In a Nutshell:

- The instant loan app market is expanding fast, with apps like PalmCredit meeting the rising demand for quick personal loans.

- Must-have features for a loan lending app include KYC verification, instant loan approval, digital wallet integration, repayment tracking, and admin controls.

- PalmCredit app development with AI-based credit scoring, fraud detection, and automated repayment reminders ensures faster approvals and lower risk.

- From market research to defining workflows, designing UI/UX, building an MVP, testing, and scaling, a structured process makes instant loan app development smooth.

- The cost to build an app like PalmCredit can range between $25,000–$250,000+, using Flutter, React Native, Node.js, cloud services, and secure payment integrations.

- PalmCredit-like loan apps make money from interest, processing fees, late payments, and partnerships while keeping users engaged and loyal.

Many fintech startups struggle to scale because loan approvals take too long, default risk is unclear, and repayment tracking becomes difficult to manage.

Users expect instant credit from their phones, but developing a lending app that verifies identity, calculates eligibility, and disburses funds is complex. Without the right structure, an instant loan platform can quickly become expensive and risky.

However, apps like PalmCredit solve this by providing short-term personal loans with fast approval, automated credit checks, and simple repayment cycles. Borrowers get quick access to funds, while the app manages risk through structured lending and digital verification.

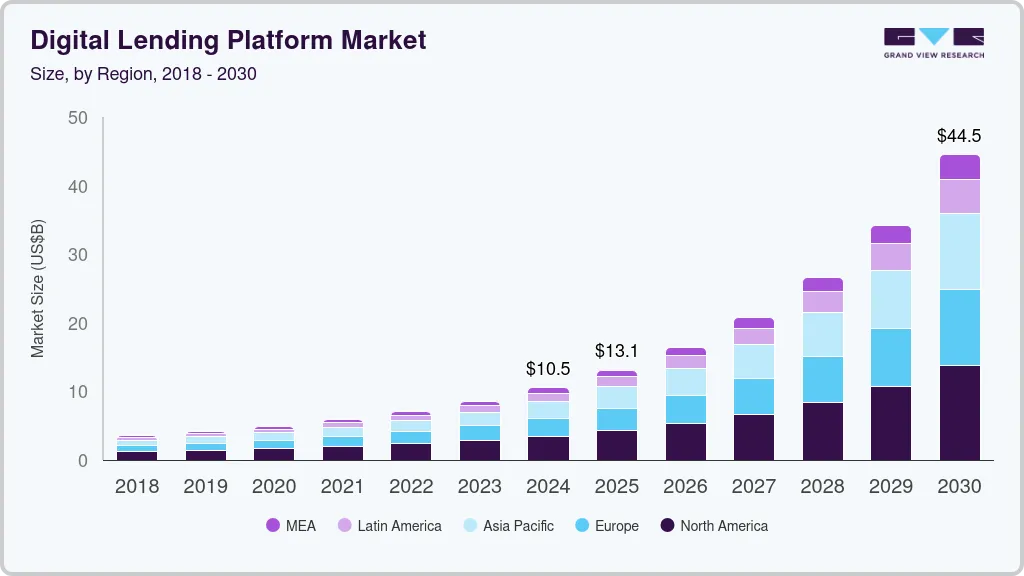

This demand is not slowing down. According to Allied Market Research, the global digital lending market is forecasted to hit $44.49 billion by 2030. It depicts a strong growth in mobile-based loan services and demand for instant loan app development.

Thus, if you are planning to build an instant loan app like PalmCredit that combines speed and smart lending logic, this creates a clear opportunity for your business to reach new heights.

In this blog, we will take you through the process to develop an instant loan app like PalmCredit that covers essential features, cost breakdown, monetization model, and key challenges to consider before launch.

So, let’s begin!

What is a PalmCredit App?

A Palmcredit app is an instant loan platform that allows users to borrow money quickly from their mobile phones. Unlike traditional banks, it approves loans within minutes, using automated systems to check creditworthiness.

For your business, this is a model of speed, convenience, and scalability. You do not just build an app; you build a platform that can manage thousands of users requesting loans at any time. It is one of the best loan lending apps.

The PalmCredit app works by allowing users to register, complete KYC verification, and submit a loan request. It checks their eligibility instantly, calculates interest, and disburses money directly to their digital wallet or bank account.

Additionally, Palmcredit earns revenue from interest, service fees, and partnerships. This makes it a profitable model for your business if you execute it correctly.

| App | Availability | Download | Rating |

| Palmcredit | iOS & Android | 10M + | 4.5/5 |

Why to Build an Instant Loan App in 2026 – Market Opportunity

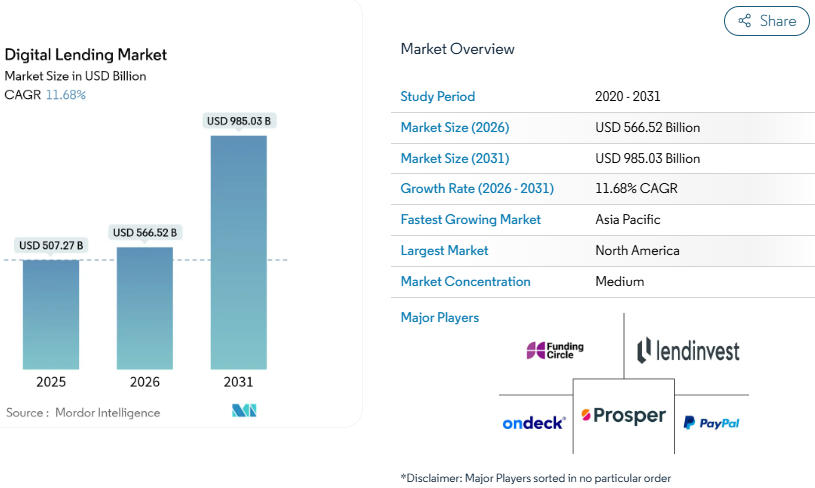

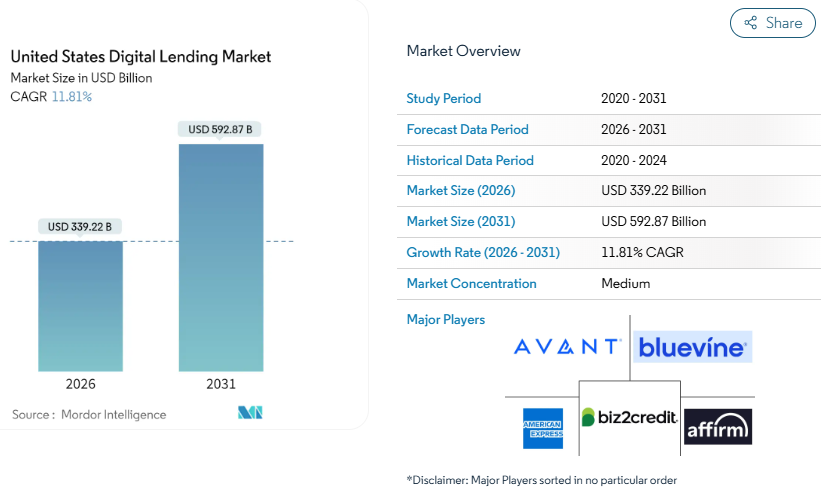

The demand for loan lending applications is exponentially growing, and 2026 is the right time to enter this market. The global market size of the loan lending industry was worth $507.27 billion in 2025. However, it is forecasted to reach from $566.52 billion in 2026 to $985.03 billion by 2031.

If we look at the US alone, the market size of digital lending is forecasted to hit $592.87 billion by 2031. This shows that people are leveraging loans from mobile phones.

As per Statista, the number of digital payment users is projected to amount to 3.81 billion by 2030. The digital payments market will reach a total transaction value of $26.89 trillion in 2026.

The CFPB reports that 53.6 million people used Buy Now, Pay Later loans in 2023. This marks a 12% year-over-year growth. This shows an increasing consumer interest in fast and flexible digital credit options.

All these numbers indicate a strong shift toward mobile-first lending and digital credit platforms. However, this creates a major opportunity to develop a loan app like PalmCredit in 2026.

Must-Have Features For Instant Loan App Development Like Palmcredit

If you want your app to succeed like Palmcredit, it is not enough to just allow users to apply for loans. You need a combination of features that make the app fast, secure, reliable, and easy to use, while giving you the control to manage operations smoothly.

We have jotted down the features table that you must check out to build an instant loan app like Palmcredit.

| Panel | Feature | Why It Matters |

| User | Easy Registration & Login | Makes onboarding fast and simple, reducing drop-offs and improving adoption. |

| KYC Verification | Ensures legal compliance and builds trust with users. | |

| Loan Application | Lets users request loans easily, increasing engagement and retention. | |

| Instant Loan Approval | Provides quick access to funds, keeping users satisfied and loyal. | |

| Digital Wallet Integration | Enables real-time fund transfer, improving convenience and reliability. | |

| Repayment Tracking | Helps users monitor repayments, reducing defaults and disputes. | |

| Notifications & Alerts | Keeps users informed about approvals, repayments, and promotions, increasing engagement. | |

| Interest & Fee Display | Shows transparency on charges, building trust and reducing confusion. | |

| Support & Chat | Provides instant assistance, enhancing user experience and retention. | |

| Account & Settings | Gives users control over profiles and payment info, improving satisfaction. | |

| Admin | User Management | Allows you to approve, block, or monitor users, reducing fraud and misuse. |

| Loan Approval Dashboard | Track loan requests and approvals efficiently, ensuring smooth operations. | |

| Transaction Management | Monitors loans and repayments accurately, maintaining financial control. | |

| Analytics & Reports | Offers insights on usage, repayment trends, and business growth. | |

| Interest & Fee Configuration | Lets you adjust rates and fees, keeping your app profitable and competitive. | |

| KYC & Compliance Management | Ensures regulatory compliance and protects your business from penalties. | |

| Notifications Management | Keeps users updated, improving repayment rates and engagement. | |

| Fraud & Risk Monitoring | Detects suspicious activities, protecting your business from financial losses. |

Advanced Features to Create an App Like PalmCredit

To make an app like PalmCredit that users actually rely on, basic lending features are not enough. Advanced features like AI in lending can help automate loan decisions, reduce risk, and manage borrower activity efficiently as your lending app grows.

Here are the advanced features that you must integrate into your PalmCredit-like app.

| Advanced Feature | What It Does | Why Does It Matter |

| AI-Based Credit Scoring | It analyzes user behavior, transaction history, and alternative data to decide loan eligibility automatically. | It reduces manual checks and helps you approve loans faster while controlling risk. |

| Smart Loan Limit System | It adjusts loan limits based on repayment history and user activity. | It rewards responsible borrowers and lowers default chances. |

| Automated Repayment Reminders | It sends alerts before due dates through SMS, email, or push notifications. | It improves on-time repayments and keeps cash flow stable. |

| Fraud Detection System | It identifies suspicious activity, fake documents, or unusual loan patterns. | It protects your lending business from financial losses. |

| Real-Time Analytics Dashboard | Tracks approvals, repayments, defaults, and user activity in one place. | It helps you make quick business decisions based on real data. |

| Multi-Level Admin Control | It allows role-based access for managers, finance teams, and support staff. | It keeps operations organized and prevents internal errors. |

How to Build an Instant Loan App Like PalmCredit?

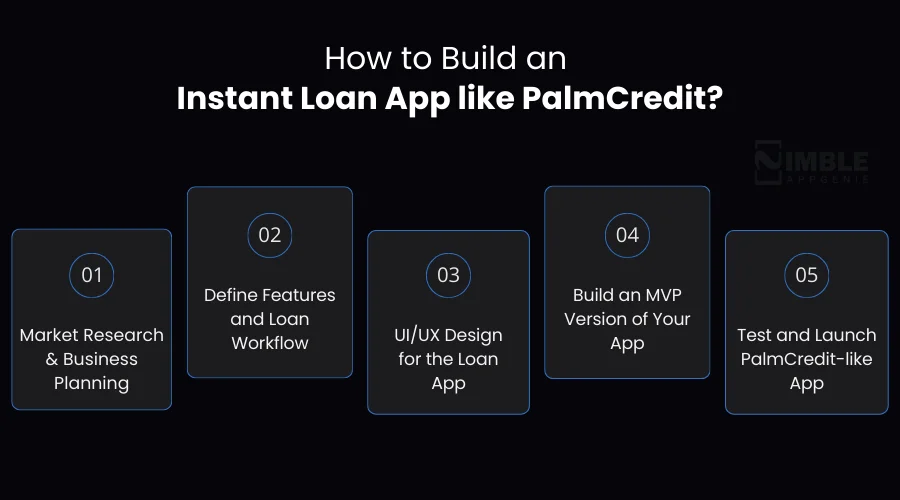

To develop an app like PalmCredit successfully, you need to follow a structured development roadmap. These steps will help you plan, build, test, and launch confidently.

Let’s have a look at the PalmCredit app development process.

Step 1: Market Research and Business Planning

Before you build an instant loan app like Palmcredit, you need to decide how your lending model will work, not just who will use it. For instance, will you provide small short-term personal loans, salary-based lending, or credit-line access?

Additionally, you need to plan risk rules, repayment duration, and minimum eligibility criteria. Many founders underestimate this step, and they think it is not important. But proper market research is the pillar of your dream project.

The success of a loan application relies more on lending strategy and risk planning than just coding. Your PalmCredit app development becomes really simple once these decisions are clear.

Step 2: Define Features and Loan Workflow

In instant loan apps, the loan workflow is the product. If you are developing an app like PalmCredit, you need to map exactly what happens from installation to final repayment.

During PalmCredit like an instant loan app development with a credit scoring system, you need to decide what loan lending app features are really crucial to add and what can wait for later. Do not avoid this part because this stage makes or breaks your app.

The lending logic impacts every technical layer during development. A poorly defined workflow makes building an app like PalmCredit costly and difficult to scale later.

Step 3: UI/UX Design For the Loan App

When creating an app like PalmCredit, design is not just about visuals. It directly affects the users’ trust and conversions. Users decide very instantly whether they feel safe using your app or not.

In personal loan app development like PalmCredit, the interface must clearly show loan amounts, repayment schedules, and total charges without confusion. Most successful loan lending apps reduce friction to just a few steps.

During PalmCredit-like lending app development, just keep the design visually appealing and intuitive. It is because complicated design often reduces approvals, even if your backend approval engine is good.

Step 4: Build an MVP Version of Your App

Do not jump into full-scale development; you can build an MVP app first. During PalmCredit-like personal loan app development, an MVP helps you validate your lending logic before investing heavily.

When you test the idea with real users, you will get feedback, and based on that, you can make the changes. Also, you need to focus on essentials like onboarding, KYC, loan application, automated approval, and repayment tracking.

Many startups build an app like PalmCredit in phases to test approval rates and repayment behavior early. Once your MVP performs well, you can confidently move toward full-fledged instant loan app development like PalmCredit with advanced automation and scalability features.

At this stage, you should also prioritize security and compliance for digital lending app systems like data encryption, secure APIs, and regulatory-ready KYC handling. When you build these safeguards in advance, it makes scaling safer and prevents costly changes later.

Step 5: Test and Launch PalmCredit-Like App

Mobile app testing is critical in instant loan mobile app development like PalmCredit, because small financial errors create major trust issues. You must simulate approval delays, repayment failures, late penalties, and transaction mismatches.

Additionally, you should monitor default patterns and user behavior closely after launch. During the first few months of a PalmCredit-like instant loan app, you can refine risk rules and scoring systems to boost approval accuracy and reduce lending losses.

Tech Stack for PalmCredit-Like App Development

To make an app like Palmcredit, you need a reliable loan lending app tech stack that supports loan approvals, payment integration, data security, and smooth lending operations.

Below is the table showcasing the technologies required for the PalmCredit app development.

| Layer | Technology Options |

| Frontend (Mobile App) | Flutter, React Native, Swift, Kotlin |

| Backend Development | Node.js, Django, Spring Boot |

| Database | PostgreSQL, MongoDB, MySQL |

| Cloud Services | AWS, Google Cloud, Microsoft Azure |

| Payment Integration | Stripe, PayPal, Razorpay, Paystack |

| Security Layer | SSL Encryption, OAuth 2.0, JWT |

| KYC Verification Tools | Onfido, Trulioo, Smile Identity |

| Analytics & Monitoring | Google Analytics, Firebase, Mixpanel |

How Much Does it Cost to Develop an Instant Loan App Like PalmCredit?

The cost to build an instant loan app like PalmCredit usually ranges between $25,000 to $250,000 or more. However, there is no fixed number. The final cost to develop a loan lending app depends on features, automation level, integrations, and MVP or full-fledged app development.

Basically, your investment will mainly depend on how advanced your lending system needs to be.

Let’s take a look at the table given below for a simplified PalmCredit app development cost breakdown.

| Development Stage | Estimated Cost Range |

| MVP Development | $25,000 – $50,000 |

| Mid-Level App With Automation | $60,000 – $150,000 |

| Full-Fledged Lending App | $150,000 – $250,000+ |

It is advisable to start with an MVP to test lending workflows and repayment behavior before scaling. This approach reduces financial risk and helps validate the lending model early.

As user adoption grows, you can move toward custom loan lending app development like PalmCredit with automation, analytics, and risk management systems.

How to Monetize an Instant Loan App Like PalmCredit?

You can monetize your loan lending app like PalmCredit through interest on loans, processing fees, and late payment penalties. Most mobile lending applications focus on recurring revenue from loan usage and financial services. Now, you have to decide how to monetize your PalmCredit-like app.

Let’s have a look at the ways loan lending apps make money.

1. Interest on Loan

When you build an instant loan app like PalmCredit, interest becomes your main profit-making engine. The idea is really simple. You just have to lend small amounts for short periods and earn a margin on every successful repayment.

It is vital to know that repeat borrowing is key to better ROI. If users trust your app and come back regularly, then small interest spreads can turn into consistent profit. This is why structuring your loan duration and repayment cycle matters from the beginning.

2. Processing Fees

Besides interest on loans, you can monetize the loan app through processing fees on every approved loan. Basically, it is a fixed or percentage-based charge that is added at the time of disbursal.

For your business, this can help you earn huge revenue immediately instead of waiting for repayment. In loan lending app development like PalmCredit, this app modelization model helps you cover verification, payment gateways, and operational costs.

3. Late Payment Penalties

Late fees are not just about penalties. But they protect your lending model. In digital lending apps like PalmCredit, missed payments are common. Structured late fees create financial discipline and protect cash flow.

When you create an app like PalmCredit, you should clearly define penalty rules so they are transparent to users and aligned with region-based regulations.

4. Financial Partnerships

Many popular P2P lending applications do not use only their own capital. They collaborate with banks or NBFCs that fund the loans, while the mobile app manages customer acquisition, onboarding, and loan processing.

In this monetization model, you can earn commission or service margins. This really minimizes your financial risk while allowing you to grow faster.

Challenges to Build an App Like PalmCredit and How to Solve Them

The challenges you might face while creating an app like PalmCredit are managing risk, compliance, and loan recovery. Many startups underestimate these operational difficulties. It is vital to avoid these mistakes while developing a loan lending app.

In this section, we will go through the challenges and their solutions of the PalmCredit mobile app development.

Challenge #1: Building the Loan Decision Engine

Developing the loan approval workflow is quite challenging because eligibility rules, credit checks, loan limits, and repayment timelines must all connect properly. If this logic is unclear, your development will slow down.

How to fix this:

You can define the lending workflow and approval conditions before building an app like PalmCredit. Most teams prototype approval logic during early custom instant loan app development like PalmCredit, to validate how loan eligibility, credit scoring, and approval decisions will work inside the app.

Challenge # 2: Integrating Multiple Third-Party Services

A lending app relies on KYC APIs, payment gateways, SMS services, cloud storage, and analytics tools. Managing these integrations together often causes delays.

How to fix this:

You can use a modular backend structure so integrations can be added and tested independently during PalmCredit like loan app development.

Challenge # 3: Ensuring Real-Time Loan and Payment Sync

Loan status, repayment updates, and transaction confirmations must stay synchronized on the user app, admin panel, and database. This is more complex than normal app development.

How to fix this:

You can implement event-based backend systems and transaction logging while making an app like PalmCredit.

Challenge # 4: Designing a Scalable Lending Backend

Instant loan apps grow quickly, and backend systems must handle approval requests, transactions, and user data simultaneously without slowing down.

How to fix this:

It is best to use cloud infrastructure and scalable fintech APIs from the beginning of digital lending app development instead of rebuilding later.

How Can Nimble AppGenie Help to Develop an App Like PalmCredit?

If you are planning to build an instant loan app like PalmCredit, the biggest challenge is turning your lending idea into a working product that borrowers can actually use.

Nimble AppGenie, a trusted loan lending app development company, assists you in planning, designing, and creating custom digital lending apps step by step without any complications.

Our expert team starts by understanding your lending model, target users, and loan workflow. Based on this, we help you decide the right features for your MVP so you can launch faster and test your lending system early.

Moreover, our dedicated development team focuses on building secure and scalable lending apps that can manage real-time loan approvals, repayments, and user data safely.

This helps startups and businesses reduce development risk and launch their instant loan platform with confidence, just like PalmCredit-style lending apps in the market.

Why Nimble AppGenie Stands Out:

- Hands-on experience in building instant loan apps.

- Structured approach for PalmCredit-like app development.

- Strong backend development for loan automation systems.

- Secure architecture for financial and user data.

- End-to-end services and post-launch support.

Conclusion

When you build an instant loan app like PalmCredit, success depends less on coding alone and more on how well the lending experience is structured.

From loan applications and approvals to repayments and credit scoring, every part must work together smoothly for the platform to perform well…

If you focus on clear workflows and stable backend systems, you usually avoid major problems after launch. Instead of rushing development, it’s better to build step by step and test how borrowers actually use the app.

When the product is planned carefully and the lending system is properly structured, launching and scaling an AI-based loan approval app becomes more manageable and predictable over time.

FAQs

The following features are crucial for your loan lending application like PalmCredit.

- Easy user registration and secure login

- Digital KYC verification

- Quick loan application and approval process

- Real-time loan status and repayment tracking

- Secure payment gateway integration

- Admin panel for loan management and monitoring

To create an app like PalmCredit, you should follow the steps mentioned below:

- Do proper market research

- Plan must-have & advanced features

- Design the intuitive UI/UX

- Develop an MVP version

- Test and deploy the app

- Maintain and update the app

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.