M-KOPA, an African fintech giant, leverages a Pay-As-You-Go (PAYG) model to serve “Every Day Earners” with affordable financial and digital products who are traditionally underserved and mostly overlooked.

Across various African countries, people usually face socioeconomic and infrastructural issues, like high device costs, no credit approach, no credit entity, limited access to digital tools, and high upfront costs.

M-KOPA emerged as a financial platform that helped confront such challenges of 5+ million customers by extending $1.5 billion in credit across five countries – Nigeria, Kenya, South Africa, Ghana, and Uganda.

Now, they have easy access to digital devices, own quality smartphones, and meet their expected financial goals.

According to McKinsey $ Company, eyeing recent reports, the African Fintech market is anticipated to expand about three to four times by 2028.

The time is ripe now! Fintech developers, entrepreneurs, and investors should act and choose mobile lending app development for markets like Africa, considering low-data usage, offline functionality, and regional payment systems.

If you’re looking to build a pay-as-you-go fintech app like M-KOPA that brings financial inclusion to emerging markets, this is the right page for you.

How to Develop an App Like M-KOPA? Here is the complete Guide, which will unveil details about how to build an app like M-KOPA, a complete explanation of the M-KOPA business model, development cost estimation for the M-KOPA app, and more.

Understanding the M-KOPA Business Model

M-KOPA’s business model is a blend of fintech, micro-lending, and IoT, crafted encircling financial inclusion and cost-effectiveness.

By fusing mobile payments, asset financing, and data analytics, M-KOPA connects low-income customers and key technology to match the steps of digital transformation in fintech while achieving enduring profitability.

In addition, consumers can access high-value products via small payments made through mobile money platforms, such as M-Pesa.

Basically, utilizing M-KOPA, customers can make a small deposit for a product they want and repay at their ease in daily or weekly installments, with no need for a full upfront payment, until they gain ownership of the product.

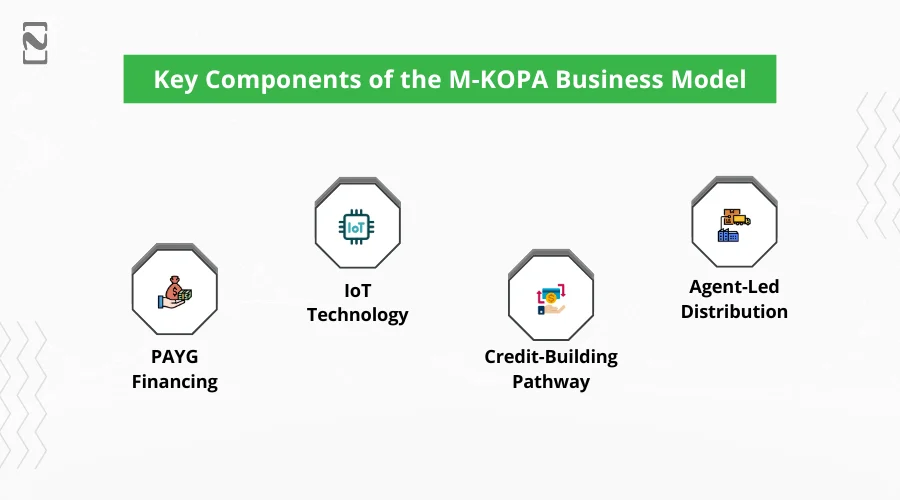

Key Components of the M-KOPA Business Model

The four core components of the M-KOPA business model app are:

1. Pay-As-You-Go (PAYG) Financing

As we have discussed, M-KOPA divides the high upfront cost of products into digital payments as per their convenience, small, daily, or even weekly.

This makes assets like e-motorbikes easily accessible to underbanked customers.

2. Internet of Things (IoT) Technology

Reaping the potential of GSM technology and embedded chips, M-KOPA remotely monitors the devices. If they find any issues with repayment, they disable the devices.

The IoT in Fintech app acts as a security measure; however, without any traditional credit checks, which ahead mitigates the risks.

3. Credit-Building Pathway

As users perform micro-payments, it creates their digital credit history. With a successful repayment record, they can get access to more financial services, including insurance and cash loans.

4. Agent-Led Distribution

A vast network of local agents ensures customers get products in remote areas as well as offering a personalized, trusted sales and support channel.

Now that we have the M-KOPA business model explained thoroughly, let’s move ahead to the working.

How M-KOPA Works?

- Customers pick a product, like a solar system or smartphone.

- Next, he/she deposits a small amount, typically via mobile money.

- Then, they receive the product, which is IoT-powered and can be remotely locked/unlocked.

- Customers then make micro-payments using mobile money over several months.

- Upon payment completion, the company unlocks the device permanently, and the customer becomes the sole owner of it.

So forth, this flexible payment model facilitates users to get access to high-cost items even with irregular or low incomes.

Why Invest in M-KOPA Like App Development – Market Research and Feasibility

M-KOPA, the pan-African fintech company, has achieved a series by the Financial Times as “Africa’s Fastest Growing Companies” for the fourth year.

Besides the point, we should delve deeper into the facts and figures of fintech for emerging markets to surge with the right decision.

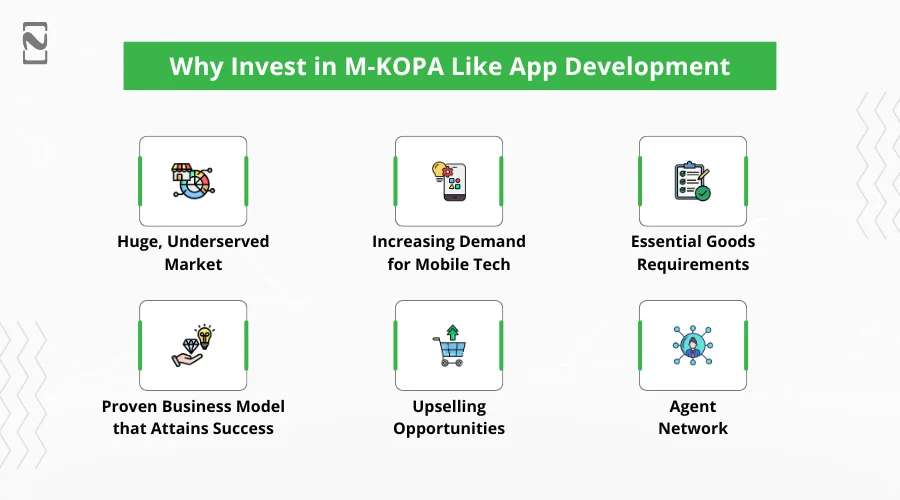

1. Huge, Underserved Market

As we read earlier in this post, the demographic of financially excluded customers is vast. So, it’s the best time to reach the untapped customer base.

2. Increasing Demand for Mobile Tech

In the emerging fintech market of African countries, smartphone usage is also growing. In turn, this will likely boost the demand for mobile access to digital services.

| In 2025, M-KOPA connected 40% first-time smartphone users, unveiling affordable access as the responsible factor. |

3. Essential Goods Requirements

PAYG solar financing apps in Africa, like M-KOPA, are spreading their roots in solar systems and other productive assets, showcasing an increasing need for pay-as-you-go access to goods that increase livelihoods.

4. Proven Business Model that Attains Success

Besides offering a micro-repayment system, the app allows users to utilize data from routine payments and IoT-enabled devices to build credit histories. Also, M-KOPA holds the caliber for regional scaling that will help it carve out success across numerous African markets.

5. Upselling Opportunities

Once consumers establish a considerable repayment record, the app can offer them additional financial products to increase their revenue streams and customer lifetime value.

6. Agent Network

M-KOPA’s proven strategy is the creation of a network for reaching a huge customer base, providing final distribution, and fostering customer trust in difficult-to-reach or rural areas.

| There’s a 17% growth in agents, which has made agents reach 35,000+, with 57% among which are pointing to M-KOPA as their prime income opportunity. |

Key Features of an M-KOPA-like App

Before you start with the development of an M-KOPA-inspired fintech solution, you should know that its core strength lies in facilitating secure repayments, affordable credit access, and real-time device control for administrators and customers.

We have created a list of key features of an M-KOPA-style PAYG App panel-wise. Check them out:

Panel 1: Features of the Customer App

Users can use this customer-facing app to flawlessly access, buy, and manage their financial products.

| Features | Key Functionalities |

| Registration & KYC | Phone-based signup, ID verification, agent-assisted onboarding |

| Product Catalog | Browse solar kits, smartphones, and appliances |

| Flexible Payments | Integration with M-Pesa, Airtel Money, MTN Mobile Money |

| Loan Dashboard | Track installments, view balance, and payment reminders |

| IoT Device Control | View device status, remote unlock/lock integration |

| Support Center | In-app chat, FAQs, SMS support |

Panel 2: Agent/Sales App Features

M-KOPA’s agent app supports customer onboarding, network, and last-mile sales.

| Features | Key Functionalities |

| Customer Onboarding | Register new customers, verify ID, assign product |

| Deposit Collection | Process down payments via mobile money |

| Device Activation | Pair and activate IoT-enabled devices |

| Sales Dashboard | View commissions, leads, and progress |

| Offline Capability | Record transactions offline and sync later |

Panel 3: Admin Panel / Dashboard Features

It’s an admin panel that lets businesses get complete visibility over their payments, customers, risk, and inventory.

| Features | Key Functionalities |

| Customer Management | Edit profile and view repayment history |

| Finance & Payments | Track real-time payments and reconcile mobile money transactions |

| Credit Analytics | AI-based credit scoring, repayment prediction |

| IoT Monitoring | Device tracking, lock/unlock controls, tamper alerts |

| Inventory & Logistics | Manage product stock, deliveries, and returns |

| Reporting Tools | Generate dashboards and KPIs |

Panel 4: IoT & Connectivity Features

As you develop an app like M-KOPA, be sure to include the following fintech app features to strengthen your app’s product management and risk mitigation system.

| Features | Key Functionalities |

| Device Connectivity | GSM and MQTT protocols for data exchange |

| Remote Control | Lock/unlock devices automatically based on payment status |

| Usage Monitoring | Collect performance and usage data |

| Device Alerts | Notify admin of tampering or faults |

Panel 5: Security & Compliance Layer

Your M-KOPA clone app development must prioritize adhering to regulatory compliance and data protection.

| Features | Key Functionalities |

| Data Encryption | End-to-end encryption for all transactions |

| Access Control | Role-based permissions for staff and agents |

| Audit Logs | Record all activities within the system |

| Regulatory Compliance | Built-in KYC and AML checks |

Benefits of Building an App Like M-KOPA

In this section, you will know how M-KOPA scaled to millions of users, including customers, investors, partners (like telecom companies, financial institutions, device manufacturers, regulators, and NGOs), and communities.

| Per the latest records as of September 2025, M-KOPA is offering around $2 billion in credit to African people in small, flexible loans who earn their livelihood through informal or micro-entrepreneurial activities. |

You already know that M-KOPA-inspired fintech solutions enable low- and middle-income consumers by simplifying credit access and ownership.

Let’s uncover more:

1. Benefits of M-KOPA for Customers

| Benefits | Description |

| Affordable Access to Essential Products | Using M-KOPA, customers can acquire high-cost assets (solar kits, smartphones, e-bikes, etc.) just by depositing a small amount initially, despite any need for full upfront payment. |

| Flexible Repayment Options | Daily, weekly, or monthly micro-payments, consumers can choose any that align with their irregular income cycles common in informal economies. |

| Ownership Through Micro-Financing | Upon completion of payments, they gain comprehensive ownership of the product, promoting independence and dignity. |

| No Collateral or Credit History Required | Even while lacking formal credit records, customers can still smoothly access financing, encouraging true financial inclusion. |

| Digital Credit Profile Creation | With regular repayments, they can create a digital credit history, opening access to digital financial services and future loans. |

| Convenience via Mobile Money | Payments and balance tracking are now easy to handle through mobile wallets like M-Pesa, with no need for a bank account. |

| Energy and Connectivity Access | Solar products drive electricity to off-grid households, while smartphones permit internet connectivity and income opportunities. |

| Customer Empowerment | Customers can access digital tools and financial services that help improve their livelihoods, productivity, and overall life’s quality. |

2. Benefits for Businesses and Fintech Startups

Whether you are a fintech developer, investor, or entrepreneur, by developing an app like M-KOPA, you can open up the doors for sustainable growth and grab opportunities across surging markets.

| Benefits | Description |

| Access to a Massive Underserved Market | You can reach Africa’s unbanked and underbanked population, appearing to as hundreds of millions of potential users. |

| Recurring Revenue Stream | Instead of one-time sales, micro-lending software solutions, like M-KOPA. Allow generating predictable, ongoing revenue through PAYG micro-payments. |

| Scalable Business Model | The digital-first approach of the app permits swift expansion across regions without the requirement for physical banking infrastructure. |

| Low Default Risk (via IoT Control) | You can lock IoT-enabled products remotely, lowering the risk of non-payment or asset loss. |

| Data-Driven Decision-Making | AI and analytics on repayment behavior help businesses by enabling product personalization and smarter credit scoring. |

| Partnership Opportunities | Seamless integration with manufacturers, telcos, and financial institutions increases reach and value. |

| Social and ESG Impact | M-KOPA fosters clean energy access, financial inclusion, and digital literacy, driving more investors and donors. |

| Brand Trust and Customer Loyalty | Transparent payment terms and reliable technology create long-term trust and repeat engagement. |

| Cross-Selling Potential | With the creation of a credit history, businesses can provide microloans, data bundles, insurance, or airtime top-ups. |

| Regulatory Alignment | Digital KYC and mobile money integration ease compliance in regulated markets. |

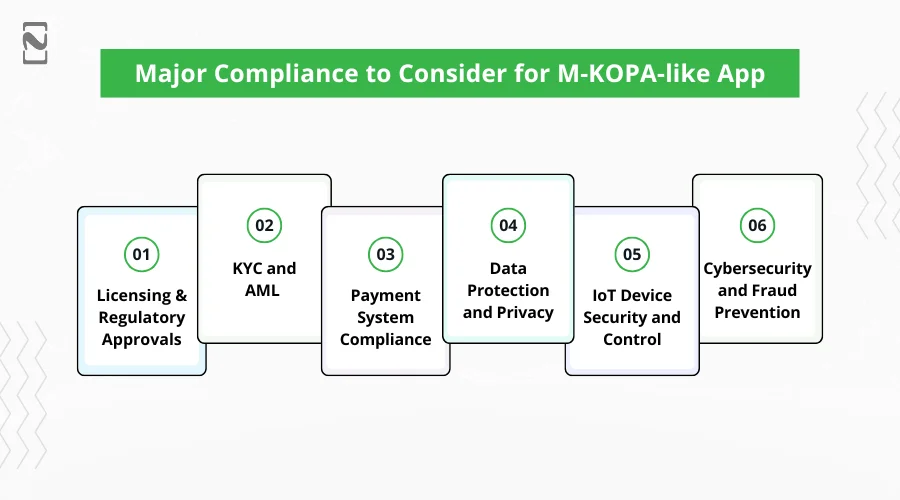

Fintech & Compliance Requirements to Consider for M-KOPA-like Fintech App

Creating a Pay-As-You-Go (PAYG) financing platform like M-KOPA demands navigating a complicated ecosystem of data protection laws, financial regulations, and operational standards.

By letting your app adhere to compliance, you can foster customer trust and ensure regulatory approval.

Below are the major fintech and compliance needs related to M-KOPA like app development:

1. Licensing and Regulatory Approvals

What: Enthusiasts should obtain the apt fintech or digital lending licenses from local regulators, like the Central Bank of Kenya or similar authorities in other regions.

Why: It ensures the platform functions legally as a payment facilitator, credit provider, or financial service entity.

2. KYC (Know Your Customer) and AML (Anti-Money Laundering)

What: Fintech apps should verify user identities via biometric verification, national ID systems, or third-party KYC APIs.

Why: A powerful KYC in Fintech App is mandatory if you are looking to stay away from fraud, money laundering, and identity theft. Also, compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws ensures real-time transaction monitoring to detect suspicious patterns.

3. Payment System Compliance

What: Integration with platforms such as Airtel Money, M-Pesa, or MTN mobile money demands following their encryption, API, and transaction policies.

Why: As pay-as-you-go app development smoothly processes constant micro-payments, it’s important to comply with payment security and mobile money standards.

This leads to greater accuracy, mitigates fraud, and guarantees regulatory transparency in financial reporting. Businesses should also follow PCI DSS standards for secure digital payments.

5. Data Protection and Privacy

What: M-KOPA-like app development emerges with the need for handling sensitive customer, IoT data, and payments, thereby compliance with data protection laws like GDPR, NDPR, or the Kenya Data Protection Act (2019) is a must.

Why: Strong privacy practices safeguard users and maintain credibility with partners and regulators. Moreover, data localization may be required in some jurisdictions.

6. IoT Device Security and Control

What: The M-KOPA business model app depends on IoT-connected devices, which is why device security is a major concern. Encryption is significant for secure communication between devices and servers that require the use of secure protocols.

Why: Anti-tampering measures and secure remote lock/unlock controls will help prevent misuse of devices. Furthermore, frequent firmware updates and user consent policy compliance guarantee that remote actions follow data and consumer protection regulations.

7. Cybersecurity and Fraud Prevention

What: Implementing bank-grade security controls in fintech platforms can prevent cyberattacks, unauthorized access, and data breaches. Real-time fraud detection, multi-factor authentication (MFA), regular penetration testing, and secure coding standards will serve the purpose.

Why: These will protect users and showcase institutional reliability.

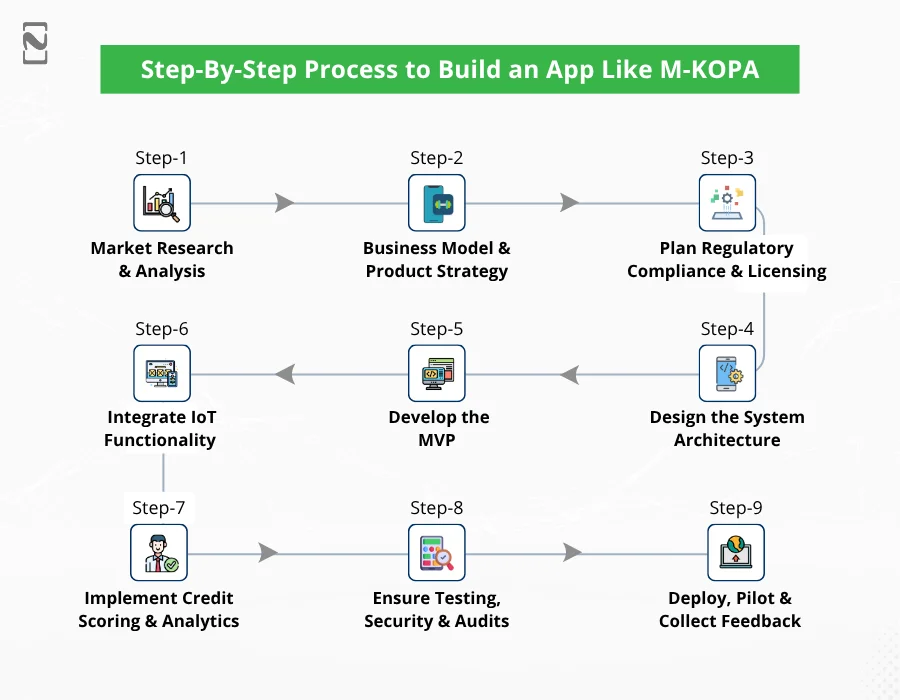

How to Build a Fintech App Like M-KOPA – Step-By-Step Process

How do you build a PAYG fintech platform like M-KOPA?

Just building an app is not enough; you need to ensure it is compliant, scalable, and result-oriented.

Here, we will talk about the steps for digital credit platform development, like M-KOPA.

Step 1: Conduct Market Research & Analysis

Start by deeply analyzing your target market, which will help you understand digital lending laws, mobile money penetration, and customer behavior.

Additionally, recognize the pain points of the key users, such as payment flexibility, access to credit, and device affordability.

Also, evaluate other PAYG models and competitors that exist in the market to pull out their strengths and weaknesses.

- Team Required: Product Manager, Business Analyst, Market Researcher

- Time Required: 3 to 4 weeks

Step 2: Define Your Business Model & Product Strategy

Next, in this phase, plan your platform’s operations. Will it perform as a tech enabler, direct lender, or follow a partnership-based model with manufacturers and banks?

You must define your PAYG payment model (daily, weekly, or monthly), and asset categories (like smartphones, solar kits, e-bikes).

Revenue stream decisions are also needed with a unit economics model development to guarantee sustainability.

- Team Required: Product Manager, Business Analyst, Finance Lead

- Time Required: 2 to 3 weeks

Step 3: Plan for Regulatory Compliance & Licensing

Now, businesses should identify the essential licenses and apply for them as a fintech startup or Digital Credit Provider (DCP) according to the laws.

Apart from that, connect with licensed financial institutions if you are issuing credit indirectly.

Remember to build frameworks for data protection, consumer protection, and KYC/AML compliance. This step is crucial to nurturing customer trust.

- Team Required: Compliance Officer, Legal Advisor, Product Manager

- Time Required: 4 to 8 weeks (often runs in parallel with design & MVP development)

Step 4: Design the System Architecture

Now it’s time to craft a high-level architecture uniting every ecosystem layer – backend, mobile app, payment gateways, IoT devices, and analytics engine.

Also include APIs for credit scoring and mobile money integration.

Leverage the power of cloud-based (Azure, AWS, or GCP) to ensure security and scalability.

- Team Required: Solution Architect, Backend Lead, DevOps Engineer

- Time Required: 2 to 3 weeks

Step 5: Develop the MVP (Minimum Viable Product) for M-KOPA-like App

Ahead, create an MVP targeting key features like PAYG payment processing, user onboarding, IoT control (lock/unlock), product catalog, and loan tracking.

Reap the rewards of Node.js / Django for the backend, and Flutter or React Native for mobile apps.

Furthermore, integrate mobile money APIs and perform testing for low-bandwidth performance.

- Team Required: Frontend Developers, Backend Developers, UI/UX Designer, QA Engineer

- Time Required: 10 – 14 weeks

Step 6: Integrate IoT Functionality (if asset-based)

If you are offering PAYG asset financing, you must integrate IoT connectivity in products.

Be sure you utilize modules, like IoT SIM cards or GSM/GPRS to enable remote monitoring and control.

The backend should lock/unlock the device if payments are not consistent and sync data to the cloud.

- Team Required: IoT Engineer, Backend Developer, DevOps Engineer

- Time Required: 4 to 6 weeks

Step 7: Implement Credit Scoring & Analytics

Don’t forget to use AI and data analytics that are best for tracking user repayment behavior, credit risk, and spending patterns.

Moreover, create a digital credit profile for every user per their payment consistency.

Besides, to get predictive analytics, you should integrate tools like Scikit-learn, BigQuery, or TensorFlow.

- Team Required: Data Scientist, Backend Developer, Product Analyst

- Time Required: 4 to 5 weeks

Step 8: Ensure Testing, Security & Compliance Audits

Businesses should perform penetration testing, implement multi-layer security (2FA, encryption, JWT tokens), and ensure PCI DSS compliance for payments.

Before you launch your app, conduct regulatory audits and run KYC/AML validation checks.

Remember to test across different regions and devices for UX consistency.

- Team Required: QA/Test Engineer, Security Engineer, Compliance Officer

- Time Required: 3 to 4 weeks

Step 9: Deploy, Pilot & Collect Feedback

In this phase, you must launch your app in the pilot region to test payment flows, market adoption, and IoT connectivity.

Next, accumulate feedback from real agents and users to boost reliability and usability.

Perform app optimization based on real-world challenges, like agent onboarding friction or network instability.

- Team Required: Project Manager, Marketing Lead, Support Team, QA

- Time Required: 4 to 6 weeks

Tools and Tech Stack Required for M-KOPA-like Fintech App Development

Developing an M-KOPA-style PAYG platform requires a powerful, secure, and scalable fintech app architecture.

Be sure your fintech tech stack supports IoT device control, real-time payments, and multi-platform access.

| Category | Recommended Tools & Technologies |

| Frontend (Mobile & Web) | Mobile: Flutter, React Native, Kotlin (Android), Swift (iOS) Web: React.js, Angular, Vue.js |

| Backend Development | Node.js (Express.js), Python (Django / FastAPI), Java (Spring Boot), or GoLang |

| Database & Storage | PostgreSQL, MySQL, MongoDB, Redis (for caching) |

| Cloud Infrastructure | AWS (EC2, RDS, IoT Core), Google Cloud, Microsoft Azure, or DigitalOcean |

| IoT Device Management | AWS IoT Core, Azure IoT Hub, Google Cloud IoT, or ThingsBoard (open-source) |

| Mobile Money and Payment Gateway Integration | M-Pesa API (Daraja), Airtel Money API, MTN MoMo API, Flutterwave, Paystack, Cellulant, or Chapa (Ethiopia) |

| Identity Verification (KYC) | Smile Identity, Onfido, VerifyMe, Jumio, or integrated national ID APIs |

| Analytics & Credit Scoring | TensorFlow, Scikit-learn, Power BI, Tableau, Apache Spark, or Google BigQuery |

| Notifications & Messaging | Firebase Cloud Messaging (FCM), Twilio, Africa’s Talking, Nexmo (Vonage), or OneSignal |

| Security & Encryption | HTTPS, SSL/TLS, AES-256 encryption, OAuth 2.0, JWT (JSON Web Tokens), and role-based access control (RBAC) |

| Fintech APIs & Integrations | RESTful APIs, GraphQL, gRPC, or WebSockets for real-time communication |

| Admin & Operations Dashboard | React.js or Angular (frontend), Node.js / Django (backend), integrated with analytics tools |

| CRM & Customer Support | Zendesk, Freshdesk, HubSpot, Salesforce Service Cloud, or custom-built CRM |

| DevOps & Deployment | Docker, Kubernetes, GitHub Actions, Jenkins, Terraform, Prometheus, Grafana |

| Testing & QA | Postman, Selenium, JMeter, Jest, Appium, Cypress |

| Compliance & Monitoring Tools | ComplyAdvantage, Sumsub, SentiLink, AuditBoard, or in-house compliance modules |

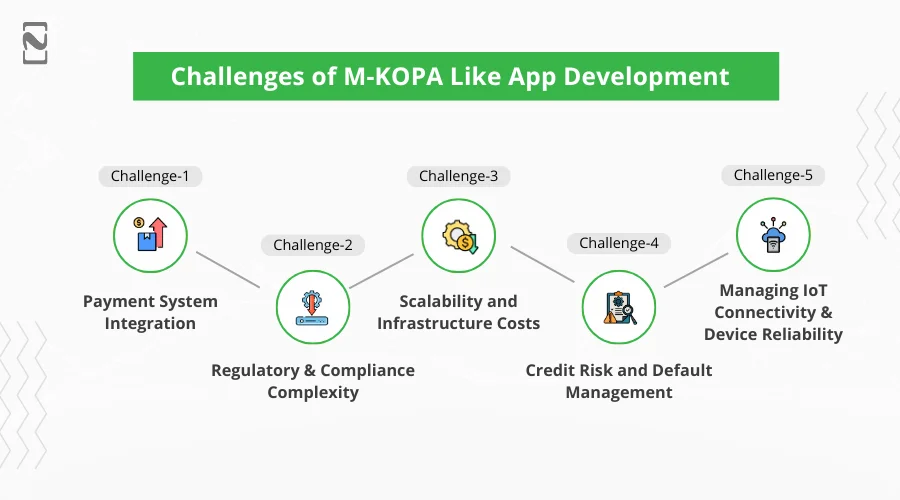

Challenges of M-KOPA Like App Development with Possible Solutions

Asset financing app development is more than fintech software development. Founders and developers need to confront numerous challenges to emerge with an expected solution.

Below, we will discuss some major ones:

Challenge #1: Mobile Money and Local Payment System Integration

Solution: You can use middleware or aggregation platforms like Cellulant, Flutterwave, or Beyonic to merge distinct APIs under a single interface.

You can handle delayed or failed transactions perfectly by implementing transaction reconciliation, payment retries, and offline caching.

Partnering with telecoms can help you guarantee reliable integrations and thorough testing in every region before scaling.

Challenge #2: Regulatory and Compliance Complexity

Solution: By engaging early with local financial partners and regulatory consultants, you can understand compliance obligations.

You can also connect with mobile network operators or licensed financial institutions to leverage the potential of their current infrastructure and licenses.

Businesses should ensure their system aligns with emerging fintech standards from day one, and for that, they must implement in-built compliance modules for AML monitoring, KYC verification, and data privacy.

Challenge #3: Scalability and Infrastructure Costs

Solution: You should adopt a microservices architecture hosted on cloud infrastructure (GCP, AWS, or Azure) to independently optimize costs.

Utilize caching layers, auto-scaling, and load balancers to maintain performance.

Challenge #4: Credit Risk and Default Management

Solution: Leverage the strength of AI/ML algorithms to implement data-driven credit scoring that helps analyze repayment consistency, device usage data, and mobile money usage. Besides, you can combine this with IoT-based access control to reduce risk.

Businesses can begin small with limited credit lines and, with time, expand eligibility as they build a repayment history.

Challenge # 5: Managing IoT Connectivity and Device Reliability

Solution: You should opt for powerful IoT device management platforms that support encryption, remote updates, and real-time monitoring.

GSM/4G IoT SIMs provide better coverage and craft fail-safe logic.

Partner with trusted manufacturers and create a refurbishment workflow for faulty or returned devices.

How Much Does It Cost to Create an App Like M-KOPA?

The total cost to build an M-KOPA-like fintech app ranges between $60,000 – $250,000+, depending on the technology complexity, feature set, team structure, and country of development.

Below, you will have a cost breakdown according to the app type you prefer per your project needs.

Development Cost Estimation for M-KOPA App

| App Scope | Estimated Cost (USD) | Timeline |

| MVP (Core Features Only) | $60,000 – $90,000 | 4–5 months |

| Full-Scale Fintech + IoT App | $120,000 – $200,000 | 6–8 months |

| Enterprise-Grade Multi-Country Platform | $250,000+ | 9–12 months |

Note: Costs can vary based on whether you build in Africa, Eastern Europe, or North America.

Get an estimate to know the affordable fintech app development pricing now!

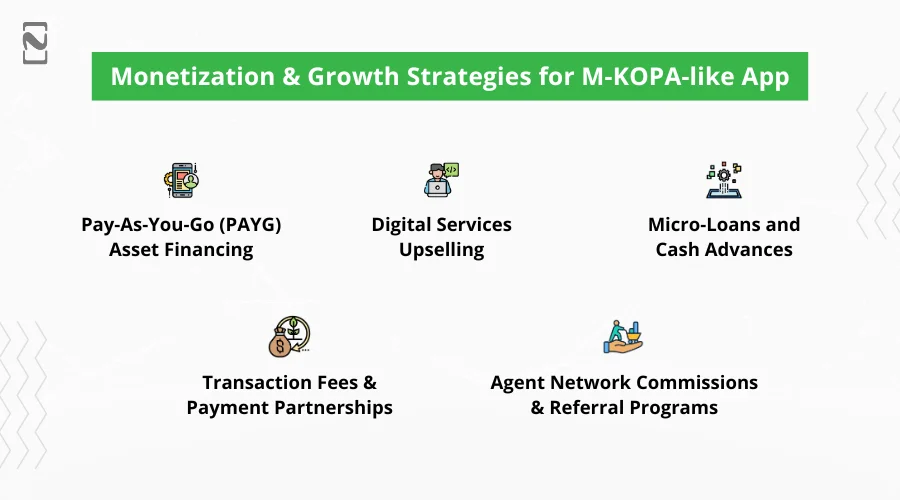

Top Monetization & Growth Strategies for M-KOPA-like Fintech App

Obviously, besides offering services, the chief objective of creating an M-KOPA-inspired fintech solution is to drive revenue.

Let’s uncover some core strategies to understand how fintech apps make money below:

1. Pay-As-You-Go (PAYG) Asset Financing

In this core revenue engine, customers deposit a small amount as an upfront cost for the assets and pay consistently via daily, weekly, or monthly installments from their mobile money. The amount includes the product cost and the financing margin.

Revenue streams:

- Profit margin on financed products

- Late payment or reconnection fees

- Interest or service fee per transaction

2. Digital Services Upsell

After the customers repay consistently, they get access to their digital products and services, like data bundles, prepaid airtime, utility payments, or life insurance, all financed within the ecosystem of the app.

Revenue streams:

- Commission from insurers, telecoms, and utility partners

- Service fee for every transaction or bundle sale

3. Micro-Loans and Cash Advances

Once users create a digital creditworthiness and repayment history, customer loan repayment apps, like M-KOPA, can offer instant cash advances or short-term microloans directly to mobile wallets.

Revenue streams:

- Interest on loans (daily or weekly)

- Processing or convenience fees

4. Transaction Fees & Payment Partnerships

Every payment made via M-Pesa or Airtel Money generates a small fee, either charged as a convenience fee to customers or shared with the mobile money operator.

Revenue streams:

- Transaction processing fees (1 to 3%)

- Cross-border payment fees for regional expansion

5. Agent Network Commissions & Referral Programs

M-KOPA and Akin’s models rely on huge agent networks for acquiring customers. Agents earn a set amount as a commission per repayment, onboarding, or referral.

Revenue streams:

- Increased user acquisition with reduced marketing spend

- Optional agent premium dashboards and subscription plans

Why Choose Nimble AppGenie to Develop M-KOPA-like App?

Now, since you have decided to build an app like M-KOPA, you should go for fintech development outsourcing. Yes, we know you are tech-savvy and can launch your fintech startup in Africa or any region of your choice. But you should know that apart from a technical edge, other stages also demand proficiency.

You should choose an expert fintech app consultant from a leading fintech app development company with years of experience in custom PAYG app development solutions.

Hire fintech app developers who have deep domain knowledge, experience with the latest technology, problem-solving skills, and every essential factor for M-KOPA-like app development.

Well, let us lighten your load by unveiling the name of a top mobile app development company serving clients globally it’s Nimble AppGenie.

Why not?

Key Highlights of Nimble AppGenie

- Expertise in Fintech

- Agile Methodology

- Commitment to High-Quality Outcomes

- Cost-Effective Approach

- Global Experience

Not convinced yet? Get deeper into a real-time case study of a fintech business thriving in the cut-throat fintech market.

Real-Time Case Study: PAYG Fintech App for a Solar Company

Challenge: A solar power company in Uganda and Kenya wanted to provide Pay-As-You-Go (PAYG) financing for solar kits, but was blocked by limited credit scoring, manual repayment tracking, and mobile money integration issues.

They require a digital platform to ease IoT device monitoring, automate financing, and scale operations.

Solution we Offered: We created a custom M-KOPA-style fintech platform that incorporated:

- Customer app

- Agent app

- IoT integration

- Credit scoring engine

- Admin dashboard

- Multi-country mobile money integration

Results Achieved:

- Reduced loan approval time from 3 to 5 days to under 10 minutes.

- 35% mitigated operational costs

- Improved repayment rates from 72% to 91%.

- 10% drop in default rate

- 25000+ active users in the first year

These insights are more than enough to make the right decision, choosing Nimble AppGenie as your fintech app development partner.

Book a free consultation and get a custom M-KOPA-style app for your business today!

Wrapping Lines

We hope you find our M-KOPA app development guide useful in getting everything you need to build your own M-KOPA alternative.

You can reach our fintech consultants with your financial inclusion app ideas to know how to develop an app like M-KOPA and get the right direction that currently ruling African fintech startups choose to follow to attain lasting success.

Ready to build your M-KOPA-style fintech app? Get a free consultation today.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.