User retention and engagement are the backbone of the rising mobile app economy.

The days are behind us when people were only looking for an app that gets the job done.

Today, people are using apps that are more engaging and simplify their lives with a clear and interactive user experience.

And that is where the concept of Fintech Gamification comes in. Adding an extra layer of interactivity in the form of reward animations, games, and progress bars, the gamification of an app simplifies a user’s journey through the app, making them come back every time they want to use a service associated with your app.

While social media and music streaming apps already have a lot of gamification built into them, fintech apps often remain bland.

Well, not anymore, as modern fintech apps use gamification to add more depth to the features and user experience.

But what is the role of Fintech Gamification? How exactly does gamification help in boosting the engagement of a fintech app?

Well, these are some questions, along with others, that we are going to answer by the end of this post.

So if you have a fintech app and want to understand the role of Fintech Gamification, make sure you read this one till the end.

What is Gamification in Fintech?

Before we begin with gamification in fintech, let’s take a brief look at the concept of gamification in general.

As the name suggests, gamification refers to the conversion of regular features into a more interactive, game-like experience that brings all the features to life.

The idea is to create a unique, user-friendly way of offering features that may not be the most interactive part of your app.

The concept is generally used with apps for social media, games, and other entertainment-oriented solutions that must garner user attention.

When it comes to gamification in fintech, the use of game-like features can help convey insights and add features that enhance application retention.

Gamification of fintech apps is effective when game design principles are applied in a fintech app environment, encouraging users to engage in money management and develop healthy financial habits.

Another important thing that the gamification of a fintech app can help you with is building user loyalty.

You see, when we talk about fintech apps, we think of complex tasks like keeping track of expenses, checking usage of the funds, learning how to invest, and checking if you have made profits or losses.

All these tasks are crucial for any individual, but these are not the most interactive or engaging ones.

Fintech Gamification makes these features more interesting for a user and makes it easier for a user to develop a habit.

Gamification and fintech apps often seem like two different things; however, when they come together, they certainly create a user experience that is worth investing in.

How Gamification in Fintech Works? Common Features

So, how is gamification in fintech implemented?

Well, the first step is to break down the fintech app processes and identify exactly which one of them can benefit the most from gamification.

You see, changing the entire app is not the right approach, as financial services are a serious affair for the users. Hence, finding the right balance is necessary.

These processes can be anything that you want your user to interact with regularly.

For instance, tracking the savings, freebies that your app offers, milestones that you have classified in your app, etc.

After you have identified the process from your fintech app to gamify, it is time to choose the right gamification techniques and features.

Several common Fintech Gamification features used in fintech can boost your app’s user experience. Let’s take a look at them below:

1] Points and Badges

The first and most common way to add gamification to your fintech application is by introducing interactive points and badges.

Give your users a reason to stay and return to your app by offering them points and badges for achieving a certain milestone on your app.

This gets the user excited to open your app regularly for that particular process that fetches them points or gives them a certain badge.

These gamification features work best for fintech apps that offer budgeting and other money management features.

The best example for this can be a BNPL solution that adds points to your account every time you use it to make a payment.

2] Progress Bars and Levels

This technique of gamification in fintech apps is a popular choice, especially in applications that push a user to develop a habit and get things done every day.

Progress bars help in creating positive reinforcement, allowing the user to identify how far they have progressed from when they started.

Once a progress bar is completed, a new level can be unlocked, giving users a sense of accomplishment.

The best example of this can be a lending app that generates a credit limit in tiers, allowing users to unlock new levels, new limits after they have used the previous limit and repaid it.

The repayment can be traced through a progress bar, which motivates users and keeps them in the loop about how much funding is yet to be paid and how much they have already paid.

3] Challenges & Streaks

To keep your users coming back to your fintech app every day, you can introduce different challenges and Streaks.

These features make the entire experience competitive for the user and their friends, bringing a community together.

Think about it, your fintech app challenges you to log in every day for 30 days straight to read the investment tip for the day?

Now that’s an interactive way. Creating regular challenges, like meeting a savings goal, adding an amount of money to your account for a week, converting your investments into profits, etc., are some of the best examples of adding gamification to your fintech application.

4] Leaderboard & Community Interaction

Talking about challenges and streaks brings us to another interesting gamification feature that fintech apps can use: leaderboards and social sharing.

Allowing users to socially share every achievement that users have made on the app can push them to be more excited to use the application.

It just brings a sense of healthy competition and gives users a reason to talk about your app among themselves.

It is also a great way to create a community for your fintech app, which can prove to be an effective strategy in the long run.

The leaderboard can be associated with a user’s budgeting skills, savings, and investment portfolio, and several other features of a fintech app, making it a perfect way to give your fintech app a gamified user experience.

Other than these, minor features like adding a scratch card to reveal a reward, animated pop-ups, adding a mascot for the app as your chatbot, etc., make the fintech app more engaging.

Gamification features that generally feel they do not belong to fintech apps can often give you the best results in improving your app’s engagement rate.

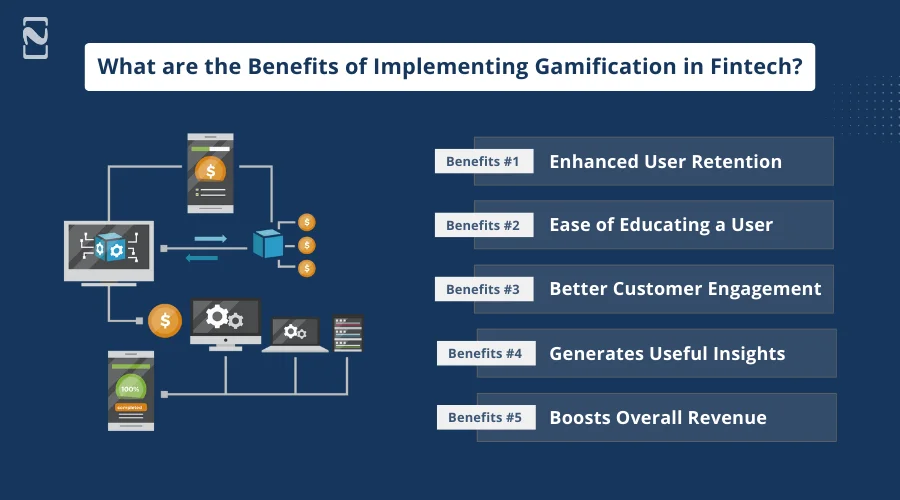

What are the Benefits of Implementing Gamification in Fintech?

Implementing the features shared above may add to the cost of developing a fintech app; however, it is certainly a great decision for the app.

How? Well, gamification in fintech fetches several benefits.

What are these benefits? Let’s explore!

-

Enhanced User Retention

A user on any app is looking for things that they can interact with. Fintech apps usually lack in capturing the attention of the users, as people only use the application to get over with a transaction, or check something.

With the help of gamification features, you can add a way to catch the attention of users and make them stay on your app for longer.

-

Ease of Educating a User

Gamification plays a massive role in educating new users. With animations and added badges, the app can easily garner attention and encourage users to finish their learning diligently.

People using fintech apps are often hesitant, especially first-time users, as not everyone is well-versed with how these services work.

With the help of gamification, all the necessary information can be conveyed directly.

-

Better Customer Engagement

People from all walks of life use a fintech app. To keep them all engaged and make the entire experience more enjoyable, gamification in fintech is a must-have.

Gamification features, as mentioned in the previous section, make it interesting for the users. So much so that they look forward to using a fintech app, which is definitely a game-changer from a fintech app’s point of view.

-

Generates Useful Insights

As a financial service provider, data can be the biggest strength for your business growth.

Adding gamified features helps you engage the users better, which further helps you translate user choices and preferences into data that further helps you identify user patterns.

These insights can be used to introduce new features and add solutions.

-

Boosts Overall Revenue

With users spending more time on your app, your overall revenue increases significantly. With more users pouring in regularly, the app automatically gets its due and goes beyond its existing reach.

Fintech Gamification features that attract a user to use the app regularly, or help them share their progress online, are definitely the best choice for fintech apps.

Other than these, the application also allows you to help implement positive reinforcement for your users, giving them a sense of accomplishment.

These benefits do not end here, as the implementation of gamification in fintech also eliminates the chances of confusion for users in identifying the status of a requested service, making the user experience effective and simpler.

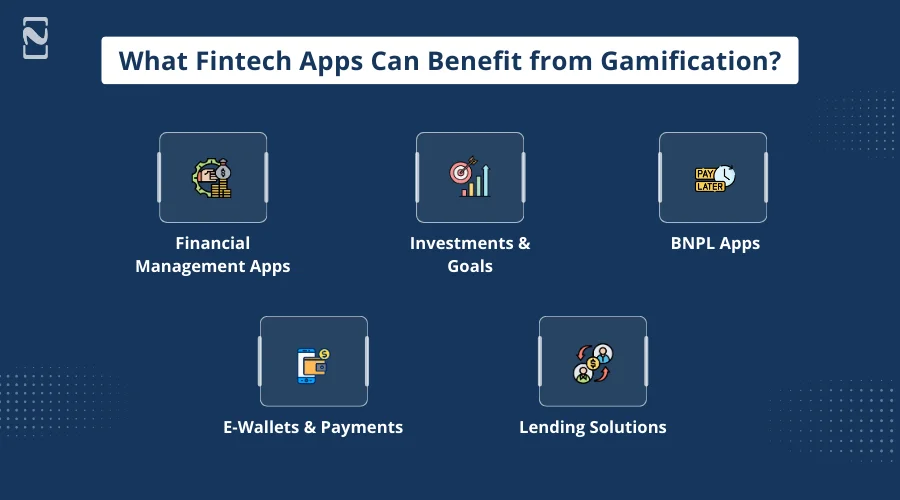

What Fintech Apps Can Benefit from Gamification?

Fintech is an umbrella term that is used to describe the combination of financial services with technology.

When we talk about gamification in fintech, it is more about combining gaming mechanics into financial services.

However, over the years, fintech has unfolded into several different categories. From banking to investments, you name it, and an app already exists for the same.

And while all the apps fall under fintech, it is not necessary that all of them can benefit from gamification.

So what kind of fintech apps can benefit from gamification? Here’s the list!

► Financial Management Apps

Mobile apps that offer financial management tools, such as your budgeting apps, interest calculators, EMI calculators, return on investment calculators, savings tracker, and more, can easily use gamification to make the experience of the user more impactful.

Implementing gamification in financial management apps can be highly beneficial.

► Investments & Goals

Another type of fintech app that can make the most of gamification features is the apps that offer investment features and help a user set financial goals and achieve them.

When a user is already motivated to save their funds and use them the right way, adding educational tips and progress bars can boost the fintech app experience significantly, making it more user-friendly and attractive.

► BNPL Apps

Buy Now Pay Later apps have emerged as an interesting concept and have taken the entire fintech world by storm.

Gamification enhances a user’s overall journey when using a BNPL app, from finding the right deals to reminders of the payments.

Gamification in BNPL can be added to all of them, making it more and more interactive.

► E-Wallets & Payments

Gamification in e-wallets makes it possible for the user to keep track of their expenses and payments easily.

Monthly spends, payment rewards, and much more can be integrated into an e-wallet with the help of gamification.

Payments can be shared instantly, and bills can be split and shared with the respective user, too.

► Lending Solutions

From unlocking new loan offers to finding exciting ways to track the repayment status, gamification in a lending app is certainly a hit for the users.

It is certainly helpful for P2P lending apps, as they are more user-oriented and need users to interact and understand how the app works clearly.

Gamification has become an integral part of development, and it really shows in the stats, too.

In the current market, 6 out of every 10 fintech apps are using an element of gamification, which clearly shows how impactful it is.

Who Can Help in Implementing Gamification in Fintech?

After understanding the impact of gamification in fintech apps and how these can give your boring fintech apps a new life, you might have gotten interested in implementing gamification.

If so, Nimble AppGenie is the perfect solution.

With 8+ years of experience and a team of highly qualified developers, Nimble AppGenie is a top fintech app development company that can help you develop fintech apps that are gamification-ready and can take your business to new heights.

All our developers are well-equipped to handle your gamification in fintech requests.

All you have to do is reach out to the experts by filling out a form and waiting for the consultation call.

Share your idea with the experts and voila! They start working on a proposal to give you a sneak peek into what the course of action will be.

Don’t worry, they do not share your idea with anyone else, as we are happy to sign an NDA with you, if needed.

So what’s stopping you from leveraging gamification? Connect today!

Conclusion

Fintech apps are all over the world and still evolving faster than any other field.

Gamification in fintech is not just a trend anymore; it is the need of the hour, and with almost every sector of financial services being able to capitalise on gamification, it only makes sense that you, too, start working on the same.

Gamification in fintech brings along several benefits and can be easily implemented with the help of professionals. With that said, we have reached the end of the post.

Hope you might have gained insights on the role of gamification in fintech and how it can easily make your financial app more effective.

Thanks for reading. Good luck!

FAQs

Adding game mechanics to financial technology apps is referred to as gamification in fintech apps. It allows the user to engage with the fintech service in a fun and interactive way.

The idea is to make financial services more accessible and fun to use for all age groups, without hampering the quality and efficiency of the service.

Yes, though the app might require a complete revamp, you can actually add gamification features to an existing fintech app with the help of a professional development service.

Gamified features generally fall under the category of a complex development process. This means it is definitely on the higher end of the cost spectrum.

In general, a fintech app with gamification can be developed in the price range of $50,000 to $150,000, depending on different factors such as your choice and the extent of gamification required.

It is definitely a part of the development process nowadays; however, people generally are not aware of these features and gamification as a concept. This is also the reason why people often think of it as an add-on to your app.

Another reason why it may seem like an extra step is that one can easily develop a fintech app without adding gamification. Since there is a slightly cheaper alternative available, gamification is termed as an add-on.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.