What is Insurance Fraud? As you know, it’s an act that a fraudster commits to dupe an insurance process for lucrative gain. The key drivers responsible for this massive surge are AI-generated attacks (common these days), industrialized fraud rings, digital-first claims, higher premiums, business closure, and undermining integrity.

Then, who will come to the rescue? AI-based insurance fraud detection. How? Insurance companies should create AI insurance fraud detection software.

Deloitte predicts that AI-driven deployment can help P&C (property and casualty) insurers save up to $160 billion by 2032 through on-the-spot claims fraud.

| According to Market Research.com, the Global Insurance Fraud Detection Market is anticipated to grow and reach $43.0 billion by 2030, up from $12.7 billion recorded in 2024. |

Whether you are an insurance decision-maker, digital transformation leader, head of claims, insurance company, fraud investigator, insurance product manager, IT head, or enterprise architect, insurance fraud detection software development will lend a hand to mitigate losses, leveraging sophisticated algorithms, data analytics, and machine learning to detect fraudulent behavior patterns.

How to build insurance fraud detection software?

This guide provides an overview of the insurance fraud detection system, how AI detects insurance fraud, must-have features, challenges you can encounter with possible solutions, and more.

Let’s get things underway!

Understanding Insurance Fraud: Types, Risks, and Business Impact

Today, insurers are facing one of the most uncompromising and costly challenges: insurance fraud.

With the rising claims volumes and sophisticated fraud tactics, traditional detection modes fail to detect.

Let’s know the different types of insurance fraud risks they create, and their business impact, which highlights the need for building fraud detection software for insurers.

Types of Insurance Fraud

At distinct stages of the policy and claims lifecycle, you can expect insurance fraud to occur.

1. Claims Fraud

A widely-known form of insurance fraud is claim fraud.

- Inflated or exaggerated claims

- Duplicate claims across multiple insurers

- Staged accidents or fake injuries

- Misrepresentation of facts during claim filing

Claims fraud leads to increased loss ratios and delays legitimate claim settlements.

2. Identity & Synthetic Identity Fraud

Fraudsters use fabricated or stolen identities to:

- File fraudulent claims

- Purchase policies

- Launder funds via insurance payouts

Well, using rule-based systems, insurers find it hard to detect this type of fraud, and this is the main area where AI rules.

3. Underwriting Fraud

This sort of fraud happens during policy renewal or application by:

- Giving false information relevant to risk factors

- Misstating asset usage or value

- Hiding pre-existing conditions

Underwriting fraud results in incorrect pricing and lasting financial exposure.

4. Organized & Collusive Fraud

It involves fraudsters’ networks working together in:

- Organized claim rings

- Repeated fraud patterns across time and regions

- Collusion between repair shops, agents, hospitals, or claimants.

AI-backed graph and network analytics are majorly impactful in unveiling such hidden connections.

Key Risks of Insurance Fraud

Not just financial losses, insurance fraud also creates other risks:

► Financial Risk

- Reduced profitability

- Higher operational costs

- Increased claim payouts

Fraud losses usually become worse with repeated undetected patterns.

► Regulatory & Compliance Risk

- Insufficient controls can give rise to penalties.

- Lag in fraud detection may demand regulatory scrutiny.

- No clarity in decision-making escalates audit risks.

Modern regulations increasingly expect a well-documented and explainable AI insurance fraud detection process.

► Operational Risk

- Slower claims processing

- Growing manual reviews and inefficiencies

- Overwhelming claims investigation teams

Heightened false positives ahead delay legitimate claims and strain resources.

Business Impact of Insurance Fraud

The mounting insurance fraud impact on business is notable:

- Intensifying premiums for honest policyholders

- Growth opportunities are left unseen as resources attend to damage control instead of innovation.

- Augmenting loss ratios, mitigating underwriting profitability

- Lower customer satisfaction because of investigation delays

Insurers who are operating at scale also save millions in cost annually, even with small improvements in fraud detection precision.

Why Traditional Fraud Detection Methods Fall Short?

Well, this is an obvious question; you would also be eager to know why rule-based fraud detection systems don’t solve the purpose.

It’s because they:

- Depend on static rules

- Generate increased false positives

- Have no visibility into complicated fraud networks

- Lag adaptation to dynamic fraud patterns.

That’s why insurers are progressively adopting AI-powered insurance fraud detection software to shift from reactive fraud management to proactive, real-time prevention.

Fraud Across Different Insurance Sectors

Well, insurance fraud is not the same across distinct lines of business.

Every insurance sector has claim behaviors, unique risk signals, and fraud patterns. Thus, a one-size-fits-all detection approach is not effective for all.

Here arrives AI insurance fraud detection software that addresses this challenge by facilitating sector-specific detection models within a centralized platform, boosting precision while diminishing false positives.

1. Health Insurance Fraud

It’s a complicated one because of unstructured medical data and high volumes of claims.

Common fraud patterns:

- Collusion between patients and providers

- Billing for services not rendered

- Duplicate or inflated medical claims

- Upcoding or unbundling of procedures

How AI helps:

- Network analytics unveil provider–patient collusion

- Health insurance fraud detection AI helps in anomaly detection, recognizing odd billing behavior

- NLP analyzes medical records and invoices

Impact: Health insurance fraud leads to increased regulatory scrutiny, claim leakage, and late settlements.

2. Life Insurance Fraud

During payout stages and underwriting, the chances of life insurance fraud are quite high.

Common fraud patterns:

- Policy manipulation before payout

- Non-disclosure of medical history

- Fraudulent death claims

- Identity impersonation

How AI helps:

- Timely anomaly detection for insurance claims

- Predictive underwriting risk scoring

- AI-based identity verification

Impact: Without life insurance fraud detection AI, insurers suffer from loss of trust and long-term financial exposure.

3. Auto Insurance Fraud

At First Notice of Loss (FNOL) and during repair claims, auto insurance fraud occurs.

Common fraud patterns:

- More than one claim for the same incident

- Staged accidents

- Fake injury claims

- Inflated repair or towing invoices

How does AI auto insurance fraud detection software work?

- Pattern detection across locations, claim histories, and vehicles.

- Image analysis for vehicle damage validation

- Behavioral analytics at FNOL

Impact: Auto insurance fraud results in longer investigations, customer dissatisfaction, and higher payouts.

4. Travel Insurance Fraud

With the growing digital policy adoption, travel insurance fraud is also increasing.

Common Fraud Patterns:

- Duplicate claim across insurers

- Manipulated travel or medical documents

- Fake trip cancellation claims

How does AI-powered travel insurance fraud detection software help?

- Automated validation of travel data

- Cross-policy pattern detection

- AI-driven document verification

Impact: Operational inefficiencies and claims leakages.

5. Property & Casualty (P&C) Insurance Fraud

P&C fraud escalates during high-impact events and natural disasters.

Common Fraud Patterns:

- Contractor or vendor collusion

- Inflated damage estimates

- Repeated claims on the same property

- False disaster claims

How does AI-enabled P&C insurance fraud detection software help?

- Network analytics to identify organized fraud rings

- Historical pattern scan for repeat fraud

- Geospatial analytics to validate events

Impact: P&C insurance fraud ends up with mounting catastrophe-relevant risk and accumulated losses.

6. Commercial Insurance Fraud

Typically, commercial insurance fraud is sophisticated and high-valued.

Common Fraud Patterns

- Collusion with service providers and vendors

- False asset valuation

- Inflated business interruption claims

How AI Helps:

- Relationship mapping across entities

- Advanced risk scoring for complicated claims

- Financial anomaly detection

Impact: Commercial insurance fraud leads to huge financial losses and deep legal exposure.

What Is Insurance Fraud Detection Software?

Insurance fraud detection software is an ultimate savior for insurers that helps prevent losses, boost efficiency, and target and scrutinize high-risk cases, leveraging AI, advanced analytics, and machine learning to automatically scan a huge volume of insurance data, pinpointing suspicious patterns, anomalies, and connections to flag possible fraud in real-time.

Such systems move a step ahead of the basic rules to reveal complex schemes and hidden networks, mitigating false positives and manual effort while automating legitimate claims.

How Insurance Fraud Detection Software Works

The insurance fraud detection software follows the steps below:

- Data Collection & Integration

- Risk Analysis & Pattern Detection

- Fraud Scoring & Decisioning

- Case Management & Investigation

How is AI insurance fraud detection software better than traditional ones?

Traditional vs AI-Powered Fraud Detection Software – A Quick Comparison

| Aspect | Traditional Fraud Detection | AI-Powered Fraud Detection |

| Detection Method | Static rules | Machine learning & AI |

| Adaptability | Low | High (self-learning models) |

| Fraud Pattern Coverage | Known patterns only | Known and unknown patterns |

| False Positives | High | Significantly reduced |

| Scalability | Limited | Highly scalable |

| Decision Speed | Batch processing | Real-time insurance fraud detection |

Role of AI & Machine Learning in Insurance Fraud Detection

How AI is Transforming Insurance Fraud Detection?

Artificial Intelligence (AI) and Machine Learning (ML) strengthen the base of modern insurance fraud detection systems.

| The global AI in insurance market is expected to reach about $141.44 billion by 2034 at a CAGR of 33.06%. |

AI-driven solutions constantly learn from data, are resilient to evolving fraud tactics, and deliver swift, more precise detection at scale.

The insurers who have to deal with highly sophisticated fraud schemes and increased claim volumes should opt for AI as a strategic necessity.

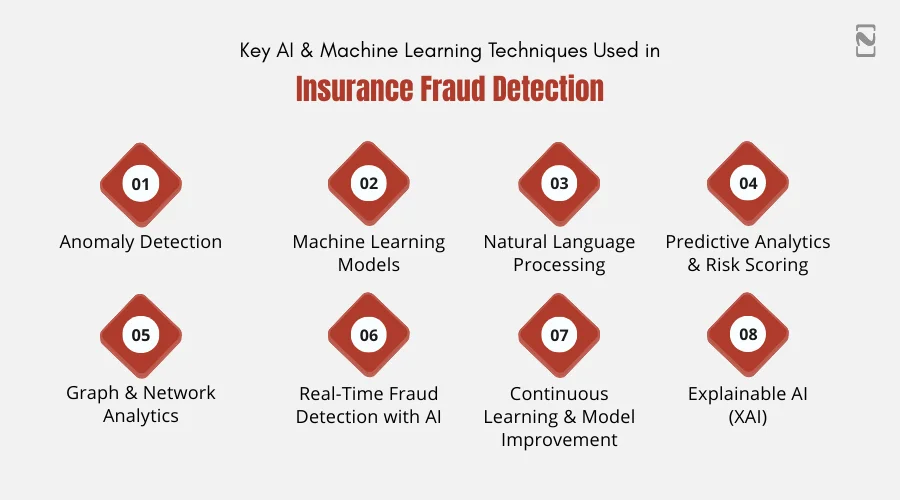

Key AI & Machine Learning Techniques Used in Insurance Fraud Detection

1. Anomaly Detection

- AI recognizes deviations from general claim behavior, such as:

- Abnormal claim amounts

- Unusual claim frequency

- Suspicious location patterns or timing

Anomaly detection majorly helps in detecting previously missed fraud tactics.

2. Machine Learning Models

ML models study past claims data to foretell the possibility of fraud.

- Supervised Learning: The models are trained on non-fraud and labeled fraud cases.

- Unsupervised Learning: ML models pinpoint anomalies with no prior labels.

- Semi-supervised Learning: Fuses both approaches for enhanced precision.

Such machine learning insurance fraud detection models allot fraud risk scores in real-time to claims.

3. Natural Language Processing (NLP)

NLP empowers AI systems to deeply analyze unstructured data, embracing:

- Adjuster notes

- Claim descriptions

- Medical or repair invoices

By identifying sentiment patterns, suspicious language, and inconsistencies, NLP improves fraud detection precision.

4. Predictive Analytics & Risk Scoring

AI in predictive analytics insurance fraud gauges various risk indicators at the same time to:

- Prioritize investigations

- Anticipate fraud probability

- Automate low-risk claim approvals

This way, insurers can focus human efforts on more valuable jobs.

5. Graph & Network Analytics

AI maps relationships between entities, like:

- Service providers

- Policyholders

- Addresses, vehicles, or phone numbers

This detects collusive networks and organized graph analytics insurance fraud rings that traditional tools fail to detect.

6. Real-Time Fraud Detection with AI

AI-powered fraud detection is best at real-time decisioning, where:

- Risky claims are instantly fagged

- Fraud risk assessment takes place at FNOL (First Notice of Loss)

- Legitimate claims are rapidly processed

AI fraud detection for insurance claims mitigates fraud losses while boosting customer experience.

7. Continuous Learning & Model Improvement

Over time, AI models improve by:

- Adapting to fresh fraud approaches

- Learning from investigator feedback

- Retraining on revised data sets

Thus, insurance fraud detection systems stay accurate, effective, and futuristic.

8. Explainable AI (XAI)

In insurance, decisions should be explainable and auditable.

Explainable AI strengthens insurers by:

- Understanding the reasons behind a claim flagging

- Lowering unfair and biased outcomes

- Justifying decisions to regulators.

XAI fosters trust across investigators, compliance teams, and customers.

Business Impact of AI in Insurance Fraud Detection

The benefits of AI in insurance fraud detection are:

- Faster claims processing

- Reduced fraud losses

- Better customer satisfaction

- Lower false positives

- Improved investigator productivity

Even small profits in detection precision can lead to notable cost savings.

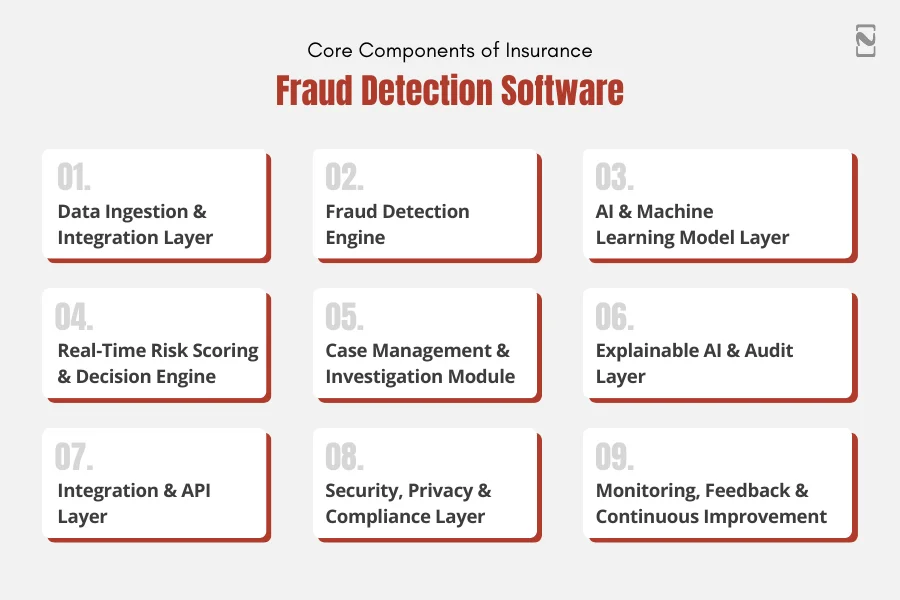

Core Components of Insurance Fraud Detection Software

For your information, a perfect combination of real-time processing, AI models, investigation workflows, and data intelligence builds an insurance fraud detection system, which is effective and scalable.

1] Data Ingestion & Integration Layer

The bedrock of any fraud detection platform is a data ingestion and integration layer.

Key Functions:

- It takes structured as well as unstructured data from various sources.

- Besides, the layer connects with external and third-party data providers.

- Seamless integration also takes place with internal systems, like CRM, claims, or policy.

Common Data Sources are:

- Past fraud records

- Claims and policyholder data

- Repair invoices, medical bills, documents, and images

- Identity data and external risk

Significance: With well-integrated and high-quality data, you can influence fraud detection results and model accuracy.

2] Fraud Detection Engine

Next is a fraud detection engine, which serves as the intelligent core of the system.

Components include:

- Machine learning models for better predictive fraud scoring

- Rule-based checks for familiar fraud scenarios

- Anomaly detection algorithms for new and surfacing fraud patterns

Several modern systems harness the potential of a hybrid approach, fusing AI and rules to balance explainability, accuracy, and speed.

3] AI & Machine Learning Model Layer

This layer strengthens the advanced fraud detection abilities.

Includes:

- NLP models for scanning claim descriptions and documents

- Supervised learning models for well-known fraud patterns

- Graph and network models for collusive fraud

- Unsupervised models for anomaly detection

Key Capabilities:

- Adaptive fraud detection over time

- Ongoing learning from new data

- Lower false positives through smarter pattern recognition

4] Real-Time Risk Scoring & Decision Engine

This Insurance Fraud Detection Software’s layer enables prompt fraud assessment.

Functions:

- This layer assigns fraud risk scores to transactions or claims.

- It applies confidence levels and thresholds.

- Furthermore, the layer triggers automated alerts or actions.

Outcomes:

- Risky cases are pointed out for review.

- Low-risk claims are fast-tracked

- Medium-risk cases follow predefined workflows.

This layer proves to be useful for improving customer experience and fraud prevention.

5] Case Management & Investigation Module

When the cases are flagged, the investigator demands efficient tools, and this layer helps them with the same.

Key Features:

- Investigator dashboards

- Notes, audit logs, and reporting

- Evidence aggregation and visualization

- Workflow automation and case tracking

Significance: AI underscores the risks, but human expertise is also considered for fraud confirmation. This module connects automation and human judgment.

6] Explainable AI & Audit Layer

Insurance decisions should be defensible and transparent, and this layer gives an explanation, fostering trust.

Capabilities Include:

- Feature-level insights and confidence scores

- Explanation of flagged claim

- Audit trails for regulatory reviews

Explanable AI confirms compliance while reinforcing trust among regulators, investigators, and customers.

7] Integration & API Layer

Fraud detection software needs an insurer’s ecosystem to operate within, and that should be integrated well with the necessary third-party systems and platforms.

Integrations Include:

- Payments systems

- Policy administration platforms

- Claims administration platforms

- External analytics and reporting tools

Open APIs guarantee smooth data flow and rapid adoption.

8] Security, Privacy & Compliance Layer

Security is unavoidable as industry data is sensitive.

Key Considerations:

- Role-based access control

- Data encryption (at rest and in transit)

- Secure model deployment

- Compliance with data protection regulations

This layer safeguards organizational integrity and customer data.

9] Monitoring, Feedback & Continuous Improvement

With your dynamic fraud patterns, your system should also evolve.

Includes:

- Automated model retraining

- Model performance monitoring

- Investigator feedback loops

- False positive/negative analysis

Continuous enhancement ensures lasting effectiveness.

Quick Glimpse of How These Components Work Together

| Stage | Component Involved | What Happens | Business Value |

| Data Intake | Data Ingestion & Integration Layer | Claims, policy, and external data are collected and normalized | Complete, high-quality data for accurate detection |

| Intelligence | AI & Machine Learning Models | Patterns, anomalies, and fraud signals are analyzed | Early identification of suspicious activity |

| Decisioning | Risk Scoring & Decision Engine | Fraud risk scores are generated and thresholds applied | Faster, consistent fraud decisions |

| Investigation | Case Management & Investigator Tools | High-risk cases are reviewed and validated by experts | Reduced false positives, better accuracy |

| Learning Loop | Feedback & Model Monitoring | Investigation outcomes retrain AI models | Continuous improvement and adaptability |

As fraud patterns appear to be different across industry sectors, AI-powered fraud detection software leverages a combined set of intelligent components to safeguard from every such fraud type, as showcased below:

Quick Review of Fraud Types and How Insurance Fraud Detection Software Shields Against Them

| Fraud Type | Where It Occurs | Common Fraud Patterns | How AI-Powered Software Defends |

| Claims Fraud | Claims submission & processing | Inflated claims, fake injuries, staged accidents, and duplicate claims. | ML models detect abnormal claim amounts and frequencies; real-time risk scoring at FNOL; anomaly detection flags unusual patterns |

| Underwriting Fraud | Policy application & renewal | False disclosures, hidden medical history, and misrepresentation of risk. | Predictive risk scoring during underwriting; AI detects inconsistencies; cross-validation with historical and external data |

| Identity & Synthetic Identity Fraud | Policy creation & claims | Stolen identities, repeated identity usage, and fake personas. | AI-based identity verification; pattern matching across identities, behavioral analytics, devices, and locations |

| Organized & Collusive Fraud | Claims & service provider ecosystem | Fraud rings and repeated collaboration between claimants and providers | AI uncovers recurring entities and collusion patterns; Graph and network analytics identify hidden relationships |

| Health Insurance Fraud | Medical claims processing | Upcoding, duplicate billing, and billing for non-existent services. | NLP analyzes medical records and invoices; anomaly detection marks abnormal billing behaviors |

| Auto Insurance Fraud | FNOL & repair claims | Staged accidents, fake injuries, and inflated repair bills. | Image analysis for vehicle damage; pattern detection across vehicles and locations; behavioral analysis at FNOL |

| Life Insurance Fraud | Underwriting & claims | Non-disclosure, policy manipulation, and fake death claims. | Predictive modeling for underwriting risk, identity verification, and anomaly detection in claim timelines |

| Property & Casualty Fraud | Claims after incidents or disasters | Inflated damage estimates and repeated property claims. | Geospatial analytics validate event legitimacy; historical pattern analysis notices repeat fraud |

| Travel Insurance Fraud | Claims after travel events | Fake cancellations, duplicate claims, and manipulated documents. | Document verification using AI; automated claim validation; cross-policy pattern analysis |

| Commercial Insurance Fraud | High-value corporate claims | Inflated business interruption claims and vendor collusion | Financial anomaly detection; advanced risk scoring models; relationship mapping across entities |

Technology Stack Required for AI Insurance Fraud Detection Software Development

AI-powered insurance fraud detection software demands an AI-ready, secure, and scalable technology stack.

We have curated a table exhibiting a crucial tech stack for you to reduce your workload and help you develop an enterprise-grade fraud detection platform.

Category-Wise Technology Stack for AI Insurance Fraud Detection Software

| Category | Technologies / Tools |

| Data Sources & Integration | REST / GraphQL APIs, Apache Kafka, RabbitMQ, Apache NiFi, Talend |

| Data Storage | PostgreSQL, MySQL, MongoDB, Cassandra |

| Big Data & Processing | Apache Spark, Hadoop |

| Data Lakes | Amazon S3, Azure Data Lake |

| AI & Machine Learning | Python, TensorFlow, PyTorch, Scikit-learn |

| Anomaly Detection | Isolation Forest, Autoencoders, One-Class SVM |

| Natural Language Processing (NLP) | spaCy, Hugging Face, NLTK |

| Graph & Network Analytics | Neo4j, NetworkX |

| Real-Time Analytics | Apache Flink, Spark Streaming |

| Rules & Decision Engine | Drools, Custom Rule Engines |

| Backend Application Layer | Java (Spring Boot), Node.js, .NET |

| Frontend & Dashboards | React, Angular, Vue.js, D3.js |

| Reporting & Visualization | Power BI, Tableau |

| Cloud Infrastructure | AWS, Azure, Google Cloud |

| DevOps & CI/CD | Docker, Kubernetes, Jenkins, GitHub Actions |

| Security & Compliance | Encryption (AES, TLS), IAM, Audit Logs |

| MLOps & Model Governance | MLflow, Evidently AI, Prometheus |

Note: As technology stack choice depends on fraud complexity, claim volume, and regulatory requirements, you can customize the technology stack accordingly while maintaining a unified AI fraud detection platform.

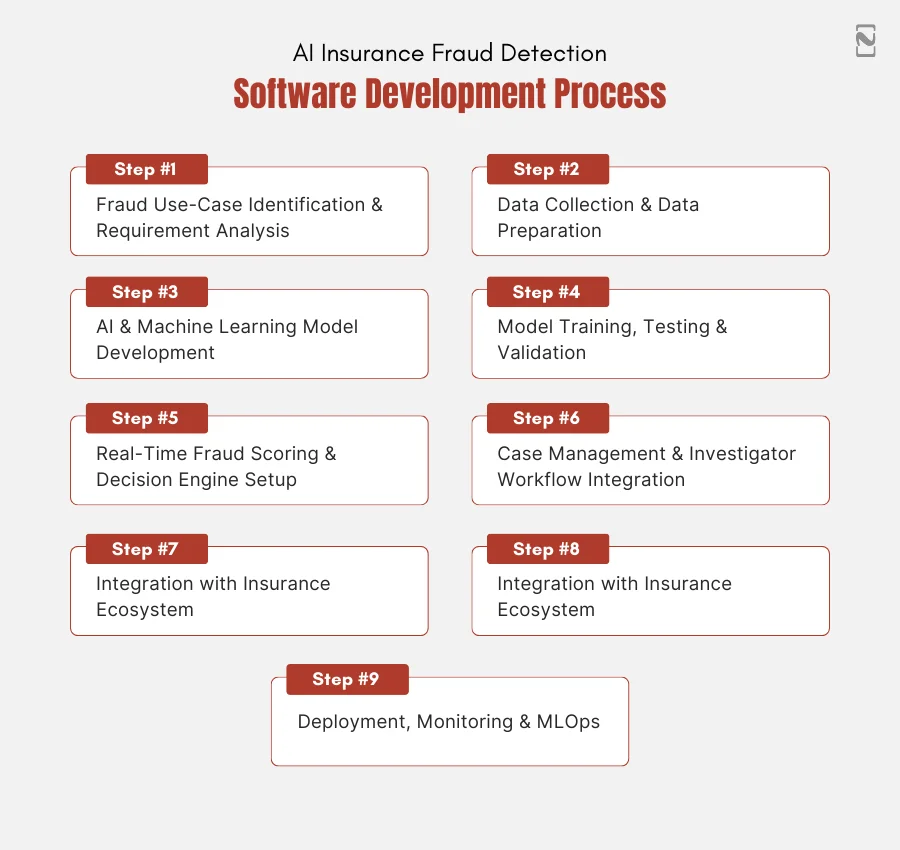

AI Insurance Fraud Detection Software Development Process

Building AI insurance fraud detection software is not limited to model training. It demands a well-structured process that fuses the power of AI development, data engineering, domain expertise, and compliance-driven deployment.

Let’s have a walkthrough of the end-to-end development process that insurtechs and insurers generally follow:

1. Fraud Use-Case Identification & Requirement Analysis

The developers start with clarity, where they:

- Identify fraud types to focus on (we have already discussed)

- Define business objectives

- Decide detection edge (FNOL, underwriting, or post-claim)

- Define success metrics

Significance: When you align AI models with real fraud scenarios instead of generic datasets, they become more effective.

2. Data Collection & Data Preparation

You should be aware of the fact that AI fraud detection in insurance is data-backed. In this stage, we will target the same.

Data Sources Include:

- External third-party data

- Claims and policy data

- Customer behavior data

- Historical fraud cases

- Documents, invoices, images

Key Steps Considered:

- Featured Engineering

- Labeling fraud vs non-fraud cases

- Data cleaning and normalization

- Handling imbalanced datasets

Reality Check: You will have to spare most of your time and effort for this phase, so no shortcuts allowed.

3. AI & Machine Learning Model Development

From this phase of the development process, the intelligence is built.

Model Commonly Chosen:

- NLP models for text-heavy claims

- Supervised ML for known fraud patterns

- Graph models for fraud rings

- Unsupervised ML for anomaly detection

Key Considerations:

- Feature importance analysis

- Bias detection and mitigation

- Model accuracy vs explainability

Pro Tip: In insurance, every time, explainable AI confronts black-box accuracy.

4. Model Training, Testing & Validation

You should battle-test your model before you go live.

Activities Include:

- Cross-validation and testing

- False-positive analysis

- Training on historical data

- Performance evaluation

Objective: This phase ensures the model grabs the fraud without obstructing genuine customers.

5. Real-Time Fraud Scoring & Decision Engine Setup

Now, your model is all set to start functioning.

What happens here:

- In this phase, the confidence levels and thresholds are applied

- In real-time, the fraud risks are generated

- Automated actions are triggered.

This stage of AI insurance fraud detection solution development triggers real-time fraud detection at claim processing and FNOL.

6. Case Management & Investigator Workflow Integration

Here, AI flags risks that humans confirm to be fraud.

Key Capabilities:

- Audit logs

- Evidence and reasoning visibility

- Investigator dashboards

- Workflow automation

Significance: With human-in-the-loop validation, you can keep your system compliant and precise.

7. Integration with Insurance Ecosystem

You must ensure your system fits in the existing system.

Integration includes:

- External data providers

- Claims management platforms

- CRM and payment systems

- Policy administration systems

With seamless integration, you can attain less internal resistance with rapid adoption.

8. Security, Compliance & Explainability Implementation

You should also ensure Insurance AI is regulation-ready.

Key Requirements:

- Explainable AI outputs

- Audit trails for decisions

- Compliance with data protection laws

- Data access control and encryption

This phase guarantees that your solution is enterprise-grade as well as future-proof.

9. Deployment, Monitoring & MLOps

Well, even after you build an AI insurance fraud detection system, your work is still undone.

Post-deployment activities:

- Drift detection

- Model performance monitoring

- Continuous retraining

- Investigator feedback loops

Result: The system grows with the evolving fraud tactics; there’s no stable model.

Quick View of End-to-End Process

| Phase | Focus |

| Strategy | Fraud Use Cases & KPIs |

| Data | Collection, Cleaning, Labeling |

| AI | Model Building & Training |

| Validation | Accuracy & False-Positive Control |

| Decisioning | Real-time Risk Scoring |

| Operations | Investigation Workflows |

| Compliance | Security & Explainability |

| Evolution | Monitoring & Retraining |

Key Features to Consider in AI-Powered Fraud Detection Software

While you build insurance fraud detection software, you should ensure its functionality is bound to your company’s unique needs.

Below, we have curated a table including features of insurance fraud detection software that the insurance industry commonly requests.

| Feature | Description | Business Benefit |

| Real-Time Fraud Detection | Evaluates claims or transactions instantly utilizing AI models | Catch fraud early, improve customer satisfaction, and reduce claim leakage. |

| Anomaly & Pattern Detection | Identifies unusual behavior, emerging fraud patterns, and outliers. | Detect new and sophisticated fraud tactics not covered by rules |

| Predictive Risk Scoring | Assigns a fraud probability score to every claim or policy | Prioritizes investigation efforts and enhances operational efficiency |

| Natural Language Processing (NLP) | Analyzes unstructured text data from claim descriptions, medical reports, or invoices | Detects suspicious language, inconsistencies, and document fraud. |

| Graph & Network Analytics | Maps relationships between entities like providers, policyholders, and claims | Identifies organized fraud rings, collusion, and repeat offenders. |

| Hybrid Rule + AI Engine | Combines traditional rules with machine learning models | Maintains compliance while enhancing detection accuracy |

| Case Management & Investigator Dashboard | Centralized interface for managing investigations and flagged claims. | Streamlines workflow, reduces manual effort, and ensures consistent fraud review. |

| Explainable AI (XAI) | Offers reasoning behind fraud flags and scores | Builds regulatory compliance, transparency, and trust with investigators |

| Integration & API Support | Connects flawlessly with policy administration, claims systems, and third-party data | Enables quicker adoption, seamless data flow, and ecosystem connectivity |

| Continuous Learning & Model Retraining | Updates models based on feedback, new data, and evolving fraud patterns | Ensures sustained accuracy and adapts to surfacing fraud tactics |

| Reporting & Analytics | Detailed dashboards and KPI tracking for fraud trends | Enables data-driven decision-making and performance evaluation |

| Security & Compliance | Data encryption, regulatory adherence, and role-based access | Safeguards sensitive customer and insurance data, ensuring legal compliance |

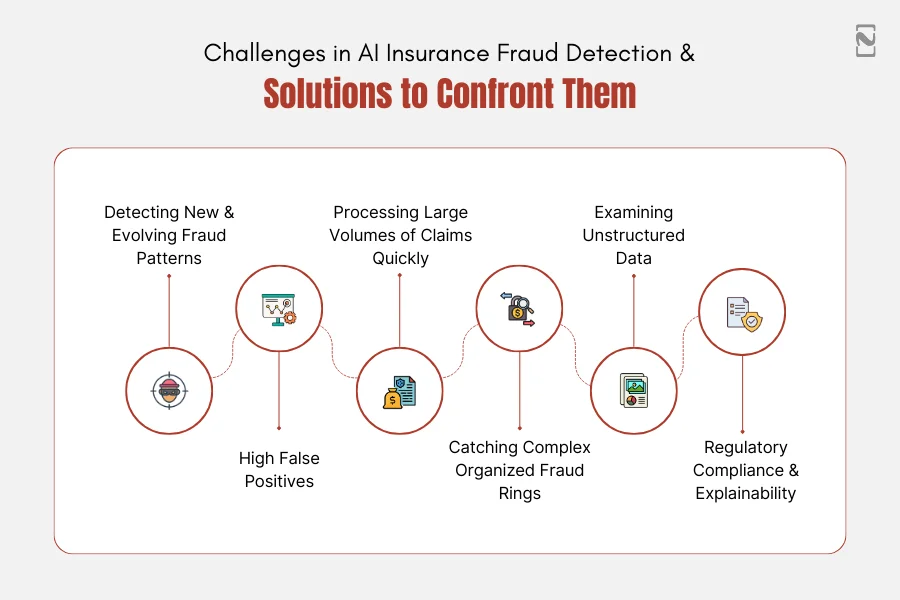

Challenges in AI Insurance Fraud Detection & Solutions to Confront Them

Building and deploying AI for insurance fraud detection makes you encounter several challenges.

The best thing is that challenges in AI insurance fraud detection can be addressed effectively with AI-driven solutions.

Let’s have a structured overview:

Challenge 1: Detecting New and Evolving Fraud Patterns

Solutions:

- Machine Learning Anomaly Detection

- Predictive Risk Scoring

- Continuous Model Retraining

Challenge 2: High False Positives

Solutions:

- Feature Importance Analysis

- Hybrid AI + Rule-Based Engines

- Investigator Feedback Loops

Challenge 3: Processing Large Volumes of Claims Quickly

Solutions:

- Stream Processing Frameworks

- Real-Time Fraud Scoring

- Automated Decision Workflows

Challenge 4: Catching Complex Organized Fraud Rings

Solutions:

- Cross-Entity Pattern Detection

- Graph & Network Analytics

- AI-Powered Relationship Mapping

Challenge 5: Examining Unstructured Data

Solutions:

- Sentiment & Text Similarity Analysis

- Natural Language Processing (NLP)

- Automated Document Verification

Challenge 6: Regulatory Compliance & Explainability

Solutions:

- Audit Trails & Reporting Dashboards

- Explainable AI (XAI) Models

- Role-Based Access & Secure Data Handling

Quick-Scan Table: AI Solutions to Insurance Fraud Challenges

| Challenge | AI Solutions |

| Detecting new & evolving fraud patterns | ML anomaly detection, predictive risk scoring, and continuous model retraining |

| High false positives | Hybrid AI + rule-based engines, feature importance analysis, and investigator feedback loops |

| Processing large volumes of claims quickly | Real-time fraud scoring, automated decision workflows, and stream processing frameworks |

| Detecting complex, organized fraud rings | Graph & network analytics, AI-powered relationship mapping, and cross-entity pattern detection |

| Analyzing unstructured data | NLP, sentiment & text similarity analysis |

Cost of Developing Insurance Fraud Detection Software

The AI insurance fraud detection software cost depends on various factors, like AI complexity, integration needs, data volume, and compliance needs.

Well, there is no fixed price, but various projects fall under predictable ranges. On average, the cost to build insurance fraud detection software ranges between $30,000 and $500,000 and can go up.

Cost Breakdown Analysis By Complexity

| Solution Type | Description | Estimated Cost Range |

| Basic Rule-Based Fraud Detection | Predefined rules, limited automation | $30,000 – $60,000 |

| AI-Assisted Fraud Detection | ML models + rules, batch processing | $60,000 – $120,000 |

| Advanced AI Fraud Detection Platform | Real-time AI, NLP, and graph analytics | $120,000 – $250,000+ |

| Enterprise-Grade AI Fraud Detection System | Custom AI, scalability, compliance | $250,000 – $500,000+ |

Key Factors That Influence Cost

| Cost Driver | Impact on Budget |

| Number of fraud use cases | Higher use cases mean higher cost |

| Data quality & availability | Poor data raises preparation effort |

| Real-time vs batch detection | Real-time upsurges in infrastructure cost |

| Integration complexity | Legacy systems increase development time |

| Explainable AI requirements | Adds model and reporting complexity |

| Regulatory compliance | Improves security and audit costs |

Ongoing & Maintenance Costs

| Category | Estimated Annual Cost |

| Model retraining & monitoring | $15,000 – $40,000 |

| Cloud infrastructure | $10,000 – $50,000 |

| System maintenance & updates | $8,000 – $25,000 |

| Compliance & security audits | $5,000 – $20,000 |

Cost Optimization Tips

- First, start with high-impact fraud use cases

- Opt for hybrid AI and rule-based approaches

- Leverage cloud-native infrastructure

- Create modular AI components for scalability

Build vs Buy: Choosing the Right Fraud Detection Approach

After insurers decide to implement fraud detection software, a question arises: whether to choose to build a custom AI solution or opt for buy-in, an off-the-shelf platform.

When to Build a Fraud Detection Solution

Best Suited for:

- Businesses looking for a long-term competitive edge

- Organizations with complex fraud scenarios

- Large insurers and insurtechs

- Companies with in-house data or AI expertise

Key Advantage: With your fraud space and regulatory needs, a custom-built solution also evolves.

When to Buy a Fraud Detection Solution

Best Suited for:

- Companies seeking quick deployment

- Small to mid-sized insurers

- Organizations with limited AI expertise

- Short-term or pilot implementations

Key Advantage: By choosing a buy-in AI solution, you get the benefit of rapid deployment with less development effort.

Hybrid Approach: Best of Both Worlds

Many insurers go for a hybrid approach:

- Customize AI models for high-risk use cases

- Buy a basic fraud detection platform

- Integrate proprietary data and workflows

IT helps diminish time-to-market while retaining regulations over crucial fraud logic.

Comparison Table – Build vs. Buy

| Criteria | Build (Custom Development) | Buy (Ready-Made Solution) |

| Time to Market | Longer (6 to 12 months) | Faster (weeks to deploy) |

| Initial Cost | Higher upfront investment | Lower upfront cost |

| Customization | Completely customizable to business requirements | Limited customization |

| AI Model Control | Full control over data and models | Vendor-controlled models |

| Integration Flexibility | High (fits better with existing systems) | Depends on vendor APIs |

| Scalability | Crafted for future growth | Limited by vendor architecture |

| Explainability & Compliance | Custom-built for regulatory needs | Predefined compliance features |

| Data Ownership | Full ownership | Often shared or restricted |

| Long-Term Cost | Lower at scale | Higher recurring licensing fees |

| Competitive Advantage | Robust differentiation | Same capabilities as competitors |

Regulatory, Security & Compliance Considerations

AI-powered insurance fraud detection software should function within rigid security, regulatory, and compliance frameworks.

As these systems deal with sensitive financial, health, and personal data, insurers should ensure clarity, auditability, and trust at each stage.

1. Key Regulatory Considerations

An AI fraud detection platform insurance must align with applicable global and regional regulations.

Core requirements are:

- Auditability of automated decisions

- Data protection and privacy compliance

- Fair, unbiased, and non-discriminatory outcomes

- Transparent and explainable AI decisions

If you fail to comply, you have to face reputational damage, regulatory penalties, and loss of customer trust.

2. Security Considerations

Insurance fraud detection systems are always a high target as the system processes sensitive insurance data.

Security Should Address:

- Secure integrations with third-party systems

- Data confidentiality and encryption

- System monitoring and threat detection

- Secure access controls

Security should be embedded by design only, not acknowledged as an afterthought.

3. Compliance Considerations for AI Systems

AI introduces extra compliance needs beyond traditional software.

Key focus areas are:

- Continuous monitoring and documentation

- Explainable AI (XAI) for regulatory audits

- Bias detection and fairness checks

- Human-in-the-loop decision-making

Insurers should ensure AI supports compliance instead of creating regulatory risk.

Future Trends in AI-Driven Insurance Fraud Detection

As we discussed, in 2026, AI-driven insurance fraud detection is evolving into a “predict-and-prevent” ecosystem.

Soon, there will be a time when static rules will not be considered, and insurers will move to autonomous AI agents and real-time behavioral intelligence.

Besides, there are more trends in AI-powered insurance fraud detection that you may encounter in the future.

Explainable AI Becoming a Regulatory Standard

Regulators want clarity in AI decisions. Explainable AI (XAI) will switch from a “good-to-have” to a mandatory need specifically for customer-facing actions and automated claim decisions.

Multimodal AI for Complex Fraud Scenarios

Future fraud detection systems are predicted to fuse the strength of images, documents, text, transaction data, and behavioral data into a single intelligent layer, enhancing detection precision for document-heavy and complex gains.

Cloud-Native & API-First Fraud Platforms

Ahead, in 2026, fraud detection solutions will be modular, cloud-native, and API-driven, allowing rapid integration with third-party data providers, claims systems, and insurtech ecosystems.

Shift Toward Real-Time & Preventive Fraud Detection

Fraud detection will shift from post-claim scan to real-time prevention at underwriting, FNOL, and policy assurance. AI models will soon stop fraud before any loss rather than locating it after payout.

Continuous Learning & Adaptive Models

Self-learning AI models will take the place of static fraud rules that constantly adapt to surging fraud patterns, leveraging investigator feedback and real-time data.

Escalated Use of Graph AI for Organized Fraud Rings

Graph-based AI will be the core to detect collusion and organized fraud networks, allowing insurers to unveil hidden relationships across providers, policyholders, claims, and vehicles.

AI Governance & Model Lifecycle Management

With growing AI adoption, insurers will increasingly invest in model governance, embracing performance monitoring, version control, regulatory reporting, and bias detection.

Greater Human-in-the-Loop Automation

Despite full automation, insurance companies will go for AI-assisted decisioning, where AI manages prioritization and detection while investigators target complex cases and validation.

Quick Scan of Future Trends in AI Insurance Fraud Detection

| Trend | Impact on Insurers |

| Real-time fraud prevention | Reduced claim leakage and faster decisions |

| Explainable AI mandates | Improved compliance and trust |

| Graph AI adoption | Better detection of organized fraud |

| Multimodal AI | Higher accuracy across complex claims |

| Human-in-the-loop AI | Balanced automation and control |

| Adaptive AI models | Continuous fraud detection improvement |

| AI governance frameworks | Lower regulatory and operational risk |

| Cloud-native platforms | Faster scalability and innovation |

How Nimble AppGenie Can Help Build AI-Powered Insurance Fraud Detection Software

Nimble AppGenie helps insurtech companies and insurers craft, develop, and scale AI insurance fraud detection software that’s explainable, accurate, and compliance-ready.

From strategy to deployment, our trusted Insurance app development company opts for the approaches that target real business impact, besides fraud detection algorithms in insurance.

Key Highlights of Nimble AppGenie

- Fraud use-case discovery and AI strategy

- Custom AI/ML model development (ML, NLP, Graph AI)

- Data engineering and integration with claims systems

- Real-time fraud scoring and decision engines

- Explainable AI (XAI) and compliance-ready architecture

- Investigator dashboards and case management

- Cloud deployment, MLOps, and continuous optimization

Our AI developers create AI solutions that integrate smoothly with your current insurance ecosystems while being scalable and futuristic.

Real-Time Case Study: AI Fraud Detection Platform for a Mid-Size Insurer (Client Name Confidential)

Client Profile – Property & Casualty Insurance from North America, claiming increasing auto and property claims

Challenges They Faced:

- Increasing fraudulent claims across property and auto lines.

- Restricted visibility into organized fraud networks.

- Delayed investigation cycles are affecting claim settlement time

- High false positives using rule-based fraud systems.

Solutions We Offered:

We built and deployed a custom AI fraud detection platform with:

- NLP models

- Machine learning models

- Graph analytics

- Investigator dashboard

- Real-time fraud scoring

- Cloud-native deployment

Result Achieved:

- 40% improvement in fraud detection accuracy

- 32% reduction in false positives

- 45% rapid claim investigation time

- Higher investigator productivity

- Drop in fraud loss leakage

Conclusion

Well, AI insurance fraud detection software has now become a business need. Also, traditional rule-based systems can’t match the steps of growing fraud schemes.

Leveraging the power of NLP, machine learning, real-time decision engines, and graph analytics, insurers can diminish false positives, proactively locate fraud, pace claims processing, and be compliant with dynamic regulations.

Here, the pathway to success is picking the right approach, either building a custom solution, adopting a hybrid model, or scaling existing systems by integrating AI.

Insurance firms that invest in AI fraud detection platforms will diminish losses, foster customer trust, and boost operational efficiency in the long run.

Collaborate with an AI fraud detection software development company with your project details and start your development journey now.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.