Decentralization of Financial Services has certainly opened the door to several new opportunities in the fintech market. The idea of building financial infrastructure on a public blockchain is not only fascinating but also super convenient.

Giving a refresh to the highly complex cryptocurrency market, DeFi introduced some interesting digital products such as DeFi banking, decentralized crypto exchanges, Peer-to-Peer lending, and much more.

What started as a unique approach to blend the security of blockchain with financial exchanges while completely decentralizing them from traditional banks has certainly turned into a billion-dollar industry, with more and more businesses entering the field.

Every business/startup today is eying the DeFi market. One of the key questions that everyone is looking to answer is how? How to develop a DeFi app? Where to find the best DeFi app development service? And above all, how to be at the top of the DeFi revolution?

Well, if you, too, are looking for an answer to any of these questions, then don’t worry, as you have reached just the right post. In this DeFi app development guide, we are going to learn everything about the De-Fi ecosystem and identify the process of building a DeFi app.

But before we jump into the intricacies of the process, let’s take a look at DeFi as a concept.

Understanding the DeFi Ecosystem

DeFi applications are designed in a manner to provide an interface that automates the transactions among users by providing them with options to select the best.

It is a short term for decentralized finance, which represents an umbrella for financial services over public blockchains. Through DeFi, people can perform most of the things that banks usually support, such as earning interest, borrowing, lending, trading derivatives, trading assets, and much more.

The DeFi ecosystem includes stablecoins, decentralized exchanges, and money markets, along with other financial products and services that smart contracts create and operate on the blockchain.

The finance app does it much faster and doesn’t require any paperwork or integration with a third party.

These apps are designed to communicate with the blockchain, assisting people to utilize their money for performing purchases, loans, trading, gifts, or any way they want without any third party.

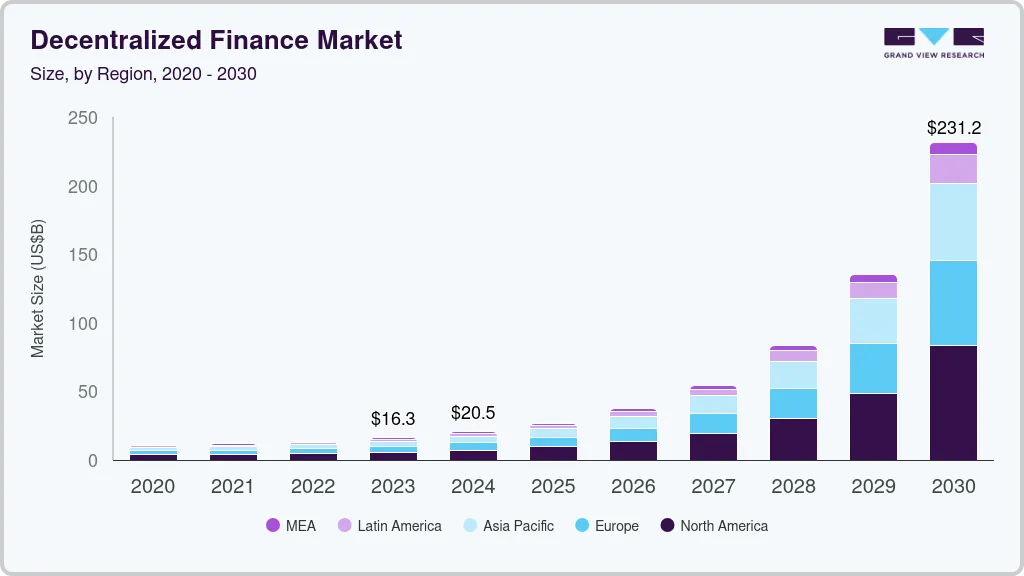

To give you a perspective of how rapidly the DeFi market is growing, it is important to identify where the market is headed. Let’s check out some key stats of the DeFi market to understand it better.

- The market size of DeFi is estimated to be USD 51.22 billion in 2025, and it is forecasted to reach USD 78.49 billion by 2030. The market is growing at a CAGR of 8.96% during the forecasted period (2025-2030).

- The global decentralized finance (DeFi) market size was valued at USD 20.48 billion in 2025. It is further forecasted to expand at a CAGR of 53.7% and touch USD 231.19 billion by 2030.

- Additionally, the market growth is driven by digital currency usage and is projected to reach USD 48.02 billion by the year 2031.

Looking at the market opportunities, entering the decentralized market can certainly be a good decision. So how do you penetrate the market? Developing a DeFi solution of your own is a good option.

However, before developing a solution of your own, you must have some insight into how a DeFi app works. Keep on reading, as we have discussed the way these apps work.

How Does a DeFi App Work?

The working procedure of the DeFi app is essential to examine before planning the launch.

DeFi may be a strange concept to you; however, people are using the platform in day-to-day aspects. Peer-to-peer lending can be considered one of the prime examples.

Under this process, the businesses don’t need to visit the banks. The system of DeFi works similarly to that of banks.

Check out the given steps for more info:

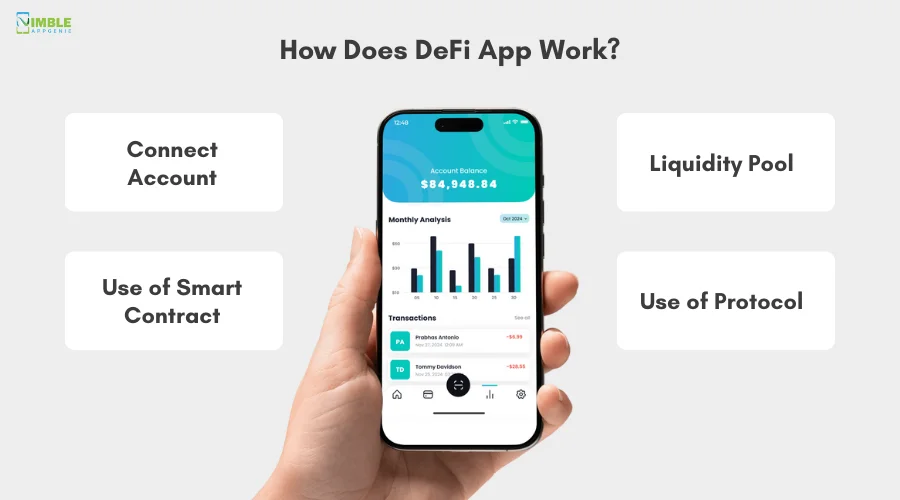

♦ Connect Account

Within the first step, the users are required to link their accounts with the application.

Other than this, users can directly deposit the funds into the DeFi app without involving any banks.

♦ Use of Smart Contract

With the help of blockchain technology in fintech, the app helps users connect with the expected lenders.

Smart contracts assist in connecting two parties, comprising end users and entities, in the form of computer code that is programmed to execute the platform automatically through a custom RPC for optimized transactions.

♦ Liquidity Pool

Through a liquidity pool, users can continue with their pledges on the protocols while building in the smart contract.

It is all connected through blockchain technology, where the transaction arrives at the distributed databases.

♦ Use of Protocol

Through the protocol, users can borrow money by pledging collateral to an individual or group.

Here, you might borrow money in crypto and create a digital contract between the lender and the borrower.

The functionality of the application DeFinitely gives you the surety that using the same is secure and allows you to enter the market with a DeFi app of your own.

However, there are multiple types of applications. That again raises the question, what type of De-Fi app should you go for? Check out the next section to know more.

Types of DeFi Apps

Decentralized Finance has gradually turned into a whole industry that uses different types of DeFi apps. Blockchain in Fintech has paved the way for different solutions that can be deployed to leverage the growing demand of secure crypto and decentralized applications.

There are several different DeFi apps that you can pursue through DeFi app development and enter the market with a solution of your own.

Here are some popular types for your reference:

► Decentralized Exchanges (DEXs)

Decentralized exchanges are all about assisting users to trade in crypto assets via blockchain transactions without any need for a centralized intermediary.

This type of application can help users trade crypto assets via blockchain transactions without any need for a custodian intermediary.

► Lending & Borrowing Platforms

DeFi lending is quite similar to the old lending services that are offered by banks. The only difference here is that this type of app offers P2P decentralized applications.

These platforms are designed to help people borrow and lend funds, and allow crypto holders to earn an effective amount of income.

► Stablecoin Platforms

Stablecoin platforms offer digital assets that are well-designed to maintain a stable price over time.

Within Stablecoin DeFi apps, cryptocurrencies are pledged to stable assets. These can be determined as platforms where the value is pegged and then tied to another currency, commodity, or financial statement.

► Yield Farming & Staking Platforms

Under this type of DeFi app, yield farming and liquidity mining can be determined as a short-term investment.

Energy is a high-risk, volatile investment where the investor can lend, borrow, as well as lock the crypto assets. This is an advanced type, where the users are allowed to receive rewards through allocating digital assets.

► Decentralized Derivatives

Decentralized derivatives DeFi apps provide permissionless access that allows anyone to participate without needing permission from a central authority.

This type of DeFi app can be useful in addressing the issue of users related to the approval of loans from the central authority, and reduces the hassle of visiting banks or the main branches of these banks.

Other than these, there are more solutions that can be created using the decentralized approach. You need to identify modern opportunities and accordingly make your next move.

With so many options available, it is clear that decentralization of finance is not just a trend that may or may not survive; it is a whole industry. So how do you make the most of this rising industry?

Going for DeFi app development seems to be a vital step that you should take. Launching a mobile app that leverages DeFi can help you in the long term. So how do you do that? Well, check out the next section to find out!

How to Launch a DeFi Application? Step-by-Step Process

Developing and launching a DeFi app of your own requires you to go through a complete app development process. From identifying the basic features to add in your app, to writing code for each functionality, the process is quite vivid and needs proper understanding.

To give you a better perspective, we have discussed all the steps involved in DeFi app development below. Check them out!

Step 1: Planning Your DeFi App

It is important to develop the project objectives and ensure that your DeFi app is capable of achieving them. You should be able to conduct in-depth market research to determine the target market as well as build a distinct value for the app.

Based on the very first step of DeFi app creation, you should identify the specific problem that exists in the market and understand the target audience.

Here, you can identify the specific DeFi use case that you further wish to address with the app. All you need is to conduct surveys and focus groups, along with competitor analysis. You should clarify the target segment and then proceed with the app effectively.

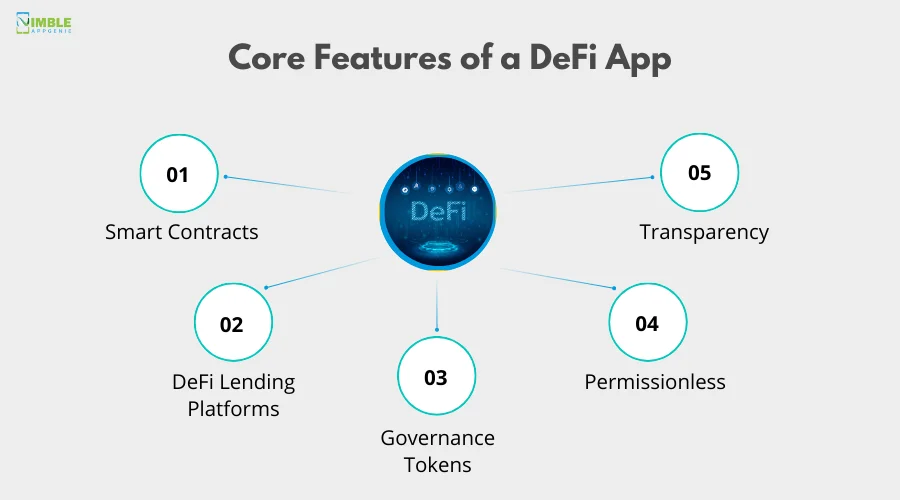

Step 2: Core Features of a DeFi App

You cannot imagine an app without its features, right? Thus, evaluating the type of features is a crucial determinant. The key principle behind DeFi is to remove third parties like banks from the financial system.

Here is a list of the top DeFi app features:

-

Smart Contracts

The DeFi mobile app has this core feature of utilizing smart contracts for automating financial transactions, through reduces human error risk. It enables functions such as loan processing and automated payments, along with decentralized governance.

-

DeFi Lending Platforms

DeFi lending platforms assist users in earning interest on their cryptocurrency holdings by lending them to borrowers. It offers margin trading options and assists long-term investors in lending assets.

-

Governance Tokens

Governance tokens provide users with voting power to influence protocol decisions. This feature is responsible for decentralizing control and promoting community-driven development.

-

Permissionless

One of the crucial features of DeFi that can be helpful to grab attention is its permissionless nature. The app doesn’t follow the conventional principles of access that are followed in traditional finance.

-

Transparency

Transparency is a feature that helps merchants and customers maintain trust in the DeFi app. Smart contracts are published over the blockchain, and records of completed transactions do exist for review.

Well, adopting these fintech app features can be helpful here for building your dream DeFi app.

Step 3: Technology Stack for DeFi App Development

After adopting the right features, you should implement a suitable fintech app tech stack. Here’s a table to consider.

| Component List | Technologies and Tools |

| Frontend | React.js, Vue.js, Web3.js, Tailwind CSS |

| Blockchain | Solana, Polygon, the distributed ledger, smart contracts, and Ethereum |

| Programming Languages | Rust, Vyper, C++, Java, PHP, Golang |

| Testing and Security Tools | Slither, OpenZeppelin, Remix, MythX |

| Wallet Integration | Wallet Connect, MetaMask, Web3.js, Ethers.js |

| Development Tools | Alchemy, Infura, Truffle, Hardhat, Ganache |

| Oracles | Brand Protocol, Chain-link |

| Storage | Arweave, Interplanetary File System |

This is an effective table helpful for considering the development process of the DeFi app.

Step 4: Building the DeFi App

Now is the time to consider creating a DeFi app. Here, you combine all the technologies and steps and proceed to make a complete fintech app.

You should evaluate the essential technologies, along with the right design. Along with this, here you will take into account the type of elements, such as developer community support, security, transaction speed, and scalability.

The technology should be built by considering a user-centric interface. The platform makes use of security protocols, software, and connectivity, along with hardware advancements.

Step 5: Ensuring Security and Compliance

It is important to develop a risk evaluation plan for identifying security patterns. You should continue with risk assessments, which are helpful for identifying the type of risk involved in your next DeFi app.

After analyzing, it is important to set up the fintech app security patterns and controls. Thus, you should adopt and implement robust security technology.

Here, it is important to utilize security compliance and related automated solutions. Under this pattern, you can check the current regulations and implement them successfully.

Step 6: Testing and Deployment

The fintech mobile app testing and deployment pattern is essential to carry out to ensure that the service provided by the app remains error-free and bug-free.

Under this step, you should develop the software, ensuring that it is integrable, and then finally deploy it successfully.

You need to deploy the app on the decided platforms like Android, iOS, or Hybrid.

Step 7: Launching Your DeFi App

Now, it’s time to make the DeFi app available to the end user. You can opt for various mobile app marketing tactics, helpful to launch the project in the market.

It is important to launch the app on the pre-planned date because it will not keep your end users waiting and can aid in building a diversified and strong connection with the audience successfully.

Here, you should evaluate the principles and every nuance related to the DeFi industry, and ensure that your app is effective in attracting users.

Finding a development team is a much better way to get over with DeFi app development rather than struggling with the entire process on your own.

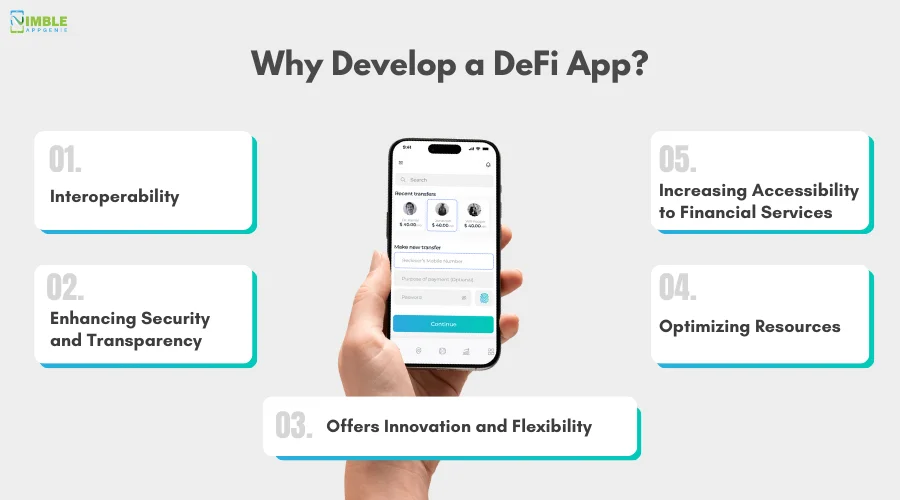

Why Develop a DeFi App? Is it Worth the Effort?

Looking at the steps involved, one can understand that it is certainly a tedious process.

Some of you may be wondering if the trouble is actually worth it? What exactly does DeFi bring to the table for your existing business, and what ways does it help you grow your business?

Well, the questions are understandable, as you surely need a reason to invest in a comprehensive process of DeFi app development. Here are some of the reasons why you should consider developing a DeFi business.

Reason 1: Interoperability

Creating a DeFi app is helpful for you as it can successfully align with the other products and systems.

In the current era, financial apps should be synced with other apps to provide effective services to the target users. This can be a vital reason for continuing with DeFi app development.

Reason 2: Enhancing Security and Transparency

When creating a DeFi app, you will need to adopt multi-factor authentication and securely store the private keys that help to protect the user’s funds and data.

Additionally, you will help in keeping the data of users safe with the app. Here, you can add smart contracts acting as the backbone of DeFi apps.

Reason 3: Offers Innovation and Flexibility

DeFi platforms are at the forefront of financial innovation, offering new financial products and services, including yield farming, liquidity mining, and synthetic assets.

Businesses might have more flexibility and independence in their financial dealings through these features.

Reason 4: Optimizing Resources

DeFi app development will be helpful to merchants who are bothered by banks, charging huge interest on any digital transactions.

Creating DeFi apps can assist these merchants in having a platform where they can directly interact with the blockchain-powered platforms and reduce their operational costs.

Reason 5: Increasing Accessibility to Financial Services

Creating DeFi apps further can be useful in increasing the accessibility of financial services. This is one of the important reasons to continue with these protocols.

This assists the users to directly participate in financial activities without any kind of intermediaries. With the assistance of this approach, businesses can lower costs and may broaden access.

These are all the reasons to consider for your DeFi app creation.

Cost to Develop a DeFi App

The average cost to develop a DeFi app typically ranges from $35,000 to $300,000, depending on diversified factors including complexity, features, and many other determinants.

Other than the cost to develop a fintech app, one of the essential components is the time taken to build a DeFi app.

Here is a table to consider when determining “how much time does it take to make a DeFi App?”

| App Development Process | Time Zone |

| 1. Market analysis | 1-2 Months |

| 2. Feature Choice | 1-2 Months |

| 3. Implementing Tech Stack | 2-3 Months |

| 4. Building a Complete App | 1-2 Months |

| 5. Ensuring Security and Compliance | 1-2 Months |

| 6. Testing and Compliance | 1-2 Months |

| 7. Launching App | 1-2 Months |

| 8. Total Time Taken | 8- 15 Months |

Till now, we have discussed briefly the DeFi ecosystem, its market stats, reasons, types, working process, resources required, and the steps to build a DeFi app.

Now, it is essential to identify the streams of earning money. After all, the end goal of every established business is to earn higher revenue.

Please consider the following section for the same.

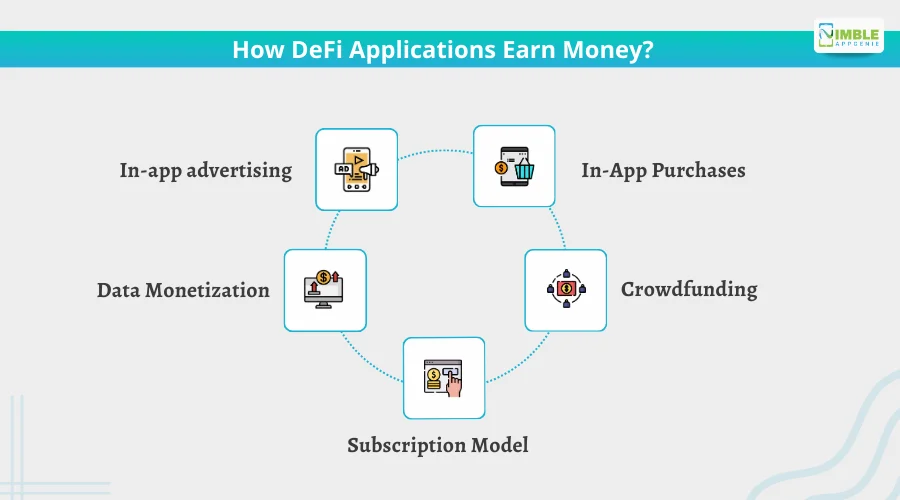

How Do DeFi Applications Earn Money?

It is essential to consider the types of patterns for earning money via creating a DeFi app.

Here’s a list of fintech app monetization models to be considered.

1] In-App Advertising

Through in-app advertising, you can connect with clients and may charge a fee for posting their ads. This is one of the monetization frameworks that can help connect with the brands and have a permanent source of monetization.

2] In-App Purchases

With in-app purchases, you can allow users to have a list of features that they can purchase according to their requirements.

It’s all about the purchases that your end users can make to evaluate the new features. You can earn permanent revenue via this stream.

3] Data Monetization

Under data monetization, it is important to obtain consent from the users and then utilize their data for monetization purposes.

In this procedure, the company may utilize the data it generates; however, it must export the data through reports and Excel sheets.

4] Crowdfunding

Crowdfunding can be effective for your business, where you can fund a project or venture by raising small amounts of money from a large number of people via the Internet. For a DeFi app, you can raise quality funds, which may go towards a general donation.

5] Subscription Model

To build a DeFi app and earn revenue from the same, you can opt for the subscription model.

It is a model where users can sign up to pay for a premium version or subscription. Here, the user can connect with the business, and you may adopt it as a permanent source of revenue.

These are all the strategies to undertake for earning money via building a DeFi app. After evaluating the monetization frameworks, you might be bothered by the type of challenges. Consider them all below.

Development Challenges in DeFi Apps

When working with all of these steps and integrating multiple technologies and monetization strategies into a single application, there are multiple challenges that you might come across.

Some of the core challenges that you might encounter when dealing with DeFi app development include:

➢ Security Vulnerabilities

DeFi apps may face significant security concerns due to the immature nature of the technology. Avoiding the issues related to security can result in hazards to the reputation of the brand.

DeFi apps often operate in an unregulated environment, which makes them susceptible to fraud and other malicious activities.

➢ Scalability Challenge

With low scalability and liquidity, the app can face a huge issue. During peak activity times, the network can become congested.

This can further lead to app crashes, disappointing the users from continuing with the app. Scaling challenges might refer to difficulties and obstacles encountered when trying to improve the performance of the overall app.

➢ Poor User Experience

A bad user experience can result in negative reviews from users. It might impact the complete brand image.

You cannot ignore the design of an app, as this will impact the user experience. Bad UX will result in slow-loading sites, frustrated users, and many more negative results.

➢ Lack of Regulations

If you are unaware of the regulations, you cannot succeed with your app. Thus, it’s essential to continue with the type of DeFi app only after evaluating the current regulations of the industry.

You should evaluate severe sanctions, along with millions of dollars in fines. This will be effective in learning the issues to avoid while building a DeFi app.

These are all challenges to consider when building a DeFi app. You can connect with an experienced company to know more.

How Does Nimble AppGenie Help Build a DeFi App?

At Nimble AppGenie, we are experts in providing and implementing cutting-edge technology solutions.

We are a leading Fintech App Development Company, offering diversified blockchain app development solutions.

Our team is ready to provide a vision for your dream project and assist you in discovering various updated technologies for your DeFi app, in delivering quality, and that too on time, as per our commitment.

Conclusion

To develop a DeFi app, all you need is the right series of steps, starting from market research to app launch and maintenance.

Along with this, developers can use Rust, Vyper, and C++ as programming languages in DeFi app development, and choose Solana or Polygon as the blockchain.

There can be a series of challenges that your DeFi app might face, including security vulnerabilities, scalability challenges, and a lack of regulations.

Here, the cost of creating a DeFi app might be impacted by different factors, including complexity, app design, maintenance cost, and many others. Connecting with an experienced team can help you here.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.