In a Nutshell:

- Learn how to build a DeFi app with a clear DeFi app development process, from idea validation to launch.

- Understand the different DeFi app types you can build: DEX, lending & borrowing platforms, staking apps, yield farming platforms, and wallets.

- Know the DeFi app development cost in 2026 based on type, complexity, and development stages.

- Explore the best tech stack for DeFi app development, including blockchain platforms, smart contract languages, frontend frameworks, and oracles.

- Choose from multiple DeFi app monetization models to let your app make money.

- Discover how Nimble AppGenie helps you build revenue-generating DeFi apps with real-world expertise and end-to-end support.

What is DeFi? Let’s have a quick recall!

DeFi (Decentralized Finance) is a financial system that has gained traction lately. It leverages blockchain and cryptocurrencies to facilitate direct transactions between businesses and individuals. DeFi removes intermediaries like banks and thus speeds up processes and reduces costs.

Nowadays, businesses and startups are building a DeFi app to drive new revenue streams, enabling users to smoothly borrow, lend, stake, trade, and earn yields directly through smart contracts. This diminishes cost and increases accessibility.

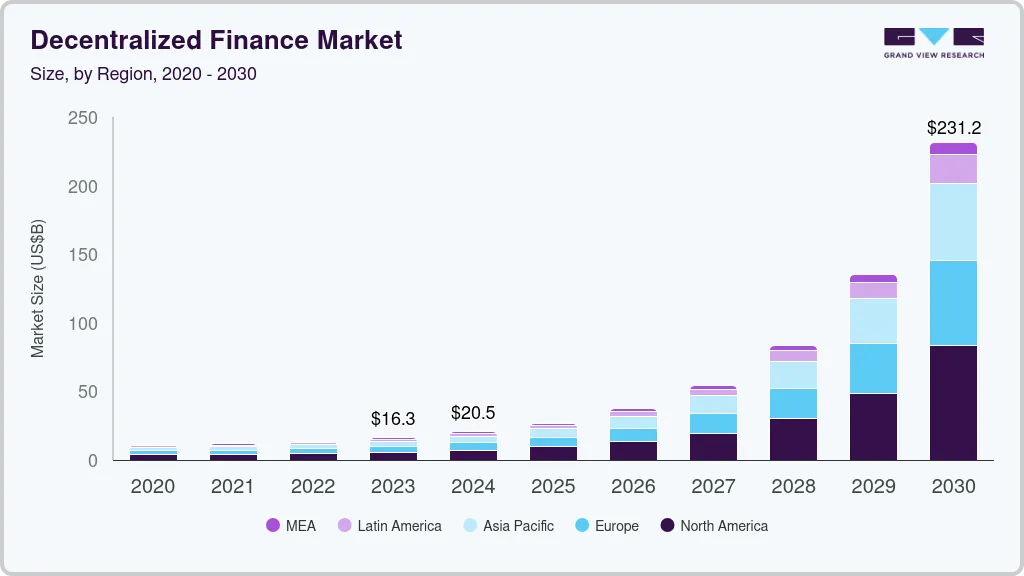

If you are a founder, product owner, a DeFi company, token issuer, or a strategic investor, you should develop a DeFi to capitalize on the growing market size of DeFi, forecasted to hit $78.49 billion by 2030, and recorded to be $51.22 billion in 2025.

But, how to build a DeFi app?

Well, you need a clear DeFi app development process, follow robust security practices, meticulously plan DeFi app cost, and choose the right DeFi app tech stack.

No need to be confused! Nimble AppGenie is here with a DeFi app development guide that will surely help you with DeFi app development and every minute detail you need for the successful creation of your app.

Let’s get the ball rolling!

What Is a DeFi App?

A DeFi app (decentralized finance app), a blockchain-based application, delivers financial services, like lending, trading, staking, and borrowing, without even depending on centralized intermediaries, such as brokers or banks.

Don’t confuse it with a fintech app.

DeFi app development is an advanced form of fintech app development built on blockchain technology.

What DeFi apps do is only use smart contracts to streamline transactions and transparently impose rules on the blockchain.

During DeFi application development, developers create protocols, and users directly interact with the system using digital wallets, while maintaining complete control over their assets.

This decentralized approach reduces costs, improves transparency, and provides global access to financial services while diminishing reliance on third-party institutions.

How Does a DeFi App Work – An Architecture Overview

As we discussed above, a DeFi app performs on a decentralized architecture where blockchain networks, smart contracts, and user-focused interfaces work collaboratively to foster trustless financial services.

Let’s dismantle the DeFi app architecture to learn better.

- Smart Contracts: These self-executing programs are deployed on the blockchain that define the basic logic of the DeFi app, such as rewards distribution, lending rules, swaps, and interest calculations.

- Blockchain Network: The blockchain (for example, Ethereum and Polygon) validates transactions, hosts smart contracts, and ensures transparency and immutability across the DeFi application.

- Frontend Interface: It’s the user-facing layer that eases users to flawlessly interact with the DeFi app. It communicates with smart contracts through Web3 frontend development libraries and puts forth real-time data in a simple interface.

- Wallets: Crypto wallets (like WalletConnect or MetaMask) sign transactions, authenticate users, and handle digital assets without storing private keys on centralized servers.

- Oracles: These offer off-chain data, like interest rates or asset prices, to smart contracts, allowing precise and secure execution of DeFi operations.

Together, these components make a decentralized system where financial transactions automatically execute with security and no intermediaries.

Why Develop a DeFi App? Is It Worth the Effort?

Looking at the steps involved, one can understand that it is certainly a tedious process.

Some of you may be wondering if the trouble is actually worth it? What exactly does DeFi bring to the table for your existing business, and what ways does it help you grow your business?

Well, the questions are understandable, as you surely need a reason to invest in a comprehensive process of DeFi app development.

Here are some of the reasons why you should consider developing a DeFi business.

Reason 1: Interoperability

Creating a DeFi app is helpful for you as it can successfully align with the other products and systems.

In the current era, financial apps should be synced with other apps to provide effective services to the target users. This can be a vital reason for continuing with DeFi app development.

Reason 2: Enhancing Security and Transparency

When creating a DeFi app, you will need to adopt multi-factor authentication and securely store the private keys that help to protect the user’s funds and data.

Additionally, you will help in keeping the data of users safe with the app. Here, you can add smart contracts acting as the backbone of DeFi apps.

Reason 3: Offers Innovation and Flexibility

DeFi platforms are at the forefront of financial innovation, offering new financial products and services, including yield farming, liquidity mining, and synthetic assets.

Businesses might have more flexibility and independence in their financial dealings through these features.

Reason 4: Optimizing Resources

DeFi app development will be helpful to merchants who are bothered by banks, charging huge interest on any digital transactions.

Creating DeFi apps can assist these merchants in having a platform where they can directly interact with the blockchain-powered platforms and reduce their operational costs.

Reason 5: Increasing Accessibility to Financial Services

Creating DeFi apps further can be useful in increasing the accessibility of financial services. This is one of the important reasons to continue with these protocols.

This assists the users to directly participate in financial activities without any kind of intermediaries. With the assistance of this approach, businesses can lower costs and may broaden access.

These are all the reasons to consider for your DeFi app creation.

Types of DeFi Apps You Can Build

DeFi application development is opted for several financial use cases, but each comes with a unique business model, technical complexity, and feature set.

Below, we have explained the most common types of DeFi apps you can create.

1. Decentralized Exchange (DEX)

With a DEX, users can directly trade cryptocurrencies from their wallets utilizing smart contracts.

These platforms depend on DeFi liquidity pools, not the order book,s and generate revenue via DeFi transaction fees or swaps.

Tip: Choose decentralized exchange (DEX) development if you want to earn transaction fees from high trading volume.

2. Lending & Borrowing Platforms

DeFi lending and borrowing platforms allow users to lend their assets to earn interest or borrow funds by offering collateral.

Smart contracts handle liquidations, interest rates, and repayments without any mediators.

Tip: Lending & borrowing platform development helps generate recurring interest-based revenue.

3. Yield Farming Platforms

Leveraging these apps, users increase returns by providing staking assets or liquidity across multiple protocols. These platforms usually utilize incentive tokens to drive more participation and liquidity growth.

Tip: Yield farming platforms’ development supports swift user acquisition through incentives.

4. Staking Applications

With DeFi staking features, users lock tokens to support network security or earn rewards. Commonly, they are picked for long-term asset holding strategies or governance participation.

Tip: Staking applications development improves long-term retention and token utility.

5. DeFi Wallets

Wallet integration in DeFi apps offers secure access to decentralized applications, enabling users to interact with smart contracts, manage assets, and participate in various DeFi protocols through a single interface.

Tip: Build a DeFi wallet to create a DeFi ecosystem gateway.

| DeFi App Type | Best For Businesses That Want To |

| DEX | Earn transaction fees from high trading volume |

| Lending & Borrowing | Generate recurring interest-based revenue |

| Yield Farming | Rapid user acquisition via incentives |

| Staking | Improve token utility & long-term retention |

| DeFi Wallet | Build a DeFi ecosystem gateway |

BONUS TIP: How to Choose the Right DeFi App Type?

Well, you should consider the following three pointers before you choose a type for a DeFi app development.

- Business Model & Revenue Goals,

- Technical Complexity & Budget, and

- Target Users & Market Maturity.

You should balance your business objectives, technical capabilities, and market opportunities to choose the right DeFi app type.

How to Launch a DeFi Application? Step-by-Step Process

How to build a DeFi app?

Here are the DeFi app development steps you should follow to create a business-ready and secure decentralized finance application.

Step 1: Idea & Use-Case Validation

It is important to develop the project objectives and ensure that your DeFi app is capable of achieving them. You should be able to conduct in-depth market research to determine the target market as well as build a distinct value for the app.

Based on the very first step of DeFi app creation, you should identify the specific problem that exists in the market and understand the target audience.

Here, you can identify the specific DeFi use case that you further wish to address with the app. All you need is to conduct surveys and focus groups, along with competitor analysis. You should clarify the target segment and then proceed with the app effectively.

Business Insight: Early validation saves development costs and ensures your DeFi solution works on the real pain points.

Step 2: Choosing a Blockchain Platform

Pick the blockchain that suits your DeFi app goals.

Ethereum provides wide adoption and DeFi tooling, whereas Polygon mitigates transaction fees, and Solana offers high-speed execution.

Tip: Consider transaction speed, network fees, scalability, and developer ecosystem when selecting your platform.

MVP vs Scale: For MVPs, you can choose Polygon DeFi development or Binance Smart Chain as they are cost-efficient blockchains; full-scale apps may demand multi-chain deployment or Ethereum DeFi app development.

Step 3: Smart Contract Development for DeFi

As you know, smart contracts are the core of any DeFi app; they define lending rules, staking rewards, automated governance, and swap logic.

Tip: Utilize modular and reusable smart contracts to drop audit costs and ease future upgrades.

MVP vs Scale: You may include core features in MVP, but for full-scale platforms, you should include advanced features, such as cross-chain integrations or dynamic interest rates.

Step 4: Frontend & Wallet Integration

The frontend connects users to your DeFi app and ensures smooth interaction with smart contracts.

Wallet integration is important for secure transactions.

Business Insight: An intuitive and clean interface boosts adoption and mitigates onboarding friction.

Tip: Incorporate token balances and real-time transaction feedback to foster trust.

Step 5: Backend & APIs

DeFi apps run mainly on-chain, but the backend manages user dashboards, analytics, off-chain data, and notifications.

DeFi oracle integration with APIs for lending rates, price feeds, or external DeFi protocols.

MVP vs Scale: MVPs may depend on minimal backend support, but full-scale apps require strong infrastructure for alerts, analytics, and scaling user requests.

Step 6: Security Testing & Audits

DeFi apps handle real money, and this makes security crucial.

Perform smart contract audits, stress testing, and penetration testing to safeguard against exploits.

Tip: Go for a bug bounty program to include external ethical hackers and reinforce trust.

Business Insight: Early investments in audits avoid expensive hacks and protect reputation.

Step 7: Deployment & Launch

Now, it’s time to make the DeFi app available to the end user. You can opt for various mobile app marketing tactics, helpful to launch the project in the market.

It is important to launch the app on the pre-planned date because it will not keep your end users waiting and can aid in building a diversified and strong connection with the audience successfully.

Here, you should evaluate the principles and every nuance related to the DeFi industry, and ensure that your app is effective in attracting users.

Finding a development team is a much better way to get over with DeFi app development rather than struggling with the entire process on your own.

Closely monitor liquidity, user activity, and on-chain performance.

Tip: Choose a staged rollout in which you should start with the beta version to a limited audience before you go for a full-scale launch.

MVP vs Scale: MVP rolls out test core functionality, whereas a full-scale launch demands liquidity provisioning, marketing, and governance setup.

Must-Have Features for a DeFi App (MVP vs Advanced)

For a successful DeFi app development, you need to balance user experience, security, and user experience.

Here, we will talk about both MVP and advanced DeFi app features.

MVP includes essential features to quickly validate the idea.

Advanced apps incorporate revenue-optimized and scalable functionalities.

► MVP Features Table

| Features | Description | Business / Technical Insight |

| User Onboarding & Wallet Integration | Simple wallet connection (MetaMask, WalletConnect) | Reduces friction, drives early adoption |

| Core DeFi Functionality | One primary function: token swap, staking, or lending | Allows fast MVP launch to validate concept |

| Smart Contract Security | Basic audited smart contracts for essential operations | Ensures minimum security for early users |

| Transaction Management | Single liquidity pool / simple transaction execution | Enables basic user interactions |

| Analytics Dashboard | Basic dashboard showing balances and transactions | Helps founders monitor MVP adoption |

| Notifications | Email or in-app notifications for transactions | Enhances engagement without complex setup |

► Advanced Features Table

| Feature | Description | Business / Technical Insight |

| Multi-Wallet Support & KYC | Integrate multiple wallets + optional KYC/AML compliance | Improves adoption and expands regulatory compliance |

| Multi-Function Platform | Combine swapping, lending, borrowing, staking, and yield farming | Increases revenue streams & user retention |

| Modular Smart Contracts | Multi-sig governance, bug bounty programs, and continuous auditing | Enhances security, reduces risks, and increases user trust |

| Advanced Liquidity Management | Multi-pool management and automated market making (AMM) | Optimizes trading efficiency and yields for users |

| Advanced Analytics & Reporting | Real-time dashboards, user metrics, and protocol KPIs | Supports strategic business decisions |

| Cross-Chain Integrations | Connect to multiple blockchains and layer-2 solutions | Expands user base and transaction volume |

Best Tech Stack for DeFi App Development

It’s crucial to choose the right DeFi app tech stack to create a user-friendly app.

You need to meticulously pick the tools and technologies as it impacts your development costs, speed, future scalability, and security.

Consider the table we have curated for your ease.

| Component List | Technologies and Tools |

| Frontend | React.js, Vue.js, Web3.js, Tailwind CSS |

| Blockchain | Solana, Polygon, the distributed ledger, smart contracts, and Ethereum |

| Programming Languages | Rust, Vyper, C++, Java, PHP, Golang |

| Testing and Security Tools | Slither, OpenZeppelin, Remix, MythX |

| Wallet Integration | Wallet Connect, MetaMask, Web3.js, Ethers.js |

| Development Tools | Alchemy, Infura, Truffle, Hardhat, Ganache |

| Oracles | Brand Protocol, Chain-link |

| Storage | Arweave, Interplanetary File System |

DeFi app development cost in 2026 depends on the development stage, the type of app, and the technical complexity.

Time Required to Build a DeFi App

What’s the time to build a DeFi app?

You can check the breakdown of the DeFi app development timeline based on the development stage.

| App Development Process | Time Zone |

| 1. Market analysis | 1-2 Months |

| 2. Feature Choice | 1-2 Months |

| 3. Implementing Tech Stack | 2-3 Months |

| 4. Building a Complete App | 1-2 Months |

| 5. Ensuring Security and Compliance | 1-2 Months |

| 6. Testing and Compliance | 1-2 Months |

| 7. Launching App | 1-2 Months |

| 8. Total Time Taken | 8- 15 Months |

Cost to Build a DeFi App

The average cost to develop a DeFi app typically ranges from $35,000 to $300,000, depending on diversified factors including complexity, features, and many other determinants.

Other than the cost to develop a fintech app, one of the essential components is the time taken to build a DeFi app.

Here is a table to consider when determining “how much time does it take to make a DeFi App?”

Till now, we have discussed briefly the DeFi ecosystem, its market stats, reasons, types, working process, resources required, and the steps to build a DeFi app.

Now, it is essential to identify the streams of earning money. After all, the end goal of every established business is to earn higher revenue.

Please consider the following section for the same.

We have created three separate tables for a clear explanation.

Cost by App Type

| DeFi App Type | Approximate DeFi MVP Development Cost | Approximate Cost (Advanced) |

| Decentralized Exchange (DEX) | $40,000 – $70,000 | $100,000 – $200,000 |

| Lending & Borrowing Platform | $50,000 – $80,000 | $120,000 – $250,000 |

| Yield Farming Platform | $30,000 – $50,000 | $80,000 – $150,000 |

| Staking App | $20,000 – $40,000 | $50,000 – $100,000 |

| DeFi Wallet | $25,000 – $45,000 | $60,000 – $120,000 |

Cost by Development Stage

| Development Stage | Approximate Cost |

| Idea & Use-Case Validation | $2,000 – $5,000 |

| Smart Contract Development | $15,000 – $50,000 |

| Frontend & Wallet Integration | $10,000 – $40,000 |

| Backend & APIs | $8,000 – $30,000 |

| Security Audits & Testing | $5,000 – $20,000 |

| Deployment & Launch | $3,000 – $10,000 |

Cost by Complexity

| Complexity Level | Features / Scope | Approximate Cost |

| Low | Single feature, simple smart contract, basic frontend | $20,000 – $40,000 |

| Medium | Multi-feature, modular smart contracts, multi-wallet support | $50,000 – $100,000 |

| High | Multi-feature, cross-chain integrations, high security, advanced UX | $100,000 – $250,000 |

Monetization Models for DeFi Apps

Multiple ways can help your DeFi apps generate revenue, depending on their user base, type, and functionality.

Here, DeFi app monetization models can help.

Here we have explained the most common DeFi platform revenue model from which you can choose which you should choose for sustainable growth.

Lending & Borrowing Interest Spread

Charging a big amount as an interest rate to borrowers can help your lending platform to earn revenue.

And, the difference, the interest spread, becomes the protocol’s revenue.

Transaction & Swap Fees

Various DeFi platforms, mostly DEXs, take a small DeFi transaction fee, which is automatically accumulated by smart contracts and divided among liquidity providers or protocols.

Staking & Yield Farming Commissions

If your platforms are offering staking or yield farming, you can charge a small commission on rewards for users.

Premium Features & Enterprise Integrations

Also, you can make your DeFi apps offer analytics or advanced tools for institutional investors, professional traders, or enterprise clients.

So, the revenue comes from:

- API access fees

- Subscription fees

- Custom integrations

Token Utility & Governance

You can allow your DeFi apps to create an extra revenue stream, and you can issue a native token.

Some of those relevant revenue streams are:

- Token appreciation with the growing adoption,

- Premium features or access unlocked by holding tokens, and

- Governance tokens for voting rights.

Cross-Protocol Partnerships

You can collaborate your app with other DeFi protocols or service providers to drive revenue, like:

- Referral fees

- Co-branded initiatives

- Shared liquidity rewards

Common Challenges in DeFi App Development and Solutions

When you build a DeFi app, you will encounter various user-focused, regulatory, and technical challenges.

Confronting those early challenges will help you emerge with a scalable and secure app that will run successfully in the competitive market.

Challenge #1: Regulatory & DeFi Compliance Challenges

Solution: You should include KYC/AML processes, take legal advisors’ consultation who know with crypto and blockchain compliance, and stay updated with applicable regional regulations.

Challenge #2: Smart Contract Vulnerabilities

Solution: Remember to conduct rigorous testing, smart contract security audit, and adopt battle-tested frameworks.

Also, implement multi-sig governance and modular contracts for reducing risks.

Challenge #3: Scalability & Network Costs

Solution: Choose sidechains, layer-2 solutions, or an alternative blockchain for DeFi app development to diminish fees and boost throughput.

Moreover, you should perform smart contract optimization for increased gas efficiency.

Challenge #4: Liquidity & Market Adoption

Solution: Product owners should incentivise liquidity providers early with token incentives or rewards.

Connect with other protocols to magnetize initial users and bootstrap liquidity.

Challenge #5: User Experience & Wallet Integration in DeFi Apps

Solution: Prioritize easing onboarding, integrate several wallet options, and offer real-time transaction feedback.

Furthermore, reduce friction when conducting usability testing.

Challenge #6: Security of Oracles & Off-Chain Data

Solution: Leverage the potential of a trusted decentralized oracle, perform routine monitoring, and implement redundant oracle feeds.

How Does Nimble AppGenie Help Build a DeFi App?

DeFi app development is a complicated process that demands expertise in smart contracts, security audits, blockchain development, and wallet integration.

Partnering with an experienced and proficient DeFi app development company can help you.

Well, you don’t have to load yourself in search of the best, as Nimble AppGenie has deep expertise in both fintech app development and DeFi solutions.

By providing DeFi app development services, the company will support you from conception to deployment and will deliver a successful DeFi application.

Key Highlights of Nimble AppGenie

- End-to-End Development

- Seamless Wallet Integration

- Scalable & User-Friendly UI/UX

- Blockchain Expertise

- Custom Token & Staking Solutions

- Smart Contract Excellence

Real-Time Case Study (Client Name Hidden)

Project: Decentralized Lending & Staking Platform

Scope: Lending, borrowing, staking, and token rewards

Solution We Offered:

- Our team of Fintech app developers created modular smart contracts for lending, borrowing, and staking.

- Smoothly integrated wallets (MetaMask, WalletConnect) and responsive UI.

- Performed Chainlink oracle integration for real-time asset pricing

- Conducted full security audits before app launch.

Results:

- 10,000+ active users in the first month

- $5M+ transactions processed securely

- 40% boosted user retention through tokenised staking rewards

Nimble AppGenie delivers scalable DeFi apps within the defined time and budget, and, as expected, that fuse technical precision with business-focused outcomes.

Conclusion

DeFi application development is a strategic move that comes with opportunities to create transparent financial solutions.

In order to accomplish success in custom DeFi app development, you should know every step is crucial, from idea validation and smart contracts deployment to ensuring security.

Hire DeFi app developers from an experienced fintech app development company like Nimble AppGenie.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.