Do you think about growing your insurance business and connecting better with your customers? One smart way is to develop an app like the Progressive Insurance app.

This type of app helps people purchase policies, manage claims, and obtain roadside assistance, among other services.

The report states that more than 86% of insurance customers now use mobile apps to manage their policies, and apps like Progressive have set a strong example.

It has more than 10 million downloads, and users rate it highly for being simple and helpful.

So if you run an insurance company and want to grow, give customers more comfort, and stay in their pocket, then this is the perfect time to think smart.

In this blog, we will discuss the major steps to develop an app like Progressive for your own business.

What is the Progressive Insurance App?

The Progressive Insurance app is a mobile app developed by Progressive, one of the largest car insurance companies in the USA. It helps customers manage their insurance easily, right from their phone.

With this app, users can see their insurance policy, pay their bills, file a claim if something goes wrong, and even get roadside assistance if their car breaks down.

One of the best things about the app is that it saves time. Users do not have to call customer service for everything.

| App | Availability | Downloads | Rating |

| Progressive | iOS & Android | 10M + | 4.8/5 & 5/5 |

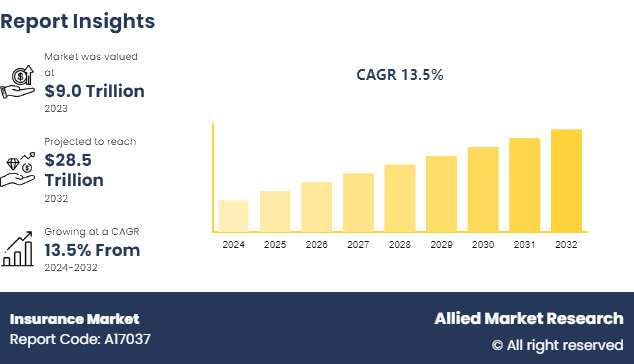

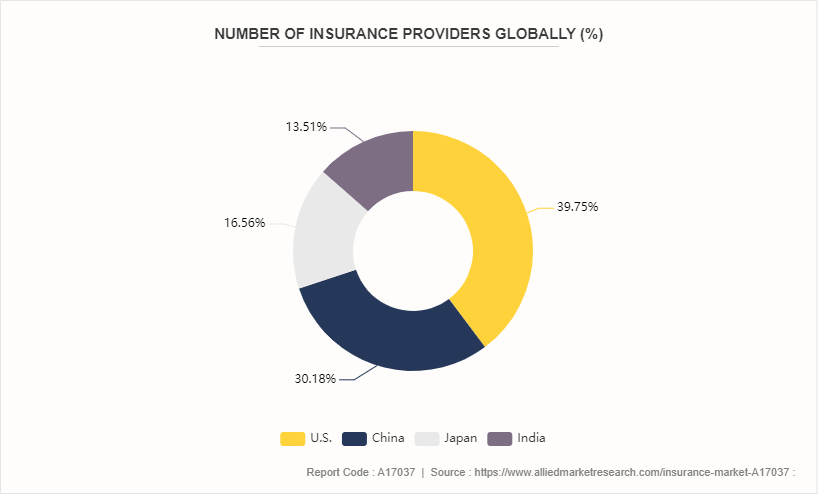

Market Overview of the Insurance Industry

Source: Allied Market Research

- The worldwide market size of the insurance industry is forecasted to hit $9.8 trillion by 2027, according to BCC Research.

- The global insurance market is expected to reach $8.21 trillion by 2025.

- Non-life insurance (like car, health, and home insurance) will be the largest part, worth around $4.60 trillion.

- Reports by Statista say that on average, each person is expected to spend about $1,050 on insurance in 2025.

- The United States will have the biggest insurance market, with estimated sales of $3.9 trillion.

- The global market for AI in insurance is projected to hit $79.86 billion by 2032.

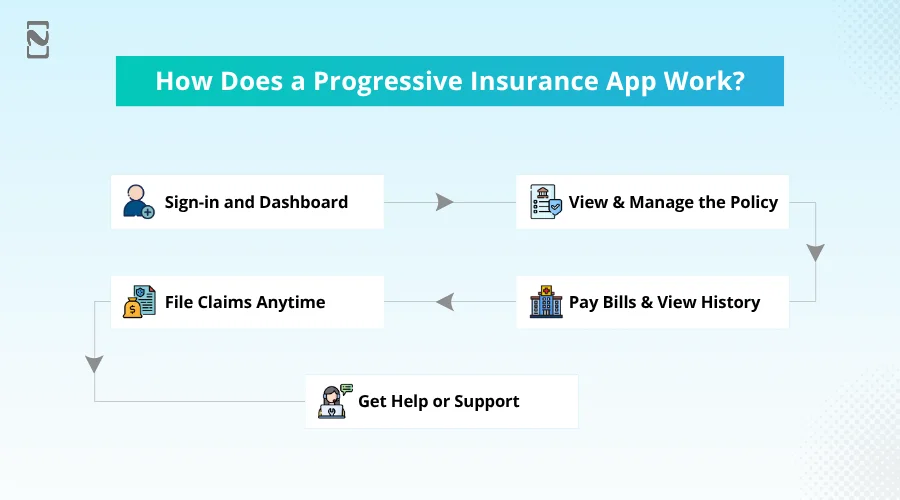

How Does the Progressive Insurance App Work?

Do you want to develop an app like Progressive Insurance? Check out the step-by-step process below to understand the working mechanism of the Progressive insurance app.

1. Sign-In & Dashboard

Firstly, users download the app and then sign up using their Progressive account or creating one. After logging in, the app shows them a dashboard with all their insurance details, like policy, etc.

2. View and Manage the Policy

Users can check their car insurance policy, see what is covered, and make changes if required. It is easy to update their contact details, add vehicles, or even make coverage changes.

3. Pay Bills and View History

The progressive app allows users to pay their insurance bills using a card or a bank account. They can also see their last payments and know when the next one is due.

4. File Claims Anytime

Had an accident? Users can file a claim directly from the app by adding details and images. The app helps guide them through each step.

5. Get Help on the Go

Need roadside assistance? Just tap for towing or jump-start services. They can also chat or call support anytime through the app.

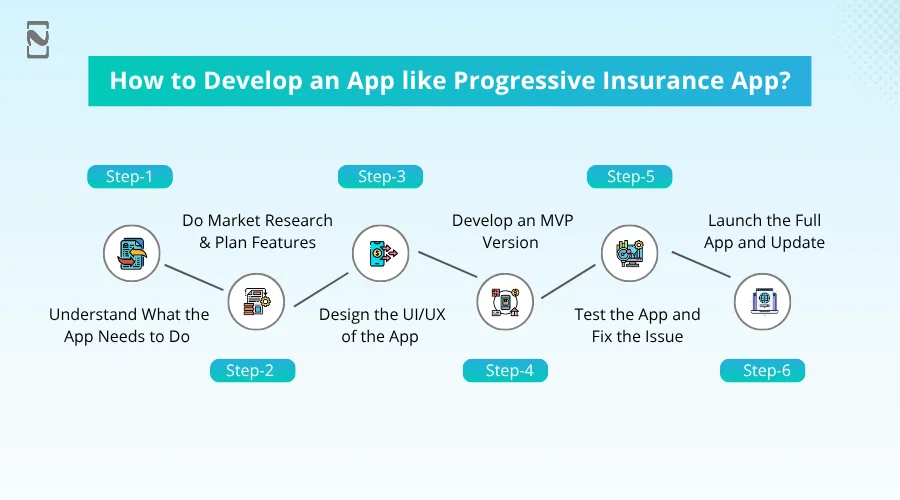

How to Develop an App Like the Progressive Insurance App?

If you want to create an app like Progressive Insurance, you need to follow a clear step-by-step process.

This kind of insurance application helps users manage their insurance easily from their mobile. Here are the steps to develop such an app from planning to launch.

► Understand What the App Needs to Do

You may have similar mobile app ideas. So it is vital to first know what the Progressive Insurance app does. It enables users to purchase insurance, manage their policy, pay bills, and talk to customer service.

Before you develop your own app, you should decide which of these features your app will have. Also, study other insurance apps and note down the most useful things they provide.

You should also think about who will use the app and what issues it will solve for them. This planning stage helps you avoid confusion later.

► Do Market Research and Plan Features

Now, perform the market research. Just look at what similar apps like Progressive are doing, what customers are saying in reviews, and what features are most popular. This step helps you find what is missing in other apps so you can make yours better.

After this, you should make a list of features your app will need. For example, user login, quote calendar, payment system, claims filing, and so on. Don’t try to add everything at once. Just begin with the essential parts that users really need.

► Design the UI/UX of the App

Next comes the design part. When you develop an app like the Progressive Insurance app, it is vital to keep the design simple.

It’s about how the insurance app looks and how people will move around inside it. The design should be easy to use and visually appealing.

You can create a wireframe of screens. Also, you can think of how the buttons, forms, and menus will work. A good and visually appealing design makes the insurance app feel seamless and easy for users.

► Develop an MVP Version

Now, before you develop an app like Progressive Insurance, start by developing an MVP app version. This is really important as it decides whether your app really works and the audience really loves it or not.

It is vital to add only the core features in the MVP version. The objective is to test the app with real users and see how it works. You don’t need a full-featured app in the beginning.

You just need to launch with a few core features. After that, you need to connect the genuine feedback and improve the app. This saves budget and time.

► Test the App and Fix the Issue

Once your insurance app’s MVP version is created, you need to test it properly. You can use the insurance app just like a normal user would and check if everything works smoothly. Besides, you can look for bugs, errors, and anything that does not feel right during the mobile app testing process.

Additionally, you can ask a small group of people to try out your app. And also give feedback. Their feedback will show you what is missing or what needs to be fixed. You should update and improve the app based on their recommendations.

► Launch the Full App and Update

Lastly, after the testing, the insurance app has made changes, and you can launch the full version of your application. Put it on the App Store. Just make sure your insurance app is secure. Mobile app security is very important for the success of your app.

After the launch, you can thoroughly check how users are using the app. You can integrate more features like roadside assistance or virtual ID cards based on what users want. Also, you should keep on fixing issues and update the app for smooth performance.

Must-Have Features of an App Like Progressive Insurance

To build an app like Progressive Insurance, you need to integrate must-have features that make it easy for users to get support anytime.

Here are the must-have features you should check out.

| User Panel | Admin Panel |

| Sign up / log in | View and manage customer accounts |

| View insurance policy details | Edit or update policy details |

| Download digital ID card | Approve or reject claims |

| Make payments and view billing history | Assign claims to claim adjusters |

| Set up auto-pay | Monitor claim status and history |

| File a new claim | Manage payments and refunds |

| Upload documents for a claim | View user activity and app usage |

| Track claim status | Send notifications or alerts to users |

| Request roadside assistance | Access analytics and reports |

| Get a new insurance quote | Manage agent accounts |

| Update personal info | Handle customer support tickets |

| View driving habits | Set system settings and access levels |

| Get push notifications and reminders | |

| Chat with support or contact the help center | |

| Renew or cancel policy |

Cost to Develop an App Like Progressive Insurance

Overall, the cost to develop an app like Progressive Insurance depends on factors like app complexity, features you add, and project requirements.

But we can provide you with a ballpark estimate of Progressive Insurance app development cost that can be around $25,000 to $200,000.

| Progressive App Complexity | Cost Estimation |

| Basic App | $25,000 – $70,000 |

| Intermediate App | $70,000 – $150,000 |

| Complex App | $200,000 + |

So, if you are planning to build an insurance app, it is vital to first decide on your budget. Also, do proper planning and make a strategy before making any hefty investment. This will help you reduce the cost of developing an insurance app.

Besides, you can also calculate the progressive app development cost with the following formula.

App Development Cost = Developer’s Hourly Rate * Development Time

From this formula, you can easily measure how much money you would require to develop an app. For better consultation, you can talk to a mobile app development company who have expertise in developing insurance apps.

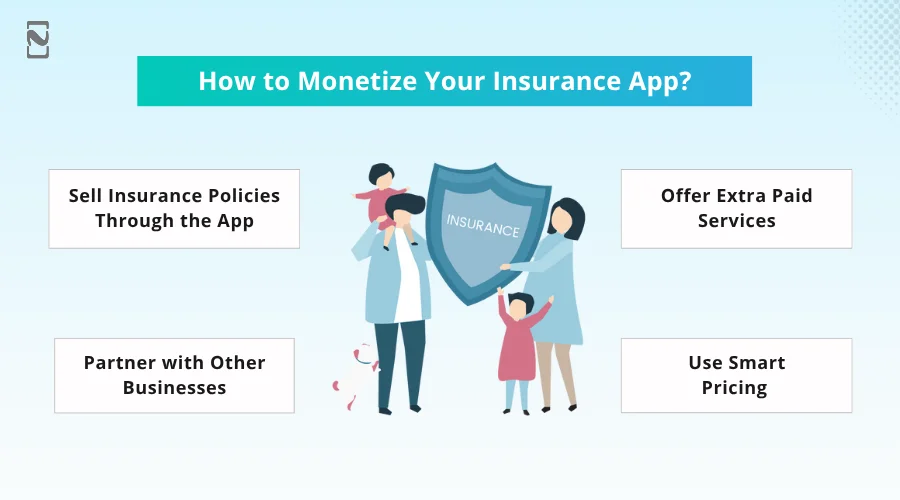

How to Monetize App Like Progressive Insurance?

Developing an insurance app is a great idea, but making money from it is just as essential. Apps like Progressive earn in multiple ways. So, let’s have a look at the app monetization strategies below that can help you earn a better ROI.

➤ Sell Insurance Policies Through the App

The most direct way to earn money is by selling insurance policies. For example, car, home, life, or health insurance from the app. Users can compare plans, get quotes, and buy insurance without going to an office.

Every time someone buys a plan, you earn money. Besides, you can provide multiple plans with different features and prices to fit different people’s needs.

➤ Offer Extra Paid Services

The next way to earn money is by offering paid add-on services. For instance, you can provide roadside assistance, faster claim approval, or access to a 24/7 agent.

These features can be added for a small monthly fee. Many people are willing to pay more for comfort and speed.

➤ Partner With Other Businesses

You can work with garages, car dealerships, hospitals, or repair shops. These partners can pay you a fee to be featured in your business app development.

When a customer visits these places through your app, you get paid. This is a good way to earn money without charging the customers directly.

➤ Use Smart Pricing

Similar to the Progressive app, you can use telematics to track how safely someone drives. The app records things like speed, braking, and phone use while driving.

If someone drives safely, you can offer them lower rates. This not only keeps your customers happy but also brings in more customers. You can make money over time since safe drivers mean fewer claims.

How Nimble AppGenie Can Help You Develop an App Like Progressive Insurance?

Developing an app like Progressive Insurance sounds challenging, but with the right team, it doesn’t have to be. Nimble AppGenie is a leading insurance app development company that not only writes code but also helps shape the whole idea.

You might know what you want your app to do. Maybe it allows users to buy a policy or check their coverage. But you are not sure how to put it all together. That’s okay! We know how these insurance apps should work and what the real audience really needs.

We also develop mobile apps that are not just nice to look at, but also very simple to use. No messy layouts for confusing steps. Everything is simple and works properly on any mobile phone.

And after the app is live? We stay in the picture, update, fix bugs, and make new feature enhancements. We can handle this all too. If you are serious about investing in progressive app development, our team knows how to do it right from day one.

Conclusion

These days, insurance mobile apps are no longer just a nice thing to have; they are a must. Insurance companies should have their mobile apps because they help in many ways.

A mobile app helps you keep up with market trends, attract more users, earn more money, and stay ahead of the competition. Most young people, especially Gen Z, prefer using apps over websites or paperwork.

So, it’s important for insurance companies to go digital. A mobile app makes it easier to manage policies, handle claims, improve customer loyalty, and more. If needed, you can also hire a development team to develop an app like Progressive Insurance for your business.

FAQs

- Do thorough market research.

- Plan out the feature list

- Choosing the right technology

- Hire a development team

- Create an appealing UI/UX

- Develop an MVP version

- Test and launch the app

- Market and update the app

Developing a Progressive Insurance mobile application can have multiple benefits. Let’s have a look:

- Enhances customer experience

- Streamlines operations

- Reach a wider audience

- Analyze customer data

- Claim Management

- Increased efficiency

To monetize your app like Progressive Insurance, you should follow the points below.

- In-app advertisement

- Referral marketing

- Selling insurance policies

- Earning commissions

- Charging service fees

- Premium features

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.