Considering customer experiences with traditional banking, there are numerous issues they face, like high banking fees, limited working hours, slow and sometimes complicated onboarding, and no transparency in services.

With the increasing consumer need for efficiency, convenience, and real-time access to their finances, the demand for a mobile banking app is surging.

Why? Well, such branchless, fully digital banking apps are crafted particularly to run on cloud infrastructure that confronts various relevant challenges users face with traditional banking.

One such South African banking giant that’s gaining traction is Tyme Bank. Serving 10+ million users, Tyme Bank is expanding at a faster pace, over 6,500 a day, as recorded in last year’s report.

With time, the platform witnessed rising deposits that reached R6.9 billion in March 2025, up from R6.3 billion in June 2024.

It’s the right time to capitalize on the fintech market that’s increasing with leaps and bounds and is predicted to hit around $652.80 billion by 2030.

If you are a fintech entrepreneur, strategist, product manager, developer, or investor seeking how to develop an app like TymeBank, you are on the right page.

Let’s get started!

What is the Tyme Bank App?

Specifically designed for the South African market, the Tyme Bank app facilitates users to perform financial management directly from their mobile phones.

Digital banks like Tyme Bank are catching everyone’s eye by offering essential services like fee-free accounts, the power to pay bills and send money, kiosk-based onboarding, cloud-native infrastructure, and saving tools, all with no physical bank branches.

Simply put, TymeBank is a digital-only bank that you can operate via its app and website, leveraging self-service kiosks at distinct partner stores, such as Boxer and Pick n Pay, for services like account opening.

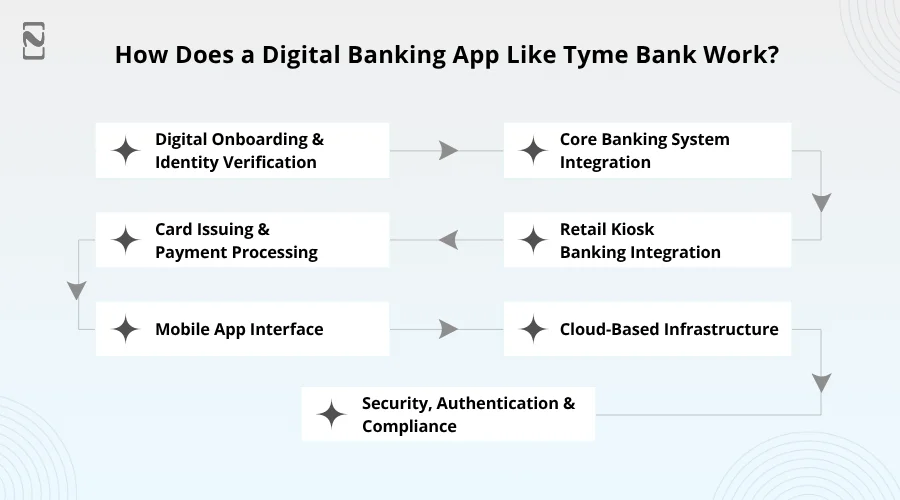

How Does a Digital Banking App Like Tyme Bank Work?

How does Tyme Bank offer banking without branches?

TymeBank, a branchless banking platform that provides a comprehensive suite of banking services through digital channels.

This cloud-native bank improves traditional banking services rather than replacing them.

Let’s sink in to know Tyme Bank’s working mechanism:

1. Digital Onboarding & Identity Verification

Enthusiasts usually ask, “How does Tyme Bank onboard customers digitally?” Well, users start by entering their national ID number with their personal information through a kiosk or mobile app.

Ahead, systems will connect to KYC in fintech apps from third-party providers or government databases for ID validation.

When successful verification is attained, the user’s bank account is automatically created.

2. Core Banking System Integration

Post account creation, the bank’s core system manages all the activities, like transactions, deposits, balances, interest, etc., in real time.

Ahead, mobile app contacts with this core through secure fintech APIs. After each transaction, the customers instantly check their updated balances.

3. Retail Kiosk Banking Integration

Next, self-service, physical kiosks are linked to this mobile banking platform’s CRM systems. Utilizing these, users can sign up, undergo identity verification, and directly print cards.

Then, the data gets synced with the mobile app from the kiosk inputs. This is how Tyme Bank integrates retail kiosks.

4. Card Issuing & Payment Processing

After user account creation, the banking system assigns or arranges a debit card (Visa) with no manual effort. Users can collect their cards from kiosks or get them delivered. For all further card details, they can utilize the app features.

5. Mobile App Interface

The mobile app, the customer-facing layer, pulls data via APIs from the backend to showcase real-time details, like history, balances, etc., and safely sends commands back.

The app is adopted for handling customer inputs, such as PIN resets, transfers, or card requests.

6. Cloud-Based Infrastructure

Talking about the cloud environment, all systems, be they databases, APIs, core banking, or analytics, are deployed in it. It guarantees high availability, scalability, and diminishes operating costs.

7. Security, Authentication & Compliance

On login, or if the system senses high-risk activity, it conducts multi-factor authentication, end-to-end encryption of data, whether it’s in transition or at rest, regulatory monitoring, and real-time fraud detection. All data being used complies with relevant regulations.

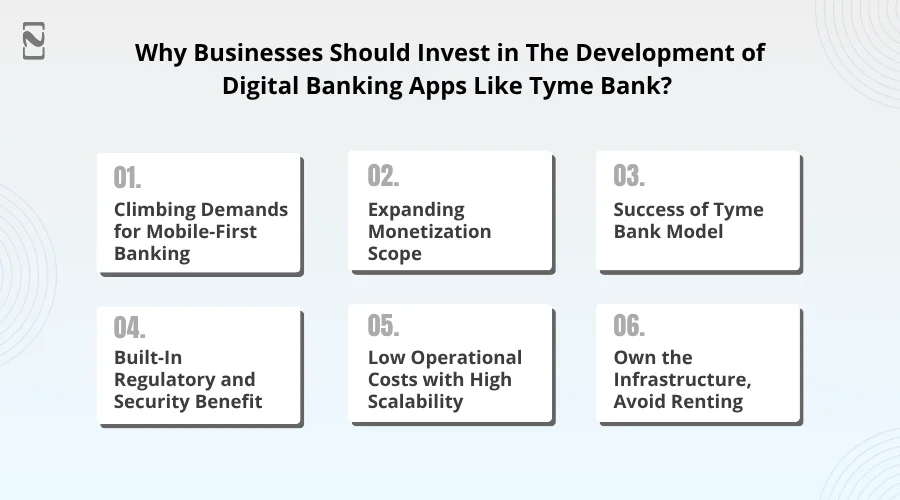

Why Businesses Should Invest in Developing an App Like Tyme Bank?

-

Climbing Demands for Mobile-First Banking

Consumers want fast, handy, and branchless banking. Here, Tyme Bank emerges with the convenience and accessibility to win customers that we saw last year with the increasing app usage in South Africa.

Tip: Businesses looking to embark on their fintech journey can grab the opportunity seamlessly while the segment is still growing.

-

Expanding Monetization Scope

How do fintech apps make money? Considering such digital banks, they monetize through partner offers, credit products, data analytics, interchange fees, premium account tiers, and more. (We will get deeper into this topic later in this post.)

Tip: Reap the benefits of a monetization that’s diverse, flexible, and easy to control the entire ecosystem because of the swift digital transformation in Fintech today.

-

Success of the Tyme Bank Model

Per the latest fintech app statistics reported in July, the Singapore-based digital bank had around 17.5 million retail customers in the Philippines and South Africa.

Post-disrupting the banking sector of these countries, this mobile-first banking solution is spreading its roots globally.

-

Built-In Regulatory and Security Benefits

Tyme Bank’s digital banking model is a live example of how digital onboarding integration can become customers’ most trusted, compliant, and secure.

Modern digital banks can integrate biometric security, automated KYC/AML, and end-to-end encryption to boost customer confidence in utilizing their functionality.

Tip: Develop an app like Tyme Bank without leaving the legacy of traditional banks that most users still cherish following.

-

Low Operational Costs with High Scalability

Obviously, traditional banks with physical infrastructure, staff, and branches have high fixed costs.

Digital banks, low-cost banking apps like Tyme Bank, can cut costs as they run on cloud-native infrastructure, demanding fewer resources.

Scaling to millions of users can be cost-effective with the proper tech architecture.

-

Own the Infrastructure, Avoid Renting

Digital banking platforms like Tyme Bank allow you to own it, besides only launching a product by owning its infrastructure.

Thus, while brainstorming how to start a fintech business, you should scan Tyme Bank’s digital banking model, which allows owners to have complete control over compliance, features, and a mobile-first banking experience.

Must-Have Features for Tyme Bank Like Platform Development

If you want to rise to the occasion, especially in the cut-throat market, you should choose to incorporate a core set of features aiming for smooth accessibility, affordability, and a unique user experience.

Below, we have curated a list of the best features of the Tyme Bank mobile app that you can consider:

► Customer Panel Features

| Features | Explanation |

| Digital Account Opening (eKYC) | It permits users to open a bank account online using their ID verification. |

| View Balance & Transactions | This feature lets customers easily check their account balance and transaction history. |

| Fund Transfers | It facilitates users to transfer money to other accounts or banks. |

| Debit Card Management | Users can manage card settings, such as PIN setup, freeze/unfreeze, and reissue. |

| Goal-Based Savings | It permits users to set their savings goals with ever-changing interest rates. |

| Bill Payments | Users can directly pay utility, airtime, and other bills through the app. |

| Push Notifications & Alerts | This feature sends real-time alerts for logins, transactions, and offers. |

| Biometric Login | It enables secure login via facial recognition or fingerprint. |

| In-App Support/Chat | Users get help through live chat or chatbot within the app. |

| Profile & Security Settings | It helps manage user profiles, 2FA, passwords, and notification preferences. |

► Admin Panel Features

| Features | Explanation |

| User & Account Management | The feature helps customers view, modify, or deactivate their accounts. |

| KYC/AML Monitoring | It helps track customer verification and identify suspicious activity. |

| Transaction Monitoring | Admin can review and audit all transactions across the platform. |

| Fraud Detection & Alerts | This feature points out unusual patterns and automatically raises red flags. |

| Role-Based Access Control | With this feature, the admin can assign roles and permissions to the internal team members. |

| Card Issuance Management | Helps manage and track issued debit cards and activation status. |

| Dashboard & Analytics | It lets admins visualize key metrics like revenue and active accounts. |

| Audit Logs & System Tracking | Maintain documentation of admin actions and system changes for compliance. |

| Customer Support Tickets | This feature permits the admin to view and handle support queries that customers raise. |

| System Configurations | It regulates interest rates, limits, fees, and other core settings. |

► Agent/Kiosk Panel

| Features | Explanation |

| Assisted Customer Onboarding | The feature allows users to open accounts through ID verification and data input. |

| ID Verification Integration | An agent can enter an ID to instantly validate a customer’s identity. |

| Instant Account Creation | It allows real-time account creation linked to the core system. |

| Debit Card Printing/Issuing | This feature permits printing and handing out debit cards at the kiosk post account creation. |

| Card Activation | It lets the user activate the printed debit card, freeing up the customer from doing it manually. |

| Customer Search & Lookup | The feature finds existing users using ID or mobile number. |

| Basic Account Status View | It shows basic details like account number, balance, and card status. |

| Limited Admin Access | This app feature only permits kiosk agents to access assigned tools and views. |

| Offline Mode (Optional) | It permits basic data entry if the internet is unavailable, which syncs when online. |

| Hardware Integration | Connect with card printers, ID scanners, or biometric devices. |

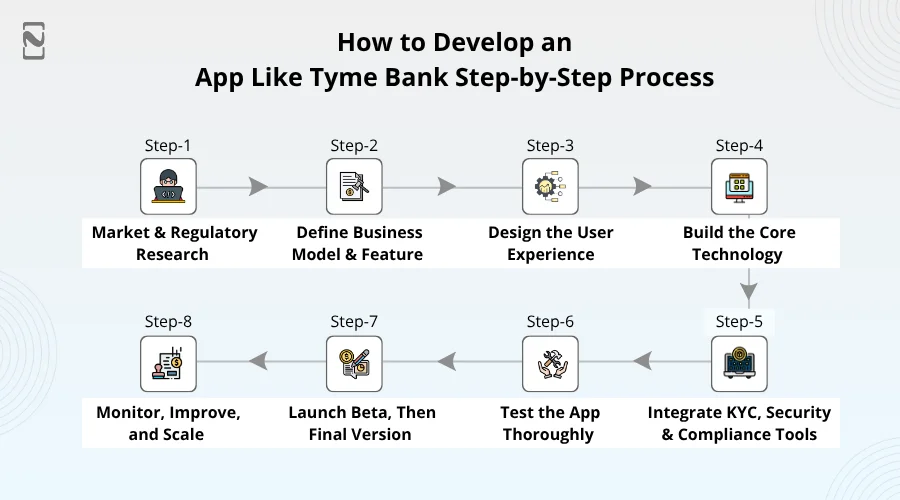

How to Develop an App Like Tyme Bank – Step-by-Step Process

Now, as you know about the core features that you can include, next, you should learn how to build a branchless banking app like Tyme Bank.

Step 1: Market & Regulatory Research

Start by identifying the target audience and scrutinizing their financial behavior, demographics, and pain points. Decide who you are serving – rural populations, tech-savvy urban residents, or freelancers demanding specific tools.

Ensure staying up-to-date with the latest technologies such as AI in fintech, blockchain, open banking frameworks, IoT in fintech, and more.

Identify the gap between traditional banks and mobile banking platforms. Remember to research all the applicable laws, embracing Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Team Required: Business Analyst, Legal Advisor, Fintech Consultant

Time Needed: 2-4 weeks

Step 2: Define Business Model & Features

You can make money from subscriptions, partnerships with third-party services, advertising, and subscriptions.

So, decide your revenue strategy. Choose the core features for your cloud-native bank to foster trust and boost user engagement. Also, to lead the pack, opt for AI-powered financial consulting services.

Team Required: Founders, Product Manager, Financial Strategist

Time Needed: 2-3 weeks

Step 3: Design the User Experience

This step will help you to build a cloud-native digital bank. If you are emphasizing creating a user-friendly mobile-first banking solution, craft simple wireframes and interactive prototypes to test your app’s functionality.

You should prioritize making an easy-to-understand, intuitive, and clear interface, referring to Tyme Bank’s user experience design. Besides, keep the language simple and visualize the data leveraging charts and graphs.

Team Required: UX Designer, UI Designer, Product Owner / Stakeholder

Time Needed: 3-5 weeks

Step 4: Build the Core Technology

In this phase, you should execute the design of the Tyme Bank-like app you created and build its technical base.

Go for the most suitable Banking tech stack (check the next section for this) based on your business goals, budget, and app’s features.

Leverage the power of microservices to build a scalable cloud-native architecture to handle fundamental banking functions.

Next, it’s time to develop the app’s frontend for the platform you want to target, Android, iOS, or others. You should ensure that your app is responsive and functions perfectly across distinct devices.

Team Required: Mobile Developers (iOS/Android), Backend Developers, DevOps Engineer (for deployment), QA Tester (to help from early stages)

Time Needed: 10-16 weeks

Step 5: Integrate KYC, Security & Compliance Tools

Your app is all about financial data, so all these integrations are non-negotiable. Integrate KYC API to automate customer ID verification via facial recognition, document scanning, and checking against watchlists.

Besides, you should implement security features from the beginning. This incorporates automated fraud detection, end-to-end data encryption, and a secure infrastructure with every access control. Utilize a compliance monitoring system to keep abreast of dynamic regulations.

Team Required: Compliance Officer, Backend Developer, Security Engineer

Time Needed: 4-6 weeks

Step 6: Test the App Thoroughly

You should conduct rigorous testing to guarantee your app is reliable, secure, and functional before rolling it out.

Besides, perform integration testing, unit testing, and end-to-end testing for accurate component verification. Penetration testing is also significant in recognizing vulnerabilities.

Authentication and access control testing will help your sensitive data stay well-protected. Accumulate user feedback through performance and usability testing and identify areas for improvement.

Team Required: QA Engineers, Testers

Time Needed: 3–5 weeks (parallel with development)

Step 7: Launch Beta, Then Final Version

After letting your app undergo testing, launch its beta version in which you allow a limited audience to use your app for stability testing. Incorporating fixes and feedback, deploy its final version to decided app store.

Team Required: Product Manager, Marketing Lead, Customer Support Team, Developers (for fixing feedback-based issues)

Time Needed: 2-3 weeks

Step 8: Monitor, Improve, and Scale

Even after a successful launch, your app needs constant monitoring and integration. In this, you track server load, system health, and transaction volumes to watch your app handling surging demands.

Respond to the feedback loops, such as user analytics and in-app surveys, to pinpoint and fix bugs and plan possible updates.

Team Required: Product Manager, DevOps & Developers, Customer Support, Marketing & Growth Team

Time Needed: Ongoing

Recommended Tech Stack to Develop a Platform Like Tyme Bank

Before you finalize your tech stack, you should analyze what technology Tyme Bank uses.

However, in this section, we will pull out the tools and technology you can keep in view for your Tyme Bank-like app.

- Frontend (Mobile App): Flutter, React Native

- Frontend (Web/Admin Dashboards): React.js, Vue.js

- Backend (API & Business Logic): Node.js, Java (Spring Boot), Python (optional for specific services)

- Database: PostgreSQL, MongoDB

- Cloud Infrastructure: AWS, Google Cloud Platform, Microsoft Azure

- Core Banking Engine: Mambu, Thought Machine, Custom microservices

- KYC & AML Integration: Jumio, Onfido, Trulioo, ComplyAdvantage, Alloy

- Card Issuing & Payments: Marqeta, Galileo, Mastercard, Visa, Flutterwave, Yoco

- Authentication & Security: OAuth 2.0, OpenID Connect, Firebase Auth, Keycloak

- Biometric & Two-Factor Authentication: Face ID, Fingerprint APIs, Twilio Authy, Okta

- Notifications: Firebase Cloud Messaging, OneSignal

- DevOps and CI/CD: Docker, Kubernetes, Jenkins, GitHub Actions, Terraform

- Monitoring & Logging: Datadog, Prometheus, Grafana, ELK Stack (Elasticsearch, Logstash, Kibana)

- Analytics & Reporting: Metabase, Power BI, Looker

- CRM & Customer Support: Zendesk, Freshdesk, Intercom

- Document & File Storage: Amazon S3, Google Cloud Storage

- Compliance & Audit: Vanta, Drata, Custom audit logging system

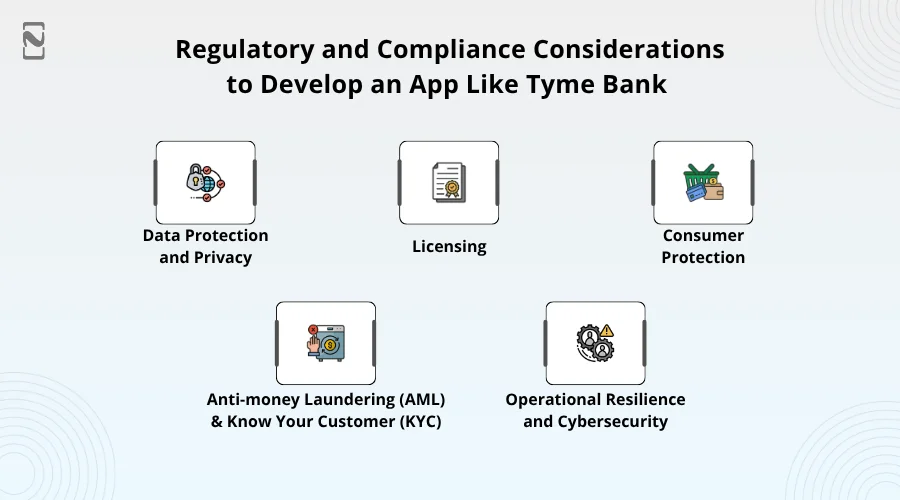

Regulatory and Compliance Considerations to Develop an App Like Tyme Bank

If you are planning to build an app like Tyme Bank in Africa, or anywhere globally, you should pay attention to regulatory and compliance specifications.

-

Data Protection and Privacy

You need strict security measures, such as access controls, encryption, and multi-factor authentication.

-

Licensing:

While you develop an app like Tyme Bank, be sure you secure a banking license or partner with a currently licensed bank. Thus, your product can overcome regulatory blockages and capital needs.

-

Consumer Protection:

Regulations guarantee transparency and fair treatment for customers, embracing a defined process, clear terms, and pricing for managing customer complaints.

-

Anti-Money Laundering (AML) and Know Your Customer (KYC)

Digital banks need to follow risk-based processes for customer identity verification, usually leveraging digital and biometric verification modes.

-

Operational Resilience and Cybersecurity:

A Cloud-native bank infrastructure should bear cyberattacks, high traffic, and other disruptions. This incorporates strong cybersecurity protocols, rigorous testing, and business continuity plans.

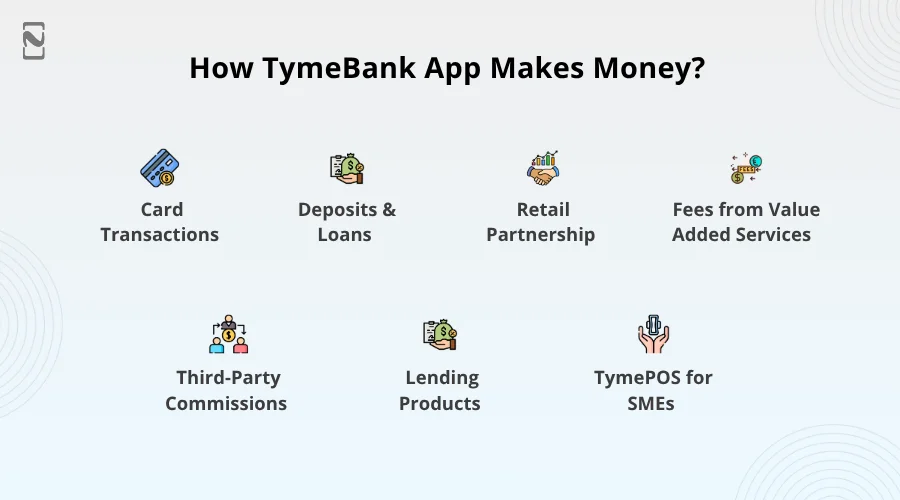

How TymeBank App Make Money?

By operating on a low-cost, high-volume model, Tyme Bank generates revenue via distinct channels. You should know to get knowledge about key money-making options.

Let’s uncover the top revenue streams:

1. Card Transactions

On every purchase a customer makes using their TymeBank debit card, the bank earns an amount from the merchant’s bank, also known as an interchange fee.

Tip: This creates recurring revenue at scale with a large user base.

2. Deposits & Loans

TymeBank lends money in the name of personal loans and overdrafts, consequently gets an interest margin, while paying back less interest to customers on their deposits.

3. Retail Partnership

As Tyme Bank kiosks are installed in retail stores, these partnerships might include revenue sharing, data-driven promotions, and co-marketing.

Tip: It’s best to go for it as it offers increased visibility, and you get shared profits on every financial product sold in-store.

4. Fees from Value-Added Services

Yes, Tyme Bank allows basic banking for free, but may charge for:

- Loan products

- Premium accounts

- Business accounts

- International accounts

5. Third-Party Commissions

Tyme Bank may earn referral fees or commissions from partners for:

- Investment products

- Insurance Sales

- Bill payments

6. Lending Products

The mobile banking platform charges fees and interest on:

- Credit lines or overdrafts

- Personal loans

- Buy Now Pay Later (BNPL) models

Tip: By allowing customers to request credit, you can foster customer trust and drive more profits.

7. TymePOS for SMEs

TymeBank offers point-of-sale systems to small businesses, and revenue comes from device sales, leases, transaction fees, and value-added services.

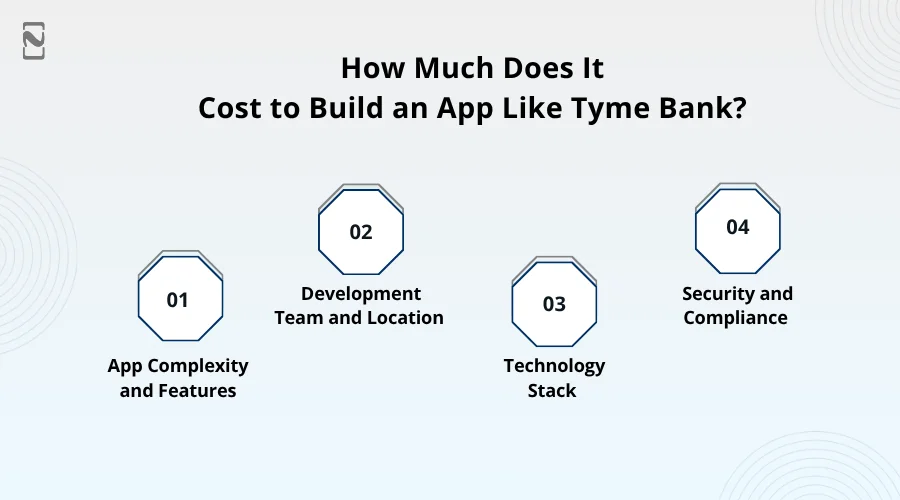

How Much Does It Cost to Develop an App Like Tyme Bank?

Tyme Bank-like app development costs can range from $50,000 to over $500,000.

The figures fluctuate because of varied cost-affecting aspects like app complexity, features, development team and location, technology stack, and more.

Learn about some major factors below:

-

App Complexity and Features:

Simple app development costs you less compared to a custom app (enterprise-level).

The more features you include in your mobile banking platform, the more it becomes complex, which in turn augments the development cost.

-

Development Team and Location

The rates to hire developers can be hourly, weekly, or monthly, which vary with the changing regions of the development team you hire.

-

Technology Stack

You can make your modern banking mobile app a success by choosing a robust and scalable tech stack.

Talking about Tyme Bank, Amazon Web Services (AWS) helps boost efficiency and scalability.

-

Security and Compliance

This factor is non-negligible for a digital bank and adds a significant amount to the development cost.

Financial regulatory compliance, like GDPR, KYC, and PCI, requires dedicated resources and time.

Challenges You Can Expect While Developing an App Like Tyme Bank

Building an app like TymeBank usually comes with challenges that you need to beat to attain your business goals.

Here are some critical issues you need to confront:

Challenge #1

Your branchless banking app should comply with stringent financial regulations.

Solution: You must hire compliance professionals, perform frequent audits, opt for KYC integration, and ensure you store user data by adhering to local laws.

Challenge #2

Safeguarding users’ personal and financial data is significant because even a single breach is enough to ruin trust and end up with lawsuits.

Solution: You need to ensure that you implement powerful encryption protocols, leverage the potential of biometrics and OTPs to reinforce user authentication. Also, follow secure coding practices, restrict access internally, and keep an eye on anomalies.

Challenge #3

With an obvious reason for distrust, users hesitate in trusting new digital banks, particularly in places where traditional banking services and cash are prioritized.

Solution: Developers should concentrate on making onboarding simple and swift by introducing selfie ID verification, digital KYC, and more. Moreover, the communication should be transparent and clear about the fees and services. You can also offer real-time support through WhatsApp or live chat.

Challenge #4

Generally, it’s technically complicated and highly risky to create reliable real-time systems for payments, account management, loans, savings, etc.

Solution: You can go for a core banking engine like Thought Machine and Mambu. Aim for a modular architecture that allows you to create and test features independently. Opt for a strong backend to guarantee high transaction integrity and availability.

Challenge #5

As TymeBank is a branchless, digital bank, it depends on retail connections for third-party ATM/payment network and account access.

Solution: You can simply partner with ATM providers, retail chains, and payment gateways in the start only. Additionally, create or integrate with APIs to permit deposits, card issuance, real-time payments, and withdrawals. Also, allow account setup in-store by offering services like smart kiosks.

How Can Nimble AppGenie Help You Build an App Like Tyme Bank?

When you look for a development partner, opt for a fintech app development company that offers specialized tools, custom fintech solutions, expertise, and support across every crucial edge of building a TymeBank-style app.

Once such a Tyme Bank-style app development company with years of experience and a team of proficient mobile app developers is Nimble AppGenie.

From starting a fintech business to how to lead the fintech market, we provide a complete suite of app development to help you deliver customer-centric fintech solutions.

Still not sure? Let us help you.

Key Highlights of Hiring Nimble AppGenie

- Industry Expertise

- End-to-End Development

- Regulatory & Compliance Support

- Core Banking Integration

- Scalable Architecture

- Post-Launch Maintenance

- Faster Time to Market

Wrapping Lines

We hope you find this South African digital banking app guide helpful.

Thinking of building your own digital bank? Well, that’s great! Start your digital onboarding app development journey now.

Before this, you should know why fintech startups fail and the reasons behind it. So forth, you can avoid making those moves and kickstart a safe and goal-focused fintech app.

Talk to our fintech development experts to make your fintech startup ideas a reality.

FAQs

- MVP (Minimum Viable Product): 4–6 months

- Full-featured product: 9–18 months

Timelines rely on team size, feature complexity, and compliance processes.

Yes, by partnering with a card issuing provider like Mastercard or Visa, you can offer physical debit cards through platforms such as:

- Marqeta

- M2P

- GPS (Global Processing Services)

You’ll need a team with the following specialists:

- Product Manager

- UX/UI Designer

- Frontend and Backend Developers

- DevOps Engineer

- QA/Testers

- Security & Compliance Experts

- Legal/Regulatory Consultant

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.