In a Nutshell:

- Mobile banking has become an everyday essential for a modern-day user. More than 70% of Gen Z opt for mobile banking as their primary banking interface.

- Open banking APIs, Agentic AI, and Behavioral Biometrics are some of the most prominent trends seen in the latest mobile banking apps.

- The focus of banking has certainly shifted towards green banking, which focuses more on sustainability.

The 21st century is dominated by smartphones, fundamentally changing the way we interact with shopping, travel, and personal finance. Mobile banking apps are no longer just a convenience; they are the primary digital financial interface for the modern consumer.

As user demands shift towards automation and personalized experiences, the concept of “invisible” banking is becoming more and more prominent, and the landscape is evolving.

While there was a time when having an app that showed the user their account balance in real-time was cutting-edge, staying ahead in today’s market means understanding the Generative AI and Agentic AI uses in the banking industry.

If you are planning to enter the digital banking market with an app of your own, then this post is certainly for you. In this one, let us take a look at some of the rising mobile banking trends that can help you be at the top of the market.

So without further ado, let’s start by understanding the current market status, and then move on to the top mobile banking trends that you should be aware of in 2026.

The State of Mobile Banking in 2026

Mobile banking has certainly boomed in the past decade. The rise of smartphones and highly connected devices has made it easier for users to stay in touch with their banks, 24×7.

While 89% of consumers use mobile banking, physical branches are evolving into “Trust Anchors” for complex consultations, while daily transactions have moved almost entirely to mobile.

The rise of Agentic AI is the most transformative trend, shifting apps from passive tools to active financial assistants that manage wealth autonomously.

Modern apps use a combination of biometric authentication (face/fingerprint) and behavioral analytics to ensure that even if a device is stolen, the account remains inaccessible to unauthorized users.

So, it is no wonder that:

- Young adults are leading the charge in mobile banking adoption, with nearly three-quarters (74.1%) of those aged 15-24 using their phone as their primary way to manage their finances.

- This trend extends beyond just one generation; a whopping 97% of Millennials and an impressive 89% of all consumers rely on mobile banking apps.

- The preference for mobile is clear – six out of ten mobile users choose apps over websites for their banking needs.

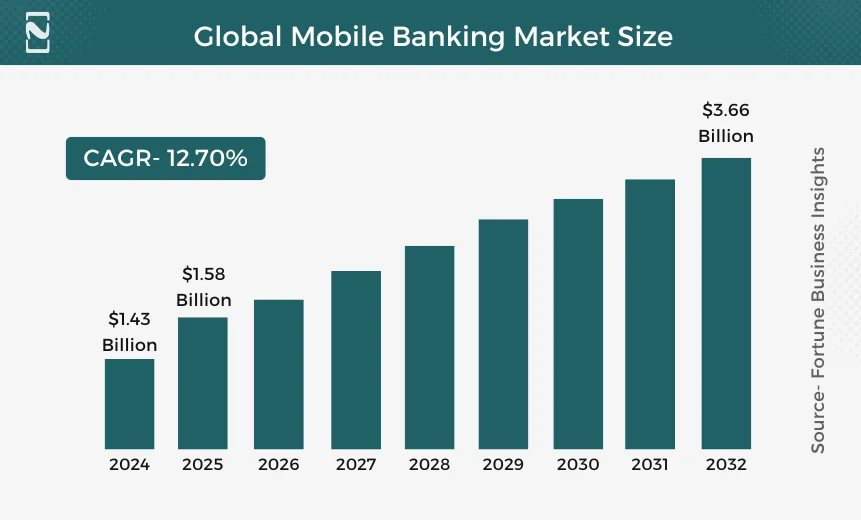

- The global mobile banking market is projected to reach $3.66 billion by 2032, growing at a CAGR of 12.70%.

- Hyper-personalization can increase banking revenue by up to 15% by reducing churn and improving cross-selling.

- And nearly everyone, around 90%, uses their app to check account balances.

- Businesses that personalize their mobile banking apps can potentially increase revenue by 15%, making it a win-win for both banks and their customers.

With these brief mobile banking statistics, it is clear that mobile payment technology, especially banking, is taking centre stage.

With each passing day, technological advancements are at the forefront of the digital revolution for banking apps, meaning the market still has potential and is likely to undergo further transformation.

Let’s look at those trends that will be responsible for the change.

Top Mobile Banking Trends for 2026

When we talk about banking apps, the first few things that come to mind are your account management features and additional accessibility features like loan applications, transfers, banking statements, etc.

2025 played a pivotal role in changing what to expect from a banking app as it introduced advanced features like chatbots and AI-powered personalization.

However, solutions that only stick to these features have slowly turned obsolete. In 2026, the modern mobile banking trends focus more on creating a personalized experience that redefines the way people interact with mobile banking apps.

1] The Shift to Agentic AI

While basic AI handled chatbots, Agentic AI now acts on the user’s behalf. These apps don’t just recommend investments; they can execute trades based on pre-set risk tolerances or automatically move funds to high-yield accounts to beat inflation.

This means that while the chatbots were only returning the solutions to user queries, Agentic AI takes it a step further and can take action when required, and as directed by the user.

The idea of implementing Agentic AI takes automation to a whole new level, as the AI can learn through user behaviour and ensure that it takes the right action when required.

From the user’s perspective, it is like having an intelligent AI assistant managing their banking services for them, as they direct it to do.

2] Biometric & Behavioral Authentication

With financial institutions remaining a top target for data breaches, security has moved beyond fingerprints.

Mobile banking is one of the most prominent targets when it comes to cyber attacks. Hence, the focus is certainly on enhancing the security practices.

Behavioral biometrics-analyzing typing rhythm and gait—provides a continuous layer of “invisible” security without interrupting the user experience.

While the past few years have been quite effective in improving security, the latest biometric technology and behavioural authentication can take the level of security further, making it ironclad.

3] Blockchain & Central Bank Digital Currencies (CBDCs)

Blockchain has been around the fintech realm since its inception. While in the early years, it was only associated with crypto transactions and digital currencies.

However, with the advent of CBDCs and international transactions, blockchain is the new enabler of secure and reliable transactions.

Leading apps like Revolut have integrated blockchain for near-instant cross-border settlements. In 2026, we might see more apps preparing for CBDC integration, allowing for programmable money and faster government-to-citizen payments.

With the help of blockchain and CBDCs, the new focus is on bringing international transactions up to the speed of regular transactions, i,e., making them real-time and instant.

4] Financial “Edutainment” & Gamification

Several banking solutions have already seen results with the integration of educational content in their mobile banking apps.

The gamification of banking services generally refers to adding goals and daily activities to give your user an interactive reason to return to the app every day.

Traditional banking is often perceived as “dry.” To combat this, apps are using Edutainment (like Chime’s partnership with Zogo) to reward users for completing financial literacy modules.

This “Edutainment” model increases daily active users (DAU) by making savings feel like a game.

5] Green Banking & ESG Tracking

The carbon footprint of banking services is one of the core reasons why digitization makes so much sense, with the focus on sustainability and more convenience for the users.

Modern mobile banking solutions are more aware and focus on Environmental, Social, and Governance aspects, ensuring that all the necessary regulations are met.

Sustainability is now a core feature. Modern apps include Carbon Footprint Trackers that estimate the environmental impact of every purchase, nudging users toward eco-friendly brands and offering “Green Loans” for renewable energy projects.

6] Smart Bots & Conversational UI

Gone are the days when you had to go through multiple features just to find the feature you want to use.

Thanks to integrated smart bots and conversational interfaces, which allow users to simply speak up and tell the app what they want to be done.

The “menu-heavy” app is dying. Conversational UI allows users to perform complex tasks—like “dispute my last Starbucks charge”-through a single voice or text prompt.

The modern conversational UI not only simplifies the experience of the user but also helps you as a service provider to reduce your expenses. The 24/7 support reduces operational costs by up to 30%.

7] Cardless ATM Access

2026 is definitely going to be a year of improved user security and mobile banking experiences.

Cardless transactions have already taken over in the past few years, with mobile wallets and NFC payments replacing traditional cards.

The latest trends in mobile banking now suggest the same, as we might omit the use of physical debit and ATM cards in the upcoming years. The physical debit card is becoming a secondary backup.

Using NFC and QR code technology, users can withdraw cash simply by tapping their phone at an ATM, significantly reducing the risk of “skimming” fraud.

8] The Rise of Neobanks & “Super Apps”

Neobanks are a concept that has emerged to new heights in the past few years, and in 2026, they are all ready to take over the mobile banking experience of users.

These banks are digital-first and ditch the traditional physical branches. However, that is not the only reason why they are more appealing to the users.

You see, Neobanks are winning by offering “Super App” ecosystems.

These platforms integrate banking, insurance, and even travel booking into one interface, eliminating the need for multiple financial apps.

Fintech superapps, especially neobanks in general, are one of the fastest-growing solutions and are certainly a rising mobile banking trend in 2026.

Related Read: Neobank vs Digital Banks

9] Hyper-Personalized User Journeys

Understanding user-behaviour and usage patterns is something that is going to change completely.

While the early personalization referred to rearranging the app interface according to the user’s preferences, today it has turned into understanding what the user might require next and aligning the services accordingly.

The best example of a hyper-personalized user journey is that, using Big Data, banks now offer “Predictive Liquidity” alerts.

If an app predicts a user will overdraw based on upcoming bills and spending patterns, it can offer a micro-loan or an automated transfer before the overdraft occurs.

10] Open Banking & API Ecosystems

Open Banking allows your app to “talk” to your other financial tools.

This creates a 360-degree view of the finances for the user, giving them a clear view of their net worth, consolidating data from mortgage lenders, crypto wallets, and traditional accounts into a single dashboard.

With modern payment solutions and neobanking apps leveraging open banking APIs, it is only fair for banking apps to be open to the idea of collaborating with modern solutions.

And 2026 is definitely the year when top mobile banking apps will break away from traditional banking and move towards an open-banking model, in one way or another!

The trends clearly indicate the direction in which mobile banking is evolving. While the initiative is more focused on automation and simplifying the user experience, 2026 is all set to redefine the way mobile banking works.

Hence, being in the field of mobile banking will need you to upgrade your user experience along with the features that users are looking for. If you are wondering who can help you leverage these mobile banking trends, then check out the next section.

How Nimble AppGenie Can Help to Leverage Top Mobile Banking App Trends

With all these trends, you can easily identify the potential of the mobile banking industry and how it is all set to grow larger than ever before. To ensure that you are in the front seat when these trends take over, we highly recommend that you opt for solid banking app development services by Nimble AppGenie.

With years of experience and a solid banking app development portfolio, they are the best partners to have for mobile banking solutions. The app developers are highly skilled and have hands-on expertise in integrating the latest technologies and AI-based solutions into any app, making it future-ready!

Reach out today and start your journey towards a better mobile banking experience, leveraging the latest trends.

Conclusion

Mobile banking trends are ever-changing, and it is as important to leverage these changes in order to grow in the current competitive landscape.

Be it the introduction of agentic AI solutions or advanced biometric technology, all of it is not just a feature anymore. These have become an integral part of any mobile banking solution.

The easiest way to make your banking app stand out from the competition is to ensure that you have implemented all the necessary features, leveraging the trends that are helpful to your users.

However, you must also keep in mind that not all the trends are to be integrated in a single solution, as it can be overwhelming for your customers. Hence, consulting with an experienced mobile banking app development company is the right choice for your business.

With that said, we have reached the end of this post. In case you have further questions, feel free to reach out to our experts. Thanks for reading, good luck!

FAQs

AI offers personalized financial experiences. By analyzing your financial data, the app can recommend budgeting strategies, suggest investment opportunities aligned with your risk tolerance, and even predict future spending patterns.

Biometrics like fingerprint or facial recognition add an extra layer of security compared to traditional passwords. This makes unauthorized access to your mobile banking app significantly more difficult.

Gamification uses game-like elements like points, badges, and leaderboards to make financial activities more engaging. This encourages users to participate in healthy financial habits like saving and budgeting.

Open banking APIs allow secure data sharing between financial institutions and third-party apps. This enables features like personalized financial guidance and the aggregation of your financial data from different accounts into a single view.

By analyzing vast amounts of user data, mobile banking apps can predict future trends, offer targeted financial products, and deliver more relevant information. This empowers you to make informed financial decisions.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.