Over 70% of insurance customers say they’re more likely to stay loyal to companies that offer simple online platforms. The GEICO app is a perfect example. It has more than 10 million downloads and has some of the highest user ratings in the industry.

If you run a car insurance business and don’t have a mobile app yet, you’re falling behind. Today’s customers want to do everything on their phone, including view policies, make payments, file claims, and more. And if your competitors are providing that and you’re not? That’s business lost.

Therefore, it is the right time to develop an app like GEICO that gives a digital presence to your business. It’s more about giving your customers what they want, while making your operations smoother and more efficient behind the scenes.

In this blog, we will discuss the steps to develop a car insurance app like GEICO. From features and design to costs without any jargon, we will discuss just clear steps to help you bring your car insurance business online the smart way.

So, let’s begin!

What is a GEICO App?

GEICO is a car insurance app that helps users manage their car insurance from their mobile phones. They can simply check their policy or view their digital ID card right from their phone anytime.

Besides, if a user meets with an accident, they can file a claim through the GEICO app. Simply, a user has to upload photos or videos and track the progress from the app.

Just in case a user’s car breaks down on the way, they can call for roadside assistance like towing, jump starts, or car unlocking if locked out. One of the amazing things about this app is the virtual assistance. GEICO’s chatbot can answer users’ questions and guide them.

Market Overview of the Car Insurance Industry

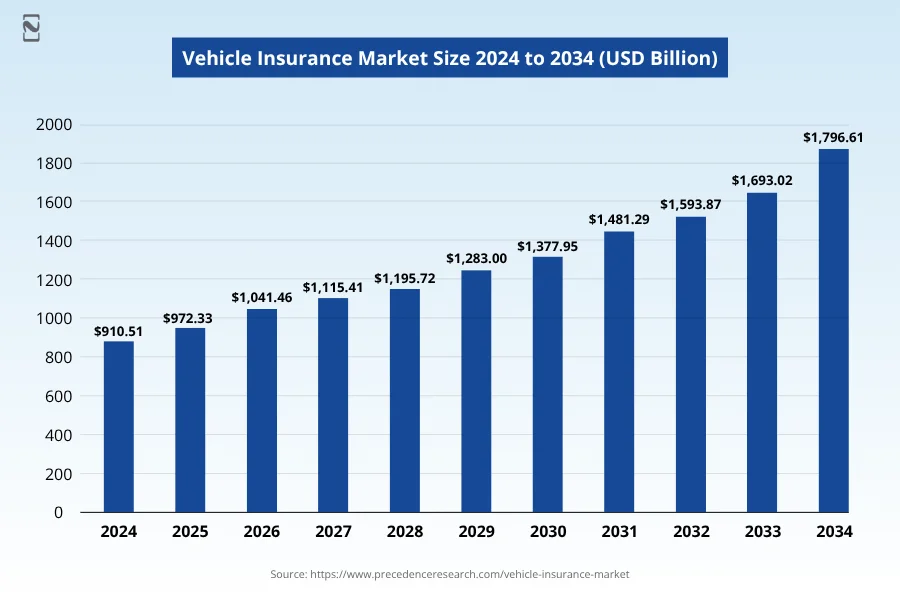

- As per precedence research, the global car insurance market is projected to hit $1,796.61 billion by 2034 at a CAGR of 7.03%. The car insurance industry is powered by increasing car ownership. As more people buy cars, the demand for insurance rises.

- With the advent of AI in insurance, the efficiency of claims processing and customer support has increased.

- The United States led the car insurance industry’s highest share of 34% in 2024. Thanks to telematics and IoT, usage-based insurance has increased, according to Pristine Market Insight.

- A report by IMARC Group shows that the increase in EVs and autonomous driving technologies also brings new opportunities for insurers. This necessitates adjustments in risk assessment models and policy offerings.

How Does a GEICO App Work?

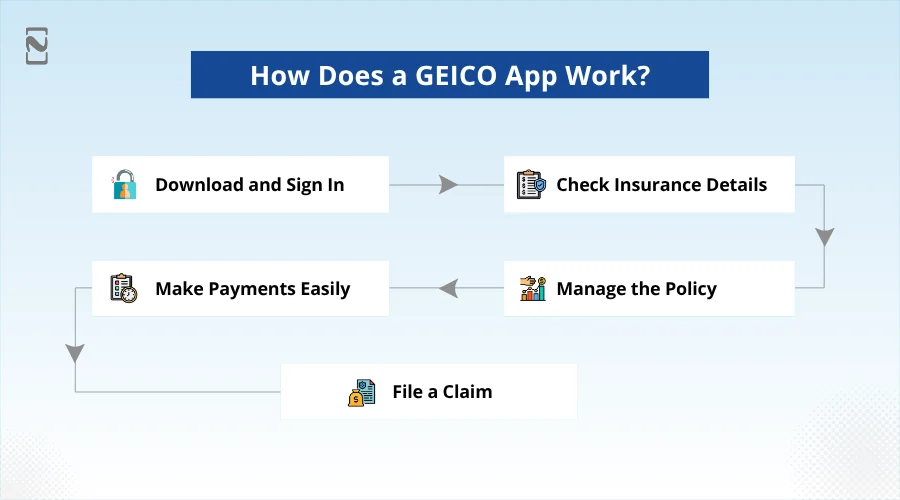

The workflow of a car insurance app called GEICO is really simple for users.

If you want to know its working mechanism for users, then here is the step-by-step process given below.

-

Download and Sign In

Firstly, a user goes to the Play Store or App Store, whichever mobile phone they use. They download the GEICO app and log in by using their contact number. Also, they can use fingerprints or Face ID for instant access.

-

Check Insurance Details

Once a user is logged in, they can check the main page or the home page. It shows their policy number, car details, and due payments. Also, they can see or download their online insurance ID card.

-

Manage the Policy

From the dashboard, a user can go to the policy section to see their full insurance policy details. They can update their contact and car details and add or remove vehicles.

-

Make Payments Easily

Now, a user taps on the payment section and sees how much they need to pay. They can select the payment mode, like card or net banking. They can also set auto-pay for hassle-free transactions.

-

File a Claim

If a user meets with an accident, they tap on the claim option and fill in the details. They can take photos and submit the claim, and track the progress.

How to Build an App Like GEICO?

If you have car insurance mobile app ideas but lack knowledge about their implementation, then you should seek assistance from a mobile app development company.

This is what your GEICO car insurance app development journey would look like.

Step 1: Understand What App Should Do

The first stage in developing an app like GEICO is to understand what your car insurance app needs to do. GEICO’s app helps users manage their insurance policies, get new quotes, make payments, and more.

So, you need to think about what your target audience will need from your car insurance app. Just jot down all the features you want to add. Also, you should look at what other insurance apps are doing so you can learn what works well and what does not.

Step 2: Choose the Right Team

Once you know what your car insurance app should do, you need to find the right development team to build it. You will need people who can design the app well, write the code, and test the app.

You can hire a professional mobile app development team or build your own team with experts. A good team will make sure the app looks good, works well, and is finished on time. Choosing the right team is really very important because they will turn your idea into a real app.

Step 3: Design the UI/UX

After setting up your development team, the next step is designing how the car insurance app will look and feel. The GEICO app development design should be visually appealing and user-friendly. You can just think about how the user will move through the app from one screen to another.

Also, you can choose the colors, fonts, and layouts that are clean and look professional. Make sure everything is really easy to find, like buttons do payment or claims. A fully-functional app makes your target audience happy and more likely to keep using it.

Step 4: Build an App Like GEICO

Once you design the UI/UX, the mobile app developers will develop an app like GEICO. They will write the code to integrate all the core features you planned in the beginning. The car insurance app should work on both Android and iOS.

It should simply connect to your database so that users can view their policy information and make payments. This stage takes a bit of time, especially if the app has a lot of features. Now developers need to ensure that the car insurance app. Also, the mobile app security is top-notch, since it manages personal and payment information.

Step 5: Test the Application

Before you can finally launch your car insurance app like GEICO, it needs to be carefully tested. Mobile app testing helps to make sure everything runs or works well on every device. You need to check if the features work properly.

If the app loads fast or not, and if there are any bugs or errors in the app. It is better to fix all these issues before the real users start using your car insurance app. Testing helps make sure the app is smooth and reliable.

Step 6: Launch and Update

Lastly, once your car insurance app’s testing is done, you can successfully launch the app by following the guidelines of both the app stores. However, your app’s task does not stop there.

You need to keep checking how users are using the car insurance app and listen to their feedback. Also, you must keep updating the app to fix issues and add new features. A good, visually appealing app keeps improving even after it is launched.

Must-have Features of a Car Insurance App like GEICO

Choosing the right features to develop an app like GEICO is essential for your app’s success. A well-mixed feature set boosts user satisfaction and simplifies claim progress. This can enhance the overall insurance services.

We have mentioned below the must-have features that you must integrate into your app.

| User Panel | Admin Panel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advanced Features to Include in an App like GEICO

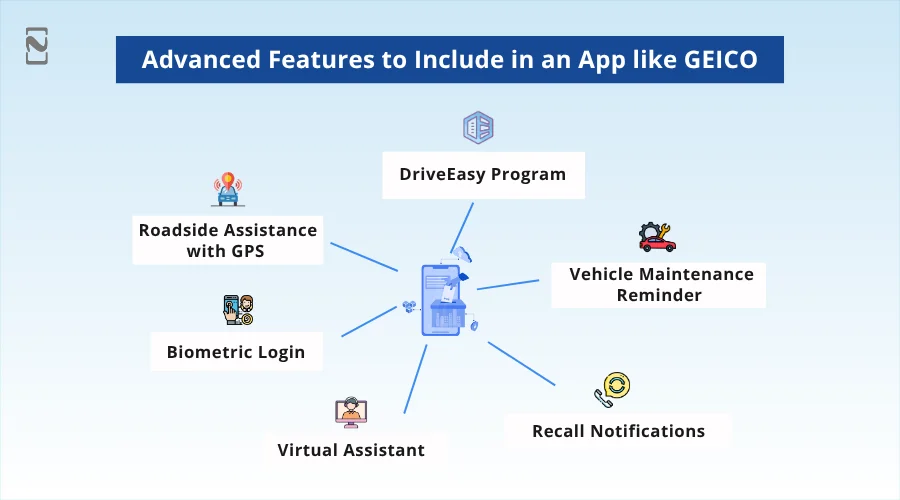

Now that you know the must-have features required for your car insurance app. It is vital to integrate advanced features that make your GEICO clone app development more useful and smarter for users.

So, here are the customized advanced features you can add to your app.

-

DriveEasy Program

This feature enables users to track their driving with their phone’s sensor. It checks things like fast driving, hard braking, and using phones while driving. If a user drives safely, you can provide them a discount on their insurance.

-

Vehicle Maintenance Reminder

You can integrate a vehicle maintenance alert feature when you develop an app like GEICO. So users can get reminders when it is time to get an oil change, tire rotation, and so on. It also keeps track of their past services to help them maintain their car better.

-

Recall Notifications

If there is a safety recall for a user’s car, like airbag issues, your app will alert them. It checks their car’s details and alerts them if the manufacturer has issued a recall.

-

Virtual Assistant

You can hire app developers to integrate a smart virtual assistant. Users can type in their questions, and it will help them find features, explain things about their policy, or guide them through tasks like filling a claim.

-

Biometric Login

Users can simply log in to the car insurance app using their fingerprint or face scan. This can make it a bit faster and more secure than typing in a password every time.

-

Roadside Assistance with GPS

If a user’s car breaks down or they need a tow, they can request help from the GEICO app. They use their mobile phone to access your app where they are, so help can reach them faster.

How Much Does it Cost to Develop an App like GEICO?

Generally, the cost to develop an app like GEICO can be between $25,000 – $180,000. It can increase or decrease depending on your project requirements. Your app complexity, features, and technologies you use to build it can affect the GEICO app development cost.

Let’s take a quick look at a quick breakdown of the cost to build an app like GEICO.

| App Complexity | Cost Estimation |

| Simple GEICO-like App | $25,000 – $70,000 |

| Intermediate GEICO-like App | $80,000 – $140,000 |

| Complex GEICO-like App | $150,000 – $180,000+ |

These are just rough estimates of the cost to develop an insurance app. If you want to build a customized car insurance app, then it is essential to consult with an app development expert. They will provide a quotation once you share your project requirements.

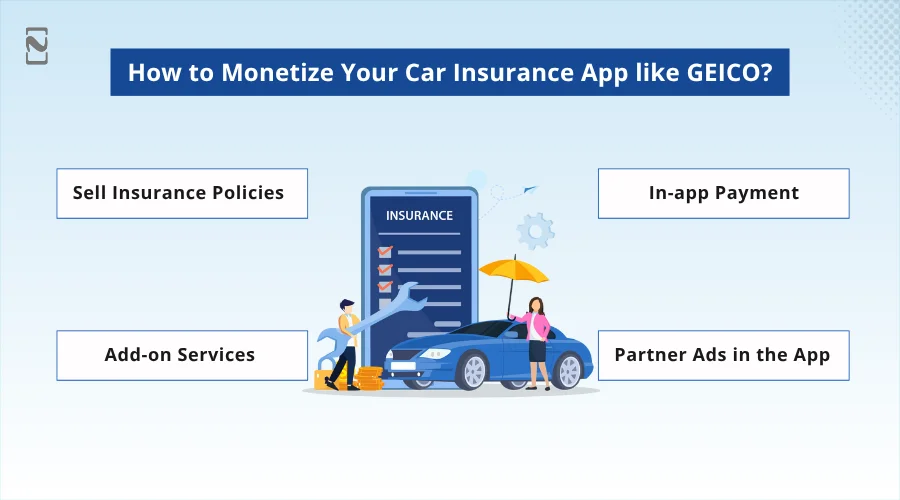

How to Monetize Your Car Insurance App Like GEICO?

To make money from your car insurance app like GEICO, you need to implement some app monetization strategies.

We have mentioned below the most popular revenue streams that many car insurance apps follow.

-

Sell Insurance Policies

One of the most popular ways to earn money from a car insurance app like GEICO is by selling insurance policies. People can use the app to get quotes, compare plans, and buy car insurance directly from the app.

When a customer buys a policy, the company earns money. The car insurance app can also help with renewals and policy changes, which keeps users coming back.

-

In-app Payment

Another famous revenue stream is in-app payments. The car insurance app enables users to pay their insurance bills safely and quickly. They can just add a small service charge or processing fee to each payment. This way, you can earn money while giving users a seamless payment experience.

-

Add-on Services

Apart from regular car insurance, you can provide additional services like roadside assistance, car towing, or accident support. These services can be sold as small upgrades to the user’s plan. People are often ready to pay a little more for an add-on piece of mind during emergencies.

-

Partner Ads in the App

Lastly, you can show advertisements from car-related businesses like garages, car rentals, or service shops. If users click or buy something through those ads, you earn a small commission on that. This revenue model works well if the app has a huge user base.

Why Choose Nimble AppGenie for Car Insurance App Development?

Nimble AppGenie assists car insurance businesses in building a simple and visually appealing mobile app. Our expert team designs mobile apps that work seamlessly, look aesthetically pleasing, and are easy to use.

We will make sure the car insurance app fits your project’s requirements and is ready to boost your business. Being the best insurance app development company, we manage everything from planning to designing and testing to launching your car insurance mobile app.

We keep the cost of developing an app like GEICO reasonable while giving the best quality. Nimble AppGenie integrates features like chatbots, voice assistants, and speech-to-text, so users get quick assistance and better services.

We can help you develop easy-to-use vehicle insurance solutions. Let’s join hands to bring value to your business and keep your insurance data secure.

Conclusion!

Developing a car insurance app is beneficial for insurance companies. It helps them make more money, get more customers, and spend less on daily work.

Thus, if you have an insurance business and want to develop an app like GEICO, Nimble AppGenie is the right choice. You can reach out to us to get a custom plan and strategy for your unique app idea.

FAQs

– Sell insurance policies

– In-app payment

– Add-on services

– Partner ads in the app

1. Conduct market research

2. Plan out the features

3. Design the user interface

4. Develop an MVP version

5. Test the application

6. Launch the application

7. Market and update the app

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.