Isn’t it fascinating that you can simply walk up to any point-of-sale counter and complete the payment in a matter of seconds with a tap of your smartphone?

The use of NFC has certainly made it possible for every user.

Mobile payments have completely changed the way people make transactions today. Gone are the days when there were long queues in cafes as the person ordering was fiddling with their pockets for change.

With the rise of e-wallets and digital payments, the entire market has undergone significant changes, as more and more online and cashless transactions are being carried out.

What has made the entire mobile payment experience enjoyable for the users is the different methods that are available to them. NFC payments are one such method.

The use of Near Field Communication for making payments has brought a lot of convenience for both the user and the merchant.

In this post, let us take a closer look at NFC mobile payments, what they are about, and how they work. We will also take a look at the opportunities that NFC mobile payments offer.

What is NFC Mobile Payment?

As the name suggests, NFC mobile payment is a digital method that allows two devices to interact and exchange funds with one another.

The idea is to add NFC functionalities to a regular e-wallet app by leveraging the existing NFC hardware on smartphones.

NFC technology has been around for a while now and has been used in access cards and credit/debit cards, allowing tap and pay.

Now, when smartphones are being used to make all types of payments, adding NFC only seems like a valid decision.

With the integration of NFC support, the device is ready to make contactless payments directly on a tap-to-pay terminal, without carrying a physical card for the same.

The wireless technology seems perfect, as unlike Wi-Fi or Bluetooth, the range is significantly lower, making it safer for the user. Not to mention the connection is secure, which brings convenience too.

If you are wondering how exactly an NFC mobile payment transaction goes through, check out the next section.

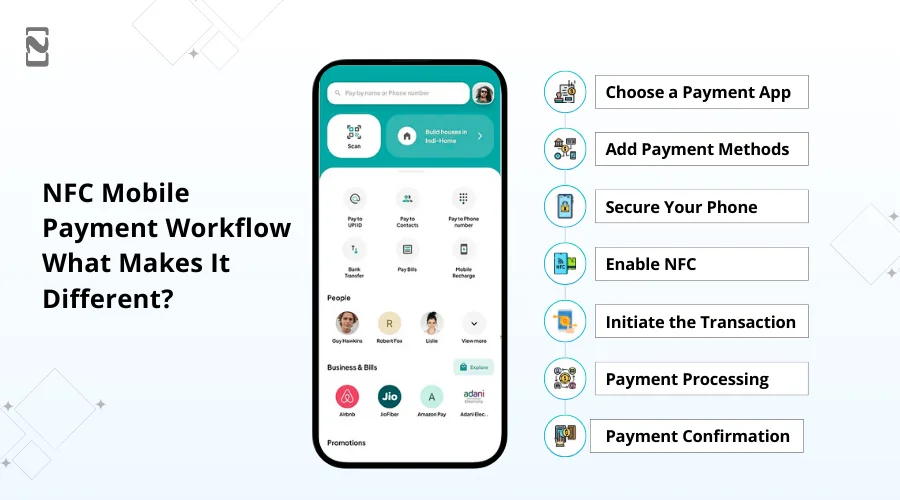

NFC Mobile Payments Workflow: What Makes It Different?

NFC mobile payments have become increasingly popular over the past few years, and the reasons seem clear: convenience.

More and more businesses have adopted NFC payment terminals so that they can offer their customers a hassle-free experience. The workflow of the entire process also indicates the same.

Let’s take a look at the complete flow.

1. Choose a Payment App

Download and install a mobile payment app like Apple Pay, Google Pay, Samsung Pay, or your bank’s app. These apps securely store your payment information.

2. Add Payment Methods

Open the app and add your payment methods, like credit cards, debit cards, or even loyalty cards. You may need to take a picture of your card or manually enter the details.

3. Secure Your Phone

Ensure your phone has a PIN, password, or biometric lock (like fingerprint or facial recognition) to protect your payment information.

4. Enable NFC

First, make sure your smartphone has NFC capability. Most modern smartphones have this feature. Then, turn on NFC in your phone’s settings.

5. Initiate a Transaction

Look for a payment terminal at the store that has the NFC symbol. It typically looks like a Wi-Fi signal icon. Hover your smartphone close to the NFC symbol on the payment terminal (usually within 1-2 inches). Your phone and the terminal communicate through NFC

6. Payment Processing

The NFC technology securely sends your payment information to the terminal, and the transaction is processed almost instantly.

7. Payment Confirmation

Once the payment is approved, you’ll receive a confirmation on your phone and sometimes a receipt via email or in the app. The best part of this entire process is that it hardly takes a minute to complete.

NFC mobile payments are fast and secure because they use short-range wireless communication to transmit your payment details to the terminal. Plus, they don’t share your actual card number, adding an extra layer of security to your transactions.

The convenience that comes with NFC payments is something that makes it all the more effective and convenient than traditional mobile payments.

Here’s a quick table of comparison to give you some perspective.

| NFC vs Traditional Payment Methods | ||

| Aspect | Traditional Mobile Payment | NFC Mobile Payments |

| Technology | Uses SMS, USSD, or mobile app | Utilizes Near Field Communication (NFC) technology |

| Hardware Requirement | Requires a basic mobile phone with SMS capabilities or a smartphone with internet access and a mobile banking app | Requires an NFC-enabled smartphone and an NFC-compatible payment terminal or device |

| Authentication | Typically involves a PIN, password, or biometric verification for access to mobile banking apps | Usually requires a secure device unlock (PIN, fingerprint, face recognition) and proximity to the NFC terminal for payment |

| Security | Security is primarily dependent on PIN/password and encryption for data transmission. Susceptible to phishing attacks and SIM card cloning | Generally considered more secure due to tokenization and encryption of payment data. Less susceptible to phishing attacks as it doesn’t transmit card information |

| Payment Process | Involves sending payment instructions via SMS, USSD, or mobile app to the recipient or payment gateway | Requires tapping or bringing an NFC-enabled device near the payment terminal to initiate a transaction |

| Transaction Speed | Slower compared to NFC payments, as it involves manual entry of payment details and SMS confirmation | Faster, as it requires only a brief physical interaction between the NFC device and the terminal |

| Merchant Acceptance | Limited merchant acceptance, as not all vendors support mobile payments, especially in remote areas | Increasingly widespread acceptance at retailers, restaurants, and public transportation systems, especially in urban areas |

| Payments | May or may not support payments, depending on the technology used and merchant acceptance | Specifically designed for payments, allowing quick and convenient transactions without physical contact |

| Accessibility and Convenience | It may be less convenient due to the need for typing and manual input of payment details | Offers greater convenience and speed, especially for small and frequent transactions |

| Costs and Fees | Costs may include SMS charges (if applicable), data usage fees, and any fees imposed by the mobile payment service provider | Fees may be associated with specific NFC mobile payment services or banks, but they are often minimal. |

| Supported Payment Methods | Typically supports a range of payment methods, including bank transfers, mobile wallets, and card payments | Primarily supports card payments, but can also integrate with mobile wallets and other payment methods |

Developing a Custom NFC Mobile Payment App: Step-by-Step Process

Knowing the convenience that an NFC mobile payments application offers, you may be wondering what it takes to develop one for yourself.

The market is accepting NFC as a payment method, making it a great opportunity for businesses to enter the fintech realm.

If you are planning to do the same, then you must have an idea about the steps involved in developing an NFC mobile payments app.

Step 1: Ideation & Market Research

The first thing to do is establish the idea and have a quick look at the market statistics. Thorough market research can give you a better foundation to establish your business properly.

If you are wondering where to begin, a quick Google search is a good option. However, make sure you dig deep and find all types of fintech market statistics and reports to understand it all better.

Step 2: Wireframing & Design

After you have identified the opportunities and the gap, it is time to give your vision shape.

Build a wireframe and start with a basic UX/UI design to understand how exactly the application will look and feel.

This is the step where you can go all in so that when you start the implementation, you can cut it short and simplify the process. Identifying the right design for the application is certainly crucial.

Step 3: Identify Features & Functionalities

With a design framework in mind, the next step is to choose the right set of features to power your app.

For your reference, we have added the most commonly used features in an NFC mobile payment application that you can check out and choose from.

Through each of these features, you can add more and more functionality to the app, making it more reliable for the user.

| NFC Mobile Payment App Features | |

| User Registration and Authentication | Transaction History |

| Wallet Integration | Push Notifications |

| Tokenization | Remote device deactivation. |

| Balance Management | Fingerprint/Face ID Enrollment |

| Offline Mode | Analytics and Reporting |

| Customization Options | Cross-Platform Compatibility |

| Digital Receipts | Card Management |

| Feedback and Ratings | User Tutorials and Help Center |

| Accessibility Features | Language and Currency Preferences |

| Location-Based Services | In-App Wallet Top-Up |

| Offline Payments | Privacy Controls |

| Integration with Other Apps | Customer Support |

| Multi-Currency Support | Peer-to-Peer (P2P) Transfers |

| Rewards and Loyalty Programs | Bill Splitting and Request Payments |

Step 4: Develop Functionalities

Now that you have the list of features and functionalities you want to build, it is only right to start with the development process.

You can finish the application through the development of individual modules, one after the other, to ensure that each of the functionalities is built robustly.

Don’t forget, you can always upgrade the tech stack to be more and more advanced with the features you offer.

Step 5: Testing & Quality Assurance

After you have successfully developed all the functionalities, it is time to check and ensure the quality of the application.

You see, building the application is not enough; it has to be refined to the extent that your user does not have to worry about the bugs or a feature failing to execute.

The NFC payments app must be tested for everyday use cases so that there are no issues left for a potential customer, in any possible scenario.

Once you have tested the application, it is now time to deploy the application. The deployment makes it possible for a user to find the application and use it from the application stores of their respective operating systems.

However, all these steps require access to funds. You need to have a set budget to build your application. In the next section, let’s quickly take a look at how much it would cost to develop an NFC mobile payment application.

Cost to Develop NFC Mobile Payment App

The cost to develop an NFC mobile payment app typically ranges from $25,000 – $250,000.

The range is significantly vast as there are different factors, a combination of features, and use-cases that make the application cost vary. However, that also means you can customize the application to your best abilities.

However, this often creates a sense of confusion as a novice doesn’t realize how much the application will cost or what sort of budget one should have.

So, if you are looking for an accurate cost estimation, it’s highly recommended that you consult an eWallet app development company that can help you with the same.

Conclusion

This is all you need to know about mobile payment technology and developing an app for NFC mobile payment.

With your own NFC payment solution, you can take over the market in no time, as more and more businesses are looking for ways to deliver a better customer experience.

From collecting and managing payments to keeping track of every transaction, an NFC mobile payment application can help you do all of it, giving your customers a hassle-free experience.

With that said, we have reached the end of this post. Hope you found all your queries resolved. In case you have any further questions, feel free to contact our experts.

Thanks for reading. Good luck!

FAQs

NFC (Near Field Communication) mobile payments enable secure, contactless transactions using smartphones or other devices equipped with NFC technology.

NFC allows two devices, like a phone and a payment terminal, to exchange data wirelessly over short distances. To make a payment, simply tap your NFC-enabled device near the terminal.

Yes, you can add multiple credit or debit cards to your NFC payment app and select your preferred card when making a payment.

Transaction limits vary by payment provider and retailer. Some may require a PIN or fingerprint for higher-value transactions.

Typically, there are no additional fees for using NFC mobile payments. However, check with your bank or payment provider for any specific terms and conditions.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.