A growing range of fintech products has made access to money easy for the common man. Gone are the days when one had to struggle to borrow funds, as today it’s all possible from the convenience of your smartphone.

You may have heard of traditional payment/borrowing methods, such as credit cards, loans, or payments made through easy monthly installments. One of the emerging trends that relates to the same is Buy Now, Pay Later.

Popularly referred to as BNPL, this mode of payment is a game-changer for users as it allows them instant access to funds for their shopping purposes and helps them break down the payments into convenient installments, without interest.

However, with multiple methods available to a user, it often comes with confusion for the user as to which one they should choose. BNPL vs Credit Cards or any other traditional method, which is better?

If you, too, are confused about the same, then this post is certainly for you. In this one, let us draw a comparison between BNPL and Credit cards, along with traditional lending methods like loans.

An Overview of Buy Now Pay Later Apps

Before we begin with the comparisons, let us quickly understand what exactly a BNPL app is. BNPL apps refer to fintech products that let users borrow small loans for online purchases.

As the name implies, Buy Now Pay Later applications allow a user to pay by borrowing through the app without having to spend anything from their pockets. These solutions offer an alternative to traditional credit, allowing users to make purchases immediately and pay in installments, often interest-free.

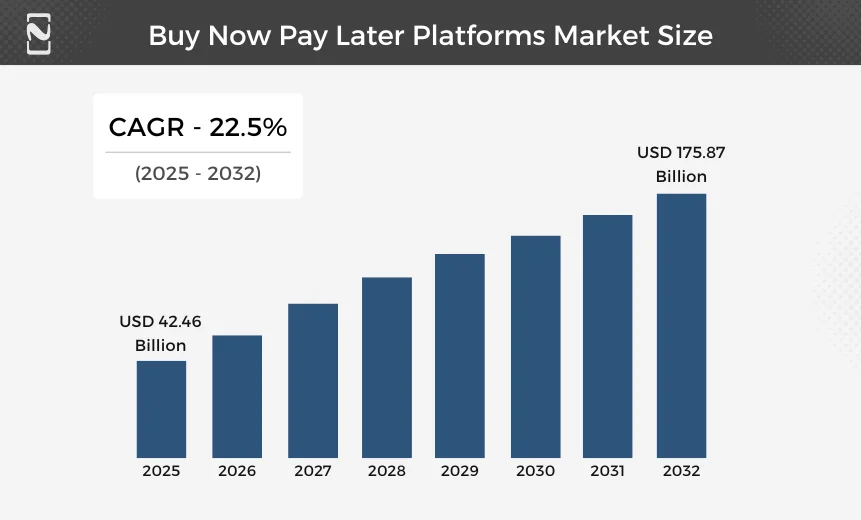

The global BNPL market is on a sharp rise, projected to touch USD 175.87 billion by 2032, as seen in the latest BNPL statistics. This surge is driven by the appeal of BNPL’s straightforward, flexible payment options, particularly among younger consumers.

With easy sign-up processes and minimal credit checks, Buy Now Pay Later apps like Klarna, Afterpay, and Affirm are becoming increasingly popular for online and in-store shopping, making them a significant part of the fintech revolution.

BNPL vs Credit Cards: A Complete Breakdown

With that out of the way, let’s start with the comparison between your traditional credit cards and the modern BNPL apps.

Generally, both methods offer a similar kind of payment solution; however, they have a significantly different approach, costs, and impact on consumer finances. There are several factors that make both worthy of a user trying them out.

Let’s break them down and understand the pros and cons of both:

► Credit Cards as a Payment Method

Credit cards have been around for a long time now. People are well-versed in using these cards to access instant funds allocated to them by their banks. Credit cards let you make purchases without having to pay from your savings and then pay off the balance at a decided date every month.

♦ Pros of Using a Credit Card :

- Accepted at almost every type of POS

- Additional rewards and points for making purchases.

- No interest on the balance if the bill is paid in full every month.

♦ Cons of Using a Credit Card :

- Directly affects your credit score if payments are not made on time.

- If payments are not made in full, heavy interest may accrue.

- Several hidden charges/membership charges may be levied.

► BNPL as Payment Method

BNPL is a much more sophisticated version of modern-day credit solution as it offers a set limit and allows you to make purchases online through direct payment via the app, and makes it easy to pay back by breaking the sum down into easy monthly payments. There is a set date when you have to make the payment for the limit that you have used.

♦ Pros of using BNPL :

- No credit check required.

- No interest policy, even on monthly payments.

- Periodic payment dates for better operational efficiency.

♦ Cons of using BNPL :

- Not available for all types of purchases, only accepted by a handful of platforms.

- BNPL late payments may result in high delay charges.

- Lack of security as no security codes are required to access.

With that classification of BNPL & Credit Cards, you might have got an idea of how things work for both the payment/borrowing methods. Now, let’s put BNPL vs Credit card and draw a comparison based on several factors.

This comparison aims to shed light on their fundamental differences, helping consumers make informed decisions that align with their financial goals and preferences.

| Features | BNPL Services | Credit Cards |

| Interest Rates | Typically offers 0% interest if payments are made on time. Late fees may apply for missed payments. | Interest is charged on balances carried beyond the payment due date, with APRs varying significantly. |

| Repayment Terms | Short-term, often spanning a few weeks to a few months. | Flexible, with the option to carry balances indefinitely, provided minimum payments are made. |

| Fees | Mainly late payment fees; some providers may charge administrative fees. | It can include annual fees, late payment fees, balance transfer fees, and foreign transaction fees, among others. |

| Approval Process | It generally requires minimal credit checks, making it accessible to a wider audience. | Involve credit checks with approval based on your credit history and score. |

| Impact on Credit Score | Less likely to impact credit scores if payments are timely; missed payments may be reported. | Regular use and timely payments can build credit history; missed payments and high utilization can negatively impact credit scores. |

| Rewards and Benefits | Typically, BNPL services do not offer rewards or additional benefits. | Many credit cards offer rewards, cashback, airline miles, and other benefits. |

| Consumer Protection | Varies by provider, but generally less comprehensive than credit cards. | Offers extensive consumer protections, including dispute resolution, fraud protection, and extended warranties. |

| Flexibility in Use | Available mainly at participating retailers. | Widely accepted almost everywhere, providing greater flexibility in use. |

| Financial Management | Encourages discipline with fixed repayments over the short term. | Offers flexibility but requires discipline to avoid high interest and debt accumulation. |

After breaking down the comparison between the two, you can get a clear picture of what kind of method is suitable for you.

Still, to summarize all of it, we can say:

• Use a Credit Card

If you are looking for long-term financing with perks related to international travel, and a payment method that is accepted worldwide.

• Use BNPL

If you are looking for payment assistance with smaller purchases and need help with budgeting while avoiding unnecessary card fees, interest, or hidden charges.

While this is the verdict of putting BNPL vs Credit Card, the comparison does not end here, as there are other traditional methods too that often confuse an individual. Let’s quickly compare them too in the next section!

BNPL vs Traditional (Loans & EMIs): Comparison

The comparison between Buy Now and Pay Later (BNPL) services vs traditional loans highlights a fundamental shift in consumer finance.

Traditional loans have long been the go-to for significant financial needs, offering structured repayment plans over months or years. BNPL, a relatively new entrant, offers a more flexible and accessible alternative for financing smaller purchases.

Here is a quick comparison between the two:

| Features | BNPL Services | Traditional Loans |

| Interest Rates | Often 0% if repaid on time; otherwise, late fees apply. | Typically, fixed or variable interest rates are often higher than 0%. |

| Repayment Terms | Short-term (weeks to a few months). | Longer-term (months to years). |

| Approval Process | Minimal credit checks and instant approval. | Comprehensive credit checks and a longer approval process. |

| Access to Funds | Immediate at the point of sale. | May involve a delay as funds are disbursed. |

| Flexibility | Fixed repayment schedules with less flexibility. | More flexible repayment options, including the possibility of refinancing. |

| Credit Building | They are less likely to impact your credit score; some services do not report to credit bureaus. | A positive impact on your credit score if repayments are made on time; missed payments can harm your credit. |

| Usage | Typically for smaller, consumer purchases. | Suited for larger financial needs, such as auto loans, home improvement, or debt consolidation. |

| Security/Collateral | Not required. | May be required to secure loans. |

| Fees | Late fees may apply; no prepayment penalties. | Origination fees, prepayment penalties, and other charges may apply. |

BNPL vs EMIs: Comparison

When considering financing options for purchases, consumers often weigh the benefits of Buy Now, Pay Later (BNPL) services against Equated Monthly Installments (EMIs) typically offered by banks or financial institutions.

BNPL vs EMI, both options allow for spreading the cost of purchases over time, but they cater to different needs and come with distinct terms and conditions.

Here is a quick comparison between BNPL vs EMIs:

| Features | BNPL Services | EMIs (Equated Monthly Installments) |

| Interest Rates | Often 0% if repaid on time; late fees for missed payments. | Interest rates vary; they generally include interest charges. |

| Repayment Terms | Short-term, ranging from a few weeks to a few months. | Longer-term, it can extend to years depending on the loan. |

| Approval Process | Simple, often with instant approval at the point of sale. | May require a more detailed credit check and application process. |

| Flexibility | Fixed repayment dates with limited flexibility. | Fixed monthly payments, but with the potential for prepayment or adjustment in some cases. |

| Usage | Ideal for smaller, consumer-oriented purchases. | Used for a wide range of purchases, from electronics to home appliances, often for higher amounts. |

| Access to Credit | Accessible to a wider audience, including those with thin or no credit history. | Typically requires a good credit history to qualify. |

| Impact on Credit Score | They are less likely to impact your credit score; some services do not report to credit bureaus. | It can positively or negatively affect your credit score, depending on your repayment history. |

| Collateral | Not required. | It may not require collateral, but it depends on the nature of the loan. |

| Fees | Late fees may apply; generally, no prepayment penalties. | May include processing fees, prepayment penalties, and other charges. |

Looking at all these comparisons, you might have gotten a sense that BNPL is much simpler and better, as it offers great flexibility. If you are still confused about how BNPL is the better option for you, then check out the next section!

What Makes BNPL the Better Option?

Buy Now, Pay Later (BNPL) schemes are increasingly favored for their consumer-friendly approach to financing. Thus, challenging traditional financial products like credit cards, loans, and EMIs.

Here’s why BNPL stands out as a preferred option for many consumers:

1. Ease of Use and Convenience

BNPL platforms are renowned for their user-friendly interfaces and seamless integration into the checkout processes of online and physical stores. This ease of use, coupled with instant approval processes, makes BNPL an exceptionally convenient option for on-the-spot financing decisions.

2. No or Low Interest

One of the most compelling advantages of BNPL services is the offer of zero or minimal interest rates for consumers who adhere to their repayment schedules. This starkly contrasts with the often high interest rates associated with credit cards and certain loans.

3. Budget Management

BNPL’s structured repayment plans assist consumers in managing their monthly budgets more effectively. By breaking down a purchase into smaller, manageable installments, consumers can plan their finances better without the anxiety of a significant one-time expenditure.

4. Accessible to More Consumers

BNPL services typically require less stringent credit checks than traditional credit cards or loans. This makes them accessible to a broader spectrum of consumers, including those with limited or no credit history.

5. Minimal Impact on Credit Score

For those cautious about their credit score, BNPL can be a safer option. While missed payments may still be reported, the use of BNPL services generally has a lesser impact on credit scores compared to traditional credit products.

6. Encourages Responsible Borrowing

With fixed repayment terms and clear schedules, BNPL encourages a more disciplined approach to borrowing, potentially reducing the risk of accruing unmanageable debt levels that can occur with revolving credit products like credit cards.

7. Transparency

BNPL agreements are typically straightforward, with clear terms, repayment schedules, and any applicable fees laid out upfront. This transparency helps consumers understand exactly what they’re committing to, avoiding hidden fees and complex terms. This can sometimes accompany traditional credit agreements.

8. Tailored for Modern Shopping Habits

BNPL services are designed with modern consumers in mind, particularly those who prefer shopping online. The integration of BNPL options into e-commerce platforms caters directly to the shopping habits of younger generations.

9. No Collateral Required

Unlike some traditional loans that may require collateral, BNPL services offer unsecured financing, removing a significant barrier to access for many consumers. Moving forward, let’s explore the reasons to develop a BNPL solution for lending and fintech businesses. Ready to proceed with this section?

Why Should You Develop a BNPL Solution?

Knowing the potential that the BNPL market has and how consistently the market has shown growth, it is clear that it is definitely a strategic move.

The rise of BNPL services is reshaping consumer credit, driven by changing consumer preferences and the demand for more flexible payment options. For fintech and lending businesses, the Buy Now, Pay Later (BNPL) solution represents a strategic move to tap into a rapidly growing market segment.

Here are the key reasons why businesses should consider developing a BNPL solution:

➤ Expanding Market Reach

BNPL solutions appeal to a broad demographic. This includes younger consumers who may be wary of traditional credit systems but are comfortable with digital-first financial products. Offering BNPL can help businesses reach a wider audience, including those with thin or no credit histories.

➤ Enhancing the Customer Experience

Integrating BNPL options can significantly enhance the customer experience by providing more flexibility in payment methods. This flexibility can improve customer satisfaction and loyalty, leading to increased repeat business.

➤ Building Customer Trust

Transparent BNPL offerings that come with clear terms and no hidden fees can help build trust between businesses and their customers. This trust is crucial for long-term customer relationships and brand loyalty.

➤ Increasing Conversion Rates

BNPL options at the point of sale can reduce cart abandonment rates and increase conversion rates. Consumers are more likely to complete a purchase when offered the option to pay in installments, especially for higher-priced items.

➤ Driving Average Order Value

BNPL services can encourage consumers to make larger purchases than they would typically make if they had to pay the full amount up front. This can lead to an increase in the average order value, boosting overall sales.

➤ Staying Competitive

As BNPL becomes a more common expectation among consumers, offering this payment option can help businesses stay competitive. Not offering BNPL could lead to potential customers choosing competitors who provide these flexible payment terms.

➤ Adapting to Regulatory Changes

Fintech regulations and laws are infamous for being very strict. But what if we told you that BNPL can help you with it? Well, it can. Here’s how:

Developing a BNPL solution that complies with local laws and regulations can provide a competitive edge and ensure long-term sustainability.

➤ Leveraging Data Insights

Operating a BNPL service can provide valuable insights into consumer behavior, preferences, and spending patterns. This data can be instrumental in tailoring marketing strategies, optimizing product offerings, and enhancing customer engagement.

➤ Generating New Revenue Streams

BNPL solutions open up new revenue streams for businesses. While offering interest-free options to consumers, businesses can still generate revenue through merchant fees and late payment fees, where applicable.

Hence, reaching out to a BNPL App Development company and starting your journey in the growing fintech path is certainly the right option. Nimble AppGenie can be of great help if you are looking for support with fintech app development for BNPL solutions.

Conclusion

The Buy Now, Pay Later phenomenon represents more than just a fleeting trend in the financial sector; it’s a testament to the shifting paradigms of consumer credit and purchasing behavior.

As we’ve explored, BNPL stands out for its user-centric approach, offering an enticing blend of zero-interest options, straightforward terms, and minimal impact on credit scores. For businesses, the allure of BNPL lies in its potential to boost sales, enhance customer experience, and tap into new market segments.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.