Running a business has changed totally in recent years, and small businesses now depend on smart POS apps like Yoco to keep payments smooth and quick.

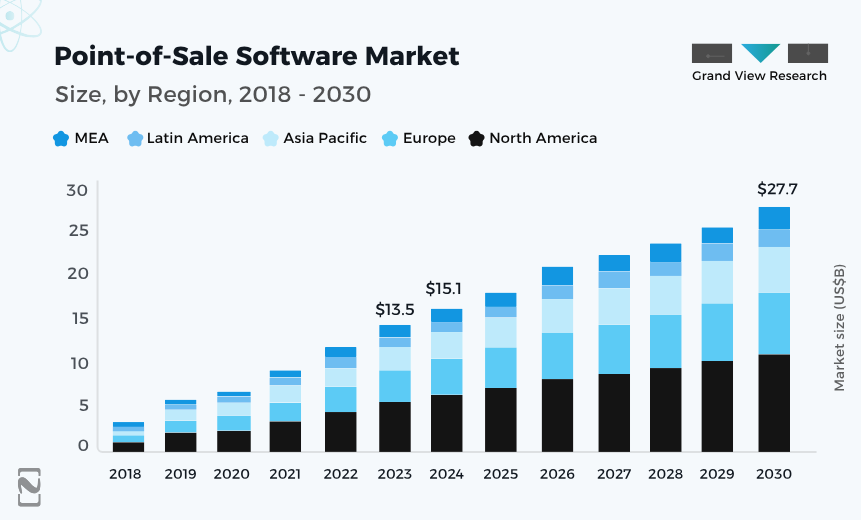

According to recent reports, the worldwide POS market is growing at a rate of 15% per year.

This shows how strongly businesses are shifting to digital payment platforms. That’s a huge opportunity for businesses planning to build a POS app that makes transactions really easy for both sellers and buyers.

If you are one of those who want to develop an app like Yoco, then now is the perfect time to help you become the next industry leader in the POS market.

But developing an app like Yoco is not just about accepting payments. It is about developing something outstanding that helps small businesses to manage sales, track inventory, and grow their business faster.

So, in this blog, we will be showing you how to develop a POS app like Yoco, along with what features to integrate and how much investment is required.

So, let’s begin!

Understanding Yoco: What Makes It Unique?

Yoco is a mobile POS app that allows small and mid-size businesses to manage their sales, accept payments, and track their finances.

With only a mobile app and a small card reader, they can easily use it for their business. It simply works with a credit and debit card, along with mobile payments.

They can easily track their business sales with the sales history feature and get insights with business reports.

Besides, they can also send, track, and handle invoices and payment links, and handle their business with ease from a mobile app.

It really makes selling easy and fast for small businesses, which helps them grow hassle-free.

The Yoco payment app has served around 200,000 small and mid-size business owners in South Africa.

Market Statistics of the Point of Sale System

The above graph shows that the market size of POS software is forecasted to reach $27.71 billion by 2030 with a CAGR of 10.8%.

However, if we look at a particular region, the USA alone POS market is projected to hit 17,389.0 million by 2032.

Also, South Africa alone generated revenue from the POS segment was $1,558.9 million in 2024 and is forecast to generate $2,479.6 million by 2030.

Moreover, the number of mobile app users in the POS mobile segment is projected to grow to around 19.26 million by 2030.

These figures show that there will be a huge demand for POS systems in the coming years.

So, if you are planning to develop a POS mobile app like Yoco, then now is the perfect time to invest in this industry and take your business to new heights.

Why Do Businesses Need a POS App Like Yoco?

Running a business today isn’t just about selling. It’s also about how you get paid.

So, what makes a POS payment app like Yoco so in demand?

Let’s have a look at the reasons below.

1. Accepting Card Payments is Easy

A POS application like Yoco allows businesses to take card payments from customers in an easier and faster way. With just a mobile phone and a Yoco-like device, they can easily accept payments.

This means businesses would not lose any money if the customers have cash. This type of app is perfect for small businesses that want to look professional and grow their revenue.

2. Keeps Track of Sales Automatically

With a Yoco-like app, businesses do not need to write down every sale or worry about counting cash at the end of the day.

The Point-of-Sale application records every type of transaction and shows how much you earn.

Besides, you can easily check sales on your mobile app anytime. This helps your business better plan ahead without requiring any paperwork or software.

3. Safe and Trusted for Business and Customers

Yoco made payments really safe and secure. Businesses do not have to worry about managing cash. Also, their customers feel safer using cards.

This type of Point-of-Sale app is really accepted by many businesses and comes with support if support is needed.

It also builds trust with customers, and they see businesses provide modern, reliable payment options, just like bigger stores.

Step-by-Step Process to Develop an App like Yoco

In this section, we will focus on the app development process for businesses.

Let’s have a look at the steps below to start a POS business and build a POS app like Yoco.

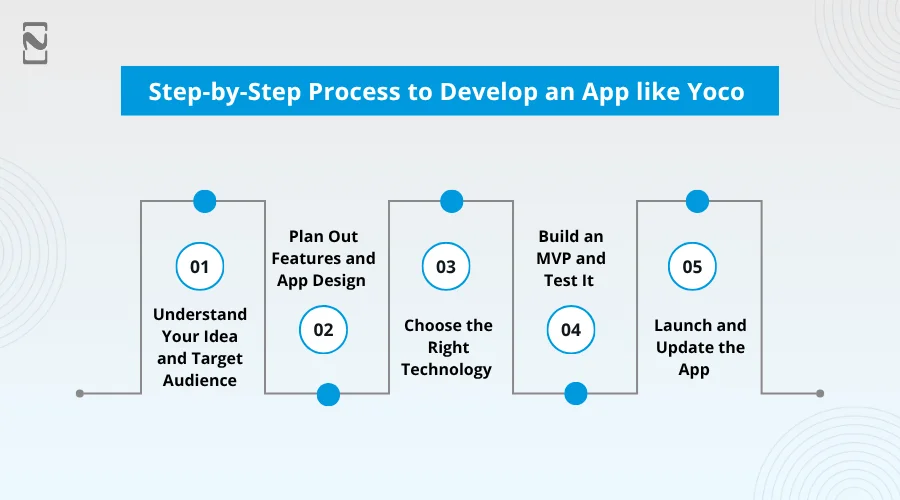

Step 1: Understand Your Idea and Target Audience

Before you develop an app like Yoco, get crystal clear on what your POS app will do and who it is for.

Yoco helps small businesses accept payments easily, so you should think about your target audience, their challenges, and what features make their lives easier.

Now sketch out your main idea, and note down must-have features like payment processing, payment dashboard, sales tracking, and so on.

Knowing your potential audience makes sure that an app like Yoco solves real issues and makes it something they actually want to use.

Step 2: Plan Out Features and App Design

No, turn your idea into a clear plan. You can list all the features your Point-of-Sale app like Yoco will need.

For example, secure payments, user accounts, transaction history, and so on. Once you define the must-have and nice-to-have features, you can focus on fintech app design.

You should keep it simple and visually appealing so users may know how to use it without a manual.

Now, create a mobile app wireframe or rough sketches of layouts that show how screens will look. A visually appealing and beautifully designed payment app where users can expect safety.

Step 3: Choose the Right Technology

After designing a Point-of-Sale app, you can choose the right technology for your POS payment app like Yoco.

For something similar to Yoco, you will need a mobile-friendly platform, a strong backend for payments, and secure databases.

Just decide if you want a native for iOS, Android, or a cross-platform solution.

You can integrate payment gateways and ensure security measures like encryption are in place. Choosing the right technology makes your app faster, reliable, and scalable.

Step 4: Build an MVP and Test It

This is where you begin the actual process to develop an app like Yoco. Mobile app developers will write code for the app’s frontend and backend.

But do not try to make your app fully-featured from day one.

You should build an MVP app that has must-have features. It really helps to test your unique app idea with real-time users and collect their feedback.

Their feedback will guide your next moves. This way, you can learn fast and make the necessary changes.

Just make sure your payment app works for people before spending time on extra features.

Step 5: Launch and Update the App

After testing and modifying the app like Yoco, you can launch your POS payment app to a wider audience. You can pay close attention to how users are using it and where they face issues.

Also, encourage feedback, and fix bugs really fast. Gradually, you can integrate advanced features based on what users really want and not what they think they need.

Also, you can update and improve the POS payment application, which can build trust over time.

A successful application grows with its users, solving their issues better with every update, just like Yoco does for small businesses.

Must-have Features to Add in a POS Payment App like Yoco

Now that you have a clear understanding of the process to develop an app like Yoco. It is vital to carefully select the right fintech app features for your app.

So, here are the must-have features that you must take into consideration for a Yoco-like app.

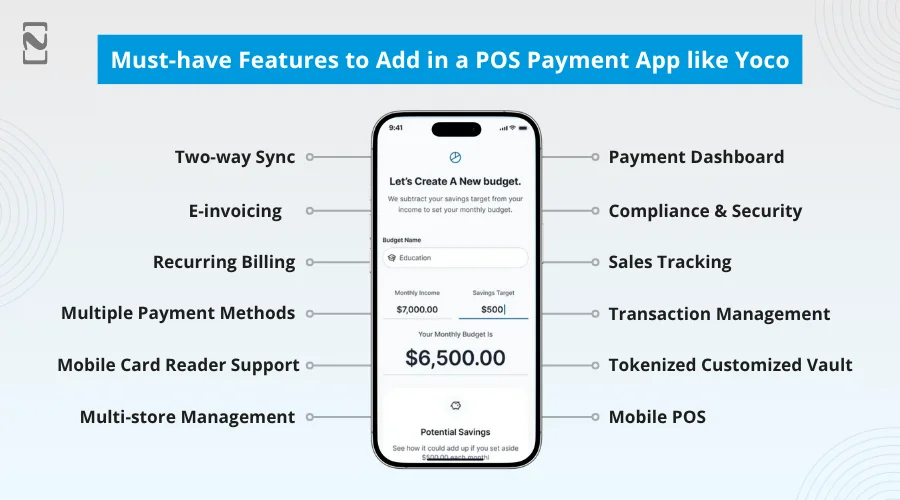

Two-way Sync

No one likes updating data in multiple places, right? With two-way sync, any change you make in the application, like adding products or updating prices, automatically reflects everywhere in real time.

This feature keeps everything perfectly in sync without any extra effort.

Payment Dashboard

You can think of the payment dashboard as your app’s control center. It shows your daily, weekly, or monthly sales, top-selling products, and total earnings in one clean view.

You always know exactly how your business is performing.

E-invoicing

When you develop an app like Yoco, you should integrate an e-invoicing feature into it.

This feature allows businesses to send smart digital invoices to customers within seconds.

It looks professional, saves time, and keeps every payment record neatly organized for easy tracking.

Compliance and Security

When money is involved, security comes first. This feature ensures that your POS app, like Yoco, follows all payment fintech laws and regulations and uses top-grade protection to keep every transaction safe from fraud.

Recurring Billing

This feature is perfect for subscription-based businesses that automatically charge customers on fixed dates.

No matter if it is a gym membership or a monthly service, payments happen on time without any manual reminders.

Sales Tracking

This feature helps business owners to see what is selling and what is not.

Every sale is recorded in real time, which makes it really easy to find trends, plan offers, and grow smarter.

Multiple Payment Methods

You should integrate a payment gateway feature that allows customers to pay however they want. For example, cards, UPI, wallets, or bank transfers.

The more options they have, the smoother their checkout experience becomes.

Transaction Management

With this Point-of-Sale feature, businesses can easily manage all the transactions, like successful, pending, or failed, through a mobile app like Yoco.

It helps in staying transparent, fixing payment issues fast, and keeping customers happy.

Mobile Card Reader Support

Your POS payment app like Yoco, can connect with a mobile card reader, so payments can be accepted anywhere.

For example, in-store, at events, or even on the move. It is quick, reliable, and super convenient.

Tokenized Customized Vault

Your customer’s card and payment details are stored securely using mobile app security technology for end-to-end encryption.

This means faster future payments and zero worries about data security.

Multi-Store Management

If a business has more than one branch, this feature makes life really easy. Owners can monitor sales, staff, and stock from all stores in a single dashboard.

Mobile POS

Turn any mobile phone into a billing system. With a mobile POS, businesses can accept payments, generate receipts, and manage sales right from their mobile phone.

You do not need to require bulky machines.

How Much Does it Cost to Build an App like Yoco?

If you are thinking about developing a point-of-sale payment app like Yoco, you should know it is not a small project.

It takes intuitive design, reliable mobile payment technology, and lots of testing to ensure payments are seamless and secure.

On average, the cost to develop an app like Yoco can range anywhere between $25,000-$200,000. It is totally dependent on how detailed you want it to be.

The basic version with must-have features will obviously cost less. But if you develop a highly advanced payment app with Point-of-Sale features, then the cost to build a fintech app will require a huge budget.

Yes, it is a good amount of money for the Yoco app development project, but once it is developed correctly, it can manage thousands of transactions daily and become a stable source of income.

How to Monetize Your POS Payment App like Yoco?

To monetize your POS payment application like Yoco, you have to follow the crucial monetization strategies that Yoco and other apps have followed.

Below are a few app monetization models that can help you earn huge revenue.

1. Small Transaction Fees

You can earn huge revenue from every payment your customers process. Instead of charging big monthly fees, keep it light.

You can take a small amount or a percentage of the fee from each transaction.

It really feels easy on the pocket for small businesses, and when more people use your app like Yoco, it adds up to a steady income stream for you.

2. Premium Subscription Plans

You can provide a free version of your POS app for basic use and a paid plan with extra perks. For example, advanced sales analytics, custom invoices, and priority support.

This way, small merchants can start free and upgrade when their business grows. It is a win-win situation. As they scale smoothly and you earn recurring revenue.

3. Hardware Integration

Another way to earn money from your POS app like Yoco, is hardware integration.

You can sell or rent card machines, receipt printers, or barcode scanners that sync perfectly with your app like Yoco.

People love convenience, and when everything connects easily, they will happily pay for it. You are not just providing software, you are giving a full business solution.

Why Choose Nimble AppGenie for Developing an App like Yoco?

Choosing Nimble AppGenie to develop an app like Yoco is more than just hiring a team. It is about partnering with a company that genuinely cares about your idea.

Being a leading fintech app development company, we take time to understand what you want and turn it into a mobile app that can handle real business growth.

Our expert developers do not rush the process. We focus on creating a smooth user experience that makes your point-of-sale app stand out.

What clients really appreciate is the honesty, clear updates, and ability to deliver what is promised on time.

We have already developed successful payment and fintech mobile applications, so we know how to handle challenges and make things work flawlessly.

At Nimble AppGenie, you do not just get an app developed. You get a trusted partner who helps you shape a brand that users will trust.

Final Thoughts

Now that you know what it takes to develop an app like Yoco, it is time to put your idea into action.

A beautifully developed POS app can do more than just process payments. It can help businesses run smoothly, grow faster, and build stronger customer trust.

All you need is the right tech team and a clear vision. Consulting with an experienced mobile app development company can turn your dream concept into a secure and visually appealing POS platform that stands out in the market.

FAQs

To develop a point-of-sale payment app like Yoco, follow the steps below:

- Know your audience and goal

- Plan out the main features

- Choose the right tech stack

- Design the user interface

- Build an MVP app

- Test and launch the app

You can integrate the following features into your payment app like Yoco:

- Sales tracking

- Mobile card reader

- Tokenized custom vault

- Transaction management

- Two-way sync

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.