In a Nutshell:

- Digital transformation in insurance is leading to a revolutionized industry, making traditional workflows a bygone take and welcoming tech-driven solutions.

- Key drivers are advanced technologies, like AI, cloud platforms, and automation, which are leading to better risk management, faster claim processing, and improved customer experiences.

- Insurers reap multiple benefits, including cost reduction, operational efficiency, more personalized services, and enhanced compliance through digital tools.

- You should address key challenges that arise while you ensure a successful digital transformation journey, like data security, legacy system integration, and workforce adaptation.

- Stay competitive by adopting surging insurance technology trends, utilizing innovative solutions, and smoothly implementing a strategic blueprint for futuristic insurance operations.

- Nimble AppGenie specializes in strengthening insurance companies to navigate digital transformation in insurance by offering custom technology solutions.

Today, the insurance industry is facing a drastic change and the key drivers are dynamic customer expectations, competitive pressures, and technological advancements.

Traditional, old processes are usually paper-based and so forth, slow. Digital solutions are replacing them and helping users with automated operations, improved customer experiences, and improved decision-making.

This shift, digital transformation in insurance, is reshaping how insurers process claims, manage policies, and engage with clients.

Insurers seeking long-term growth and operational efficiency should adopt advanced technologies, such as AI and predictive analytics, to make the most of the benefits of digital transformation in insurance, like reduced operational costs, faster claim processing, and better compliance with regulatory standards.

Whether you are a C-level executive, IT professional, or belong to claims or risk teams, you should understand climbing insurance technology trends, leverage innovative tools, and implement a strategic plan for digital adoption.

This post talks about what is digital transformation in insurance is, key trends driving change, benefits to reap, challenges to overcome, and every detail you need for successful digital adoption.

What is Digital Transformation in Insurance?

Digital transformation in insurance means using modern technology to make insurance work better.

It helps insurance firms to improve their operations, customer dealings, claims handling, and risk management.

This drastic change affects every part of the business. By implementing the latest technologies in insurance, insurers can save time, reduce errors, and assist them in handling both customers and employees.

Insurers can use things like online portals to file claims, software to detect fraud automatically, and online systems to manage documents.

Simply put, digital transformation in insurance involves insurance digitalization, implementing digital insurance solutions, and advanced insurance software solutions. Through modernization, you can help insurers automate operations, boost efficiency, and improve customer experiences while unveiling the benefits.

What are the Major Digital Trends in the Insurance Industry?

Tech is shaking up insurance, making it way easier and quicker to get covered. Stuff like AI, apps, and data are helping companies step up their game.

Let’s dive into the biggest InsurTech trends happening right now.

Customer-centric Approach

In the past, insurance companies focused more on building their range of services than actually meeting customer needs.

But that’s changing. Today, the focus is on the customer, their needs, behaviors, and preferences.

This shift has led to better, more transparent communication between insurance companies and their customers. It helps in building trust and stronger bonds.

Data Analytics is Driving Smarter Decisions

Going digital does not mean losing that personal touch. It’s about making smarter, data-driven decisions. Analytics helps insurance companies improve their operations and serve customers.

With the right data, businesses can create a custom app tailored to specific customer needs. This gives them an edge in a competitive market.

Conversational AI in Insurance

Here, AI-powered virtual assistants and chatbots simplify customer interactions, resolve queries rapidly, and boost overall satisfaction. Insurers can automate routine jobs to target complex claims and personalized services.

Several emerging technologies, besides the above ones, are influencing the future of insurance.

Mobile Apps Make Insurance Easier

Nowadays, customers like buying products and services with as little human interaction as possible. That’s why mobile apps and online platforms are growing.

For example, Lemonade, a well-known US insurer, allows you to get coverage instantly with just a mobile phone.

It’s hard to beat that speed. Because of this trend, many insurance companies are now developing their own apps or shifting their services online to make things quick and easy for customers.

Cloud-Based Insurance Platforms

They enable seamless data access, scalable infrastructure, and rapid deployment of digital solutions.

IoT and Telematics

Insurers can accumulate real-time data using these for risk assessment, usage-based insurance, and proactive loss prevention.

Blockchain Technology

The technology boosts transparency, efficiency, and security in smart contracts and claims processing.

Robotic Process Automation (RPA)

It automates repetitive jobs, like underwriting, policy administration, and compliance reporting, increasing operational efficiency.

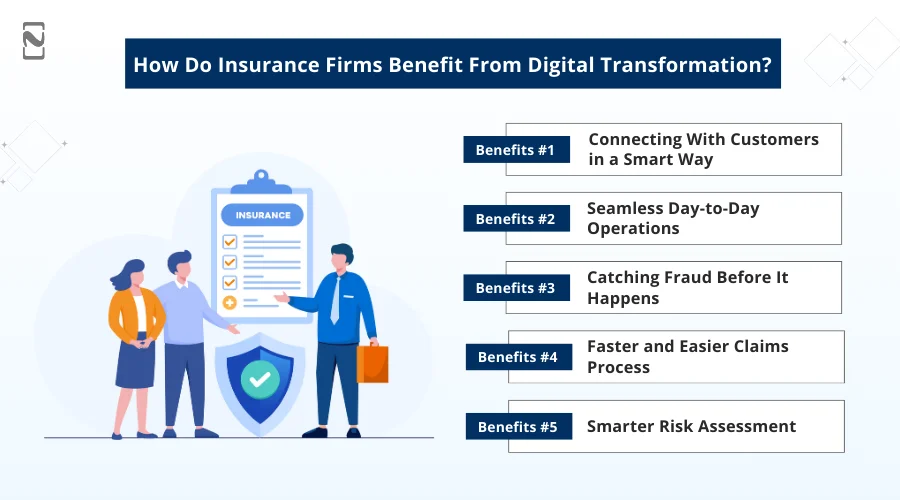

Benefits of Digital Transformation in Insurance

Digital transformation in insurance helps brands gain top benefits through better customer experiences, swift operations, and better decision-making. Insurers can diminish costs, boost efficiency, and deliver more personalized digital services through insurance process optimization, where digital technologies automate policy management, claims processing, and customer interactions.

Insurance is known for lots of paperwork, slow tasks, and constant customer questions, all of which can make things tough for agents.

But digital transformation is changing that. It helps make the work faster, simpler, and more efficient.

Want to know how? Let’s take a closer look at the benefits of digital transformation in insurance.

1. Connecting With Customers in a Smart Way

Customer experience can make or break trust in insurance. That’s why companies are now using mobile apps to improve how they interact with customers.

For example, instead of waiting on hold to speak with an agent, customers can now use mobile apps or websites to do things like:

- File a claim

- Compare insurance plans

- Check the status of their policy

These self-service options make the whole process faster and a lot easier. This leads to happy customers and very few complaints.

2. Seamless Day-to-Day Operations

Insurance companies deal with a ton of paperwork and repetitive tasks every day. But now, automation is changing that. For instance, with the adoption of AI in Insurance apps, tasks like

- Verifying claim documents

- Issuing policies

- Underwriting applications

It can be done much faster, often in just a few hours instead of days. This means employees can focus more on essential tasks. For example, helping clients and growing the business.

3. Catching Fraud Before It Happens

Insurance fraud is a serious issue nowadays. It costs the industry billions every year. But with the help of new technology, companies are staying one step ahead.

For example, AI-powered mobile apps can scan thousands of claims in real-time and detect anything suspicious, like duplicate claims or inconsistent data.

So, instead of investigating after the damage is done, insurers can now find and stop fraud early. This saves a lot of time and money.

4. Faster and Easier Claims Process

Filing a claim used to mean endless forms, delays, and back-and-forth emails. But not anymore. Now, policyholders can:

- Upload accident photos directly from the app

- Submit claim details online

- Track progress in real time

For example, someone involved in a minor car accident can click a photo and submit it through a car insurance app like Progressive Insurance.

They receive updates within hours. It does not require any paperwork or phone calls. This kind of fast online process enhances accuracy and reduces stress for everyone involved.

5. Smarter Risk Assessment

In the past, insurance companies used basic details like your age or where you live to decide how much you should pay. But that did not always feel fair.

Now, with digital transformation in insurance, they can look at real-time data to understand risk better.

For example, in car insurance, a small device in your car called a telematics device can track how you drive, things like:

- How fast do you go

- How often do you drive?

- How hard you brake

This helps the company see if you’re a safe driver. If you are, you could get lower prices. It’s a fairer system for both the company and the customer.

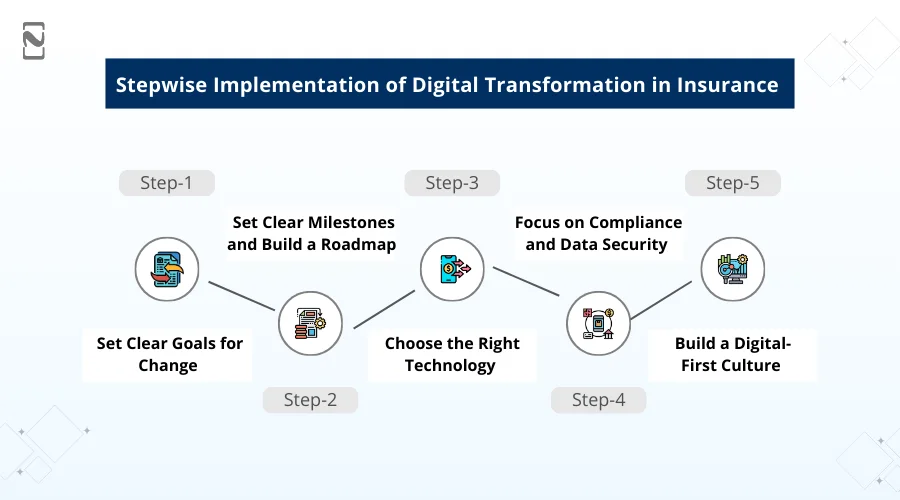

Stepwise Implementation of Digital Transformation in Insurance

To implement digital transformation in insurance, you can start with a stepwise approach where you first assess your existing systems, and then adopt digital insurance solutions and ultra-modern insurance software solutions.

Going digital is not just a trend in the insurance world; it is a must. But it is not always easy. Many insurance firms struggle because they do not fully understand how to make the shift.

Let’s break down the digital transformation insurance process.

Step 1: Set Clear Goals for Change

You can start by looking closely at how your business currently works. Especially the process that affects customers. For example, if it takes too long to handle claims, your customers would not be happy.

In fact, 79% of insurance companies say their old systems slow them down. So, the first step is knowing what needs to improve and what you want to achieve.

Step 2: Set Clear Milestones and Build a Roadmap

Once your goals are clear, map out a digital roadmap. You should focus on the most important areas first. For example, using RPA or robotic process automation to speed up claims.

As per the McKinsey report, insurers with a clear strategy can reduce operational costs by up to 30%. That’s a huge benefit for the business and your customers.

Step 3: Choose the Right Technology

There is no shortage of technology options like AI, cloud computing, machine learning, IoT, and so on. From customer service to backend operations, these technologies can improve everything.

But not every technology fits every business. So, choose only those technologies that actually fit your business goals and fulfill customers’ needs.

Step 4: Focus on Compliance and Data Security

Insurance digitization also means managing sensitive data or information more responsibly. That’s why staying compliant with regulations like GDPR or CCPA is essential.

A Deloitte report indicates that 64% of insurers view data security as one of the primary obstacles to their digital transformation journey. So, making security and compliance a priority is a must.

Step 5: Build a Digital-First Culture

Digital transformation is not just about using new technologies. It is also about changing how your team works.

That means creating a culture where people are open to learning and adapting. You can invest in training and digital skill-building.

A PwC report found that companies that train their teams see productivity rise by up to 25%. Once this culture is in place, your insurance business is no longer just transforming.

Digital innovation in the insurance industry is leading to a fully digital future.

Challenges in Implementing Digital Solutions in Insurance

The challenges of implementing digital solutions in insurance include data security risks, complex legacy system modernization, and resistance to change. Besides, insurers should also navigate rigid regulatory compliance in digital insurance, making a strategic blueprint and the right tech partnerships necessary for successful transformation.

While digital transformation brings many benefits, insurance companies often face many key challenges when trying to make the switch.

So, let’s take a look at the challenges and their solutions.

1. Old or Legacy Systems

Many insurance firms still use old software that is not developed for today’s technology. These outdated systems are complex to update and slow down new digital improvements.

Solution:

Insurance companies can slowly upgrade their systems step by step. If companies use modern platforms that work with old systems, it can help during the transition.

2. Rules and Regulations Compliance

The insurance industry has many strict rules around customer data and security. These rules can make it harder to launch new digital software quickly.

Solution:

Working closely with legal and compliance teams at the beginning of the process helps avoid issues. Using tech solutions designed to meet regulations can also speed things up.

3. Keeping Data Safe

Insurance business transformation means handling more customer data online, which increases the risk of hacking or data leaks. Keeping this data safe is a big challenge.

Solution:

Strong cybersecurity software and regular security checks are important. Training staff on data safety also helps reduce the data leak risks.

How Nimble AppGenie Drives Digital Transformation in Insurance with Future-Ready Solutions

Insurance companies collaborate with Nimble AppGenie to accelerate digital transformation in insurance by building and implementing next-gen digital insurance solutions.

Our team specializes in insurance digitization, modern insurance software solutions, and AI-powered automation that help insurers streamline processes, deliver improved customer services, and attain measurable insurance process optimization.

We work closely with insurers to upgrade their legacy infrastructure, integrate emerging technologies, and implement cloud-based platforms aligned with dynamic insurance technology trends.

Nimble AppGenie ensures the clientele harnesses the full potential of digital transformation in insurance while maintaining regulatory alignment and data security.

With domain expertise and innovation-led deployment, we support insurers in improving agility, mitigating operational costs, and outshining competitors.

Still not convinced? Let’s have a walkthrough of one of the impressive projects accomplished by our insurance app development company.

Real-Time Digital Transformation Case Studies in Insurance

Case Study 1: AI-Driven Claims Automation for a Health Insurance Provider

Challenge: Manual claims processing resulted in high operational costs, long turnaround times, and poor customer satisfaction.

Solution We Offered: Nimble AppGenie implemented an AI-powered claims automation platform with intelligent document processing and workflow automation.

Outcome:

- 40% Faster claim settlement

- Improved compliance and accuracy

- Reduced manual intervention

- Enhanced customer experience through real-time claim tracking

Conclusion

You can digitize insurance completely, implementing digital transformation in insurance by adopting high-performance insurance software solutions.

By achieving legacy system modernization in insurance, ensuring regulatory compliance in digital insurance, and through insurance process optimization, insurers can drive insurance innovation in 2026 and hold a competitive edge in a speedily evolving digital landscape.

Connect with a trusted insurance app development company with years of experience and proficiency in digitizing the insurance industry.

FAQ’s

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.