Buy Now Pay Later or BNPL App Development has become the new trend in the market.

Over the years, the Fintech industry has given us many innovations from sci-fi-like technologies to concepts that redefine financial convenience.

BNPL is one such concept.

Driven by leaders like Klarna, Afterpay, and Apple Pay Later, the market is growing in popularity among users at a tremendously amazing rate, drawing attention from around the world.

Are you interested in developing a BNPL app for your business?

In this BNPL app development guide, we shall be discussing everything you need to know about developing a BNPL app from why you should go for it to how much it is going to cost you.

By the end of this guide, you’ll know all you need to know.

Buy Now Pay Later Trends and Statistical Insights

Fintech statistics show the booming market is the reason behind the rising interest of businesses and investors in buy now pay later app development.

Let’s have a look.

- Global buy now pay later market size was valued at $23.22 billion in 2022 and is projected to grow from USD 30.38 billion in 2023 to $122.19 billion by 2030, exhibiting a CAGR of 22.0% during 2023-2030.

- The US BNPL market size was valued at USD 14.40 Billion in 2022 and is expected to hold the largest market share.

- The BNPL user base in the United States of America is expected to reach 80 million by 2025, with the average BNPL transaction value in the US being around $130.

Amazing, right?

If you think this is something to be excited about, you are in the same room as a billion other people, who are vouching for it.

The rise of BNPL is more due to the need and much required financial relief it offers than other factors. But what is this BNPL? Well, let’s discuss just that below.

Understanding the BNPL App Concept

BNPL App Development is quite a simple concept.

The Buy Now Pay Later or BNPL mobile application allows the user to avail the loan in an instant to cover up an online payment. The user can pay the amount later down the line without incurring any interest.

Hence the name Buy Now and Pay Later.

However, customers aren’t the online target audience, merchants are as well. Digital platform owners can integrate BNPL alongside payment gateway integration, providing a more lucrative option for users.

The concept is simple enough and growing quite popular and the reason behind this is very clear.

You see, sometimes the user wants to buy something, maybe it is one sale, maybe they need it that badly. But the problem arises when they don’t have that much money at hand at the moment.

This is where the app comes in delivering financial relief.

As such, BNPL solutions us often seen in eCommerce and on-demand applications, offering seamless payment processing that’s much simpler than traditional loans.

Speaking of loans, BNPL apps are – in fact – a form of loan lending app development. However, one must not confuse it with cash advance apps.

Here’s how they are different.

BNPL vs Cash Advances

While Cash advance apps seem like synonyms for BNPL applications, they are a little different, branching off from the same soft loan tree.

Here’s how they compare:

| Features | BNPL | Cash Advances |

| 1. Concept | Split the cost of a purchase into smaller, interest-free payments over a set timeframe. | Access a line of credit from a credit card issuer or bank, repaid with interest and fees. |

| 2. Application Process | Typically quicker and easier, often requiring minimal information and credit checks. | may involve a more complex application process with credit checks and approval times. |

| 3. Fees | may have late fees or other charges for missed payments, but typically no interest is charged if payments are made on time. | Typically accrues interest from the date of advance, even if paid back in full within a promotional period. |

| 4. Impact on Credit Score | may have minimal impact on your credit score if used responsibly and payments are made on time. | Late payments or defaults can significantly damage your credit score. |

| 5. Suitability for Purchases | Generally suitable for smaller to medium-sized purchases. | can be used for larger purchases or unexpected expenses. |

| 6. Regulation | Subject to evolving regulations, but generally less regulated than traditional credit products. | Heavily regulated by federal and state laws, with consumer protection measures in place. |

| 7. Availability | Offered by a growing number of retailers, online marketplaces, and dedicated BNPL providers. | Primarily available through credit card issuers and banks. |

Now that we are done differentiating the Buy Now Pay later app and cash advance platform, it’s time to look at how the Buy Now Pay Later platform works.

Buy Now, Pay Later App Working (For Users & Merchants)

It’s time to see How the Buy-Now Pay Later App Works!

Now, from a business perspective, there are two working processes for two types of users. They are:

- People who want to avail of a soft loan via the BNPL app

- Merchants who integrate BNPL into the platform

So, with this cleared out of the way, let’s look at both of the processes:

How Customers Use BNPL App

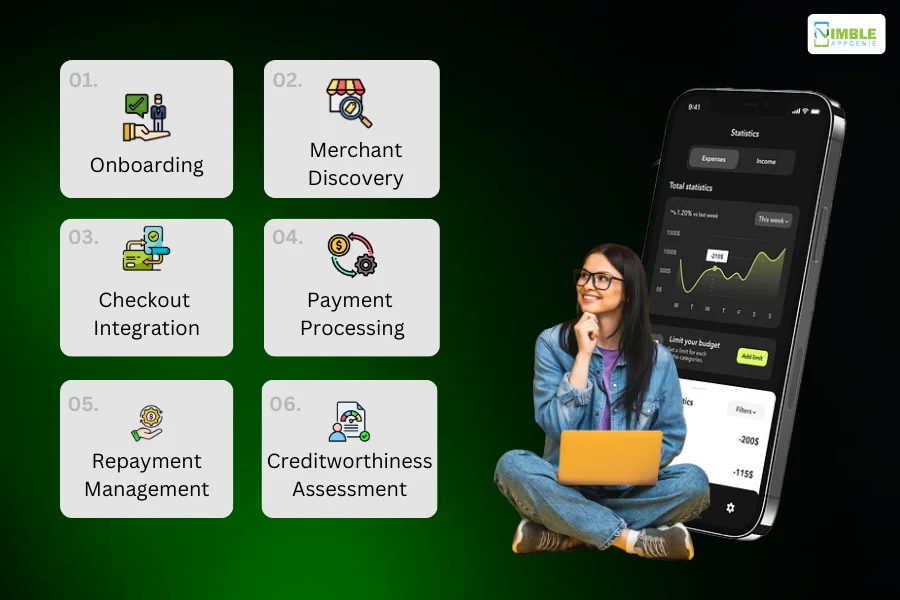

- Onboarding: Design a seamless onboarding process that collects essential user information while complying with regulations. Consider offering social login options for faster registration.

- Merchant Discovery: Integrate functionalities to help users discover merchants that accept your BNPL service. This could involve partnerships, location-based services, or curated lists.

- Checkout Integration: Develop robust APIs that seamlessly integrate with merchant checkout processes, allowing users to choose BNPL as a payment option with minimal friction.

- Payment Processing: Implement secure payment processing systems to handle transactions between your platform, merchants, and users. Ensure compliance with PCI DSS standards.

- Payment Splitting: Design algorithms to automatically split purchase amounts into pre-defined installments based on chosen plans (e.g., bi-weekly or monthly).

- Repayment Management: Build user-friendly interfaces for customers to track upcoming payments, manage repayment schedules, and make timely payments. Consider offering various payment methods for convenience.

- Creditworthiness Assessment: Depending on your business model, you might need to develop or integrate systems for assessing user creditworthiness, balancing risk management with a smooth user experience.

Merchant Integration

- API Integration: Provide clear and easy-to-use APIs for merchants to integrate your BNPL service into their existing infrastructure. Offer comprehensive documentation and support to facilitate smooth integration.

- Settlement Process: Establish efficient settlement processes to transfer funds to merchants after BNPL purchases, ensuring timely payouts and clear communication.

- Risk Management: Implement robust risk management strategies to mitigate potential defaults and fraudulent activities. This might involve collaborating with credit bureaus or developing internal risk assessment models.

- Reporting and Analytics: Provide merchants with access to insightful reports and analytics regarding BNPL transactions on their platform. This empowers them to track performance, identify trends, and optimize their BNPL offerings.

So, that’s how BNPL app works for its two target users.

With this basic information cleared out of the way, it’s time to move further with our Comprehensive Guide to BNPL App Development.

Why are BNPL Apps Trending?

Wondering, what makes BNPL apps such a sensation among users? You aren’t alone.

Understanding why the market you are planning to enter is so popular is a big part of setting up BNPL app development project for success.

So, why then? What makes BNPL solution a preferable choice for customers and merchants? Well, there are various success drivers behind this niche, let’s discuss a few of them in detail below:

For Consumers

Convenience and Flexibility

If we have to define BNPL concept in 2 words, it would be “financial convenience”.

These platforms offer a convenient way to spread out payments for purchases without incurring interest charges if payments are made on time.

This flexibility appeals to budget-conscious consumers who want to manage their finances effectively.

And that’s why they are super popular among users.

Improved Accessibility

Falling into the “loan lending apps” category, Pay Later Apps are often compared to its counterpart parts. Including, traditional credit cards and loans.

The winner is clear, BNPL.

Here’s why:

These apps often have less stringent eligibility requirements, making them accessible to a wider range of consumers, including those with limited credit history.

All in all, they deliver improved accessibility.

Enhanced Shopping Experience

Whether the user is ordering something via on-demand apps, or shopping on an eCommerce platform, if they are a few dollars short or don’t want the cart to ruin their budget, BNPL app is their best friend.

BNPL can remove upfront financial barrier, encouraging impulse purchases and potentially increase average order value for merchants.

Seamless integration at checkout further streamlines the shopping experience.

Perceived as a Responsible Option

Compared to traditional credit cards with potentially high-interest rates and revolving debt, BNPL is often perceived as a more responsible payment option, especially for younger generations.

That’s yet another big reason why millions of users across the world choose BNPL apps over traditional options.

For Merchants

Increased Sales

Every merchant that has employed buy now pay later integration in their solution and has seen an increase in revenue generation.

BNPL can incentivize purchases by making them more affordable, potentially leading to increased sales and conversion rates for merchants.

Expanded Customer Base

Another big reason why offering BNPL as a payment option has become a trend among merchants is that it can attract new customers.

Particularly those who might not qualify for traditional credit cards.

Faster Payment Processing

Lastly, no one likes slow payment processes whether it is customer or merchant. Merchants receive the full purchase amount upfront from the BNPL provider.

Thus, eliminating the risk of chargebacks and simplifying their payment collection process.

Why Develop BNPL App?

Now that you know what BNPL apps are, how they work, and why people love them, you might be wondering if BNPL Mobile App Development for Business is the right decision.

Well, to back up your decision to invest in this app development with reason, we shall be discussing some points as to why you should do it.

So with this being said, let’s get right into it:

1. Revenue Generation Potential

What is the main goal of starting a business? It is simple to generate revenue.

Yes, you might have some other reasons too like a hobby, or greater good, but this still remains one of the main objectives of a business.

With BNPL projected to cross $4 Trillion by 2030. Yes, not million, not billion, but trillion. For those who have no idea regarding the subject, this is absolutely massive.

So if you develop a Buy Now Pay Later app today, there is a high chance you can generate billions in revenue after years of hard work. How do you want that?

2. Growing Market

It is no secret that the BNPL global market is growing at quite an exponential rate.

With explosive growth, the market is expected to become one of the largest in features. A growing market is all you need when you are entering an industry.

Moreover, another reason why a growing market is recommended for newer businesses is that it offers a lower barrier to entry and a better chance of growth.

This is one of the reasons to develop a BNPL app.

3. Next Steps: Fintech Innovation

It’s no secret, the fintech market is one of the largest in the world and BNPL is taking it by storm.

This niche is constantly evolving, offering ample opportunities for businesses to innovate and create cutting-edge solutions.

You can contribute to the advancement of BNPL technology by integrating advanced features like AI-powered credit scoring, personalized payment plans, and seamless integration with various platforms.

This is one of the big reasons to consider BNPL app development.

4. Unique Value Proposition

The unique value proposition is the bread and butter of market success.

BNPL apps give you just that.

This platform caters to a specific consumer need – flexibility and affordability. It enables users to manage their finances effectively and make larger purchases without the burden of upfront costs.

By addressing this need, your app can attract a loyal user base and differentiate itself in a competitive market.

5. Reach The Unreached User Base, Responsibly

Lastly, one of the big reasons to create BNPL app is so you can reach the unreached.

BNPL, when used responsibly, can empower individuals to manage their finances better and avoid the pitfalls of high-interest credit cards.

By developing a BNPL app with transparent terms and robust risk management practices, you can contribute to financial inclusion and responsible lending practices.

So, these are some of the top reasons to create a pay later application. Now, let’s move to the next section, where we shall be discussing some of the top apps to learn from.

Popular BNPL Apps To Get Inspired

With the sudden rise of the BNPL market, many companies have risen as market leaders in the United States of America.

Here, we shall be looking at some of the top BNPL apps and learn from their success.

Therefore, these are, as mentioned below:

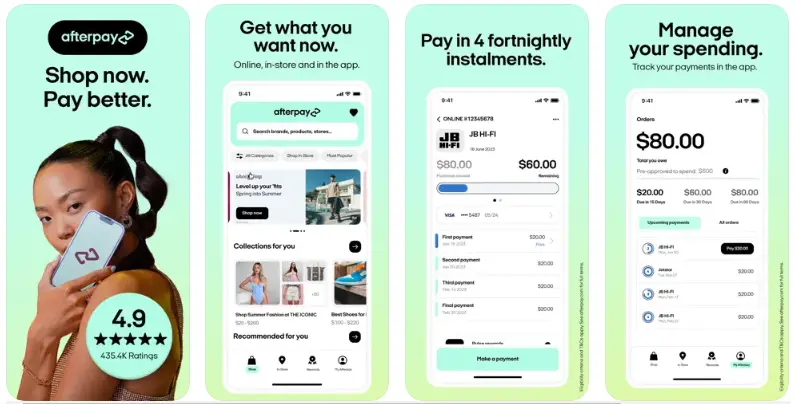

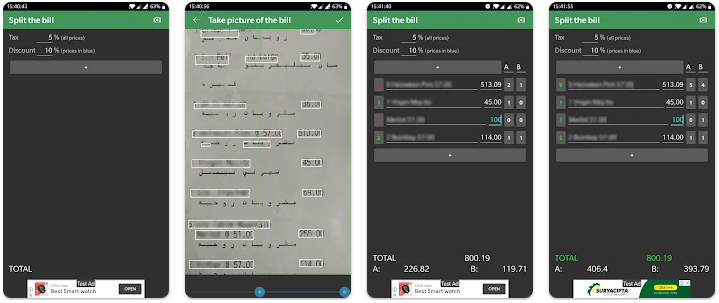

1. Afterpay

The first one on our list is Afterpay. It is one of the best BNPL platforms in the USA.

The platform decides you a loan amount based on your credit score and financial history.

You would be surprised to know many who want to create a BNPL app, want to create an app like Afterpay.

Coming back to the topic, while returning money, the user has to make one payment upfront and the rest of the amount can be paid off during 6 6-week time period.

This Platform is compatible with more than 100,000 merchants worldwide. And 23,000 of these are in the USA alone.

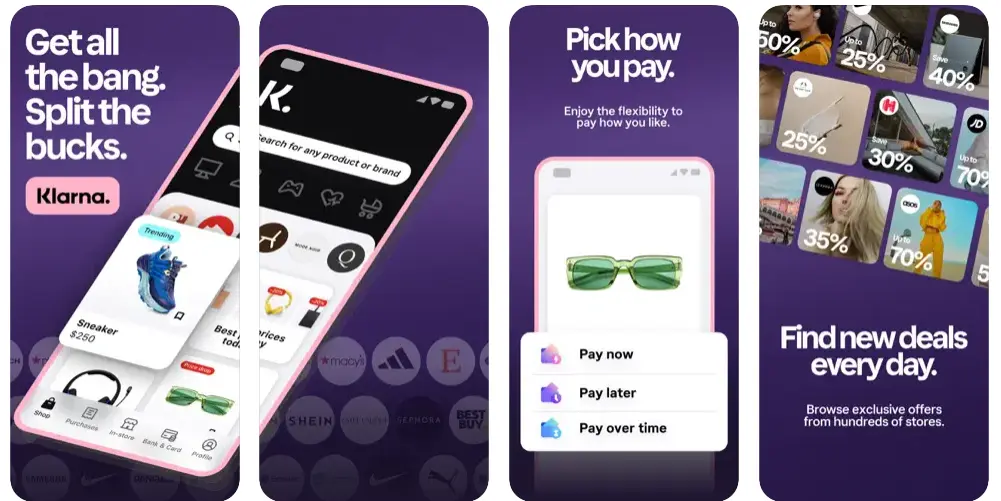

2. Klarna

Klarna is yet another US-based BNPL solution that is known for its various repayment methods. Standing out from the rest, it allows users to pay back up to 36 months.

The Buy Now Pay Later app doubles as a personal shopper, showing customers deals, providing shopping advice, and helping you cross each item on your wish list.

Klarna is spread across 17 countries, partnering with over 250,000 merchants. While it doesn’t offer a physical card like Afterpay, what it does offer is a virtual one-time card. This can be used to make payments in-store that aren’t affiliated with the platform.

3. PayPal Pay Later

PayPal itself is an excellent example of what you can do with a good concept and eWallet app development. Nevertheless, everything changed when this fintech platform decided it wanted to entire BNPL market.

This came in the form of Pay in 4. This Buy Now Pay Later software provider allows the user to slit the total cost in EMI which can be paid over 6 weeks at most. The range of loans falls between $30 and $1500.

Since this platform is backed by PayPal, a multinational company, there are millions of merchants affiliated with it.

4. Splitit

Splitit is a unique BNPL platform that allows users to split their purchases into smaller, interest-free installments over a longer period (up to 24 months) compared to other options.

Unlike most BNPL services, Splitit leverages the user’s existing credit card and doesn’t require a separate loan application or credit check.

This makes it a good option for users who want to avoid additional debt or those with limited credit history.

However, it’s important to note that Splitit might not be as widely accepted as other BNPL providers, and the authorization hold placed on your credit card for the full purchase amount can impact your available credit until the installments are paid off.

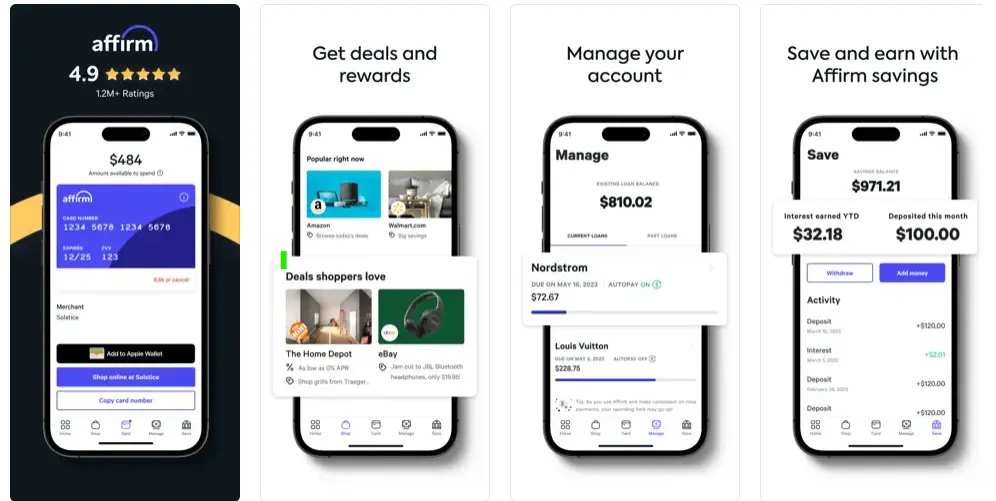

5. Affirm

Affirm is a popular BNPL platform and among the top lending apps in the market today.

The platform is known for its flexible payment options and transparent pricing. Users can choose to split their purchase into 3, 6, or 12 monthly installments with known interest rates upfront.

In addition to this, Affirm offers pre-qualification without impacting your credit score, allowing you to see if you’re eligible and the potential interest rate before committing to a purchase.

However, using Affirm may involve credit checks for larger purchases, and interest rates can vary depending on your creditworthiness and loan amount.

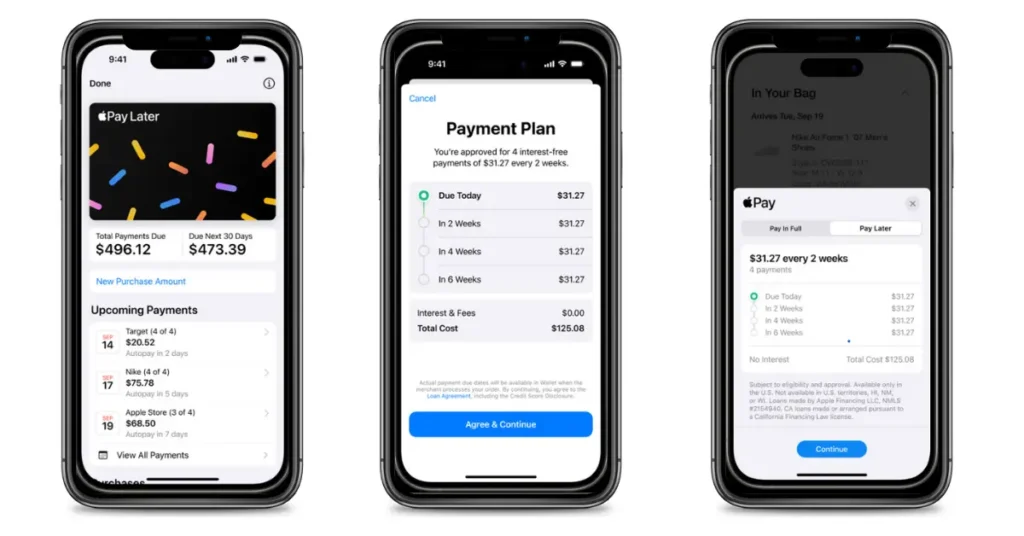

6. Apple Pay Later

Apple Pay Later is a relatively new BNPL option integrated directly into Apple devices.

It allows users to split their purchase into four equal payments spreads over six weeks with no interest or fees.

This service is convenient for Apple users who already have their payment information stored in their Apple Wallet.

While Apple Pay Later offers a simple and convenient option for Apple users, its limited payment options and restricted availability might not be suitable for all purchase scenarios.

These are the three most popular BNPL apps at the moment in the United States market. So, with this being said, let’s look at some pros & cons of this platform.

Pay Later As A Feature: BNPL Integration With Other Solutions

BNPL is such a concept that it is quite compatible with several other industries, as every industry involves payments.

However, there are some solutions that are much more compatible and can benefit from BNPL integration. In this section of the blog, we shall be looking at some such solutions.

With this being said, let’s get right into it:

eCommerce App

As per Statista, there are over 2.14 Billion online shoppers worldwide. And people love it so much that 16% of total global sales happen through e-commerce.

Despite big spending, not everyone has the kind of money to buy whatever they want whenever they want it.

But that changes with BPNL integration into eCommerce app development.

A combination of these two solutions can literally mean billions in revenue. Therefore, this is something that you should consider.

On-Demand Apps

Finally, we have on-demand apps.

We have seen amazing growth in the on-demand app economy with people absolutely loving the platform.

Now, due to the instant payment instant delivery nature of these platforms, several on-demand app development solutions can utilize BNPL integration.

They are:

These are just a few of the ever-growing on-demand markets that can benefit from pay-later functionality.

Travel App

Travel app development is filled with a lot of innovative features, but one thing that a lot of them are missing is the BNPL integration.

Truth be told, tours and travel aren’t cheap for the end user.

With the current state of the economy and personal finances, end users can very much appreciate a quick loan with Buy Now Pay Later service.

EdTech Apps

eLearning app development has become a sensation across the world among businesses and educational institutes alike after the pandemic.

And the trends continue even today.

In the current scenarios, where people prefer learning at their own pace via top elearning apps, BNPL can help struggling students buy crucial courses and pay for them easily.

This is one of the “responsible” business model approaches.

So, these are the top niche and mobile app platforms that can use BNPL integration and benefit the end user. With this out of the way, let’s discuss the feature in detail.

Features to Include in the Buy Now Pay Later App

Features are one of the most important parts of buy now pay later app development.

The reason is that it is only with the right combination of features and functionality that can you capture your customers.

Therefore, to give you an idea of what you should be including in the application, we shall be discussing some basic features that you should consider including in your Buy Now Pay Later clone app development.

| Features | User Panel | Merchant Panel | Admin Panel |

| 1. Account Management | Create and manage profiles, update personal information, and set preferences | Register and manage store accounts and update business details | Manage user and merchant accounts and review activity logs |

| 2. Transactions | View transaction history, track repayments, download statements | View transaction history with users and manage refunds and disputes | View all transactions, generate reports, and monitor platform performance |

| 3. Payment Processing | Initiate purchases using BNPL, manage payment methods, and schedule repayments | Receive payments through BNPL, manage payouts, reconcile transactions | Manage payment gateways, configure fees and interest rates |

| 4. Security | Secure login (password, biometrics), two-factor authentication | Secure login and manage store security settings | Manage user data security and enforce compliance regulations |

| 5. Customer Support | Access FAQs, contact support team through chat or email | Access support resources, contact dedicated account manager | Manage support inquiries from users and merchants and monitor resolution metrics |

| 6. Notifications | Receive notifications about upcoming payments and promotional offers | Receive notifications about transactions, disputes, and platform updates | Send notifications to users and merchants for various purposes |

| 7. Additional Features | Budgeting tools, loyalty programs, purchase history filtering | Product listings, manage promotions, and track customer behavior | User management, analytics dashboards, reporting tools |

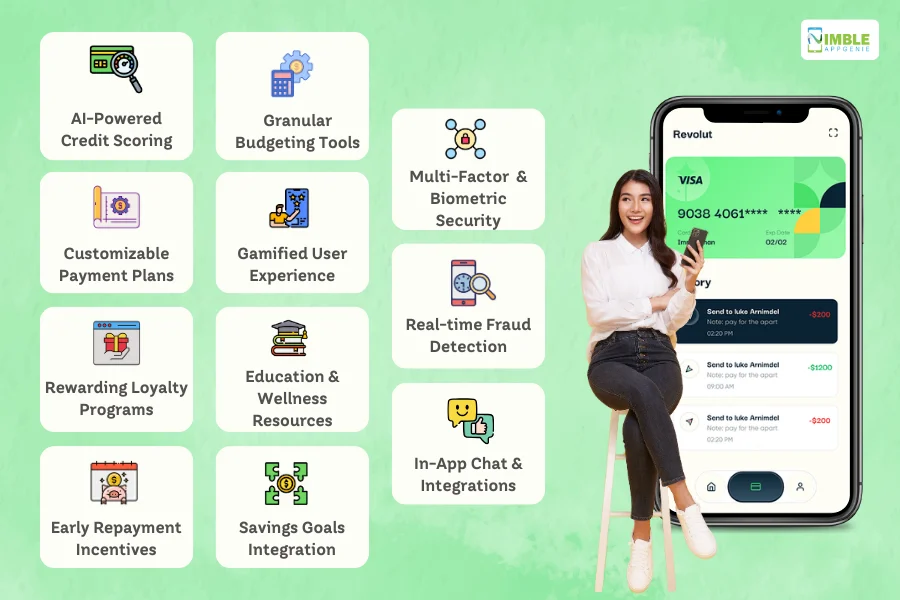

Advanced Features To Capture Users

A big part of learning how to create a buy now pay later app that’s successful among people is covering the advanced feature.

So, here’s a list of advanced BNPL app features that you should consider including.

AI-powered Credit Scoring

Move beyond traditional credit checks. Leverage AI to dynamically assess creditworthiness, enabling personalized loan limits and interest rates for each user, fostering inclusivity and responsible borrowing.

Granular Budgeting Tools

Empower users to take control of their finances. Integrate budgeting tools that allow users to track spending, set financial goals, and manage BNPL usage seamlessly within the app, promoting responsible financial behavior.

Customizable Payment Plans

This Buy now pay later app feature allows users to personalize their repayment plans, choosing installments, frequency, and duration based on their individual circumstances, increasing user satisfaction and loyalty.

Gamified User Experience

Gamification is something you can’t ignore. Implement gamification elements like points, badges, and leaderboards to incentivize responsible BNPL usage, motivate timely repayments, and boost user engagement.

Rewarding Loyalty Programs

Want to cultivate a loyal user base? Reward users for consistent app usage through loyalty programs that offer exclusive benefits, discounts, or cashback, encouraging repeat business and positive word-of-mouth.

Financial Education and Wellness Resources

Integrate educational resources to empower users with financial literacy. Provide tips on responsible credit usage, budgeting strategies, and achieving financial goals, fostering trust and building long-term customer relationships.

Early Repayment Incentives

With this feature, BNPL app will encourage responsible borrowing, offering incentives like discounts or rewards for early loan repayments.

Savings Goals Integration

Connect financial aspirations with this feature that allows users to link their BNPL app to their savings goals. Plus, it enables users to visualize progress and track their journey towards financial objectives, reinforcing responsible financial habits.

Multi-factor Authentication and Biometric Security

Implement robust security measures like multi-factor authentication and biometric authentication options to safeguard user information and prevent unauthorized access, building trust and confidence in your platform.

Real-time Fraud Detection

With real-time fraud detection, the platform can combat fraudulent activities. It uses AI and machine learning to detect suspicious transactions in real-time, protect users from financial harm and ensure the integrity of your platform.

In-app Chat Support and Seamless Integrations

Consider including real-time chat support within the BNPL app for immediate assistance and integrate with popular financial management tools. Thus, enhancing user experience and convenience.

With all said and done, we finally look at BNPL app development process in the section below.

Buy Now Pay Later App Development Process

Finally, it’s time to answer the most asked question:

“how to build a buy now pay later app?”

In this section of the complete guide to BNPL app development, we shall be going through step-by-step app development process, discussing everything in great detail.

With this being said, let’s get started with these steps:

Step 1: Come Up With An Idea

The first thing you need to do before Buy Now Pay Later App Development is come up with an app idea.

Easier said than done, coming up with a core concept for the app is the most crucial part as it will shape every action and plan from this point onwards.

To improve the concept and sharpen it into a final product, we will back it with information gathered through market research.

Step 2: Market Research

Mobile app market research is the part where we shall gather information about:

- Target users of the platform

- Competitors and their strengths

- Market conditions

- Barriers

- Other market-related insights

And much more.

All of this information will play a crucial role in molding the BNPL app concept in its final form. After which, we will validate it.

Step 3: Validate the Idea – MVP

It’s time to validate the idea.

So, before we create the final version of the app, we will develop a minimum viable product.

This is a form of a prototype that makes the whole process that much more efficient. What makes this one of the important steps to build a BNPL app is the fact that, MVP can help companies gather important feedback as well as support app funding rounds.

In any case, this is often seen as an optional step.

Once this is done, we can move to the next step of the Buy Now Pay Later App Development process.

Step 4: Monetization

Let’s make some money!

Businesses often wonder how they will generate money via the BNPL app. Well, that’s where fintech app monetization is in.

Without the right monetization strategy, you won’t be able to generate revenue. Thus, defeating the concept of BNPL.

Here are some top fintech business models that you can use for your app. Some of these are, as mentioned below:

| Strategy | Description | Pros |

| Merchant fees: Charge a percentage of each transaction to merchants for using your BNPL service. | Simple and widely used model. Generates revenue directly from transactions. | Predictable income stream, scalable by transaction volume. Requires strong merchant partnerships. |

| User interest: Offer BNPL plans with interest for users who choose not to pay on time or opt for longer repayment periods. | can generate significant revenue depending on interest rates and user behavior. | Increases user adoption and flexibility, but can be perceived as predatory. |

| Late fees: Charge penalties for missed payments to encourage timely repayments. | Generates additional revenue from delinquent users. | Disincentivizes late payments and improves cash flow. can be seen as punitive and damage user experience. |

| Subscription model: Offer premium features or benefits for a monthly or annual subscription fee. | Recurring revenue stream, creates loyal user base. | Provides additional value to users and differentiates your app. can be challenging to justify the cost to users. |

| Data Insights: Offer anonymized data analytics and insights to merchants based on user behavior and purchase trends. | Creates a valuable service for merchants beyond BNPL. | Generates revenue without relying on transactions or user fees. Requires robust data infrastructure and user consent. |

| Referral program: Reward users for referring new customers to your app. | Low-cost ways to acquire new users and drive growth. | Generates organic user acquisition and brand awareness. Requires strong referral incentives and tracking mechanisms. |

| Partnerships: Collaborate with other brands and services to offer bundled deals or co-branded BNPL options. | Expands reach and attracts new user segments. | Create mutually beneficial partnerships and increase value proposition. Requires careful partner selection and alignment. |

| Loyalty program: Reward users for using your app with points or cashback redeemable for future purchases. | Encourage repeat usage and user engagement. | Builds customer loyalty and increases lifetime value. can be costly to implement and maintain. |

Step 5: Compliance and Regulations

Make sure your plan is compliant with all the fintech regulations and laws of the land. Because you don’t want to invest millions and then find out you are doing something illegal.

This is especially important for all the fintech apps you are developing. Here’s a general list of regulations and rules to keep in mind during the Buy Now Pay Later App Development Process.

| Category | Regulation | Description | Impact on BNPL App |

| Money Transmission | State Money Transmitter Laws: Varies by state | Requires licensing for transmitting money, often with background checks, financial stability assessments, and consumer protection requirements. | Mandatory compliance for most BNPL providers. |

| FinCEN Money Services Business (MSB) Registration: Financial Crime Enforcement Network (FinCEN) | Applies if operating across multiple states or exceeding transaction thresholds. Requires registration, reporting, and AML/KYC compliance. | may be required for some BNPL platforms, impacting registration, reporting, and compliance procedures. | |

| Lending | State Consumer Lending Laws: Varies by state | Regulates consumer lending, potentially requiring licensing, interest rate limitations, and disclosure obligations. | may apply if offering financing options, impacting licensing, interest rates, and user disclosures. |

| Truth in Lending Act (TILA): Federal Reserve Board | Mandates clear and consistent disclosures of credit terms for consumer loans. | Applies if offering financing options, requiring accurate and transparent disclosures. | |

| Consumer Financial Protection Bureau (CFPB): Regulates consumer financial products and services. | may require licensing or compliance for some BNPL activities, depending on specific offerings. | Potential impact of licensing, consumer protection, and complaint handling procedures. | |

| Data Privacy & Security | Gramm-Leach-Bliley Act (GLBA): Federal government | Sets data security and privacy standards for financial institutions. | Requires implementation of data security measures and user privacy protections. |

| Fair Credit Reporting Act (FCRA): Federal government | Regulates consumer credit reporting and data privacy. | Impacts data collection, handling, and disclosure practices related to user creditworthiness. | |

| State-specific data privacy laws: Individual states | may impose additional data privacy requirements, such as the California Consumer Privacy Act (CCPA). | Compliance is needed depending on data collection practices and user location. | |

| Other Considerations | Banking Partner Regulations: Varies by bank | If partnering with banks, adhere to their specific licensing and compliance requirements. | Ensure compatibility with partner bank regulations and data security protocols. |

| Anti-Money Laundering (AML) and Know Your Customer (KYC): Federal government | Requires financial institutions to implement AML/KYC measures to prevent financial crime. | Mandatory implementation of AML/KYC procedures for user verification and transaction monitoring. |

Step 6: Hire Mobile App Developers

With everything finalized, it’s time to find BNPL app developers. Now, there are a few different ways you can do this.

These are, as mentioned below.

- Outsource to FinTech Solutions Development Company

- Hire a local Development Agency

- Assemble in House Team

- Or Strengthen In House Team via Staff Augmentation

These are different methods that you can use. But there are some considerations to keep in mind while doing this for instance:

- Check their expertise

- Interview with the team

- Consult past clients and their experience

- Clearing out on NDAs and code ownership

And so on.

This will take you a long way in terms of development. After all, this is among the most important steps to develop a buy now pay later app.

Step 7: Finalize App Development Platform

In the process of creating a BNPL app for your business, an important thing is to choose a platform.

Currently, there are a few options, namely, native app development and hybrid app development. Within native app development, you can choose between the two giants:

Now, it’s evident that choosing between these platforms can be quite a difficult decision to make. So, here’s a breakdown to help you with the sane,

| Platform | Pros | Cons | Ideal for |

| Native Development (iOS/Android) |

|

|

|

| Hybrid Development (React Native, Flutter) |

|

|

|

Once we are done with choosing the platform for BNPL app development, let’s move to the next section where we shall deal with the tech stack at large.

Step 8: Choose Tech Stack

Tech Stack refers to the technologies used for creating BNPL app.

This includes programming languages, toolkits, frameworks, and so on. It is important to choose the right set of technology as it can highly affect performance.

| Category | Technology Options | Description |

| 1. Frontend | React Native, Flutter, Xamarin | Cross-platform frameworks for building mobile apps. They allow for code reusability across iOS and Android platforms, speeding up development time and reducing costs. Xamarin uses C# for development with native performance. |

| 2. Backend | Node.js, Django, Ruby on Rails, FastAPI | Node.js is known for its non-blocking I/O and event-driven architecture, suitable for real-time applications. Django and Ruby on Rails offer robust MVC frameworks for rapid development. FastAPI is a modern, high-performance web framework for building APIs with Python. |

| 3. Database | MongoDB, PostgreSQL, MySQL, Cassandra | MongoDB is a NoSQL database known for its flexibility and scalability. PostgreSQL and MySQL are relational databases known for ACID compliance. Cassandra is a distributed NoSQL database known for linear scalability and high availability. |

| 4. Payment Gateway | Stripe, PayPal, Braintree, Square | Payment gateways offering APIs for securely handling transactions and integrate various payment methods. Square provides a suite of payment solutions, including APIs for online and in-person payments. |

| 5. Authentication | JSON Web Tokens (JWT), OAuth2, Amazon Cognito | JWT provides stateless authentication. OAuth2 offers delegated authorization. Amazon Cognito provides user authentication, authorization, and management services, supporting various authentication mechanisms and integration with identity providers. |

| 6. Cloud Platform | AWS, Google Cloud Platform (GCP), Microsoft Azure | Cloud service providers offer scalable infrastructure services, managed services, and AI capabilities suitable for building and scaling BNPL applications. |

| 7. Analytics | Google Analytics, Mixpanel, Amplitude | Platforms offer advanced analytics and behavioral insights to track user interactions, conduct A/B testing, and optimize user experiences. |

| 8. Security | SSL/TLS, OWASP Top 10, Two-Factor Authentication | Secure protocols and practices for encrypting data in transit and mitigating common security risks. |

| 9. Push Notifications | Firebase Cloud Messaging (FCM) Pusher | Services for sending targeted push notifications to users, enhancing engagement and providing timely updates on transactions and offers. |

Choosing the right tech stack is just as important as choosing the right BNPL app development service. So, consider future growth, compatibility, and other important aspects. It’s advised that you learn from the existing platform and take advice from experienced developers.

Step 9: Buy Now Pay Later Design Process

We have already discussed the feature of the application previously in the blog. And those features are developed here.

Now, it’s time to design the application.

Now, this is where UI/UX Designer comes in. It is important to create an aesthetically pleasing application that drives user engagement.

Once this is done, we can move to the next process.

Step 10: BNPL App Development

With the designing done, it’s time to work on front-end and back-end development.

The BNPL developer team will be working together to put together the platform as one in form a mobile app, bringing different platforms together.

By all means, this is the most resource and time consuming process of developing a BNPL application.

That’s why, it’s advised you maintain a good communication channel with the BNPL app development service provider through this step.

Step 11: Testing

With the development time, it’s time to invest in app’s testing.

QA and testing is something that goes on for the entire development process, but after the final product is made, the last round of testing is important to ensure the quality of the product.

Here, bugs, issues, and client-desired changes will be made. But keep in mind, at this stage, only minor changes can be made, not major ones.

Step 12: Deployment

With all said and done, it’s time to deploy the application.

Currently, the deployment process is different for iOS and Android applications. But in any case, once the app is submitted for deployment, it takes 2 weeks at max to get approved.

Also Read: “How To Launch Android App On Play Store?” and “How To Publish iOS App On App Store?”

Step 13: App Maintenance & Support

App maintenance & support services are important processes and they make sure your app maintains its successful run.

Therefore, this is something that you should consider.

These are the different BNPL mobile app development processes. With this done, let’s see how much all of this will cost you.

How Much Does it Cost to Develop A BNPL App?

You might have already figured out that doing a simple Google search won’t get you the exact cost of BNPL app development.

So, How much does it cost to develop a BNPL app?

The reason behind this is simple; each project is unique with unique specifications. Therefore, the mobile app development cost is also unique.

On average cost to develop a BNPL app can be anywhere between $25,000 and $105,000.

There are factors that can highly affect fintech app development costs and some of them are, as mentioned below:

- App development platform

- Hosting

- Complexity

- Tech Stack

- Location of Developer

- Features and Design

- API integration

- Type of BNPL App

- Maintenance & support

These are the factors that can highly affect the Buy Now Pay Later App Development Cost.

Now, if you want closer cost estimation, you would need to share specifications with an app development company and they will give you a closer estimate.

Do’s & Don’ts of BNPL App Development

Now, before we wrap up this guide to BNPL app development, let’s have a look at some of the do’s and don’t’s.

In layman’s terms, these are some common mistakes to avoid and best practices for BNPL app development.

These are, as mentioned below:

“Do” This In BNPL App Development

- Conduct thorough market research: Understand the competitive landscape, target audience, and regulatory environment.

- Validate your idea: Develop a minimum viable product (MVP) to test your concept with real users.

- Prioritize user experience: Design a seamless and intuitive interface that is easy to navigate and use.

- Ensure robust security: Implement strong security measures to protect user data and financial information.

- Comply with regulations: Adhere to all relevant financial regulations and consumer protection laws.

- Offer transparent terms and conditions: Clearly explain fees, interest rates, and repayment options.

- Integrate with relevant platforms: Partner with e-commerce platforms and other businesses to reach a wider audience.

- Develop a sustainable business model: Choose a viable monetization strategy that aligns with user needs.

- Invest in marketing and user acquisition: Build brand awareness and attract new users.

- Provide excellent customer support: Offer responsive and helpful support to address user inquiries and concerns.

Don’t Do This In BNPL App Development

- Rush into development: Take the time to plan and strategize before starting development.

- Underestimate the complexity: BNPL apps involve complex financial regulations and technical considerations.

- Neglect security: Insufficient security measures can lead to data breaches and reputational damage.

- Offer misleading information: Be transparent about fees, interest rates, and potential risks.

- Ignore regulations: Non-compliance can result in hefty fines and legal repercussions.

- Overlook user experience: A clunky or confusing interface will deter users from using your app.

- Neglect mobile optimization: Ensure your app is optimized for both iOS and Android devices.

- Skimp on testing: Thorough testing is crucial to identify and fix bugs before launch.

- Neglect ongoing maintenance: Regularly update your app with new features and security patches.

- Ignore user feedback: Actively listen to user feedback and iterate based on their needs.

Nimble AppGenie Can Help You Disrupt The Market – Here’s How

Made up your mind to develop a BNPL app?

Nimble AppGenie can be your partner in this journey as an established Buy Now Pay Later App Development Company.

Over 700 Projects and recognition from Clutch.co, TopDevelopers, GoodFirms, and DesignRush, we have what it takes to turn your idea into reality.

We have done this before:

- Pay By Check– Pay by Check is a popular ewallet mobile app in the United States of America. It allows users to transfer, pay, or even exchange currency.

- DafriBank– Digital Bank of Africa is a leading banking portal that also allows users to trade cryptocurrencies and provides e-wallet advantages.

- SatPay– An eWallet platform is a Versatile eWallet Solution that allows users to request, receive, and send payments without hassle.

- CUT– an E-wallet Mobile App, CUT is available in China and Myanmar. It works well with both RMB and MMK currencies.

- SatBorsa– a Currency Exchange Fintech app, SatBorsa is one of the platforms that is available on both platforms, iOS, and Android.

As an established fintech app development company, we can help you with your development needs.

Hire BNPL app developer with just a click and get a dedicated team assigned to you within 24 hours. Experience true innovation and deliver value to your end users with Nimble AppGenie.

Conclusion

BNPL is a growing concept. It is popular with a promising future. If you have a good idea with Buy Now Pay Later App Development services, you will be able to create a business that can have the potential to generate billions of dollars.

If this is what you want to do, we highly recommend that you consult a market-leading custom mobile app development company that can help you with the same.

FAQs

A BNPL app allows users to make purchases and split the cost into smaller, interest-free payments over a set timeframe.

They offer convenience, flexibility, and improved accessibility compared to traditional credit cards and loans.

Potential for high revenue generation, growing markets, opportunities for innovation, unique value propositions, and reaching a new user base responsibly.

Some of the top BNPL apps are: Afterpay, Klarna, PayPal Pay in 4, Splitit, Affirm, Apple Pay Later

User features: avail loan, flexible repayment, e-wallet integration, push notifications, account management.

AI-powered credit scoring, personalized payment plans, loyalty programs, gamification elements.

Come up with an idea, conduct market research, validate the idea, develop a minimum viable product (MVP), choose a monetization strategy, obtain licenses and certifications, ensure compliance with regulations, create a budget, hire developers, choose an app development platform, select a tech stack, design the app, develop the back-end, test the app, deploy the app, provide maintenance and support.

The cost to develop a Buy Now Pay Later App can vary depending on several factors, but typically ranges between $25,000 and $55,000.

E-commerce apps, fintech apps, on-demand apps, travel apps, fashion apps, EdTech apps.

Conducting thorough market research, validating your idea, choosing the right monetization strategy, obtaining necessary licenses and complying with regulations, creating a budget, and hiring experienced developers.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.