI can manage many tiny tasks that used to take more time for humans. For instance, reading forms, checking documents, entering data, or sending updates. All this can be done by AI in seconds. It minimizes paperwork for the customers and also helps the company save time.

In combination with AI humanizer, the system can further enhance user interactions by adding a personal touch to automated processes. This synergy creates a more engaging and efficient experience, allowing employees to focus on higher-priority tasks.

Besides, employees do not have to waste hours on routine jobs and can focus on helping people with more crucial things. The app also becomes seamless and fast to use, which makes customers happier.

5. Detecting Fake Claims

Some people try to trick insurance companies by providing wrong details. They also make fake claims. It causes money loss for the company and delays for honest people who need assistance.

AI helps stop this by checking for anything that looks unusual. It compares old and new data and sends a warning if something fishy is found. This helps ensure that real claims get managed faster and more fairly for all.

Real-World Use Cases of AI in Insurance

AI is not just a big idea anymore. Insurance companies are using it in real life. From speeding up claims to helping customers through chatbots, these real-world examples show how AI is making insurance faster.

Let’s have a look at the use cases.

-

Lemonade – AI Settles Claims in Seconds

Lemonade is an insurance company in the USA. If something you own gets stolen or damaged, you can file a claim through this app.

Their smart AI system checks your details, reviews your policy, and if everything looks fine, it can approve and send the money in just a few seconds. Also, some people have even been paid in 3 seconds. No paperwork, no waiting.

-

Ping An – AI Checks Car Damage from Photos

Ping An is a China-based insurance company. If your car gets into an accident, you do not need to wait for someone to come and inspect it. You just take a few pictures, upload them to your app, and the system will figure out how bad the damage is. It tells you the repair cost and shows nearby garages.

-

Allianz – AI Reads Claim Documents

When someone files a claim, Allianz often sends many documents. For instance, hospital bills, reports, forms, etc. Instead of making a person read all of it, Allianz uses a smart app to do it. It picks out the essential details quickly so the company can move faster and make fewer errors.

-

Zurich Insurance – AI Detects Fraud

Zurich uses AI to find claims that do not look right. For instance, if someone keeps filing claims that seem suspicious, or the story does not add up, the system notices it. It then alerts a human to double-check. This helps stop cheating and saves the company a lot of money.

Future of AI in the Insurance Industry

The future of AI in insurance looks bright. Many tasks that take time now will become much faster. People will use mobile apps to buy insurance, ask questions, and get help without talking to an agent. AI chatbots will answer most questions right away.

AI will help make smart insurance plans. For instance, if someone drives safely, the app can provide a lower price. Claims will be easier, too. People can upload images, and AI will check the damage and process the claim fast.

Due to this, more companies are now investing in insurance apps with AI features. These apps help customers manage everything from their mobile phones.

In short, AI and mobile apps will work together to make insurance simple yet fast. But companies must keep customer data safe and use AI in fair ways.

How Does Nimble AppGenie Help with AI Integration in Your Insurance App?

If you are planning to add AI to your insurance app but do not know where to begin, Nimble AppGenie is your one-stop destination.

Our team can provide robust insurance app development services for businesses and has the expertise to add AI in a way that works.

Let’s say you have an insurance app. Nimble AppGenie can integrate features like chatbots that talk to users, check documents, or systems that provide users the right insurance plan as per their habits.

We do not just throw in random AI features. First of all, we understand your goals. We plan, develop, and test everything so it runs seamlessly.

Our expert team takes care of the hard stuff, while you focus on running your business.

We also ensure that everything is safe and easy for your users to use. If you want to develop an app that is future-ready, Nimble AppGenie is the team to consult with.

Conclusion

AI is no longer the future of insurance; it is the present. From helping customers file claims in seconds to providing 24/7 chatbot support, AI is transforming the insurance industry at every level. It is creating mobile apps smarter and more user-friendly.

As more people turn to mobile apps for their insurance requirements, companies that adopt AI early will stand out. This is the time to act.

No matter if you are creating a new app or improving an old one, AI is the right way to take your services to the next level.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.