Fintech has become an integral part of every user’s daily life. While the concept of combining financial services with technology to provide a better experience is already fascinating, advanced tech integrations have also had a significant impact on how these services are utilized.

One such technology is blockchain. You might have heard about it in the context of cryptocurrency and decentralized finance (DeFi).

Blockchain has introduced various possibilities in fintech, particularly for companies, as it enables them to automate processes and make transactions more efficient, secure, and transparent.

How? You wonder?

Well, that is exactly what we are going to discuss today! In this post, let us take a closer look at blockchain technology and its impact on fintech.

We will also discuss the benefits of using blockchain in fintech and what exactly the use cases are where the technology can be used. So without further ado, let’s get started!

Blockchain in Finance: An Overview

To understand the impact of Blockchain in transforming the fintech realm, let’s start by understanding its role.

Blockchain has always been used for decentralization of information, in order to keep it secure and untraceable.

When it comes to financial transactions, blockchain brings a lot of benefits.

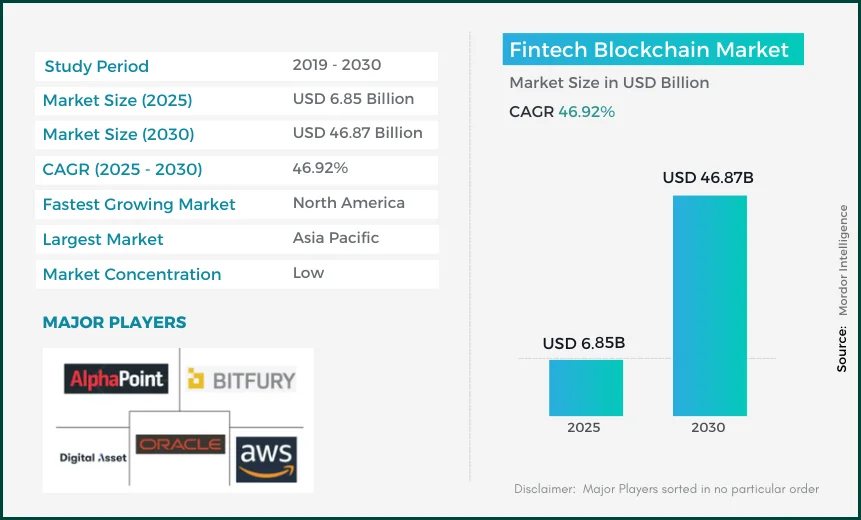

If we look at the market stats, the technology is certainly growing, as the market size of Blockchain was valued at $4.66 billion in 2024 and is expected to touch a whopping $31.84 billion by 2029.

As per the reports, the CAGR turns out to be 46.92%, which is quite impressive for the current volatile market.

However, with the rise of financial technology and its everyday use cases, professionals have started integrating Blockchain with different fintech solutions.

The use of blockchain has, in fact, given rise to the use of decentralized finance, also known as DeFi, the trend of which is catching up in the overall market.

Types of Blockchain Used in Fintech

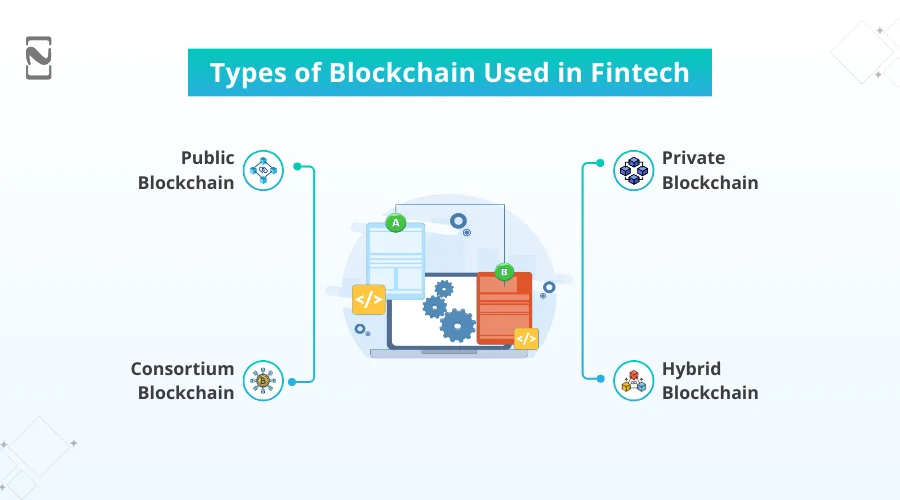

Blockchain itself is a complex concept that not everyone is familiar with. There are different types of blockchains being used in the current market, and each of them serves a different purpose.

For instance, a cryptocurrency transaction uses a different type of blockchain than what an Insurance transaction will use.

The differences are based on how much control a company or the user can have over the blockchain.

Here are the types you can use with fintech –

Public Blockchain

This is a blockchain that is used in fintech services, which is open to the public to examine and help run. A great example of this can be Ethirium, which is a cryptocurrency.

Users from around the world can check the transactions, join the blockchain, and update it, as this blockchain is public.

Private Blockchain

On the other hand, private blockchains, as the name suggests, are private to a certain company and are only used for trusted deals and internal operations.

The blockchains are highly efficient as the number of users and transactions is limited. Banks that have a high bandwidth of transactions are known to use private blockchains.

Consortium Blockchain

When a few companies come together to share a blockchain for their internal use, it is considered a Consortium Blockchain.

It is generally a common occurrence in the insurance industry as multiple trade finance groups come together to settle claims from different banks on the same blockchain.

Hybrid Blockchain

As the name suggests, a hybrid blockchain is a combination of public and private blockchains.

Companies that deal in digital currencies often go for this type of blockchain as it allows them to keep information private while maintaining public access for users to be able to verify the transactions.

Based on the requirements of the regulator and the user, one can integrate blockchain in fintech.

The entire purpose of this classification is to ensure that all types of fintech services know which one can be used for their services and what they can integrate for better performance of their fintech solution.

Use-Cases of Blockchain in Fintech: Where is it Implemented?

The role that blockchain is playing in the current fintech app market is much more than just decentralizing the ledger for transactions. Instead, it finds a lot of applications in the market.

Here are some industrial use cases of the blockchain in fintech

1. Digital Payment Processing

One of the key aspects of how blockchain technology can be used is for efficient cross-border transactions and quick payment processing.

The blockchain directly transfers the money between the parties, reducing the role of intermediaries, making the transaction cost-effective and faster.

2. Reducing Fraudulent Activities

Implementing blockchain can be highly beneficial if a fintech is looking to enhance fintech security and reduce fraud. That is because blockchain allows you to record all the transactions and makes it impossible to alter the records.

Now, when you have an unalterable transaction record, the fraud is reduced to a great extent, as every transaction is verifiable.

3. Smart Contracts

Blockchain introduces the use of smart contracts that help in establishing and enforcing the agreements that were pre-determined.

These are considered “smart” because they are automatically triggered when the decided conditions are met, making the execution error-free and compliant.

4. Digital Verification

One of the key issues that fintechs have faced over the years is the verification of users. A user is not comfortable sharing their personal information over just any network.

Hence, blockchain reduces the issue, allowing them to store personal identification data on a decentralized network, making it more secure.

The companies are also at an advantage as they can access the blockchain when required without any tampering or identity theft.

5. Supply Chain

Now, you may be wondering what the supply chain has to do with fintech? Well, when a supply chain is built, a complete ecosystem of finances is created where multiple parties are involved in regular transactions as per the supply.

Blockchain finds its use case in a supply chain as it can create an unchangeable record of the transactions related to products and fees related to the supply chain, making it more efficient and ethical.

6. Compliance & Regulations

With the implementation of blockchain, your fintech application becomes transparent, making it more and more compliant with the strict fintech regulations.

With blockchain taking over the intermediaries in a fintech application, the documentation also becomes simplified, making it more and more accurate and compliant.

7. Managing Investments

The idea of building a blockchain is not limited to making two-way transactions, as it also helps you manage your investment transactions.

While investment fintech platforms today face issues of reliability, integrating blockchain in the same can help in effective tracking of the investments and make it more convenient for the user with reduced associated transaction costs.

8. Insurance

You might have already understood the pattern here. Blockchain is a game-changer for businesses that rely on underwriting and transparency.

Insurance services require clarity in communication in order to process claims. Not to mention, they also need to authenticate the claims made. This is where blockchain comes in handy, as it can reduce fraud.

While all these industries enjoy the combination of blockchain and fintech, it is quite understandable that the blockchain is certainly ready to transform the fintech realm completely.

Benefits of Using Blockchain in Fintech

Knowing the uses of blockchain in different fintech services, one might wonder what benefits blockchain brings.

Well, there are several benefits of using blockchain in the aforementioned use-cases, which is also the reason why more and more users are inclined towards a blockchain-enabled fintech platform.

Check out the benefits below to understand how blockchain is transforming fintech for good –

► Improved Security

The first benefit of blockchain, as you might have guessed from the uses of blockchain as discussed, is the security that it offers.

The fact that the transactions recorded are unchangeable and cannot be altered makes it a rock-solid technology to improve security.

Not to mention, the decentralized nature of storing information makes it more secure than any other way of storing data.

► Enhanced Transparency

With all the transactions being carried out directly in the blockchain, the transparency is improved massively.

Irrespective of the type of blockchain being used, the parties involved have access to check the transactions securely, making the entire process super transparent.

► Minimal Costs

Use of blockchain helps in eliminating different financial intermediaries from the process, which minimizes the transaction costs and processing fees that a user might have to pay.

► Quicker Transactions

When there are no third parties involved, the transactions are completed much faster, making it an efficient instant payment system.. In some cases, the use of blockchain enables transactions to settle instantly without having to worry about money laundering or getting stuck.

► Ease of Traceability

Blockchain transactions are immutable and highly guarded, making them easily traceable. Sure, the decentralized nature keeps the information secure from the public eye.

However, if you are a party in the blockchain, you can easily trace the transaction to the origin, reducing the chances of any fraudulent activities.

The benefits clearly indicate the core reasons why blockchain has found its use case in multiple sectors of fintech.

The whole idea of transforming fintech with blockchain technology arises from the fact that blockchain makes it easy for the application to finish regular tasks faster and more efficiently.

Integrating blockchain technology in fintech is unarguably the best decision one can take, considering the benefits that it has to offer.

However, it is important to understand that implementing blockchain technology is not that easy. You need professional assistance for proper integration.

Check out the next section to identify who can guide you better.

Let Nimble AppGenie Transform Your Fintech App with Blockchain

Integrating blockchain only seems like a great decision on your own until you find out how complex it is to choose the right blockchain and implement it as per the requirements.

You see, while financial technology is advancing continuously, the executives necessary to complete the blockchain integration in fintech are limited.

Nimble AppGenie is one of the leading names that comes to mind when we talk about digital transformation in fintech with blockchain.

With decades of experience, the developers they have are the best you can find to get your fintech application upgraded with blockchain technology.

Our experts have hands-on experience in implementing blockchain with fintech solutions, giving them enough expertise to meet your needs as a fintech app development company.

So what’s stopping you from making your next move? Leverage blockchain technology today by connecting with Nimble AppGenie!

Conclusion

Integrating blockchain into a fintech application is not just a feature; it is the future! With all the industries that this trend can cater to, and the benefits it offers, you can understand how crucial a role blockchain is going to play in the transformation of financial services in the upcoming years.

The blockchain market is also growing exponentially, which indicates the market reception. All you need to do is choose the right blockchain, suitable for your line of work, and take action accordingly.

Hope these insights, benefits, and use cases of blockchain help you understand the importance of it in fintech.

That will be all for this post. Thanks for reading, good luck!

FAQs

- Public Blockchain,

- Private Blockchain,

- Consortium Blockchain,

- Hybrid Blockchain.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.