In a Nutshell:

- BNPL platform strategically to reduce cart abandonment and boost conversions by giving customers flexible payment options.

- BNPL solution drives growth and ensures your app supports installments and instant approvals to improve customer satisfaction.

- Overcome the challenges of BNPL integration for businesses in advance to avoid revenue loss and legal risks.

- BNPL technology, like APIs, SDKs, and webhooks maintain real-time updates, secure transactions, and seamless backend synchronization.

- Nimble AppGenie ensures end-to-end BNPL success by handling integration, compliance, development, and optimization.

Buy Now, Pay Later (BNPL) has moved from being a trend to a standard payment expectation for online businesses. With the BNPL market forecasted to reach $80.15 billion by 2033, more companies are now focusing on BNPL integration to boost conversions and checkout flexibility.

BNPL integration for businesses means adding a buy now, pay later option directly into their website or app so customers can pay in installments. Additionally, the business receives the full payment upfront through a BNPL provider.

This payment model has proven to increase conversion rates, average order value, and customer retention. It is especially for high-value purchases and subscription-based services.

This BNPL implementation guide is written for business owners, founders, and product teams who want a clear understanding of how BNPL integration works, what technologies are involved, and how to implement it without unnecessary complexity.

So, let’s begin!

What Is BNPL Integration?

BNPL integration is the process of integrating a Buy Now, Pay Later payment option to your website or mobile app with a third-party BNPL provider. It allows customers to split their purchase into installments while the business receives payment upfront.

From a business standpoint, Buy Now Pay Later integration is not about providing credit. Instead, it is about optimizing the checkout experience and reducing payment friction that often leads to cart abandonment. The best buy now pay later apps are Klarna, Affirm, etc.

When a customer selects BNPL at checkout:

- The BNPL provider performs instant eligibility checks

- The transaction is approved within seconds

- The business completes the sale without waiting for customer repayments

The best BNPL providers for small businesses then manage installment collection, customer communication, and repayment risk. This makes the integration of BNPL a low-risk and scalable payment solution for businesses that want to grow without managing lending operations.

BNPL integration is commonly used by e-commerce platforms, marketplaces, subscription-based services, fintech, and digital product companies.

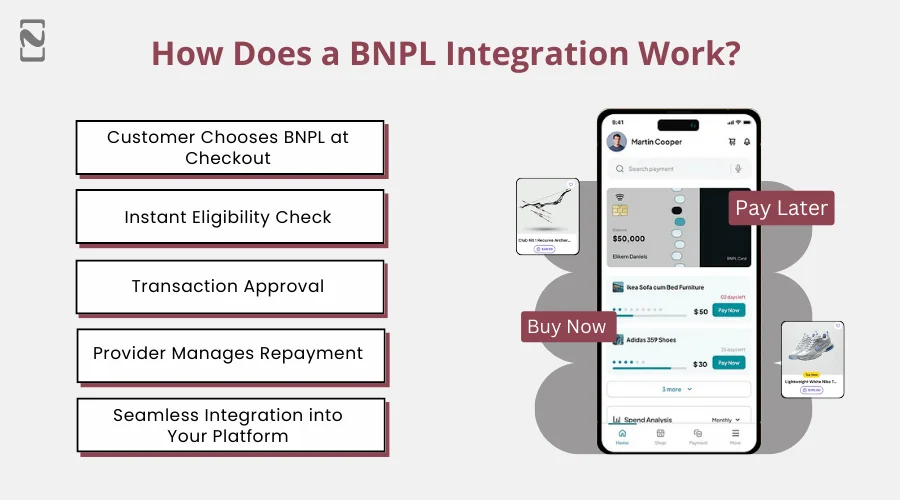

How Does a BNPL Integration Work?

You can integrate BNPL into websites or apps like Klarna, but knowing the working mechanism helps ensure a smooth setup.

Let’s see how it typically works:

Customer Chooses BNPL at Checkout

At the checkout page, the customer selects Buy Now, Pay Later alongside other payment options.

Instant Eligibility Check

The best BNPL providers for small businesses do a quick approval process using alternative credit scoring models.

Transaction Approval

Once approved, the purchase will be confirmed. Customers pay in installments, while the business receives payment upfront from the BNPL provider.

Provider Manages Repayment

The BNPL provider handles installment collection, customer notifications, and repayment tracking. This removes the need for businesses to manage credit risk.

Seamless Integration into Your Platform

From the business side, BNPL for eCommerce functions like any other payment method. The difference is higher conversions and potentially larger orders.

| Note: It helps businesses to reduce cart abandonment, increase average order value, and expand the customer reach. |

What Are the Key Technologies Required to Integrate BNPL?

Integrating BNPL requires a few core technologies that make the payment process seamless, secure, and reliable. Knowing these fintech app tech stacks will help you plan the integration effectively.

Let’s take a look:

1. APIs (Application Programming Interfaces)

Let’s start with the financial APIs:

- BNPL providers offer RESTful APIs that seamlessly integrate with your e-commerce platform.

- These BNPL API integrations facilitate payment processing, user authentication, and data synchronization, crucial for implementing BNPL services.

2. SDKs (Software Development Kits)

The second on the list is SDKs.

- BNPL SDK for apps provides pre-built code libraries and tools, making it easier to develop applications that incorporate BNPL functionality without starting from scratch.

- They often include sample code, debugging tools, and extensive documentation to expedite the development process.

3. Webhooks

Lastly, it’s time to talk about webhooks.

- Webhooks are used for real-time data communication between the BNPL service and your system, ensuring that transaction updates are received immediately.

- They help in maintaining the integrity and synchronization of transactional data across platforms.

With the basics of BNPL out of the way, it’s time to look at the reasons why you should consider BNPL integration in the section below.

What are the Benefits of BNPL Integration for Businesses?

The benefits of BNPL platform integration aren’t just convenience for customers. It delivers measurable business benefits.

Here’s why many companies are adopting BNPL integration:

Increased Sales Conversion

Introducing BNPL options at checkout can significantly reduce the financial burden on consumers, making higher-priced items more accessible.

This accessibility can lead to increased sales conversions as customers are more likely to proceed with purchases they can pay for over time.

The immediate gratification paired with deferred payments appeals to a broader audience, thereby boosting sales volumes.

Increased Average Order Value

Customers who use BNPL services often feel more comfortable making larger purchases since the payment is spread out over time.

This can increase the average order value (AOV) as customers add more items to their cart or opt for higher-priced goods, knowing that the financial impact is manageable.

Competitive Edge

Offering a BNPL platform like Afterpay can give businesses a competitive advantage in markets where flexible payment options are not yet standard.

Being an early adopter of BNPL can position a company as customer-centric and innovative, attracting consumers who seek out the best shopping terms and conditions.

Improved Customer Loyalty

BNPL integration for businesses can lead to enhanced customer loyalty.

Customers are more likely to return to retailers that provide convenient and flexible payment options that align with their financial situation.

This ongoing engagement fosters a deeper connection with the brand, encouraging repeat business and building a loyal customer base over time.

Enhanced Shopping Experience

BNPL streamlines the payment process by offering customers a quick and seamless checkout experience.

This convenience is crucial in today’s fast-paced retail environment, where ease of transaction can be a decisive factor in where consumers choose to shop.

An enhanced shopping experience leads to higher customer satisfaction and positive brand associations.

Broader Customer Base

By incorporating BNPL services, businesses can attract a wider demographic.

This includes younger consumers who may not have established credit but are looking for ways to finance purchases responsibly.

This expansion of the customer base will help businesses tap into new market segments and drive growth.

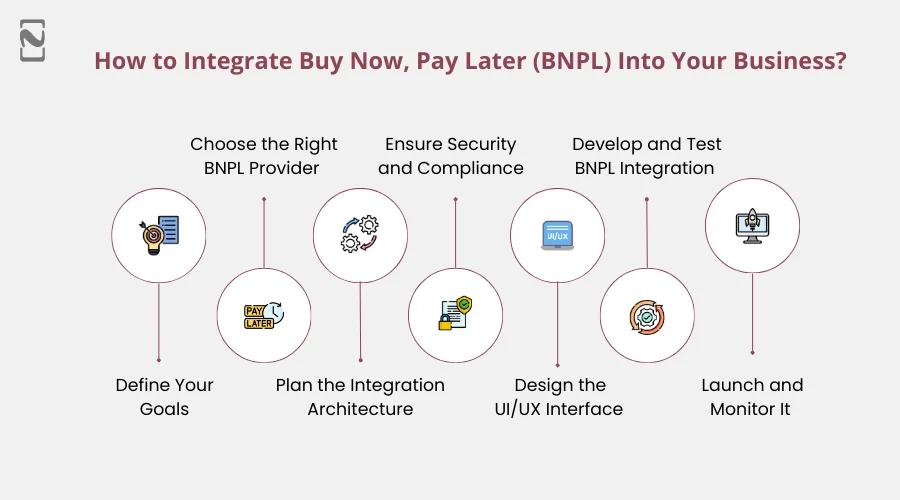

How to Integrate Buy Now, Pay Later (BNPL) into your Business?

BNPL integration for businesses is more than just adding a payment button. It’s a strategic process that involves planning, Buy Now Pay Later technology, compliance, and customer experience.

Below is the step-by-step BNPL integration process for founders, product managers, and business owners.

Step 1: Define Your Goals

First of all, it is vital to clearly define why your business requires BNPL service. Are you trying to reduce cart abandonment, increase average order value, or attract new customer segments?

When you set measurable KPIs, it ensures that the integration is tied to results, not just technology. For example, an electronics store targeted abandoned carts worth over $1,200. After the integration of BNPL, they achieved a 25% increase in sales with BNPL payment solutions.

| Tip: You should focus on specific outcomes like conversion rate or revenue impact, rather than vague goals like increasing sales with BNPL payment flexibility solutions. |

Step 2: Choose the Right BNPL Provider

Once you know your objective, selecting the best BNPL provider for small businesses like Affirm or Klarna is critical. You can look beyond fees and consider API reliability, integration speed, mobile SDKs, payout timelines, and regulatory compliance.

For example, a SaaS startup picked Klarna because its SDK enabled one-click installment selection on mobile. This reduces development from four weeks to one.

If you have a large business, then you may need providers that handle multi-country credit checks to simplify compliance.

| Tip: Test 2–3 providers in a sandbox environment with your actual checkout flow before committing to ensure seamless adoption. |

Step 3: Plan the Integration Architecture

Integration planning determines how BNPL fits into your platform. You have to decide whether BNPL will appear on product pages, cart pages, or checkout. Additionally, you have to make sure your backend can handle orders, inventory, refunds, and webhooks automatically.

For example, an online fashion marketplace used webhooks to mark orders as paid only after the first installment cleared. This prevents premature shipping. It is best to use the document fallback flow for declined payments to reduce cart abandonment.

| Tip: Draw flow diagrams for all payment scenarios. It includes declines and refunds to avoid operational errors during development. |

Step 4: Ensure Security and Compliance

BNPL handles sensitive financial information and is regulated differently across regions. The dedicated development team can encrypt customer data, maintain PCI DSS compliance, and secure user consent for credit checks and installment terms.

If you are operating internationally, it is best to adapt workflows to meet local laws. For instance, a European eCommerce website modified its BNPL disclosure text to comply with GDPR and consumer protection rules to prevent potential fines.

| Tip: Treat compliance as part of UX; clear terms and transparent communication build customer trust and reduce support issues. |

Step 5: Design the UI/UX Interface

A smooth, transparent user experience and user interface will drive BNPL adoption. You can show installment amounts, total cost, and payment schedules clearly at checkout.

Additionally, you can consider showing BNPL on product pages for an intuitive, visually appealing UI. For example, a subscription software platform added one-click BNPL selection on pricing pages, boosting adoption by 15%.

You can use recognizable provider logos and links to FAQs to build credibility. Confusing placement or hidden options can reduce adoption, even if the integration works perfectly.

| Tip: Conduct small user tests to confirm that customers immediately understand and trust BNPL options. |

Step 6: Develop and Test BNPL Integration

Now comes the main stage to integrate the BNPL solution to improve checkout conversions. Develop turns your BNPL plan into action.

You can start by integrating the provider’s fintech APIs or SDK into your checkout. This ensures it handles approvals, declines, installment schedules, and refunds automatically.

Besides, you can implement webhooks to keep your backend updated in real-time for every payment event. Now, test all edge cases like canceled subscriptions, mid-installment adjustments, or partial refunds.

Lastly, you have to verify the checkout flow on mobile, desktop, and apps to ensure buttons and messages display correctly. For instance, a fashion retailer created a test environment simulating declined transactions and refunds. This prevents revenue loss before launch.

| Tip: Maintain a BNPL test matrix covering all scenarios and use automated tests to prevent errors in future updates. |

Step 7: Launch and Monitor It

Lastly, you can launch the BNPL checkout solution. Once it is live, you will need to track adoption rates, conversions, average order value, and recurring revenue. Also, it is vital to monitor failed payments, webhook errors, and customer feedback.

You can even adjust placement, messaging, and flow based on actual user behavior. For example, a fashion eCommerce store moved the BNPL selection from the checkout button to the product page.

This increased adoption by 20%. Continuous monitoring is vital to ensure BNPL meets your business goals without disrupting operations.

| Tip: You can review KPIs weekly initially, then monthly, to optimize performance and improve ROI over time. |

What are the Challenges and Solutions in BNPL Integration?

You might face many challenges while integrating BNPL into the business. But addressing them upfront ensures smooth implementation, protects revenue, and keeps your business compliant.

Below are the challenges that are paired with practical solutions.

Technical Complexity

Challenges: BNPL requires connecting checkout, inventory, CRM, and backend systems. Fintech legacy systems may not support real-time updates that can cause order or payment mismatches.

Solution: You can conduct a technical audit and document all systems that BNPL interacts with. Also, use webhooks for real-time updates and create a sandbox environment for testing.

| Tip: You can map each payment event to a backend action in a flow diagram. This makes sure nothing slips through during development. |

Regulatory Compliance

Challenges: BNPL is regulated differently in different regions. It includes disclosure requirements and consumer protection rules. Non-compliance can lead to fines or reputational damage.

Solution: You can partner with providers that handle credit checks and risk management, but also review your own checkout flow for compliance. Besides, you can add clear terms and consent screens, and localized language.

| Tip: You should regularly review updates to regulations in your operating regions and adjust your checkout flow proactively. |

Managing Costs and Fees

Challenges: BNPL providers charge per-transaction fees, which can impact profit margins. It is especially on low-ticket items.

Solution: You can model different order scenarios to understand the cost of developing a BNPL app. Besides, you can negotiate fees with providers or adjust pricing strategies for BNPL-eligible products.

| Tip: Track BNPL performance metrics like conversion lift versus cost per transaction to optimize your strategy over time. |

Consumer Trust and Acceptance

Challenges: Confusing flows, hidden terms, or unclear installment schedules can make customers hesitant to use BNPL.

Solution: You can offer clear, upfront installment details and visual cues during checkout. Also, it is vital to include provider logos and a brief FAQ so that consumers can trust you.

| Tip: Test messaging and positioning on different pages, like product, cart, and checkout, to find the placement that drives maximum adoption. |

Build In-House vs Outsource BNPL Integration

When you integrate BNPL into your business, you may face a major decision. Build the system with an in-house team or outsource to an experienced mobile app development services provider. The best choice relies on your budget, technical expertise, and compliance requirements.

Let’s take both options.

Build In-House

When it works: Large financial institutions or enterprises with strong development, compliance, and risk teams.

Pros:

- Full control over lending logic, risk models, and installment structures.

- Customizable checkout experience.

- Direct ownership of data and analytics.

Cons:

- High upfront development costs and ongoing maintenance.

- Slower time-to-market if you are building APIs and SDKs.

- Regulatory and compliance burden remains on your team.

| Tip: You can only build in-house if your business has the technical expertise, capital, and regulatory support to sustain it long-term. |

Outsource to a BNPL Provider

When it works: Most startups, SMBs, and enterprises that want a fast, low-risk integration.

Pros:

- Quick implementation using APIs or SDKs.

- Providers handle credit checks, risk, repayment, and compliance.

- Predictable per-transaction costs with no heavy upfront investment.

- Continuous provider support and updates.

Cons:

- Limited customization compared to an in-house system.

- Dependence on provider uptime and policies.

| Tip: Outsourcing is often the fastest path to monetizing BNPL benefits if your priorities are speed and compliance. |

How Can Nimble AppGenie Help Integrate BNPL into Your Business?

Nimble AppGenie is a leading BNPL app development company that helps you integrate BNPL smoothly into your checkout systems. We work closely with you to understand your business needs and customer behavior to ensure the BNPL solution fits perfectly with your existing processes.

Our team manages the entire integration, from connecting BNPL providers and configuring APIs to making sure payments, refunds, and orders are tracked accurately.

Additionally, we will ensure that your BNPL setup follows all security and compliance standards. After launch, we monitor your system and optimize performance. This helps your business increase conversions, improve cash flow, and deliver a better customer experience.

Why Nimble AppGenie is the right partner:

- Real experience integrating BNPL into businesses of all sizes

- Custom solutions designed around your checkout and customers

- Complete support from planning to launch and beyond

- Transparent communication and reliable post-launch support

Conclusion

With the US BNPL market projected to reach USD 80.15 billion by 2033, integrating BNPL solutions offers businesses increased sales conversions, enhanced customer loyalty, and improved cash flow.

The idea behind BNPL integration is to add the convenience of instant payments and monthly settlements, allowing your customers to spend more and buy things when required.

By following strategic steps, including assessing needs, selecting the right provider, and ensuring seamless integration, businesses can leverage BNPL to revolutionize their payment systems and capitalize on its potential for sustained growth and competitive advantage.

FAQs

Buy Now Pay Later (BNPL) is a payment option that allows consumers to purchase products immediately and pay for them in installments over time. It’s gaining popularity due to its convenience and the financial flexibility it offers, making products more accessible by spreading the cost over time.

According to a 2024 report by Mordor Intelligence, the US BNPL market is projected to reach USD 167.58 billion by 2032, with a Compound Annual Growth Rate (CAGR) of 20.7%. This explosive growth underscores the increasing acceptance and widespread use of BNPL services.

A 2024 study by Coresight Research found that 43% of U.S. consumers have already utilized BNPL services, a significantly higher percentage than in some other countries like India, indicating rapid adoption in the U.S. market.

BNPL integration can significantly increase sales conversions, enhance customer loyalty, and improve the overall shopping experience. It also helps in attracting a broader customer base, improving cash flow, reducing credit risk, increasing average order value, and providing a competitive edge.

Integrating BNPL services requires APIs for seamless payment processing and data synchronization, SDKs for application development, and webhooks for real-time data communication. Ensuring system compatibility and scalability is also crucial.

Challenges include handling technical complexities, ensuring regulatory compliance, selecting the right BNPL provider, managing integration costs, and building consumer trust and acceptance.

Businesses should assess their needs, select the right BNPL provider, plan the integration architecture, address security considerations, focus on user experience, ensure legal and regulatory compliance, develop and test the integration, deploy and monitor the integration, and collect feedback for optimization.

BNPL allows consumers to manage finances more effectively by splitting purchases into smaller, manageable installments. This can lead to more frequent purchases and higher average order values, especially for bigger-ticket items, as it makes them more accessible.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.