Insurance applications have been around for a while now. People looking to invest in the insurance market and take their business online are surely considering building their applications.

However, one of the key questions that keeps bugging them is what would it cost to develop an insurance app in 2026? Well, this post will answer it for you!

In this post, let us take a look at every aspect of development that defines its cost. We will also take a closer look at the factors that affect this cost, as well as what are some smart ways to optimize it.

With that said, let’s get started by understanding more about the current insurance app market.

Overview of the Insurance App Market

The insurance app market has always been a growing one. This is because people are becoming more and more aware of the power of insurance and hence are always on the lookout for the best deals.

If we talk about the insurance app market, it has seen immense growth over the years, making it more and more prominent and relevant for users and opening new doors for businesses working in the fintech industry.

The digitization of insurance has surely made it more accessible to a wider audience, allowing Gen Z to take more interest.

This raises the demand for insurance services, making it a lucrative field for investors and entrepreneurs.

The market size as of 2025 is set at $11.25 billion, and the market size is expected to reach $42.31 billion by 2030 with a CAGR of 30.34%.

In this post, let us take a deeper dive into development and understand the costs associated with the process.

We will also try to answer all the questions related to development and how you can.

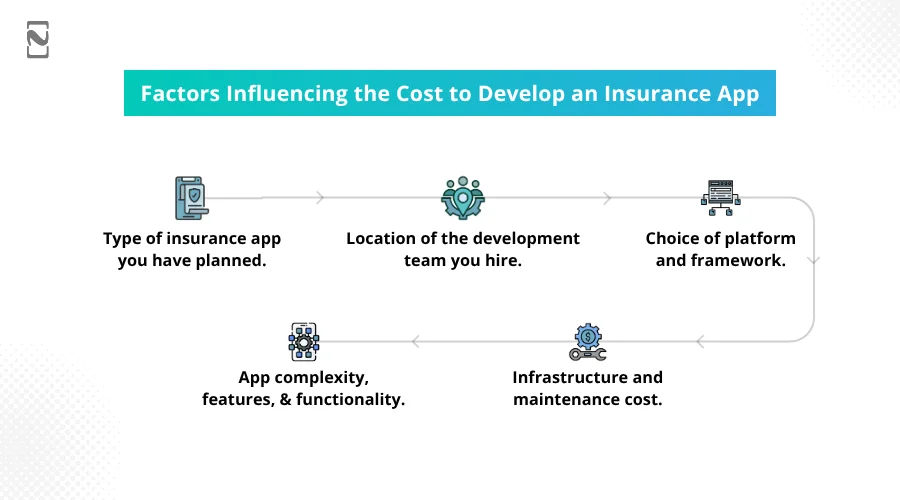

Factors Influencing the Cost to Develop an Insurance App

When talking about the cost of developing an insurance app, you should keep the following factors in mind.

Building your own digital insurance platform or an insurance app can surely help you grow as a business, thanks to the growth in Insurtech that allows the creation of insurance solutions supported by technology for a continued growth trajectory.

While technology has certainly made it easier for the insurance business to thrive, it is not that easy.

If you are planning to take advantage of this growing field of business, you should be aware of the different factors that affect the cost of developing an insurtech app.

These factors include:

- Type of insurance app you have planned.

- Location of the app development team you hire.

- Choice of platform and framework.

- App complexity, features, & functionality.

- Infrastructure and maintenance costs.

The cost of developing an insurance app revolves around the tech you choose, the domain you plan, and the team of experts you hire.

All of these decisions define the course of development, along with how much it is going to cost.

The most crucial decision among all these factors is finding the right guidance and development partners.

Types of Insurance App (Health, Auto, Life, etc.)

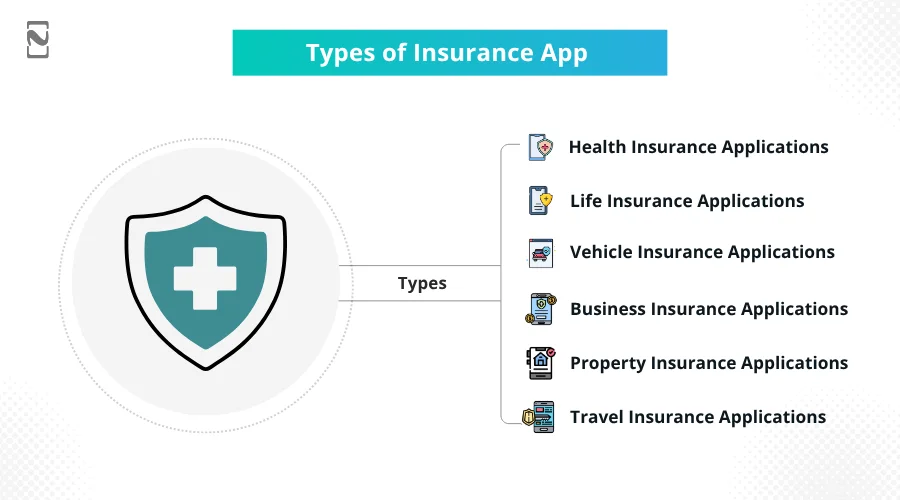

Now that you know about the factors, let’s start dissecting those factors, starting with the types of insurance applications that you can choose from.

The current insurance app market offers lucrative opportunities in various industry sectors.

These include:

♦ Health Insurance Applications

One of the most popular types of insurance applications, health insurance apps can be found on almost every working professional’s smartphone.

When you develop a health insurance app, it’s essential to design it in such a way that everything from choosing a payment plan to identifying covered expenses can be done seamlessly through the application. This ensures a user-friendly experience for policyholders.

Development Cost Estimate: $15,000-$150,000

♦ Life Insurance Applications

These are common insurance applications that allow a user to manage their life insurance plans.

People find it highly useful as these apps simplify routine processes like premiums, upcoming payments, reviewing of terms and conditions, interest calculation, etc.

Development Cost Estimate: $25,000-$200,000

♦ Vehicle Insurance Applications

Simplifying the process of getting your vehicle insured, these apps work as digital middlemen between vehicle insurance providers and consumers.

A user can get their vehicle insured simply through the app, without having to visit an agency physically. Things like filing a claim, uploading pictures, etc., can be done through these apps easily.

Development Cost Estimate: $10,000-$170,000

♦ Business Insurance Applications

These applications play a crucial role in the corporate structure in preventing businesses from going bankrupt in times of distress or a mishap.

Business owners can easily choose the right policy as per their business size and requirements.

Connecting with the right expert can help you identify how a business insurance app is developed and how it simplifies the job.

Development Cost Estimate: $25,000-$200,000

♦ Property Insurance Applications

With the help of a property insurance application, a user gets the ease to find appropriate policies to protect their personal properties, such as their homes, flats, jewels, artworks, etc.

The services that these applications offer are highly attractive to the users, making them popular among a wider range of audiences.

Development Cost Estimate: $15,000-$150,000

♦ Travel Insurance Applications

Travel insurance apps have found their way into every traveler’s itinerary through booking applications and portals.

People traveling around the globe can easily check for their respective insurance policies, protecting themselves, their luggage, and other aspects of their travel.

Development Cost Estimate: $5,000-$100,000

With so many verticals to explore, insurance technology surely is one of the fastest-growing fields. You can choose any and accordingly plan your approach for development.

Ensure that you research all of these and make an informed decision. Based on this choice, there will be different costs to build an insurance app that you will have to bear.

Choosing the type of app and the vertical of insurance you plan to tap sets the tone in terms of features you need, the development expertise required, and the budget it would take.

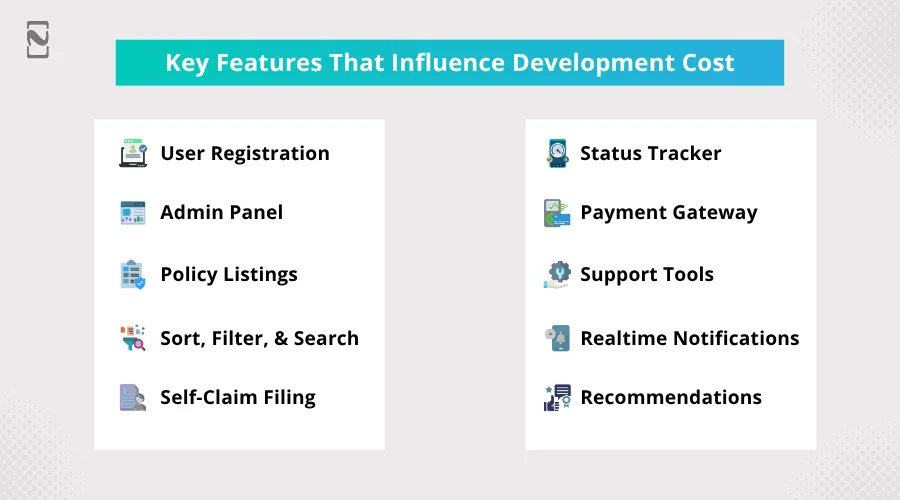

Key Features That Influence the Development Cost of Insurance App

One of the most important factors that affects the cost of building an insurance app is the type of features and functionalities you need in your app.

While discussing features for insurance applications, some are essential in every sector of insurance technology.

Then, some added advanced features elevate the user experience to the next level and help you stand out from the competition.

Here is a list of features that influence the development cost of insurance applications for your reference:

1. User Registration

A single page to help them sign up with their basic information and create user credentials for logging into their account later.

2. Admin Panel

This is the panel where your user’s profile is visible. This holds all the information about the user, along with their policy details and transaction history. To the user, it serves as a profile section.

3. Policy Listings

This is the section where all the policies that your company offers are listed. You can even become an insurance aggregator, allowing a user to access multiple policies in the same domain.

4. Sort, Filter, & Search

People looking for a specific policy under a specific budget can easily use these features. This allows sorting the listed policies based on budget, duration, etc.

5. Self-Claim Filing

Claim forms and self-claiming options are another feature that is always integrated to give users flexibility in drafting claims and filing them on their own.

This is a must-have feature for any insurance app.

6. Status Tracker

Once a user has filed a claim, they should be able to identify its current status, whether it is being considered, approved, or denied.

7. Payment Gateway

An integrated payment gateway allows a user to pay for insurance services right from the application. This makes payments for renewals, premiums, and buying new policies much easier.

8. Support Tools

There are several ways an insurance application can implement support for any application. Features like chat, calling, chatbots, live interactions, and more.

9. Real-time Notifications

Insurance applications also include real-time notifications and reminders to ensure that you never miss a premium and are aware of any updates in your policy or app.

10. Recommendations

Personalized recommendations are another feature that many insurance apps integrate.

Based on your search data and what you have already mentioned in your requirements, the app starts recommending policies and add-ons.

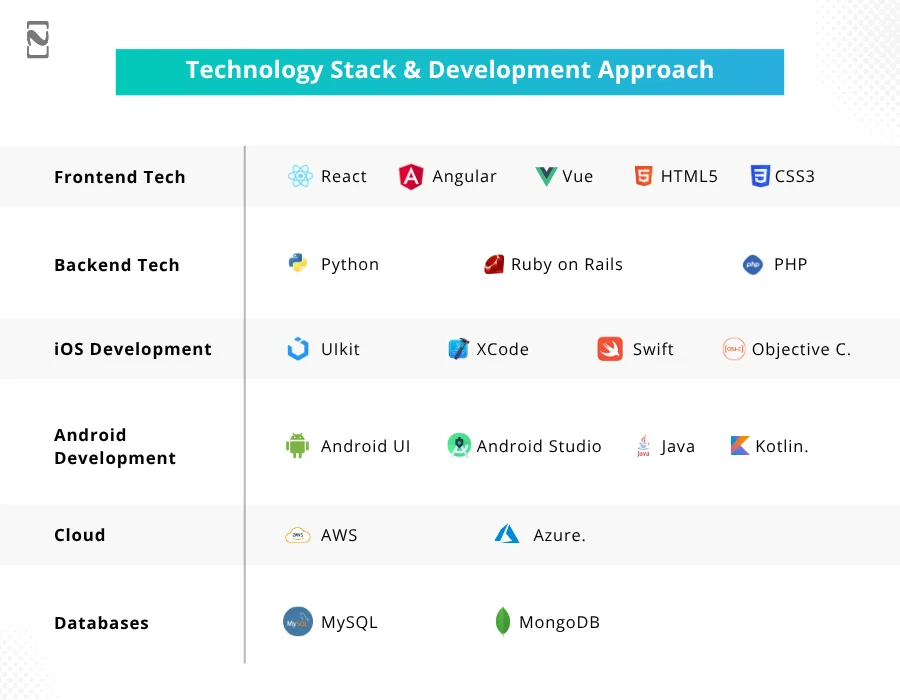

Technology Stack & Development Approach

All of these features are necessary for almost every vertical of the insurance industry you choose. To integrate all these features, you need a tech stack that can be used to develop them.

Technologies are the basic building blocks of any application, and understandably, they have a crucial role in deciding the overall insurance development cost.

Different technologies are required to develop an insurance app.

Here are some technologies you will require to design different modules of your insurance application:

► Frontend & Backend Technologies

Frontend technologies help you build the interface of your application. On the other hand, the backend is more complex as it is used to design all the functionalities.

- Frontend Tech: React, Angular, Vue, HTML5, CSS3.

- Backend Tech: Python, Ruby on Rails, PHP.

► Native vs. Cross-Platform Development

Another thing that you need to consider while choosing the technology for your application is what type of development you plan to approach.

If you are going to release the application only for Android devices or only for iOS devices, you can choose the respective native development technologies, whereas if you want to enter both markets, you can opt for cross-platform development.

Technologies for respective development approach:

- iOS Development: UIKit, XCode, Swift, Objective-C.

- Android Development: Android UI, Android Studio, Java, and Kotlin.

► Cloud Services & Database Management

To support your application’s cloud and database management requirements, you can go for the following technology options:

- Cloud: AWS, Azure.

- Databases: MySQL, MongoDB

With all these technologies powering the app, you can expect the application to perform well and get the job done for you.

These technologies take up a major chunk of development cost, as they serve as the basic tools that are used to build your solution.

Development Team & Cost Breakdown for Insurance App

One of the key factors that affects the cost to create an insurance app is the team that you choose.

Different internal and external factors can help you save costs and get the best app development services on a budget.

These factors include:

➤ In-House vs. Outsourcing Development

If we talk about going for an in-house development approach, it might cost you on the higher side as you have to build your team, hire people on a payroll, and look after them even after the work is done.

On the other hand, you can simply hire a company that provides app development services and already has a team to deploy for your projects.

If we talk about the cost:

- Hiring new employees and building an in-house team might cost you: $50,000-$100,000.

- Outsourcing your work to an experienced app development firm might cost you: $25-$45/hour.

Now, while you can imagine how many hours’ worth of money you’ll be spending just on the team.

Keep in mind that this does not include the cost of resources, machines, and subscriptions to tools that you will need to build the application.

➤ Estimated Cost by Region (USA, Europe, Asia)

The location of the team you hire is extremely important. That is because geological factors such as currency exchange rates, availability of resources, and cost of resources vary from region to region.

This is also the reason why you can see the difference between a project estimate from a European firm and the same from an Asian development company.

Here’s a quick cost breakdown by region:

- Hourly Rates in US: $50-$100

- Hourly Rates in Europe: $40-$90

- Hourly Rates in Asia: $20-$60

These rate ranges define everything from what an iOS professional to the cost of hiring an Android developer in these regions.

If you are looking to save money on the cost of developing an insurance app, you now know which region to choose for hiring developers.

Cost Estimation Based on App Complexity

Now that you are familiar with almost every factor that affects the cost to develop an insurance app, let us take a look at different cost estimations.

You see, based on the choices you make, you will end up with either of the following tiers of applications:

► Basic Insurance App (Cost & Timeline)

If you go for a basic application that simply allows a user to complete basic tasks such as browsing plans and filing claims, it might take somewhere between 3 to 6 months and cost you somewhere between $25,000-$60,000.

► Medium-Complexity Insurance App (Cost & Timeline)

A medium complexity application comes with all the basic features and offers additional features such as internal payment gateways, data fetching, video and photo galleries, etc.

Since it has added functionalities to be developed, it will take 6-9 months and cost anywhere around $70,000-$120,000.

► Advanced Insurance App with AI & Blockchain (Cost & Timeline)

Advanced insurance applications use the latest technologies, such as AI in insurance, machine learning, blockchain, etc., and understandably cost more.

The application has all types of advanced features, be it an AI chatbot, blockchain-based security, encryption, personalization tools, etc.

Developing a full-fledged advanced insurance app might take 9-15 months, depending on the tech you choose, and the cost might range between $130,000-$250,000.

| Type of App | Time to Develop | Cost of Development |

| Basic Application | 3-6 months | $25,000 – $60,000 |

| Medium App | 6-9 months | $70,000 – $120,000 |

| Advanced App | 9-15 months | $130,000 – $250,000. |

Based on what fits your requirements and how much you can invest, you can opt for the application.

This classification can help you understand the investment you are looking at and help you plan the course of action accordingly.

Optimizing the Cost to Develop an Insurance App

In case you are wondering if there is a chance to keep everything under a budget and optimize the cost to make an insurance app.

Then check out the following tips that might help you out:

1. Outsource the Job

Outsourcing third-party IT services can help you save a lot of resources.

You see, hiring a team of developers and paying them for a full-time role is significantly higher than hiring an outsourced development service provider that charges you a simple fee and gets the job done.

2. Always Choose Longevity

While deciding on your application features, make sure you keep the focus on longevity and opt for sustainable features.

This also means that you should choose a design that stays relevant in the long run and becomes the identity of your application in the long run.

3. Scalable Tech > Latest Tech

There are a lot of technologies that keep emerging now and then. However, you should be aware that not every technology or tech trend is here to stay.

You need to choose tech that is scalable and can be modified as the number of users increases on your platform.

A scalable technology is always better than something that is emerging, as you might not be aware of what the future holds for the same.

4. Functionality > Gimmicks

Make sure your application offers features that are useful and add to the convenience of the user experience.

You don’t want to clutter your application with unnecessary animations and gimmicky features that make your app slow. Keep only the selected features that are functional and get the job done.

Other than this, choosing a good and affordable development service can also help you optimize the cost to a great extent.

If you are wondering where to find a service that is pocket-friendly and does not compromise your application’s performance, then Nimble AppGenie is what you need.

Why Choose Nimble AppGenie for Insurance App Solution?

Choosing the right development partner is crucial after considering all factors that influence the cost to develop an insurance app.

If you are looking for the best developers to guide you through the process at an affordable price, Nimble AppGenie is the best choice for you.

With decades of experience and an unbeatable streak of delivering quality app solutions, we are global leaders in insurance app development services.

Our in-house team of capable developers allows us to focus on any project better, which leads to transparent communication and on-time completion of the project. Reach out today to discuss your idea!

Conclusion

The cost of the insurance app depends on several factors, and paying attention to each of them is crucial.

If you are planning to start your insurance app, make sure that you know what type of application you plan to build, what approach to development to take, what type of team to hire, which region to look for, etc.

We hope this post helps you identify all the factors affecting development cost and how you can optimize it for your benefit.

Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.