While stepping back in time, people used to have limited access to banking, send money to their families, especially in rural areas, and have minimal cash-dependency because of high theft risk.

But mobile usage was going through the roof.

So, to bridge the gap between financial exclusion and mobile accessibility, an African fintech innovation came to the surface, namely M-PESA.

Created by Safaricom, Kenya’s leading telecom provider, M-PESA is backed by Vodafone, a UK-based telecom giant.

It offers banking-like services to millions through mobile devices with no bank accounts.

Latest reports say that about 51 million customers are making $314 billion in transactions every year via M-PESA.

Eyeing the facts and figures, according to Mordor Intelligence, in 2025, the fintech market valuation is anticipated to hit $320.81 billion, and by 2030, it will likely reach $652.80 billion with a CAGR of about 15.27% during 2025-2030.

It’s time for a fintech startup, entrepreneur, bank, microfinance institution, telecom company, or running retail chains and marketplaces to build an M-Pesa app and make the most of the favorable market conditions.

But, how to develop an app like M-PESA? Well, this is why we are here. Keep reading to unveil facts on why to build a mobile money app like M-PESA, how does M-PESA work, the right tech stack to pick, M-PESA business model, revenue strategy, and every other information you need to know before you start.

Let’s get the ball rolling!

Why Invest in M-PESA App Development?

M-Pesa and other mobile money platforms are among the top reasons for the digital transformation in fintech, especially in regions where traditional banking services are too expensive to use.

You would be astonished to know that M-Pesa is responsible for 59% of GDP flows in Kenya, which makes it a ruling mobile payment system in the country.

Besides Fintech app statistics and latest reports, there are numerous reasons to consider to ensure you are making the right decision when building an app like M-PESA.

Let’s explore:

1. Big Market Opportunities

Per a World Bank survey, nearly 80% of the globe’s 1.4 billion adults are unbanked.

Here, the emergence of mobile money, like M-Pesa, offers low-cost ways to provide financial services to these populations, specifically in Africa, Latin America, and South Asia.

Apart from these regions, banked cities also reap the rewards of rapid, cheap, and more convenient banking alternatives utilizing mobile wallets.

This is a high-potential investment opportunity for you to develop an M-Pesa money app and kickstart your fintech venture.

2. High Demand for Cashless Transactions

Today, an increasing number of consumers seek digital wallet payment solutions as they meet their expectations for safe and convenient money transfers.

In fact, governments are promoting financial digitization to mitigate dependency on physical cash and boost transparency.

3. Proven and Scalable Business Model

Talking about the revenue model of M-PESA, it’s very profitable and seamlessly adaptable in distinct regions.

The fintech platform makes money from merchant payments, transaction fees, and other financial services.

M-PESA app development will empower you to replicate this model with unique customization and serve your local market.

4. Faster Time-to-Market with a Similar App to M-PESA

When you are developing an app similar to M-PESA, you don’t need to build it from scratch, and this speeds up the launch, reducing costs and time.

You can focus on meeting compliance requirements, customizing the user experience, and expanding your agent network.

5. Possibilities for Innovation

While you develop an M-Pesa-like app, you can stretch the boundaries of financial services by offering more than money transfer options, like insurance, wealth management, micro-loans and savings, bill payments, merchant tools, QR code payments, and more.

How Does M-PESA Work?

The main job of M-PESA is to convert cash into an e-balance that’s stored on the user’s SIM card, which he can use for transactions through SMS.

You don’t need a smartphone or bank account; it primarily runs through SIM-based mobile wallets and leverages USSD codes and SMS to operate.

Here’s how M-PESA works:

1. User Registration

Using a valid ID, users register at an authorized M-PESA agent. After that, registered users’ phone numbers become their mobile wallet accounts.

They receive an account linked to their SIM card, which is PIN-protected.

2. Depositing Money

A user who wants to deposit money gives physical cash to an M-PESA agent. Further, he deposits the same amount into the users’ mobile wallets.

Then, the agent and user get a confirmation SMS. The digital money is ready to be used for various transactions.

3. Sending & Receiving Money

Using his app or USSD, the user opens the M-PESA menu, enters the recipient’s phone number and the amount. and confirms the transaction through a PIN.

On the other side, the recipient receives a notification via SMS showing that a particular amount has been added to their wallet.

4. Withdrawing Money

Users go to an M-PESA agent when looking to get physical cash. The agent initiates a withdrawal from the user’s mobile wallet and gives cash to the user after performing transaction verification.

Understanding M-Pesa Business Model

Once founded for simple money transfers, the tool has evolved over time into a scalable fintech ecosystem.

1. Transaction Fee Revenue Model

This is a primary revenue source of M-PESA. Based on the amount and type of activity, like withdrawing cash, sending money, or paying bills, users pay a small fee for each transaction.

For larger funds, the amount scales accordingly, which proves to be affordable for small transfers.

2. Agent-Based Distribution Model

A huge network of agents takes part in operating M-PESA, who are typically kiosks or shopkeepers and perform as physical points to conduct cash-in and cash-out transactions.

In turn, M-Pesa shares transaction fees with these agents, which appears as a win-win revenue-sharing model.

3. Partnerships with Banks and Financial Institutions

M-Pesa has given traditional banking operations a new face by partnering with banks where they store users’ funds in trust accounts, adhering to relevant compliance and safety, and providing microloans and savings products.

The generated revenue is shared with these bodies per the usage and interest income.

4. Airtime & Bill Payments

Users can use their digital wallet to top up airtime or pay utility bills. Resultantly, M-Pesa earns commissions coming from telecom operators and involved utility providers on all the transactions.

5. Cross-Selling & Add-On Services

Besides basic money transfers and withdrawals, M-Pesa, a mobile-based digital wallet platform, provides more services, like international remittances, insurance, and Buy Now Pay Later (BNPL).

This drives additional revenue streams and increases customer retention.

A Quick Recap of M-PESA Business Model:

| Component | Revenue Type |

| Agent Network | Revenue share from fees |

| Transaction Fees | Direct revenue |

| Bank Partnerships | Interest & commissions |

| Merchant Payments | Merchant fees |

| Airtime/Bill Payments | Commission-based |

| Add-on Financial Services | Subscription or usage fees |

How Does M-PESA Make Money?

However, the chief reason to build a fintech app is to eventually make money in this emerging fintech market.

But how do fintech apps make money?

1. Merchant Service Charges

A percentage of the service fee on every transaction is charged by businesses accepting payments via M-PESA (Lipa na M-Pesa).

Thus, consumers stay fee-free, which boosts customer trust and loyalty.

2. Transaction Fees

In this revenue stream, the money comes from users in exchange for the varied services they receive the benefits of.

3. Partnership Revenue

By partnering with banks, M-PESA offers microloans and savings products to its users at a share of interest income or an amount as fees.

4. Agent Network Fees

Yes, we know that M-PESA pays an amount to agents. It also gets a portion of the transaction fees accumulated via agent-facilitated transactions.

5. Value-Added Services

If you know credit scoring, insurance, APIs for businesses, and investment tools, you provide extra monetization opportunities.

At this edge, M-Pesa either earns commissions or charges usage fees via partnerships.

6. Airtime and Bill Payment Commissions

On every transaction relevant to any purchase of mobile airtime or bill payment via M-PESA, the telecom-powered digital finance solution retains an amount as commission from utility and telecoms companies.

Key Features to Consider While You Build a Mobile Money App Like M-PESA

Well, to make your app a success like this, Africa’s leading mobile money platform, you should embrace features of an app like M-PESA.

Fintech app features must be secure, user-friendly, and scalable.

Let’s have a look at panel-wise core features:

1. User Panel Features

| Features | Description |

| User Registration | This feature helps sign up utilizing mobile number and identity verification (KYC). |

| PIN-Protected Wallet | It allows secure login and transactions via a 4 to 6-digit PIN. |

| Send & Receive Money | With this feature, you can transfer funds to/from users via mobile number or QR code. |

| Cash-In/Cash-Out Requests | Users can deposit or withdraw funds from the nearby agents. |

| Transaction History | It permits viewing past transactions with filters. |

| Bill Payments | The features ease paying for electricity, internet, water, school fees, etc. |

| Airtime Top-Up | Allows recharging of mobile airtime and internet data for self or others. |

| QR Code/USSD Payments | You can make payments via scanning QR codes or entering USSD codes. |

| Mini-Statement SMS/Email | Simplify receiving periodic summaries or transaction alerts through SMS or email. |

| Language Support | Multi-language support for local and regional dialects. |

2. Agent Panel Features

| Features | Description |

| Agent Login | This feature allows secure login to the agent dashboard. |

| Customer KYC Verification | It helps smoothly onboard agents by verifying national ID or other credentials. |

| Deposit Funds (Cash-In) | Agents can instantly accept cash and credit from users’ wallets. |

| Withdraw Funds (Cash-Out) | This feature processes cash withdrawals with agent authorization. |

| Float Balance Management | It permits viewing and managing available agent floats. |

| Commission Tracking | It tracks earnings and commissions from transactions. |

| Transaction History | Using this feature, agents can view logs of all customer transactions processed. |

| Agent Locator Tools | Find other authorized centers or nearby agents. |

| Issue Resolution Requests | It helps to submit support tickets or escalate technical issues. |

3. Admin Panel Features

| Features | Description |

| User & Agent Management | Using this feature, users can add, edit, block users or agents; monitor activity. |

| KYC & Compliance Dashboard | It allows monitoring verified accounts and identifying suspicious activity (AML compliance). |

| Transaction Monitoring | Real-time tracking of all financial transactions. |

| Commission Management | You can set and distribute commission rules for merchants and agents. |

| Fee Management | Configure thresholds, transaction fees, and promotional pricing. |

| Analytics & Reporting | Visual reports on user growth, transactions, and region-wise activity. |

| Customer Support Tools | It permits viewing user complaints, tickets, and resolution status. |

| Fraud Detection System | This feature tracks unusual behavior utilizing automated alerts and rules. |

| Backup & Security Controls | It helps manage backups, encryption, and security settings. |

| App Settings Control | Configure app appearance, notification settings, and localization. |

4. Merchant Panel Features

| Features | Description |

| Merchant Registration | Using this feature, businesses can register to accept payments via a merchant code or QR. |

| Transaction Acceptance | Merchants can receive payments through this feature from customers via mobile wallet or scan-to-pay. |

| Transaction History | It allows viewing of past sales and filters by date or amount. |

| Daily Settlement Reports | Merchants get reports for end-of-day or weekly settlements. |

| QR Code Generator | It helps create static or dynamic QR codes for payments. |

| Integration APIs | Merchants use APIs or plugins to integrate with POS systems or eCommerce sites. |

| Customer Refund Option | It permits Initiating refunds for failed or disputed payments. |

| Offer & Discounts | Run promotions or discounts via the wallet interface. |

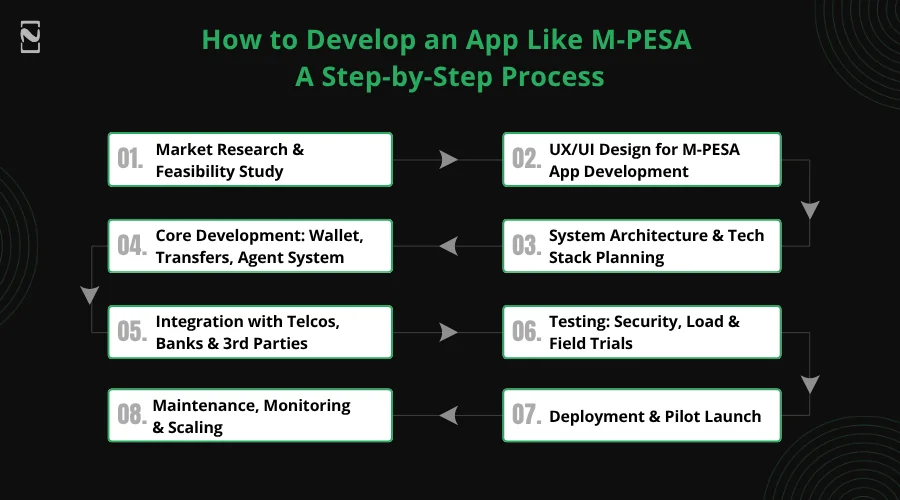

How to Develop an App Like M-PESA – A Step-by-Step Process

Developing an app like M-PESA may sound simple, but the actual process is complex and demands diligent planning, rigid regulatory compliance, and powerful technical execution.

The money transfer app development project is divided into distinct phases that we will explain below:

Step 1: Market Research & Feasibility Study

Before you start with M-PESA app development, you should identify the users’ pain points they face with the transaction processing system.

Focus on creating a blueprint focusing on resolving them first. Also, target audience behavior check is essential to analyze to deliver personalized experiences.

Get deeper to scan top competitors to know their strengths, features, and gaps to do the trick expectedly.

This step also includes finalization of your app scope, whether it will offer agent cash-out, bill pay, P2P transfer, or merchant payments.

Remember to consult with financial regulators and determine required licensing needs.

Document both compliance and technical needs.

Step 2: UX/UI Design for M-PESA App Development

While you create your app design, craft user flows, embracing registration, sending/receiving money, wallet top-up, and more.

Next, create M-PESA wireframes and interactive prototypes. You need to prioritize simplicity, specifically for non-smartphone and low-literacy users.

Be set designing interfaces for agents, users, and admins.

Step 3. System Architecture & Tech Stack Planning

Define the required backend architecture, incorporating a wallet and ledger system, and a transaction engine that can track transactions and balances.

Go for the most suitable tech stack (which we will discuss in the next section).

Create a plan for Fintech APIs, integrations (SMS, KYC, USSD) and real-time processing with consistency and automation.

As M-PESA holds the disaster recovery and geo-redundancy trait, you should also focus on incorporating it.

Build a security model that involves access control, encryption, etc.

Step 4. Core Development: Wallet, Transfers, Agent System

In this app development phase, developers will create a user app, backend services, such as agent tools, transfers, and wallet logic, and build core wallet features for all the panels.

Step 5. Integration with Telcos, Banks & 3rd Parties

If you want to boost the functionality of your mobile money app, like M-Pesa, integrate third-party services like USSD/SMS (Telco integration), national ID, APIs, selfie checks (KYC/AML tools), bill pay APIs, merchant QR payments (payment partners), and float accounts and settlement engine (banking integration).

Step 6. Testing: Security, Load & Field Trials

Thorough testing is essential to ensure your M-Pesa-style app is reliable and secure.

So, conduct integration testing (end-to-end flow), unit testing (code-level), load/performance testing, and security testing (fraud checks, PIN security).

UAT (User Acceptance Testing) with real users and agents is also necessary.

Step 7: Deployment & Pilot Launch

Now, deploy your backend to a cloud environment ensuring optimal performance and with scalable infrastructure. For the pilot region, release mobile apps with USSD code.

You need to allow onboarding of a small group of agents for cash-in/out.

Don’t forget to monitor app transactions, uptime, float movement, and user feedback.

Step 8: Maintenance, Monitoring & Scaling

After your app deployment, check for anomalies, fraud, and failed transactions in real-time.

Frequently update your app with new services: savings, micro-loans, and merchant payments.

Besides, you should build tools for agent liquidity tracking and customer support.

And, expand the agent network, feature set, and geographic coverage once you find your app performing as expectedly with basic features.

Tech Stack to Build an M-PESA-like App

Creating a mobile money app, M-Pesa demands including the right tools and technologies that can make your app perform expectedly.

Below are the recommended Fintech tech stack you can consider in M-PESA app development.

| Category | Technology/Tools |

| Mobile App Development | Android: Kotlin / Java; iOS: Swift / Objective-C; Cross-platform: Flutter / React Native |

| Frontend (Web) | React.js / Angular / Vue.js |

| Backend Development | Node.js / Django / Spring Boot |

| APIs & Architecture | RESTful API / GraphQL |

| Database | Relational: PostgreSQL / MySQL; NoSQL: MongoDB / Redis |

| Security | Authentication: OAuth 2.0 / JWT; Encryption: TLS/SSL, AES-256; Compliance: PCI DSS, GDPR, AML/KYC |

| Real-Time Features | Socket.IO / Firebase Realtime DB |

| Payment Integration | Safaricom M-PESA API, MTN MoMo API, Stripe, Paystack, Flutterwave |

| KYC & Identity | Smile Identity, Onfido, Jumio |

| SMS & USSD | Twilio, Africa’s Talking, Infobip |

| Cloud Infrastructure | AWS / Google Cloud / Microsoft Azure |

| DevOps & Deployment | Docker, Kubernetes, Jenkins, GitHub Actions |

| Monitoring & Logging | Prometheus, ELK Stack, Datadog |

| Merchant Tools | QR Code APIs (ZXing), Web Portals, REST APIs |

| Agent Tools | Agent Web Panel & Float Balance Management Modules |

Cost to Build an App Like M-PESA

What’s the cost to build a fintech app?

Well, it depends on various factors, like features you include, regulatory environment, the right development team, design, platform, complexity, and more.

However, a rough cost estimate for a basic mobile payment or wallet app ranges between $50,000 – $100,000.

Talking about more advanced versions, it can make the M-PESA app development cost lie between $100,000 - $300,000+.

Estimated Cost to Build an app like M-PESA:

| Complexity Level | Estimated Cost (USD) |

| Basic / MVP | $50,000 – $100,000 |

| Mid‑Level | $100,000 – $300,000 |

| High / Full‑Scale | $250,000+ |

Connect with a Fintech app development company with your project requirements to know the exact cost.

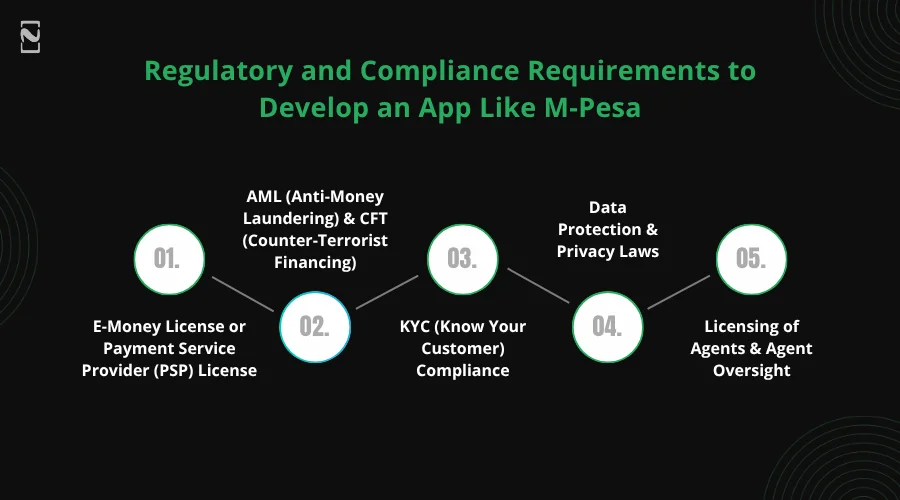

Regulatory and Compliance Requirements to Develop an App Like M-Pesa

1. E-Money License or Payment Service Provider (PSP) License

You need such a license from a financial regulator or the central bank of the target country.

Through this license, you can hold and handle digital wallets, allow peer-to-peer transfers, and offer agent-favored cash-in/out services.

Role: Authorize your app legally to store value, issue digital money, and process payments.

2. AML (Anti-Money Laundering) & CFT (Counter-Terrorist Financing)

You should implement real-time monitoring and reporting of all suspicious activity. Besides, set velocity checks, transaction limits, and monthly/daily caps.

Role: It stops terrorist financing and money laundering.

3. KYC (Know Your Customer) Compliance

For KYC in fintech apps, you must gather, verify, and store user ID information during onboarding.

Role: It prevents fraud and identity misuse.

4. Data Protection & Privacy Laws

While you look for security, comply with national and international data laws like GDPR, NDPR, and the Data Protection Act, according to your needs.

Role: Safeguards user data and keeps your app legally compliant with data laws.

5. Licensing of Agents & Agent Oversight

If you prioritize using an agent-based model, like M-PESA, agents will need to register, you should monitor their activity, and submit routine reports to regulators.

Role: If you are allowing agents for cash in/out, it helps in agent vetting and registration, reporting, float monitoring, and anti-fraud regulations.

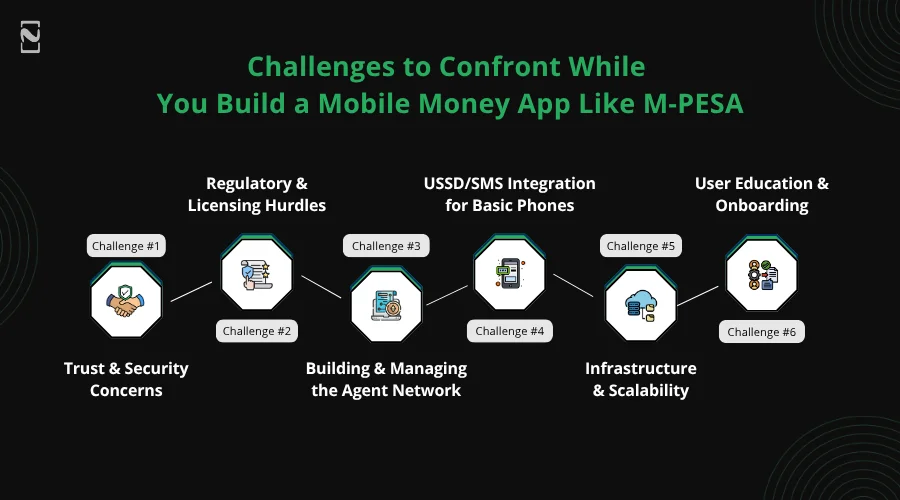

Challenges to Confront While You Build a Mobile Money App Like M-PESA

Building a mobile money app like M-PESA comes with possible challenges that you need to overcome across multiple dimensions.

Check the major ones below with solutions for your ease:

Challenge 1. Trust & Security Concerns

Users trust your app with their money, so there’s no scope for breach, as it can destroy credibility.

Threats that can block your way are phishing scams, SIM swap fraud, insider threats, and server compromise.

Solution: It’s better to implement end-to-end encryption, fraud detection systems, PIN or biometric access, and role-based access control.

Challenge 2. Regulatory & Licensing Hurdles

You may find it tough to adhere to the relevant compliance and regulations,

Solution: You must engage with regulators in the early stages and create your compliance framework in your product from the first day.

Challenge 3. Building & Managing the Agent Network

If you want to build an app like M-Pesa, you would need an agent’s network to manage cash-in/out.

But it may demand recruiting trusted agents, handling agent liquidity, preventing collusion or fraud, and tracking performance and commissions.

Solution: Create a robust agent dashboard and thoroughly train your agents.

Challenge 4. USSD/SMS Integration for Basic Phones

Well, if you want to reach every user, you will need SMS notifications, USSD menu flows, and transaction confirmations.

And, it needs extensive efforts as you need to integrate with telcos, which can be official and slow.

Solution: You must partner with telcos early and leverage the potential of platforms like Africa’s Talking to take care of USSD/SMS at scale.

Challenge 5. Infrastructure & Scalability

M-PESA holds the caliber to address millions of transactions every day.

Solution: Be sure you build a highly redundant and scalable backend to regulate transaction spikes, real-time balance reconciliation, and data backup.

Tip: Choose cloud-native tools like AWS/GCP and database sharding.

Challenge 6. User Education & Onboarding

Not all your target users might be tech-savvy. So, they may have a fear of trying digital money or may even fail to understand the app usage.

Solution: You can run awareness campaigns, collaborate with agents to guide users, and utilize voice prompts and local language support when required.

Why Choose Nimble AppGenie for a Fintech App Development, Like M-Pesa?

You may have technical skills that you can use to build an app like M-Pesa. But did you know that app development demands more than this?

Yes, app creation requires expertise, years of experience, problem-solving skills, adaptability, attention to detail, teamwork, effective communication, and more.

Well, don’t fret if you lack these essentials.

You should pick Nimble AppGenie, a trusted Fintech development company having a proven track record of making M-Pesa-like apps.

Key Highlights of Hiring Nimble AppGenie

- Global & proven project track record

- Tailored, end‑to‑end approach

- Regulatory & security readiness

- Fintech‑specific experience

- Flexible hiring & engagement model

Still in doubt?

Let’s go through a real-time case study of a successful fintech app development accomplished, offering custom fintech app development services to a global client.

Case Study: FinTech Mobile Wallet App for Emerging Market (client name is kept confidential)

Client Challenges:

- Need a scalable backend to attain quick user growth.

- Requires support for both smartphones and basic feature phones.

- Fragmented financial infrastructure.

- Lack of agent tools for float and transaction management.

- Ensuring KYC/AML compliance, security, and trust in a new market

Services We Offer:

- Mobile wallet app development

- Agent Management Module

- Backend architecture design

- Seamless bank and telco API integrations

- Security implementation

- Load & performance testing for scale-readiness

- Compliance integration

Results Delivered:

- 1M+ users onboarded within the first year

- MVP launched in 5 months

- Agent network deployed with full float management tools

- System uptime reached 99.98%

- Built a regulatory-compliant, secure digital money platform

Conclusion

Let’s conclude our guide, so building a digital wallet is about creating an ecosystem of accessibility, trust, and financial inclusion.

Success lies in aligning the right technology with local market requirements and compliance.

If you are looking for fintech development outsourcing, partner with an experienced app development company that brings power, scalability, and compliant solutions to life.

Ready to build a fintech app? Let’s talk.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.