Buy Now Pay Later (BNPL) apps have become a popular financial tool, offering consumers the flexibility to make purchases and pay over time without immediate financial strain.

These apps allow users to split payments into manageable installments, often with no interest or hidden fees.

With the growing demand for flexible payment options, various BNPL apps have emerged, each providing unique features and benefits.

In this blog, we will explore the best buy now pay later apps, understand how they work, and help you choose the right one for your needs.

Understanding BNPL Apps

Buy Now Pay Later (BNPL) apps have transformed the landscape of consumer financing by offering a flexible alternative to traditional credit cards and loans.

These apps allow users to purchase goods and services immediately while spreading the payment over a series of installments, typically without interest or with low-interest rates.

The primary attraction of buy now pay later apps lies in their simplicity and convenience, making it easier for consumers to manage their finances.

BNPL apps offer various payment plans, such as the popular pay-in-four model, where users split the total cost into four equal payments.

Other options include monthly financing plans that can extend up to 60 months. Unlike traditional financing methods, many BNPL services perform only a soft credit check, which does not impact the user’s credit score.

In any case, now that we are done with this, it’s time to look at the best buy now pay later application in the market.

Best Buy Now Pay Later Apps

It’s time to look at the list of best buy now, pay later apps.

So, whether you are looking for inspiration for a BNPL app of your own or just another one to use in financial emergencies, this is for you.

So let’s get right into it:

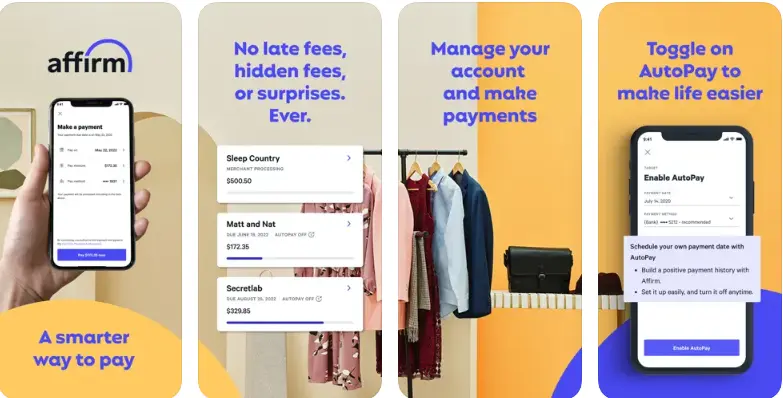

1. Affirm

Let’s start with one of the best BNPL apps.

Namely, Affirm.

As a leading name in the buy now pay later world, the platform offers a range of flexible payment plans, including pay-in-four and monthly installments up to 60 months.

Known for its transparent terms, Affirm charges no late fees and partners with numerous retailers such as Amazon, Walmart, and Expedia.

It performs a soft credit check for prequalification, ensuring no impact on the user’s credit score.

Affirm allows users to choose a payment schedule that works best for them, with interest rates ranging from 0% to 36%.

- No late fees

- Flexible payment schedules

- Soft credit check for prequalification

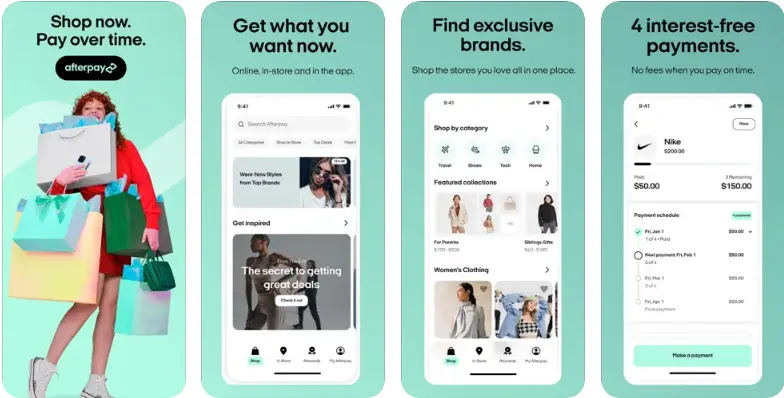

2. Afterpay

If you’ve heard of pay-later apps, there’s a high chance you’ve heard of this one.

Afterpay is easily among the top 10 BNPL apps.

As a leading app, it splits purchases into four equal installments, due every two weeks.

It’s a great option for students and those who prefer no-interest payments. Afterpay doesn’t charge fees as long as payments are made on time; however, late payments incur fees.

Available at retailers like Old Navy, Nordstrom, and Gap, Afterpay is accessible through both online and in-store purchases via a virtual card.

No wonder so many investors, businesses, and startups want to create an app like Afterpay.

- No interest on installments

- Virtual card for in-store purchases

- Reminder for due payments

3. Klarna

Klarna provides multiple payment options, including pay-in-four, pay-in-30, and monthly financing for up to 36 months.

Apps like Klarna are known for their rewards programs. The platform specifically allows users to earn points for every dollar spent, which can be redeemed for exclusive deals.

It partners with over 200,000 retailers such as Macy’s, Etsy, and Sephora.

Klarna conducts a soft credit check for most payment plans, ensuring minimal impact on credit scores.

- Rewards program

- Flexible payment options

- No interest on pay-in-four and pay-in-30

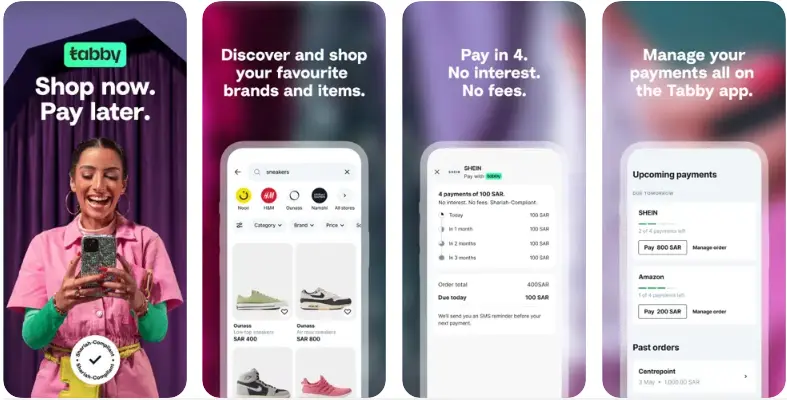

4. Tabby

Tabby is a leading buy now pay later service widely used in the Middle East.

It allows users to split their purchases into four interest-free payments. Tabby doesn’t charge any fees for on-time payments and partners with over 2,000 retailers in the UAE and Saudi Arabia.

It’s a convenient option for shoppers looking for flexible payment solutions in the region.

- Interest-free installments

- No late fees

- Over 2,000 retail partners

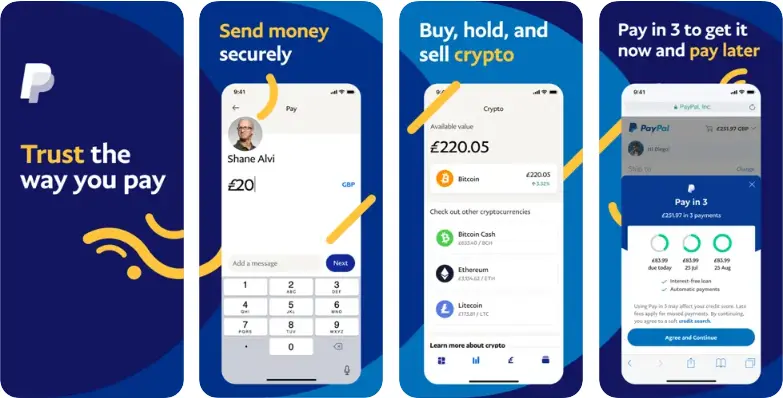

5. PayPal Pay in 4

Apps like PayPal and PayPal itself rule the market like an OG.

Did you know it has its own Buy Now Pay Later solution? It is known as PayPal’s Pay in 4.

As the name suggests, this one allows users to split purchases into four interest-free payments.

Integrated directly into PayPal’s checkout process, it provides a seamless payment experience. PayPal’s Pay in 4 doesn’t charge any fees or interest, making it an attractive option for many.

It supports purchases from $30 to $1,500 and performs a soft credit check for eligibility.

- No interest or fees

- Integrated with PayPal

- Protected by PayPal Purchase Protection

6. Openpay

Openpay provides flexible repayment options for purchases, allowing users to choose between fortnightly or monthly installments.

It supports a wide range of industries, including healthcare, automotive, and retail.

Openpay performs a soft credit check and offers payment plans ranging from 2 to 24 months, catering to various financial needs.

- Flexible repayment options

- Supports multiple industries

- Soft credit check

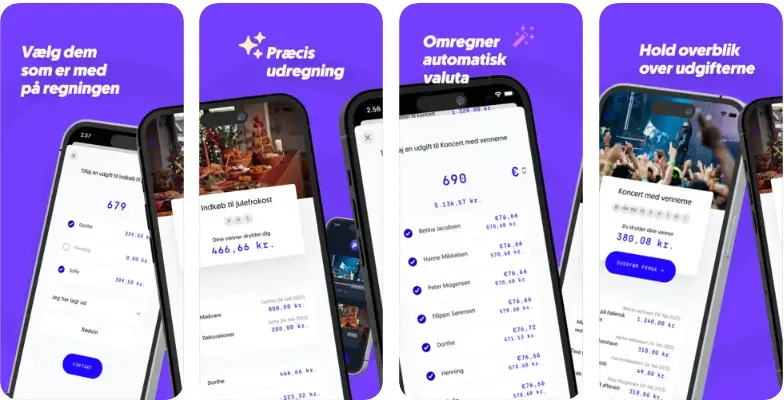

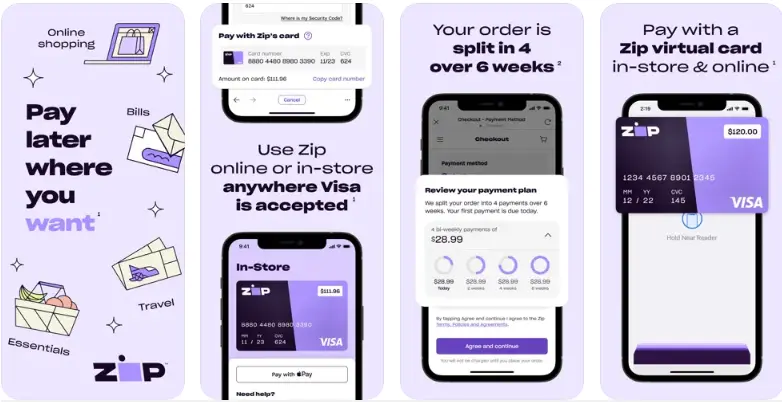

7. Zip (previously Quadpay)

Zip doesn’t ring a bell? Try Quadpay

As one of the best BNPL apps in the USA, it allows users to split purchases into four interest-free installments.

It’s an excellent option for those with bad credit, as it doesn’t perform hard credit checks or report to major credit bureaus.

Users can shop anywhere Visa is accepted and manage payments through the Zip app. Zip charges a $1 fee for each installment payment, making it transparent and predictable.

- No hard credit checks

- Accepted anywhere Visa is

- $1 fee per installment

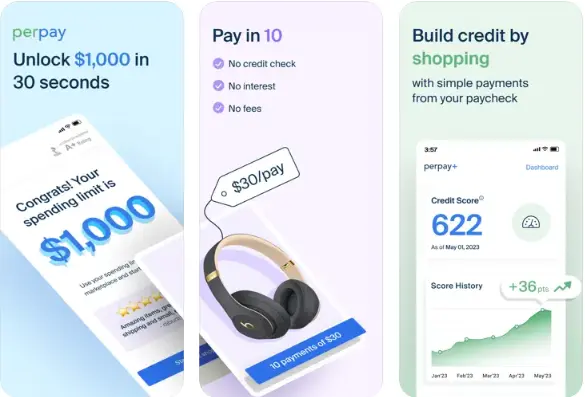

8. Perpay

Perpay helps users build credit while offering a simple pay-over-time solution.

It doesn’t require a credit check and reports on-time payments to credit bureaus. This is something that makes this pay later application stand out.

Users can shop from Perpay’s marketplace and split payments into manageable installments deducted from their paycheck.

This feature makes Perpay particularly beneficial for those looking to improve their credit scores.

- No credit check

- Builds credit

- Payroll deduction for payments

9. Paidy

Paidy, a Japanese BNPL service, lets users split their payments into three interest-free installments.

It doesn’t require a credit card or perform a credit check, making it accessible to a broad audience.

Paidy supports online and in-store purchases, providing a flexible and inclusive payment option for Japanese consumers.

- No credit card required

- Interest-free installments

- Supports online and in-store purchases

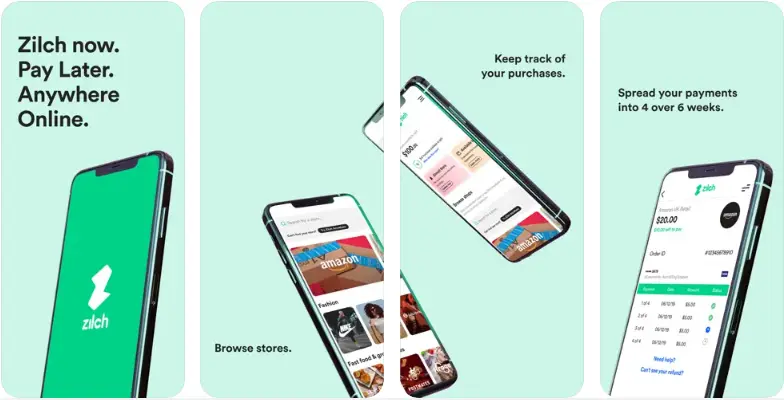

10. Zilch

Zilch offers a unique approach by providing users with the ability to split payments over six weeks, with zero interest if paid on time.

It features a virtual Zilch card that can be used at any online store that accepts Mastercard.

Zilch also provides cashback rewards, enhancing its appeal to savvy shoppers looking for additional savings.

If you are looking for a smooth BNPL integration in your tech ecosystem, this is the one.

- Zero interest

- Virtual Mastercard

- Cashback rewards

Availability: Android

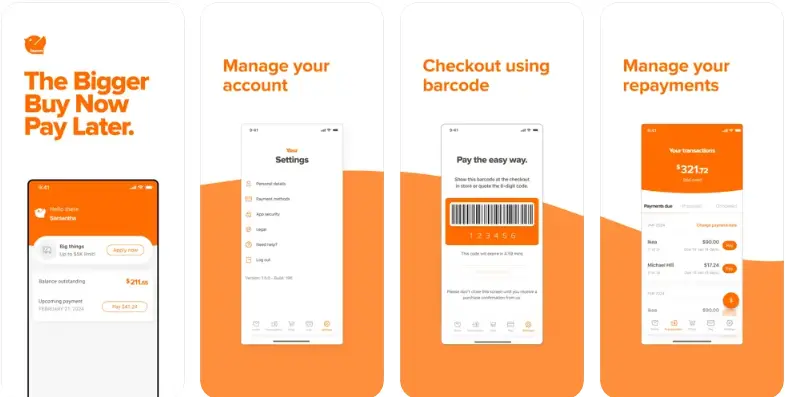

11. Humm

Humm offers two types of BNPL plans: “Little Things” for purchases up to $2,000 and “Big Things” for purchases up to $30,000.

Users can choose repayment terms ranging from 5 to 60 months with interest-free periods.

Humm performs a soft credit check and is popular in Australia and New Zealand, making it suitable for both small and large purchases.

This is the implementation of a unique fintech app idea brought to reality. This is clearly seen in its working, features, and benefits.

- Two BNPL plans

- Interest-free periods

- Soft credit check

Comparison of Top BNPL Apps

Selecting the right Buy Now Pay Later app depends on understanding its unique features, payment plans, fees, and credit check requirements.

Here’s a detailed comparison of the top BNPL apps:

| App | Payment Plans | Interest Rates | Late Fees | Credit Check |

| Affirm | Pay in 4, monthly for up to 60 months | 0% – 36% | None | Soft/Hard |

| Afterpay | Pay-in-4 | 0% | Up to 25% off the order | Soft |

| Klarna | Pay-in-4, Pay-in-30, or monthly for up to 36 months | 0% – 29.99% | Up to $7 | Soft/Hard |

| Sezzle | Pay-in-4 | 0% | Various fees for rescheduling | Soft |

| PayPal Pay in 4 | Pay-in-4 | 0% | None | Soft |

| Zip (Quadpay) | Pay-in-4 | 0% | $1 per installment | Soft |

| Perpay | Payroll Deductions | 0% | None | None |

Affirm stands out for its extensive range of financing options and transparency with no late fees, making it ideal for larger purchases.

Afterpay and Klarna offer simple, interest-free installment plans, with Klarna providing additional flexibility with its pay-in-30 and monthly financing options.

Sezzle and PayPal Pay in 4 are great for short-term, interest-free plans, though Sezzle allows payment rescheduling for added flexibility.

Zip (Quadpay) is notable for its wide acceptance and low fees. Splitit offers a unique solution using existing credit cards without any credit checks or fees.

Perpay and Sunbit are tailored for users looking to build credit or finance essential services, respectively.

Apart from the consumer POV, a lot of investors, businesses, and startups are working with a BNPL app development company to create their own unique solutions.

This clearly shows the rising demand for such a solution.

Conclusion

BNPL apps offer a convenient way to manage purchases by splitting costs into affordable installments.

With a variety of options available, it’s essential to choose an app that aligns with your spending habits, payment preferences, and financial goals.

From interest-free plans to flexible payment schedules, these apps provide valuable alternatives to traditional credit methods.

By understanding the features and benefits of each BNPL app, you can make informed decisions that enhance your shopping experience and financial well-being.

FAQs

Many BNPL apps offer interest-free payments if made on time. However, some may charge late fees or interest for longer-term financing options.

Most BNPL apps perform soft credit checks that do not affect your credit score. However, some may conduct hard credit checks for long-term financing options.

Some BNPL apps report payment histories to credit bureaus, which can help build credit if payments are made on time.

Popular BNPL apps include Affirm, Afterpay, Klarna, Sezzle, Tabby, and PayPal Pay in 4, each offering unique features and benefits.

Consider factors such as payment plans, fees, interest rates, credit check requirements, and retailer partnerships to choose the right BNPL app for your needs.

Yes, BNPL apps are generally safe to use. They offer secure transactions and transparent payment terms. Always read the terms and conditions to understand any potential fees or penalties.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.