Business Intelligence in banking, popularly known as BI, has gained enormous popularity in different fields.

From the corporate world to the world of finance, business intelligence helps find efficient insights about the entire process.

Making the most out of business intelligence has become the best decision for several businesses, and fintech is no different.

When we talk about businesses that can benefit from adding BI to their business, banking and financial services are at the top of the list.

With the digitization of banking services, the number of transactions that take place regularly has gone through the roof. With so many transactions regularly taking place, the generated data is also in high volumes.

Processing all of this data intelligently can help in generating insights that are best for the business. And that is where BI can come in handy. In this post, let’s take a look at ways business intelligence can be beneficial for banking.

Without further ado, let’s get started by understanding what exactly business intelligence is and what its applications are in banking.

What is Business Intelligence? Applications in Banking

Business intelligence refers to the idea of breaking down volumes of data into insights that can help in decision-making and improve the overall performance of the brand.

It is of great help in fields that generate abundant raw data, as business intelligence can structure the data and break it down to identify key information that can help identify pain points, trends, and problem-solving.

If you connect the dots with banking, you will realize that BI in banking makes a lot of sense.

This is because high volumes of transactions and a significantly high number of customers generate tons of data for the bank, which usually goes unused, as there is no transaction processing system to break it down for insights.

At the end of the day, banks offer multiple products that their customers use, and to push the correct product towards the correct customer, they need insights that BI can easily provide.

However, the role of BI in banking does not end at delivering insights, as it has other applications too. Find out more about them below!

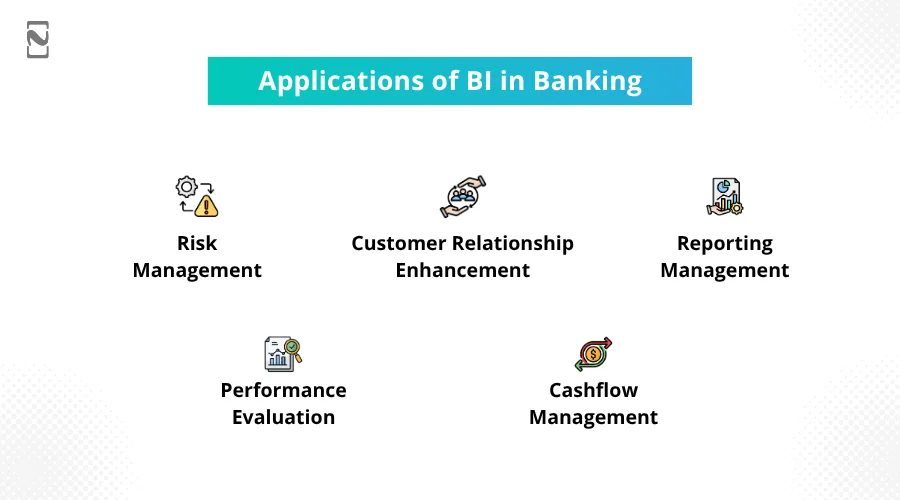

Applications of BI in Banking:

- Risk Management: Manage uninvited risks and fraudulent activities by identifying user patterns.

- Customer Relationship Enhancement: Understanding the requirements of users by analyzing their behavior on your platform.

- Reporting Management: Building a reporting system that highlights every datapoint to understand the system is something that every banking institution can benefit from.

- Performance Evaluation: Business intelligence can evaluate the performance of every individual and identify their performance and growth to give you a better picture.

- Cashflow Management: BI can identify the issues that may be causing a hindrance in the cashflow management of your organization and provide you with enough insights to fix them.

Benefits of Using Business Intelligence in Banking

The applications clearly state that business intelligence surely has multiple uses in the banking sector. With enhanced usability and functionality, business intelligence also brings along several core banking benefits that make it worthwhile.

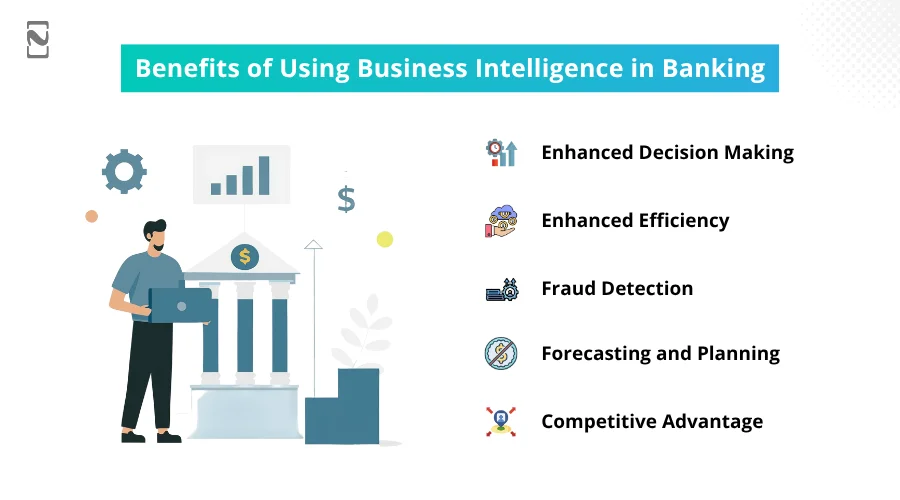

Some of the core benefits that you can unlock by using business intelligence in banking include –

Enhanced Decision Making

The decision-making process becomes much more streamlined and straightforward with the insights that business intelligence brings along.

All the incoming data can be easily processed for key identifiers, making it easier for the business to understand user patterns and make decisions accordingly.

Enhanced Efficiency

Business intelligence allows a business to be more efficient with its regular operations. This is because, unlike a regular business, it needs dedicated resources for data analysis and reporting of data.

Business intelligence automates the entire process and makes it more and more efficient in the long run.

Fraud Detection

Business intelligence also helps in detecting unnecessary risks and fraudulent activities by breaking down the data generated through the system.

This technology allows your banking system to be more vigilant in identifying issues, suspicious patterns, and anomalies in usage patterns that may indicate the chances of fraud.

Forecasting and Planning

Predictive modeling is one of the most important forecasting techniques that business intelligence uses to anticipate future financial trends and make informed decisions.

Banking as a service is all about the convenience that can be offered to a user. Planning becomes super effective when you have BI tools to identify the issues.

Competitive Advantage

When you have an efficient operational system that is secure and allows you to plan, you already have an ample advantage over your competitors.

Business Intelligence in banking can surely put you ahead of the competition with a significant margin. However, you have to be able to use this advantage, or else the insights may lead to further confusion.

It is undeniable that integrating business intelligence into an existing banking system is not cheap. However, the benefits that it brings certainly outweigh what you spend on the integration.

Steps to Implement Business Intelligence in Banking

With all these benefits unfolding, you might be getting excited about implementing BI in banking. If you plan to do so, you must understand that there are a series of steps that are required to be carried out.

This is a complete process that can help you integrate business intelligence into your banking business.

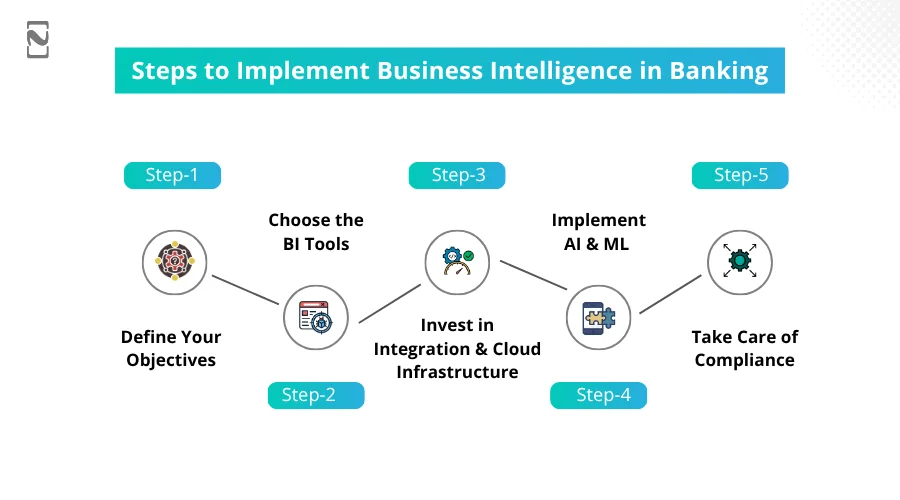

Here are the steps you can follow –

Step 1 – Define Your Objectives

Before you start the implementation, you must understand the objectives of opting for BI. The entire purpose of integrating business intelligence in your enterprise is to achieve different objectives for your business.

For banking, these objectives can be better data analysis, better decision making, more intuitive decision making, etc. Define the objectives before you start with the implementation.

Step 2 – Choose the BI Tools

Business intelligence is a technology that can be implemented through tools that can help you achieve the objectives you have defined in the previous step.

There are different platforms that you can opt for. To make the correct decision, you must consider the banking features, scalability, and ease of operation so that it can not only perform data analysis but also be implemented easily.

Step 3 – Invest in Integration & Cloud Infrastructure

Reach out to experts and invest in integrating data sources. Make sure your fintech legacy system is optimized to prioritize data quality for effective analysis.

You can hire professionals and get them onboard to do the same, or you can outsource the job to a company.

It all depends on the scale of implementation and what type of legacy system you have. Using cloud solutions can make this integration cost-effective and flexible.

Step 4 – Implement AI & ML

To achieve effective outcomes from business intelligence analysis, you can use artificial intelligence and machine learning.

AI & ML can help in predictive and descriptive analysis of all the data to identify risks and fraudulent activities.

Not to mention, AI can also be impactful in understanding customer behavior and taking initiatives that are tailored to meet customer expectations.

Step 5 – Take Care of Compliance

Lastly, since the system is being integrated into a banking system, you have several compliance issues to pay attention to.

All the regulations, such as GDPR, HIPAA, and country-specific financial regulations that your services must comply with, should be kept in mind while deciding to integrate BI into your banking system.

After you have implemented the technology in your banking application, it is time you start training your existing resources and employees to use the new technology so that you can make the most of it.

If you are not familiar with tech or need an extended team to guide you through the payment gateway integration process, you can outsource the job by hiring a team of professionals.

BI in Banking: Challenges of Implementation

As easy as the professional’s process makes BI implementation appear, it is not that easy.

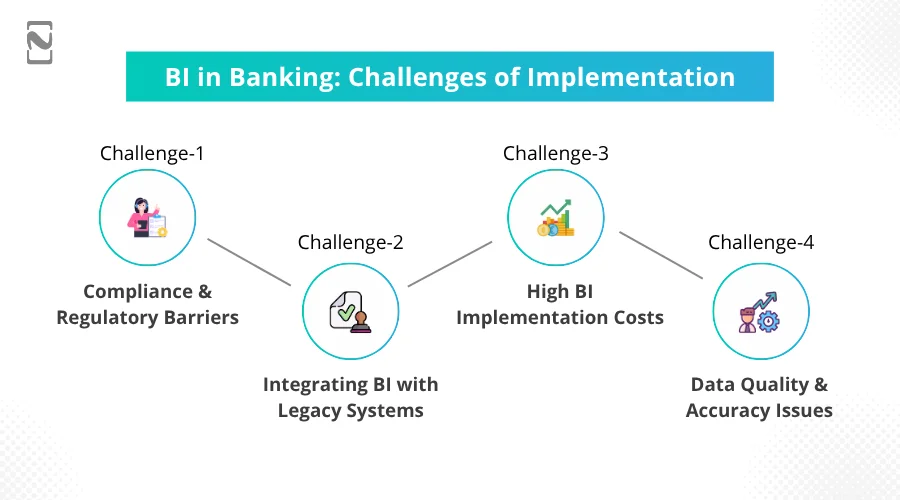

There are several challenges that even the best of professionals might encounter in integrating business intelligence into their banking solution.

- Challenge #1 – Implementing BI While Maintaining Compliance & Regulations

Solution: Find the right BI tools that make the implementation easy without compromising on regulatory compliance.

- Challenge #2 – Legacy System Integration With Business Intelligence

Solution: Tweaking existing systems with possible upgrades and then implementing BI to leverage existing data.

- Challenge #3 – High Resource & Implementation Cost of BI Tools

Solution: Build your integration strategy in such a way that the cost of tools and resources is balanced. Hiring a banking software development company and outsourcing the integration can surely make a difference.

- Challenge #4 – Data Quality & Accuracy Issues While Implementing BI

Solution: Make sure that the integration between financial legacy systems and the BI processors is done efficiently. Also, create identifiers to indicate the usefulness of the data.

Other than these, moving old data to a new intelligent system can also be a challenge; however, that can be done by implementing cloud computing resources.

These challenges often become a deal breaker for banks to migrate towards a smarter and intelligent solution.

However, with the right guidance and ample experience, these challenges can be overcome. The key here is to find the right guidance and experts.

Wondering who can help you get the best results and integrate business intelligence into your banking solution? Check out the next section for an answer.

Integrate BI into Your Banking System with Nimble AppGenie

All the factors that we have discussed so far make it clear that business intelligence has its use cases and brings a lot of productivity to the system.

To ensure proper implementation of business intelligence without compromising the performance of the existing system, you can reach out to Nimble AppGenie.

The experts are pioneers in integrating BI into different existing systems. Not only can they help you build a fresh banking solution with business intelligence.

They can even help you integrate BI into an existing banking system, allowing you to be smart without having to hamper your existing data.

Conclusion

The idea of combining advanced technology with banking and financial services is not new.

Business Intelligence can help in building a system that is not only advanced but highly smart to analyze patterns and identify the key factors that can boost business performance.

Identifying business opportunities, making better decisions, helping with fraud detection, forecasting, and planning are some of the most prominent use cases of BI in the banking system.

Needless to say, introducing BI in your banking business can surely make a difference and is highly advised.

Reach out to the experts today and take your banking business to the next level.

Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.