Financial crime is a huge problem, and it is getting harder to catch. That’s why more banks, fintech companies, and other businesses are using AML software to stay secure.

AML compliance software helps find suspicious money laundering activity, check customers’ details, and follow government rules.

Therefore, in this blog, we will discuss what AML software is, how it works, its types, and why it matters for anyone dealing with digital payments.

So, let’s begin!

What is AML Software?

AML software or just simply an anti-money laundering tool that is mainly used by financial institutions like banks, fintech companies, insurance companies, etc.

It helps companies detect and stop suspicious or illegal money-related activities.

For example, money laundering, fraud, or extortion for criminal purposes. It simply watches the money going in and out of accounts. Fraud detection and AML go hand-in-hand.

If something looks suspicious or strange, it alerts the banks or companies so they can check it. It also helps businesses follow the law and keeps the financial system clean.

Market Overview of Anti-Money Laundering Software (AML)

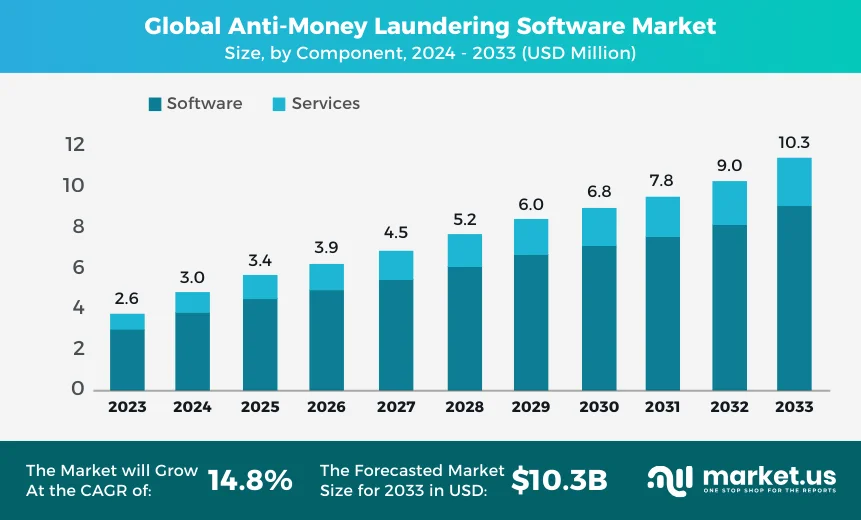

According to Market.us, the global Anti-Money Laundering Software Market has achieved substantial growth, reaching a size of USD 2.6 billion in 2023. Now, it is forecasted to hit USD 10.3 billion by 2033 at a Compound Annual Growth Rate (CAGR) of 14.8% during the period from 2024 to 2033.

This shows how important AML software is becoming for banking and fintech security around the world.

North America currently leads the AML software market, thanks to strict financial regulations and a large number of banks and financial institutions in the region.

In terms of revenue, the AML compliance software segment made up the largest share in 2024, contributing 57% of the market.

When looking at software usage, transaction monitoring was the top application that accounted for 51% of the market in 2024.

This is largely because digital banking, like mobile or online banking, has become more common. It makes financial systems more vulnerable to criminal activities.

To keep up with the growing number of digital transactions, financial institutions are shifting towards more efficient technologies.

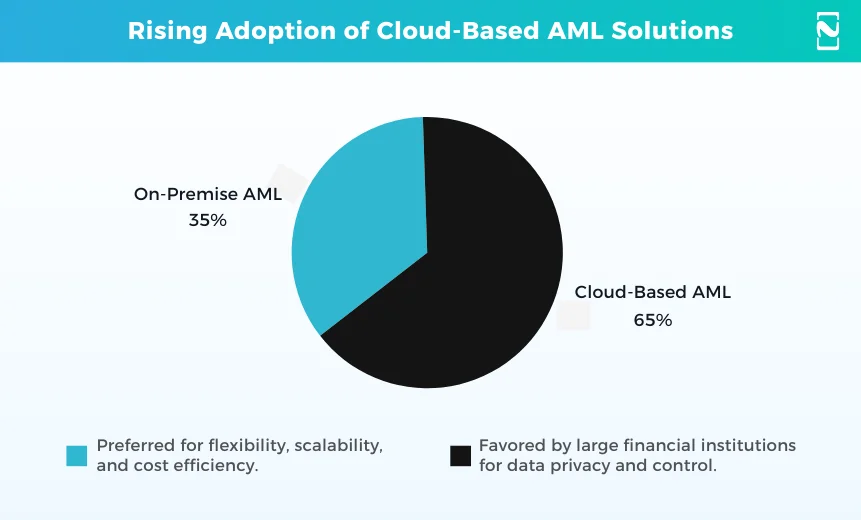

In 2025, about 65% of AML software solutions are cloud-based. This move allows banks to scale their systems more easily.

How Does AML Software Work?

AML software helps detect suspicious financial activity by tracking transactions, checking customer details, and spotting unusual patterns.

It automates the process, making it faster and more accurate.

Let’s have a look at the AML software workflow.

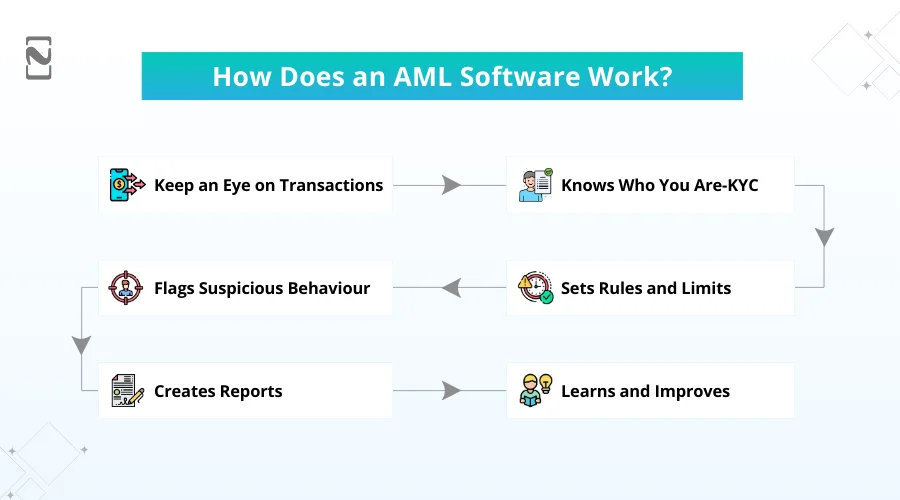

Step 1: Keep an Eye on Transactions

AML compliance software watches over all financial transactions happening in a bank or financial company.

It checks things like how much money is moving, where it is going, and whether the activity looks normal for that customer.

If anything seems unusual, like large amounts suddenly being moved to risky countries. It raises a red flag.

Step 2: Know Who You Are-KYC

Before you can open an account or do business, the AML software helps verify your identity.

This is called KYC. It checks your identity name, address, ID, and compares them to official records or watchlists. This helps stop criminals from using fake identities.

Step 3: Set Rules and Limits

AML software comes with built-in rules. For example, if a person deposits more than $10,000 in one day, it might be flagged.

These rules can be customized by the bank depending on its policies. The software uses these fintech regulations and rules to figure out what looks suspicious.

Step 4: Flag Suspicious Behavior

If someone is doing something odd, like splitting large deposits into smaller ones to avoid detection, the software can catch it.

These are called suspicious activity. The AML system creates alerts for staff to review and decide if they require a report, and performs behavioral analytics in AML.

Step 5: Creates Report

If something serious is found, the software helps generate official reports like suspicious activity reports or SARs. The information is then sent to regulators or government agencies.

Step 6: Learns and Improves

Many modern AML systems use AI in banking apps to get smarter over time. They learn from past alerts and decisions to improve accuracy.

It also reduces false alarms and catches real threats more effectively.

6 Major Types of AML Software

When it comes to anti-money laundering, different types of AML compliance software are used to tackle different parts of the issue.

Here are the quick and main types of AML software.

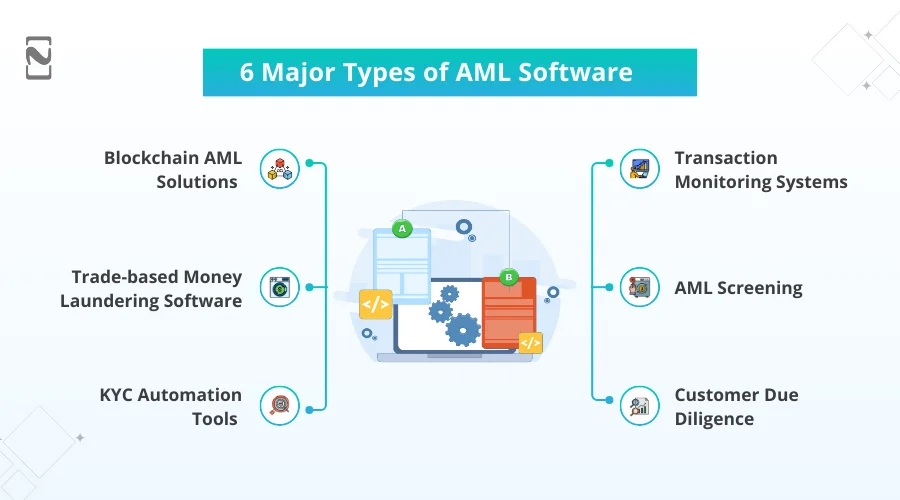

1. Blockchain AML Solutions

Blockchain AML solutions are used to track suspicious activities like cryptocurrencies. Since crypto platform transactions are often anonymous, this software helps find unusual patterns or movements across blockchain networks.

Example: Chainalysis – It helps governments, banks, and crypto companies monitor crypto wallets and detect illegal transactions.

2. Transaction Monitoring Systems

An AML transaction monitoring system is a type of software that watches customer transactions in real time.

It flags anything out of the ordinary, like unusually large transfers or frequent international payments that do not fit the customer’s usual behavior.

Example: Actimize by NICE – A widely used system by banks to monitor daily transactions and catch suspicious activity.

3. Trade-based Money Laundering Software

TBML software is used mostly in international trade, such as shipping data, invoices, and product values, to spot possible money laundering through fake trade deals or over-/under invoicing.

Example: TradeSun – It helps financial institutions identify shady trade deals hidden in complex paperwork.

4. AML Screening

AML screening tools display names of customers and businesses against global watchlists, sanctions lists, and politically exposed persons lists.

This helps catch high-risk individuals or organizations before doing business with them.

Example: World-Check by Refinitiv – It scans global databases to flag risky individuals or companies.

5. KYC Automation Tools

KYC automation tools quickly and securely verify customer identities. KYC in fintech apps often utilizes AI to analyze ID documents, selfies, and biometric data.

This is a big help for banks, fintech companies, and even crypto platforms that need to onboard customers quickly but safely.

Example: Onfido – It is used by many fintech companies to verify identities digitally.

6. Customer Due Diligence

CDD tools help assess the risk level of a customer before and during a relationship. This covers checking their background, course if found, and ongoing behavior.

So, even after someone becomes a customer, the system checks for any changes or red flags.

Example: ComplyAdvantage – It helps businesses run checks and keep customer profiles up to date.

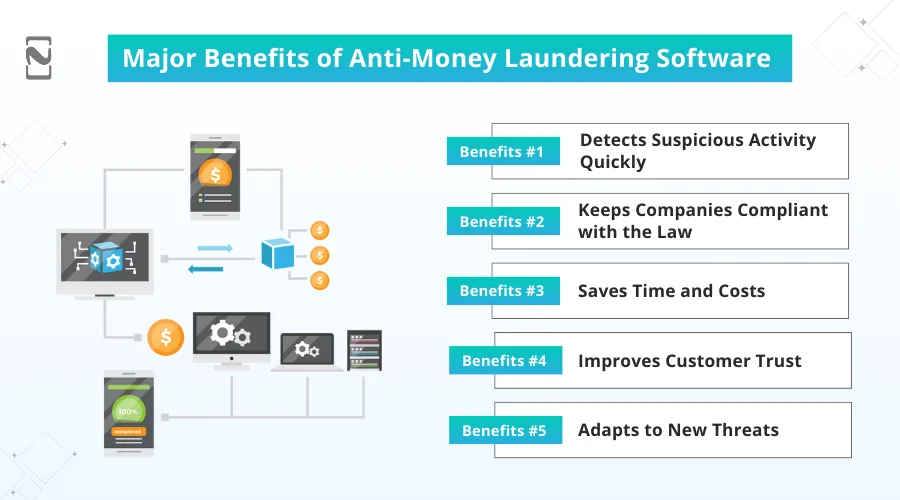

Major Benefits of Anti-Money Laundering Software

As we all know, financial crimes like money laundering are becoming so simple.

That’s why AML compliance software is used by almost every financial institution to stay compliant, safe, and protect both themselves and their customers.

Let’s have a look at the benefits of AML software for financial institutions.

Detects Suspicious Activity Quickly

AML software uses AI technology to scan through thousands, or we can say millions of transactions, in real time.

It spots anything unusual, like a customer moving large sums of money or transferring funds to high-risk countries.

With software, this would take humans days or weeks. AML compliance software does it in seconds, which helps institutions act before any real damage is done.

Keeps Companies Compliant with the Law

Financial institutions must follow strict government rules to prevent money laundering.

AML compliance software helps them meet these needs by automatically checking customer data, tracking transactions, and generating reports.

It reduces the risk of heavy fines or losing their license because of missed steps or human error.

Saves Time and Costs

Before AML compliance software, teams had to go through every transaction by hand, which was slow and expensive. With software, a lot of work is automated.

This frees up staff to focus on more important tasks and cuts down on the need for large security and compliance teams. It also helps avoid the huge costs of legal penalties.

Improves Customer Trust

When people know their bank or service provider takes security seriously, they feel safer.

AML software shows that a company is serious about preventing crime and protecting its customers. This builds trust and strengthens the company’s reputation in the long run.

Adapting to New Threats

Criminals are always finding ways to hide black money. Good AML compliance software gets regular updates and uses AI to learn and evolve.

This means it can spot new types of suspicious behavior that even humans might miss, keeping the organizations one step ahead.

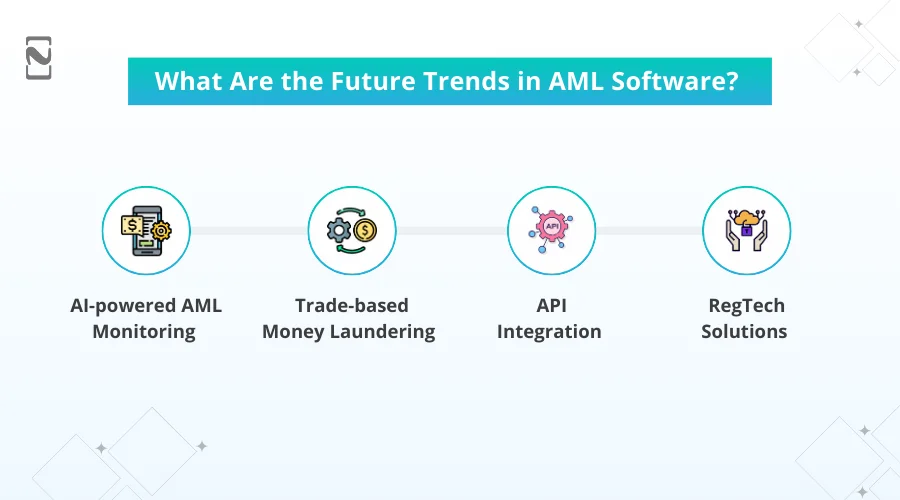

What Are the Future Trends in AML Software?

From AI tools that help track money to crimes involving cryptocurrency, these future trends are pushing banks and regulators to work harder to stop financial crimes.

Here are the major future trends in AML or Anti-Money Laundering software.

► AI-powered AML Monitoring

AI will play a big role in the future of AML. Traditional systems used to rely on simple rules, like flagging a transaction if it is over a certain amount.

But criminals have gotten better at avoiding these red flags. But AI is the real savior here.

AI-driven AML software can look at huge amounts of data and spot patterns that humans might miss.

For example, it can learn what normal transactions look like and then notice when something is off, even if it does not break a rule.

It’s like having a super-smart assistant that watches over your financial activity 24/7. Over time, AI in fintech and banking systems gets even better because they learn from each case they see.

This helps banks catch suspicious behavior faster and reduce false alarms.

► Trade-based Money Laundering

TBML is when criminals use international trade to hide illegal money. For example, they might lie about the price or quantity of goods in shipments to move money across borders without raising suspicion.

This is becoming a bigger concern because global trade is complex and difficult to monitor. AML compliance software is now being built to better track and analyze trade data.

If you look at shipping records, invoices, and payment patterns, new software can catch strange activity that may point to TBML. It is a growing area, and regulators are paying close attention.

► API Integration

APIs are tools that allow different software systems to talk to each other. You can think of it like plugging one app into another so they can work together.

In the world of AML, Stripe or PayPal API integration means connecting different systems like customer databases, transaction records, and third-party services.

So they all share information in real time. This makes the whole AML process more seamless and efficient.

For example, if a new customer signs up, the system can instantly run checks in the background and alert the team if something looks suspicious.

This helps financial institutions stay updated as new data becomes available.

► RegTech Solutions

RegTech is a regulatory technology. It means tech tools designed to help businesses follow the rules, especially financial regulations.

With AML rules getting stricter globally, financial companies are turning to RegTech to stay compliant.

The software helps automate things like customer identity checks, risk assessments, and reporting suspicious activity.

Instead of doing all this work manually, RegTech makes it faster and more accurate. It is becoming a must-have for banks and fintech companies.

Final Thoughts

AML software is becoming more important as financial crimes grow more advanced. It helps banks and fintech companies detect suspicious activity and stay compliant with laws.

With AI, automation, and real-time monitoring, the whole process becomes faster. As digital banking grows, having the best AML system is really essential, and this is only possible with the expertise of an experienced AML software development company.

So, if you are developing a secure financial product, collaborate with a trusted fintech app development company like Nimble AppGenie to get started right away.

FAQs

- Transaction monitoring

- Customer due diligence with KYC verification

- Risk assessment

- Suspicious Activity Reporting

- Case management

- Regulatory AML reporting

Some of the best AML compliance software solutions include:

- NICE Actimize

- Oracle Financial Services

- ComplyAdvantage

- SAS AML software

- LexisNexis Risk Solutions

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.