Fintech as an industry has grown exponentially over the past few years, and Fintech APIs have played a crucial role in this growth.

How? Well, enabling interconnectivity among different solutions to create a uniform experience for the user becomes one of the toughest challenges, especially in fintech apps, where a user may have their account in a bank and prefer using payment modes offered by a third party.

Fetching crucial information like transaction information, account details, balance, etc., is only possible with Fintech APIs.

In other words, Fintech APIs are tools that allow financial technology to communicate and share data with financial services and systems. However, that is just the tip of the iceberg of information you should have about Fintech APIs.

If you plan to develop a fintech app for your business, APIs can play a crucial role in the overall execution. In this post, we are going to discuss all aspects of a fintech API and answer some of the core questions, including: What are fintech APIs? What are the types of fintech APIs? Where are the core use-cases of fintech APIs? And more!

So without further ado, let’s get started!

What are Fintech APIs?

For those who are unfamiliar with the concept, an Application Programming Interface, or APIs, work as interfaces that connect a service to your platform.

What this means is that APIs help in connecting external services into a fintech app, bringing more and more functionalities for the users.

While it can often be difficult to create specific code blocks to enable a feature, fintech API integration allows fetching data and features directly from the source to your app, simplifying the execution of functionality.

They work to streamline your experience. Well, as you know, APIs act as a gateway that receives requests, processes them, and delivers the necessary information to the recipient.

For example, when a user connects a personal finance app to their bank accounts via an API, the app sends a request to the bank’s system. The bank API then confirms the request and sends out an authentication request. This is how a Fintech API works.

In the next section, let’s take a closer look at Fintech APIs and understand their importance of the same.

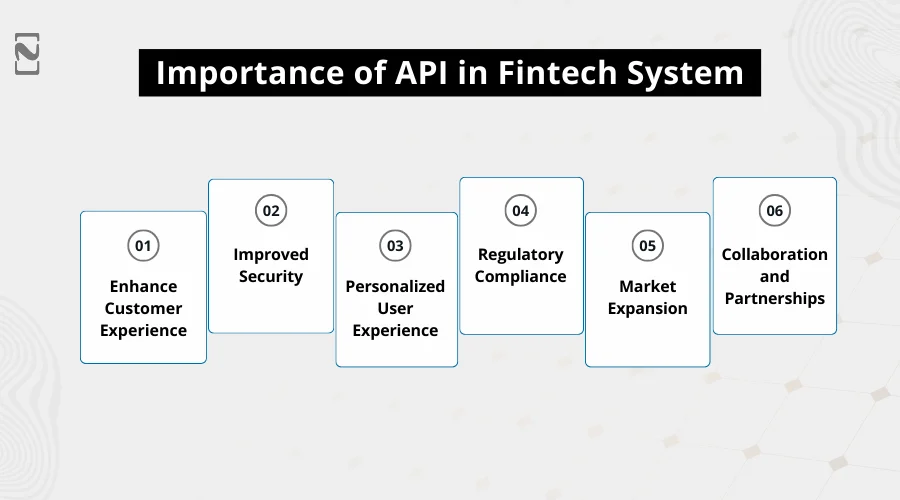

Importance of APIs in Fintech Systems

Financial systems have become an integral part of every user’s everyday life. Knowingly or unknowingly, every online payments/banking user interacts with a fintech API.

With the rise of open banking, fintech APIs have proven to be highly reliable and important for enabling snappy financial transactions and services.

The importance of Fintech APIs can be identified through various roles that they play in any application or system. What are these roles you ask? Let’s learn about them below!

♦ Enhance Customer Experience

First of all, APIs allow fintech companies to access and analyze customer data. With that, you get to create a more personalized experience for your users.

In addition, these tools make it easier for users to take control of their finances across different channels, leading to better customer loyalty and experience.

♦ Improved Security

Where money is involved, security becomes a top concern.

Well, the good news is APIs can help with security in fintech systems in many different ways that include regulatory and compliance requirements of their target market.

APIs can address validation errors, server failures, and even incorrect requests, which is how they protect the sensitive financial data of users.

♦ Personalized User Experience

Fintech APIs enable the collection and analysis of vast amounts of financial data.

This can be used to tailor services to individual user preferences and needs. This personalization enhances customer satisfaction and loyalty, driving business growth.

♦ Regulatory Compliance

Navigating the complex regulatory environment of the financial industry is a major challenge.

Fintech APIs often come equipped with built-in compliance measures that conform to industry standards such as GDPR, PCI DSS, and more.

This helps fintech companies ensure that they are not only providing innovative services but also adhering to the necessary legal frameworks.

♦ Market Expansion

APIs in fintech allow companies to expand their services across different geographical markets without significant barriers.

They enable easy adaptation to local financial systems and regulations, helping businesses scale internationally with less friction.

♦ Collaboration and Partnerships

If you want to be successful among consumers, collaboration is important.

The use of APIs in fintech fosters collaboration between fintech startups, traditional banks, and tech companies.

These partnerships create a more integrated financial services landscape, where companies can leverage each other’s strengths to deliver comprehensive solutions to users.

By harnessing the power of APIs in fintech, companies are not only enhancing their operational capabilities but are also driving the financial sector towards a more innovative and user-focused future.

This is why APIs have become foundational in the development and expansion of fintech solutions globally.

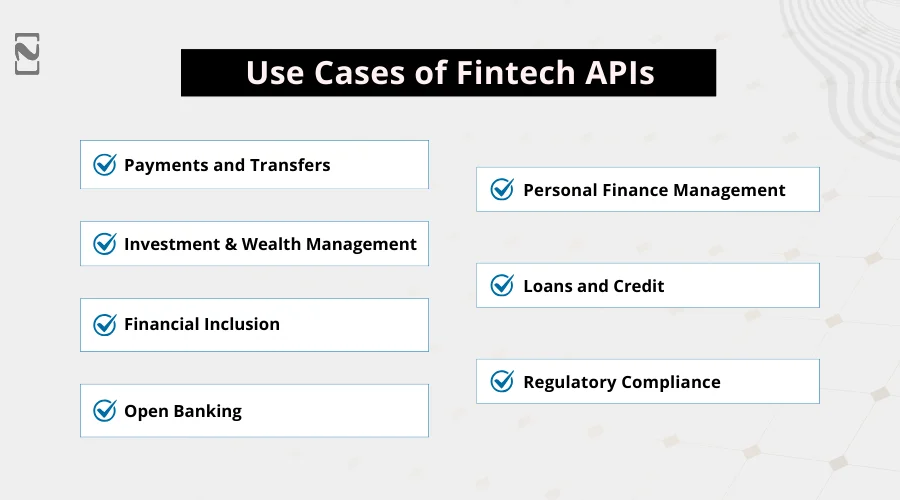

Use Cases of Fintech APIs

As mentioned earlier, Fintech APIs are changing the way financial services are launched and managed.

Harnessing the power that these APIs, companies can do a lot of things, including improve their user experience and introduce innovative solutions. The best part is that there are different Fintech APIs that can be used for different purposes in a fintech app.

Fintech APIs make it easier to integrate features that may be vital to your users. Some of the key use cases that a fintech API can help you fulfil are mentioned below.

1. Payments and Transfers

Modern fintech apps are commonly used for enabling payments and P2P transactions. These features have certainly made their way to almost every fintech solution, and when planning to enter the growing fintech market, you must integrate these features into your solution.

Fintech APIs can help you achieve them with minimal effort. Payment APIs streamline the process of inflow and outflow of money.

They allow businesses to incorporate payment processing capabilities into their platforms, enhancing smoother transactions without the requirement for external payment gateways like Square. This use case is important for peer-to-peer payment apps and online service providers.

2. Personal Finance Management

When developing a fintech app, you must design it in such a way that it not only delivers on the promises but also allows your users to interact with your app. You see, fintech solutions are more of a utility app that a user only uses when they want.

This directly impacts the retention rate and engagement of the app. This is where personal finance management features come into play.

By integrating Fintech APIs for expense tracking, fintech apps can target users with a broad view of their financial risks and give customized budgeting advice.

This is possible through safe access to transaction history and bank data, improving financial literacy & helping users make better decisions. This also allows you to get more retention as the user keeps returning to your app.

3. Investment & Wealth Management

Fintech APIs can enable ease of managing your investments while helping your users to be more in touch with their assets. When developing an investment app, you need multiple streams of market news, market stats, and other information.

A Fintech API can help you fetch all the required data while allowing your users to interact directly with the market. Investment APIs are used by investment and wealth management apps to offer services that include automated investing and portfolio management.

Market data and trading platforms can be easily accessed by these APIs, making it easier for users to manage their assets and make better investments.

4. Loans and Credit

One of the key issues that loan and credit apps often face is in identifying the user’s credit background and whether they should be given a credit limit or not.

Fintech APIs help in attaching direct sources for KYC and background checks that help in simplifying the loans and identifying the credit history of the user.

The APIs can also help to automate the loan approval process; Credit Scoring APIs are of help. They are mainly used for cash-advance apps and loan lending apps.

Usually, they aim to provide lenders with immediate access to an applicant’s credit history, enabling quicker and more accurate credit decisions.

5. Financial Inclusion

With the help of Fintech APIs, any existing app that works in a similar industry can start offering financial services, allowing people from different parts of the world. This is a game-changer for countries with a high unbanked population, as they do not need brick-and-mortar banks to spread the services.

Instead, they can simply use fintech APIs to offer crucial banking services, promoting financial inclusion in its purest form. Fintech APIs aim to streamline financial services to underbanked populations.

Fintech companies can reach a broader audience by facilitating simple and accessible banking services. So, it improves financial inclusion on a global scale.

6. Regulatory Compliance

When building an application from scratch, you need to take care of so many fintech regulations and compliance requirements.

However, when you go for an API coming from a respected name in the industry, it is already compliant with the industry standards, saving you a lot of trouble and effort to finish the compliance requirements.

With regulatory and compliance consent, financial institutions can stick to revolving regulations by automating compliance checks and reporting.

This is important for preserving the reliability of financial systems and protecting consumer data. With fintech regulations growing more complex, this is very important.

7. Open Banking

Open Banking is one of the most popular use cases for APIs, as it allows more techfin companies to enter the market. With the help of an open banking system, you don’t have to be a bank traditionally.

All you need to do is integrate a fintech API for an open banking solution and get things in line with fintech infrastructure, enabling your users to get an experience similar to that of a banking app.

Open Banking APIs nurture an open and competitive financial services environment. They allow third-party developers to build innovative financial services and applications that can access bank data.

The idea of using fintech APIs is highly beneficial for people who are tight on a budget and need to hit the market as soon as possible. APIs make integrating new features easier while costing less than what it would to build the feature from scratch. More importantly, it can save you valuable time.

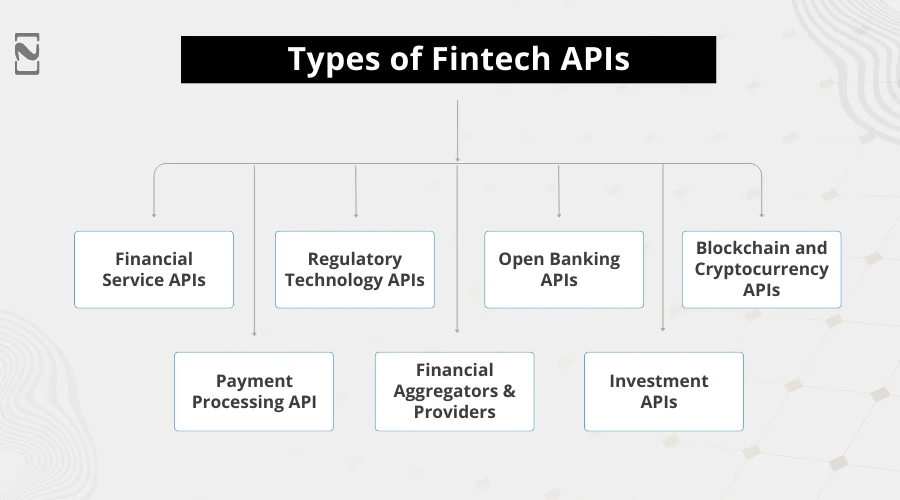

Types of Fintech APIs

The use cases clearly indicate that there are many ways fintech APIs can be used. However, you need to have clarity that there is no one-size-fits-all API. There are different types of APIs that you might need.

Let’s take a look at each of them and learn how they work.

1] Financial Service APIs

A Financial service API is a solution that offers a variety of apps and systems to communicate & exchange data securely.

It enables third-party developers to access and integrate financial information from banks, investment firms, and other institutions. This ultimately provides consumers with more convenient and personalized financial services through various apps and platforms.

2] Payment Processing API

A payment processing API is a set of tools and protocols that allow software applications to communicate with a payment processing system.

This enables them to accept and manage payments within their platform, acting as a bridge between a business’s website and app.

A payment gateway, without the need to build a payment infrastructure from scratch, helps businesses streamline their payment process and integrate payment gateway functionality into their applications.

3] Regulatory Technology APIs

Known as RegTech APIs.

These are application programming interfaces that allow different software systems to interact and exchange data. APIs allow fintech companies to follow regulations and generate compliance reports.

This includes regulatory compliance processes by automating data collection, analysis, and reporting, allowing companies to reduce costs and minimize the risks associated with non-compliance.

4] Financial Aggregators and Providers

Well, one of the most famous types of Fintech APIs is “Financial Aggregators and Providers”.

These APIs allow third-party apps to access financial information, including bank accounts and balances.

Such an API allows users to access their financial data from multiple sources in one place.

5] Open Banking APIs

Open Banking APIs are a part of the Fintech APIs.

It allows users to share financial information with the user’s consent.

These APIs let you access banking services, including account information, balance checks, and transaction histories.

They allow third-party developers to create a banking app that offers users insights into their finances without needing to log in to multiple banking portals.

6] Investment APIs

Investment APIs offer features that include stock trading and financial planning. Usually, they are used in robo-advisor platform development, investment app development, and more.

Such APIs aim to provide users with real-time market data, customized investment advice, and automated rebalancing based on individual risk.

7] Blockchain and Cryptocurrency APIs

With the growing demand for digital currencies, these APIs are growing.

They give features that include a crypto wallet & blockchain data insights, supporting the growing demand for crypto-related services.

By knowing the types of APIs available and how they can be of use for you, you might have gained clarity on what kind of fintech APIs you want in your app.

These different APIs help you create a streamlined solution, giving you the freedom to choose the right features, without having to integrate bloat-features that may not be of use to your users.

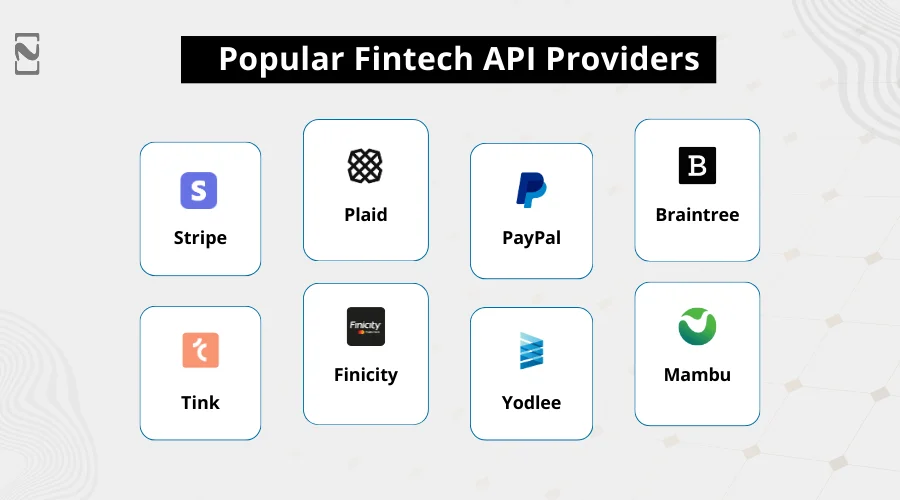

Popular Fintech API Providers

The categories of Fintech APIs help in identifying the right approach, making it more and more interesting for you to choose the right set of features, without having to invest in building functionality from scratch.

However, when we talk about opting for a Fintech API for your app, we need to be sure that these APIs come from trusted sources. After all, it involves financial services.

Fortunately, there are several big players in the Fintech API industry. Let’s take a look at some of the most popular fintech API providers, so you have enough options to choose from.

► Stripe

Stripe’s API empowers businesses to accept a huge variety of online payments that include credit cards, debit cards, ACH transfers, etc. Stripe API integration makes this process seamless and efficient.

It offers features that include invoicing, fraud detection, and managing subscriptions, streamlining the payment experience for both businesses and their customers.

► Plaid

Plaid is a popular Fintech API that acts as a bridge between financial institutions and Fintech apps.

It allows users to seamlessly connect their bank accounts to different financial applications, with supporting features including transaction history access and verifying financial information.

► PayPal

Usually, PayPal is a digital payment solution famous for being a top choice for making financial transactions.

The popularity is so strong that investors often Google how to develop an app like PayPal. Businesses can use these PayPal APIs to send invoices, manage subscriptions, & handle issues- all through the same application.

► Braintree

A branch of PayPal, Braintree offers a well-designed API specifically designed for developers to integrate payment functionalities.

Braintree has different features, including mobile wallet integration, fraud prevention tools, and a safe transaction processing system.

► Tink

Tink is a pan-European platform focused on open banking. It offers access to a huge network of financial institutions, allowing developers to build applications that harness users’ financial data securely.

Tink’s API facilitates features including data aggregation, payment initiation, & personal financial management tools.

► Finicity

Like Plaid, Finicity is a leading API solution enabling account aggregation and data retrieval from different financial institutions.

Finicity API offers different tools for the verification of assets and income, simplifying processes for loan applications & different financial services.

► Yodlee

Yodlee API offers access to financial data from a variety of banks & financial institutions, which is why it is one of the prominent players in the account aggregation space.

It offers features such as account balance retrieval, transaction history access, and different categorization of financial data, allowing developers to build strong personal finance management applications and result-oriented fintech solutions.

► Mambu

Mambu offers a comprehensive API suite. Fintech companies and banks use Mambu’s API to create and launch innovative financial products and services.

It provides various features, including account management, loan origination, core banking services, and more, facilitating rapid development & deployment of Fintech solutions.

With all these options, choosing the right Fintech API for your business becomes super convenient. Based on your trust and requirements, you can choose the provider.

Keep in mind that all of these APIs may have different specifications, requirements, and integration stipulations. Hence, once you have chosen the set of fintech features to integrate with your solution, you must find a professional API integration expert who can help you integrate the solution.

If you are still looking for assistance in that department, check out the next section, as we might have just the right solution for you!

Who Can Help With Flawless Fintech API Integration?

Identifying the key players in the fintech API market, you might have made up your mind on what type of API you want to use.

The real question that remains is how? How do you plan to approach this integration, and more importantly, who will help you with Fintech API integration? Well, worry no more as I have just the right answer, Nimble AppGenie.

With years of experience and hands-on expertise in fintech app development services, the experts at Nimble AppGenie are well-versed in delivering quality fintech API integration services.

All you have to do is identify the features you need and share them with the experts, and they can identify your core requirements, and they will start working on the project with the intent to deliver the best solution possible.

Connect today to get started with your fintech app integration and give your solution more abilities than ever!

Conclusion

Looking at the way fintech has evolved over the years, it is clear that fintech APIs are a crucial part of the entire digital financial ecosystem. Understandably, the role of fintech APIs becomes even more significant with the functionalities that it brings along.

When building a fintech platform of your own, you will require fintech APIs to support additional features and functionalities. Hence, you must pay attention to the APIs you integrate, along with the Fintech API provider that you choose.

Almost every major fintech app provider offers a fintech API, as it is also a great way to collaborate with other players in the market. Identifying the right API integration partner can play out well in the long term for your fintech app.

Hopefully, you got enough insights about fintech APIs and why they are important. For further assistance on fintech API integration, we recommend you reach out to our professional developers, as they are well-equipped to handle your fintech API requirements.

With that said, we have reached the end of this post. Thanks for reading, Good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.