Banco do Brasil’s mobile app has become a trusted name in digital banking that serves millions of Latin Americans. In 2024, studies showed that more than 78% of banking users in Brazil preferred managing their finances through mobile apps.

This shift highlights the growing demand for secure and user-friendly banking solutions. If you’re planning to develop an app like Banco do Brasil, success comes from blending smart technology with a deep understanding of user needs.

Thus, in this blog, we will discuss the process to create an app like Banco do Brasil. Learning from Banco do Brasil’s approach can give you a clear path to creating a solution like Banco do Brasil that users trust and rely on.

What is the Banco do Brasil App?

Banco do Brasil is a mobile banking app, or we can say a super app of financial services. It allows users to handle their bank accounts and cards from their mobile phones. Users can easily check their balances, send or receive money, and manage their cards.

One of the best things about the BB app is that it provides a feature specially for users with disabilities. They can simply customize the font size and adjust shortcuts on the home screen to improve usability. This makes Banco da Brasil one of the best mobile banking apps.

Besides, the Banco do Brasil app provides multiple services like instant Pix, Pix installments, payments, purchases with cashback, etc. Let’s take a look at how the Banco do Brasil app works.

- First, a user creates an account using a password, biometric authentication modes, or two-factor authentication for mobile banking app security.

- Now the app merges with their existing Banco do Brasil accounts and cards.

- After that, a user can simply transfer the money, pay bills, or invest money in a few simple clicks.

- Lastly, the BB app regularly monitors transactions and notifies the user of any unusual activity.

Market Statistics and Facts About Mobile Banking Apps

The demand for mobile banking apps is booming with the advent of mobile technology. If we look at the mobile banking statistics, the market size of the mobile banking industry is projected to rise to $23.33 billion by 2032.

In addition to this, the global mobile banking users will be more than 2.17 billion by the end of 2025. This is a 35% rise since 2020. As always, North America leads the market with 61% mobile banking penetration in 2025.

If we look at the Banco do Brasil app, it accounted for 26.3 million users in the first quarter of 2025. On the Google Play Store, the BB app has 100 million downloads with a 4.5 rating.

These statistics highlight the rising demand for digital banking solutions, which present a significant opportunity for businesses to invest in a mobile banking app.

Steps to Develop an App Like Banco do Brasil

To build an app like Banco do Brasil, you have to perform thorough research and proper planning.

Below is the process of developing an app similar to Banco do Brasil :

1. Do Research and Define the App’s Goal

You have to start by thoroughly studying Branco do Brasil app and other mobile banking apps. You also have to understand what features your target audience uses the most. For example, balance checks, transfers, and bill payments.

Then define your own goals, like what problems your mobile banking app will solve and who it is for. This step is essential to help you shape the app’s purpose and overall direction before starting your project.

2. Create Wireframes and Design UI

Next, you have to plan how your mobile banking app will look and flow. To do that, create a mobile app wireframe that shows each screen, button, and menu. Then design a visually appealing and intuitive user interface that develops trust in your audience and makes navigation really simple.

Now, just focus on accessibility and readability so users of all ages can handle it very easily. Just remember to keep the banking app design very professional and similar to a real bank’s brand image.

3. Choose the Right Technology Stack

Now decide whether to develop an app like Banco do Brasil for Android, iOS, or both. After deciding on the desired platform, you should now choose the reliable programming languages and tools for the security and performance of the app.

It is vital to know that choosing the right tech stack is essential because if you select the wrong technology, your whole code will be messed up and cost you a lot.

4. Develop and Test the App

This is the stage where you write the code for developing your dream app. You have to add features to the app that we have mentioned below. Once your backend is successfully created, test every part to make sure it works well and keeps user data safe.

You should allow a few people to try it first and give feedback. Now collect the feedback and fix any bugs or issues before launching it on the Google Play Store and App Store.

5. Launch and Update the App

After the mobile is tested, you can launch it on the desired platforms. But always remember to follow the proper guidelines of both platforms before releasing the app on them.

Now, if you want your mobile banking app to remain at the top of the market, you should regularly update your app by adding new features, fixing bugs, and improving security. Mobile banking app maintenance is really important for your app’s smooth performance and user retention.

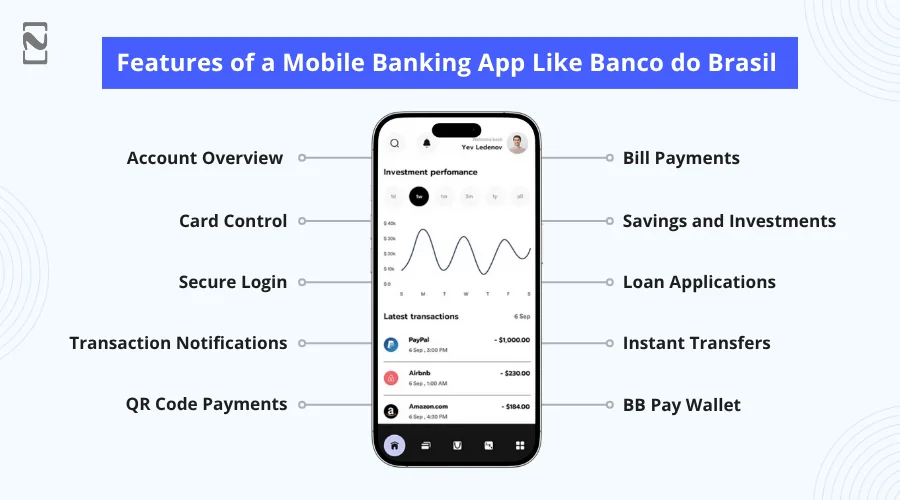

Features of an App Like Banco do Brasil

To make your app, like Banco do Brasil, a huge success, you need to focus on choosing the right mobile banking app features that align with your budget.

We have listed down some of the Banco do Brasil-like app features that you must consider :

► Account Overview

Users can check their bank balances, check recent transactions, and know upcoming scheduled payments. The simple dashboard assists people in knowing their financial situation without any confusion.

► Bill Payments

When you develop an app like Banco do Brasil, you should integrate a bill payment feature into it. It enables users to pay any type of bill. Additionally, users can scan barcodes or manually enter information.

► Card Control

Users can simply manage debit and credit cards right in the app. They can block or unlock cards, set spending limits, and control online purchases.

► Savings and Investments

Your mobile app, like Banco do Brasil, should provide access to savings accounts and investment options with a few clicks. Users can check balances, track returns, and deposit funds.

► Secure Login

Login should be very simple and hassle-free for users. You should provide biometric authentication, PIN codes, or two-factor authentication. This ensures that user accounts and transactions are fully secure.

► Loan Applications

Your app should not be complicated so that users can easily apply for personal loans or credit lines. They can also check interest rates, monthly payments and eligibility in real time from the app.

► Transaction Notifications

Users can get instant notifications for all account activity, like deposits, payments, and transfers. It will help users to stay aware of their spending and detect any unusual activity.

► Instant Transfers

You should provide an instant payment system in the app that allows users to send money to anyone using Pix, DOC, or TED. They can save their frequent recipients, scan QR codes, and confirm transactions.

► QR Code Payments

Users can easily pay at stores or transfer money by scanning QR codes. It makes the payments really safe and cashless, which allows people to complete transactions instantly. They do not need to carry physical money.

► BB Pay Wallet

Users can use a digital wallet for payments, online shopping, and peer-to-peer transfers from their mobile banking app. They can store cards, make contactless payments, and track wallet activity securely.

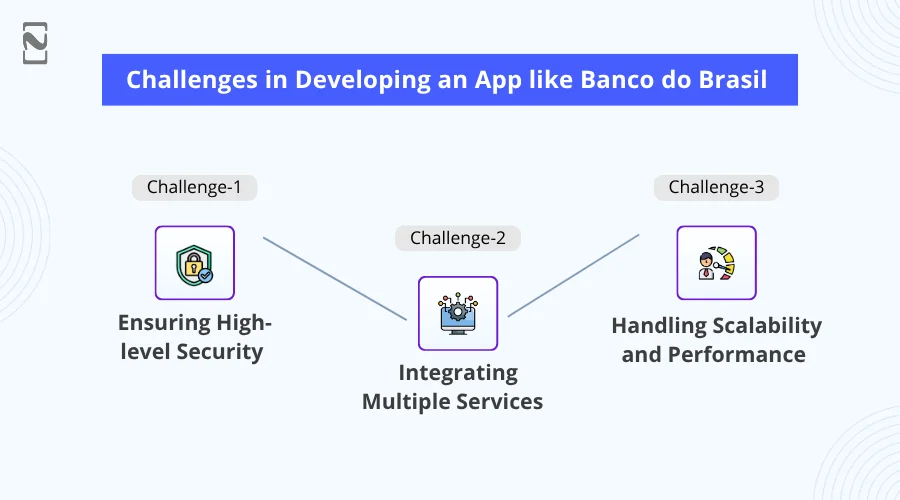

Challenges in Developing an App Like Banco do Brasil & How to Solve Them

After knowing the features and Banco do Brasil app development process, it is vital to understand the development challenges of mobile apps you might face throughout the process.

Below are some common development challenges :

♦ Ensuring High-Level Security

Digital banks’ mobile apps, like Banco do Brasil should protect sensitive user data like personal information, account numbers, and passwords. Even a minor vulnerability can lead to fraud or regulatory penalties.

Solutions :

Mobile app developers can implement end-to-end encryption, multi-factor authentication, and secure APIs. Also, if you perform regular audits and penetration testing, it helps you detect vulnerabilities before the app launch.

♦ Integrating Multiple Services

A mobile bank app like Banco do Brasil often combines checking, savings, loans, Pix transfers, and investments. Poor integration can cause crashes or failed transactions.

Solutions :

You can use modular architecture with clear APIs for each service. Also, it is advisable to do continuous testing that ensures smooth interaction between modules and prevents transaction errors.

♦ Handling Scalability and Performance

Apps like Banco do Brasil must support millions of users simultaneously. Poorly optimized systems can slow down or crash during peak hours.

Solutions :

You can use cloud-based infrastructure, load balancing, and optimized databases to develop an app like Banco do Brasil. Stress testing ensures the app can handle large traffic without downtime.

How Much Does it Cost to Build an App like Banco do Brasil?

The cost to develop an app like Banco do Brasil can range anywhere from $25,000-$150,000. This is not a fixed price; it can fluctuate based on your requirements. You’ll have to spend more if you want customizations in your mobile banking app.

Let’s understand the cost to develop a mobile banking app like Banco do Brasil with the table below.

| App Complexity | Cost Estimation |

| MVP Version | $25,000-$70,000 |

| Intermediate Version | $70,000-$100,000 |

| Highly-Complex Version | $100,000-$150,000 |

This table clearly explains which version required what cost. So, you can accordingly decide which type of version you want to build as per your budget. But it is advisable to first do proper planning and set a proper budget before investing a huge amount.

Monetization Strategies For Your App Like Banco do Brasil

After knowing the Banco do Brasil app development cost, it is essential to monetize your dream application. But how? Well, you have to implement some popular banking app monetization strategies that many apps follow.

Here are some of them you should consider :

➤ Service Fees on Premium Features

You can provide basic banking for free but charge small fees for premium features like instant transfers, investment insights, or higher withdrawal limits. These extra features attract serious users who can pay for convenience.

However, you have to keep the main app free for everyone so that your actual audience will not go away. This way, you can earn a huge revenue from your mobile banking app.

➤ Partner Marketplace Inside the App

The next strategy you can implement is by partnering with huge brands like insurance, travel, retail, etc, who can offer these services. The bank earns a share each time users buy or sign up through an app like Banco do Brasil that turns daily transactions into a profit.

➤ Subscription for Money Management Tools

The most famous monetization strategy is the subscription model. You can add optional paid plans for tools that help users track spending, set goals, and plan savings automatically.

Many customers pay monthly for simplicity and personalized insights, making it a stable, recurring income for the app.

How Nimble AppGenie Can Help You Develop an App like Banco do Brasil?

Nimble AppGenie helps businesses build next-gen solutions. We combine secure technology, visually appealing design, and deep fintech expertise to deliver mobile banking app development solutions that build trust.

Our approach covers everything from concept and compliance to deployment and support to ensure reliability in every step. We develop your customized mobile banking app like Banco do Brasil by integrating advanced features to help financial institutions with seamless digital banking experiences.

Our team understands banking innovation and is committed to helping your brand reach greater heights. Thus, if you join hands with Nimble AppGenie, we can turn your dream project into a bold, digital banking success story.

Conclusion

When you develop an app like Banco do Brasil, it takes time, planning, and the right team. It’s not just about building features; it’s about building trust, security, and a smooth user experience when you create a mobile banking app.

You just focus on what real users need, from easy navigation to fast transactions and strong data protection. With clear goals and a user-first mindset, you can turn your mobile banking app idea into a reliable and successful digital solution.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.